TIDMFA.

RNS Number : 5934N

FireAngel Safety Technology Group

26 September 2023

26 September 2023

FireAngel Safety Technology Group plc

('FireAngel', the 'Group' or the 'Company')

Interim Results

FireAngel (AIM: FA.), a leading developer and supplier of home

safety products, announces its unaudited interim results for the

six months ended 30 June 2023 ("H1 2023" or the "Period").

FINANCIAL HIGHLIGHTS

-- Revenue down 16% to GBP21.4 million (H1 2022: GBP25.6

million) with UK revenue growth of 11% offset by a 63%

decline in International revenue

-- Gross profit down 32% to GBP3.8 million (H1 2022: GBP5.6

million)

-- Loss before tax of GBP4.0 million (H1 2022: GBP1.7 million)

-- Non-underlying items(1) of GBP0.4 million (H1 2022:

GBP0.1 million)

-- Underlying loss before tax(2) of GBP3.6 million (H1

2022: GBP1.7 million)

-- Underlying EBITDA(3) GBP(1.6) million (H1 2022: GBP(0.1)

million)

-- Inventory at 30 June 2023 of GBP10.0 million (30 June

2022: GBP4.7 million) reduced to GBP8.5 million at 31

August 2023

-- Net debt(4) (before lease obligations) at 30 June 2023

of GBP5.4 million (30 June 2022: GBP3.8 million; 31

December 2022: GBP4.8 million) comprising cash of GBP1.2

million, debt of GBP2.5 million and drawings under the

Company's invoice finance facility of GBP4.1 million.

As at 31 August 2023, net debt (3) (before lease obligations)

w as GBP4.2 million

-- Fundraising of GBP6.1 million (gross) was announced

on 6 June 2023

(1) Non underlying items comprise a share-based payments charge

of GBP0.2m, restructuring and strategic review costs of GBP0.4m and

the extinguishment of a financial liability gain of GBP0.3m (2022:

share-based payment charge of GBP0.1m)

(2) Underlying loss before tax is before non-underlying

items

(3) Underlying EBITDA is earnings before tax, depreciation and

amortisation, finance costs and non-underlying items

(4) Net debt is calculated as the net value of cash and cash

equivalents, invoice discounting facilities and loans and

borrowing.

BUSINESS HIGHLIGHTS

-- New business won includes contracts signed with Yale,

British Gas Services and a Middle East government agency

-- Signing of delivery and production contracts with Techem

and our long term manufacturing partner

-- Price rises agreed with major customers during H1 2023

-- Resignation of Executive Chairman John Conoley on 6

June 2023 and replaced by Andrew Blazye (Non-Executive

Chair) and Neil Radley (CEO)

-- Strategic review commenced on 6 June 2023 and actions

already taken to reduce inventory (GBP1.5 million reduction

from 30 June 2023 to 31 August 2023) and operating costs

-- Reinvigoration of Senior Leadership Team with 3 key

appointments made since period end

BUSINESS OUTLOOK

-- Future projections continue to be worked on and verified

-- Key products (NGSA with Techem and our own HEG solution)

due to be delivered in 2024

-- Cost management initiatives being implemented including

the right sizing of manufacturing capability. This has

resulted in the recent notice of termination of one

manufacturing supplier contract

-- Realisation of certain assets for cash being explored

-- Due to the ongoing strategic review, combined with the

notice of termination of one manufacturing supplier

contract referred to above and the uncertainty around

the realisation of any asset sales, the Directors believe

there are some material uncertainties which could impact

the Company's future cash forecasts and banking covenants

(details of which are set out below in note 2 to the

Financial Information)

Andrew Blazye, Non-Executive Chair of FireAngel, commented: "The

significant headwinds facing the Company are being addressed, the

benefits of which will start to bear fruit in 2024."

For further information, please contact:

FireAngel Safety Technology Group 024 7771

plc 7700

Andrew Blazye, Non-Executive Chair

Neil Radley, Chief Executive Officer

Zoe Fox, Chief Finance Officer

Shore Capital (Nominated adviser 020 7408

and broker) 4050

Tom Griffiths/David Coaten/Tom Knibbs

0204 529

Houston (Financial PR) 0549

Kate Hoare/Kelsey Traynor/Ben Robinson

Notes to Editors

About FireAngel Safety Technology Group plc

FireAngel's mission is to protect and save lives by making

innovative home safety products which are simple and accessible.

FireAngel is one of the market leaders in the European home safety

products market.

FireAngel's principal products are connected smoke alarms, CO

alarms, heat alarms and accessories. The Company has an extensive

portfolio of patented intellectual property in Europe, the US and

other selected territories. Products are sold under FireAngel' s

leading brands of FireAngel, FireAngel Pro, FireAngel Specification

and AngelEye.

For further product information, please visit:

www.fireangeltech.com

CHAIR'S STATEMENT

My appointment as Non-Executive Chair of FireAngel on 6 June

2023 coincided with the announcement of the Company's GBP6.1

million fundraising. The net proceeds of the fundraising have

provided FireAngel with the capital which it can use to begin to

drive an improvement in business momentum and, as such, I would

like to thank our shareholders (old and new) for their valuable

support.

Along with the fundraising, the Company announced that a

strategic review would be undertaken to explore options to realise

value for shareholders, which may or may not involve a sale of the

Company, which is being led by its newly appointed Chief Executive

Officer, Neil Radley. The strategic review is focused on future

proofing the Group and returning it to profitability as quickly as

possible and, even though it has yet to be completed, the Board is

encouraged by its early findings.

