TIDMCGH

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

RESULTS OF PRE-FEASIBILITY STUDY

Road Town, Tortola, British Virgin Islands (30 June 2011)

Chaarat Gold Holdings Limited (AIM - CGH), the AIM quoted exploration and

development company with assets in the Kyrgyz Republic, is pleased to announce

the results of an encouraging Pre-Feasibility Study ("PFS") for the explored

section of its 100% owned Chaarat gold Project (the "Project") located in

Western Kyrgyzstan.

HIGHLIGHTS

* Mine life estimated on current resources of 13 years

* Mine has the potential to produce in excess of 200,000 ounces per annum in

full production

* Cash operating cost estimated at $501*/ounce

* all figures in United States dollars, unless otherwise noted

Dekel Golan, CEO of Chaarat, commented: "The prefeasibility study is a

substantial milestone in the long process of unlocking the value of the Chaarat

deposit, and demonstrates the robustness of the project and points the way to

its development. Furthermore the Company remains enthusiastic that these

positive results can be significantly improved with more work which can increase

the resource and reserve base and reduce costs.

"The Company is currently in the process of building an early stage production

unit for the Tulkubash project with the objective of eliminating a lot of the

uncertainty related to the infrastructure status of the project and easing

concerns related to the perception of doing business in the Kyrgyz Republic.

The Company is comfortable that the fundraising completed earlier this year

will be sufficient to build the Tulkubash project and that additional equity

finance will not be required for this phase."

Further information about the Company:

Chaarat Gold Holdings Limited +44 (0) 20 7499 2612

c/o Central Asia Services Limited

Dekel Golan - CEO dekel@chaarat.com

Linda Naylor - Finance Director linda.naylor@chaarat.com

Westhouse Securities Limited +44 (0) 20 7601 6100

Tim Feather tim.feather@westhousesecurities.com

Richard Baty richard.baty@westhousesecurities.com

Bankside Consultants +44 (0) 20 7367 8888

Simon Rothschild simon.rothschild@bankside.com

PRE-FEASIBILITY STUDY

The prefeasibility study was compiled by SNC-Lavalin South Africa (Pty) Ltd in

conjunction with Chaarat employees in the Kyrgyz Republic and in the UK.

The operation described in the PFS is based initially on open pit followed by

underground mining, milling of the ore and its preparation for gold leaching by

pressure oxidation technology. The gold will be leached via a Carbon-in-Leach

("CIL") extraction circuit. The mine will operate at an average production rate

of 1.718 Mt of ore per annum after a commissioning period of six months. Over

the 13 years life of mine production will average about 202,000 ounces of gold

annually at a cash operating cost estimated at $501/ounce.

The financial analysis has been based on a gold price of $1,250/ounce which

reflects a lower price than current market value. No allowance has been made

for inflation or escalation. The discount rate used was 8%.

OPERATING HIGHLIGHTS OF THE PROJECT

Project Performance[1]

