TIDMHHV

19 December 2023

HARGREAVE HALE AIM VCT PLC

(the "Company" or the "VCT")

Full Year Results and Notice of AGM

Hargreave Hale AIM VCT plc announces its results for the year

ended 30 September 2023.

The Company also announces that its 2024 Annual General Meeting

will be held at 4:45pm on 8 February 2024 at 88 Wood Street,

London, EC2V 7QR.

The Company's Annual Report and Financial Statements for the

year ended 30 September 2023 and the formal Notice of the Annual

General Meeting will be posted to shareholders who have elected to

receive hard copies and in accordance with Listing Rule 9.6.1

copies of the documents have been submitted to the UK Listing

Authority and will shortly be available to view on the Company's

corporate website at https://www.hargreaveaimvcts.co.uk and have

also been submitted to the UK Listing Authority and will be shortly

available for inspection from the National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

Strategic report

The report has been prepared by the Directors in accordance with

the requirements of Section 414A of the Companies Act 2006.

Financial highlights for the year ended 30 September 2023

Tax free

dividends Ongoing

Net asset value (NAV) per NAV total paid in Share price charges

share return the period total return ratio

46.34p -14.70%(1) 5.00p -23.51%(1) 2.24%(1)

-- GBP13.6 million invested in Qualifying Companies in the year.

-- 91.65% invested by VCT tax value in Qualifying Investments at 30 September 2023.

-- Final dividend of 1.50 pence per share proposed for the year end.

-- Offer for subscription closed to further applications on 10 February 2023, having raised GBP40 million.

-- New Offer for subscription launched on 7 September 2023 to raise GBP20 million, together with an over--allotment facility to raise up to a further GBP20 million.

Summary financial data 2023 2022

NAV (GBPm) 151.92 160.51

NAV per share (p) 46.34 60.19

NAV total return (%)(1) -14.70 -33.42

Market capitalisation (GBPm) 140.96 167.32

Share price (p) 43.00 62.75

Share price discount/premium to NAV per share

(%)(1) -7.21 +4.25(2)

Share price 5 year average discount to NAV per

share (%)(1) -5.64 -5.65

Share price total return (%)(1) -23.51 -28.06

(Loss)/gain per share for the year (p) -9.32 -33.42

Dividends paid per share (p) 5.00 6.65

Ongoing charges ratio (%)(1) 2.24 2.06

(1) Alternative performance measure definitions and illustrations can be found in this report.

(2) The FY22 year end premium to NAV is a function of the year end NAV of 60.19 pence per share and the year end share price.

Financial Calendar

Financial calendar

Record date for final dividend 5 January 2024

Payment of final dividend 15 February

2024

Annual General Meeting 8 February

2024

Announcement of half-yearly results for the six June 2024

months ending 31 March 2024

Payment of interim dividend (subject to Board approval) July 2024

Chair's statement

Introduction

I would like to welcome shareholders who joined us as a result

of the recent offers for subscription. As always, we are grateful

to new and existing shareholders who continue to support the VCT,

despite the difficult times we continue to live through.

The financial year started with some significant headwinds,

including high inflation, a dislocation in the UK Government bond

market and a forecast by the Bank of England that the United

Kingdom would endure the longest recession of the last 100 years.

Whilst we would not wish to downplay the hardship that followed,

the economy was stronger than predicted, in part due to Government

intervention in the energy market over the winter. UK consumer

confidence staged a partial recovery off historic lows, employment

remained strong and, towards the end of the period under review, UK

real wage growth turned positive.

As I noted in our interim report, uncertainty is a theme that we

have all learned to live with these past few years. To this list,

we must now add the implications of the terrible events that

continue to unfold in Israel and Gaza.

Whilst we are encouraged that much of the deep pessimism that

permeated markets at the start of the financial year did not

manifest, we remain mindful of the macro-economic backdrop, both

here and abroad. The cost of borrowing has changed dramatically

within the year, impacting the financial sector and companies with

high levels of debt. Last year, this manifested itself within the

UK pension industry. This year, stress emerged in parts of the US

and European banking system. Remote as this might seem, it affected

companies closer to home, particularly pre-clinical and clinical

stage companies within the life sciences industry that were reliant

upon funding from Silicon Valley Bank (SVB). Those exposed to SVB

became more cautious with their budgets, which in turn reduced

demand for the products and services sold into them. Several of our

portfolio companies have seen weaker trading as a consequence of

this.

When launching the 2022 offer for subscription, we were cautious

about the short-term outlook but spoke about the opportunity for

value creation over the medium term. Our experience over the period

under review is consistent with that view. Generating short-term

performance has been very difficult with the market applying

asymmetrical responses to news flow: positive updates are not

getting full recognition whilst those that disappoint are often

treated harshly. Stock market liquidity is a major contributory

factor. With many active managers now deep into their third year of

outflows, there are few institutional buyers of shares in small UK

companies. Taken together, this has left the sector in deep value

territory.

The malaise that continues to hang over markets in the UK and

elsewhere has heavily impacted the primary markets in which

companies raise new capital through the sale of new shares. With

valuations so depressed and very little capital available for

investment (away from VCTs), very few companies have undertaken an

initial public offering (IPO). On AIM there were just 3 VCT

qualifying initial public offerings within the year. Despite this,

we are pleased to report that we deployed capital into VCT

qualifying companies ahead of budget, highlighting the importance

of having a defined pool of capital, a diversified portfolio and a

flexible investment policy.

