TIDMCGH

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

UNAUDITED RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2011

Road Town, Tortola, British Virgin Islands (27 September 2011)

HIGHLIGHTS

* Progress in exploration and implementation of the Tulkubash project

throughout the period

* Work commenced on access road and power line

* Initial start up phases delineated: targeted production late 2012 early

2013 dependent on seasonal considerations

Dekel Golan, Chief Executive of Chaarat, commented:

"The Company has sustained progress with both exploration and on planning and

initiating the infrastructure for the mining operation; the proceeds of the

placing completed in February are starting to be deployed, whilst our resource

base continues to grow as expected.

"As we make the preparations for production, a particularly pleasing feature of

our exploration programme is the increasing predictability of the resource and

the continued high grades delineated."

For further information about the Company please contact:

Chaarat Gold Holdings Limited +44 (0) 20 7499 2612

c/o Central Asia Services Limited dekel@chaarat.com

Dekel Golan CEO linda.naylor@chaarat.com

Linda Naylor FD

Westhouse Securities Limited +44 (0) 20 7601 6100

Tom Price tom.price@westhousesecurities.com

Richard Baty richard.baty@westhousesecurities.com

Bankside Consultants +44 (0) 20 7367 8888

Simon Rothschild simon.rothschild@bankside.com

About Chaarat Gold

Chaarat Gold is an exploration and development company operating in the Kyrgyz

Republic. The Company's main activity is the development of the Kiziltash

Project (comprising the Contact Project and the Main Zone) and the Tulkubash

project situated within the Middle Tien Shan Mountains of Kyrgyzstan, which form

part of the Tien Shan gold belt. The Company has delineated a JORC compliant

mineral resource of 4.736Moz at a grade of 4.28g/t gold across both projects.

Chaarat's key objective is to become a low cost gold producer; with initial

production from the Tulkubash project, targeting combined annual production of

over 200,000 ounces per annum as the Kiziltash Project comes on stream.

Disclaimer

This press release includes forward-looking statements. Such forward-looking

statements involve known and unknown risks, uncertainties and other important

factors beyond Chaarat's control that would cause the actual results,

performance or achievements of Chaarat to be materially different from future

results, performance or achievements expressed or implied by such forward-

looking statements. Such forward-looking statements are based on numerous

assumptions regarding Chaarat's present and future business strategies and the

environment in which Chaarat will operate in the future. Any forward-looking

statements speak only as at the date of this document. Chaarat expressly

disclaims any obligation or undertaking to disseminate any updates or revisions

to any forward-looking statements contained in this document to reflect any

change in Chaarat's expectations with regard to these or any change in events,

conditions or circumstances on which any such statements are based. As a result

of these factors, the events described in the forward-looking statements in this

press release may not occur either partially or at all.

Operational Review

During the period the Company has started the implementation of the Tulkubash

project, the first part of the Chaarat project to be brought into production,

and continued its exploration activities elsewhere on both the Chaarat project

and on other projects within its portfolio of assets. The early stages of the

implementation of the Tulkubash project have primarily involved the

organisation and infrastructure aspects, such as the negotiation and signing of

contracts for the access road, power line and work camps.

Infill drilling at the Tulkubash open pit section has continued in order to

provide further data for the preparation of a detailed mining plan and to enable

the inclusion in our resources of lower grade ore at between 1 and 2 g/t. This

change to the cut off grade will increase the open pit resource of the Central

Tulkubash Zone significantly as well as reducing the strip ratio. The inclusion

of recent drill results in the resource estimate and refining the pit design

should improve the economics of the project by further reducing the strip ratio

and improving grade. An updated resource estimate will be announced as soon as

is practicable. Encouraging exploration results from the deeper underground

zones confirm that underground mining will take precedence over open pit

operations in mine planning.

The Engineering, Procurement, Construction Management ("EPCM") phase of the

Tulkubash project implementation is well underway. The Company will manage the

project. Progress with permitting, engineering and construction is described

below. The Company is actively recruiting to fill a few key positions as it

prepares to become fully operational.

Although the political climate in the country is somewhat tense at present with

the presidential election expected in late October, overall Chaarat has operated

normally over the period and our relationships with the authorities have

remained positive.