Independent market assessments have ratified the Board's

confidence in the continuing demand for the Group's safety

products, driven by societal and regulatory changes across several

of the Group's markets, including fire and carbon monoxide alarm

legislation, along with wider social housing reform and

environmental legislation, which is due to be enacted in the UK

later this year. Forthcoming regulatory tailwinds, particularly in

Germany and France, are expected to underpin further growth in

future years and the Board remains confident in the Company's

long-term fundamentals.

Nevertheless, there remains much work to be done. The well

publicised global supply chain issues of 2022 affected the Company

significantly, resulted in lower production than planned and led to

restricted and intermittent supply to end customers. Sadly, this

loss of momentum will not be recovered in 2023 and its impact is

clear in these interim results, resulting, as previously announced,

in H1 2023 unaudited revenue of GBP21.4 million which is down 16%

on the comparable period last year (H1 2022: GBP25.6 million).

Analysis of the Group's operations by the senior leadership team

and external advisors has identified areas where we can improve

market penetration, product margin, procurement and inventory

controls and tighten cost management. We are already taking action

in a number of these areas and will look to target an improved

performance from these self-help measures which, while beginning to

have an impact in H2 2023, will be much more meaningful in 2024 and

beyond.

Board

Alongside the announcement of my appointment as Chair, the

Company announced the appointment of Neil Radley as Chief Executive

Officer and the resignation of its former Executive Chairman, John

Conoley. Neil, who has over 20 years' experience in the finance,

retail and technology sectors and was previously the CEO of

Universe Group plc, an AIM quoted provider of transaction products

and services to the retail industry, brings a valuable breadth of

experience to lead the Group through this next phase.

On 25 July 2023, the Company announced that Simon Herrick, its

Senior Independent Director, had resigned with immediate effect due

to the increased commitment of his other business interests. As

separately announced today, Graham Bird has been appointed with

immediate effect as Senior Independent Director and Jon Kempster

will resign as a Non-Executive Director on 30 September 2023.

Graham is currently Chief Financial Officer of XP Factory plc, was

formerly a Non-Executive Director of Universe Group plc and brings

a wealth of experience to the Board which will prove invaluable

during this transitional period.

Andrew Blazye

Non-Executive Chair

CHIEF EXECUTIVE'S STATEMENT

BUSINESS AND FINANCIAL REVIEW

Overview

I joined FireAngel in June 2023 following the announcement of

the Company's successful fundraising with a clear mandate to lead a

turnaround of the business. My first priority was to lead an

in-depth strategic review which has proved a vital foundation in

helping us to understand and address certain key issues to enable

us to drive the Group forward.

As these interim results clearly show, there has been a

significant loss of momentum in the Group over the course of the

last nine months which will not be recovered in this financial

year. Our immediate focus is therefore on addressing the issues

associated with these challenges, in order to regain sales momentum

and improve cash flows. We have already made a number of important

management changes and begun various operational initiatives,

further details of which are set out below, and I have been pleased

with the way our teams are responding during this transitional

period.

Financial Performance

The Company achieved revenues of GBP21.4 million in H1 2023,

down 16% on the same period last year (H1 2022: GBP25.6 million).

Gross profit was down by 32% to GBP3.8 million (H1 2022: GBP5.6

million), taking into account GBP1.1 million of losses on hedging

contracts and with no purchase price variance costs (H1 2022:

hedging gains of GBP1.4 million and exceptionally high purchase

price variance costs of GBP1.6 million). Underlying gross margin

was 17.9% (H1 2022: 21.9%) resulting in an underlying loss before

tax for the Period of GBP3.6 million (H1 2022: underlying loss

before tax of GBP1.7 million) and a reported loss before tax of

GBP4.0 million (H1 2022: loss before tax of GBP1.7 million). The

Group continues to make headway on cost savings through its

self-help measures. The benefits from the measures taken in H1

2023, including price increases, are now being realised and further

measures taken in H2 2023 as part of the Company's ongoing

strategic review (further details of which are set out below) will

begin to be realised in Q4 2023 and throughout 2024.

The average exchange rate for USD to GBP in H1 2023 was 6% lower

than the average rate for H1 2022 which increased the GBP value of

USD denominated purchases compared to the comparable period in the

prior year and reduced the gross margin. The average exchange rates

against GBP are summarised below:

Average Average for H1

for year

ended 31

December

----------- ---------- -----------------

2022 2022 2023

---------- -------- -------

US Dollar 1.24 1.31 1.23

---------- -------- -------

The revenue split in H1 2023 between the Group's business units

was as follows:

Unaudited Unaudited

Six months Six months

ended ended

30 June 2023 30 June 2022 Change

Revenue GBP000 GBP000 GBP000 %

-------------------- -------------- -------------- ----------------------- ------

UK Trade 4,120 4,025 95 2%

UK Retail 8,773 7,157 1,616 23%

UK Fire & Rescue

Services ("F&RS") 1,786 1,575 211 13%

UK Utilities

& Leisure 1,256 1,642 (386) (24%)

-------------------- -------------- -------------- ----------------------- ------

Total UK sales 15,935 14,399 1,536 11%

International 3,306 8,404 (5,098) (61%)

Techem 1,118 1,698 (580) (34%)

Pace Sensors 1,089 1,055 34 3%

-------------------- -------------- -------------- ----------------------- ------

Total revenue 21,448 25,556 (4,108) (16%)

-------------------- -------------- -------------- ----------------------- ------

From 1 January 2023, certain customers previously reported

within the UK Trade business unit are now reported through UK

Utilities & Leisure . The 2022 comparatives have been adjusted

accordingly.