Performance

As described in more detail in the Investment Manager's report,

this has been a second consecutive difficult year for performance.

In contrast to last year, when we suffered a substantial

(unrealised) loss of value across investments in public and private

companies, this year the material declines were confined to the

portfolio of investments in public companies. The value of the

investments in private companies were protected by the difficult

decisions made last year and, in some cases, better trading.

Although the markets demand a cautious approach, we are hopeful

that we might start to see some value recovery within the private

companies in the current year. It is worth reiterating at this

point that the predominant factor that drove down the valuations in

our investments in private companies last year was the broad based

(and deep) de-rating of publicly listed companies.

Whilst higher interest rates are a source of concern for many

and likely to weigh on economic activity, they have also made a

significant positive impact on the income generated from within the

VCT, either from cash held on deposit or from recently acquired

short-dated fixed income investments. Investment grade fixed income

assets were a feature of the investment portfolio for a number of

years during and after the financial crisis until negative real

yields (and therefore high prices) forced us to exit those

positions. We have been able to use the sell off in the bond market

this year to rebuild positions that will continue to generate

substantial income for the VCT for several years.

At 30 September 2023, the NAV per share was 46.34 pence which,

after adjusting for the dividends paid in the year of 5 pence,

gives a NAV total return for the year of -14.70%(1) . The NAV total

return (dividends reinvested) for the year was -15.93%(1) compared

with -8.28% in the FTSE AIM All-Share Index Total Return (also

calculated on a dividends Index reinvested basis). The Directors

consider this to be the most appropriate benchmark from a

shareholder's perspective, however, due to the range of assets held

within the investment portfolio and the investment restrictions

placed on a VCT it is not wholly comparable.

The earnings per share total return for the year was a loss of

9.32 pence (comprising a revenue profit of 0.27 pence and a capital

loss of 9.59 pence). Revenue income increased by 168% to GBP2.6m as

a result of an increase in dividends received from non-qualifying

equity, non-qualifying fixed income investments and bank interest.

Interest accrued on loan note instruments increased after the

Investment Manager made two follow on (qualifying) investments into

Kidly Ltd. For the first time, income received into the revenue

account exceeded expenses, resulting in a revenue profit for the

year of 0.27 pence per share (FY22: -0.36 pence per share).

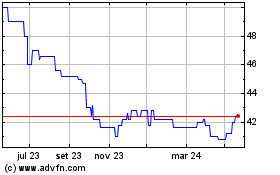

The share price decreased from 62.75 pence to 43.00 pence over

the reporting period which, after adjusting for dividends paid,

gives a share price total return of -23.51%(1) , the fall amplified

by the normalisation of the share price, having briefly traded at a

premium at the close of the last financial year.

Investments

The Investment Manager invested GBP13.6 million into 10

Qualifying Companies during the period. The fair value of

Qualifying Investments at 30 September 2023 was GBP89.1 million

(58.7% of NAV) invested in 63 AIM companies and 5(2) unquoted

companies. At the year end, the fair value of non-qualifying

equities and the Marlborough Special Situations Fund was GBP15.4

million (10.1% of NAV) and GBP8.3 million (5.4% of NAV)

respectively, with most of the non-qualifying equities listed

within the FTSE 350 and offering good levels of liquidity should

the need arise. GBP17.4 million (11.4% of NAV) was held in

short-dated investment grade corporate bonds, GBP2.0 million (1.3%

of NAV) was invested in a UK Government bond exchange traded fund

and GBP19.2 million (12.7% of NAV) held in cash at the period end.

Further information can be found in the Investment Manager's

report.

Dividend

The Directors continue to maintain their policy of targeting a

tax free dividend yield equivalent to 5% of the year end NAV per

share.

In the 12-month period to 30 September 2023, the Company paid

dividends totalling 5 pence (2022: 6.65 pence). A special dividend

of 2 pence and a final dividend of 2 pence (2021: 3.15 pence) in

respect of the 2022 financial year was paid on 10 February 2023 and

an interim dividend of 1.00 penny (2022: 1 penny) was paid on 28

July 2023.

A final dividend of 1.50 pence is proposed (2022: 2 pence)

which, subject to shareholder approval at the Annual General

Meeting, will be paid on 15 February 2024 to ordinary shareholders

on the register on 5 January 2024.

Dividend re-investment scheme

Shareholders may elect to reinvest their dividend by subscribing

for new shares in the Company. Further information can be found in

the shareholder information section.

On 10 February 2023, 1,836,516 ordinary shares were allotted at

a price of 54.95 pence per share, which was calculated in

accordance with the terms and conditions of the dividend

reinvestment scheme (DRIS), on the basis of the last reported NAV

per share as at 20 January 2023, to shareholders who elected to

receive shares under the DRIS as an alternative to the final

dividend for the year ended 30 September 2022 and special dividend

announced on 19 December 2022.

On 28 July 2023, 591,318 ordinary shares were allotted at a

price of 49.29 pence per share, which was calculated in accordance

with the terms and conditions of the DRIS, on the basis of the last

reported NAV per share as at 7 July 2023, to shareholders who

elected to receive shares under the DRIS as an alternative to the

interim dividend for the year ended 30 September 2023.

