TIDMCGH

RNS Number : 8289P

Chaarat Gold Holdings Ltd

11 June 2015

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

PRELIMINARY ANNOUNCEMENT OF AUDITED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2014

Road Town, Tortola, British Virgin Islands (11 June 2015)

Chaarat (AIM - CGH), the AIM quoted exploration and development

company with assets in the Kyrgyz Republic, today publishes its

preliminary results for the year ended 31 December 2014.

Highlights for the year

-- Definitive Feasibility Study (DFS) nearing completion on schedule

-- Upfront capital cost of Project reduced by removal of requirement for a tunnel

-- Resource base confirmed at 6.1 million ounces of gold (JORC compliant)

-- Public hearings proceeding smoothly

Dekel Golan, CEO of Chaarat, commented:

"The Annual Report is our opportunity to consolidate into a

single document the progress made in 2014. We identified China as

the primary source forboth machinery and finance and therefore we

agreed it would be logical to use a Chinese company to prepare the

feasibility study for the Chaarat Project. NERIN is nearing the

completion of the feasibility study which will assist in

underpinning the value of the deposit. Working together we have

removed the need to construct a tunnel at an early stage of the

project which will contribute significantly to NPV as well as

reducing the upfront capital cost and project risk.

Additional drilling has allowed us to increase the resource to

6.1 Million ounces (JORC Compliant) and maintained the status of

Chaarat amongst the world's largest and highest gradeundeveloped

deposits.

We continue to work with the local communities, contributing to

their development and the maintenance of local infrastructure.

2015 will be a milestone year for Chaarat."

Enquiries:

Chaarat Gold Holdings

Limited + 44 23 800 11747

c/o Central Asia Services info@chaarat.com

Limited

Dekel Golan CEO

Linda Naylor FD

Numis Securities Limited +44 (0) 20 7260 1000

John Prior, Paul Gillam

(NOMAD)

James Black (Broker)

Chairman's statement

Dear shareholder

Last year was not an easy year for our sector. The gold price

plunged during 2013 from above USD1700 per ounce to USD1200 and

during 2014 it seems to have been accepted that USD1200-USD1250 per

ounce is the new "long term gold price". That realisation, to the

great dismay of investors, meant that a large number of projects

which were marginally profitable, or not profitable at all, had to

be written down. The sector as a whole became less interesting to

shareholders and as a result share prices dropped to multi-year

lows. Your company share price was not an exception.

The Board had therefore to consider the best way to tackle the

new reality and make sure the value hidden in the Chaarat deposit

is optimally unlocked and more importantly not diminished.

It became clear to us that whilst the mining sector has become

unattractive to many western investors that is not the case in

other regions of the world. We have seen a keen interest from many

regions in Asia be it China, Japan, Korea and the Arab Gulf. Such

interest is shown both by the private sector as well as state owned

enterprises and sovereign wealth funds.

That situation forced us to consider carefully consider our

options and make sure that whatever effort we are making will be

effective and productive.

The decision of the Board was to "look East". We had to

recognize that the investment environment both of our sector, the

mining industry,as well as the infrastructure development in

general,has changed and is dominated more and more by Asian

companies. This dominationexists in the provision of finance,

construction and operational services such as contract mining.

It became apparent that in order to finance a project from China

one has to have a Chinese compliant Bankable Feasibility Study. To

ensure the interface between feasibility study towards basic

engineering, detailed engineering and construction is seamless and

effective it seemed best to work with Chinese engineering, so a

decision presented itself: let us finish the relevant preparatory

chapters by the current advisors and seek to consolidate this by a

first class Chinese engineering company.

This was not an easy decision: we were aware of the cultural

differences and in some cases different technical approaches. It

was clearly going to be a challenge and indeed it has been. Having

said that, we believe that we are marching towards the completion

ofa robust and bankable study;which will both demonstrate the value

of the Chaarat deposit as well as allow us to finance the

construction of the first stage. I would like to extend my thanks

to the patient investors who have been supporting us and assure you

all we are doing our best to cross these turbulent times

safely.

Christopher Palmer-Tomkinson

Chairman

Chief Executive Officer's Report

Dear shareholder

2014 was dedicated to consolidating the knowledge and data

collected over the years in order to produce a "Definitive

Feasibility Study" (DFS), identifying gaps in the information and

filling them. This is the final stage before securing finance and

starting the detailed engineering and construction of the

Project.