+-----------------------------------------+-----------+

| Production Data | |

+-----------------------------------------+-----------+

| Life of Mine | 13 years |

+-----------------------------------------+-----------+

| Annual plant throughput | 1.78Mt |

+-----------------------------------------+-----------+

| Metallurgical recovery Au | 92% |

+-----------------------------------------+-----------+

| Average annual gold production | 202,000oz |

| | |

+-----------------------------------------+-----------+

| Total gold produced | 2.48Moz |

+-----------------------------------------+-----------+

| Operating Costs/ Tonne Ore | |

| | |

+-----------------------------------------+-----------+

| Mining | $41.17/t |

+-----------------------------------------+-----------+

| Processing | $16.13/t |

+-----------------------------------------+-----------+

| Tailings treatment | $0.90/t |

+-----------------------------------------+-----------+

| G&A | $1.50/t |

+-----------------------------------------+-----------+

| Total Operating Cost/Tonne Ore | $59.70/t |

+-----------------------------------------+-----------+

| Cash Operating Costs/Ounce Ore | $527/oz |

+-----------------------------------------+-----------+

| Silver credit not included in cash cost | $26/oz |

+-----------------------------------------+-----------+

| | |

+-----------------------------------------+-----------+

| Capital Cost | |

+-----------------------------------------+-----------+

| Initial investment capital | $473.7M |

+-----------------------------------------+-----------+

| | |

+-----------------------------------------+-----------+

| | |

+-----------------------------------------+-----------+

| Economics @ $1,250/oz Au After Tax | |

+-----------------------------------------+-----------+

| Net Present Value After Tax @ 0% | $980M |

+-----------------------------------------+-----------+

| Net Present Value After Tax @ 8% | $354M |

+-----------------------------------------+-----------+

| Internal Rate of Return After Tax | 18.0% |

+-----------------------------------------+-----------+

| Pay back | 4 years |

+-----------------------------------------+-----------+

1. For the purpose of this study and in light of the spatial distribution of

different types of resource, a certain proportion of inferred resource was

included in the economic calculation but was not included in the reserve

calculation.

CAPITAL COSTS

Capital costs for the mine infrastructure, on-site process plant, mining

operations development and other related items have been estimated using

construction data from recently completed projects in the region and are based

on quotes from reliable suppliers. Mining costs include pre-stripping of the

open pit in preparation for production. Underground costs include portal and

access development. Quotations for infrastructure facilities, such as power and

the access road, were received from competent suppliers familiar with working in

the region. Equipment costs have mostly been based on budgetary quotations

received with an appropriate indexation of piping, electricity and metal-works

elements.

Investment Capital Cost Estimate

The investment capital cost below includes mine infrastructure during the first

year of operation. The initial capital requirement is reduced due to the

availability of operational income.

+-----------------------+------------------------+

| Category | Prefeasibility Results |

+-----------------------+------------------------+

| | |

+-----------------------+------------------------+

| Mining pre production | $51,336,000 |

+-----------------------+------------------------+

| Site Development | $48,000,000 |

+-----------------------+------------------------+

| Process Plant | $309,595,000 |

+-----------------------+------------------------+

| Infrastructure | $60,008,000 |

+-----------------------+------------------------+

| Tailings Disposal | $2,325,000 |

+-----------------------+------------------------+

| Owner's Costs | $21,047,000 |

+-----------------------+------------------------+

| Contingency | $42,094,000 |

+-----------------------+------------------------+

| Total | $534,405,000 |

+-----------------------+------------------------+

FINANCIAL ANALYSIS

The financial analysis of the Project uses a discounted cashflow model

incorporating the mine production schedule, estimated capital and operating

costs and local tax and royalty as are currently applied in the Kyrgyz Republic.

The financial analysis has been based on a gold price of $1,250/oz which

reflects a lower price than current market value. No allowance has been made

for inflation or escalation.

Chaarat Gold Project Financial Analysis Summary

+-----------------------------------+-----------------+

| Project Data | Estimated Value |

+-----------------------------------+-----------------+

| | |

+-----------------------------------+-----------------+

| Life of Mine | 13 years |

+-----------------------------------+-----------------+

| Total gold produced | 2.48Moz |

+-----------------------------------+-----------------+

| Total ore mined | 21.9Mt |

+-----------------------------------+-----------------+

| Initial project capital cost | $473.7M |

+-----------------------------------+-----------------+

| Cash Operating Cost (years 2-11) | $501/oz |

+-----------------------------------+-----------------+

| Base Case Gold Price | $1,250/oz |

+-----------------------------------+-----------------+

| After Tax Net Present Value @ 8% | $354M |

+-----------------------------------+-----------------+

| After Tax Internal rate of Return | 18.0% |

+-----------------------------------+-----------------+

Gold Price Sensitivity Analysis

+---------------+--------+--------+---------+

| Gold Price/oz | $1,000 | $1,250 | $1,500 |

+---------------+--------+--------+---------+

| NPV @ 0% | $481 M | $980M | $1,495M |

+---------------+--------+--------+---------+

| NPV @ 8% | $60M | $354M | $660M |

+---------------+--------+--------+---------+

| IRR | 9.8% | 18% | 25.5% |

+---------------+--------+--------+---------+

PROJECT OVERVIEW

Deposit

The Chaarat deposit (the "Deposit") is a sediment-hosted, intrusion-related,

structurally controlled deposit, located in the Tien Shan belt of Kyrgyzstan.