Total UK sales improved by 11% on the comparable period in the

prior year to GBP15.9 million (H1 2022: GBP14.4 million) driven

mainly by the impact of price increases which successfully

mitigated the reduction in UK sales volumes in H1 2023. New

contract opportunities secured during the Period included Yale

(announced on 26 January 2023) and British Gas Services Limited

(announced on 31 March 2023). However, the impact of the delay in

signing the British Gas Services contract resulted in a significant

decline in UK Utilities & Leisure's revenue in the Period.

International sales fell by more than half to GBP3.3 million (H1

2022: GBP8.4 million), which was primarily the result of the impact

of new legislation in Benelux which had led to a surge in customer

demand for products in the comparable period in the prior year and

significantly less demand in H1 2023 as customers looked to reduce

inventory intake. Whilst the Group was pleased to have secured a

new contract with a government agency in the Middle East (announced

on 12 May 2023), the delay in signing this contract also compounded

a weaker international performance in H1 2023.

The Company's partnership with Techem Energy Services GmbH

("Techem") continued to progress well during the period. On 18

April 2023, the Group announced the signing of production and

delivery contracts with Techem and its long-term manufacturing

partner, marking yet another important milestone. Initial shipments

of the next generation smoke alarm ("NGSA") being developed for

Techem are expected to commence in late 2024 and be significantly

cash generative for the Group thereafter. I am also pleased to

confirm that the sixth (of ten) contractual NGSA development

milestone of our agreement with Techem has also now been

successfully delivered on schedule. This deliverable which includes

all plastic parts for the product and sample units with functional

Printed Circuit Boards ("PCBs") represents the final milestone

based around product design and subsequent deliverables are focused

on the testing and production of devices.

The GBP1.1 million (H1 2022: GBP1.7 million) of revenue from

Techem in H1 2023 is recognised under IFRS15 accounting standards,

adopting the input methodology approach to phase revenue

recognition as this is based upon direct efforts to satisfy the

dominant component of the performance obligation which is the

product design. The total revenue associated with this contract

amalgamates the background IP, minimum royalty amounts and the

charges for the product development phases. The revenue reported in

the Period is lower than in H1 2022 due to the phasing of the

development work and lower costs incurred in the Period.

As a result of H1 2023's weak sales volume performance and a

lack of agility in the Group's forecasting process to cope with

these shifts in demand, inventory was GBP10.0 million at 30 June

2023 (30 June 2022: GBP4.7 million). This has been an immediate

area of focus for the Company's strategic review and the actions

being taken to improve sales performance, as detailed below, have

meant that this had fallen to GBP8.5 million as at 31 August 2023.

We are now focused on renegotiating contracts with suppliers to

better reflect the current volume demand and manage our existing

stock. As a result, notice was served earlier this month to end the

manufacturing contract with one supplier and both sides are working

together to ensure a smooth exit.

On 14 June 2023, the Group successfully completed a fundraising

resulting in net proceeds of GBP5.3 million which were used to

reduce debt and for working capital purposes. The reinforced

balance sheet position left the Group with n et debt(4) (before

lease obligations) at 30 June 2023 of GBP5.4 million (30 June 2022:

GBP3.8 million; 31 December 2022: GBP4.8 million) comprising cash

of GBP1.2 million, debt of GBP2.5 million and drawings under the

Company's invoice finance facility of GBP4.1 million. As at 31

August 2023, net debt (4) (before lease obligations) w as GBP4.2

million.

The Group has invested over GBP2.5 million into its new Home

Environment Gateway ("HEG") product which is due to be launched in

Q1 2024. The Company believes the solution opens up the Trade

market by allowing inter-connected capability within and between

connected premises. In addition, it extends functionality into the

damp and mould detection market with full monitoring capability.

The business model allows for long term recurring revenue.

(4) Net debt is calculated as the net value of cash and cash

equivalents, invoice discounting facilities and loans and

borrowing

Strategic Review Update

Whilst the strategic review, which was announced on 6 June 2023,

remains ongoing, the following outlines the two phases of work

being undertaken by the Company:

Phase One - Refocusing business under new management team

H2 2023 - Q1 2024

Recover sales performance and cash generation. Key issues

currently being addressed:

-- Sales: analysis has shown that the Group needs to focus

more on key segments of the market where it is underweight

compared to its competitors. In addition, improvements

in its forecasting process are being made so that issues

can be identified and dealt with much earlier in the business

cycle. Investment in the Company's sales team to seek

out new opportunities is also being made.

-- Margins: certain customers, products and market segments

have been identified where the Group's returns are not

adequate and, therefore, unless appropriate returns are

obtained, the Group will cease doing business with those

customers and/or withdraw products and/or exit certain

market segments.

-- Products: the Board has analysed the Company's product

roadmap for the medium term and is in the process of finalising

its strategy. The Home Environment Gateway product is

expected to be launched in Q1 2024 and the NGSA being

developed for Techem remains on track for a late 2024

delivery. The strategic review has focused on understanding

those products where the Group can leverage its IP versus

those which it can source 'ready made' (but with the expected

FireAngel quality) direct from manufacturers. A new range

of smoke and heat detectors is being planned for delivery

in early 2025. In addition to analysing the Company's

product roadmap, a review of all current products has

been made with the plan to reduce our current product

offer from more than 200 SKUs to less than 100.

-- Manufacturing: as a result of poor historical sales forecasting,

the Group's procurement has been out of sync and, as a

result, it has built up excess inventory. In the short

term, the Board is focused on reducing the inventory to

appropriate levels through reducing manufacturing volumes

and is working closely with manufacturing partners to

reduce the impact on their production schedules. As highlighted

previously, this has resulted in a fall in inventory from

GBP10.0 million at 30 June 2023 to GBP8.5 million at 31

August 2023.

-- Cost Management: a thorough review of the Group's cost

base has been undertaken and cost savings are being implemented.