We had started work on the DFS with a team of consultants, but

at a certain point, it became clear that there have been

fundamental changes in the mining sector and strategically we had

to consider where we could most successfully obtain finance and

engineering. After much deliberation we decided to entrust the

completion of the DFS to a Chinese engineering company, China Nerin

Engineering Co,. Ltd. (NERIN). One should never underestimate the

challenge of bridging cultural differences. However we are

convinced that our efforts to overcome the challenges of the early

stage of the process will be rewarded as we move to the more

advanced stages of engineering, finance and construction.

Infrastructure

Our previous team of DFS advisers recommended that, due to the

location of the deposit in a narrow valley, the production facility

should be located in an adjacent valley. This would necessitate the

construction of a tunnel to connect the plant to the mine site.

NERIN, together with local Kyrgyz companies, studied the

alternatives and identified a layout which will eliminate the need

to construct a tunnel for at least the first ten years of

operation. The elimination of the immediate requirement for a

tunnel will reduce the upfront cost of the project considerably, as

well as reducing the uncertainty involved in developing a tunnel

and the lead time to production. This is a major breakthrough in

minimizing risks and adding value to the Chaarat Project.

On the electric supply front we have secured an extension to the

power supply quota. Most of the power in the Kyrgyz Republic is

generated from hydroelectric power stations which makes the cost of

power amongst the cheapest on earth at less than USD0.03/kWh. More

capacity is being added now and the country is effectively a net

power exporter. This is a significant positive for a large future

power consumer such as the Chaarat Project.

Access by road to site has improved after our work to widen the

state road to the south of Chaarat's site in order to enable the

transport of larger cargoes. The state road from Bishkek and Osh to

Chatkal is now open throughout the year. The access road from the

main road to Chaarat needs improvement. The design of the required

upgrade has been completed and it is awaiting approval now by the

relevant authorities.

Geology

Initially we focussed on a lengthy and meticulous process of

verification and due diligence to ensure that the geological

database (which includes millions of items of data) is as error

free as possible. Once that was completed a new Resource Estimation

was calculated. 6,000 metres of additional drilling and some

trenching were undertaken in 2014 to provide missing data. The

additional results were incorporated into the resource calculation

by a team experienced with Asian deposits.

We were very pleased to report that the resource base of Chaarat

now comprises 6.1 million ounces of gold. The resource is composed

of two different types of ore, free milling and refractory, so an

average grade for the whole deposit is not very informative. The

full analysis can be seen in the resource table. The refractory

section should also be divided into the open pittable section and

the underground section as a different cut-off grade will be

applied.

This work confirms Chaarat as one of the world's largest gold

finds of the 21(st) century and as one of the largest high grade

undeveloped gold deposits in the world.

Mining

TetraTech, from our previous team of advisers, had already

completed extensive work on the rock mechanics and hydrology

profile of the areas where the open pit is to be situated. This has

enabled our mine designersfrom NERIN to complete the preliminary

pit design and determine the "potential mill feed" (the quantity

and grade of ore available for delivery to the mill). This is not

yet a determination of reserves but is an approximation which is

optimized from the detailed pit design.

Metallurgy

We were encouraged by metallurgical reports from a leading

metallurgical institute in China (IMME) that their proprietary

version of the bioxidation process was found to be suitable for

processing the Chaarat ore. Bioxidation produces marginally better

gold recovery results than the previously recommended Pressure

Oxidation process (POX) and underpins a lower capital requirement

for Chaarat and certainly a much lower technological challenge.

Bioxidationis used in many operating mines in Central and Northern

Asia such as Olimpiada (Russia - Polyus Gold), Jinfeng (China-

Eldorado Gold) andKokpatas (Uzbekistan - Navoi Mining and

Metallurgical Combinat (NMMC), the largest in the world).

Chaarat will not begin processing refractory ore before its

third year of operation so there is still plenty of time to

optimize the technology to ensure maximum recovery at the lowest

operating costs. NERIN (the engineering company working on our

DFS)were joint designers of the Jinfeng BIOX plant which achieves

recoveries of about 85% of gold, according to information provided

by El Dorado Gold.

Operations

We have decided that as a junior company it is best to employ an

experienced mining contractor to take full responsibility for the

mining. This approach will reduce upfront capital expenditure and

more importantly reduce the operational challenge. Requests for

proposals have been sent to a number of contractors with suitable

experience in the region.

Your management team has continuedto pursue completion of a DFS

which will both underpin financing of the first stage of the

Project and determine a valuation benchmark for the Company. The

DFS remains on track for delivery imminently.