Progress and Strategy

The six month period since the completion of the GBP51.6 million fund raising,

announced in February 2011, has been dedicated to completing and refining the

project scope and establishing the foundations on which a successful mine can

be built and operated.

Work has focused on seven areas:

1. Project scope and configuration definition - important modifications to the

project configuration have been identified and made.

2. Permitting - a permitting strategy has been initiated and implemented to

ensure both the development of the oxide portion of the deposit (Tulkubash)

as well as continuing the exploration of the sulphide section of the Chaarat

target area (Kiziltash).

3. Engineering - the project configuration and Front End Engineering Design has

been completed to facilitate the tender for the detailed engineering of the

process plant and other elements of the project (tailings facility, waste

dump site etc.) scheduled to take place in 2012.

4. Geology - our knowledge and understanding of the oxide section has been

improved and this will help to achieve an increase in the open-pit oxide

resource.

5. Construction - infrastructure elements have been developed; primarily road

improvement, power line construction and building of work camps for our

personnel.

6. Development of operational plans and procedures are being implemented ready

for the take over from the project construction team.

7. Organisation - the necessary support functions such as HSE, logistics and

compliance processes are being established. The HR needs of the company have

been identified and a strategy developed to ensure they are met.

Additional exploration activity has also been undertaken at our other

properties, Mironovskoye, Chontash and Kyzil Ompul, although the Company's

current focus is firmly on the Chaarat project.

Project Scope and configuration

The original strategy was to build a small scale 700-1,000 tonnes per day (tpd)

modular plant which would later be replaced by a larger plant with two 2,500 tpd

lines to be built in two stages.

Engineering and financial analysis has highlighted operational improvements

which management believe could have distinct financial and operational

advantages. It is now envisaged that the first 2,500 tpd line will be built in

the final location but certain aspects of the line will initially be scaled

down. The same elements can later be expanded with minimal cost and

interruption to activity so as to enable the full 2,500 tpd capacity. Although

the plant will cost slightly more than the modular plant originally planned, it

will provide greater expansion flexibility and, management believes, prove more

economical in the long run.

The current plan is to build the plant in the following phases:

Phase 1 (2,500t Run Of Mine (ROM)/day) - As originally envisaged, this involves

a simple flow-sheet with crushing, grinding and carbon-in-leach, which has a low

capital cost, is simple to design, construct and operate. A flotation

concentrator is added to allow for separate cyanidation of concentrate and

flotation tailings. The flow-sheet is flexible for the varied pyrite content in

the feed ore and able to achieve high recoveries on Tulkubash ores.

Further analysis has led to the definition of "Start-up Phase-1" for the

Tulkubash which will use the original flow-sheet described above, but with

capacity reduced to 1,000 tpd. The major cost saving items are the permanent

crushing circuit and the aerial rope way which are to be delayed until the mine

capacity is increased to 2,500 tpd which will be referred to as "Final Phase-1".

Phase 2 (2,500t ROM/day) - This comprises a complete single train refractory

gold treatment plant with crushing, milling, pressure oxidation, slurry wash and

carbon-in-leach circuit. The Phase 2 flow-sheet is similar to the final flow-

sheet but with only one mill and autoclave.

Phase 3 (2,500 - 4,000t ROM/day) - An additional mill is installed which

increases the potential plant feed to 5,000t ROM/day. The flotation concentrator

is re-commissioned and some of the plant feed is beneficiated in this phase to

allow for the operation of the single autoclave. This flow-sheet has maximum

flexibility with high recoveries at low throughputs and the ability to increase

throughput as the mining is developed. Recoveries will be lower at the higher

throughput.

Phase 4 (5,000t ROM/day) - The final plant with two autoclaves, able to treat

the total 5,000t ROM/day and achieving the maximum gold recovery.

Permitting and Engineering

The infrastructure will be used for the whole project so our permitting strategy

is to seek permits both for the Kiziltash, the large exploration project on the

rest of the Chaarat target area, as well as the Tulkubash project. The required

permits have been issued and the work on the infrastructure projects has begun

as described below.

