Virgin Money UK PLC Maximum Acceptance Amount to Tender Offer (1375O)

08 Junho 2022 - 4:58AM

UK Regulatory

TIDMVMUK

RNS Number : 1375O

Virgin Money UK PLC

08 June 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON

(AS DEFINED IN REGULATION S UNDER THE UNITED STATES SECURITIES ACT

OF 1933, AS AMENDED (THE "SECURITIES ACT")) OR IN OR INTO THE

UNITED STATES OF AMERICA, ITS TERRITORIES AND POSSESSIONS

(INCLUDING PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN

SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS, ANY STATE OF

THE UNITED STATES OF AMERICA AND THE DISTRICT OF COLUMBIA) OR IN OR

INTO ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE,

PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT.

8 June 2022

Virgin Money UK PLC

(incorporated with limited liability in England and Wales with

Registered Number 09595911)

(formerly CYBG PLC)

Legal Entity Identifier (LEI): 213800ZK9VGCYYR6O495

ANNOUNCES MAXIMUM ACCEPTANCE AMOUNT IN RELATION TO TENDER OFFER

TO PURCHASE NOTES FOR CASH

Further to the announcement dated 7 June 2022 in relation to the

invitation of Virgin Money UK PLC (the "Issuer") to holders of its

outstanding GBP450,000,000 8 per cent. Fixed Rate Reset Perpetual

Subordinated Contingent Convertible Notes (ISIN: XS1346644799) (the

"Notes"), to tender such Notes for purchase by the Issuer for cash,

the Issuer hereby confirms that the Maximum Acceptance Amount is

GBP450,000,000. As the Maximum Acceptance Amount is equal to the

principal amount of the Notes, the Issuer confirms that it will

accept for purchase any validly tendered Notes up to the Maximum

Acceptance Amount without such Notes being scaled by a Scaling

Factor. Capitalised terms used and not otherwise defined in this

announcement have the meanings given in the tender offer memorandum

prepared by the Issuer dated 7 June 2022 (the "Tender Offer

Memorandum").

FURTHER INFORMATION

Noteholders are advised to read carefully the Tender Offer

Memorandum for full details of and information on the conditions of

and procedures for participating in the Offer.

The Issuer is not under any obligation to accept for purchase

any Notes tendered pursuant to the Offer. The acceptance for

purchase by the Issuer of Notes tendered pursuant to the Offer is

at the sole discretion of the Issuer and tenders may be rejected by

the Issuer for any reason.

A complete description of the terms and conditions of the Offer

is set out in the Tender Offer Memorandum. Any questions or

requests for assistance in connection with: (i) the Offer, may be

directed to the Dealer Managers; and (ii) the delivery of Tender

Instructions or requests for additional copies of the Tender Offer

Memorandum or related documents, which may be obtained free of

charge, may be directed to the Tender Agent, the contact details

for each of which are set out below.

Dealer Managers

Barclays Bank PLC Citigroup Global Markets Limited

5 The North Colonnade Citigroup Centre

Canary Wharf Canada Square

London E14 4BB Canary Wharf

United Kingdom London E14 5LB

United Kingdom

Telephone: +44 (0) 20 3134 8515

Attention: Liability Management Group Telephone: +44 20 7986 8969

Email: eu.lm@barclays.com Attention: Liability Management Group

Email: liabilitymanagement.europe@citi.com

Goldman Sachs International Morgan Stanley & Co. International plc

Plumtree Court 25 Cabot Square

25 Shoe Lane Canary Wharf

London EC4A 4AU London E14 4QA

United Kingdom United Kingdom

Telephone: +44 20 7774 4836 Telephone: +44 20 7677 5040

Attention: Liability Management Desk Attention: Liability Management Team, Global Capital

Email: Liabilitymanagement.eu@ny.email.gs.com Markets

Email: liabilitymanagementeurope@morganstanley.com

Tender Agent

Kroll Issuer Services Limited

The Shard

32 London Bridge Street

London

SE1 9SG

United Kingdom

Telephone: +44 20 7704 0880

Attention: Owen Morris

Email: virginmoney@is.kroll.com

Website: https://deals.is.kroll.com/virginmoney

DISCLAIMER

This announcement must be read in conjunction with the Tender

Offer Memorandum. No offer to acquire or exchange any securities is

being made pursuant to this announcement. This announcement and the

Tender Offer Memorandum contain important information, which must

be read carefully before any decision is made with respect to the

Offer. If any Noteholder is in any doubt as to the action it should

take, it is recommended to seek its own financial, legal and any

other advice, including in respect of any tax financial,

accounting, regulatory and tax consequences, immediately from its

broker, bank manager, solicitor, accountant or other independent

financial, tax or legal adviser. Any individual or company whose

Notes are held on its behalf by a broker, dealer, bank, custodian,

trust company or other nominee must contact such entity if it

wishes to participate in the Offer. None of the Issuer, the Dealer

Managers or the Tender Agent or their respective directors,

employees or affiliates makes any recommendation as to whether

Noteholders should participate in the Offer and none of the Issuer,

the Dealer Managers or the Tender Agent nor any of their respective

affiliates will have any liability or responsibility in respect

thereto.

Announcement authorised for release by Lorna McMillan, Group

Company Secretary.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFPMRTMTAMMFT

(END) Dow Jones Newswires

June 08, 2022 03:58 ET (07:58 GMT)

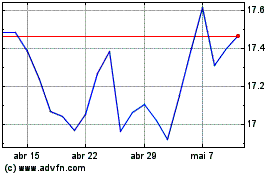

Ve Bionic Etf (LSE:CYBG)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

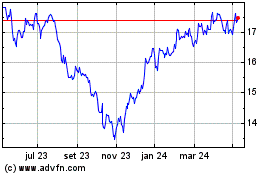

Ve Bionic Etf (LSE:CYBG)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024