The Chaarat Project is located in a mountainous area along the Sandalash River

valley, on the western border of Kyrgyzstan. The valley marks the north-

easterly trending hinge zone of an anticline, the north-western limb of which

consists of a sequence of Upper Proterozoic and Cambrian-Ordovician

siliciclastic rocks - the Chaarat formation, which dips at around 50(0)

northwest hosts the Chaarat mineralisation. The formation comprises greywacke,

sandstone with siltstone, shale, rhythmically bedded siltstone and black shale

with limestone lenses and an upper tillite.

The gold mineralisation in Chaarat is defined as "deep epithermal" due to the

"epithermal" element suite - Au, Ag, Sb and As, typical of those found in

similar deposits within the Tien Shan belt. Mineralisation is associated with a

series of sericiticaly altered sulphide rich lodes, within a quartzitic and

shale rich meta-sedimentary succession. The lodes occur in three mineralised

structures; the Main Zone, the Contact Zone and the Tulkubash Zone. The

mineralised zones are generally developed sub-parallel to the strike and dip at

between 45 and 90 degrees. The gold mineralisation is associated with Ag and As

mineralisation.

RESOURCE ESTIMATION

The resource estimate announced on 7 February 2011 was compiled from all core

drill holes completed on 10 sub-project areas at Chaarat to date. The 282 holes

(totalling 57,677 m) included in the resource estimate were drilled on the three

sub-parallel zones of mineralisation at Chaarat, the Main, the Contact and the

Tulkubash Zones, which are characterised by mineralisation up to 37 metres wide

and dipping at 45 to 90 degrees to the northwest. In all project areas the

mineralisation remains open down dip, and on the majority, also along strike.

The bulk of mineralisation has been delineated in three clusters; the Contact

project cluster 2,093,000oz the Main Zone cluster (projects M2400, M3000, M3400

and M3900 totalling 1,734,000oz) and the Tulkubash zone (321,000oz).

The resource database contains 56,458 gold assay records from surface, adit and

drill-core samples. In addition, Wardell Armstrong International ("WAI") has

reviewed 4,027 umpire assays, 1,328 results of reference materials and 2,450

blanks sent to three laboratories and concluded that the quality and quantity of

data are sufficient to support the Mineral Resource estimates reported.

Samples were prepared and assayed at the Stewart Group laboratories in Bishkek.

Analysis for gold was done on sawn half core samples using fire assay methods.

Standard reference materials, blank and field duplicate samples were inserted

prior to shipment from site to monitor the quality control of the assay data.

The resource estimate was made from a 3D block model utilising commercial mine

planning software. Mineralised shells were generated using a cut off gold grade

of 2 g/t. The grade interpolation estimated values for gold using ordinary

kriging.

Mineral Resources

+----------------+-------------+--------------+-------------+

| Classification | Tonnes '000 | Grade g/t Au | Ounces '000 |

+----------------+-------------+--------------+-------------+

| Indicated | 13,238 | 4.30 | 1,841 |

+----------------+-------------+--------------+-------------+

| Inferred | 19,190 | 4.20 | 2,565 |

+----------------+-------------+--------------+-------------+

| Total | 32,428 | 4.20 | 4,406 |

+----------------+-------------+--------------+-------------+

1. Mineral resources at the Chaarat Project are reported at 2 g/t Au cut-off

grade.

2. The contained gold represents estimated contained metal in the ground and has

not been adjusted for the metallurgical recoveries of gold.

3. Sunit Patel, M.Sc. (Geology), FGS, GSSA, who is an employee of Chaarat is the

qualified person responsible for the Chaarat mineral resource estimate.

Reserve and Resource Estimation

A&B Global Mining, a South African firm specialising in mine design and reserve

evaluation, were retained to prepare the reserve estimation for the project. In

certain areas of the mineralised body the Indicated and Inferred resources were

spatially organised in such a way that the mine design had to include some of

the 60% of the inferred resource as mineable material. No inferred resource was

included in the Probable reserve, but the mineable portion of the inferred

resource was included in the economic analysis of the Project.

The mine design, reserve estimate, mining costs and mining fleet requirements

for the project were prepared by A&B Global Mining.

