TIDMCGH

RNS Number : 8913R

Chaarat Gold Holdings Ltd

27 September 2017

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

INTERIM STATEMENT FOR THE SIX MONTHSED 30 JUNE 2017

Road Town, Tortola, British Virgin Islands (27 September

2017)

Chaarat (AIM - CGH), the AIM quoted exploration and development

company with assets in the Kyrgyz Republic, today publishes its

unaudited results for the period ended 30 June 2017.

HIGHLIGHTS

-- Funding of USD 15 million secured via the issue of

convertible loan notes to finalise the Tulkubash Heap Leach Project

Bankable Feasibility Study and begin preparations for

construction

-- Development of the Tulkubash Heap Leach Project accelerated

by an intensive drilling programme and construction of access

road

-- Drilling results to date support the Board's confidence in

the potential to increase the reserves of the Tulkubash Project

-- Geotechnical works completed in preparation for detailed design

-- Senior management team continues to be strengthened in preparation for construction

-- Successful Kyrgyz Investor Forum held in May amid government

expressions of support for the Chaarat Gold Project

-- Licence agreement signed with Kyrgyz Government confirms

approval to bring stages one and two of the Chaarat Gold Project to

production following successful submission of the Technical Project

and positive public hearing

Martin Andersson, Chairman of Chaarat, commented: "I am

delighted with the progress during the first six months of 2017,

and subsequently, and the diligent execution of our plans to take

the Tulkubash heap leach project into production.

Based on the progress we have achieved, including the positive

drilling results and with all local permitting secured, the

management team are now working on budgets, plans and timelines to

accelerate construction ahead of securing the full construction

financing.

The improving climate in the country for mining companies has

been demonstrated not only by the recent licence agreement signed

by the Kyrgyz Government and Chaarat, confirming approval for the

plan to take stages one and two of the Chaarat Project to

production, but also the successful conclusion of the long running

dispute between the Kyrgyz government and Centerra in relation to

the Kumtor mine.

I would like to welcome our convertible holders and new

shareholders and thank all shareholders and convertible holders for

their support. The Board and management team at Chaarat are well

aware of the challenges ahead but can look forward with increasing

confidence based on a record of solid achievement so far in

2017."

Enquiries:

Chaarat Gold Holdings

Limited + 44 20 7499 2612

c/o Central Asia Services info@chaarat.com

Limited

Robert Benbow CEO

Linda Naylor FD

Numis Securities Limited +44 (0) 20 7260 1000

John Prior, Paul Gillam

(NOMAD)

James Black (Broker)

About Chaarat Gold

Chaarat Gold is an exploration and development company operating

in the Kyrgyz Republic with a large, high grade resource - the

Chaarat Gold Project. The Company's key objective is to become a

low cost gold producer generating significant production from the

development of the Chaarat Gold Project. Chaarat is engaged in an

active community engagement programme to optimise the value of the

Chaarat investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high quality gold and mineral deposits in the

Kyrgyz Republic by building relationships based on trust and

operating to the best environmental, social and employment

standards.

Further information is available at www.chaarat.com

CHIEF EXECUTIVE OFFICER'S REPORT

Dear Shareholder

Reporting progress is easier than achieving that progress and as

I write about our progress this year, I want to recognize the

efforts of our employees in achieving the accomplishments discussed

below. Our progress would not be possible without them. We continue

our steady progress towards putting the Tulkubash heap leach

project into production.

The Company executed the license agreement with the Kyrgyz

government as announced on 20 September 2017. This marks a major

milestone in advancing the mine. The agreement approves both the

oxide and the refractory ore project and supports the Company's

plan to develop the Tulkubash deposit first and the refractory ore

project at a later date. It also approves the local Kyrgyz

environmental assessment and mitigation measures. The Company is

working on an environmental and social impact analysis that meets

international standards. We are pleased that the agreement

recognizes the support of local communities in the Chatkal

region.