Share Buybacks

To maintain compliance with the discount control and management

of share liquidity policy, the Company purchased through share

buybacks 7,183,338 ordinary shares (nominal value GBP71,833) during

the 2023 financial year at a cost of GBP3,636,841 (average price:

50.63 pence per share).

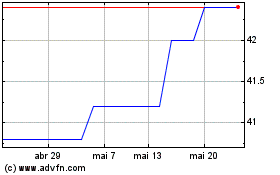

As at 18 December 2023, a further 2,039,414 shares have been

repurchased post the year end at a cost of GBP873,229 (average

price: 42.82 pence per share).

(1) Alternative performance measure definitions and

illustrations can be found in the glossary of terms.

(2) Excluding companies in administration or at risk of

administration with zero value.

Share price discount

The Company aims to improve liquidity and to maintain a discount

of approximately 5 per cent. to the last published NAV per share

(as measured against the mid-price) by making secondary market

purchases of its shares in accordance with parameters set by the

Board.

We continued to operate the discount control and management of

share liquidity policy effectively during the period. As at 30

September 2023, the Company had 1 and 5 year average share price

discounts of 6.06% and 5.64% respectively.

The Company's share price was trading at a discount of 7.21%(1)

as at 30 September 2023 compared to a premium of +4.25%(1) as at 30

September 2022, this being calculated using the closing mid-price

of the Company's shares on 30 September 2023 as a percentage of the

year end net asset value per share, as published on 5 October

2023.

As at 15 December 2023, the discount to NAV was 6.71% of the

last published NAV per share.

Offer for subscription

The Directors of the Company announced on 5 September 2022 the

launch of an offer for subscription for shares to raise up to GBP20

million, together with an over-allotment facility of up to a

further GBP30 million. On 10 February 2023, the Company announced

it had received valid applications of approximately GBP40 million.

The Board decided not to utilise any further sums under the

over-allotment facility and therefore the offer for subscription

was closed to further applications. The offer resulted in gross

funds being received of GBP40 million and the issue of 66 million

shares.

New Offer for subscription

The Directors of the Company announced on 7 September 2023 the

launch of a new offer for subscription for shares to raise up to

GBP20 million, together with an over-allotment facility of up to a

further GBP20 million. The offer was approved by shareholders of

the Company at a general meeting on 11 October 2023.

On 18 December 2023, the Company had allotted 17.6 million

shares raising gross proceeds of GBP8.1 million. The Company has

received valid applications for a further GBP0.5 million. Future

decisions by the Board about the potential use of the

over-allotment facility, in part or in full, will be made with

advice from the Investment Manager and subject to investor demand

and the deployment of capital into VCT qualifying companies.

Cancellation of share premium

At the general meeting of the Company held on 7 October 2022, a

special resolution was passed approving the cancellation of the

Company's share premium account to expand the size of the Company's

distributable reserves.

We are pleased to confirm the cancellation of the share premium

account of the Company was approved by the High Court of Justice in

England and Wales and, accordingly, the amount standing to the

credit of the share premium account (GBP133.2m) of the Company as

at 9 May 2023 was cancelled.

Cost efficiency

The Board reviews costs incurred by the Company on a regular

basis and is focused on maintaining a competitive ongoing charges

ratio (OCR). The year end ongoing charges ratio was 2.24%(1) (FY22:

2.06%(1) ) when calculated in accordance with the AIC's "Ongoing

Charges" methodology. The increase in the OCR is principally driven

by the fall in the average net assets across the year that followed

the drop in the NAV per share. Other factors included an increase

in the number of independent non-executive directors to five and

below inflation increases in remuneration. The Company also made

modest investments to improve shareholder communication through

investments into the Company's website, video updates and an

increased number of shareholder events. The Ongoing Charges

methodology divides ongoing expenses by average net assets.

Board remuneration

Following a review of Board remuneration, and taking into

account peer group analysis and inflation, the Board has agreed to

increase its remuneration by 5%, effective from 1 October 2023. The

annual remuneration of the Chair will increase to GBP41,000, the

independent non-executive directors to GBP32,000 and the

non-independent non-executive director, Oliver Bedford, to

GBP29,500.

An additional fee of GBP1,500 will continue to be paid to the

Chair of the Management and Service Provider Engagement Committee.

The Chair of the Audit Committee will continue to receive an

additional fee of GBP3,000.

Investment Manager

On 2 November 2022, the Company's Investment Manager changed its

name from Hargreave Hale Limited (trading as Canaccord Genuity Fund

Management) to Canaccord Genuity Asset Management Limited

(CGAM).

(1) Alternative performance measure definitions and

illustrations can be found in the glossary of terms.

Annual General Meeting

Shareholders are invited to attend the Company's Annual General

Meeting (AGM) to be held at 4.45 pm on 8 February 2024 at 88 Wood

Street, London, EC2V 7QR. The AGM will be followed by a

presentation from the Investment Manager and a drinks

reception.

Those shareholders who are unable to attend the AGM in person

are encouraged to raise any questions in advance with the Company

Secretary at HHV.CoSec@jtcgroup.com. The deadline for the advance

submission of questions is 5.00 p.m. on 1 February 2024. Answers

will be published on the Company's website on 8 February 2024.