Reserve Statement of the Chaarat project

+---------------------------------------------+------+------+----+------+------+

|Classification |Tonnes| Grade| Au| Grade|Ag Moz|

| | '000|g/t Au| Moz|g/t Ag| |

+---------------------------------------------+------+------+----+------+------+

|Probable Reserve |12,555| 4.02|1.62| 12.66| 5.11|

+---------------------------------------------+------+------+----+------+------+

|Mineable Inferred Resource |11,658| 3.54|1.33| 10.01| 3.75|

+---------------------------------------------+------+------+----+------+------+

|Material considered mineable (Probable |24,213| 3.78|2.95| 11.38| 8.86|

|reserve and inferred resource) | | | | | |

+---------------------------------------------+------+------+----+------+------+

1. The open pit cutoff grade to economic limits has been calculated dynamically

by the open pit optimisation software (Datamine NPVS) and for underground 2.41

g/t for cut and fill and 2.29 g/t for sub level open stoping (SLOS) mining

method is used. The gold price is assumed to be $1,200/ounce.

2. The reserves evaluation for the open pit and the underground project is

scheduled with all resources, and the reserve statement and reserve evaluation

was undertaken in accordance with NI43-101 guidelines.

MINING

The mine would be operated as both open pit and underground mining operations to

achieve the designed rate of 4,000-5,000 tonnes per day.

Open pit

The open pit mine is designed for conventional multiple open pit operations

using 40t dump trucks with 90/35t class excavators for a five year Life of Mine

(LOM) to produce at a peak mining rate of 48Mt of material and 1.69Mt of ore per

year with production starting from year one. Waste rock will be hauled to a

dedicated waste dump adjacent to the open pit. Ore will be transported to the

plant through aerial ropeway and trucks on an ongoing basis.

Underground

The deeper extension of the ore bodies at Kiziltash below the economic pit

limits would be mined by underground mining operations to produce approximately

17Mt of 15 year LOM. This will involve approximately 120,000 metres of waste

development and 12,000 metres of ore development. The total waste handling

would be just over 9Mt.

Drilling will be done with fully mechanised twin and single boom jumbo drill

rigs. Loading and hauling will be done by LHD loading (3t/5t) and dump truck

hauling (20t).

Mining rate and grade

The mine design was generated in order to maximise the minable material. It has

been recognised however, by SNC Lavalin as well as the Company, that it would be

beneficial to change the ROM grade at the expense of LOM. A&B Global estimate

that the re-design of the mine will reduce the LOM (based on known resource)

from 16 to 13 years, but that the resulting grade will be 3.85g/t as against

3.51g/t in the maximised version. The lower LOM with higher grade scenario was

used by the Company in the financial models.

Metallurgy

Extensive metallurgical testwork has defined that the most effective gold

recovery process for Chaarat is whole ore pressure oxidation followed by

cyanidation to produce gold and silver doré. Overall gold recovery using this

process has been estimated at 92%. Based on these design criteria a

conventional crushing, screening and grinding circuit has been designed using

three stages of crushing followed by a ball mill. The milled material after

treatment for pH adjustment and pre heating is fed into an autoclave where it is

heated under pressure in the presence of oxygen to oxidise the sulphidic

minerals. The oxidised material is fed into a CIL battery of tanks where it is

stripped of gold. Tailings from the CIL circuit will be detoxified prior to

disposal in a conventional tailings dam.

The plant will be operated continuously with a planned throughput of 1,850,000t

per year. Annual gold production will average approximately 202,000oz with a

total of 2.48Moz of gold to be recovered over the life of the mine. Doré

produced on site will be sold for further refining.

In order to reduce the technological risk, initially or in general, it is

possible to add a flotation circuit and process the flotation concentrate by the

same POX method. The gold recovery from the concentrate will improve to 95% but

as the gold collection to the concentrate will only be 86%-90%, the overall gold

recovery was conservatively estimated to be 82% for this scenario. This

alternative was not evaluated at the same level of detail as the whole ore

treatment.

Infrastructure

Access Road

The Chaarat deposit licence area is situated in the Sandalash River valley in

the north west of Kyrgyzstan. The only existing road access was constructed by

Soviet Geological Survey teams in the early 1970's. This access road starts in

the Chatkal Valley some 23km north of the village Kanysh-Kiya and routes over

the Kumbel Pass at 3,250 metres to the Sandalash Valley, a road distance of

approximately 30km.