In order to fast track the development at Tulkubash, the smaller first phase

project, we are in the process of filing for the mining permit which we expect

to be granted early next year. Based on our recent application experience, we

have no reason to believe that the granting of this permit will pose any serious

problems.

Geology

A total of 18,961 metres were drilled during the first half of the year, mostly

in the Tulkubash project, and in the deeper zones of the Contact Project (CP)

5,516 metres were drilled to the end of August.

Our understanding of the geology of the Tulkubash project has improved

considerably, and we await the preparation of a formal independent

resource/reserve calculation by our advisers. Since most of the lower grade

material will need to be mined in order to develop the open pit, work undertaken

suggests that it will be more economic to process rather than discard this lower

grade material. The Company is considering the option of stockpiling the lower

grade ore (between 1g/t-2g/t) to ensure that the cash flow from initial

production will be maximised.

The results of drilling along strike in the north and south sections are

encouraging. We are in the early stages of investigating whether it is possible

that the lower strip ratio sections of the pit can be extended on strike, thus

improving the economics of the operation significantly.

We have continued to drill the deeper parts of the deposit in the CP and initial

indications are that there is a correlation between the widening of the ore body

and higher grade. The result is more ounces per vertical metre in this body,

which is still open on strike, both towards the north and south as well as down

dip. The continuity, predictability and consistent grade of this deposit

underline our belief that this is a world class ore body.

Construction

Our strategy has been to achieve as much as possible on the infrastructure front

in 2011, leaving us to complete the construction of the specific elements such

as process plant, workshops etc. next season.

Work on the two major infrastructure items has begun. Road construction

commenced in June. We are concentrating on the more complex areas for road

construction, as well as the critical areas which need to be completed first, in

order to ensure easier logistics for next year. Currently two contractors are

working on the road and a third may be added in due course.

The power line project has been given to a large Kazakh company (ASPMK-519) and

is progressing as expected.

Additional preliminary works including the start of earthworks in the plant area

and the construction of two camps (miners' camp and plant camp) are also

underway. Work on the former has started, whereas the latter is due to be built

next year.

Orders for long lead items such as the mill are to be placed in the near future

in order to minimise the potential for delays.

Operations

The mining and operations team is being recruited, training plans are being

drawn up and implemented, mining equipment is being sourced and plans and

procedures are being established.

As operations will begin with the Tulkubash open pit, production can be ramped

up with a relatively small work force and a simple operation.

Organisation

The various support functions, such as logistics and procurement, are being

strengthened and expanded. The finance function is preparing for the significant

shift from being an exploration company to a mine builder and producer. The

buildup of staff and systems is progressing satisfactorily, albeit more slowly

than we would have liked.

Financial Results

As expected, the loss for the period at US$7,665,382 reflects the increased

expenditure on operations in particular on the drilling activity on site, where

12 drill rigs are in operation, 2 underground and 10 on surface.

Other assets

In addition to the Chaarat project, the Company progressed work on its other

exploration assets acquired last year. Drilling was carried out in the Tunduk

section of the Kyzil Ompul licence area. Geophysical work was done in Chontash

to identify the best location for additional drilling in this promising

property. A local company has been retained to conduct a Feasibility Study on

Mironovskoye in order to facilitate the sale or introduction of a partner to

this project. With copper and gold prices at historic highs this "ready to mine"

deposit is attractive to prospective partners.

Summary

The Company has made good progress in the period, both on exploration and

planning as well as initiating the infrastructure for first production at the

Chaarat project. The proceeds of the placing completed in March are being

deployed, whilst our resource base continues to grow as expected.

As we prepare for production, a particularly pleasing feature of our exploration

programme is the increasing predictability of the resource and the continued

high grades delineated.

