TIDMCGH

Chaarat Gold Holdings Ltd

("Chaarat" or "the Company")

PRELIMINARY ANNOUNCEMENT OF AUDITED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31

DECEMBER 2009

Road Town, Tortola, British Virgin Islands (20 May 2010)

Chaarat Gold Holdings Limited has today published its preliminary results for

the year ended 31 December 2009.

Highlights

* Significant progress on the Prefeasibility Study (PFS) during 2009 - on

track for completion in Q3 2010

* PFS findings indicate the potential of implementing an initial high grade,

low-cost, open pit mine within the Tulkubash T0700 Project Area

* Optimal processing solution for ore identified

* 5,357 metres in 25 drill holes and 206 metres of adits completed during 2009

* JORC compliant mineral resource of 4.009 million ounces of gold at a grade

of 4.14g/t delineated subsequent to year end

* The mineral resource of the contiguous C5300 and C4600 Project Areas in the

Contact Zone totals 1.71 million ounces at a grade of 4.19 g/t Au

* The mineral resource of the contiguous M2400 and M3000 projects in the Main

Zone totals 1.23 million ounces at a grade of 4.18 g/t Au

* The mineral resource of the T0700 project area contains 336,000 ounces at a

grade of 4.18 g/t Au

* 55% of resource now within the indicated category (2008: 49%)

Chairman's report

It has been another exciting year for your company. Much has been achieved;

drilling has increased our JORC resource to over four million ounces of gold,

work on the prefeasibility study continues apace and in September we welcomed a

new shareholder to our register in the form of China Nonferrous Metals

International Mining Co. Ltd (CNMIM), a member of the China Nonferrous Metals

Mining Co. Ltd (CNMC) group. Together with a strong gold price, these factors

have contributed to an increasingly positive sentiment surrounding Chaarat.

Having seen our shares trade at depressed levels in late 2008, early in 2009

management visited Australia and Hong Kong with a view to identifying potential

interest in Chaarat as well as to investigate the possibility of a complementary

or alternative quotation for our stock. The Directors believe that Asian markets

may have a better understanding of Asian regional risk. Mountainous Central Asia

is where, to use industry parlance, "elephants" are to be discovered. Quoting

Nick Holland, the CEO of Goldfields: "Kyrgyzstan is the next mining frontier."

This view seems to be shared by many Asian investors.

In May 2009 we completed a private placing of 18.6 million shares at 12p per

share, largely with existing shareholders, for a consideration of GBP2.2 million.

Shortly thereafter, in September, a further placing followed at a price of 25p

per share. This placing introduced to Chaarat a major Chinese state owned

enterprise, CNMC. CNMC, through its subsidiary CNMIM, subscribed for new shares

which equated to 19.9% of the company and showed its support and belief in

Chaarat by buying shares at a premium to the market price and placing two high

ranking officers as directors on our board.

We are therefore pleased to welcome as directors Mr Luo Tao, President of CNMC,

and Mr David Tang, President of CNMIM. The significant financial support of

CNMC and its experience and contacts in mineral and metals related industries

will be of considerable value to Chaarat.

You will see from the Chief Executive's report on operations that the outcome of

our drilling programme has once again confirmed our optimism about the

resource. There has been consistency in both grade and continuity of

mineralisation in the important Contact Zone which now hosts more than 1.7

million ounces. This project remains open at depth and along strike and we are

very hopeful that it will continue to grow.

Another encouraging aspect of last year's work has been the identification of

oxide mineralisation in the Tulkubash Zone. It is too early to make definitive

predictions, but if a sufficient tonnage of gold bearing oxides that are

amenable to a direct leaching process can be amassed, which we believe is

probable, we should be able to develop a modest sized open pit gold mine in less

than two years. Upon validation, the mining of the Tulkubash Zone would become

the subject of a separate study and we would move straight to the feasibility

stage on this project.

Progress on the prefeasibility study covering the mining of the Main and Contact

Zones has meanwhile moved on according to plan. Whilst we were hoping to

complete the study earlier, a decision was made last year to postpone the work

as new information changed some of our views about geo-technical aspects.

Given the physical location of our project in the Kyrgyz Republic which borders

China, and given the respect our Chinese shareholder CNMIM commands both in

mainland China and Hong Kong, the board is currently assessing the option of a

listing on the Hong Kong stock exchange. The principal reasons for seeking a

Hong Kong listing would be to enhance liquidity and to endeavour to have our

share price better reflect its true value.