A review of the upgrade of the access road, carried out by local company ECO-

Service, has indicated that this original route can be followed and developed

with expansion of the hairpin radii and adjustment to the incline angles in

several areas. The cost of upgrading the road has been included in the capital

cost of the project.

Power Supply

Two main options exist for supplying the required estimate of 25MW external

power supply to the Project. Both involve the construction of a 110kV power

line. One option is to construct a power line from the Kristal substation

through the Chatkal Ridge, a distance of some 160km. The other option is to

connect to the northern part of the Kyrgyz Republic grid near the town of

Kirovka. The Company has already been granted a power quota from the Kristal

location, but as a result of changes in the organisation of the national grid

organisation, the northern line towards Kirovka is a cheaper and better option.

Both options require the construction of a 20 km 110KVA power line from the

Chatkal valley road to the deposit as well as a distribution network (for mine,

plant, camps, etc.) as well as backup generating system. The contract for this

line, which is the main construction challenge, as well as the backup generating

unit and internal distribution is currently being negotiated and their

construction will commence immediately on signing of the contract.

It should be noted that the option of a power line from Kirovka was not included

in the PFS work.

Operating Costs

Life of mine operating cost is estimated to be $59.70 per tonne of ore mined,

excluding production royalties. This cost leads to a cash cost of production of

$501 per oz of gold produced (assuming $26 credit from silver production) for

the whole ore processing solution. The numbers include mining, processing,

tailings treatment and general and administrative costs.

Risk Analysis

Risk management on all projects and studies is a critical aspect of project

management. SNC-Lavalin recognises the significance of analysing risks and

opportunities and providing mitigation strategies on an ongoing basis,

particularly the risks associated with operating technically advanced circuits

in remote locations.

In light of this, SNC-Lavalin provided strong input into the process flowsheet

development. The design of the plant was carefully considered to minimise any

unnecessary risks. In light of this, the flowsheet is considered to be

commercially proven technology. All the primary process units are considered to

be low risk.

Next steps

In early 2011 the Company raised a total of $80 million (net) which will enable

it to commence the construction of certain elements of the infrastructure and a

small capacity mine to treat the free milling segment of the ore. The Company

is actively pursuing the strategy of construction of the smaller Tulkubash

Project. At the same time significant exploration effort, as well as

engineering work, is focused on finding ways to improve the NPV and IRR of the

project as a whole.

NOTES

This report combines the input from different sources. The aspects related to

the processing plant capital and operating costs have been estimated by SNC-

Lavalin South Africa (Pty) Ltd office.

The aspects related to reserve calculation and the associated capital and

operating costs have been estimated by A&B Global Mining.

The resource estimate on which the work was based is the resource estimation

prepared by Wardell Armstrong International which was announced on 7 February

2011.

The financial analysis to generate net present value, internal rate of return

and tax calculations was carried out by the Company.

SNC-Lavalin South Africa (Pty) Ltd, incorporated the infrastructure design,

capital and operating costs into the PFS. The resource calculation was done by

Wardell Armstrong International.

About Chaarat Gold

Chaarat Gold is an exploration and development company operating in the Kyrgyz

Republic. The Company's main activity is the development of the Kiziltash and

Tulkubash projects situated within the Middle Tien Shan Mountains of Kyrgyzstan,

which form part of the Tien Shan gold belt. The Company has delineated a JORC

compliant mineral resource of 4.406Moz at a grade of 4.20g/t gold across both

projects. Chaarat's key objective is to become a low cost gold producer; with

initial production from the Tulkubash project, targeting annual production of

over 200,000 ounces per annum as the Kiziltash project comes on stream.

www.chaarat.com

Disclaimer

This press release includes forward-looking statements. Such forward-looking

statements involve known and unknown risks, uncertainties and other important

factors beyond Chaarat's control that would cause the actual results,

performance or achievements of Chaarat to be materially different from future

results, performance or achievements expressed or implied by such forward-

looking statements. Such forward-looking statements are based on numerous

assumptions regarding Chaarat's present and future business strategies and the

environment in which Chaarat will operate in the future. Any forward-looking

statements speak only as at the date of this document. Chaarat expressly

disclaims any obligation or undertaking to disseminate any updates or revisions

to any forward-looking statements contained in this document to reflect any

change in Chaarat's expectations with regard to these or any change in events,

conditions or circumstances on which any such statements are based. As a result

of these factors, the events described in the forward-looking statements in this

press release may not occur either partially or at all.