Dekel Golan

Chief Executive Officer

Consolidated income statement

For the six months ended 30 June

6 months to 6 months to 12 months to

30 June 30 June 31 December

2011 2010 2010

(unaudited) (unaudited) (audited)

Note USD USD USD

Exploration expenses (5,158,736) (2,519,529) (7,242,318)

Administrative expenses (2,427,264) (1,558,026) (3,432,711)

Administrative expenses - Share 5 (488,062) (221,594) (588,587)

options expense

Administrative expenses - Other (179,171) (11,673) (18,514)

Administrative expenses - Foreign (219,044) (61,935) (168,336)

exchange loss

Operating loss (8,472,277) (4,372,757) (11,450,466)

Financial income 806,895 8,270 14,363

Loss for the period, attributable (7,665,382) (4,364,487) (11,436,103)

to equity shareholders of the

parent

Loss per share (basic and diluted) 2 (3.38)c (3.87)c (9.12)c

- USD cents

Consolidated statement of comprehensive income

For the six months ended 30 June

6 months to 6 months to 12 months to

30 June 30 June 31 December

2011 2010 2010

(unaudited) (unaudited) (audited)

USD USD USD

Loss for the period, attributable to (7,665,382) (4,364,487) (11,436,103)

equity shareholders of the parent

Other comprehensive income:

Exchange differences on translating (22,869) (102,621) (143,478)

foreign operations

Total comprehensive loss for the (7,688,251) (4,467,108) (11,579,581)

period attributable to equity

shareholders of the parent

Consolidated balance sheet

At 30 June

30 June 30 June 31 December

2011 2010 2010

(unaudited) (unaudited) (audited)

USD USD USD

Assets

Non-current assets

Intangible assets 11,658 30,010 20,082

Mining exploration assets 8,349,367 - 8,349,367

Property, plant and equipment 1,291,003 720,759 596,502

Other receivables 359,989 - 50,456

10,012,017 750,769 9,016,407

Current assets

Inventories 594,102 146,430 150,035

Trade and other receivables 2,088,481 903,874 1,619,590

Cash and cash equivalents 82,432,362 3,007,319 10,124,977

85,114,945 4,057,623 11,894,602

Total assets 95,126,962 4,808,392 20,911,009

Equity and liabilities

Equity attributable to shareholders

Share capital 2,503,562 1,129,110 1,470,339

Share premium 128,501,973 27,499,843 48,949,592

Other reserves 14,196,746 13,529,935 13,839,590

Translation reserve (1,106,203) (1,042,477) (1,083,334)

Accumulated losses (51,708,236) (37,159,481) (44,173,760)

92,387,842 3,956,930 19,002,427

Non- current liabilities

Deferred tax 487,000 - 487,000

487,000 487,000

Current liabilities

Trade payables 1,431,876 527,360 646,788

Accrued liabilities 820,244 324,102 774,794

2,252,120 851,462 1,421,582

Total liabilities 2,739,120 851,462 1,908,582

Total liabilities and equity 95,126,962 4,808,392 20,911,009

Consolidated statement of changes in equity

For the six months ended 30 June

Share Share Accumulated Other Translation Total

capital premium losses reserves reserve USD

USD USD USD USD USD

Balance at 1,129,110 27,499,843 (32,798,843) 13,312,190 (939,856) 8,202,444

31 December

2009

Currency - - - - (102,621) (102,621)

translation

Net income - - - - (102,621) (102,621)

recognised

directly in

equity

Loss for the - - (4,364,487) - - (4,364,487)

six months

ended

30 June 2010

Total - - (4,364,487) - (102,621) (4,467,108)

comprehensive

income for

the six

months

Share options - - 3,849 (3,849) - -

lapsed

Share options - - 221,594 - 221,594

expense

Balance at 1,129,110 27,499,843 (37,159,481) 13,529,935 (1,042,477) 3,956,930

30 June 2010

Currency - - - - (40,857) (40,857)

translation

Net income - - - - (40,857) (40,857)

recognised

directly in

equity

Loss for the - - (7,071,616) - - (7,071,616)

six months

ended

31 December

2010

Total - - (7,071,616) - (40,857) (7,112,473)

comprehensive

income for

the six

months

Share options - - 57,337 (57,337) - -

lapsed

Share options - - - 366,992 - 366,992

expense

Issuance of 119,282 7,500,134 7,619,416

shares for

acquisition

Issuance of 221,947 14,386,364 - - - 14,608,311

shares for

cash

Share issue - (436,749) - - - (436,749)

costs

Balance at 1,470,339 48,949,592 (44,173,760) 13,839,590 (1,083,334) 19,002,427

31 December

2010

Currency - - - - (22,869) (22,869)

