TIDMCGH

RNS Number : 0415H

Chaarat Gold Holdings Ltd

29 July 2019

29 July 2019

Chaarat Gold Holdings Limited ("Chaarat" or "the Company")

Kapan Resource and Operational Update

February-June 2019 inclusive (five months)

Chaarat (AIM:CGH), gold mining company with assets in the Kyrgyz

Republic and Armenia, provides an update regarding the Kapan mine

which the Company acquired on 30th January, 2019. All the

statistics below relate to the period ending 30 June 2019.

Operational highlights

- Environmental Social and Governance ("ESG") statistics for

2019 year to date reflect a safe working environment. One lost time

injury ("LTI") involving a contractor was reported for the period

under review. The Company has started introducing the same ESG

requirements for contractors

- Run of mine (RoM) ore production increased by 8% year on year

relative to the same five-month period in 2018

- RoM grade in gold equivalent (AuEq) terms declined 14% year on

year, resulting in a 6% decline in contained RoM metal

- Contained AuEq adjusted for all payable metals increased 9%

year on year Mill throughput in the first 5 months of ownership is

up 23% year on yeardue to the processing of RoM stockpile

material

- Production of copper concentrates was up 12% year on year in

conjunction with a 16% increase in AuEq ounces recovered to copper

concentrate

- Production of zinc concentrate was down 10% year on year due

to lower RoM zinc grades and slightly lower mill recoveries

- Milling rates of approximately 800,000 tonnes on an annualized

basis have been achieved for sustained periods over the period

under review, which gives us confidence that a further 5% increase

in mill throughput is achievable

- Costs per tonne of ore treated was 10% lower year on year.

This has enabled the Company not only to absorb the impact of the

lower RoM ore grades but also positions the company well for an

anticipated recovery in RoM grade as management develops a better

understanding of the ore body

- Legacy issues: a number of legacy issues and operational

challenges have been identified by the Chaarat management team.

These have had a negative effect on operations in the near term.

Management has installed mitigation measures to offset these

challenges and they are delivering results. Based on the current

work programme the Company believes the mine will reach its

operational targets by the end of Q3

- New Mineral Resource Estimate ("MRE"). New Mineral Resource of

1.775Moz AuEq (Measured & Indicated based on the results of

69,000 meters of drilling completed in 2018. The MRE gives

Management confidence based on historical resource to reserve

conversion rates at Kapan that the mine will continue to replace

mined reserves and should continue to extend mine-life for several

years beyond the current life of the mine. This work programme has

improved the Company's understanding of the ore body and will help

to optimize short, medium and long-term operational planning and

execution

- With the new team now fully integrated at the asset, the

Company is confident that Kapan will reach full year operational

target run rates by the end of Q3 2019, including our target of 65

Koz of AuEq for 2019

Artem Volynets, Chief Executive Officer of Chaarat Gold,

said:

"I'm pleased with the progress that the new management team are

making at Kapan. Our ESG statistics have been outstanding, showing

solid management commitment to establishing a safe operating

environment.

"Also positive is a revised and more accurate Mineral Resource

Estimate of 1.775Moz Au Eq in M&I Resource. This, based on

69,000m of exploration drilling done in 2018, better reflects the

underlying potential and value of the asset. We are especially

encouraged by the significant increase in M&I Resource of 54

per cent from 1.15 to 1.775Moz Au Eq, which supports our belief

that we will be able to replace reserves at Kapan on a continuous

bases going forward.

"Although this year has seen a challenging start to ownership

due to a number of legacy issues, our experienced management and

mine-site team identified these early and began remedial work

immediately with encouraging results.

"As we continue to streamline operations and drive other

improvements, we are confident that Kapan will achieve our targeted

operational results in Q3 of this year".

ESG update

There were no LTIs related to direct employees in the period

under review although there was one LTI involving a contractor.

Prior to Chaarat taking over the business, no data was recorded on

contractors' injuries. As part of an improved ESG management

system, the Company now includes contract employees in all aspects

of the new safety management programme.

