Proposed Acquisition of Kyrex Limited

21 Junho 2010 - 3:01AM

UK Regulatory

TIDMCGH

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

Proposed Acquisition of Kyrex Limited

Road Town, Tortola, British Virgin Islands (21 June 2010)

Chaarat Gold Holdings Limited (AIM: CGH), announces that it will today post an

offer document in relation to the proposed share for share acquisition of Kyrex

Limited ("Kyrex") (the "Offer").

Kyrex

Kyrex is a private exploration company, incorporated in Guernsey, with four

large licence areas in the north west of the Kyrgyz Republic.

The three most prospective assets are Chontash, Mironovskoye and Kyzil Ompul.

The proposed acquisition provides an opportunity to add exploration projects to

the Chaarat portfolio whilst developing the Chaarat gold project, the Company's

principal asset, towards production.

Further details of the three most prospective assets are set out below:

Chontash

Chontash is a skarn molybdenum-gold-copper deposit which contains potential for

a large scale copper gold porphyry deposit.

The licence has been held by Kyrex's subsidiary since 2006. Significant

exploration was undertaken in 2007/08, comprising 12 drill holes totalling over

2,800m and extensive trenching.

In July 2008 SRK Consulting Zimbabwe undertook an exploration property review in

which it established a resource estimate, classifying 3.2 million tonnes at a

grade of 0.223% molybdenum (Mo) in the Inferred category under the JORC

standard, and recommended further exploration work be undertaken on the

property. While Chontash has been identified as a molybdenum skarn, the

Soviet-era drilling results indicate some potential for significant copper

values to the east of the licence area. This potential has been verified by

geophysical works as well as a number of drill holes which, when penetrating the

skarn, showed gold and copper values. On a regional scale, Chontash appears to

be at the southern end of a metallogenic belt of large porphyry copper deposits

including Almalyk in Uzbekistan.

Mironovskoye

Mironovskoye is a gold-silver-copper deposit with a strike length of 1.4 km.

The deposit was extensively explored during the Soviet-era by driving adits and

drifts, with 5 km of underground development being completed in total. The main

economic minerals were identified as copper, gold and silver.

Work undertaken by Kyrex indicates that the resource model may have been based

on bismuth cut-offs and a grade of 1.2% Cu and 1.7g/t Au could be estimated for

a similar tonnage. Mironovskoye is easily accessible and infrastructure is in

place with the previously operating gold mine of Taldy Bulak only 30 km to the

southwest.

Kyzil Ompul

Kyzil Ompul is an early stage licence area in which a number of small gold,

copper, molybdenum, lead and uranium deposits have been delineated by Soviet

geological teams. To date Kyrex's exploration has been relatively limited and

has focused on base and precious metal prospects previously identified. This

has comprised geophysical surveys (IP and magnetic) and trenching and sampling

to confirm the Soviet-era data. Chaarat believes that Kyzil Ompul, which means

"red hill" in the local language, has reasonable prospectivity for an IOCG (Iron

Oxide Copper Gold) type deposit. Future programmes will focus on regional

target generation including GIS compilation and interpretation of all data and

regional aeromagnetic surveys in order to produce targets for additional

exploration.

No significant mineral potential has been defined to date in Kyrex's fourth

licence area, Severochontashskaya, where expenditure has been minimal.

Details of the Offer

The terms of the Offer were derived from an independent relative technical

valuation of the material mineral assets of Chaarat and Kyrex undertaken by SRK

Consulting (UK) Limited ("SRK"). The Company commissioned the valuation as part

of its due diligence process.

The Offer comprises 54 fully paid Chaarat ordinary shares of US$0.01 each (the

"Shares") for each Kyrex share. Assuming Chaarat acquires the whole of the

issued and to be issued share capital of Kyrex, the aggregate consideration will

comprise 11,928,222 Shares, equating to 10.56 per cent. of the Company's current

issued share capital.

The Offer will remain open for 15 business days from 22 June 2010. Provided

acceptances have been received from shareholders representing at least 75 per

cent. of the issued share capital of Kyrex, the drag along provisions in the

articles of association of Kyrex will enable Chaarat to acquire the remainder of

the issued and to be issued Kyrex shares.

Chaarat has received irrevocable undertakings to accept the Offer from

shareholders holding 122,556 Kyrex shares, representing 58.5 per cent. of

Kyrex's issued share capital.

Pursuant to the subscription agreement dated 10 July 2009 between Chaarat and

China Nonferrous Metals Int'l Mining Co Ltd ("CNMIM"), Chaarat is required to

give notice to CNMIM if it intends to issue any Chaarat shares for cash or non

cash consideration. CNMIM may within 15 business days of receipt of the notice

give written notice to require Chaarat to issue such number of Chaarat shares to

CNMIM on the same terms as the Offer, as is necessary to maintain the percentage

holding of CNMIM prior to the Offer, being 19.9 per cent. The required notice

has been sent to CNMIM and the price at which CNMIM will be required to

subscribe for the shares is the mid-market closing price on 18 June 2010 of

40.5p per share.