We initiated a drilling program earlier this year to add oxide

resources to our mineral inventory. As reported in our update

released on 7 September 2017, we are encouraged by the interim

results received so far. Originally planned as an 11,000-meter

program, excellent drilling productivity is allowing us to extend

the drilling program to 15,000 meters. We are encouraged by the

assay results and even more encouraged that the northeast trend

remains open-ended. As winter approaches, the drilling program will

wind down and we will begin building the new resource model,

designing the mine and reporting resources and reserves early next

year.

Construction of a new 16 km access road from the Chatkal valley

to the top of Kumbel pass began in late May. Two Kyrgyz contractors

are working on this road, one from the top down and one from the

bottom up. We expect the two will be connected by the end of the

construction season. This road will provide safe access to the top

of Kumbel pass for transporting equipment and supplies during

construction and operating supplies during operations. The access

road will be extended from the top of Kumbel pass down to the

project site as part of the next project construction program.

The Company continues to advance design of the crushing

facility, heap leach facility, ADR plant and infrastructure.

Geotechnical site investigations for detailed design were completed

this season for all facilities thus allowing foundation designs to

proceed. The Company is currently reviewing design schedules for

meeting our goals for beginning construction in the second quarter

next year.

Key additions to the project team are a Head of Geology to

oversee the drilling program and a Commercial Manager and a

Technical Manager to manage preparations for construction. The

requirement for additional personnel has been identified and a

recruitment schedule put in place as part of the construction

planning. Attracting high quality personnel to the project

continues to be our primary goal in recruitment.

I am proud of our team's efforts in achieving these results. Of

special note is the efforts of our Kyrgyz governmental group in

getting the license agreement signed amid a presidential election

campaign. The support from the Kyrgyz government and the local

communities reflects the hard work of our team.

With Highest Regards

Robert D. Benbow

Consolidated income

statement

For the six months

ended 30 June

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2017 2016 2016

(unaudited) (unaudited) (audited)

USD USD USD

Exploration expenses (745,085) (991,276) (1,060,180)

Administrative expenses (1,490,480) (1,568,432) (3,297,786)

- Share options expense (449,108) (981) (1,962)

- Foreign exchange

gain/(loss) 2,924 3,808 (334,185)

-------------------------------- ------------ ------------ -------------

Total administrative

expenses (1,936,664) (1,565,605) (3,633,933)

Other operating income - 589,327 220,784

-------------------------------- ------------ ------------ -------------

Operating loss (2,681,749) (1,967,554) (4,473,329)

Finance income / (expenses) 17,312 18,453

Taxation (387,507) - -

-------------------------------- ------------ -------------

-

---------------------------- ------------ ------------ -------------

Loss for the period,

attributable to equity

shareholders of the

parent (3,069,256) (1,950,242) (4,454,876)

-------------------------------- ------------ ------------ -------------

Loss per share (basic

and diluted) - USD

cents (0.87) (0.71) (1.52)

-------------------------------- ------------ ------------ -------------

Consolidated statement

of comprehensive

income

For the six months

ended 30 June

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2017 2016 2016

(unaudited) (unaudited) (audited)

USD USD USD

Loss for the period,

attributable to

equity

shareholders of the

parent (3,069,256) (1,950,242) (4,454,876)

Other comprehensive

income:

Items which may

subsequently

be reclassified to

profit and loss

Exchange differences

on translating

foreign

operations and

investments 388,392 2,689,088 2,601,427

Other comprehensive

income for the

period,

net of tax 388,392 2,689,088 2,601,427

Total comprehensive

loss for the period

attributable to

equity

shareholders of the

parent (2,680,864) 738,846 (1,853,449)

---------------------- ------------------ ------------------ -----------------------------------

Consolidated balance

sheet

At 30 June

30 June 30 June 31 December

2017 2016 2016

(unaudited) (unaudited) (audited)

USD USD USD

Assets

Non-current assets

Intangible assets 26,960 31,042 26,572

Mine properties 25,554,289 21,764,870 23,424,508

Property, plant and

equipment 740,682 906,746 840,682

Assets in construction 10,274,026 10,185,681 10,008,201

36,595,957 32,888,339 34,299,963

--- ------------------ ------------------ -------------- -------------------

Current assets

Inventories 285,778 360,134 208,955

Trade and other

receivables 1,632,740 254,165 365,944

Cash and cash

equivalents 13,694,150 2,063,517 3,284,929

15,612,668 2,677,816 3,859,828

Total assets 52,208,625 35,566,155 38,159,791

-------------------------- ------------------ ------------------ -------------- -------------------

