TIDMHDT

RNS Number : 9807U

Holders Technology PLC

29 November 2023

29 November 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

SUCH JURISDICTION.

Holders Technology plc

("Holders Technology", the "Group" or the "Company")

Proposed cancellation of admission of Ordinary Shares to trading

on AIM

Tender Offer to purchase up to 2,256,765 Ordinary Shares at 43p

per Ordinary Share

Re-Registration as a private limited company

and

Notice of General Meeting

Holders Technology (AIM:HDT) announces that a circular (the

"Circular") will be sent to Shareholders later today detailing the

following proposals:

-- the proposed cancellation of the admission to trading of the

Ordinary Shares on AIM (the "De-Listing");

-- a tender offer, closing at 1.00 p.m. on 20 December 2023 (the

"Closing Date"), for up to 2,256,765 Ordinary Shares, representing

approximately 53 per cent. of the Company's issued share capital

being the Ordinary Shares that the Concert Party are not currently

interested in, at 43 pence per Ordinary Share (the "Tender Offer");

and

-- re-registration as a private limited company (the

"Re-Registration") (together the De-Listing, Tender Offer and

Re-Registration are the "Proposals").

Unless otherwise stated, terms used in this announcement have

the same meanings as given to them in the Circular.

The Circular sets out the terms of the Tender Offer and

incorporates a notice of a General Meeting. A Proxy Form and Tender

Form for use by Shareholders who hold their Ordinary Shares in

certificated form in connection with the General Meeting and Tender

Offer, respectively, are also being despatched with the

Circular.

The Tender Offer is conditional on the Acceptance Condition

being satisfied, that is, receipt of valid tenders in respect of at

least 289,367 Ordinary Shares. The 289,367 Ordinary Shares

represent approximately 6.85 per cent. of the issued ordinary share

capital of the Company. If the Acceptance Condition is satisfied by

1.00 p.m. on the Closing Date, the Concert Party would hold more

than 50 per cent. of the issued ordinary share capital of the

Company following completion of the Tender Offer.

The Panel has confirmed that any buy-back by the Company of

Ordinary Shares, pursuant to its existing authorities, at or below

the Tender Offer Price following the date of this Circular but

prior to the Closing Date shall, for the purposes of satisfaction

of the Acceptance Condition, be treated as if validly tendered

under the Tender Offer. The Company reserves the right, if approved

by the Independent Directors, to make such purchases during the

Tender Offer period.

Background

The Board has undertaken a thorough review of the benefits and

drawbacks to the Company retaining its admission to trading on AIM.

For the reasons outlined below, the Board is of the view that the

legal and regulatory burden, as well as the costs associated with

maintaining the Company's admission to trading on AIM, outweigh the

benefits of a public quotation.

In the Company's half year report for the six months ended 31

May 2023, released on 16 August 2023, the Company announced that

its trading performance had been disappointing due to the generally

adverse economic climate resulting in weak customer demand. As

confirmed by the interim results this resulted in a loss for the

Company during the six-month period ended 31 May 2023. In response

to this the Group reduced its cost base by implementing a number of

measures, including a reduction in headcount and temporary

reductions in employee salaries, as well as reductions in the

Directors' salaries. These steps taken by the Board have helped to

improve the Group's financial performance in the second half of the

year.

Trading has improved in the second half of the year, in line

with the Group's trading performance in previous years,

particularly as December (being the first month in the Company's

financial year) is typically a weaker trading month. The Board

however remains cautious moving into December 2023 and the next

financial year as the difficult economic climate continues to

adversely impact the Company's manufacturing customers across both

the PCB and lighting markets, as well as continuing to cause

project delays and cancellations.

The Directors are mindful in particular that some of the

reductions in the cost base were temporary, such as the agreement

of the Directors and other staff to reduce their salaries. These

benefits will not therefore accrue to the business indefinitely.

