TIDMCGH

RNS Number : 0388L

Chaarat Gold Holdings Ltd

27 April 2020

The following amendment has been made to the 'Confirmed proceeds

and closure of the Placing' announcement released on 27 April 2020

at 7.00am under RNS number 9286K.

The number of Placing Shares in respect of which application for

admission to trading on AIM has been made has been changed to

42,112,025 Placing Shares.

All other details remain unchanged.

The full amended text is shown below.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

Not for release, publication, or distribution to United States

newswire services or for release, publication or dissemination in

the United States and does not constitute an offer of the

securities herein.

This press release does not constitute an offer to sell, or a

solicitation of an offer to buy, securities in the United States or

any other jurisdiction. Any securities described in this press

release have not been, and will not be, registered under the US

Securities Act of 1933, as amended, and may not be offered or sold

in the United States absent registration except in transactions

exempt from, or not subject to, registration under the US

Securities Act and applicable US state securities laws. There is no

public offering of the securities in the United States

expected.

27 April 2020

Chaarat Gold Holdings Limited

("Chaarat" or the "Company")

Confirmed proceeds and closure of the Placing

Chaarat (AIM:CGH), the AIM-quoted gold mining company with

assets in the Kyrgyz Republic and Armenia is pleased to announce

that, further to its announcement of 15 April 2020 (RNS 6997J), it

has closed the Placing (1) , having raised gross proceeds of

approximately US$13.8 million from the issue of 42,112,025 new

ordinary shares of US$0.01 each (the "Placing Shares") at 26 pence

per Placing Share, subject to the admission of the Placing Shares

to trading on the AIM market of London Stock Exchange plc

("Admission").

The share issue consists of:

-- the subscription for 12,954,962 Placing Shares by existing

shareholders and new investors;

-- the subscription for 25,396,945 Placing Shares by Labro

Investments Limited ("Labro"), Chaarat's largest shareholder,

the majority of shares in which Martin Andersson (the executive

chairman of Chaarat) is directly beneficially interested;

and

-- the subscription for 3,760,118 Placing Shares by directors

(including 2,569,868 by Martin Andersson) and senior management.

Following the subscriptions for the Placing Shares announced

today, the Company has decided to close the Placing with immediate

effect.

Chaarat also announces that it has issued 297,330 new ordinary

shares of US$0.01 each. These comprise:

-- 177,330 new ordinary shares (2) issued to Labro (the "Labro

Fee Shares") pursuant to drawdowns made by the Company on

the committed revolving term loan facility (the "Labro Facility")

announced by the Company on 14 December 2018 (RNS number

5046K); and

-- 120,000 new ordinary shares (the "Option Shares") issued

to satisfy the Company's obligations under the Company's

2017 incentive plan to a former director on the exercise

by that director of previously vested options.

An application has been made to the London Stock Exchange for

the 42,112,025 Placing Shares, the 177,330 Labro Fee Shares and the

120,000 Option Shares (together, the "New Ordinary Shares") to be

admitted to trading on AIM, and it is expected that admission will

become effective and dealings in the New Ordinary Shares will

commence at or around 8:00am (London time) on 30 April 2020.

Following Admission of the New Ordinary Shares:

-- the Company's enlarged issued share capital will comprise

524,562,210 ordinary shares of US$0.01 each. This figure

may be used by shareholders of the Company as the denominator

for the calculations by which they will determine whether

they are required to notify their interests in, or a change

to their interest in, the Company under the Financial Conduct

Authority's Disclosure Guidance and Transparency Rules Sourcebook;

and

-- Labro and Martin Andersson will hold the following ordinary

shares of US$0.01 in the capital of the Company: of shares % of issued

share capital

------------------

Labro (3) 202,828,442 38.67%

------------------ ------------ ---------------

Martin Andersson

(4) 5,829,996 1.11%

------------------ ------------ ---------------

Combined Total 208,658,438 39.78%

------------------ ------------ ---------------

Financing update

In view of the level of interest in the Placing beyond the

announced $12 million, Labro's participation in the Placing was

reduced from US$10 million to US$8.3m and comprised a US$2 million

cash subscription and a conversion to equity of US$6.3 million of

indebtedness under the Labro Facility, reducing the outstanding

principal amount and interest accrued under the Labro Facility to

US$ Nil . US$6.5 million of the Labro Facility remains available

for drawdown until 31 December 2020.