Equity and

liabilities

Equity attributable

to shareholders

Share capital 3,517,757 2,729,353 3,517,757

Share premium 136,553,470 132,108,746 136,553,470

Share warrant reserve 1,358,351 1,358,351 1,358,351

Convertible loan

note

reserve 867,373 - -

Other reserves 15,183,538 14,926,889 14,848,878

Translation reserve (15,539,037) (15,839,768) (15,927,429)

Accumulated losses (105,709,385) (100,328,935) (102,754,577)

-------------------------- ------------------ ------------------ -------------- -------------------

36,232,067 34,954,636 37,596,450

--- ------------------ ------------------ -------------- -------------------

Non-current

liabilities

Deferred tax - - -

Convertible loan

notes 14,273,151 - -

Current liabilities

Trade payables 450,731 132,663 401,096

Accrued liabilities 1,252,676 478,856 162,245

-------------------------- ------------------ ------------------ -------------- -------------------

1,703,407 611,519 563,341

--- ------------------ ------------------ -------------- -------------------

Total liabilities 15,976,558 611,519 563,341

-------------------------- ------------------ ------------------ -------------- -------------------

Total liabilities

and equity 52,208,625 35,566,155 38,159,791

-------------------------- ------------------ ------------------ -------------- -------------------

Consolidated statement of changes in equity

For the six months ended 30 June

Share Share Share Convertible Accumulated Other Translation

capital premium warrant loan losses reserves reserve Total

USD USD reserve note USD USD USD USD

USD reserve

USD

Balance at

31 December

2015 2,729,353 132,108,746 1,358,351 - (98,405,125) 14,952,340 (18,528,856) 34,214,809

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Currency

translation - - - - - - 2,689,088 2,689,088

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Other

comprehensive

income - - - - - - 2,689,088 2,689,088

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Loss for

the six

months

ended

30 June

2016 - - - - (1,950,242) - - (1,950,242)

Total

comprehensive

income for

the six

months

ended

30 June

2016 - - - - (1,950,242) - 2,689,088 738,846

Share options

lapsed - - - - 26,432 (26,432) - -

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Share options

expense - - - - - 981 - 981

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Balance at

30 June 2016 2,729,353 132,108,746 1,358,351 - (100,328,935) 14,926,889 (15,839,768) 34,954,636

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Currency

translation - - - - - - (87,661) (87,661)

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Other

comprehensive

income - - - - - - (87,661) (87,661)

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Loss for

the six

months

ended 31

December

2016 - - - - (2,504,634) - - (2,458,995)

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Total

comprehensive

income for

the six

months

ended

31 December

2016 - - - - (2,504,634) - (87,661) (2,592,295)

Share options

lapsed - - - - 78,992 (78,992) - -

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Share options

expense - - - - - 981 - 981

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Issuance

of shares

for cash 788,404 4,587,757 - - - - - 5,376,161

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Share issue

cost - (143,033) - - - - - (143,033)

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Balance at

31 December

2016 3,517,757 136,553,470 1,358,351 - (102,754,577) 14,848,878 (15,927,429) 37,596,450

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Currency

translation - - - - - - 388,392 388,392

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Other

comprehensive

income - - - - - - 388,392 388,392

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Loss for

the six

months

ended

30 June

2017 - - - - (3,069,256) - - (3,069,256)

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Total

comprehensive

income for

the six

months

ended

30 June

2017 - - - - (3,069,256) - 388,392 (2,680,864)

Share options

lapsed - - - - 114,448 (114,448) - -

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Share options

expense - - - - - 449,108 - 449,108

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Equity element

of

convertible

loan note - - - 867,373 - - - 867,373

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Balance at

30 June 2017 3,517,757 136,553,470 1,358,351 867,373 (105,709,385) 15,183,538 (15,539,037) 36,232,067

-------------- --------- ----------- --------- ------------ ------------- ---------- ------------ -----------