The recent political upheaval in the Kyrgyz Republic has been unhelpful. Our

operations have been unaffected even though these events have given rise to

uncertainty. So far the interim governing body has been accepted by the

principal international powers giving grounds for hope in what has been a

turbulent period for the country. The interim government appears determined in

its efforts to achieve democratic elections within six months. We are hopeful

that this can be fulfilled.

The coming year will present us with new challenges relating to the development

of a four million ounce gold project. We will have to broaden our managerial

resource from the current very tight team as we move into the development stage.

We look forward to the completion of the prefeasibility study and moving to the

next stage which is a definitive feasibility study.

Christopher Palmer-Tomkinson

Chairman

Operations Report

During 2009, the company continued to move the Chaarat Project from exploration

to development. Considerable progress has been made on the prefeasibility study

which is on track for completion during the third quarter of 2010.

Much of management's time was dedicated to developing a more easterly focus for

the company. This takes account not only of the geographical position of our

deposit, but also the growing Chinese involvement in Central Asia. We are aware

that securing project finance from western financial institutions remains

difficult, and realising that most equipment nowadays comes from China, Chaarat

took a strategic decision to turn east. We are also of the belief that Asian

and Australian investors may be more comfortable with an investment in Central

Asia than European investors. Visits were made to Australia and Hong Kong and

it became clear to us that the presence of a credible Chinese investor will be

of significant strategic value.

The share register was strengthened in two stages; in April 2009 we raised GBP2.2

million, mostly from existing shareholders at a price of 12p. Three months later

the company announced that China Nonferrous Metals International Mining Co. Ltd

(a subsidiary of China Nonferrous Metals Mining Co. Ltd) had subscribed for

19.9% of the company at a price of 25p which was a significant premium to the

market price. This investment was a strong statement of support and belief in

Chaarat. Indeed our share price has been boosted by the combination of positive

exploration news, shareholders' support and an improved understanding of the

potential of our project.

Exploration

The exploration season, which only started after the cash injection from CNMIM,

was shorter than usual. However, the work done was very important and resulted

not only in a larger resource statement but also provided us with a better

insight and understanding of the deposit and the best way to develop it.

Main Zone

The Main Zone currently extends to over 4 km of strike and includes seven bodies

with a total stated resource of 1.87 million ounces at a grade of 4.15 g/t Au.

This resource, which is open in all directions, has mostly underground

potential. The ability to drill from surface is limited, so the company has

started to develop an adit to enable it to drill from underground and add

resource in those areas where it is most beneficial for the mine design.

Chaarat and its advisors are now working on the conceptual mine design which

will determine the best location for a production and access adit. The location

of the exploration adit has been selected to coincide with the location of the

production access adit so that the time to production is shortened and the money

spent on the adit is not wasted.

Although most of the resource is to be mined by underground methods a

considerable portion is amenable to open pit mining. The company's advisors

have generated a preliminary pit shell and it will now be easier to identify the

locations where surface drilling will not only increase resource in general, but

will also contribute to a low cost open pit resource.

Contact Zone - Growing and consolidating

The Contact Zone continues to deliver both predictable and encouraging results.

During the year two more drives, cutting through the zone, were completed from

the drift which runs along the mineralised body, bringing the total number of

cross cuts going through the zone to four. These cross cuts provide invaluable

information about the mineralised material and the host rock; which allows the

company to design the mining work with accuracy and confidence.

The adit was extended southwards and an additional drilling chamber - DC-5 - was

constructed to allow additional drilling and to increase the strike.

Significant drilling from DC-3 resulted in strike increases as predicted. We

believe that drilling from DC-5 will result in further strike extensions.

Towards the end of the season the northern-most cross cut was completed and

provided more comfort that the mineralised zone is consistent, wide and well

mineralised.

Tulkubash - An independent project?

The Tulkubash Zone, the least explored and least understood zone, provided us

with some major positive news this year. It appears that the mineralisation in

this zone is somewhat different from the other zones with very low levels of

silver, arsenic and antimony as well as sulphur. A number of metallurgical

tests have indicated that the mineralisation is free milling and thus does not

require oxidation to retrieve the gold. This is a significant development as

the need to oxidise ore adds considerably to the complexity and cost of gold

projects.