Phase Two - Optimising business to deliver sustainable

growth

FY2024

Deliver key investment initiatives and improve planning. Key

issues currently being addressed:

-- Sales/Margin Growth and Stock Management: ensure the short

term initiatives noted above are sustained and built upon

-- Improve Forecasting: independent market research has confirmed

the annualised total potential European market at over

GBP0.5 billion per annum. FireAngel must ensure it has

the right product set to take advantage of the current

and future fast evolving legislative landscape

-- NGSA Delivery : launch of the NGSA in partnership with

Techem - initial shipments of products expected to commence

in late 2024

-- HEG: ensure that the solution is launched in a manner

that maximises the commercial opportunities

-- Build Generation 6 Product Range: utilising certain IP

and learnings from the Techem partnership, launch a new

range of Smoke and Heat detectors. Target date Q1 2025.

Senior Management

As the Company enters a new phase in its history, Nick Rutter

(Chief Product Officer) Rene Nolten (Sales Director) and James

Seaman (Product Delivery Director) will be leaving shortly to

pursue new opportunities. On behalf of the Group, I would like to

thank each of them for their contributions during their time with

us.

I am also pleased to announce the appointments of Neal Marathe

(Sales Director) and John Walsh (Product Delivery Director) who

have already joined and Adrian Wilding (Commercial Director) who

will join us in early October. We look forward to their

contribution as we continue to deliver on our plans.

Current Trading and Outlook

As previously outlined, whilst every effort is being made to

mitigate the impact of the momentum lost across the Group in H1

2023, it will take some time to recover.

The Company will continue to build on the progress made since

June 2023 as the Board seeks to refocus the Group and expects to

see the benefit of further cost management initiatives in Q4 2023

and into 2024.

I would like to thank all of the staff at FireAngel for their

ongoing commitment to the Group during what has been a challenging

period.

Neil Radley

Chief Executive Officer

Consolidated income statement

For the six months ended 30 June 2023

(Unaudited) (Unaudited) (Audited)

Six months ended 30 June 2023 Six months ended 30 June 2022 Year ended 31 December 2022

Before Non-underlying Before Non-underlying Before Non-underlying

non-underlying items Total non- items Total non- items Total

items (note 5) underlying (note 5) underlying (note 5)

Note items items

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------- ------ -------------- -------------- -------- ---------- -------------- -------- ---------- -------------- --------

Revenue 3 21,448 - 21,448 25,556 - 25,556 57,461 - 57,461

Cost of sales (17,619) - (17,619) (19,952) - (19,952) (47,414) 54 (47,360)

------------- ------ -------------- -------------- -------- ---------- -------------- -------- ---------- -------------- --------

Gross profit 3,829 - 3,829 5,604 - 5,604 10,047 54 10,101

Operating

expenses (7,300) (638) (7,938) (7,359) (76) (7,435) (15,362) (1,127) (16,489)

Other

operating

income 6 69 - 69 - - - 834 - 834

Other

operating

expenses 6 - - - - - - (358) - (358)

------------- ------ -------------- -------------- -------- ---------- -------------- -------- ---------- -------------- --------

Loss from

operations (3,402) (638) (4,040) (1,755) (76) (1,831) (4,839) (1,073) (5,912)

Interest

received on

discounted

cash flows 188 - 188 148 - 148 227 - 227

Finance

income - 272 272 - - - - - -

Finance costs (372) - (372) (44) - (44) (422) - (422)

------------- ------ -------------- -------------- -------- ---------- -------------- -------- ---------- -------------- --------

Loss before

tax (3,586) (366) (3,952) (1,651) (76) (1,727) (5,034) (1,073) (6,107)

Income tax

credit 7 70 - 70 194 - 194 262 - 262

------------- ------ -------------- -------------- -------- ---------- -------------- -------- ---------- -------------- --------

Loss

attributable

to equity

owners of

the Parent (3,516) (366) (3,882) (1,457) (76) (1,533) (4,772) (1,073) (5,845)

------------- ------ -------------- -------------- -------- ---------- -------------- -------- ---------- -------------- --------

Basic

earnings per

share 9 (2.1) (0.8) (3.2)

Diluted

earnings per

share 9 (2.1) (0.8) (3.2)

------------- ------ -------------- -------------- -------- ---------- -------------- -------- ---------- -------------- --------

All amounts stated relate to continuing activities.

Consolidated statement of comprehensive income

For the six months ended 30 June 2023

(Unaudited) (Unaudited) (Audited)

Six months Six months ended 30 June Year ended 31 December 2022

ended 30 June 2022

2023

GBP000 GBP000 GBP000

------------------------------------------ --------------- -------------------------- -----------------------------

Loss for the period (3,882) (1,533) (5,845)

Items that may be reclassified

subsequently to profit and loss:

Exchange differences on translation of

foreign operations (net of tax) (53) 196 85

------------------------------------------ --------------- -------------------------- -----------------------------

Total comprehensive loss for the period (3,935) (1,337) (5,760)

------------------------------------------ --------------- -------------------------- -----------------------------

Consolidated statement of financial position

As at 30 June 2023

(Unaudited) (Unaudited) (Audited)

30 June 2023 30 June 2022 31 Dec 2022

Note GBP000 GBP000 GBP000

--------------------------------- ---- -------------- ------------- ------------

Non-current assets

Goodwill 169 169 169

Other intangible assets 9,805 11,702 10,197

Purchased software costs 975 1,409 1,192

Property, plant and equipment 1,913 2,684 2,175

12,862 15,964 13,733

--------------------------------- ---- -------------- ------------- ------------

Current assets

Inventories 10,030 4,706 8,061

Trade and other receivables 10,832 13,599 13,804

Current tax asset 447 621 690

Derivative financial assets - 971 -

Cash and cash equivalents 11 1,243 656 1,431

--------------------------------- ---- -------------- ------------- ------------

22,552 20,553 23,986

--------------------------------- ---- -------------- ------------- ------------

Total assets 35,414 36,517 37,719

--------------------------------- ---- -------------- ------------- ------------

Current liabilities

Trade and other payables (10,502) (11,128) (13,805)