Shareholder Engagement

Shareholder engagement is given a high priority by the Board.

Following a recent review, the Board agreed to significantly

improve the website and develop new content (including video

content) for shareholders to provide more information about the

Company's activities and performance. The new website is live at

www.hargreaveaimvcts.co.uk.

The Company is working hard to make new, better and more

accessible content and hope that shareholders will find the output

useful. The website also introduces new functionality to allow

shareholders to request by email updates on shareholder events, the

performance of the Company (interim management statements, fact

sheets and video updates) and information on the Company's

fundraising activities.

In addition to this, the Board wants to provide shareholders

with more opportunities to meet directly with the Directors and the

CGAM VCT management team. As a result, the number of in--person

events has been increased with the introduction of three new

in-person quarterly updates in February, May and August to sit

alongside the AGM in February and the annual shareholder event in

November. The Board will look to run an event outside of London in

the current financial year to improve access for those unable to

attend London based events. The Board is aware that increased

engagement carries a cost; we therefore hope shareholders will be

able to attend at least one of these events. Further information on

future events and recordings of previous updates can be found on

the Company's website.

Whilst the Board strongly encourages shareholders to make use of

everything the website has to offer, the Directors recognise that

it is not for everyone. Should you prefer, you can of course

continue to communicate with the Chair, any other member of the

Board or the Investment Manager by writing to the Company, for the

attention of the Company Secretary.

Within the 2023 financial year, the Investment Manager gave

three presentations covering the 12 months to 30 September 2022 on

23 November 2022, the 6 months to 31 March 2023 on 21 June 2023 and

the 3 months to 30 June 2023 on 16 August 2023.

Subsequent to the year end, the Investment Manager gave a

presentation covering the 12 months to 30 September 2023 on 29

November 2023. The well attended shareholder event was once again

held at Everyman Cinema, Broadgate, City of London. It included

presentations and a pre-recorded interview with several guest

speakers and contributions from a number of portfolio companies,

including a panel discussion and a presentation from the Investment

Manager's VCT team. The event concluded with the screening of a

feature film. Summary recordings of the Investment Manager's

presentations are available to view on the Company's website

https://www.hargreaveaimvcts.co.uk.

The next shareholder event will be held at the Investment

Manager's offices at 88 Wood Street, London EC2V 7QR following the

conclusion of the AGM to be held at 4.45 pm on 8 February 2024. The

presentation will cover the 3 months to 31 December 2023.

Shareholders are asked to register their interest in attending the

shareholder event through the Company's website

(www.hargreaveaimvcts.co.uk) or by emailing

aimvct@canaccord.com.

Electronic communications

As ever, we are respectfully asking shareholders to opt into

electronic communications and update their dividend payment

preference from cheque to bank transfer. Switching to the digital

delivery of shareholder communications and dividend distributions

is more cost efficient and more secure whilst also helping to

reduce our environmental footprint.

The Company no longer prints and distributes interim reports to

shareholders. The interim results continue to be available for

download on the Company's website (www.hargreaveaimvcts.co.uk) and

a summary of the results are published via a Regulatory Information

Service on the London Stock Exchange. Where necessary, the

Administrator can produce and send out a hard copy.

To support the digital experience, the Company has invested in

an upgraded website to improve the experience and include more

regular updates to the content, including recorded updates from the

manager and portfolio companies. Much of the new content will be

available for distribution by email. You can register your interest

in (and opt out of) email updates through the Company's

website.

Shareholders are also encouraged to make use of Equiniti's

shareview portal, which can be used to monitor their investment,

review their transaction history, see information on dividend

payments and update their communication preferences.

Electronic Voting

Electronic proxy voting is available for shareholders to

register the appointment of a proxy and voting instructions for any

general meeting of the Company once notice has been given. This

service assists the Company to make further printing and production

cost savings, reduce our environmental footprint and streamline the

voting process for investors.

Regulatory update

There were no major changes to VCT legislation during the period

under review.

On 23 September 2022, the Government announced that it intended

to extend the sunset clause that, if not otherwise repealed or

extended, would result in the withdrawal of the upfront 30% income

tax relief for new investment into VCTs from 6 April 2025.

The sunset clause, introduced as part of the 2015 EU State aid

review, does not affect the Capital Gains Tax relief or tax free

dividend payments, nor does it affect investors' income tax relief

on VCT investments made before 6 April 2025.

On 22 November 2023, the Chancellor of the Exchequer announced

as part of the Autumn Statement the intention to extend the VCT and

EIS schemes to 5 April 2035. The Government will introduce new

legislation as part of a future finance bill.

Consumer Duty

The Financial Conduct Authority (FCA) introduced the Consumer

Duty on 31 July 2023 to improve the standard of care provided by

firms that are involved in the manufacture or supply of products

and services to retail clients.

Consumer Duty comprises a new principle and suite of other rules

and guidance to be followed by firms involved in the manufacture

and distribution of a product to put consumers in a better position

to take responsibility for meeting their financial needs and

objectives. For consumers, this should:

-- give confidence that firms are acting in good faith, in line with their interests;

-- allow them to make informed choices about products and services that are fit for purpose and designed to meet a designated target market;

-- improve the information available to assist with the review of the products and services most likely to meet their needs;

-- support the correct delivery of benefits that consumers should reasonably expect from the product and services they subscribe to;

-- improve the standard of customer service; and

-- help them obtain fair value from financial products and services.

