TIDMGCL TIDMTTM

RNS Number : 6106U

Geiger Counter Ltd

24 November 2023

Geiger Counter Limited Plc

Monthly Investor Report - November

The full monthly factsheet is now available on the Company's

website and a summary can be found below.

NCIM - Geiger Counter Ltd - Fund Page for Geiger Counter Ltd

Enquiries:

For the Investment Manager

CQS (UK) LLP

Craig Cleland

0207 201 5368

For the Company Secretary and Administrator

BNP Paribas S.A., Jersey Branch

Dean Plowman/Ann-Marie Pereira

01534 813 967/ 01534 709198

-----------------------------------------------------------------------

Fund Description

The objective of the Geiger Counter Fund is to provide investors

with the potential for capital growth through investment primarily

in the securities of companies involved in the exploration,

development and production of energy, predominantly within the

uranium industry. Up to 30% of the value of the Company's

investment portfolio may be invested in other resource-related

companies from outside the energy sec

Portfolio Managers

Keith Watson and Robert Crayfourd

Key Advantages for the Investor

-- Access to mining assets in the uranium sector

-- May benefit from embedded subscription share

-- Low correlation to major asset classes

Key Fund Facts (1)

Total Gross Assets GBP99.1m

Reference Currency GBP

Ordinary Shares:

Net Asset Value 64.84p

Mid-Market Price 48.25p

Net gearing (4) 16.09%

Discount (25.59%)

Ordinary Share and NAV Performance (2)

One Month Three Months One Year Three Years Five Years

(%) (%) (%) (%) (%)

NAV 0.96 42.88 24.48 317.51 219.72

Share Price -7.21 24.52 -7.21 194.21 135.37

Commentary (3)

After the previous month's price jump, the spot U3O8 price made

a modest further gain in

October, closing the month up 1.9% at $74.5/lb. While the

uranium market price continued to

rise, the Fund NAV slipped marginally, consolidating 1% in

October versus a sterling decline of 2.4% registered by the

Solactive Uranium Pure Play Index. The funds NAV discount widened

slightly over the month, close to the highest in 7 years, despite

the strong performance and positive sector fundamentals. The fund

bought back shares which was accretive to the NAV per share.

Strong performance contributions were made by US in-situ project

developers, UEC and Ur-Energy which rose 22% and 14% respectively

in sterling terms. The pull-back by Paladin and Iso Energy largely

offset these gains with both stocks retracing 15% in sterling

terms, giving back nearly half their prior month increases.

Explorer Iso Energy's decline followed an all-share acquisition of

Uranium Consolidated, which owns a portfolio of development assets,

at the end of September and the subsequent equity issue to raise

proceeds to pursue a larger exploration programme on its expanded

portfolio. The Fund participated in the placing by Iso Energy,

alongside the group's other largest shareholders NexGen, Energy

Fuels and Mega Uranium.

Cameco's Q3 results showed that the group achieved a sales price

of US$52.57/lb during the period, versus spot prices which remained

above $55/lb. Following the rise in spot uranium prices, which

exceeded US$70/lb at the end of the quarter, the group updated its

expectations for its full year realised price of C$63.50/lb, or

approximately US$47/lb when translated using the exchange rate at

end-September. This is indicative of the drag effect of prior

forward sales contract terms on its uranium mining revenues.

Cameco's guidance for full year uranium deliveries was maintained

at between 31-33Mlbs U3O8, of which around 29Mlbs per annum is

already contracted for the five years.

Elsewhere, French state-owned uranium fuel supplier Orano

announced plans to expand

capacity at its Tricastin processing facility. An investment of

$1.8bn is being made to increase capacity at the Georges Besse II

enrichment plant by more than 30% in recognition of western

government's desire to reduce the risk of fuel disruption given

Russia's dominant global position in this area. In addition, the

European Council reached a tentative agreement to reform an EU

electricity price mechanism. This may remove the requirement for

France's state-owned utility EDF to sell over a third of its

nuclear energy production at below market prices, which should now

increase the company's motivation to expedite repairs and reconnect

the remaining offline reactors to the grid.

Gross Leverage Commitment Leverage

(%) (%)

Geiger Counter Ltd 116 116

CQS (UK) LLP

4th Floor, One Strand, London WC2N 5HR, United Kingdom

T: +44 (0) 20 7201 6900 | F: +44 (0) 20 7201 1200

CQS (US), LLC

152 West 57th Street, 40th Floor, New York, NY 10019, US

T: +1 212 259 2900 | F: +1 212 259 2699

CQS (Hong Kong) Limited

3305 AIA Tower, 183 Electric Road, North Point, Hong Kong,

China

T: +852 3920 8600 | F: +852 2521 3189

Tavistock Communications

18 St. Swithin's Lane, London EC4N 8AD

T: +44 20 7920 3150 | geigercounter@tavistock.co.uk

Sources: 1R&H Fund Services (Jersey) Limited, as at the last

business day of the month indicated at the top of this report.

2R&H Fund Services Limited/DataStream, as at the last business

day of the month indicated at the top of this report, total return

performance net of fees and expenses based on bid prices. These

include historic returns and past performance is not a reliable

indicator of future results. The value of investments can go down

as well as up. Please read the important legal notice at the end of

this document. 3Market data sourced from Bloomberg unless otherwise

stated. The Fund may since have exited some or all of the positions

detailed in the commentary.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DOCUSVWROKUAURA

(END) Dow Jones Newswires

November 24, 2023 04:30 ET (09:30 GMT)

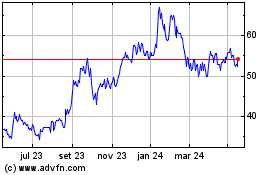

Geiger Counter (LSE:GCL)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

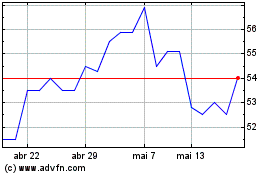

Geiger Counter (LSE:GCL)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024