Lease liabilities (324) (463) (397)

Provisions 12 (329) (658) (502)

Invoice discounting facilities 10 (4,128) (1,361) (3,451)

Loans and borrowings 10 (640) (693) (664)

Derivative financial liabilities (1,070) - (1,563)

--------------------------------- ---- -------------- ------------- ------------

(16,993) (14,303) (20,382)

--------------------------------- ---- -------------- ------------- ------------

Net current assets 5,559 6,250 3,604

--------------------------------- ---- -------------- ------------- ------------

Non-current liabilities

Loans and borrowings 10 (1,837) (2,426) (2,133)

Lease liabilities (270) (263) (94)

Provisions 12 (342) (568) (471)

(2,449) (3,257) (2,698)

--------------------------------- ---- -------------- ------------- ------------

Total liabilities (19,442) (17,560) (23,080)

--------------------------------- ---- -------------- ------------- ------------

Net assets 15,972 18,957 14,639

--------------------------------- ---- -------------- ------------- ------------

Equity

Called up share capital 6,046 3,621 3,621

Share premium account 34,167 30,009 30,009

Warrant reserve (1,517) - -

Currency translation reserve 185 349 238

Retained earnings (22,909) (15,022) (19,229)

------------------------------ -------- -------- --------

Total equity attributable

to equity holders of the

Parent Company 15,972 18,957 14,639

------------------------------ -------- -------- --------

Consolidated statement of changes in equity

For the six months ended 30 June 2023

Share Currency

Called up share premium Warrant translation Retained

capital account reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------- ------ -------- --------- ------------ --------- -------

Balance at 1 January 2022 3,621 30,009 - 153 (13,565) 20,218

---------------------------------- ------ -------- --------- ------------ --------- -------

Loss for the six months - - - - (1,533) (1,533)

Foreign exchange gains from

overseas subsidiaries - - - 196 - 196

---------------------------------- ------ -------- --------- ------------ --------- -------

Total comprehensive income/(loss)

for the six months - - - 196 (1,533) (1,337)

---------------------------------- ------ -------- --------- ------------ --------- -------

Transactions with owners

in their capacity as owners:

Issue of equity shares - - - - - -

Premium arising on issue of -

shares - - - - -

Share issue expenses - - - - - -

Credit in relation to share-based

payments - - - - 112 112

---------------------------------- ------ -------- --------- ------------ --------- -------

Total transactions with owners

in their capacity as owners - - - - 112 112

---------------------------------- ------ -------- --------- ------------ --------- -------

Balance at 30 June 2022 3,621 30,009 - 349 (15,022) 18,957

---------------------------------- ------ -------- --------- ------------ --------- -------

Balance at 1 January 2023 3,621 30,009 - 238 (19,229) 14,639

------------------------------------ ----- ------ ----- ---- -------- -------

Loss for the six months - - - - (3,882) (3,882)

Foreign exchange gains from

overseas subsidiaries - - - (53) - (53)

------------------------------------ ----- ------ ----- ---- -------- -------

Total comprehensive income/(loss)

for the six months - - - (53) (3,882) (3,935)

------------------------------------ ----- ------ ----- ---- -------- -------

Transactions with owners

in their capacity as owners:

Issue of equity shares 2,425 - - - - 2,425

Premium arising on issue of

shares - 1,893 - - - 3,410

Share issue expenses - (769) - - - (769)

Debt to equity valuation adjustment 272 (272) -

Warrant reserve - 1,517 - - -

Credit in relation to share-based

payments - - - - 202 202

Total transactions with owners

in their capacity as owners 2,425 1,396 1,517 - (70) 5,268

------------------------------------ ----- ------ ----- ---- -------- -------

Balance at 30 June 2023 6,046 31,405 1,517 185 (23,181) 15,972

------------------------------------ ----- ------ ----- ---- -------- -------

Consolidated cash flow statement

For the six months ended 30 June 2023

(Unaudited) (Unaudited) (Audited) Year ended 31 Dec

Six months ended 30 June Six months ended 30 June 2022

2023 2022

GBP000 GBP000 GBP000

---------------------------- ---------------------------- ---------------------------- ----------------------------

Loss before tax (3,952) (1,727) (6,107)

Finance expense (88) (104) 195

---------------------------- ---------------------------- ---------------------------- ----------------------------

Operating loss for the

period (4,040) (1,831) (5,912)

Adjustments for:

Depreciation of property,

plant and equipment, and

right-of-use assets 732 720 1,465

Amortisation of intangible

assets 1,078 963 2,069

Loss on disposal of

non-current assets 1 9 19

Non-underlying items 638 76 1,073

Cash flow relating to

non-underlying items (447) (330) (582)

Increase in fair value of

derivatives (493) (680) 1,854

Operating cash flow before

movements in working

capital (2,531) (1,073) (14)

Movement in inventories (1,968) (968) (4,270)

Movement in receivables 3,094 (4,021) (4,147)

Movement in payables (3,595) 2,995 5,673

Cash used by operations (5,000) (3,067) (2,758)

Income taxes received

/(paid) 382 38 39

Net cash used by operating

activities (4,618) (3,029) (2,719)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Investing activities

Capitalised development

costs (469) (623) (928)