Consolidated cash

flow statement

For the 6 months ended

30 June

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2017 2016 2016

(unaudited) (unaudited) (audited)

USD USD USD

Operating activities

Loss for the period (3,069,256) (1,950,242) (4,454,876)

Adjustments:

Amortisation expense

- intangible assets 38 3,580 7,287

Depreciation expense

- property, plant

and equipment 135,019 197,905 332,698

(Profit)/loss on disposal

of property, plant

and equipment 3,587 (154,700) 40,074

Provision for inventories - - (22,660)

Finance income (20,991) (17,312) (18,453)

Other operating income - - (220,784)

Share based payments 449,108 981 1,962

Interest payable 408,498 - -

Decrease in inventories (77,255) (15,557) 147,423

(Increase)/Decrease

in accounts receivable (584) (1,688) (590)

Increase/(Decrease)in

accounts payable (364,838) 291,999 (58,507)

Net cash flow used

in operations (2,536,674) (1,645,034) (4,246,426)

--------------------------------------- ----- ----------------------- ---------------------- ------------------------

Investing activities

Purchase of tangible

fixed assets (60,657) (28,351) (68,812)

Capitalisation of

development activities (2,153,360) (181,138) (2,052,669)

Sale of subsidiary - - 200,000

Proceeds from sale

of equipment (27,999) 1,224,585 1,106,055

Interest received 20,991 17,312 18,453

--------------------------------------- ----- ----------------------- ---------------------- ------------------------

Net cash used in investing

activities (2,221,025) 1,032,408 (796,973)

--------------------------------------- ----- ----------------------- ---------------------- ------------------------

Financing activities

Proceeds from issue

of share capital - - 5,376,162

Proceeds from issue

of convertible loan

note 15,000,000 - -

Issue costs (267,975) - (143,033)

Net change from financing

activities 14,732,025 - 5,233,129

Net change in cash

and cash equivalents 9,974,326 (612,626) 189,730

Cash and cash equivalents

at beginning of the

period 3,284,929 2,839,159 2,839,159

Effect of changes

in foreign exchange

rates 434,895 (163,016) 256,040

---------------------------------------------- ----------------------- ---------------------- ------------------------

Cash and cash equivalents

at end of the period 13,694,150 2,063,517 3,284,929

---------------------------------------------- ----------------------- ---------------------- ------------------------

Notes to the financial statements

1 Loss per share

The loss per share is calculated by reference to the loss of USD

3,069,256 for the six months ended 30 June 2017 and the weighted

average number of shares in issue of 351,775,832 during the period.

There is no dilutive effect of share options.

2 Basis of preparation of financial statements

The financial information set out in this interim statement does

not constitute statutory accounts.

The unaudited results for the period ended 30 June 2017 have

been prepared on the basis of the accounting policies adopted in

the audited accounts for the year ended 31 December 2016 except as

disclosed below in relation to the issue of convertible loan notes.

The results for the period are derived from continuing activities.

The figures for the period ended 31 December 2016 have been

extracted from the statutory financial statements, prepared under

IFRS, which are available on the Group's website www.chaarat.com.

The auditor's report on those financial statements was

unqualified.

The proceeds received from the issue of the Company's

convertible loan notes have been allocated into their liability and

equity components. The amount initially attributed to the debt

component equals to the discounted cash flows using a market rate

of interest that would be payable on a similar debt instrument that

does not include an option to convert. Subsequently, the debt

component is accounted for as a financial liability measured at

amortised cost until extinguished on conversion or maturity of the

loan note. The remainder of the proceeds is allocated to the

conversion option and is recognised in other reserves within the

shareholders' equity, net of income tax effects.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LFMFTMBBTBRR

(END) Dow Jones Newswires

September 27, 2017 02:00 ET (06:00 GMT)

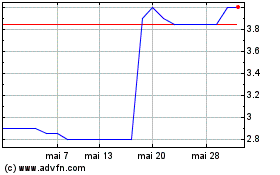

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024