TIDMCGH

RNS Number : 0025V

Chaarat Gold Holdings Ltd

04 August 2020

4 August 2020

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

H1 2020 Production and Operational Update

Chaarat (AIM:CGH), the AIM-quoted gold mining Company with an

operating mine in Armenia and assets at various stages of

development in the Kyrgyz Republic, announces its production and

operational results for the half year ended 30 June 2020 (the "half

year", "H1" or the "Period") for its Kapan Gold Mine ("Kapan"), in

Armenia, progress at the Tulkubash project and a general corporate

update.

COVID-19 update

-- COVID-19 prevention measures have been successfully implemented

at all Chaarat offices and sites since mid-February leading

to no cases on record within the group during H1.

-- We have also worked closely with our communities to provide

support and assistance via medical supplies and infrastructure

to help with preventive measures. These measures are not

limited to but include the following

o Kapan/Armenia

-- Donated beds and equipment to the medical

centre of Kapan

-- Provided diagnostic test kits and masks to

the Kapan regional hospital

-- Provided computers to help school children

attend remote classes

-- Sent gifts to the nurses of Kapan for their

contribution during this pandemic

o Tulkubash - Chatkal/Kyrgyz Republic

-- Delivered flour, masks, and disinfectant to

communities in the Chatkal region

-- Donated masks and hand sanitisers to hospitals

-- Donated PCR thermocycler and PCR tests for

COVID-19 to the Kyrgyz Ministry of Health

o Chaarat is continuing to follow best practice

to prevent our employees from contracting COVID-19

and supporting the communities on an ongoing basis.

o In mid-July, Chaarat provided oxygen concentrators

to the local hospitals in Chatkal, Kyrgyz Republic.

H1 Kapan Update

H1 H ighlights

-- H1 2020 had a total recordable injury case rate (per one

million hours worked) of 0.7. The Company had one Lost

Time Injury ('LTI') in Q1 2020 at its Kapan Operation.

There were no recordable injuries in Q2 2020.

-- Gold equivalent production of 26,960 ounces ("oz") including

543 ounces produced from third-party ore - compared to

29,607 oz produced in H1 2019 (- 9%) but slightly up from

26,906 in H2 2019 - consisting of:

o 13,179 ounces of gold;

o 261,551 ounces of silver;

o 960 tonnes of copper; and

o 3,997 tonnes of zinc.

-- Realised gold price increased by 25.5% compared to previous

period but is offset by comparable decreases in copper

and zinc prices. The mine achieved an average gold price

for the Period of USD1,665 /oz versus USD1,327 /oz in

H1 2019 in line with the average gold price for the six

months to end June. However, base metals saw significant

declines in prices in Q1, before improving in late Q2:

o Realised gold price of USD 1,665/oz vs USD 1,327/oz

in H1 2019 (+ 25.5%)

o Realised silver price of USD 16.4/oz vs USD 15.2/oz

in H1 2019 (+ 7.9%)

o Realised copper price of USD 5,400/t vs USD 6,123/t

in H1 2019 (- 11.8%)

o Realised zinc price of USD 1,959/t vs USD 2,568/t

in H1 2019 (- 23.7%)

-- Total tonnes mined in H1 2020 was 360,957t showing a trend

of increasing output from the mine from H1 2019 with 326,278t

(+ 10.6%) and H2 2019 with 352,104t (+ 2.5%).

-- Gold equivalent grades mined in H1 2020 were 2.87 g/t

versus 3.02 g/t in H1 2019 (- 5%) and 2.84 g/t in H2 2019

(+ 1%). The grades in H1 2020 were still impacted by mining

in lower-grade areas and we are now in the process of

developing towards higher-grade areas.

-- Grades are expected to improve in the next quarters as

a result of the targeted development work carried out

year to date and the ongoing review of the mine by the

new geology team focusing on identifying high grade that

requires minimal development mining.

-- Copper and zinc recoveries increased year on year (by

1% and 2% respectively), but gold to Cu concentrate was

down as a result of the lower gold head grade in ore.

Third-party ore recovery is tracked separately due to

it being of a completely different nature to our own polymetallic

ore.

-- Unit costs improved quarter on quarter with efficiency

gains throughout the operation. This has not as yet materialised

in the all-in-sustaining cost ("AISC" (2) ) due to lower

production of gold in H1 2020 and mining in the lower-grade

areas. AISC were at USD1,076 /oz compared to H2 2019 (USD1,108

/oz) but higher compared to H1 2019 (USD972/oz).

-- Underground development of 11,216 metres for the half

year is comparable to both H1 and H2 2019.

-- Two new cyclone clusters were installed in late Q2 to

replace old inefficient units and are showing improved

results thus far. More improvements are expected in H2

2020.

-- Chaarat was able to sign two new contracts with third-party

ore providers in Q2 2020 and started to receive continuous

feed from June 2020. These additional feeds will help

increase economics in the mill and support Chaarat in

achieving its annual targets.

-- The Chaarat technical team has identified a mineralised

area with excellent exploration potential ("East Flank")

adjacent to the existing Kapan mine. This target is based

on an historic drilling database of 62 drill holes comprising

22 km of drilling. The East Flank Exploration Target,

indicates a potential 5-6 million tonnes with Au grades

of 2.25 - 2.75 g/t. Resource definition drilling will

be required, and evaluation, followed by access development

in order to increase throughput in the mill currently

expected by H2 2022.

Outlook

-- Chaarat remains on track to deliver on its AuEq 55koz

guidance for the year, as previously set out in the FY

2019 Production, Operational and Financial Update release

on 19 February 2020.

-- A portion of the copper concentrate and third-party concentrate

produced in June was not financially recognised in H1

2020 due to late shipment. This led to lower AuEq sold

in H1 2020 but will contribute positively to results in

July 2020. Further, a stronger H2 is expected with improved

economic performance as new higher-grade zones are mined

from development in H1 2020.