Even more exciting is the fact that most of the Tulkubash's current resource can

be mined by the open pit method which means production costs may be very low.

The company believes that drilling in the right places, which is what we intend

to do this season, may significantly increase the resource.

The company is currently assessing whether it should fast-track the project to

feasibility study. It is management's belief that there is potential for having

a modest production base from Tulkubash in a much shorter time frame than

originally envisaged.

Mineral resource

The mineral resource calculation was prepared again this year by SRK Consulting

(Johannesburg). The detailed resource table broken down by projects and

resource category is below.

At 2.0g/t Cut-off|Indicated Resources | Inferred Resources | Total Resources

=---------+--------+------+-----+-------+------+-----+-------+------+-----+-------

| | Mass |Gold | Gold | Mass |Grade|Content| Mass |Grade|Content

Zone |Sub-Zone| |Grade|Content| | | | | |

| +------+-----+-------+------+-----+-------+------+-----+-------

| | kt | g/t | Koz | kt | g/t | koz | kt | g/t | koz

=---------+--------+------+-----+-------+------+-----+-------+------+-----+-------

| M2400 |2,900 |4.11 | 390 | 800 |3.96 | 106 |3,700 |4.08 | 496

+--------+------+-----+-------+------+-----+-------+------+-----+-------

| M3000 |3,800 |4.11 | 504 |1,500 |4.57 | 226 |5,300 |4.24 | 730

+--------+------+-----+-------+------+-----+-------+------+-----+-------

| M3400 | | | |1,000 |4.17 | 134 |1,000 |4.17 | 134

+--------+------+-----+-------+------+-----+-------+------+-----+-------

Main Zone| M3900 |1,500 |3.76 | 182 | 700 |3.86 | 90 |2,200 |3.79 | 272

+--------+------+-----+-------+------+-----+-------+------+-----+-------

| M4400 | | | | 300 |3.86 | 41 | 300 |3.86 | 41

+--------+------+-----+-------+------+-----+-------+------+-----+-------

| M5000 | 100 |5.81 | 13 | 400 |5.20 | 59 | 500 |5.32 | 72

+--------+------+-----+-------+------+-----+-------+------+-----+-------

| M6000 | 300 |3.88 | 39 | 600 |4.33 | 90 | 900 |4.18 | 129

=---------+--------+------+-----+-------+------+-----+-------+------+-----+-------

Main Zone Totals |8,600 |4.05 | 1,127 |5,400 |4.28 | 744 |14,000|4.15 | 1,871

/Averages | | | | | | | | |

=---------+--------+------+-----+-------+------+-----+-------+------+-----+-------

| C4000 | 400 |3.33 | 39 | 500 |3.33 | 55 | 900 |3.33 | 94

Contact +--------+------+-----+-------+------+-----+-------+------+-----+-------

Zone | C4600 | 900 |3.97 | 116 |1,900 |4.16 | 247 |2,800 |4.10 | 363

+--------+------+-----+-------+------+-----+-------+------+-----+-------

| C5300 |6,700 |4.19 | 906 |3,200 |4.24 | 439 |9,900 |4.21 | 1,345

=---------+--------+------+-----+-------+------+-----+-------+------+-----+-------

Contact Zone |8,000 |4.12 | 1,061 |5,600 |4.13 | 741 |13,600|4.13 | 1,802

Totals /Averages | | | | | | | | |

=---------+--------+------+-----+-------+------+-----+-------+------+-----+-------

Tulkubash| T0700 | | | |2,500 |4.18 | 336 |2,500 |4.18 | 336

=---------+--------+------+-----+-------+------+-----+-------+------+-----+-------

Grand |16,600|4.09 | 2,188 |13,500|4.20 | 1,821 |30,100|4.14 | 4,009

Totals/Averages | | | | | | | | |

It is worth noting that not only was the resource significantly increased but

also the portion of the resource in the indicated category has increased from

49% to 55%.

The Tulkubash Zone, which is included in its entirety in the inferred category,

will benefit this coming year from increased drilling activity and we expect a

significant portion of it to be transferred to the indicated category in the

next resource update.