translation

Net income - - - - (22,869) (22,869)

recognised

directly in

equity

Loss for the - - (7,665,382) - - (7,665,382)

six months

ended

30 June 2011

Total - - (7,665,382) - (22,869) (7,688,251)

comprehensive

income for

the six

months

Share options - - 130,906 (130,906) - -

lapsed

Share options - - - 488,062 - 488,062

expense

Issuance of 1,033,223 82,986,647 - - - 84,019,870

shares for

cash

Share issue - (3,434,266) - - - (3,434,266)

costs

Balance at 2,503,562 128,501,973 (51,708,236) 14,196,746 (1,106,203) 92,387,842

30 June 2011

Consolidated cash flow statement

For the 6 months ended 30 June

6 months to 6 months to 12 months to

30 June 30 June 31 December

2011 2010 2010

(unaudited) (unaudited) (audited)

USD USD

Operating activities

Loss for the period (7,665,382) (4,364,487) (11,436,103)

Adjustments:

Amortisation expense - intangible 12,292 13,107 25,520

assets

Depreciation expense - property, 227,399 312,944 490,024

plant and equipment

(Profit)/loss on disposal of (218,606) 3,052 5,094

property, plant and equipment

Finance income (20,050) (8,270) (14,363)

Share based payments 488,062 221,594 588,587

Foreign exchange (gains)/losses (219,044) 2,909 (42,590)

(Increase)/Decrease in inventories (444,067) 10,261 8,553

(Increase)/Decrease in accounts (468,891) (294,386) (1,080,142)

receivable

Increase in accounts payable 343,538 380,200 688,041

Net cash flow used in operations (7,964,749) (3,723,076) (10,767,379)

Investing activities

Purchase of computer software (8,953) - (3,664)

Purchase of property, plant and (1,099,976) (40,299) (98,445)

equipment

Acquisition of subsidiary (net of - - 5,865

cash acquired)

Proceeds from sale of equipment 389,090 - -

Loans repaid - 4,407 4,407

Interest received 276,710 8,270 14,363

Net cash used in investing activities (443,129) (27,622) (77,474)

Financing activities

Proceeds from issue of share capital 84,019,870 - 14,608,310

Issue costs (3,434,266) - (436,749)

Net cash from financing activities 80,585,604 - 14,171,561

Net change in cash and cash 72,177,726 (3,750,698) 3,326,708

equivalents

Cash and cash equivalents at 10,124,977 6,812,046 6,812,046

beginning of the period

Effect of changes in foreign exchange 129,659 (54,029) (13,777)

rates

Cash and cash equivalents at end of 82,432,362 3,007,319 10,124,977

the period

Notes to the financial statements

1 Dividend

No dividend is proposed in respect of the period.

2 Loss per share

The loss per share is calculated by reference to the loss of USD 7,665,382 for

the six months ended 30 June 2011 and the weighted average number of shares in

issue of 226,931,389 during the period. There is no dilutive effect of share

options.

3 Basis of preparation of financial statements

The unaudited results have been prepared on a going concern basis and on the

basis of the accounting policies adopted in the audited accounts for the year

ended 31 December 2010. The results for the period are derived from continuing

activities.

The financial information set out in this half-yearly report does not constitute

statutory accounts. The figures for the period ended 31 December 2010 have been

extracted from the statutory financial statements, prepared under IFRS, which

are available on the Group's website www.chaarat.com. The auditor's report on

those financial statements was unqualified.

4 Mining exploration and development costs

During the exploration phase of operations, all costs are expensed in the Income

Statement as incurred.

A subsequent decision to develop a mine property within an area of interest is

based on the exploration results, an assessment of the commercial viability of

the property, the availability of financing and the existence of markets for the

product. Once the decision to proceed to development is made, exploration,

development and other expenditures relating to the project are capitalised and

carried at cost with the intention that these will be depreciated by charges

against earnings from future mining operations over the relevant life of mine on

a unit of production basis.

5 Intangible assets - acquired mining exploration assets

Mining exploration assets acquired on the acquisition of subsidiaries are

carried in the balance sheet at their fair value at the date of acquisition less

any impairment losses, pending determination of technical feasibility and

commercial viability of those projects.