-- Chaarat's focus is on access to more "value adding" areas

of the mine for the rest of 2020. The technical team is

making good progress on updating the mining plan for H2

2020 and the years to come.

-- New mine equipment will provide immediate operational

improvements along with mill circuit upgrades This, with

third-party ore will increase operational efficiency in

H2 2020.

-- Chaarat's 2020 half-year results will be published in

September 2020.

(1) Gold equivalent ounces based on gold price of USD 1,500/oz

and gold ratios of 83 for silver (Au/Ag), 7,778 for copper (Au/Cu)

and 20,968 for zinc (Au/Zn).

(2) AISC on a gold oz produced basis exclude smelter TC/RC

charges, others which add c. USD 234/oz. Sustaining capex of c. USD

2.3 million in H1 2020 is included in the AISC.

Tulkubash Construction Update

Chaarat is continuing with detailed engineering, and current

works are being completed on time despite precautionary measures

taken in response to the COVID-19 situation. Design on the Heap

Leach Facility (HLF) and Adsorption-Desorption Recovery Facilities

(ADR) is almost complete, and work on the crushing circuit and

final equipment selection is ongoing. Further equipment

mobilisation is on hold, as previously announced, due to the

ongoing international travel and border restrictions .

General Corporate Update

The Company is continuing its discussions with several parties

and is working to finalise the project financing by the end of

2020. Interest from newly contacted banks has led to a thorough

review of additional proposals to further optimise the financing

structure for the Tulkubash asset.

As announced on 27 April, the Company completed an equity

capital raise of USD13.8m reducing its working capital facility to

zero and the overall debt outstanding.

Since then Chaarat has further reduced the Kapan acquisition

financing by USD2 million with USD30 million now outstanding and

the consolidated corporate debt reduced to USD69 million.

Artem Volynets, Chief Executive Officer, commented:

"Before discussing our operational performance, I would like to

talk first about the ongoing COVID-19 pandemic. I am very proud of

the team and their proactive approach to managing the safety of our

employees as well as actively contributing to community efforts

during this difficult period. Through these efforts the impact on

our business was minimal in H1. Unfortunately, in July we have had

our first cases at our Tulkubash site. This outbreak was

effectively managed and brought under control quickly with minimal

disruption to ongoing works or plans. The overall situation in the

Kyrgyz Republic worsened significantly in July which impacted the

extended families of several employees. Our heartfelt condolences

go out to them and their loved ones.

At Kapan, we are pleased to report that we are still on track

for our operational guidance of 55koz for 2020, despite some

challenges. The continuous improvements in the AISC and the

benefits of higher utilisation and the new equipment have already

shown improvements in June which bodes well for a strong second

half of the year.

At Tulkubash the current works are being completed in accordance

with the schedule and budget. The restrictions on people and

equipment mobilisation, as well as precautionary measures

undertaken for contractors and employees at this time, will delay

first gold pour until the end of 2022, as previously announced.

However, the time will be used wisely as it allows us to optimise

critical aspects of this first stage of our existing Kyrgyz

operations."

Enquiries

Chaarat Gold Holdings Limited +44 (0)20 7499 2612

Artem Volynets (CEO) info@chaarat.com

Numis Securities Limited

Paul Gillam (NOMAD) +44 (0) 20 7260 1000

SP Angel Corporate Finance

LLP + 44 (0) 20 3470 0470

Ewan Leggat (Joint Broker)

finnCap Limited +44 (0)20 7220 0500

Christopher Raggett (Joint

Broker)

Camille Gochez (Joint Broker)

About Chaarat

Chaarat is a gold mining company which owns the Kapan operating

mine in Armenia as well as Tulkubash and Kyzyltash Gold Projects in

the Kyrgyz Republic. The Company has a clear strategy to build a

leading emerging markets gold company with an initial focus on

Central Asia and the FSU through organic growth and selective

M&A.

Chaarat is engaged in active community engagement programmes to

optimise the value of the Chaarat investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high-quality gold and mineral deposits by

building relationships based on trust and operating to the best

environmental, social and employment standards. Further information

is available at www.chaarat.com/ .

H1 2020 PRODUCTION & OPERATIONAL SUMMARY

H1 2020 H1 2019

Tonnes ore mined (Kapan) 360,957 326,922

AuEq Grade mined (Kapan) 2.84 3.02

Tonnes ore milled (Kapan) 355,523 381,313*

AuEq Grade milled (g/t) 2.89 2.97

Tonnes ore milled (3(rd)

Party Ore) 10,127 0

Au Grade (g/t) (3(rd) Party

Ore) 3.43 0

AuEq Recovery (%) 79.2 81.3

Gold equivalent production

(oz)** 26,960 29,607

Gold production (oz) 13,179 17,706

Silver production (oz) 261,551 275,302

Copper production (t) 960 896

Zinc production (t) 3,997 3,191

Realised gold price (USD/oz) 1,665 1,327

AuEq sold 20,882 28,882

AISC (USD/oz)*** 1,076 972

* Higher throughput due to stockpile

** Including 543oz of Au production from 3(rd) Party Ore

*** AISC on a gold oz produced basis exclude smelter TC/RC

charges and others which add c. USD 234/oz. Sustaining capex of c.

USD 2.3 million for H1 2020 is included in the AISC.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDUOSKRRBUWRAR

(END) Dow Jones Newswires

August 04, 2020 02:00 ET (06:00 GMT)

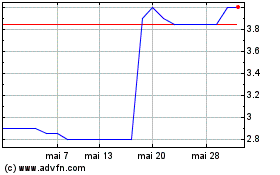

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024