HALF YEAR RESULTS TO 30 JUNE 2008

Chaarat Gold Holdings

Ltd

9 September 2008

Ticker- AIM:CGH

HALF YEAR RESULTS TO 30 JUNE 2008

Chaarat Gold Holdings (AIM -CGH) ('Chaarat or the 'Company') is

pleased to announce its half-year financial results for the six

months ended 30 June 2008.

Highlights

* The Company continued its underground exploration throughout the

winter and re-commenced surface exploration in June.

* The Company released its resource update recording estimated

resources of 3.13million ounces of gold at an average grade of

4.41 grams/tonne, demonstrating the success of its 2007

exploration programme. (See news release dated 22 April 2008).

* Drilling results from the first drill chamber demonstrated

increased width and grade of the mineralised zone at the adit

level and below as compared to the surface width and grade. (See

news release dated 5 August 2008).

* A positive scoping study was completed by consultants Behre

Dolbear International Ltd. This indicated the economic viability

of the Chaarat Project and suggested a possible mining rate of

over 200,000 ounces of gold per annum. (See news release dated 19

June 2008).

* Subsequent to 30 June, Chaarat received a routine two year

renewal of its exploration licence over its 604 square kilometre

property. The renewal extends to the period from 1 January 2009

to 31 December 2010. (See news release dated 26 August 2008).

Dekel Golan - CEO comments; "2008 has seen successful and encouraging

progress, well on track for moving Chaarat from its current advanced

exploration phase towards planned production during 2012. The

Scoping Study prepared by Behre Dolbear has allowed us to refine our

planning of infrastructure, extraction technology, legal and

environmental studies and sustainability. Good progress is being made

on all these fronts and we plan to shortly proceed to a

Pre-Feasibility Study, with a target completion date during 2009".

Disclaimer

This press release includes forward-looking statements. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond Chaarat's control

that would cause the actual results, performance or achievements of

Chaarat to be materially different from future results, performance

or achievements expressed or implied by such forward-looking

statements. Such forward-looking statements are based on numerous

assumptions regarding Chaarat's present and future business

strategies and the environment in which Chaarat will operate in the

future. Any forward-looking statements speak only as at the date of

this document. Chaarat expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statements contained herein to reflect any change in

Chaarat's expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based.

As a result of these factors, the events described in the

forward-looking statements in this press release may not occur either

partially or at all.

+-------------------------------------------------------------------+

| Enquiries: | |

|------------------------------------------------+------------------|

| Chaarat Gold Holdings Ltd | Tel: +44 (0) 20 |

| | 7499 2612 |

|------------------------------------------------+------------------|

| Dekel Golan - Dekel@chaarat.com | |

|------------------------------------------------+------------------|

| Terry Cross - terry@caserve.co.uk | |

|------------------------------------------------+------------------|

| Canaccord Adams Limited | Tel: +44 (0) 20 |

| | 7050 6500 |

|------------------------------------------------+------------------|

| Mike Jones - Mike.Jones@canaccordadams.com | |

|------------------------------------------------+------------------|

| Smith's Corporate Advisory | Tel: +44 (0) 20 |

| | 7239 0140 |

|------------------------------------------------+------------------|

| Dominic Palmer-Tomkinson - | |

| Tomkinson@smiths-ca.com | |

+-------------------------------------------------------------------+

Chief Executive's Report

I am pleased to present Chaarat Gold's Half Year Results for the six

months to 30 June 2008.

Exploration

For the first time Chaarat successfully operated throughout the year,

without ceasing exploration activities during the winter season. On

22 April 2008 the Company released its resource update recording

estimated JORC compliant resources of 3.13million ounces of gold at

an average grade of 4.41 grams/tonne, thereby demonstrating the

success of its 2007 exploration programme. These results represented

a 68% increase over the estimated 1.86 million ounce resource

declared after the 2006 season.

The majority of the exploration work carried out during the first

half of 2008 was conducted underground, with surface work being

initiated following the winter season.

The exploration adit passed through extensive mineralisation in the

Contact zone in February 2008. Two drifts running parallel to the

strike of the mineralised body in the hanging wall are on schedule.

The results of drilling from the first underground drill chamber were

very encouraging. Drilling is currently being conducted from Drill

Chamber #2 which was excavated and equipped in May 2008, with

drilling scheduled for completion by the end of September 2008.

Subsequent to completion of drilling in Drill Chamber #2, drilling

will commence from Drill Chamber #3, situated 200metres to the North

of Drill Chamber #2. If positive results from Drill Chamber #2 and

horizontal drilling from the drift confirm the exploration value of

this approach to delineation of the resource, a fourth drill chamber

will be developed 200metres to the South of Drill Chamber #2.

