TIDMCGH

RNS Number : 7969S

Chaarat Gold Holdings Ltd

29 September 2014

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

UNAUDITED RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2014

Road Town, Tortola, British Virgin Islands (29th September

2014)

Chaarat (AIM - CGH), the AIM quoted exploration and development

company with assets in the Kyrgyz Republic, today publishes its

unaudited results for the period ended 30 June 2014.

HIGHLIGHTS

-- Data collection for the enlarged scope Definitive Feasibility

Study (DFS) complete and evaluation underway

-- Drilling in Tulkubash Zone to increase oxide resource for the

heap leach operation completed

-- Geotechnical and hydrological site investigation of the new production plant area completed

-- Community engagement strengthened

Dekel Golan, Chief Executive Officer of Chaarat, commented:

"We continue to manage our limited financial resources wisely

and diligently with the aim of delivering a solid feasibility study

on the basis of which we will either engage a Joint Venture partner

or pursue alternative project financing options. The results from

the DFS to date continue to demonstrate the potential of the

Chaarat Project as one of the largest and best undeveloped deposits

in the world."

Enquiries:

Chaarat Gold Holdings + 44 23 800 11747/+ 44

Limited 20 7499 2612

c/o Central Asia Services info@chaarat.com

Limited

Dekel Golan CEO

Linda Naylor FD

Numis Securities Limited +44 (0) 20 7260 1000

John Prior, Stuart Skinner

(NOMAD)

James Black (Broker)

Further information is available at www.chaarat.com

Chief Executive Officer's Report

During the summer our efforts have been focused on the data

collection required for the enlargement in scope of the DFS, since

we identified that the optimal strategic development of the Project

would be two production lines which would share infrastructure but

be economically viable as standalone projects.

In order to increase the returns generated from the first stage

standalone heap leach operation, we undertook about 6,500 metres of

diamond core drilling to both increase the resource of the open

pittable heap leachable Tulkubash Project as well as to identify

and demonstrate additional strike for its continuation to the

north. The results of this drilling will be included in the new

resource calculation currently being prepared. GeoSystems

International, Inc has been retained to review the current resource

model as well as update it for the latest drilling results.

All field data and most other relevant data have been collected

and collated relating to the new location for the production

facility in the adjacent valley. The design and costs of the tunnel

required to connect the deposit with the mine site will be

undertaken as part of the detailed work on the scope of the

Project. There are a number of critical decisions to be made with

regard to scope, which will be an iterative process and must be

worked through before we can move to the detailed planning

process.

We are encouraged by the appointment of NFC and NERIN to

complete the DFS that there will be a comprehensive review of

available development options for the Project so that we are in the

best possible position to make these critical decisions relating to

it.

On the metallurgy front, as previously reported, we are

reviewing bio-heap oxidation as an option for the oxidation of the

sulphide ore during the second stage of development of the Project.

This method, which was originally used and patented by Newmont at

its Carlin mine in Nevada, may offer a lower capital cost way to

oxidize the ore than pressure oxidation and also ensure an

acceptable level of gold extraction from the ore is obtained.

Initial results have been encouraging, but as with the project

scope, we will not draw conclusions before all results are

evaluated and considered.

As well as reviewing the bio-heap oxidation option, more and

larger scale metallurgical work is underway to maximize and

optimize the accuracy of the feasibility study work.

This time last year we said that "The Board considers that the

sale of the Project may take away any future "upside" from

shareholders and the preference of the Board is therefore to

introduce a significant partner or partners to the Project

company." A number of entities from different countries have

expressed interest in partnering with Chaarat in the development of

the Project. We do not expect any meaningful development on this

front before the feasibility study is nearer completion in 2015

when a value benchmark can be attributed to the Project for the

purpose of negotiations.

Community relations

We have continued to engage with the residents of the Chatkal

valley, the adjacent valley to the deposit. We have carefully

targeted our community engagement budget and with local help

ensured that its impact has been maximised.

The Community Consultation Group established last year has met

and been updated on the progress with the Project. This group is

the community representative body to discuss the Project with

Chaarat and the conduit to air the concerns and wishes of the local

population. Chaarat is committed to work according to the IFC and

Equator principles and to ensure its activities in the region are

undertaken in consultation with the local stakeholders.

We continue to work with the local Akimiat (council) on

improvement to the road infrastructure with sections of the road

being widened by our blasting and road building team. The water

distribution system in Jany- Bazar collapsed recently following

years of disrepair but has been restored following a combined

effort by Chaarat and the local council.