The Directors believe that reducing the Company's cost base by

De-Listing and re-registering as a private limited company will

provide permanent cost savings that will over the longer term

improve the financial position and resilience of the Company during

uncertain market conditions.

The Board is aware that not all Shareholders will be able or

willing to continue to own Ordinary Shares following the

De-Listing. The Tender Offer therefore provides shareholders a

means to realise their investment in the Company for cash at 43

pence per Ordinary Share, representing a premium of approximately

10.26 per cent. to the closing share price on the Latest

Practicable Date, and a premium of approximately 12.88 per cent to

the volume weighted average closing share price over the 30 day

period ended on the Latest Practicable Date. The Tender Offer will

be financed from the Company's existing cash resources. The Concert

Party has irrevocably undertaken not to accept the Tender Offer in

respect of 1,967,399 Ordinary Shares, which will free up the

Company's cash resources to afford the other Shareholders the

opportunity to tender their entire interest in the Ordinary Shares

for cash should they so choose.

De-Listing

Pursuant to Rule 41 of the AIM Rules, the Directors have

notified the London Stock Exchange of the intention to cancel the

admission of Ordinary Shares to trading on AIM, subject to

Shareholder approval. Under the AIM Rules, the De-Listing can only

be effected by the Company after securing a special resolution of

Shareholders in a general meeting (being not less than 75 per cent.

of the votes cast).

The Proposals seek (amongst other matters) the approval of

Shareholders for the De-Listing. Assuming that the De-Listing

resolution is approved, the earliest date that the De-Listing could

take place is 8.00 a.m. on 8 January 2024.

Tender Offer

The Board is aware that not all Shareholders will be able or

willing to continue to own Ordinary Shares following the

De-Listing. The Tender Offer therefore provides shareholders a

means to realise their investment in the Company for cash at 43

pence per Ordinary Share, representing a premium of approximately

10.26 per cent. to the closing share price on the Latest

Practicable Date, and a premium of approximately 12.88 per cent to

the volume weighted average closing share price over the 30 day

period ended on the Latest Practicable Date.

Under the Tender Offer, SP Angel will purchase up to 2,256,765

Ordinary Shares (representing approximately 53.43 per cent. of the

Company's voting rights) from Qualifying Shareholders at 43 pence

per Ordinary Share. The Tender Offer Price represents:

-- a premium of approximately 10.26 per cent. over the closing

mid-market price of an Ordinary Share on 28 November 2023, being

the Latest Practicable Date; and

-- a premium of approximately 12.88 per cent to the volume

weighted average closing share price over the 30 day period ended

on 28 November 2023, being the Latest Practicable Date.

Circumstances in which the Tender Offer may not proceed

There can be no guarantee that the Tender Offer will take place.

The Tender Offer is conditional on the passing of the Tender Offer

Resolution (to give effect to the terms of the Tender Offer) at the

General Meeting by the requisite majority. The Tender Offer is also

conditional on receipt of valid tenders in respect of at least

289,367 Ordinary Shares (representing approximately 6.85 per cent.

Of the issued ordinary share capital of the Company as at the

Latest Practicable Date and 12.82 per cent. Of the issued ordinary

share capital of the Company (excluding the Concert Party Shares)

as at the Latest Practicable Date) by 1.00 p.m. on the Closing

Date, so that the Concert Party will exercise more than 50 per

cent. of the voting rights in the Company following completion of

the Tender Offer and the cancellation of the Ordinary Shares

repurchased thereunder, in order to satisfy the Acceptance

Condition. The Tender Offer is further conditional on various other

conditions specified in the Tender Offer Deed.

If the Tender Offer does not occur for any reason, Qualifying

Shareholders will not receive the Tender Offer Price for each of

their Ordinary Shares under the Tender Offer.