The current underground drilling program will allow us to extend the

current resource of 1.248Moz in the Contact Zone both along strike

and to depth, along a strike length of some 640 metres, which is a

still only a small part of the almost 10 kilometre strike of the

contact zone. Should the grade and width found in drilling from Drill

chambers #1 and #2 prove consistent, the C53 Project will become very

significant in its own right and permit the generation of the first

mine planning block model for a pre-feasibility study.

In order to facilitate the exploration work, exclusively conducted by

local contractors, Chaarat is actively supporting the development of

local contractors. We view this approach as good operational practice

as well as an integral part of the sustainable development approach

of the Company. We have assisted a number of local contractors in

acquiring modern or new equipment and we regularly provide expert

assistance to improve their skills base. Such assistance, mostly by

way of advances and loans, has proven very useful.

Scoping and Pre-Feasibility Studies

The Company commissioned Behre Dolbear International Ltd. ("Behre

Dolbear"), an independent and internationally recognised engineering

consulting firm, to prepare a scoping study on the economic viability

of the Chaarat Project, as well as setting out a recommended work

programme to develop the project to the mining stage.

The Scoping Study was completed during June 2008. The details of the

scoping study can be found in the press release published on 19 June

2008. The report concluded that the Chaarat property is an

economically viable property and that the targeted production rate of

a minimum of 200,000 saleable ounces of gold per year can technically

and operationally be achieved.

Discussions are underway with a number of parties about the

commissioning of a pre-feasibility study. We expect to announce

shortly the party or group of parties who will undertake this study.

Project Development:

Staff

A new Project Manager, Mr. Scott Salisbury, joined the Company during

May. Scott brings with him significant experience in mining in

Australia as well as managing operations in less developed

environments such as Tanzania and Mauritania.

Metallurgy

In parallel with metallurgical studies to develop a gold dor�

product, following the advice of a number of experts, the Company has

decided to also direct more effort towards investigating the

alternative possibility of producing a high grade gold and silver

concentrate. The ability to produce such concentrate would allow the

Company to either treat the concentrate in a location where the

environmental concerns can be minimised, or to sell the concentrate

outright. The Company is commissioning Mintek, a South African

metallurgical laboratory with significant experience in similar ores,

to develop a suitable process.

Development

A number of potentially suitable locations for the plant and tailings

dam have been identified. The required geotechnical work to

substantiate the suitability of those locations is being planned and

is likely to take place during the 2009 summer season.

The survey and design of the access road up the Sandalash river

valley, to link an existing public road system to site and provide

year-round access to site, was commissioned by Maccafferri in August

2008. The length of the road to be planned and built is approximately

20 km, significantly less than previously believed.

Environmental work

With a better understanding of the area of influence of the project,

the detailed planning of the Environmental Baseline Study has

commenced. A review of potential project infrastructure sites and

access routes has identified that the study area was significantly

larger then originally estimated. Our environmental advisors, Knight

Piesold and Co. (USA), are working with us to determine a revised

scope of work, to ensure that the study is executed to the highest

international standards. The initial study phase incorporating the

full area of influence covered by the project will commence in the

spring of 2009.

Dekel Golan

Chief Executive Officer

Consolidated income statement

For the six months ended 30 June

6 months to 6 months to 12 months to

30 June 30 June 31 December

2008 2007 2007

(unaudited) (unaudited) (audited)

USD USD USD

Exploration expenses (2,997,849) (740,665) (5,298,560)

Administrative expenses (1,739,306) (287,530) (1,623,792)

Other operating income/(expense) 14,569 858 (2,852)

Operating loss (4,722,586) (1,027,337) (6,925,204)

Financial expense (247,475) - -

Financial income 178,239 87,387 384,858

Loss for the period,

attributable to equity

shareholders of the Company (4,791,822) (939,950) (6,540,346)

Loss per share (basic and

diluted) - USD cents (6.67)c (1.70)c (11.21)c

All amounts relate to continuing activities.