Artem Volynets, Chief Executive Officer of Chaarat, said:

" We are delighted to see continued support from our keys

shareholders as well as welcome new investors into the exciting

Chaarat story. Raising US$13.8 million beyond the previously

announced US$12 million in the current challenging market

environment shows the attractiveness of Chaarat's value

proposition. The prime motivation behind this placing was to

strengthen the balance sheet and allow the Company to continue its

strategy amidst the current macro-economic factors.

We believe that continuous stability of the Kapan operation in

Armenia, along with progress on the Tulkubash construction

programme in the Kyrgyz Republic, and the deleveraging of the

business allows us to progress with our strategic plans and take

advantage of the opportunities presented. "

(1) Definitions

Capitalised terms used but not otherwise defined in this

announcement have the meanings given to them in the 'Proposed

Equity Capital Raise and Funding Update' announcement released on

15 April 2020 under RNS Number 6997J.

(2) Regulation 19 Waiver

There is a provision in the Company's Articles of Association

(the "Articles") (Regulation 19) which states that the Board has

the right to require any holder of more than 20% of the Ordinary

Shares to make a mandatory offer to all the Company's shareholders

to acquire their Ordinary Shares if they acquire an additional

interest in any Ordinary Shares.

The Labro Fee Shares do not fall under the waiver for market

share purchases of up to three million Ordinary Shares announced by

the Company on 24 February 2020 (RNS number 8217D) and, as

explained below, a separate waiver has been granted by the

Board.

The Labro Facility requires the Board to exercise its discretion

under Regulation 19 of the Articles so as not to require a

mandatory offer to be made in connection with the issue to Labro of

any Ordinary Shares pursuant to the Labro Facility or as a result

of any redemption or purchase by the Company of its own voting

shares at any time in the future, but not in respect of any other

purchase of Ordinary Shares or any interest therein by Labro (the

"Waiver"). The Board has resolved to grant the Waiver.

285,541 of the shares being subscribed for by Martin Andersson

personally do not fall under the waiver granted by the board on 14

April 2020 and announced by the Company on 15 April 2020 ( RNS

number 6997J). On 24 April 2020, the Board (excluding Martin

Andersson) exercised its discretion to waive the requirement for a

mandatory offer for the Company by Labro, to allow Martin Andersson

to receive an additional 285,541 Ordinary Shares in the

Placing.

(3) Labro also holds loan notes for US$1,000,000 (the "Loan

Notes") convertible into 2,849,330 ordinary shares of US$0.01 each

in the capital of the Company ("Ordinary Shares") (assuming full

conversion of principal and interest to maturity). If all the Loan

Notes were subsequently converted (assuming full conversion of

principal and interest to maturity), if an additional 8 million

shares fell due to be issued to Labro pursuant to the loan security

fee arrangements announced by the Company on 15 April 2020 (RNS

6997J), and if no options to subscribe for Ordinary Shares issued

by the Company were exercised, no other convertible loan notes

issued by the Company were converted and no other Ordinary Shares

were issued), Labro would hold 213,677,772 Ordinary Shares

representing 39.91% of the resulting enlarged share capital.

(4) Pursuant to restricted share awards and share options

granted by the Company to Mr Andersson, he may become entitled to a

further 18,111,821 Ordinary Shares. If Mr Andersson were to acquire

all the shares to which he may become entitled (and no other

restricted share awards vested and no other options to subscribe

for Ordinary Shares issued by the Company were exercised and no

other Ordinary Shares were issued), on a combined basis, Labro and

Mr Andersson would together hold 237,619,589 Ordinary Shares

representing 43.07% of the resulting enlarged share capital.