In addition to ongoing skill building activities, such as

scholarships for students and work placements, Chaarat assisted in

establishing two community operated shops. These delivered

essential supplies to the local population at prices obtained in

more competitive markets by cutting out some expensive middlemen.

The cost to Chaarat was minimal but the goodwill impact

significant.

Funding

The additional data collection due to the enlargement in scope

of the DFS has now been completed. The fixed price agreement with

NFC and NERIN to complete the DFS will retain the costs of the DFS

within the existing budget. With a reasonably high degree of

visibility over future costs the Board continues to monitor closely

all expenditure of a discretionary nature. As we have just reached

the end of the season a comprehensive review of all operational

areas is underway to ensure all staff and efforts are focused on

the complementary objectives of the DFS preparation and the

realisation of proceeds from equipment and fixed asset sales. The

realisation of proceeds will give the Board additional flexibility

to elect as and when additional funds need to be raised after

completion of the DFS. During the period USD 520,398 was raised

from the sale of equipment. Our exploration assets at Mironovskoye

and Kyzil Ompul have attracted expressions of interest from

potential buyers which are being vigorously pursued.

Dekel Golan

Chief Executive Officer

About Chaarat Gold

Chaarat Gold is an exploration and development company operating

in the Kyrgyz Republic with a large, high grade resource - the

Chaarat Gold Project. The Company's key objective is to become a

low cost gold producer generating significant production from the

development of the Chaarat Gold Project. Chaarat is preparing a

Definitive Feasibility Study (DFS) and continuing its active

community engagement programme to optimise the value of the Chaarat

investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high quality gold and mineral deposits in the

Kyrgyz Republic by building relationships based on trust and

operating to the best environmental, social and employment

standards.

Consolidated income

statement

For the six months

ended 30 June

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2014 2013 2013

(unaudited) (unaudited) (audited)

USD USD USD

Exploration expenses (1,484,299) (7,017,604) (4,780,317)

Impairment of assets - - (4,061,949)

Administrative expenses (1,753,273) (2,865,015) (4,962,471)

- Share options expense (120,990) (338,383) (756,356)

- Foreign exchange

gain/(loss) 16,826 (551,330) 8,309

------------------------------------- ------------ ------------ --------------

Total administrative

expenses (1,857,437) (3,754,728) (5,710,518)

Other operating income/(expense) 44,052 591 (43,027)

------------------------------------- ------------ ------------ --------------

Operating loss (3,297,684) (10,771,741) (14,595,811)

Finance income 31,612 110,315 219,601

------------------------------------- ------------ ------------ --------------

Loss for the period,

attributable to equity

shareholders of the

parent (3,266,072) (10,661,426) (14,376,210)

------------------------------------- ------------ ------------ --------------

Loss per share (basic

and diluted) - USD

cents (1.30) (4.26) (5.74)

------------------------------------- ------------ ------------ --------------

Consolidated statement

of comprehensive income

For the six months

ended 30 June

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2014 2013 2013

(unaudited) (unaudited) (audited)

USD USD USD

Loss for the period,

attributable to equity

shareholders of the

parent (3,266,072) (10,661,426) (14,376,210)

Other comprehensive

income:

Exchange differences

on translating foreign

operations and investments (2,752,373) 494,377 (528,755)

Other comprehensive

income for the period,

net of tax (2,752,373) 494,377 (528,755)

Total comprehensive

loss for the period

attributable to equity

shareholders of the

parent (6,018,445) (10,167,049) (14,904,965)

-------------------------------- ------------ ------------ -------------

Consolidated balance

sheet

At 30 June

30 June 30 June 31 December

2014 2013 2013

(unaudited) (unaudited) (audited)

USD USD USD

Assets

Non-current assets

Intangible assets 73,019 120,942 103,718

Mining exploration

assets 6,803,149 8,349,367 7,192,913

Mine properties 23,151,084 13,676,260 21,657,042

Property, plant and

equipment 6,450,722 7,026,987 7,691,266

Assets in construction 13,782,021 14,863,864 14,477,613

50,259,995 44,037,420 51,122,552

----------------------------------- ------------------ ------------------ ------------------

Current assets

Inventories 1,251,030 2,336,790 1,753,802

Trade and other receivables 1,085,444 2,697,557 857,903

Cash and cash equivalents 7,122,223 20,727,659 11,163,079

9,458,697 25,762,006 13,774,784

Total assets 59,718,692 69,799,426 64,897,336

------------------------------------ ------------------ ------------------ ------------------