Consolidated balance

sheet

At 30 June

30 June 30 June 31 December

2008 2007 2007

(unaudited) (unaudited) (audited)

USD USD USD

Assets

Non-current assets

Intangible assets 25,628 - 4,797

Property, plant and

equipment 2,064,833 613,683 1,215,273

Other receivables 38,388 37,886 37,740

2,128,849 651,569 1,257,810

Current assets

Inventories 294,167 - 475,846

Trade and other

receivables 1,706,812 903,768 742,433

Cash and cash

equivalents 7,004,269 3,756,955 13,128,822

9,005,248 4,660,723 14,347,101

Total assets 11,134,097 5,312,292 15,604,911

Liabilities and equity

Equity attributable to

shareholders

Share Capital 718,834 3,739 718,834

Share premium 15,665,928 11,204,939 15,665,928

Other reserves 11,405,955 258,647 11,048,357

Foreign currency reserve (421,416) 12,979 (408,059)

Retained losses (16,787,682) (6,395,464) (11,995,860)

10,581,619 5,084,840 15,029,200

Current liabilities

Trade payables 481,972 117,452 401,253

Accrued liabilities 70,506 110,000 174,458

552,478 227,452 575,711

Total liabilities and equity 11,134,097 5,312,292 15,604,911

Consolidated cash flow

statement

For the six months ended 30

June

6 months to 6 months to 12 months to

30 June 30 June 31 December

2008 2007 2007

(unaudited) (unaudited) (audited)

USD USD USD

Operating activities

Result for the period before (4,791,822) (939,950) (6,540,346)

and after tax

Adjustments:

Amortisation expense

intangible assets 2,671 - 430

Depreciation expense

property, plant and

equipment 256,757 46,717 200,415

Loss on disposal of

property, plant and

Equipment 5,838 2,091 3,541

Interest income (179,498) (65,809) (263,558)

Share based payment expense 357,598 10,138 163,306

Foreign exchange 247,475 1,178 87,875

(Increase)/decrease in 181,679 - (475,846)

inventories

(Increase)/decrease in (965,027) (815,168) (633,208)

accounts receivable

Increase/(decrease) in (23,233) 142,601 490,859

accounts payable

Net cash flow used in

operations (4,907,562) (1,618,202) (6,966,532)

Investing activities

Purchase of computer (23,560) - (5,227)

software

Purchase of property plant (1,129,357) (541,482) (1,297,372)

and equipment

Proceeds from sale of 2,644 5,208 13,750

equipment

Loans repaid - - 40,000

Interest received 179,498 65,809 203,079

Net cash used in investing

activities (970,775) (470,465) (1,045,770)

Financing activities

Proceeds from issue of share - 4,999,049 23,264,751

capital

Issue costs - - (2,453,076)

Net cash from financing

activities - 4,999,049 20,811,675

Net change in cash and cash

equivalents (5,878,337) 2,910,382 12,799,373

Cash and cash equivalents at

beginning of the period 13,128,822 846,573 846,573

Effect of changes in foreign (246,216) - (517,124)

exchange rates

Cash and cash equivalents at

end of the period 7,004,269 3,756,955 13,128,822

Consolidated statement of changes in

equity

For the six months ended 30 June

Share Share Retained Other Translation

Capital Premium losses Reserves Reserve Total

USD USD USD USD USD USD

Balance at 3,431 6,454,707 (5,455,514) - 11,801 1,014,425

31 December

2006

Currency - - - - 1,178 1,178

translation

Net gain - - - - 1,178 1,178

recognised

directly in

equity

Loss for the

six months - - (939,950) - - (939,950)

ended

30 June 2007

Total

recognised

income and

expense for

the six

months

attributable

to equity

shareholders

of the

Company - - (939,950) - 1,178 (938,772)

Issuance of

shares and

options for

cash 308 4,750,232 - 248,509 - 4,999,049

Share options

expense - - - 10,138 - 10,138

Balance at 3,739 11,204,939 (6,395,464) 258,647 12,979 5,084,840

30 June 2007

Currency - - - - (421,038) (421,038)

translation

Net loss - - - - (421,038) (421,038)

recognised

directly in

equity

Loss for the

six months - - (5,600,396) - - (5,600,396)

ended

31 December

2007

Total

recognised

income and

expense for

the six

months

attributable

to equity

shareholders

of the

Company - - (5,600,396) - (421,038) (6,021,434)

Transfer to

reserves -

reverse

acquisition * (3,739) (11,204,939) - 11,208,678 - -

Share for

share

exchange -

reverse

acquisition * 572,136 - - (572,136) - -

Share options

expense - - - 153,168 - 153,168

Issuance of

shares for

cash 146,698 18,119,004 - - - 18,265,702

Share issue - (2,453,076) - - - (2,453,076)

costs

Balance at 718,834 15,665,928 (11,995,860) 11,048,357 (408,059) 15,029,200

31 December

2007

Currency - - - - (13,357) (13,357)

translation

Net gain - - - - (13,357) (13,357)

recognised

directly in

equity

Loss for the

six months - - (4,791,822) - - (4,791,822)

ended

30 June 2008

Total

recognised

income and

expense for

the six

months

attributable

to equity

shareholders

of the

Company - - (4,791,822) - (13,357) (4,805,179)

Share options

expense - - - 357,598 - 357,598

Balance at 718,834 15,665,928 (16,787,682) 11,405,955 (421,416) 10,581,619

30 June 2008

* The transfers to reserves during 2007 represented the issued share

capital and share premium of subsidiary Chaarat Gold Limited prior to

its reverse acquisition of Chaarat Gold Holdings Ltd

Notes:

1 Dividend

No dividend is proposed in respect of the period.