Safety performance and safety culture on site are improving

overall with significant management focus applied to potentially

unsafe conditions, working practices and behaviours. The Company is

carrying out reinforcement work on the tailings facility to reduce

the risks related to the historic construction of the dam walls. A

full and independent assessment of the longer-term work

requirements is in progress.

Chaarat attaches great importance to sustainable community

development programmes, and is in partnership with the local

government on the various social projects considered most necessary

by the communities involved. For example, Chaarat is focused on

helping the wellbeing of children in the community, providing

donations to fund the establishment of new nursery facilities and

classrooms.

Operational update

Production Data: Feb - June 2018 2019 Delta

Ore Mined Tonnes 255,323 276,378 8 %

-------------------------- ------------- -------- -------- ------

Head grade AuEq (gpt) 3.76 3.25 -14 %

-------------------------- ------------- -------- -------- ------

Contained Metal AuEq (oz) 30,884 28,909 -6 %

------------- -------- -------- ------

Ore milled Tonnes 261,750 321,538 23 %

-------------------------- ------------- -------- -------- ------

Head grade AuEq (gpt) 3.74 3.24 -13 %

-------------------------- ------------- -------- -------- ------

Contained Metal AuEq (oz) 31,455 33,479 6 %

------------- -------- -------- ------

Copper Conc Produced Tonnes 3,505 3,925 12 %

-------------------------- ------------- -------- -------- ------

Grade AuEq (gpt) 145.71 151.20 4 %

-------------------------- ------------- -------- -------- ------

Recovery Au Eq % 52.20 57.00 9 %

-------------------------- ------------- -------- -------- ------

Contained Metal AuEq (oz) 16,418 19,082 16 %

------------- -------- -------- ------

Zinc Conc Production Tonnes 5,213 4,689 -10 %

-------------------------- ------------- -------- -------- ------

Grade AuEq (gpt) 50.79 52.17 3 %

-------------------------- ------------- -------- -------- ------

Recovery Au Eq % 27.1 23.5 -13 %

-------------------------- ------------- -------- -------- ------

Contained Metal AuEq (oz) 8,512 7,865 -8 %

------------- -------- -------- ------

AuEq to all

Contained Metals concs (oz) 24,931 26,947 8%

------------- -------- -------- ------

AuEq to all

Payable Metals concs (oz) 22,881 24,927 9 %

------------- -------- -------- ------

The asset has presented more operational challenges than was

anticipated before the acquisition was finalized, resulting in

medium-term pressure on Kapan's financial performance. Because of

the lower grades in the ore, profitability in the first months of

ownership has been below the Company's initial expectations.

Following completion of the acquisition, actions were taken

immediately to stabilize the operations and mitigate production and

processing issues. Management is streamlining both mine planning

and maintenance programmes, as well as improving the metallurgical

performance of the mill.

These measures are being taken without delay. For example; to

redress a temporary shortfall in ore mined due to legacy haul truck

constraints, the Company has taken immediate action to obtain the

required engine replacements on an expedited basis. To balance the

interim period Chaarat's mining contractor has assisted by

increasing its fleet size resulting in increased trucking

rates.

Mill throughput has increased by 23% in the first five months

compared to the same period for 2018.

The production of copper concentrate is 12% up on the same

period last year. Operational improvements have also resulted in a

16% increase in AuEq ounces being recovered to copper concentrates.

Improved recovery of precious metals to copper concentrates has

also, in turn, improved profitability, due to the higher payable

levels for Au and Ag.

Zinc concentrate production is down 10% year on year due to

lower zinc grades in mined ore and slightly lower recoveries.

Actions are underway to replace one of the cyclone packs on the

mill circuit to resolve this issue. AuEq ounces in concentrate are

also down (-8%), mostly due to the improvements in the copper

circuit which have resulted in higher metal pulls to the copper

concentrate.

Additional efforts are also in place to achieve targeted grades,

reduce costs, and increase margins:

-- A cost reduction program is underway to review all major

expenditure areas and identify operational efficiencies. This will

include reviewing all contracts and procurement plans.

-- Additional sources of feed are being identified to allow the

excess capacity of the mill to be fully utilized.

-- A review of Mining Methods and Mine Planning is in progress

to identify ways to improve ore grade and reduce dilution.