Equity and liabilities

Equity attributable

to shareholders

Share capital 2,504,778 2,504,778 2,504,778

Share premium 128,551,662 128,551,662 128,551,662

Other reserves 15,127,145 14,808,155 15,013,806

Translation reserve (5,270,181) (1,494,676) (2,517,808)

Accumulated losses (83,904,676) (77,143,793) (80,646,255)

------------------------------------ ------------------ ------------------ ------------------

57,008,728 67,226,126 62,906,183

----------------------------------- ------------------ ------------------ ------------------

Non- current liabilities

-------------------------------- ------------------ ------------------ ------------------

Deferred tax 487,000 472,961 475,772

------------------------------------ ------------------ ------------------ ------------------

Current liabilities

Trade payables 1,442,676 1,423,399 617,181

Accrued liabilities 780,288 676,940 898,200

------------------------------------ ------------------ ------------------ ------------------

2,222,964 2,100,339 1,515,381

----------------------------------- ------------------ ------------------ ------------------

Total liabilities 2,709,964 2,573,300 1,991,153

------------------------------------ ------------------ ------------------ ------------------

Total liabilities

and equity 59,718,692 69,799,426 64,897,336

------------------------------------ ------------------ ------------------ ------------------

Consolidated statement of changes in equity

For the six months ended 30 June

Share Share Accumulated Other Translation

capital premium losses reserves reserve Total

USD USD USD USD USD USD

Balance at 31

December 2012 2,504,778 128,551,662 (66,631,199) 14,618,604 (1,989,053) 77,054,792

-------------- --------- ----------- ------------ ---------- ----------- ------------

Currency

translation - - - - 494,377 494,377

-------------- --------- ----------- ------------ ---------- ----------- ------------

Other

comprehensive

income - - - - 494,377 494,377

-------------- --------- ----------- ------------ ---------- ----------- ------------

Loss for the

six months

ended

30 June 2013 - - (10,661,426) - - (10,661,426)

Total

comprehensive

income for

the

six months

ended

30 June 2013 - - (10,661,426) - 494,377 (10,167,049)

Share options

lapsed - - 148,832 (148,832) - -

-------------- --------- ----------- ------------ ---------- ----------- ------------

Share options

expense - - - 338,383 - 338,383

-------------- --------- ----------- ------------ ---------- ----------- ------------

Balance at 30

June 2013 2,504,778 128,551,662 (77,143,793) 14,808,155 (1,494,676) 67,226,126

-------------- --------- ----------- ------------ ---------- ----------- ------------

Currency

translation - - - - (1,023,132) (1,023,132)

-------------- --------- ----------- ------------ ---------- ----------- ------------

Other

comprehensive

income - - - - (1,023,132) (1,023,132)

-------------- --------- ----------- ------------ ---------- ----------- ------------

Loss for the

six months

ended

31 December

2013 - - (3,714,784) - - (3,714,784)

-------------- --------- ----------- ------------ ---------- ----------- ------------

Total

comprehensive

income for

the

six months

ended

31 December

2013 - - (3,714,784) - (1,023,132) (4,737,916)

Share options

lapsed - - 212,322 (212,322) - -

-------------- --------- ----------- ------------ ---------- ----------- ------------

Share options

expense - - - 417,973 - 417,973

-------------- --------- ----------- ------------ ---------- ----------- ------------

Balance at 31

December 2013 2,504,778 128,551,662 (80,646,255) 15,013,806 (2,517,808) 62,906,183

-------------- --------- ----------- ------------ ---------- ----------- ------------

Currency

translation - - - - (2,752,373) (2,752,373)

-------------- --------- ----------- ------------ ---------- ----------- ------------

Other

comprehensive

income - - - - (2,752,373) (2,752,373)

-------------- --------- ----------- ------------ ---------- ----------- ------------

Loss for the

six months

ended

30 June 2014 - - (3,266,072) - - (3,266,072)

-------------- --------- ----------- ------------ ---------- ----------- ------------

Total

comprehensive

income for

the

six months

ended

30 June 2014 - - (3,266,072) - (2,752,373) (6,018,445)

Share options

lapsed - - 7,651 (7,651) - -

-------------- --------- ----------- ------------ ---------- ----------- ------------

Share options

expense - - - 120,990 - 120,990

Balance at 30

June 2014 2,504,778 128,551,662 (83,904,676) 15,127,145 (5,270,181) 57,008,728

-------------- --------- ----------- ------------ ---------- ----------- ------------

Consolidated cash

flow statement

For the 6 months ended

30 June

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2014 2013 2013

(unaudited) (unaudited) (audited)