When such a project is deemed to no longer have technical or commercially viable

prospects to the Group, acquired mining exploration costs in respect of that

project are deemed to be impaired and written off to the statement of total

comprehensive income.

Subsequent mining exploration costs incurred on those projects are expensed in

accordance with the Group's accounting policy below.

6 Share options

During the period the Company issued the following share options:

+----------------+-----------+----------+

| Exercise price | Number | Date |

+----------------+-----------+----------+

| GBP0.70- GBP1.50 | 5,400,000 | 07/03/11 |

+----------------+-----------+----------+

| GBP1.00 | 400,000 | 10/03/11 |

+----------------+-----------+----------+

| GBP0.70- GBP1.50 | 2,700,000 | 21/03/11 |

+----------------+-----------+----------+

| GBP0.60- GBP1.00 | 100,000 | 04/04/11 |

+----------------+-----------+----------+

| GBP0.60- GBP1.00 | 100,000 | 18/04/11 |

+----------------+-----------+----------+

| | 8,700,000 | |

+----------------+-----------+----------+

The total number of share options outstanding was:

At 31 December 2010 11,125,253

Awarded 8,700,000

Lapsed in period (734,757)

Exercised in period (26,000)

At 30 June 2011 19,064,496

An amount of USD 488,062 was recognised as share based payment expense during

the six month period ended 30 June 2011 (six months ended 30 June 2010: USD

221,594; 12 months ended 31 December 2010: USD 588,587).

7 Post Balance Sheet Events

As a result of the exercise of share options 127,500 ordinary shares were issued

and admitted to AIM on 26 July 2011.

Directors and Advisers

Directors

C Palmer-Tomkinson Non-Executive Chairman

L Tao Non-Executive Deputy Chairman

D Golan Chief Executive Officer

A Novak Executive Director

L Naylor Finance Director

R Weinberg Non-Executive Director

D Tang Non-Executive Director

Company Secretary Auditors Solicitors (UK)

Linda Naylor PKF (UK) LLP Watson, Farley & Williams

LLP

c/o Central Asia Services Farringdon Place 15 Appold Street

Limited

6 Conduit Street 20 Farringdon Road London EC2A 2HB

London W1S 2XE London EC1M 3AP

Maclay Murray & Spens LLP

T. +44 20 7499 2612 Registrars One London Wall

E. admin@caserve.co.uk Capita Registrars London EC2Y 5AB

(Guernsey) Ltd

Longue Hougue House

Registered Office St Sampson Solicitors (Kyrgyz

Republic)

Palm Grove House Guernsey GY1 4JN Kalikova & Associates

PO Box 438 71 Erkindik Boulevard

Road Town, Tortola Depositary Bishkek, 720040

British Virgin Islands, VG1110 Capita IRG Trustees Kyrgyz Republic

Limited

Registered Number 1420336 The Registry

34 Beckenham Road Solicitors (Switzerland)

Kyrgyz Republic Office Beckenham Pestalozzi Attorneys At

Law Ltd.

Chaarat Zaav CJSC Kent BR3 4TU Lowenstrasse 1

15th floor 19 Razzakov Street 8001 Zurich

720040 Bishkek Principal Bankers Switzerland

Kyrgyz Republic Royal Bank of Scotland

International

Royal Bank Place Web Site

Investor Relations 1 Glategny Esplanade www.chaarat.com

Smith`s Corporate Advisory Ltd St Peter Port

One Angel Court Guernsey GY1 4BQ

London EC2R 7HJ

Nominated Advisor and

Broker

Financial Public Relations Westhouse Securities

Ltd

Bankside One Angel Court

1 Frederick's Place London EC2R 7HJ

London EC2R 8AE

This announcement is distributed by Thomson Reuters on behalf of

Thomson Reuters clients. The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the information contained therein.

Source: Chaarat Gold Holdings Ltd via Thomson Reuters ONE

[HUG#1550051]

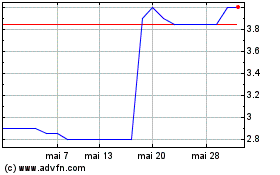

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024