Prefeasibility study

Towards the end of 2009 it became apparent that the foot and hanging walls are

more competent as we move south along the Contact Zone. A decision was taken to

postpone the mine design as these findings could have led to a change in the

proposed mining method. Additional geotechnical work was conducted which

resulted in a decision to move ahead with the original mining method. This

extra work has led to a delay in the original timetable for the mine

development.

Work on the prefeasibility study is continuing and we expect to report on its

findings during the third quarter of 2010. The biggest challenge of this

project is the mining itself; to define the most effective, productive and low

cost mining method. Significant effort has been invested into meeting this

challenge and finding the right solution.

Process

Following a rigorous sequence of metallurgical trials it became clear that the

most suitable process for the sulphide segment of the Chaarat ore is pressure

oxidation (POX). This process is well established and widely used elsewhere;

hence we do not anticipate any technical complications.

SNC Lavalin, a world leader in process engineering, and RDI, a leading Denver

based metallurgical laboratory, have agreed that the optimal process involves

flotation of the ore and pressure oxidation of the float concentrate. Following

oxidation, the concentrate, together with the tailings from the flotation

circuit, will be sent to a carbon-in-leach (CIL) circuit for gold extraction.

The process will provide a significant reduction in both capital and operating

costs, as well as technical complexity, whilst still subjecting the whole ore to

CIL high gold recovery.

An added benefit of this process is a much reduced environmental impact due to

the fact that most, if not all, the arsenic is expected to be locked in

non-soluble, non-hazardous compounds following the high pressure oxidation

process.

SNC and RDI , have also made significant progress on the design of the plant.

Suitable sites for the tailings dams and process plant and facilities have been

identified. Preliminary work has been undertaken to determine the surface and

underground water regime and the geotechnical properties of the sites in order

to allow the design of the process and tailings storage facilities.

Infrastructure

An extensive analysis of the best options for road and power has been carried

out. We have always been of the view that it may be sensible to develop our own

hydro power station. However, we are investigating alternative solutions.

Work is progressing on the access road. There has been greater focus on the

accuracy of cost estimates which we are finding are themselves now lower than we

had thought. There do not seem to be any material impediments to securing

year-round and easy access to the operations. The total distance between the

railhead and the property is 190 kilometres.

Work with the community

Chaarat continued its work with the local community during 2009 by supporting

the communities in health education and skill building. The Board resolved early

in 2010 to establish a not-for-profit organisation which will independently be

responsible for such activities and which will be able to receive assistance and

funds not only from Chaarat, but also from other additional parties. As in

previous years the company continued to grant study scholarships to students.

As this report is published, deep into 2010, the work on site has already begun.

We aim to continue to deliver growth in resource, progress in the project

development and perhaps most importantly, develop the very dedicated team which

delivers these results.

Dekel Golan

Chief Executive Officer

Consolidated income statement

For the years ended 31 December

2009 2008

Restated

Note USD USD

Exploration expenses (4,695,271) (8,244,068)

Administrative expenses (2,430,171) (2,461,734)

Administrative expenses- Share options expense (49,778) (203,350)

Administrative expenses- Other operating (32,205) (34,998)

expense

Administrative expenses- Foreign exchange loss (240,532) (645,972)

=------------------------------------------------------------------------------

Operating loss (7,447,957) (11,590,122)

Financial income 19,048 226,753

Taxation - -

=------------------------------------------------------------------------------

Loss for the year, attributable to equity

shareholders of the Parent (7,428,909) (11,363,369 )

=------------------------------------------------------------------------------

Loss per share (basic and diluted) - USD cents 2 (8.22)c (15.81)c

=------------------------------------------------------------------------------

See note 4 for details of the restatement of the share options expense for 2007

and 2008.

Consolidated statement of comprehensive income

For the years ended 31 December

2009 2008

Restated

USD USD

Loss for the period, attributable to shareholders (7,428,909) (11,363,369)

of the Parent

Other comprehensive income:

Exchange differences on translating foreign (343,968) (187,829)

operations

Income tax relating to components of other - -

comprehensive income

=-----------------------------------------------------------------------------

Other comprehensive income for the year, net of (343,968) (187,829)

tax

=-----------------------------------------------------------------------------

Total comprehensive income for the period (7,772,877) (11,551,198)

=-----------------------------------------------------------------------------

See note 4 for details of the restatement of the share options expense for 2007

and 2008.