Funding and financial accounting

The price of Chaarat shares has continued to disappoint us all

but we were very encouraged by the support of our shareholders who

enabled us to complete a fundraising of USD5.1 million at the end

of 2014. This will finance us into 2016. We have continued to

dispose of assets and equipment which are not immediately required

to progress the project. By the end of 2014 we had raised USD1.64

million and further sales are ongoing.

As well as generating income from sales we have cut costs. The

main burden has fallen on our staff in Bishkek and we have had to

part company with many loyal employees and friends. I wish to thank

them for all their efforts and those of our remaining

employees.

As we near completion of the DFS for our flagship Chaarat

project we have to recognise that we do not currently have the

funds to progress our other three projects namely Chontash,

Mironovskoye and Kyzil Ompul. We have therefore, with regret, made

the decision to make a full impairment against these assets, in

compliance with international accounting standards, and released

the related deferred tax provision. Your Board is convinced that

these assets have an underlying value and we remain hopeful that we

will be able to find buyers who recognise this inherent value.

The Kyrgyz Republic

I would like to set the development of the Chaarat Project in

the context of the mining sector in the Kyrgyz Republic whichis

undergoing significant change and development. Until very recently

the country hosted only a single large operating mine and a few

large exploration projects. Gold equivalent production is likely to

triple in the next fiveyearswith the development of a number of new

mines.

Two new mines are now close to production: Taldybulak (owned and

operated by Zijin Gold) and Bozymchak (owned and operated by Kaz

Minerals). The sentiment in the industry and the approach of the

government is changing. The political saga of Centerra is drawing

to a close with the ultimate reassurance for investors that the

promise of the government not to nationalise the Kumtor has been

maintained.

Two new entities entered the Kyrgyz mining scenein 2014, a

Russian company bought the Jerooy project for over USD100 million

in cash and an Indonesian conglomerate purchased Goldfield's Kyrgyz

asset and combined it with some other assets to establish Tengri

Resources.

Highland Gold has reported the delineation of a large (3.7

million ounces JORC compliant) resource, second only to Chaarat's

6.1million ounces JORC compliant resource.

The Kyrgyz Republicis gradually learning to balance the

expectations of the different stakeholders in the mining industry.

Balancing the needs of state, communities,environment and investors

is a delicate ongoing undertakingthat is also in the interest of

all those stakeholders. There are promising signs that the Kyrgyz

Republicis moving in the right direction. We, the management of

Chaarat,hope that with the change of sentiment in-country,investor

sentiment will also change and will be reflected in the share price

of all Central Asian mining companies which are currently tradingat

a significant discount.

Dekel Golan

Chief Executive Officer

Consolidated income statement

For the years ended 31 December

2014 2013

USD USD

Exploration expenses (4,251,623) (4,780,317)

Impairment of assets (6,023,622) (4,061,949)

Administrative expenses (3,868,516) (4,962,471)

Administrative expenses- Share

options expense (256,613) (756,356)

Administrative expenses- Foreign

exchange gain (45,242) 8,309

Total administrative expenses (4,170,371) (5,710,518)

Other operating expense (81,257) (43,027)

-------------------------------------- -------------- --------------

Operating loss (14,039,998) (14,595,811)

Finance income 476,536 219,601

Taxation 486,875 -

------------------------------------- -------------- --------------

Loss for the year, attributable

to equity shareholders of the

parent (13,563,462) (14,376,210)

-------------------------------------- -------------- --------------

Loss per share (basic and diluted)

- USD cents (4.97) (5.74)

--------------

Consolidated statement of comprehensive income

For the years ended 31 December

2014 2013

USD USD

Loss for the year, attributable

to equity shareholders of the

parent (13,563,462) (14,376,210)

Other comprehensive income:

Items which may subsequently

be reclassified to profit and

loss

Exchange differences on translating

foreign operations (8,302,919) (528,755)

Other comprehensive income

for the year, net of tax (8,302,919) (528,755)

Total comprehensive income

for the year attributable to

equity shareholders of the

parent (21,866,381) (14,904,965)

-------------------------------------- ------------- -------------

Consolidated Balance

Sheet

At 31 December

2014 2013

USD USD

----------------------------- ------------- -------------

Assets

Non-current assets

Intangible assets 50,197 103,718

Mining exploration

assets - 7,192,913

Mine properties 22,653,950 21,657,042

Property, plant and

equipment 3,622,423 7,691,266

Assets in construction 12,339,224 14,477,613

Other receivables - -

38,665,794 51,122,552

----------------------------- ------------- -------------

Current assets

Inventories 847,818 1,753,802

Trade and other receivables 726,386 857,903

Cash and cash equivalents 7,608,865 11,163,079

9,183,069 13,774,784

Total assets 47,848,863 64,897,336

------------------------------ ------------- -------------

Equity and liabilities

Equity attributable

to shareholders

Share capital 2,729,353 2,504,778

Share premium 132,108,746 128,551,662

Share warrant reserve 1,358,351 -

Other reserves 15,205,510 15,013,806

Translation reserve (10,820,727) (2,517,808)

