TIDMGCL TIDMTTM

RNS Number : 7747A

Geiger Counter Ltd

24 January 2024

Geiger Counter Limited Plc

Monthly Investor Report - December

The full monthly factsheet is now available on the Company's

website and a summary can be found below.

NCIM - Geiger Counter Ltd - Fund Page for Geiger Counter Ltd

Enquiries:

For the Investment Manager

CQS (UK) LLP

Craig Cleland

0207 201 5368

For the Company Secretary and Administrator

BNP Paribas S.A., Jersey Branch

Dean Plowman/Ann-Marie Pereira

01534 813 967/ 01534 709198

-----------------------------------------------------------------------

Fund Description

The objective of the Geiger Counter Fund is to provide investors

with the potential for capital growth through investment primarily

in the securities of companies involved in the exploration,

development and production of energy, predominantly within the

uranium industry. Up to 30% of the value of the Company's

investment portfolio may be invested in other resource-related

companies from outside the energy sector.

Portfolio Managers

Keith Watson and Robert Crayfourd

Key Advantages for the Investor

-- Access to mining assets in the uranium sector

-- May benefit from embedded subscription share

-- Low correlation to major asset classes

Key Fund Facts (1)

Total Gross Assets GBP100.4m

Reference Currency GBP

Ordinary Shares:

Net Asset Value 67.07p

Mid-Market Price 54.00p

Net gearing 14.31%

Discount (19.49%)

Ordinary Share and NAV Performance (2)

One Month Three Months One Year Three Years Five Years

(%) (%) (%) (%) (%)

NAV 1.21 2.44 44.02 169.03 270.35

Share Price 0.93 3.85 26.32 100.00 164.71

Commentary (3)

The spot U3O8 price ended December at $91.50/lb, up 13.3% over

the month.

Symbolic of its ever more influential role in electricity

generation, nuclear power received

widespread endorsement from the COP 28 conference with an

international agreement to triple installed generating capacity by

2050. This boosted uranium price momentum into the calendar

year-end.

The passing of a US House vote to restrict the importation of

Russian-sourced material saw the bill progress through to the

Senate for consideration, potentially adding impetus to fuel

prices. However, equities did not keep pace with the uranium price

rise with the Fund NAV gaining 1.2% in December, similar to the

Solactive Uranium Pure Play Index sterling return.

During the month, Nexgen announced that it had received its

provincial environmental permits, the first company in more than 20

years to receive full provincial EA approval for a uranium project

in Saskatchewan. With all necessary First Nations benefits

agreements already in place, we believe the development of the

project has de-risked considerably. The issue of Federal permits,

which includes an official assessment of the Environmental Impact

Assessment by the Canadian Nuclear Safety Commission, and which is

expected to be issued later this year, represents the final step

required for the project's development. Permitting progress helped

lift the Nexgen share price by over 5% in sterling terms over the

month. Fission Energy, which owns the neighbouring Patterson Lake

project, rose by nearly 9% in sterling terms over the month.

Physically backed vehicles such as the Sprott Uranium Trust and

Yellow Cake also struggled to keep pace with the uranium price

rise, although both registered sterling returns of over 10% during

December. The Sprott Trust share price briefly exceeded its NAV

allowing it to purchase a modest 256k lbs of U3O8 during the month.

The main detractors to Fund performance were Cameco and Ur-Energy,

whose share prices slipped over 6.7% and 5.0% respectively in

sterling terms during December.

Gross Leverage Commitment Leverage

(%) (%)

Geiger Counter Ltd 115 115

CQS (UK) LLP

4th Floor, One Strand, London WC2N 5HR, United Kingdom

T: +44 (0) 20 7201 6900 | F: +44 (0) 20 7201 1200

CQS (US), LLC

152 West 57th Street, 40th Floor, New York, NY 10019, US

T: +1 212 259 2900 | F: +1 212 259 2699

CQS (Hong Kong) Limited

3305 AIA Tower, 183 Electric Road, North Point, Hong Kong,

China

T: +852 3920 8600 | F: +852 2521 3189

Tavistock Communications

18 St. Swithin's Lane, London EC4N 8AD

T: +44 20 7920 3150 | geigercounter@tavistock.co.uk

Sources: (1) R&H Fund Services (Jersey) Limited, as at the

last business day of the month indicated at the top of this report.

(2) R&H Fund Services Limited/DataStream, as at the last

business day of the month indicated at the top of this report,

total return performance net of fees and expenses based on bid

prices. These include historic returns and past performance is not

a reliable indicator of future results. The value of investments

can go down as well as up. Please read the important legal notice

at the end of this document. (3) Market data sourced from Bloomberg

unless otherwise stated. The Fund may since have exited some or all

of the positions detailed in the commentary.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DOCEANFLASALEEA

(END) Dow Jones Newswires

January 24, 2024 05:15 ET (10:15 GMT)

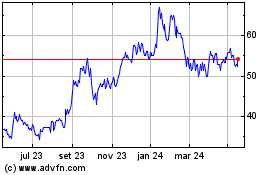

Geiger Counter (LSE:GCL)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

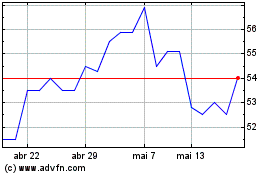

Geiger Counter (LSE:GCL)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024