The Concert Party

Rudolf Weinreich, Victoria Blaisdell, Irene Weinreich and Amanda

Stavri are all close relatives and are therefore presumed to be

"acting in concert" for the purposes of the Takeover Code

(together, the "Concert Party"). In order to provide Shareholders

the ability to realise their holding in full as part of the Tender

Offer, each member of the Concert Party has entered into

irrevocable undertakings not to tender 1,967,399 Ordinary Shares in

respect of their aggregated personal interests. The current

holdings of the Concert Party, directly or through their close

families and related trusts, are as follows:

Name Number of Ordinary Percentage of Percentage of

Shares the Company's the Company's

existing issued total Voting

share capital Rights

Rudolf Weinreich 1,578,026(1) 37.36 37.36

------------------- ----------------- ---------------

Irene Weinreich 12,976(2) 0.31 0.31

------------------- ----------------- ---------------

Rudolf Weinreich

and Irene Weinreich(3) 260,000 6.16 6.16

------------------- ----------------- ---------------

Victoria Blaisdell 83,244(4) 1.97 1.97

------------------- ----------------- ---------------

Amanda Stavri 33,153(5) 0.78 0.78

------------------- ----------------- ---------------

TOTAL 1,967,399 46.57% 46.57%

------------------- ----------------- ---------------

Notes

1. 1,463,026 shares are held directly, 3,000 shares are held in

a Barclayshare ISA and the remaining 112,000 shares are held in the

Holders (RW) Pension Scheme via AJ Bell.

2. All 12,976 shares are held in a Barclayshare ISA.

3. 260,000 shares are held in the Rudolf Weinreich 1999

Settlement of which Rudi and Irene Weinreich are trustees. Rudolf

Weinreich, Victoria Blaisdell, Amanda Stavri and Paul Weinreich are

beneficiaries.

4. 49,142 shares are held via AJ Bell and 34,102 shares are held via Barclays.

5. 2,202 shares are held directly and 30,951 shares are held in a Barclayshare ISA.

Irrevocable Undertakings

The Company has received irrevocable undertakings from each

member of the Concert Party:

-- to vote in favour of the Resolutions, equating to

approximately 46.57 per cent. of the Company's voting rights as at

the Latest Practicable Date; and

-- not to participate in the Tender Offer with respect to any of

their Ordinary Shares held, equating to approximately 46.57 per

cent. of the Company's voting rights as at the Latest Practicable

Date.

The Company has also received an irrevocable undertaking from

David Mahony, being the only Independent Director who holds

Ordinary Shares, to vote in favour of the Resolutions and to

participate in the Tender Offer with respect to all of his 20,000

Ordinary Shares held, equating to approximately 0.473 per cent. of

the Company's voting rights as at the Latest Practicable Date.

Notice of General Meeting

Implementation of the Proposals, including the Tender Offer, is

conditional, inter alia, upon all of the Proposals being passed at

the GM to be held at 11.00 a.m. on 15 December 2023 at the offices

of Fasken Martineau LLP 6th Floor, 100 Liverpool Street, London,

EC2M 2AT.

Recommendations by the Independent Directors

Under the rules of the Takeover Code, the Independent Directors

are required to obtain independent financial advice on the terms of

the Tender Offer and to make known to Shareholders the substance of

such advice and their own opinion on the Tender Offer. The

Independent Directors believe that the following points should be

taken into account by Shareholders when considering whether to

retain their Ordinary Shares or accept the Tender Offer.

The Company has benefitted from improved trading and cost

savings in the second half of the year. However, the Company

remains cautious regarding the ongoing adverse economic conditions

and any further impact this may have. The De-Listing and

Re-Registration will enable the Company to further reduce its cost

base and reduce the management time and the regulatory burden

associated with maintaining the Company's admission to trading on

AIM. The Company is not of a scale to attract sufficient interest

from institutional and other investors and therefore it is

difficult to create a more liquid market for its shares to

effectively or economically utilise its quotation. Furthermore, the

Company has not utilised its listing on AIM to raise fresh capital

or issue paper consideration to fund acquisitions.

The Tender Offer Price represents a premium of approximately

10.26 per cent. to the Company's closing share price on 28 November

2023 (being the Latest Practicable Date) and a premium of

approximately 12.88 per cent to the volume weighted average closing

share price over the 30 day period ended on the Latest Practicable

Date.