Purchase of property, plant

and equipment (153) (154) (436)

Net cash used in investing

activities (622) (777) (1,364)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Financing activities

Cash proceeds from issue of

ordinary shares (net of

expenses) 3,221 - -

Debt to equity issue of

ordinary shares 2,117 - -

Drawdown of invoice finance 24,467 23,647 55,854

Repayment of invoice finance (23,790) (22,286) (52,403)

Repayment of loan (321) (104) (426)

Repayment of lease

obligations (224) (222) (457)

Interest paid (372) (44) (422)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Net cash generated by

financing activities 5,098 991 2,146

---------------------------- ---------------------------- ---------------------------- ----------------------------

Net (decrease)/ increase in

cash and cash equivalents (142) (2,815) (1,937)

Cash and cash equivalents at

beginning of period 1,431 3,294 3,294

Non-cash movements (46) 177 74

---------------------------- ---------------------------- ---------------------------- ----------------------------

Cash and cash equivalents at

end of period 1,243 656 1,431

---------------------------- ---------------------------- ---------------------------- ----------------------------

Notes to the financial information

1. General information

These consolidated interim financial statements were approved by

the Board of Directors on 26 September 2023.

2. Basis of preparation

These consolidated interim financial statements of the Group are

for the six months ended 30 June 2023.

The condensed consolidated interim financial statements for the

six months to 30 June 2023 do not include all the information and

disclosures required in the annual financial statements and should

be read in conjunction with the Group's annual financial statements

for the year ended 31 December 2022 which are available at

www.fireangeltech.com/investors.

The condensed consolidated interim financial statements for the

six months to 30 June 2023 have not been audited or reviewed by an

auditor pursuant to the Auditing Practices Board guidance on Review

of Interim Financial Information.

The condensed consolidated interim financial statements for the

six months to 30 June 2023 have been prepared on the basis of the

accounting policies expected to be adopted for the year ending 31

December 2023. These are anticipated to be consistent with those

set out in the Group's latest annual financial statements for the

year ended 31 December 2022. These consolidated financial

statements are prepared in accordance with UK-adopted international

accounting standards in conformity with the Companies Act 2006

('IFRS'). The financial statements are presented in thousands

(GBP'000) unless otherwise indicated.

Going concern

The Group has seen a significant loss in momentum over the last

9 months with a decrease in revenue of 16% on the prior year. It is

delivering on several operational and margin improvements but

unfortunately the loss in volume of sales resulted in a larger loss

than expected for the period.

On 6 June 2023 a strategic review of the company was announced.

Whilst this remains ongoing, the work undertaken includes

refocusing the business with a new management team, recovery of

sales, cost savings and improvement in forecasting to deal with

issues much earlier in the business cycle. The review process has

also identified where the Group's returns are not adequate and

therefore unless appropriate returns are obtained, the Group will

cease doing business with those customers and/or withdraw products

and/or exit certain market segments. The forecasts have been

prepared taking these factors into consideration alongside

management's extensive industry knowledge but recognising the

uncertainty inherent in today's markets.

In determining whether the Group and Parent Company's financial

statements can be prepared on a going concern basis, the Directors

have considered the Group's business activities, together with the

factors likely to affect its future development, performance and

position. During 2023, the Company's bank waived the Q1 2023

banking covenants and reset them from June 2023. All banking

covenants since June 2023 have been met.

The Directors have reviewed the financial position of the Group,

its cash flows, borrowing facilities and banking covenants. The key

factors considered by the Directors were the:

-- implications of the current economic environment and future

uncertainties around the Group's revenues and profits by

undertaking forecasts and projections on a regular basis;

-- impact of global component shortages impacting the supply of products and costs;

-- impact of the competitive environment within which the Group operates;

-- impact of any further COVID-19 and related global supply chain issues;

-- potential actions that could be taken in the event that

revenues or gross profits are worse than expected, to ensure that

operating profit and cash flows are protected;

-- impact of major supplier exit; and

-- divesting certain assets for cash.

In addition, the Directors have reviewed the Company forecasts

for the period to 31 December 2024 and have run sensitivity

analyses on the key assumptions, including sales and margins. The

base case scenario showed sufficient cash headroom. Through

mitigating actions the sensitised downside scenarios would also

provide sufficient cash headroom.

Whilst the previously noted exit of one supplier arrangement is

seen as beneficial to the business in the medium term, due to the

timing of the notice it is too early to quantify the complete costs

of exit. This therefore provides a material uncertainty to the

Company's future cash forecasts.

Whilst the cash headroom is expected to be sufficient, the

strategic review (combined with the impact of the supplier exit)

has highlighted the need to potentially revisit our banking

covenants.

The Directors have reasonable expectations that the Group and

the Company have adequate resources to continue operations for at

least one year from the date of approval of these interim results.

Whilst the Directors have identified material uncertainties that

may cast doubt over the ability of the Group and the Company to

continue as a going concern (see above) the Directors continue to

adopt the going concern basis in preparing these financial

statements.

AIM-quoted companies are not required to comply with IAS 34

Interim Financial Reporting and accordingly the Company has taken

advantage of this exemption.

3. Operating segments

An analysis of the Group's revenue by business unit is as

follows:

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

30 June 2023 30 June 2022 31 Dec 2022

(restated) GBP000 (restated)

GBP000 GBP000

------------------------------------- ------------------ -------------------- -------------

Revenue from continuing operations:

UK Trade 4,120 4,025 9,611

UK Retail 8,773 7,157 19,776

UK Fire & Rescue Services 1,786 1,575 3,266

UK Utilities & Leisure 1,256 1,642 3,531

-------------------------------------- ------------------ -------------------- -------------

Total sales in the UK 15,935 14,399 36,184

International 3,306 8,404 16,349

Techem 1,118 1,698 2,517

Pace Sensors 1,089 1,055 2,411

-------------------------------------- ------------------ -------------------- -------------

Total revenue 21,448 25,556 57,461

-------------------------------------- ------------------ -------------------- -------------

From 1 January 2023, certain customers previously reported

within the UK Trade business unit are now reported through UK

Utilities & Leisure. The 2022 comparatives have been adjusted

accordingly.