As the Company is not regulated by the FCA, it falls outside of

the FCA's new Consumer Duty regulation. However, CGAM and Canaccord

Genuity Wealth Limited (CGWL) are regulated companies and in scope,

respectively as the designated manufacturer and distributor of the

Company. In its capacity as manufacturer, CGAM has conducted a fair

value assessment and a target market assessment. Having reviewed

both reports, the Board is satisfied that CGAM and CGWL have

complied with their obligations.

Two of the four pillars that underpin Consumer Duty relate to

consumer understanding and consumer support.

Although the Board is satisfied that these obligations are met

in full, the Company's website has been upgraded to enhance the

services and benefits derived from an investment in the Company. As

noted above, the Board and Investment Manager have jointly agreed

to host more shareholder events to support the delivery of the

consumer understanding outcome, one of the key outcomes described

under the Consumer Duty.

VCT status

I am pleased to report that the Company continues to perform

well against the requirements of the legislation and at the period

end, the investment test was 91.65% (2022: 84.85%) against an 80%

requirement when measured using HMRC's methodology. The increase in

the investment test percentage reflects progress made in deploying

capital raised through the 2022 offer and the return of capital to

shareholders through the payment of a 2 pence per share special

dividend on 10 February 2023 following the successful exit from

Ideagen plc. The Company satisfied all other tests relevant to its

status as a Venture Capital Trust.

Key information document

In accordance with the Packaged Retail Investment and Insurance

Products ("PRIIPs") regulations, the Company's Key Information

Document ("KID") is published on the Company's website at

www.hargreaveaimvcts.co.uk/document-library/.

Risk review

The Board has reviewed the risks facing the Company. Further

detail can be found in the principal and emerging risks and

uncertainties section.

Outlook

Whilst we continue to navigate an uncertain economic and

geopolitical outlook, recent news suggests that monetary policy is

likely to become more accommodating as we progress through the

year, helping to lay the foundations for a sustainable recovery in

value.

When it finally emerges, a change of sentiment in public markets

will benefit our investments in both public and private companies.

Until then, we draw comfort from a number of factors: first, the

majority of portfolio companies continue to provide updates that

are in line with expectations; second, there is a substantial

amount of growth on offer from within the portfolio, even in these

more difficult times; third, a review of valuation metrics within

the qualifying portfolio highlights the deep value on offer; and

finally, a significant majority of qualifying companies are well

funded and commercially robust.

David Brock

Chair

18 December 2023

The Company and its business model

The Company was incorporated and registered in England and Wales

on 16 August 2004 under the Companies Act 1985, registered number

05206425.

The Company has been approved as a Venture Capital Trust by HMRC

under Section 259 of the Income Taxes Act 2007. The shares of the

Company were first admitted to the Official List of the UK Listing

Authority and trading on the London Stock Exchange on 29 October

2004 and can be found under the TIDM code "HHV". The Company is

premium listed.

In common with many other VCTs, the Company revoked its status

as an investment company as defined in Section 266 of the Companies

Act 1985 on 23 May 2006 to facilitate the payment of dividends out

of capital profits.

The Company's principal activity is to invest in a diversified

portfolio of qualifying small UK based companies, primarily trading

on AIM, with a view to generating capital returns and income from

its portfolio and to make distributions from capital and income to

shareholders whilst maintaining its status as a VCT.

The Company is registered as a small UK Alternative Investment

Fund Manager (AIFM) with a Board comprising of six non-executive

directors, five of whom are independent. Canaccord Genuity Asset

Management Limited acts as investment manager whilst Canaccord

Genuity Wealth Limited (CGWL) acts as administrator and custodian.

JTC (UK) Limited provides company secretarial services.

The Board has overall responsibility for the Company's affairs

including the determination of its investment policy. However, the

Board exercises these responsibilities through delegation to

Canaccord Genuity Asset Management Limited, Canaccord Genuity

Wealth Limited and JTC (UK) Limited as it considers

appropriate.

The Directors have managed and continue to manage the Company's

affairs in such a manner as to comply with Section 259 of the

Income Taxes Act 2007.

Investment objectives, policy and strategy

Investment objectives

The investment objectives of the Company are to generate capital

gains and income from its portfolio and to make distributions from

capital or income to shareholders whilst maintaining its status as

a Venture Capital Trust.

Investment policy

The Company intends to achieve its investment objectives by

making Qualifying Investments in companies listed on AIM, private

companies and companies listed on the AQSE Growth Market, as well

as Non-Qualifying Investments as allowed by the VCT Rules.

Qualifying investments

The Investment Manager will maintain a diversified portfolio of

Qualifying Investments which may include equities and fixed income

securities as permitted by the VCT Rules. Investments will

primarily be made in companies listed on AIM but may also include

private companies that meet the Investment Manager's criteria and

companies listed on the AQSE Growth Market. These small companies

have a permanent establishment in the UK and, whilst of high risk,

will have the potential for significant capital appreciation.