The Company has not received any takeover approaches over the

last twelve-month period and the Board believes that it is unlikely

that the Company would receive any offers that represent a greater

premium to the Company's closing share price on 28 November 2023

(being the Last Practicable Date) than that of the Tender Offer

Price. As such, the Independent Directors believe that the

De-Listing and Re-Registration is in the best interests of

Shareholders. The Independent Directors unanimously recommend that

you vote in favour of the De-Listing and Re-Registration, and the

Tender Offer to be conducted by SP Angel and subsequent repurchase

by the Company under the Repurchase Agreement, as David Mahony

(being the only Independent Director who is also a Shareholder),

intends to do, in relation to his holding of 20,000 Ordinary

Shares, representing approximately 0.473 per cent. of the Ordinary

Shares currently in issue.

Shareholders should note that if they vote in favour of the

Tender Offer Resolution at the General Meeting, they are not

obligated to accept the Tender Offer for their Ordinary Shares. The

Company intends to implement a Matched Bargain Facility after the

De-Listing and so Shareholders will continue to have an opportunity

to trade their Ordinary Shares, although it is possible that the

liquidity and marketability of the Ordinary Shares will, in the

future, be more constrained than at present and the value of such

shares may be adversely affected as a consequence.

The Company will fund the Tender Offer from its existing cash

resources. Dependent on the level of take-up of the Tender Offer,

the Company's balance sheet could be materially impacted due to the

reduction of the cash position. In order to mitigate any impact on

the Company's cash position, the Company has arranged an unsecured,

interest-bearing, repayable on demand (after 6 months), loan

facility of up to GBP300,000 with Rudolf Weinreich to secure its

working capital position. The loan facility is subject to the

Tender Offer Resolution and the De-Listing Resolution being passed

at the General Meeting and there being no third-party debt facility

available to the Company .

The Independent Directors consider that the Tender Offer Price

allows Qualifying Shareholders the opportunity to exit their

investments in the near term should they wish to do so, whilst

ensuring the Company has sufficient funds to finance its ongoing

operations.

Upon De-Listing, the Company would no longer be subject to, and

its Shareholders would consequently lose the protections afforded

by, certain corporate governance regulations which apply to the

Company currently. In particular, the Company would no longer be

subject to the AIM Rules, the Disclosure and Transparency Rules and

the Market Abuse Regulation.

Subject to satisfaction of the Acceptance Condition, the Concert

Party will on completion of the Tender Offer and Repurchase,

legally and beneficially own in excess of 50 per cent. of the

issued share capital and voting rights in the Company. As a result,

the Concert Party will be able to pass or defeat any ordinary

resolution of the Company requiring a simple majority of those

attending and voting in person or by proxy at the meeting,

including, amongst other things the election of directors and

authorising the directors to allot equity securities. In addition,

dependent on the level of take up under the Tender Offer, the

Concert Party may legally and beneficially own in excess of 75 per

cent. of the issued share capital and voting rights in the Company.

Should this occur, the Concert Party will be able to pass or defeat

any special resolution of the Company.

There can be no guarantee that, after the Tender Offer closes at

1.00 p.m. on 20 December 2023 (or at such later time as specified

in an announcement of any extension to the Tender Offer period

through a Regulatory Information Service), the board of the Company

would be prepared to make a subsequent tender offer to acquire any

Ordinary Shares, or that the Concert Party would be prepared to

make any offer to acquire any Ordinary Shares in which it does not

already have an interest. Nor can there be any guarantee as to the

price of any such tender offer by the Company or potential offer by

the Concert Party.