4. Revenue recognition - Techem

In April 2021 the Group signed a long-term partnership agreement

with a Techem to provide a research and development programme for a

new generation smoke alarm. The Group has looked at the individual

elements of the contract and has concluded that there are not

separate performance obligations and as such the contract forms one

central non-distinct performance obligation.

Full details of the revenue recognition methodology and

assumptions surrounding this can be found in the Group's annual

financial statements for the year ended 31 December 2022.

(Unaudited) (Unaudited) (Audited) Year ended 31 Dec 2022

Six months Six months

ended ended GBP000

30 June 2023 30 June 2022

GBP000

GBP000

---------------------------- -------------- -------------- ---------------------------------

Revenue recognised 1,118 1,698 2,517

Costs recognised (596) (785) (1,299)

---------------------------- -------------- -------------- ---------------------------------

Gross profit attributable

to contract 522 913 1,218

Revenue recognised 4,678 2,741 3,560

Interest income recognised 504 239 318

---------------------------- -------------- -------------- ---------------------------------

Total consideration 5,182 2,980 3,878

Billing to date (3,653) (2,075) (2,546)

---------------------------- -------------- -------------- ---------------------------------

Accrued income 1,529 905 1,332

---------------------------- -------------- -------------- ---------------------------------

5. Non-underlying items

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

30 June 2023 30 June 2022 31 Dec 2022

GBP000 GBP000 GBP000

------------------------------------------------ ------------------ ------------------------ --------------

Within cost of sales

Provision against stock and disposal costs (a) - - (54)

------------------------------------------------- ------------------ ------------------------ --------------

- - (54)

------------------------------------------------- ------------------ ------------------------ --------------

Within operating expenses

Impairment of intangible assets (note b) - - 916

Impairment of tangible assets (note c) - - 30

Restructuring and fundraising costs (note d) 361 - -

Strategic review (note e) 75 - -

Extinguishment of financial liability (note f) (272) - -

Share-based payment charges 202 76 181

------------------------------------------------- --------------

366 76 1,127

------------------------------------------------- ------------------ ------------------------

Total non-underlying items 366 76 1,073

a. During 2022 the Group was able to sell stock lines that had

previously been impaired which resulted in a non-underlying credit

of GBP0.1 million. No such sales have been registered in H1 2023

with nil cash impact in the period.

b. Intangible capitalised development assets of GBP0.9 million

were impaired during the year ended 31 December 2022 as a result of

a thorough review of product lines and future development costs.

There will be no cash impact on this impairment.

c. A small number of tangible assets were impaired during the

year ended 31 December 2022 as a result of a thorough review of

tooling required for ongoing product lines. There will be no cash

impact on this impairment.

d. Restructuring and certain fundraising costs of GBP 0.4

million were incurred, with GBP0.1 million paid as at 30 June

2023.

e. Following the announcement on 6 June 2023 of a strategic

review, the Group has incurred costs to date of GBP 0.1 million.

There was no cash impact as at 30 June 2023 .

f. As part of the Company's fundraising, on 28 June 2023, the

Company agreed to a debt for equity swap with one of its major

suppliers. Trade payables due within one year with a carrying value

of GBP2.1 million were derecognised in exchange for the issue of

new ordinary shares. The gain on extinguishing the financial

liability and the realized FX movement was GBP0.3 million and has

been recognised in the profit and loss account and debited against

the share premium account.

No change to the value of the warranty provision has been made

since 2020. The balance continues to unwind and during H1 2023 the

cash outflow was GBP0.3 million.

6. Other Operating Income

From 1 January 2023, the Group has opted to treat its Research

& Development expenditure credit from HMRC as an 'above the

line' credit in other operating income to give a more

representative view of the business' performance in the Period.

Previously these claims have been accounted for within income tax.

The estimated claim value for the Period is GBP69,000 (30 June

2022: GBP91,000; 31 December 2022: GBP135,000).

Due to the global supply chain shortages faced in 2022, the

Group incurred additional costs to maintain a supply of critical

components. During the second half of 2022, the Group was able to

sell a surplus of some of these components for GBP0.8 million to a

third party recognising GBP0.5 million profit on these

transactions. The Group has not recognised these sales as revenue

as it does not view these as part of the business' ordinary

activities (either past, current or future planned). There were no

such transactions for the period ended 30 June 2023.

7. Income tax

The income tax credit for the Period is based on the estimated

rate of corporation tax that is likely to be effective for the year

to 31 December 2023.

8. Dividends

As a result of the loss reported for the Period, the Directors

do not propose payment of an interim dividend for 2023 (2022: nil

pence per share).