Related Party Disclosure

Christopher Palmer-Tomkinson, Dekel Golan and Alexander Novak, who are directors

of Chaarat, are also directors and shareholders of Kyrex, holding interests of

6.5, 28.0 and 24.0 per cent. of the issued share capital respectively. In

addition, Luo Tao and David Tang are not considered independent of the

transaction by virtue of CNMIM's right to subscribe for additional equity in the

Company in order to maintain its level of shareholding.

The Offer therefore constitutes a related party transaction in accordance with

Rule 13 of the AIM Rule for Companies. The independent directors (being Linda

Naylor and Oliver Greene), having consulted with the Company's nominated

adviser, Westhouse Securities Limited, consider that the terms of the Offer are

fair and reasonable insofar as Chaarat shareholders are concerned.

Potential changes to Directors' Interests

Provided the Offer is completed, Christopher Palmer-Tomkinson, Dekel Golan and

Alexander Novak will each receive Shares as consideration for their interests in

Kyrex. On completion of the transaction, the following changes would occur to

their respective shareholdings:

Previous Consideration Total Percentage of

Shares Shares Shares Company's

Enlarged Issued

Share Capital

Christopher Palmer-Tomkinson 6,675,000 736,344 7,411,344 5.94

Dekel Golan 11,554,033 3,166,722 14,720,755 11.79

Alexander Novak 8,960,400 2,714,958 11,675,358 9.35

On completion, and assuming full acceptance, of the Offer, the Company will have

a total of 124,839,225 Shares in issue excluding any Shares to be issued to

CNMIM pursuant to its option the terms of which are set out above.

Competent Person

Sunit Patel, M.Sc (Geology) FGS, GSSA, who is an employee of Chaarat and is an

exploration geologist with 22 years of experience in the resource industry, has

reviewed and approved the information in this announcement.

Enquiries:

Chaarat Gold Holdings Ltd

c/o Central Asia Services Ltd +44 (0) 20 7499 2612

Dekel Golan dekel@chaarat.com

Linda Naylor linda.naylor@chaarat.com

Westhouse Securities Limited +44 (0) 20 7601 6100

Tim Feather tim.feather@westhousesecurities.com

Richard Baty richard.baty@westhousesecurities.com

Mirabaud Securities LLP +44 (0) 20 7321 2508

Rory Scott rory.scott@mirabaud.com

Smith's Corporate Advisory +44 (0) 20 7239 0140

Dominic Palmer-Tomkinson tomkinson@smiths-ca.com

Conduit PR +44 (0) 20 7429 6603

Jos Simson jos@conduitpr.com

Emily Fenton emily@conduitpr.com

Chaarat

Chaarat is an exploration and development company operating in the Kyrgyz

Republic with its current main activity being the development of the Chaarat

Gold Project. The Chaarat Gold Project is situated within the Middle Tien Shan

Mountains of Kyrgyzstan which form part of the Tien Shan gold belt. The Company

has thus far delineated a JORC compliant mineral resource of 4.009 Moz at a

grade of 4.14 g/t gold. A scoping study demonstrating the economic viability of

the Chaarat Gold Project was completed at the end of 2008. The Company is

currently in the process of compiling a pre-feasibility study. Chaarat's

objective is to become a low cost gold producer targeting an initial production

of over 200,000 ounces per annum by early 2013.

Disclaimer

This press release includes forward-looking statements. Such forward-looking

statements involve known and unknown risks, uncertainties and other important

factors beyond Chaarat's control that would cause the actual results,

performance or achievements of Chaarat to be materially different from future

results, performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are based on

numerous assumptions regarding Chaarat's present and future business strategies

and the environment in which Chaarat will operate in the future. Any

forward-looking statements speak only as at the date of this document. Chaarat

expressly disclaims any obligation or undertaking to disseminate any updates or

revisions to any forward-looking statements contained in this document to

reflect any change in Chaarat's expectations with regard to these or any change

in events, conditions or circumstances on which any such statements are based.

As a result of these factors, the events described in the forward-looking

statements in this press release may not occur either partially or at all.

[HUG#1425522]

This announcement is distributed by Thomson Reuters on behalf of Thomson Reuters clients.

The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and other applicable laws; and

(ii) they are solely responsible for the content, accuracy and originality of the information contained therein.

All reproduction for further distribution is prohibited.

Source: Chaarat Gold Holdings Ltd via Thomson Reuters ONE

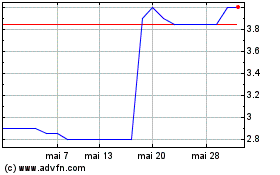

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024