Accordingly, any Shareholder who does not accept the Tender

Offer may find it difficult to sell their Ordinary Shares after the

Tender Offer closes and the De-Listing takes effect,

notwithstanding that the Company intends to make arrangements for

the Matched Bargain Facility to be put in place. Shareholders will

also not receive regular information from the Company, and will not

benefit from regulatory compliance with governance procedures

(other than under the Companies Act 2006) and will not enjoy the

protections afforded by the AIM Rules. Furthermore, there is no

guarantee that the Company or any other purchaser would be willing

to buy Ordinary Shares after the Tender Offer has closed.

In the opinion of the Independent Directors, Shareholders should

carefully consider their own individual circumstances in deciding

whether or not to accept the Tender Offer. In the absence of any

immediate prospect to sell their Ordinary Shares once the Tender

Offer closes and the De-Listing has occurred, Shareholders should

balance their desire for a cash realisation now or in the immediate

foreseeable future, against the prospect of remaining a shareholder

in a private company, with a reduced level of disclosure and

corporate governance protections that this affords them.

The Independent Directors, who have been so advised by SP Angel

as to the financial terms of the Tender Offer, consider the terms

of the Tender Offer to be fair and reasonable. In providing advice

to the Independent Directors, SP Angel has taken into account the

commercial assessments of the Independent Directors, including the

market conditions and prospects for the Company and the illiquidity

of the trading in the Company's ordinary shares on AIM.

Accordingly, the Independent Directors unanimously recommend that

Shareholders approve all three Resolutions and consider to tender,

or procure the tender, of their Ordinary Shares in the Tender

Offer, as David Mahony (being the only Independent Director who is

a Shareholder) intends to do, or procure to be done, in respect of

his own beneficial holding of 20,000 Ordinary Shares, representing

approximately 0.473 per cent. of the Company's voting rights as at

the Latest Practicable Date.

Shareholders who anticipate greater value in the Ordinary Shares

in the future whilst recognising and being willing to accept the

prospect of remaining invested in an unlisted company controlled by

the Concert Party, may decide not to accept the Tender Offer.

Notwithstanding the Independent Directors' recommendation above,

Shareholders should only make a decision as to whether to tender

all or any of their Ordinary Shares based on, among other things,

their view of the Company's prospects and their own individual

circumstances, including their tax position and are recommended to

seek advice from their duly authorised independent advisers.

If Shareholders are in any doubt about the action that they wish

to take in respect of the Tender Offer, they should consult an

independent financial adviser without delay.

Related Party Transaction

Rudolf Weinreich has agreed to make an unsecured GBP300,000 loan

facility available to the Company ("RW Facility") subject to the

Tender Offer Resolution and the De-Listing Resolution being passed

at the General Meeting and there being no third-party debt facility

available to the Company. Interest will accrue on the loan at 2%

per annum and the loan will be repayable on demand (after six

months). There are no penalties for early termination of the loan

facility.

The Company's acceptance of the RW Facility, subject to the

Tender Offer Resolution and the De-Listing Resolution being passed

at the General Meeting and there being no third-party debt facility

available to the Company, is deemed a related party transaction

under the AIM Rules for Companies. The Directors of the Company,

each of whom is independent of Rudolf Weinreich for the purposes of

the RW Facility, consider, having consulted with SP Angel, the

Company's Nominated Adviser, that the terms of the RW Facility are

fair and reasonable insofar as the Company's shareholders are

concerned.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Announcement of proposed Tender Offer, De-Listing 29 November 2023

and Re-Registration, posting of the Circular,

Proxy Form and Tender Form to Shareholders

Tender Offer opens 29 November 2023

Latest date for receipt of Proxy Form (to 11.00 a.m. on 13

be received no later than 48 hours before December 2023

the General Meeting)

Voting Record Date for the General Meeting 6.00 p.m. on 13

December 2023

General Meeting(1) 11.00 a.m. on 15

December 2023

Announcement of the result of the General 15 December 2023

Meeting

Latest time and date for receipt of Tender 1.00 p.m. on 20

Forms and TTE Instructions in relation to December 2023

the Tender Offer (i.e. close of Tender Offer)

Closing Date(2)