To maintain its status as a VCT, the Company must have 80 per

cent. by value as measured by the VCT Rules of all of its

investments in Qualifying Investments throughout accounting periods

of the VCT beginning no later than three years after the date on

which those shares are issued. To provide some protection against

an inadvertent breach of this rule, the Investment Manager targets

a threshold of approximately 85 per cent.

Non-Qualifying Investments

The Non-Qualifying Investments must be permitted by the VCT

Rules and may include equities and exchange traded funds listed on

the main market of the London Stock Exchange, fixed income

securities, bank deposits that are readily realisable, the

Marlborough Special Situations Fund and the Marlborough UK

Micro-Cap Growth Fund. Subject to the investment controls below,

the allocation to each of these investment classes will vary to

reflect the Investment Manager's view of the market environment and

the deployment of funds into Qualifying Companies. The market value

of the Non--Qualifying Investments (excluding bank deposits) will

vary between nil and 50 per cent. of the net assets of the

Company.

The value of funds held in bank deposits will vary between nil

and 30 per cent. of the net assets of the Company.

Investment controls

The Company may make co-investments in investee companies

alongside other funds, including other funds managed by the

Investment Manager.

Other than bank deposits, no individual investment shall exceed

10 per cent. of the Company's net assets at the time of

investment.

Borrowings

The Articles permit the Company to borrow up to 15 per cent. of

its adjusted share capital and reserves (as defined in the

Articles). However, it is not anticipated that the Company will

have any borrowings in place and the Directors do not intend to

utilise this authority.

To the extent that any future changes to the Company's

investment policy are considered to be material, shareholder

consent to such changes will be sought. Such consent applies to the

formal investment policy described above and not the investment

process set out below.

Investment process and strategy

The Investment Manager follows a stock specific investment

approach based on fundamental analysis of the investee company.

The Investment Manager's fund management team has significant

reach into the market and meets with large numbers of companies

each week. These meetings provide insight into investee companies,

their end markets, products and services, and competition.

Investments are monitored closely and the Investment Manager

usually meets or engages with their senior leadership team at least

twice each year. Where appropriate the Company may co-invest

alongside other funds managed by the Investment Manager.

The key selection criteria used in deciding which investments to

make include, inter alia:

-- the strength and depth of the management team;

-- the business strategy;

-- a prudent approach to financial management and forecasting;

-- a strong balance sheet;

-- profit margins, cash flows and the working capital cycle;

-- barriers to entry and the competitive landscape; and

-- the balance of risk and reward over the medium and long term.

Qualifying Investments

Investments are made to support the growth and development of a

Qualifying Company. The Investment Manager will maintain a

diversified portfolio that balances opportunity with risk and

liquidity. Qualifying Investments will primarily be made in

companies listed on AIM but may also include private companies and

companies listed on the AQSE Growth Market. Seed funding is rarely

provided and only when the senior leadership team includes proven

business leaders known to the Investment Manager.

Working with advisers, the Investment Manager will screen

opportunities, often meeting management teams several times prior

to investment to gain a detailed understanding of the company.

Investments will be sized to reflect the risk and opportunity over

the medium and long term. In many cases, the Investment Manager

will provide further funding as the need arises and the investment

matures. When investing in private companies, the Investment

Manager will shape the investment to meet the investee company's

needs whilst balancing the potential for capital appreciation with

risk management.

Investments will be held for the long term unless there is a

material adverse change, evidence of structural weakness, or poor

governance and leadership. Partial realisations may be made where

necessary to balance the portfolio or, on occasion, to capitalise

on significant mispricing within the stock market.

Non-Qualifying Investments

The Investment Manager's VCT team works closely with the

Investment Manager's wider fund management team to deliver the

investment strategy when making Non-Qualifying Investments, as

permitted by the VCT Rules. The Investment Manager will vary the

exposure to the available asset classes to reflect its view of the

equity markets, balancing the potential for capital appreciation

with risk management, liquidity and income.

The Non-Qualifying Investments will typically include a focused

portfolio of direct investments in companies listed on the main

market of the London Stock Exchange. The portfolio will mix long

term structural growth with more tactical investment to exploit

short term mispricing within the market. The use of the Marlborough

Special Situations Fund and the Marlborough UK Micro-Cap Fund

enables the Company to maintain its exposure to small UK companies

whilst the Investment Manager identifies opportunities to invest

the proceeds of fundraisings into Qualifying Companies.

The Investment Manager may use certain exchange traded funds

listed on the Main Market of the London Stock Exchange to gain

exposure to asset classes not otherwise accessible to the

Company.

Environmental, social and governance considerations

Approach

The Company regards the development of a clearly defined and

integrated ESG management system as an important pillar for the

long-term success of its business, as well as for its investee

companies.

The Investment Manager believes that companies with strong

governance, sustainable business models and balanced workforces are

more likely to create value over the long term whilst reducing

investment risk, benefiting the wider UK economy and society and

generating positive shareholder returns.

ESG in the investment process

Holding meaningful stakes in investee companies provides the

Investment Manager with the opportunity and responsibility to

positively influence investee company behaviour, both at the point

of investment and during the time in which the Company is a

shareholder.