9. Earnings per share

Earnings per share are as follows:

(Unaudited) (Unaudited) (Audited)

Six months Six months Year ended

ended 30 June ended 30 June 31 Dec

2023 2022 2022

Earnings from continuing

operations GBP000 GBP000 GBP000

-------------------------------- --------------- --------------- ------------

Earnings for the purposes

of basic and diluted earnings

per share (loss for the

period attributable to owners

of the parent) (3,882) (1,533) (5,845)

-------------------------------- --------------- --------------- ------------

Number of shares '000 '000 '000

-------------------------------- --------------- --------------- ------------

Weighted average number

of ordinary shares - basic

earnings calculation 183,092 181,067 181,067

Dilutive potential ordinary

shares from share options - - -

-------------------------------- --------------- --------------- ------------

Weighted average number

of ordinary shares - diluted

calculation 183,092 181,067 181,067

-------------------------------- --------------- --------------- ------------

30 June 30 June

2023 2022 31 Dec 2022

pence pence pence

---------------------------- -------- -------- ------------

Basic earnings per share (2.1) (0.8) (3.2)

Diluted earnings per share (2.1) (0.8) (3.2)

----------------------------- -------- -------- ------------

Basic EPS is calculated by dividing the earnings attributable to

ordinary owners of the parent by the weighted average number of

shares outstanding during the period.

Diluted EPS is calculated on the same basis as basic EPS but

with a further adjustment to the number of weighted average shares

in issue to reflect the effect of all potentially dilutive share

options. The number of potentially dilutive share options is

derived from the number of share options and awards granted to

employees and Directors where the exercise price is less than the

average market price of the Company's ordinary shares during the

period. Under IFRS no allowance is made for the dilutive impact of

share options which reduce a loss per share. The basic and diluted

EPS measures are therefore the same for the period ended 30 June

2023.

10. Loans and borrowings

(Unaudited) (Unaudited) (Audited)

30 June 31 Dec

30 June 2023 2022 2022

GBP000 GBP000 GBP000

----------------- ---------------- --------------- ------------ ----------

Canadian government COVID-19 - 23 -

loan

Bank Term Loan 2,477 3,096 2,797

Invoice discounting facilities 4,128 1,361 3,451

----------------------------------- --------------- ------------ ----------

6,605 4,480 6,248

----------------------------------- --------------- ------------ ----------

11. Cash and cash equivalents

(Unaudited) (Unaudited) (Audited)

30 June 31 Dec

30 June 2023 2022 2022

GBP000 GBP000 GBP000

-------------- ------------- --------------- ------------ ----------

Cash at bank and in hand 1,243 656 1,431

----------------------------- --------------- ------------ ----------

12. Provisions

(Unaudited)

30 June

2023

GBP000

---------- ---------- --- --- -------------

At 1 January 2022 1,553

Charge in period -

Utilisation (327)

--------------------------- --- -------------

At 30 June 2022 1,226

--------------------------- --- -------------

At 1 January 2023 973

Charge in period -

Utilisation (302)

--------------------------- --- -------------

At 30 June 2023 671

--------------------------- --- -------------

The total warranty provision is classified between less than one

year and greater than one year as follows:

(Unaudited) (Unaudited) (Audited)

30 June 31 Dec

30 June 2023 2022 2022

GBP000 GBP000 GBP000

-------------- ------------- --------------- ------------ ----------

Current provision 329 658 502

Non-current provision 342 568 471

----------------------------- --------------- ------------ ----------

Total warranty provision 671 1,226 973

----------------------------- --------------- ------------ ----------

13. Changes in liabilities arising from financing activities

Bank Invoice Lease

Loans discounting liabilities Total

facility

GBP000 GBP000 GBP000 GBP000

------- ------------- ------------- --------

Balance at 1 January 2022 3,223 - 948 4,171

-------------------------- ------- ------------- ------------- --------

Drawdown of facility - 23,647 - 23,647

Repayment of facility (104) (22,286) - (22,390)

Capital payments - - (222) (222)

Interest charge 27 22 13 62

Interest payments (27) (22) (13) (62)

Balance at 30 June 2022 3,119 1,361 726 5,206

-------------------------- ------- ------------- ------------- --------

Balance at 1 January 2023 2,797 3,451 491 6,739

-------------------------- ------- ------------- ------------- --------

Drawdown of facility - 24,467 - 24,467

Repayment of facility (320) (23,790) - (24,110)

Capital payments - - (240) (240)

FX Restatement - - (6) (6)

Interest charge 107 172 11 290

Interest payments (107) (172) (11) (290)

Acquisition of leases - - 349 349

Balance at 30 June 2023 2,477 4,128 594 7,199

-------------------------- ------- ------------- ------------- --------

14. Share capital and reserves

On 28 June 2023, the Company raised GBP6.1 million (gross)

through the issue of 120,711,091 new ordinary shares with a nominal

value of 2p each at an issue price of 5.05p per share.

The premium on issue was 3.05p per share amounting to GBP3.7

million. This was credited to the share premium account. Share

issue expenses amounted to GBP0.8 million. These were debited to

the share premium account.

As part of the above fundraising, on 28 June 2023, the Company

agreed to a debt for equity swap with one of its major suppliers.

Trade payables due within one year with a carrying value of GBP2.1

million were derecognised in exchange for the issue of new ordinary

shares. The gain on extinguishing the financial liability and the

realised FX movement was GBP 0.3 million and has been recognised in

the profit and loss account and debited against the share premium

account.

As part of the above fundraising, on 30 June 2023, a general

meeting approved the issuing of 60,355,529 warrants at 3p per

share. These warrants are exercisable from 30 June 2024 to 30 June

2026. Using the Black Scholes model, the fair value of the warrants

has been calculated at GBP1.5 million.

15. Availability

Further copies of this announcement are available on the

FireAngel Safety Technology Group plc investor relations website,

www.fireangeltech.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VELFLXKLZBBV

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

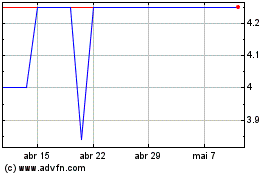

Fireangel Safety Technol... (LSE:FA.)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Fireangel Safety Technol... (LSE:FA.)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024