Accumulated losses (94,144,808) (80,646,255)

------------------------------ ------------- -------------

Total equity 46,436,425 62,906,183

------------------------------ ------------- -------------

Non-current liabilities

Deferred tax - 475,772

------------------------------ ------------- -------------

- 475,772

----------------------------- ------------- -------------

Current liabilities

Trade and other payables 561,916 617,181

Accrued liabilities 850,522 898,200

------------------------------ ------------- -------------

1,412,438 1,515,381

----------------------------- ------------- -------------

Total liabilities 1,412,438 1,991,153

------------------------------ ------------- -------------

Total liabilities

and equity 47,848,863 64,897,336

------------------------------ ------------- -------------

Consolidated Statement of Changes in Equity

For the Years Ended 31 December

Share Share Share Accumulated Other Translation

Capital Premium warrant Losses Reserves Reserve Total

USD USD reserve USD USD USD USD

USD

-------------------- --------- ----------- ----------- ------------ ---------- ------------ ------------

Balance at

31 December

2012 2,504,778 128,551,662 - (66,631,199) 14,618,604 (1,989,053) 77,054,792

-------------------- --------- ----------- ----------- ------------ ---------- ------------ ------------

Currency

translation - - - - - (528,755) (528,755)

Other comprehensive

income - - - - - (528,755) (528,755)

Loss for the

year ended

31 December

2013 - - - (14,376,210) - - (14,376,210)

Total comprehensive

income for

the year - - - (14,376,210) - (528,755) (14,904,965)

Share options

lapsed - - - 361,154 (361,154) - -

Share options

expense - - - - 756,356 - 756,356

Balance at

31 December

2013 2,504,778 128,551,662 - (80,646,255) 15,013,806 (2,517,808) 62,906,183

-------------------- --------- ----------- ----------- ------------ ---------- ------------ ------------

Currency

translation - - - - - (8,302,919) (8,302,919)

Other comprehensive

income - - - - - (8,302,919) (8,302,919)

Loss for the

year ended

31 December

2014 - - - (13,563,462) - - (13,563,462)

Total comprehensive

income for

the year - - - (13,563,462) - (8,302,919) (21,866,381)

Share options

lapsed - - - 64,909 (64,909) -

Share options

expense - - - - 256,613 256,613

Warrant expense - - 1,358,351 - - - 1,358,351

Issuance of

shares for

cash 224,575 3,672,495 - - - - 3,897,070

Share issue

costs - (115,411) - - - - (115,411)

Balance at

31 December

2014 2,729,353 132,108,746 1,358,351 (94,144,808) 15,205,510 (10,820,727) 46,436,425

-------------------- --------- ----------- ----------- ------------ ---------- ------------ ------------

Consolidated Cash Flow

Statement

For the Years Ended 31

December

2014 2013

USD USD

--------------------------------- ---------------------- ------------

Operating activities

--------------------------------- ---------------------- ------------

Loss for the year (13,563,462) (14,376,210)

Adjustments:

Amortisation expense -

intangible assets 45,230 50,914

Depreciation expense -

property, plant and equipment 1,622,409 1,076,025

Loss on disposal of property,

plant and equipment 500,319 9,349

Impairment of assets 6,023,622 4,416,403

Finance income (476,536) (219,601)

Share based payments 256,613 756,356

Loss/(gain) on foreign

exchange 45,242 (8,309)

Decrease in inventories 905,984 1,029,521

Decrease in accounts receivable 131,517 2,285,494

(Decrease) in accounts

payable (578,714) (988,359)

---------------------------------- ---------------------- ------------

Net cash flow used in operations (5,087,776) (5,968,327)

---------------------------------- ---------------------- ------------

Investing activities

--------------------------------- ---------------------- ------------

Purchase of computer software (6,777) (24,892)

Purchase of tangible assets (4,898,050) (19,486,920)

Proceeds from sale of equipment 1,029,472 -

Interest received 476,536 219,601

---------------------------------- ---------------------- ------------

Net cash used in investing

activities (3,398,819) (19,292,211)