Due diligence

The Investment Manager assesses ESG factors across the

portfolio. For Qualifying Companies, the Investment Manager will

use the information provided to develop an individualised ESG risk

map to identify issues and track behavioural themes. The Investment

Manager regularly engages with senior management teams and boards

to identify and raise issues of note, provide a forum for positive

feedback and promote change where necessary.

Engagement, exclusions and divestment policies

As part of its investment strategy, the Company has adopted

policies covering exclusions and divestment to describe behaviours

that fall outside of the Company's expectations of investee

companies. The Investment Manager has adopted an engagement policy

to create a clear framework that defines how it will interact with

investee companies.

The Investment Manager

The Investment Manager adheres to its own ESG investment and

stewardship policies. These include an ESG Policy, an Engagement

Policy, a Conflicts of Interest Policy and a Stewardship Policy

that, together with the investment mandate and the Company's ESG

approach, inform the Company's approach.

CGAM is a signatory of the United Nations Principles of

Responsible Investment (UN PRI) and HM Treasury's Women in Finance

Charter.

Risk management

The structure of the Company's investment portfolio and its

investment strategy, has been developed to mitigate risk where

possible. Key risk mitigation strategies are as follows:

-- The Company has a broad portfolio of investments to reduce stock specific risk.

-- Flexible allocations to non-qualifying equities, exchange traded funds listed on the Main Market of the London Stock Exchange, fixed income securities, bank deposits that are readily realisable, the Marlborough Special Situations Fund and the Marlborough UK Micro-Cap Fund allow the Investment Manager to adjust portfolio risk without compromising liquidity.

-- Regular meetings with investee companies aid the close monitoring of investments to identify potential risks and allow corrective action where possible.

-- Regular Board meetings and dialogue with the Directors, along with policies to control conflicts of interest and co-investment with the Marlborough fund mandates, support strong governance.

Further information can be found in this report.

Key performance indicators

The Directors consider the following Key Performance Indicators

(KPIs) to assess whether the Company is achieving its strategic

objectives. The Directors believe these measures help shareholders

assess how effectively the Company is applying its investment

policy and are satisfied the results give a fair indication of

whether the Company is achieving its investment objectives and

policy. The KPIs are established industry measures.

Further commentary on the performance of these KPIs has been

discussed in the Chair's statement and Investment Manager's

report.

1 NAV and share price total returns

The Board monitors NAV and share price total return to assess

how the Company is meeting its objective of generating capital

gains and income from its portfolio and making distributions to

shareholders. The NAV per share decreased from 60.19 pence to 46.34

pence resulting in a loss to ordinary shareholders of -8.85 pence

per share (-14.70%)(1) after adjusting for dividends paid in the

year.

The Board considers peer group and benchmark comparative

performance. Due to the very low number of AIM VCTs, the Board

reviews performance against the generalist VCTs as well as the AIM

VCTs to provide a broader peer group for comparison purposes.

Performance is also measured against the FTSE AIM All-Share Index

Total Return. With 91% of the portfolio of Qualifying Investments

in companies listed on AIM, the Directors consider this to be the

most appropriate benchmark. However, HMRC derived investment

restrictions and investments in private companies, main market

listed companies and bonds mean that the index is not a wholly

comparable benchmark for performance.

Rolling Returns to end Sep 2023 1Y 3y 5y 10y

NAV total return -14.70% -15.30% -17.18% 29.11%

Share price total return -23.51% -10.53% -15.87% 35.53%

NAV total return (dividends

reinvested) (1) -15.93% -22.40% -25.80% 18.49%

Share price total return (dividends

reinvested) (1) -24.80% -18.58% -25.16% 23.65%

FTSE AIM All-Share Index Total

Return -8.28% -21.23% -29.50% 4.21%

Source: Canaccord Genuity Asset Management Ltd

(1) The NAV total return (dividends reinvested) and share price total return (dividends reinvested) measures have been included to improve comparability with the FTSE AIM All-Share Index Total Return which is also calculated on that basis.

Reflecting the difficult market conditions that continued to

dominate through the financial year, and in common with the AIM VCT

peer group, the Company reported a significant reduction in the NAV

per share. The NAV total return fell behind the benchmark over the

year; however, it remains ahead of the benchmark over three, five

and ten years but behind the average of the AIM VCT peer group over

the same time horizons. The steep falls in valuations of companies

listed on AIM, which have heavily impacted the performance of the

Company and its AIM VCT peers, have not been mirrored in the

Generalist VCT sector, which has reported a very modest average

decline of --0.05% over the period under review (source:

Morningstar). The divergence of performance across the two peer

groups is particularly notable across the two years since the start

of the bear market with the AIM VCT sector returning an average

loss of 42.1% against the average loss within the Generalist VCT

sector of -1.1%. AIM has fallen by 42.0% over the same two-year

period. It is difficult to account for the strongly divergent

performance although the possible use of investment structures not

accessible to investors in public companies may account for some of

the difference.

(1) Alternative performance measure definitions and

illustrations can be found in the glossary of terms.

Further detailed information on peer group performance is

available through Morningstar

(https://www.morningstar.co.uk) and the AIC

(https://www.theaic.co.uk/aic/statistics).