USD USD USD

Operating activities

Loss for the period (3,145,082) (10,661,426) (14,376,210)

Adjustments:

Amortisation expense

- intangible assets 23,346 29,599 50,914

Depreciation expense

- property, plant

and equipment 445,658 647,360 1,076,025

(Profit)/loss on disposal

of property, plant

and equipment (520,398) 7,259 9,349

Impairment of assets - - 4,416,403

Finance income (31,612) (110,315) (219,601)

Share based payments 120,990 338,383 756,356

Foreign exchange (gains)/losses (16,826) (551,330) (8,309)

Decrease in inventories 502,772 446,533 1,029,521

(Increase)/Decrease

in accounts receivable (227,540) 902,907 2,285,494

Increase/(Decrease)in

accounts payable 718,811 (406,212) (988,359)

Net cash flow used

in operations (2,250,871) (9,357,242) (5,968,327)

------------------------------------------------------- ---- ------------ ------------ -------------

Investing activities

Purchase of computer

software (192) (28,582) (24,892)

Purchase of mine assets,

property, plant and

equipment (2,221,416) (7,249,367) (19,486,920)

Proceeds from sale

of equipment 520,398 - -

Interest received 31,612 110,315 219,601

------------------------------------------------------- ---- ------------ ------------ -------------

Net cash used in investing

activities (1,669,598) (7,167,634) (19,292,211)

------------------------------------------------------- ---- ------------ ------------ -------------

Net change in cash

and cash equivalents (3,920,469) (16,524,876) (25,260,538)

Cash and cash equivalents

at beginning of the

period 11,163,080 36,944,060 36,944,060

Effect of changes

in foreign exchange

rates (120,388) 308,475 (520,443)

------------------------------------------------------- ---- ------------ ------------ -------------

Cash and cash equivalents

at end of the period 7,122,223 20,727,659 11,163,079

------------------------------------------------------- ---- ------------ ------------ -------------

Notes to the financial statements

1 Loss per share

The loss per share is calculated by reference to the loss of USD

3,266,072 for the six months ended 30 June 2014 and the weighted

average number of shares in issue of 250,477,868 during the period.

There is no dilutive effect of share options.

2 Basis of preparation of financial statements

The financial information set out in this half-yearly report

does not constitute statutory accounts.

In the accounts for the year ended 31 December 2013 the payment

of USD 5.4m made to the government of the Kyrgyz Republic in

respect of the mining licence for the Chaarat Project was

capitalised. Accordingly the accounts for the period to 30 June

2013 have been restated to reflect this change in treatment, which

has reduced accumulated losses by USD 5,405,231, increased the

translation reserve by USD 236,887 and increased non-current assets

by USD 5,168,344.

The unaudited results for the period ended 30 June 2014 have

been prepared on the basis of the accounting policies adopted in

the audited accounts for the year ended 31 December 2013. The

results for the period are derived from continuing activities. The

figures for the period ended 31 December 2013 have been extracted

from the statutory financial statements, prepared under IFRS, which

are available on the Group's website www.chaarat.com. The auditor's

report on those financial statements was unqualified.

As reported in the accounts for the year ended 31 December 2013,

the original scope of the DFS has been increased to cover

additional areas of work through further drilling and data

collection. These additional areas of work were undertaken to

support the assessment of the enlarged heap leach opportunity and

collect data relating to the new location for the production

facility. Whilst the results of this additional work will add value

to the Chaarat Project (by increasing production, reducing

operating costs and reducing the environmental impact) the costs of

the DFS were increased. We also reported that further funds may be

required to cover the shortfall between the original budget and

revised budgets for completion of the DFS. This situation was

addressed by signing a fixed price agreement for the DFS with NFC

and NERIN. With the consequent reduction in the risk of a DFS

budget overrun the Board is now confident that the costs of the DFS

will not exceed its original budget.

The Board continues to monitor and reduce all expenditure of a

discretionary nature, selling materials and equipment, which were

purchased when early stage production was envisaged, and other

assets of the Group. The sale of the equipment and materials will

give the Board additional flexibility to elect as and when

additional funds need to be raised after completion of the DFS.

During the period USD 520,398 was raised from the sale of

equipment.

Subject to the continued successful realisation of these

expectations, the Board is satisfied that it has sufficient funds

to maintain the Group as a going concern and therefore considers it

appropriate to prepare these unaudited results on a going concern

basis.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFEDAIIDFIS

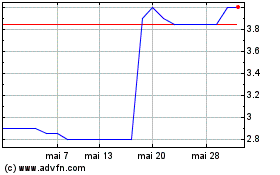

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024