-- Mill improvements through equipment and reagents are ongoing

to continue to improve recoveries and enhance concentrate

values.

The Company is confident that these initiatives will generate

additional profit for the business. A comprehensive financial

update will be provided with the H1 2019 results.

Overview of exploration and Mineral Resource Estimates

The Company announces an updated Mineral Resource Estimate

("MRE") demonstrating an increase in resources at Kapan. These have

been identified from previous exploration campaigns. The Company is

confidenct that the discovery of additional resources is likely to

maintain the life of the asset well beyond the current reserve

estimate.

The MRE is based on 69,000 metres of underground drilling

conducted during 2018. Through future exploration, it is expected

that annual replacement of depleted resources will be maintainable

on an ongoing basis. There also exists numerous exploration

opportunities for discovery of additional ore proximal to the

current workings.

The MRE update involved geological assessment of the exploration

drilling, and optimization of the modelling methodology. Since

taking ownership of the Kapan mine, Chaarat has been working to

develop a JORC-compliant resource model that better reflects

historical mining results. Sampling methods and practices have been

reviewed and modified to correct the previous resource model's

historical tendency to overestimate grade in order to achieve a

more realistic estimate. This has also led to an increase in

M&I tonnage compared to the last published Polymetal Resource

Estimate (effective 1 January, 2018).

The Company considers the current MRE to be a more technically

robust and realistic grade model than the previous one used by

Polymetal. As more mine to mill reconciliation data is obtained,

the grade estimation methodology will be further optimized to

continue improving the model.

An updated reserve statement is being developed as part of the

Midyear LoM planning process, and will be issued on completion

The new model is fully JORC-compliant and yields 8.9mt in the

Measured and Indicated category with a gold equivalent grade of

6.20g/t. The updated MRE now comprises:

Cut-off 2.5g/t AuEq Grade Metal

Class Tonnes Density Au Ag Cu Zn AuEq Au Ag Cu Zn AuEq

(mt) (g/t) (g/t) (%) (%) (g/t) (koz) (koz) (t) (t) (koz)

------- -------- ------- ------- ----- ----- ------- ------- ------- ------- -------- -------

Measured 0.65 3.05 4.01 74.88 0.88 3.44 9.01 83 1,550 5,645 22,167 186

------- -------- ------- ------- ----- ----- ------- ------- ------- ------- -------- -------

Indicated 8.27 3.02 2.57 51.70 0.59 2.37 5.99 681 13,725 48,726 195,835 1,589

------- -------- ------- ------- ----- ----- ------- ------- ------- ------- -------- -------

M&I 8.92 3.03 2.67 53.38 0.61 2.45 6.20 764 15,275 54,370 218,002 1,775

------- -------- ------- ------- ----- ----- ------- ------- ------- ------- -------- -------

Inferred 8.69 3.02 2.30 50.78 0.56 2.07 5.42 641 14,164 48,298 179,995 1,513

------- -------- ------- ------- ----- ----- ------- ------- ------- ------- -------- -------

Notes: The figures above are effective as of 10 June 2019. The

results are reported at a cut-off grade of 2.5g/t AuEq. The AuEq is

calculated AuEq = Au + Ag/84 + Cu/0.6 + Zn/1.3 based on metals

prices of $1,250/ounce Au, $15.50/ounce Ag, $6,000/tonne Cu, and

$2,500/tonne Zn and on metallurgical recoveries as determined at

site.

Conference call and Web cast:

Chaarat will hold a conference call and webcast on Wednesday,

31(st) July, 2019 at 09:00 BST. Please see the below dial-in and

webcast details.

Dial-in: +44 (0)203 059 5868

Webcast:

https://secure.emincote.com/client/chaarat/chaarat002

Competent Person

The Competent Person with responsibility for technical content

of this press release for the Company, and who has reviewed the

information contained herein, is Dorian L. (Dusty) Nicol

(FAussIMM), the Company's Senior Vice President, Exploration. He is

a geologist with more than 40 years of experience in the resource

industry who has sufficient experience relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify as a Competent Person

as defined in the 2012 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. He has supervised the work which is the subject of this

release. Mr. Nicol consents to the inclusion in the report of the

matters based on this information in the form and context in which

it appears.