1.00 p.m. on 20

December 2023

Record Date for Tender Offer 6.00 p.m. on 20

December 2023

Announcement of results of the Tender Offer 21 December 2023

by SP Angel and the Company

Tender Offer declared unconditional ("Unconditional 22 December 2023

Date"), expected purchase of Ordinary Shares

under the Tender Offer and completion of

the repurchase from SP Angel

CREST accounts credited in respect of Tender by 5 January 2024

Offer proceeds for uncertificated Ordinary

Shares

Cheques despatched in respect of Tender Offer by 5 January 2024

proceeds for certificated Ordinary Shares

Despatch of share certificates in respect by 5 January 2024

of any revised holdings of Ordinary Shares

following the Tender Offer, and any Ordinary

Shares held in CREST not tendered pursuant

to the Tender Offer

Earliest date for De-Listing / Cancellation

of admission of Ordinary Shares from AIM 8.00 a.m. on 8 January

2024

Earliest date for filing Re-Registration

at Companies House 8 January 2024

If any of the above times and/or dates change, the revised times

and/or dates will be notified to Shareholders by announcement

through a Regulatory Information Service.

All times are references to London time.

All events in the above timetable following the General Meeting

that relate to (i) the Tender Offer are conditional, inter alia,

upon the approval of the Tender Offer Resolution and (ii) the

De-Listing are conditional, inter alia, upon the approval of the

De-Listing Resolution. The Resolution to approve the Tender Offer

requires the approval of not less than 50 per cent. of the votes

cast by Shareholders in person or by proxy at the General Meeting

and the Resolutions to approve the De-Listing and the

Re-Registration each require the approval of not less than 75 per

cent. of the votes cast by Shareholders in person or by proxy at

the General Meeting.

Notes

1. The timetable assumes that there is no adjournment of the

General Meeting or extension(s) of the Closing Date. If there is an

adjournment of the General Meeting or extension(s) of the Closing

Date, all subsequent dates are likely to be later than those

shown.

2. This date may be extended in accordance with the terms and

conditions of the Tender Offer set out in Part 2 of the Circular.

If the Acceptance Condition is satisfied, the Tender Offer will

remain open for acceptance for at least 14 days after the Tender

Offer is declared unconditional, which may extend the Closing Date

and therefore the time by which Qualifying Shareholders who have

not tendered their Ordinary Shares in the Tender Offer may do so if

they wish.

3. Subject to and following the Tender Offer becoming

unconditional, settlement of the consideration to which any

Qualifying Shareholder is entitled pursuant to valid tenders

accepted by SP Angel will be made (i) in the case of acceptances of

the Tender Offer received, valid and complete in all respects, by

the Unconditional Date, within 14 days of the Unconditional Date;

or (ii) in the case of acceptances of the Tender Offer received,

valid and complete in all respects, after such date but while the

Tender Offer remains open for acceptance as referred to in Note 2

above, within 14 days of the date on which the 14 day period

referred to in Note 2 above expires.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR. Upon publication

of this announcement, the inside information is now considered to

be in the public domain for the purposes of MAR.

For further information, contact:

Holders Technology plc 01896 758781

Rudi Weinreich, Executive Chairman

Victoria Blaisdell, Group Managing Director

Mehul Shah, Group Finance Director

Website www.holderstechnology.com

SP Angel Corporate Finance LLP (Financial Adviser, 020 3470

Nominated Adviser and Broker) 0470

Matthew Johnson/Harry Davies-Ball, Corporate Finance

Abigail Wayne, Corporate Broking

Important Notices

S.P. Angel Corporate Finance LLP ("SP Angel"), which is

authorised and regulated by the FCA, is acting as nominated adviser

and broker to the Company for the purposes of the AIM Rules.