Consolidated balance sheet

At 31 December

2009 2008 2007

Restated Restated

USD USD USD

Assets

Non-current assets

Intangible assets 60,558 99,473 4,797

Property, plant and equipment 1,221,765 2,022,414 1,215,273

Other receivables - - 37,740

=---------------------------------------------------------------------------

1,282,323 2,121,887 1,257,810

=---------------------------------------------------------------------------

Current assets

Inventories 156,691 59,587 475,846

Trade and other receivables 418,239 434,610 742,433

Cash and cash equivalents 6,812,046 1,375,445 13,128,822

=---------------------------------------------------------------------------

7,386,976 1,869,642 14,347,101

Assets held for sale - 39,562 -

=---------------------------------------------------------------------------

7,386,976 1,909,204 14,347,101

=---------------------------------------------------------------------------

Total assets 8,669,299 4,031,091 15,604,911

=---------------------------------------------------------------------------

Liabilities and equity

Equity attributable to shareholders

Share Capital 1,129,110 718,834 718,834

Share premium 27,499,843 15,665,928 15,665,928

Other reserves 13,312,190 13,403,158 13,239,318

Translation reserve (939,856) (595,888) (408,059)

Retained losses (32,798,843) (25,510,680) (14,186,821)

=---------------------------------------------------------------------------

8,202,444 3,681,352 15,029,200

=---------------------------------------------------------------------------

Current liabilities

Trade payables 285,890 69,525 401,253

Accrued liabilities 180,965 280,214 174,458

=---------------------------------------------------------------------------

466,855 349,739 575,711

=---------------------------------------------------------------------------

Total liabilities and equity 8,669,299 4,031,091 15,604,911

=---------------------------------------------------------------------------

See note 4 for details of the restatement of the share options expense for 2007

and 2008.

Consolidated statement of changes

in equity

For the years ended 31 December

Share Share Retained Other Translation

capital premium losses USD reserves reserve USD Total USD

USD USD USD

Balance at

31 December 718,834 15,665,928 (11,995,860) 11,048,357 (408,059) 15,029,200

2007

Restatement - - (2,190,961) 2,190,961 - -

=-----------------------------------------------------------------------------------

Balance at

31 December 718,834 15,665,928 (14,186,821) 13,239,318 (408,059) 15,029,200

2007

(restated)

Currency - - - - (187,829) (187,829)

translation

=-----------------------------------------------------------------------------------

Net income

recognised - - - - (187,829) (187,829)

directly in

equity

Loss for

the year

ended - - (11,363,369) - - (11,363,369)

31 December

2008

=-----------------------------------------------------------------------------------

Total

recognised

income and - - (11,363,369) - (187,829) (11,551,198)

expense for

the year

Share

options - - 39,510 (39,510) - -

lapsed

Share

options - - - 203,350 - 203,350

expense

=-----------------------------------------------------------------------------------

Balance at

31 December 718,834 15,665,928 (25,510,680) 13,403,158 (595,888) 3,681,352

2008

Currency - - - - (343,968) (343,968)

translation

=-----------------------------------------------------------------------------------

Net income

recognised - - - - (343,968) (343,968)

directly in

equity

Loss for

the year

ended - - (7,428,909) - - (7,428,909)

31 December

2009

=-----------------------------------------------------------------------------------

Total

recognised

income and - - (7,428,909) - (343,968) (7,772,877)

expense for

the year

Share

options - - 140,746 (189,657) - (48,911)

lapsed

Share

options - - - 98,689 - 98,689

expense

Issuance of

shares for 410,276 12,351,904 - - - 12,762,180

cash

Share issue - (517,989) - - - (517,989)

costs

=-----------------------------------------------------------------------------------

Balance at

31 December 1,129,110 27,499,843 (32,798,843) 13,312,190 (939,856) 8,202,444

2009

=-----------------------------------------------------------------------------------

Consolidated cash flow statement

For the years ended 31 December

2009 2008

Restated

USD USD

Operating activities

Loss for the year before and after tax (7,428,909) (11,363,369)

Adjustments:

Amortisation expense - intangible assets 33,929 21,791

Depreciation expense - property, plant and 654,224 613,029

equipment

Loss on disposal of property, plant and equipment 37,546 19,701

Finance income (19,048) (226,753)