---------------------------------- ---------------------- ------------

Financing activities

--------------------------------- ---------------------- ------------

Proceeds from issue of

share capital 5,255,420 -

Issue costs (115,411) -

---------------------------------- ---------------------- ------------

Net cash from financing

activities 5,140,009

---------------------------------- ---------------------- ------------

Net change in cash and

cash equivalents (3,346,586) (25,260,538)

Cash and cash equivalents

at beginning of the year 11,163,079 36,944,060

Effect of changes in foreign

exchange rates (207,628) (520,443)

---------------------------------- ---------------------- ------------

Cash and cash equivalents

at end of the year 7,608,865 11,163,079

---------------------------------- ---------------------- ------------

Notes:

1. Preparation of accounts

The financial information set out in this announcement does not

constitute the Company's annual accounts for the years ended 31

December 2014 or 2013.

The consolidated balance sheet at 31 December 2014, the

consolidated income statement, consolidated statement of changes in

equity, consolidated cash flow statement and associated notes for

the year then ended have been extracted from the Group's 2014

annual financial statements upon which the auditors' opinion is

unqualified.

2. Significant accounting policies

The accounting policies and presentation followed in the

preparation of these final results have been consistently applied

to all periods in these financial statements and are the same as

those applied by the Group in the preparation of its annual

accounts for the year ended 31 December 2014.

Going concern and project funding requirements

Following a placing which raised USD 5.1 million, the Group had

cash and cash equivalents of USD 7.6 million and no borrowings at

31 December 2014. The fundsare expected to finance the Company into

the first quarter of 2016.

The Board has reviewed the Group's cash flow forecast for the

period to 30 June 2016, and is satisfied that it has sufficient

funds to complete the DFS and to maintain the Group as a going

concern for a period of over twelve months from the date of signing

the annual report and accounts, subject to the successful

realisation of its reasonable expectation that additional funds

will be made available by selling certain equipment and other

assets of the Group, cutting discretionary expenditure, reducing

headcount where this does not compromise safety at site or impede

the progress of the DFS, reviewing the timing of other expenditure

and pursuing other fund raising options. As at 31 December 2014 USD

1.64 million hadbeen realised from the disposal of equipment and

other assets.

However, in the absence of such arrangements being in place

these conditions indicate the existence of a material uncertainty

which may cast significant doubt over the Group's ability to

continue as a going concern and, therefore, that it may be unable

to realise its assets and discharge its liabilities in the normal

course of business. The financial statements do not include the

adjustments that would result if the Group was unable to continue

as a going concern.

After completion of the DFS further funding will be required to

bring the Chaarat Project into production. The timeframe and costs

of engaging a contractor for mining and construction, as well as

securing finance for the Project, are difficult to estimate. The

Company has a reasonable expectation that existing funds, as well

as the funds to be raised from selling equipment, should be

sufficient to complete the above process.

If this funding cannot be secured the Group may not be able to

fully develop the Project and the carrying values of the mine

properties, related plant and equipment and assets in construction,

which at 31 December 2014 amounted to approximately USD 39 million,

may become impaired.

3. Loss per share

Loss per share is calculated by reference to the loss for the

year of USD 13,563,462 (2013: USD 14,367,210) and the weighted

number of shares in issue during the year of 272,935,389 (2013:

250,477,868)

There is no dilutive effect of share options.

4. Timetable and distribution of accounts

The Annual General Meeting will be held at 9 am on 22 July 2015

at the offices of BDO, 55 Baker Street, London W1U 7EU.

Copies of the Annual Report and Notice of the Annual General

Meeting will be sent to shareholders by 18 June 2015.

Additional copies of the Annual Report and Accounts will be

available, free of charge, from Central Asia Services Limited, 12

West Links, Tollgate, Chandler's Ford, SO53 3TG, for a period of 14

days from the date of posting and will be available on the

Company's website - www.chaarat.com

Note to Editors:

About Chaarat Gold

Chaarat Gold is an exploration and development company operating

in the Kyrgyz Republic with a large, high grade resource - the

Chaarat Gold Project. The Company's key objective is to become a

low cost gold producer generating significant production from the

development of the Chaarat Gold Project. Chaarat is preparing a

Definitive Feasibility Study and continuing its active community

engagement programme to optimise the value of the Chaarat

investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high quality gold and mineral deposits in the

Kyrgyz Republic by building relationships based on trust and

operating to the best environmental, social and employment

standards.

Further information is available at www.chaarat.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAKKEFFNSEFF

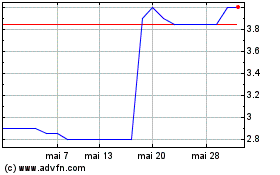

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024