Glossary of Technical Terms

"assay" qualitative or quantitative analysis of a metal or ore to

determine its components

"Ag" chemical symbol for silver

"As" chemical symbol for arsenic

"Au" chemical symbol for gold

"CIL" Carbon-in-Leach

"cut-off grade" the lowest grade value that is included in a resource

statement. It must comply with JORC requirement 19:

"reasonable prospects for eventual economic extraction" the

lowest grade, or quality, of mineralised material that

qualifies as economically mineable and available in a given

deposit. It may be defined on the basis of economic

evaluation, or on physical or chemical attributes that

define an acceptable product specification

"Inferred Resource" that part of a Mineral Resource for which tonnage, grade

and mineral content can be estimated with a low level of

confidence. It is inferred from geological evidence and

assumed but not verified geological and/or grade

continuity. It is based on information gathered through

appropriate techniques from locations such as outcrops,

trenches, pits, workings and drill holes which may be

limited or of uncertain quality and reliability

"Indicated Resource" that part of a Mineral Resource for which tonnage,

densities, shape, physical characteristics, grade and

mineral content can be estimated with a reasonable level of

confidence. It is based on exploration, sampling and

testing information gathered through appropriate techniques

from locations such as outcrops, trenches, pits, workings

and drill holes. The locations are too widely or

inappropriately spaced to confirm geological and/or grade

continuity but are spaced closely enough for continuity to

be assumed

"JORC" The Australasian Joint Ore Reserves Committee Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves, 2004 (the "JORC Code" or "the Code"). The Code

sets out minimum standards, recommendations and guidelines

for Public Reporting in Australasia of Exploration Results,

Mineral Resources and Ore Reserves

"kriging" an inverse distance weighting technique where weights are

selected via the variogram according to the samples'

distance and direction from the point of estimation. The

weights are not only derived from the distance between

samples and the block to be estimated, but also the

distance between the samples themselves. The kriging

estimates are controlled by the variogram parameters which

are interpreted from the data

"Measured Resource" that part of a Mineral Resource for which tonnage,

densities, shape, physical characteristics, grade and

mineral content can be estimated with a high level of

confidence. It is based on detailed and reliable

exploration, sampling and testing information gathered

through appropriate techniques from locations such as

outcrops, trenches, pits, workings and drill holes. The

locations are spaced closely enough to confirm geological

and grade continuity

"Mineral Resource" a concentration or occurrence of material of intrinsic

economic interest in or on the Earth's crust in such form,

quality and quantity that there are reasonable prospects

for eventual economic extraction. The location, quantity,

grade, geological characteristics and continuity of a

Mineral Resource are known, estimated or interpreted from

specific geological evidence and knowledge. Mineral

Resources are sub-divided, in order of increasing

geological confidence, into Inferred, Indicated and

Measured categories when reporting under JORC

"Moz" million troy ounces

"Mt" million tonnes

"ordinary kriging" commonly used type of kriging which assumes a constant but

unknown grade

"oz" troy ounce (= 31.103477 grammes)

"Sb" the chemical symbol for antimony

"swath analysis" used to validate a block estimate by comparing a selected

block with a composite of the data in that block

"t" tonne (= 1 million grammes)

"variogram" a method of displaying and modelling the difference in

grade between two samples separated by a distance "h",

called the "lag" distance. It provides the mathematical

model of variability with distance and is used during

kriging

"wireframe" this is created by using triangulation to produce an

isometric projection of, for example, a rock type,

mineralisation envelope or an underground stope. Volumes

can be determined directly of each solid

This announcement is distributed by Thomson Reuters on behalf of

Thomson Reuters clients. The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the information contained therein.

Source: Chaarat Gold Holdings Ltd via Thomson Reuters ONE

[HUG#1527086]

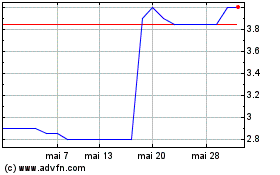

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024