Persons receiving this announcement should note that SP Angel is

acting exclusively for the Company and no one else and will not be

responsible to anyone, other than the Company, for providing the

protections afforded to customers of SP Angel or for advising any

other person on the transactions and arrangements described in this

announcement. SP Angel makes no representation or warranty, express

or implied, as to the contents of this announcement and SP Angel

does not accept any liability whatsoever for the accuracy of or

opinions contained (or for the omission of any material

information) in this announcement and shall not be responsible for

the contents of this announcement. Nothing in this paragraph shall

serve to exclude or limit any responsibilities which SP Angel may

have under FSMA or the regulatory regime established

thereunder.

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or solicitation of any offer

to purchase, otherwise acquire, subscribe for, sell or otherwise

dispose of any securities or the solicitation of any vote or

approval in any jurisdiction. Any offer (if made) will be made

solely by certain documentation which will contain the full terms

and conditions of any offer (if made), including details of how

such offer may be accepted. This announcement has been prepared in

accordance with English law and the Code and information disclosed

may not be the same as that which would have been prepared in

accordance with laws outside the United Kingdom. The release,

distribution or publication of this announcement in jurisdictions

outside the United Kingdom may be restricted by the laws of the

relevant jurisdictions and therefore persons into whose possession

this announcement comes should inform themselves about, and

observe, any such restrictions. Any failure to comply with the

restrictions may constitute a violation of the securities laws of

any such jurisdiction.

Forward-looking statements

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"anticipates", "targets", "aims", "continues", "expects",

"intends", "hopes", "may", "will", "would", "could" or "should" or,

in each case, their negative or other variations or comparable

terminology. These forward-looking statements include matters that

are not facts. They appear in a number of places throughout this

announcement and include statements regarding the Directors'

intentions, beliefs or current expectations concerning, amongst

other things, the Group's results of operations, financial

condition, liquidity, prospects, growth and strategies. By their

nature, forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances. A number of

factors could cause actual results and developments to differ

materially from those expressed or implied by the forward-looking

statements, including, without limitation: ability to find

appropriate investments in which to invest and to realise

investments held by the Group; conditions in the public markets;

the market position of the Group; the earnings, financial position,

cash flows and return on capital of the Group; the anticipated

investments and capital expenditures of the Group; changing

business or other market conditions; and general economic

conditions.

Forward-looking statements contained in this announcement based

on past trends or activities should not be taken as a

representation that such trends or activities will continue in the

future. Subject to any requirement under the AIM Rules, Prospectus

Rules, the Disclosure and Transparency Rules or other applicable

legislation or regulation, the Company does not undertake any

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

Investors should not place undue reliance on forward-looking

statements, which speak only as of the date of this

announcement.

No Profit Forecast

No statement in this announcement or incorporated by reference

into this announcement is intended to constitute a profit forecast

or profit estimate for any period, nor should any statement be

interpreted to mean that earnings or earnings per share will

necessarily be greater or less than those for the preceding

financial periods of the Company.

Notice for US Shareholders

The Tender Offer relates to securities in a non-US company which

is registered in the UK and is subject to the disclosure

requirements, rules and practices applicable to companies listed in

the UK, which differ from those of the United States in certain

material respects. This announcement has been prepared in

accordance with UK style and practice for the purpose of complying

with English law and the AIM Rules, and US Shareholders should read

this entire announcement and the Circular, including Part 2. The

financial information relating to the Company, which is available

for review on the Company's website, has not been prepared in

accordance with generally accepted accounting principles in the

United States and thus may not be comparable to financial

information relating to US companies.

The Tender Offer is not subject to the disclosure and other

procedural requirements of Regulation 14D under the US Exchange

Act. The Tender Offer will be extended into the United States in

accordance with the requirements of Regulation 14E under the US

Exchange Act to the extent applicable. Certain provisions of

Regulation 14E under the US Exchange Act are not applicable to the

Tender Offer by virtue of Rule 14d-1(c) under the US Exchange Act.

US Shareholders should note that the Ordinary Shares are not listed

on a US securities exchange and the Company is not subject to the

periodic reporting requirements of the US Exchange Act and is not

required to, and does not, file any reports with the US Securities

and Exchange Commission thereunder.