Share based payments 49,778 203,350

Foreign exchange (64,025) 618,990

(Increase)/Decrease in inventories (106,800) 416,259

(Increase)/Decrease in accounts receivable (19,489) 393,189

Increase/(Decrease) in accounts payable 117,116 (225,972)

=------------------------------------------------------------------------------

Net cash flow used in operations (6,745,678) (9,529,785)

=------------------------------------------------------------------------------

Investing activities

Purchase of computer software (117) (116,467)

Purchase of property plant and equipment (44,680) (1,642,604)

Proceeds from sale of equipment 42,500 41,885

Purchase of assets held for sale - (39,562)

Loans issued - (93,316)

Loans repaid 48,557 53,360

Interest received 6,600 219,084

=------------------------------------------------------------------------------

Net cash used in investing activities 52,860 (1,577,620)

=------------------------------------------------------------------------------

Financing activities

Proceeds from issue of share capital 12,762,180 -

Issue costs (517,989) -

=------------------------------------------------------------------------------

Net cash from financing activities 12,244,191 -

=------------------------------------------------------------------------------

Net change in cash and cash equivalents 5,551,373 (11,107,405)

Cash and cash equivalents at beginning of the year 1,375,445 13,128,822

Effect of changes in foreign exchange rates (114,772) (645,972)

=------------------------------------------------------------------------------

Cash and cash equivalents at end of the year 6,812,046 1,375,445

=------------------------------------------------------------------------------

Notes:

1 Preparation of accounts

The financial information set out in this announcement does not constitute the

Company's statutory accounts for the years ended 31 December 2009 or 2008. The

statutory accounts for the year ended 31 December 2009 have been finalised on

the basis of the financial information presented by the directors in this

preliminary announcement.

The consolidated balance sheet at 31 December 2009, the consolidated income

statement, consolidated statement of changes in equity, consolidated cash flow

statement and associated notes for the year then ended have been extracted from

the Group's 2009 annual financial statements upon which the auditors' opinion is

unqualified.

2 Loss per share

Loss per share is calculated by reference to the loss for the year of USD

7,428,909 (2008 restated: USD 11,363,369) and the weighted number of shares in

issue during the year of 90,367,958 (2008: 71,883,433). There is no dilutive

effect of share options.

3 Selected accounting policies

Basis of preparation of financial statements

The financial information has been prepared on the historical cost basis and in

accordance with International Financial Reporting Standards (IFRSs and IFRIC

interpretations) as adopted by the European Union.

At 31 December 2009, the Company had cash and cash equivalents of USD 6.8

million and no borrowings. Based on a review of the Company's budgets, and given

cash flow plans and the flexibility to alter these to suit prevailing

circumstances, the Board considers this is sufficient to maintain the Company as

a going concern for a period of over twelve months from the date of signing the

annual report and accounts. Completion of a feasibility study and bringing the

project to production will require further funding.

Basis of consolidation

Where the Company has the power, either directly or indirectly, to govern the

financial and operating policies of another entity or business so as to obtain

benefits from its activities, that entity or business is classified as a

subsidiary. The consolidated financial statements present the results of the

Company and its subsidiaries as if they formed a single entity. Intercompany

transactions and balances between group companies are therefore eliminated in

full. As permitted by BVI law the Company has not presented its own financial

information.

The consolidated income statement for the year ended 31 December 2008

consolidated the results of Chaarat Gold Holdings Limited, Chaarat Gold Limited

and Chaarat Zaav CJSC for the whole year. The consolidated income statement for

the year ended 31 December 2009 consolidated the results of Chaarat Gold

Holdings Ltd, Chaarat Gold Limited and Chaarat Zaav CJSC for the whole year and

Chaarat Operating Company GmbH since its registration on 16 March 2009.

Mining exploration and development costs

During the exploration phase of operations, all costs are expensed in the Income

Statement as incurred.

A subsequent decision to develop a mine property within an area of interest is

based on the exploration results, an assessment of the commercial viability of

the property, the availability of financing and the existence of markets for the

product. Once the decision to proceed to development is made development and

other expenditures relating to the project are capitalised and carried at cost

with the intention that these will be depreciated by charges against earnings

from future mining operations over the relevant life of mine on a unit of

production basis.