2 Loss per share

The loss per share is calculated by reference to the loss of

USD4,791,822 for the six months ended 30 June 2008 and the

weighted average number of shares in issue of 71,883,433

during the period. There is no dilutive effect of share

options or warrants.

The numbers of shares used in loss per share calculations for

the periods ended 30 June 2007 and 31 December 2007 have been

adjusted for the 300:1 share exchange of 7 September 2007.

3 Basis of preparation of financial statements

The unaudited results have been prepared on a going concern

basis and on the basis of the accounting policies adopted in

the audited accounts for the year ended 31 December 2007.

The results for the period are derived from continuing

activities.

The financial information set out in this half-yearly report

does not constitute statutory accounts. The figures for the

period ended 31 December 2007 have been extracted from the

statutory financial statements, prepared under IFRS, which are

available on the Group's website www.chaarat.com. The

auditor's report on those financial statements was

unqualified.

4 Selected accounting policy

Mining exploration and development costs

During the exploration phase of operations, all costs are

expensed in the Income Statement as incurred.

A subsequent decision to develop a mine property within an

area of interest is based on the exploration results, an

assessment of the commercial viability of the property, the

availability of financing and the existence of markets for the

product. Once the decision to proceed to development is made,

exploration, development and other expenditures relating to

the project are capitalised and carried at cost with the

intention that these will be depreciated by charges against

earnings from future mining operations over the relevant life

of mine on a units of production basis.

5 Share options

On 30 June 2008 the Company awarded 1,335,000 share options to

staff, at an exercise price of GBP�0.54 per share. The total

number of share options outstanding were:

At 31 December 2007 6,540,000

Awarded 30 June 2008 1,335,000

At 30 June 2008 7,875,000

An amount of USD 357,598 was recognised as share based payment

expense during the six month period ended 30 June 2008 (six

months ended 30 June 2007:USD 10,138; 12 months ended 31

December 2007: USD 163,306)

Directors and Advisers

Directors

C Palmer-Tomkinson Non-executive Chairman

D Golan Chief Executive Officer

T A Cross Finance Director

A Novak Executive Director

S R Comline Non-executive Director

O R Greene Non-executive Director

Company Secretary Auditors Solicitors (UK)

Watson, Farley &

Chateau Management Limited Grant Thornton UK LLP Williams LLP

PO Box 693 Grant Thornton House 15 Appold Street

Hamilton Estate Melton Street London, EC2A 2HB

Charlestown London, NW1 2EP

Solicitors

Nevis (Guernsey)

Tel +41 22 316 6620 Registrars Ogier

Capita Registrars

lee@chateaufid.ch (Guernsey) Ltd Ogier House,

2nd Floor, No 1 Le St. Julien's

Truchot Avenue

Registered Office St Peter Port St. Peter Port

Palm Grove House Guernsey Guernsey, GY1 1WA

PO Box 438

Road Town, Tortola Depositary Solicitors (BVI)

British Virgin Islands, Capita IRG Trustees

VG1110 Limited Ogier

Qwomar Complex,

Registered Number 1420336 The Registry 4th Floor

PO Box 3170 Road

34 Beckenham Road Town

Kyrgyz Republic Office Beckenham Tortola

British Virgin

Chaarat Zaav CJSC Kent, BR3 4TU Islands, VG 1110

Chokmorova Street, 127

Solicitors (Kyrgyz

720040, Bishkek Principal Bankers Republic)

Royal Bank of Scotland Kalikova &

Kyrgyz Republic International Associates

71 Erkindik

Royal Bank Place Boulevard

Web Site 1 Glategny Esplanade Bishkek, 720040

www.chaarat.com St Peter Port Kyrgyz Republic

Guernsey

Nominated Advisor and

Broker

Canaccord Adams Limited

Cardinal place, 7th

Floor

80 Victoria Street

London, SW1E 5JL

- ---END OF MESSAGE---

- ---END OF MESSAGE---

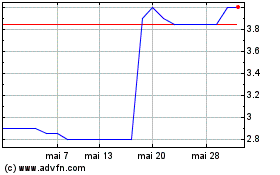

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024