INTERVIEW:Commodity Price Bubble Limits M&A Opportunity -CNMC

18 Maio 2010 - 11:39AM

Dow Jones News

High commodity prices have made most mining assets too expensive

for acquisitions, a senior executive at China Nonferrous Metals Co.

Ltd. (8306.HK) said Tuesday.

"It's sort of like a bubble," Executive VicePpresident Zhang

Keli told Dow Jones Newswires in an interview on the sidelines of a

conference here. "The price of all the commodities are going up

quickly, so the market value is increasing significantly."

CNMC remains on the lookout for potential acquisitions, while it

plans to spend $1 billion on its own mining operations this year,

Zhang said.

"We see opportunities in a lot of places, but just flashes," and

acquirers have to move quickly, he said.

CNMC is a state-owned company that has been aggressive in

expanding abroad, with stakes in mines and smelters in over 30

countries.

Zhang said the company considered bidding for Anglo American

PLC's (AAL.LN) zinc assets but found the prices too high.

CNMC prefers to invest in copper among nonferrous metals, but it

is also investing in nickel, zinc, lead and rare earths assets.

It expects the Zambia-China economic and trade cooperation zone

that it built to produce 500,000 metric tons of copper and 5,000

tons of cobalt by 2014. CNMC is also interested in gold, as the

metal is often produced as a byproduct of nonferrous mines, Zhang

said. CNMC has a stake in Canadian gold miner Chaarat Gold Holdings

Ltd. (CGH.LN), which has a mine in Kyrgyzstan.

The company plans to expand in both mining and smelting assets,

even though mining has bigger profit margins, Zhang said.

The benefits of investing in smelting plants near the mines is

that it trains and employs more local people and the country gains

more value from its mineral resources, he added.

"We're not trying to seek the utmost profit, we are only trying

to have a reasonable profit," he said.

Zhang didn't elaborate on what minimum return the company seeks

on its investments.

Company Web site: www.cnmc.com.cn/en

-By Matthew Walls, Dow Jones Newswires; +44 (0)20 7842 9412;

alex.macdonald@dowjones.com

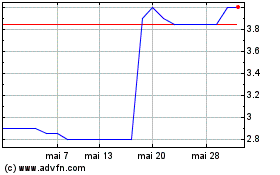

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024