Enquiries

Chaarat Gold Holdings Limited +44 (0)20 7499 2612

Martin Andersson (Executive Chairman)

Artem Volynets (CEO) info@chaarat.com

Numis Securities Limited

John Prior, Paul Gillam (NOMAD) +44 (0) 20 7260 1000

James Black (Corporate Broking)

Powerscourt

Conal Walsh +44 (0)20 7250 1446

Sam Austrums chaarat@powerscourt-group.com

About Chaarat Gold

Chaarat Gold is a gold mining company which owns the Kapan

operating mine in Armenia as well as Tulkubash and Kyzyltash Gold

Projects in the Kyrgyz Republic. The Company has a clear strategy

to build a leading emerging markets gold company with an initial

focus on Central Asia and the FSU through organic growth and

selective M&A.

Chaarat is engaged in active community engagement programs to

optimise the value of the Chaarat investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high-quality gold and mineral deposits by

building relationships based on trust and operating to the best

environmental, social and employment standards. Further information

is available at www.chaarat.com.

Glossary of Technical Terms

"Au" chemical symbol for gold

"cut off" the lowest grade value that is included in a

resource statement. It must comply with JORC

requirement 19: "reasonable prospects for eventual

economic extraction" the lowest grade, or quality,

of mineralised material that qualifies as economically

mineable and available in a given deposit. It

may be defined on the basis of economic evaluation,

or on physical or chemical attributes that define

an acceptable product specification

"g/t" grammes per tonne, equivalent to parts per million

"Inferred Resource" that part of a Mineral Resource for which tonnage,

grade and mineral content can be estimated with

a low level of confidence. It is inferred from

geological evidence and assumed but not verified

geological and/or grade continuity. It is based

on information gathered through appropriate techniques

from locations such as outcrops, trenches, pits,

workings and drill holes which may be limited

or of uncertain quality and reliability

"Indicated that part of a Mineral Resource for which tonnage,

Resource" densities, shape, physical characteristics, grade

and mineral content can be estimated with a reasonable

level of confidence. It is based on exploration,

sampling and testing information gathered through

appropriate techniques from locations such as

outcrops, trenches, pits, workings and drill

holes. The locations are too widely or inappropriately

spaced to confirm geological and/or grade continuity

but are spaced closely enough for continuity

to be assumed

"JORC" The Australasian Joint Ore Reserves Committee

Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves 2012 (the "JORC Code"

or "the Code"). The Code sets out minimum standards,

recommendations and guidelines for Public Reporting

in Australasia of Exploration Results, Mineral

Resources and Ore Reserves

"koz" thousand troy ounces of gold

"Measured Resource" that part of a Mineral Resource for which tonnage,

densities, shape, physical characteristics, grade

and mineral content can be estimated with a high

level of confidence. It is based on detailed

and reliable exploration, sampling and testing

information gathered through appropriate techniques

from locations such as outcrops, trenches, pits,

workings and drill holes. The locations are spaced

closely enough to confirm geological and grade

continuity

"Mineral Resource" a concentration or occurrence of material of

intrinsic economic interest in or on the Earth's

crust in such form, quality and quantity that

there are reasonable prospects for eventual economic

extraction. The location, quantity, grade, geological

characteristics and continuity of a Mineral Resource

are known, estimated or interpreted from specific

geological evidence and knowledge. Mineral Resources

are sub-divided, in order of increasing geological

confidence, into Inferred, Indicated and Measured

categories when reporting under JORC

"Mt" million tonnes

"oz" troy ounce (= 31.103477 grammes)

"Reserve" the economically mineable part of a Measured

and/or Indicated Mineral Resource

"t" tonne (= 1 million grammes)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDPGUPAMUPBUBB

(END) Dow Jones Newswires

July 29, 2019 06:17 ET (10:17 GMT)

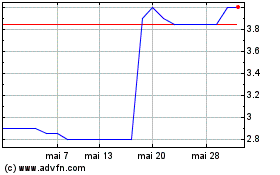

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024