Enquiries

Chaarat Gold Holdings Limited +44 (0)20 7499 2612

Artem Volynets (CEO) info@chaarat.com

Numis Securities Limited +44 (0) 20 7260 1000

John Prior, Paul Gillam (NOMAD)

James Black (Corporate Broking)

SP Angel Corporate Finance

LLP + 44 (0) 20 3470 0470

Ewan Leggat (Joint Broker)

finnCap Limited +44 (0)20 7220 0500

Christopher Raggett (Joint

Broker)

Camille Gochez (Joint Broker)

About Chaarat

Chaarat is a gold mining company which owns the Kapan operating

mine in Armenia as well as Tulkubash and Kyzyltash Gold Projects in

the Kyrgyz Republic. The Company has a clear strategy to build a

leading emerging markets gold company with an initial focus on

Central Asia and the FSU through organic growth and selective

M&A.

Chaarat is engaged in active community engagement programmes to

optimise the value of the Chaarat investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high-quality gold and mineral deposits by

building relationships based on trust and operating to the best

environmental, social and employment standards. Further information

is available at www.chaarat.com .

Appendix 1 - PDMR forms

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Labro Investments Limited

------------------------------------- --------------------------------------

2 Reason for the notification

-----------------------------------------------------------------------------

a) Position / status Person/Entity closely associated

with the Chairman

------------------------------------- --------------------------------------

b) Initial notification Amendment

/ amendment

------------------------------------- --------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------------

a) Name Chaarat Gold Holdings Limited

------------------------------------- --------------------------------------

b) Legal entity identifier 213800T2A5CV84VTFJ70

------------------------------------- --------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place

where transactions have been conducted

-----------------------------------------------------------------------------

a) Description of the Ordinary shares of US$0.01 each

financial instrument,

type of instrument

Identification code VGG203461055

------------------------------------- --------------------------------------

b) Nature of the transaction Acquisition by way of a placing

------------------------------------- --------------------------------------

c) Currency GBP

------------------------------------- --------------------------------------

d) Price(s) and volume(s) Price(s) Volume(s)

------------------------------------- ---------------- -----------------

26p 25,396,945

------------------------------------------ ---------------- -----------------

e) Aggregated information

* Aggregated volume 25,396,945

26 pence

GBP6,603,205.70

* Aggregated price

* Aggregated total

-------------------------------------- ------------------------------------------

f) Date of the transaction 15 April 2020

------------------------------------- --------------------------------------

g) Place of the transaction XLON

------------------------------------- --------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Martin Andersson

------------------------------------- -------------------------------------

2 Reason for the notification

----------------------------------------------------------------------------

a) Position / status Chairman

------------------------------------- -------------------------------------

b) Initial notification Amendment

/ amendment

------------------------------------- -------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------

a) Name Chaarat Gold Holdings Limited

------------------------------------- -------------------------------------

b) Legal entity identifier 213800T2A5CV84VTFJ70

------------------------------------- -------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place

where transactions have been conducted

----------------------------------------------------------------------------

a) Description of the Ordinary shares of US$0.01 each

financial instrument,

type of instrument

Identification code VGG203461055

------------------------------------- -------------------------------------

b) Nature of the transaction Acquisition by way of a placing

------------------------------------- -------------------------------------

c) Currency GBP

------------------------------------- -------------------------------------

d) Price(s) and volume(s) Price(s) Volume(s)

------------------------------------- ---------------- ----------------

26p 2,569,868

------------------------------------------ ---------------- ----------------

e) Aggregated information

* Aggregated volume 2,569,868

26 pence

GBP668,165.68

* Aggregated price

* Aggregated total

-------------------------------------- -----------------------------------------

f) Date of the transaction 15 April 2020

------------------------------------- -------------------------------------

g) Place of the transaction XLON

------------------------------------- -------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCDDLFLBZLBBBB

(END) Dow Jones Newswires

April 27, 2020 13:01 ET (17:01 GMT)

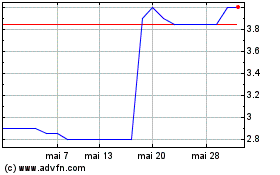

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024