4 Restatement of Administrative expenses - share options expense

On revisiting the fair value estimates of the share options management

identified that the share based payment charges were incorrectly scheduled and

as a result have reduced the period over which the share based payment is

charged to be the vesting period attached to options. As a result the years

ended 31 December 2007 and 2008 have been restated.

The effect of the restatement is detailed in the table below:

Original Restatement Restated

USD USD USD

2007

Income statement

Share option charges 163,306 2,191,460 2,354,766

Loss per share USD cents (11.2) (3.8) (15.0)

Balance sheet

Other reserves 11,048,357 2,190,961 13,239,318

Retained losses (11,995,860) (2,190,961) (14,186,821)

2008

Share option charges 752,345 (548,995) 203,350

Loss per share USD cents (16.6) 0.8 (15.8)

Balance sheet

Other reserves 11,782,189 1,620,969 13,403,158

Retained losses (23,889,711) (1,620,969) (25,510,680)

5 Timetable and distribution of accounts

The report and financial statements together with the Notice of AGM and Proxy

form will be despatched to shareholders on 4 June 2010 and the Annual General

Meeting will be held at 14:00 on 30 June 2010 at the offices of the Company's

Nominated Adviser, Westhouse Securities Limited, One Angel Court, London, EC2R

7HJ.

Additional copies of the Annual Report and Accounts, Notice of AGM and Proxy

form will be available, free of charge, from Central Asia Services Limited, 6

Conduit Street, London, W1S 2XE, for a period of 14 days from the date of

posting and will be made available on the Company's website - www.chaarat.com.

Enquiries:

Chaarat Gold Holdings Ltd

c/o Central Asia Services Ltd +44 (0) 20 7499 2612

Dekel Golan dekel@chaarat.com <mailto:dekel@chaarat.com>

Linda Naylor linda.naylor@chaarat.com

<mailto:linda.naylor@chaarat.com>

Westhouse Securities Limited +44 (0) 20 7601 6100

Tim Feather tim.feather@westhousesecurities.com

<mailto:tim.feather@westhousesecurities.com>

Richard Baty richard.baty@westhousesecurities.com

<mailto:richard.baty@westhousesecurities.com>

Mirabaud Securities LLP +44 (0) 20 7321 2508

Rory Scott rory.scott@mirabaud.com

<mailto:rory.scott@mirabaud.com>

Smith's Corporate Advisory +44 (0) 20 7239 0140

Dominic Palmer-Tomkinson tomkinson@smiths-ca.com

<mailto:tomkinson@smiths-ca.com>

Conduit PR +44 (0) 20 7429 6603

Jos Simson jos@conduitpr.com <mailto:jos@conduitpr.com>

Emily Fenton emily@conduitpr.com <mailto:emily@conduitpr.com>

Chaarat

Chaarat is an exploration and development company operating in the Kyrgyz

Republic with its current main activity being the development of the Chaarat

Gold Project. The Chaarat Gold Project is situated within the Middle Tien Shan

Mountains of Kyrgyzstan which form part of the Tien Shan gold belt. The Company

has thus far delineated a JORC compliant mineral resource of 4.009 Moz at a

grade of 4.14 g/t gold. A scoping study demonstrating the economic viability of

the Chaarat Gold Project was completed at the end of 2008. The Company is

currently in the process of compiling a pre-feasibility study. Chaarat's

objective is to become a low cost gold producer targeting an initial production

of over 200,000 ounces per annum by early 2013.

Disclaimer

This press release includes forward-looking statements. Such forward-looking

statements involve known and unknown risks, uncertainties and other important

factors beyond Chaarat's control that would cause the actual results,

performance or achievements of Chaarat to be materially different from future

results, performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are based on

numerous assumptions regarding Chaarat's present and future business strategies

and the environment in which Chaarat will operate in the future. Any

forward-looking statements speak only as at the date of this document. Chaarat

expressly disclaims any obligation or undertaking to disseminate any updates or

revisions to any forward-looking statements contained in this document to

reflect any change in Chaarat's expectations with regard to these or any change

in events, conditions or circumstances on which any such statements are based.

As a result of these factors, the events described in the forward-looking

statements in this press release may not occur either partially or at all.

[HUG#1417458]

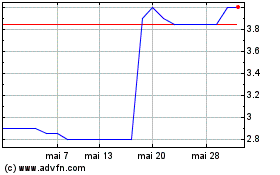

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024