It may be difficult for US Shareholders to enforce certain

rights and claims arising in connection with the Tender Offer under

US federal securities laws since the Company is located outside the

United States and all of its officers and directors reside outside

the US. It may not be possible to sue a non-US company or its

officers or directors in a non-US court for violations of US

securities laws. It also may not be possible to compel a non-US

company or its affiliates to subject themselves to a US court's

judgment.

The receipt of cash pursuant to the Tender Offer by a

Shareholder who is a US person may be a taxable transaction for US

federal income tax purposes and under applicable US state and

local, as well as foreign and other, tax laws. Each Shareholder is

urged to consult his, her or its independent professional adviser

immediately regarding the tax consequences of tendering any

Ordinary Shares in the Tender Offer.

To the extent permitted by applicable law and in accordance with

normal UK practice, the Company, SP Angel or any of their

respective affiliates, may make certain purchases of, or

arrangements to purchase, Ordinary Shares outside the United States

during the period in which the Tender Offer remains open for

participation, including sales and purchases of Ordinary Shares

effected by SP Angel acting as market maker in the Ordinary Shares.

These purchases, or other arrangements, may occur either in the

open market at prevailing prices or in private transactions at

negotiated prices. In order to be excepted from the requirements of

Rule 14e-5 under the US Exchange Act by virtue of Rule 14e-5(b)(10)

thereunder, such purchases, or arrangements to purchase, must

comply with applicable English law and regulation, including the

AIM Rules, and the relevant provisions of the US Exchange Act. Any

information about such purchases will be disclosed as required in

the UK and the United States and, if required, will be reported via

a Regulatory Information Service and will be available on the

London Stock Exchange website at www.londonstockexchange.com.

While the Tender Offer is being made available to Shareholders

in the United States, the right to tender Ordinary Shares is not

being made available in any jurisdiction in the United States in

which the making of the Tender Offer or the right to tender such

Ordinary Shares would not be in compliance with the laws of such

jurisdiction.

This announcement has not been approved, disapproved or

otherwise recommended by the US Securities and Exchange Commission

or any US state securities commission and such authorities have not

confirmed the accuracy or determined the adequacy of this

announcement. Any representation to the contrary is a criminal

offence in the United States

Rounding

Certain figures included in this announcement have been

subjected to rounding adjustments. Accordingly, figures shown for

the same category presented in different tables or forms may vary

slightly and figures shown as totals in certain tables or forms may

not be an arithmetic aggregation of the figures that precede

them.

Disclosure Requirements of the Takeover Code

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th Business Day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th Business Day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror, save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the Business

Day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Publication on Website

A copy of this announcement will be made available, subject to

certain restrictions relating to persons resident in restricted

jurisdictions, on the Company's website at

www.holderstechnology.com by no later than 12 noon (London time) on

30 November 2023. The content of the website referred to in this

announcement is not incorporated into and does not form part of

this announcement.

Rule 2.9 Disclosure

In accordance with Rule 2.9 of the Code, as at the close of

business on 28 November 2023, Holders confirms that it had in issue

4,224,164 ordinary shares of 10 pence each, each ordinary share

carrying one vote. Accordingly, the total number of voting rights

in the Company is 4,224,164. The International Securities

Identification Number ("ISIN") for the Company's Ordinary Shares on

AIM is GB0004312350.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENPPGCGGUPWPWR

(END) Dow Jones Newswires

November 29, 2023 02:00 ET (07:00 GMT)

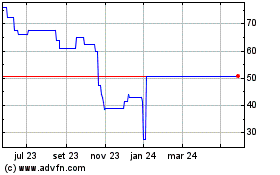

Holders Technology (LSE:HDT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

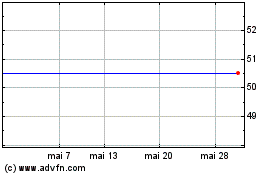

Holders Technology (LSE:HDT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024