2. Share price discount to NAV per share

The Company uses secondary market purchases of its shares to

improve the liquidity in its shares and support the discount. The

discount to NAV per share is an important influence on a selling

shareholder's eventual return. The Company aims to maintain a

discount of approximately 5 per cent. to the last published NAV per

share (as measured against the mid-price).

The Company's shares traded at a discount of 7.21%(1) as at 30

September 2023 (2022: 4.25%(1) premium) when calculated with

reference to the 30 September 2023 NAV per share. The 1 and 5 year

average share price discounts were 6.06%(1) and 5.64%(1)

respectively.

The Company's shares are priced against the last published NAV

per share with the market typically adjusting the price to reflect

the NAV after its publication. In line with the Company's valuation

policy, the Company aims to publish the quarter end NAV per share

within 5 business days of the period end to allow time for the

Investment Manager and Board to review and agree the valuation of

the private companies held within the investment portfolio.

The Company's share price on 30 September 2023 reflected the

last published NAV per share prior to the year end, which was

released on 26 September 2023. The 30 September 2023 NAV was

reported on 5 October 2023, following the review of the valuations

of the private companies.

As at 15 December 2023, the discount to NAV was 6.71% of the

last published NAV per share.

3. Ongoing charges ratio

The ongoing charges of the Company were 2.24%(1) (2022: 2.06%(1)

) of the average net assets of the Company during the financial

year to 30 September 2023.

The increase in the OCR is principally driven by the fall in the

average net assets across the year that followed the drop in the

NAV per share. Other factors included below inflation increases in

board remuneration and an increase in the number of non-executive

directors from five to six. There were also modest investments made

to improve shareholder communication through investments into the

Company's website, video updates and an increased number of

shareholder events. The Ongoing Charges methodology divides ongoing

expenses by average net assets.

The Company's ongoing charges ratio remains competitive against

the wider VCT industry and similar to other AIM VCTs. This ratio is

calculated using the AIC's "Ongoing Charges" methodology and,

although based on historical information, it provides shareholders

with an indication of the likely future cost of managing the

fund.

Cost control and efficiency continues to be a key focus for the

Board. Although the OCR increased within the year, the Board is

pleased to report that the Company's expenses incurred within the

year were below budget.

(1) Alternative performance measure definitions and

illustrations can be found in the glossary of terms.

4. Dividends per share

The Company's policy is to target a tax free dividend yield

equivalent to 5% of the year end NAV per share. The Board remains

committed to maintaining a steady flow of dividend distributions to

shareholders.

A total of 5.00 pence per share (2022: 6.65 pence) of dividends

was paid during the year, comprised of a special dividend of 2.00

pence per share paid on 10 February 2023, a final dividend of 2.00

pence in respect of the previous financial year (2021: 3.15 pence)

paid on 10 February 2023 and an interim dividend of 1.00 penny

(2022: 1.00 penny) paid on 28 July 2023.

A final dividend of 1.50 pence per share will be proposed at the

Annual General Meeting. If approved by shareholders, the payment of

the interim, final and special dividends in respect of the

financial year to 30 September 2023 would represent a distribution

to shareholders of 9.7% of the 30 September 2023 NAV per share.

The below table demonstrates how the Board has been able to

consistently pay dividends in line with the 5% target and dividend

policy.

Dividends paid/payable by financial year

Year end

NAV Dividends

Additional

Year pence per share Yield information

2010/11 61.14 4.00 6.5%

2011/12 61.35 3.25 5.3%

2012/13 71.87 3.75 5.2%

2013/14 80.31 4.25 5.3%

2014/15 74.64 4.00 5.4%

2015/16 75.93 4.00 5.3%

2016/17 80.82 4.00 4.9%

Including

special

dividend

2017/18 87.59 5.40 6.2% of 1 penny.

2018/19 70.60 3.75 5.3%

Including

a special

dividend

of 1.75

2019/20 73.66 5.40 7.3% pence.

Including

a special

dividend

of 2.50

2020/21 100.39 7.40 7.4% pence.

2021/22 60.19 3.00 5.0%

Including

a special

dividend

of 2.00

pence and

proposed

final dividend

of 1.50

2022/23 46.34 4.50 9.7% pence.

(1) Alternative performance measure definitions and

illustrations can be found in the glossary of terms.

5. Compliance with VCT regulations

A VCT must be approved by HMRC at all times and, in order to

retain its status, the Company must meet a number of tests as set

out by the VCT legislation. Throughout the year ended 30 September

2023 the Company continued to meet these tests.

The investment test increased from 84.85% to 91.65% in the

financial year. The increase in the investment test percentage

reflects progress made in deploying capital raised through the 2022

offer and the return of capital to shareholders through the payment

of a 2 pence per share special dividend on 10 February 2023

following the successful exit from Ideagen plc. The investment test

remains comfortably ahead of the 80% threshold that applies to the

Company and ahead of the target of 85% as set out in the Company's

investment policy.

The Company invested GBP13.6 million into 10 Qualifying

Companies, 4 of which were investments into new Qualifying

Companies. The Board is pleased with the level of new Qualifying

Investment, which was ahead of expectations.

The Board believes that the Company will continue to meet the

HMRC defined investment test and other qualifying criteria on an

ongoing basis.

For further details please refer to the Investment Manager's

report.

Principal and emerging risks and uncertainties

The Directors acknowledge that they are responsible for the

effectiveness of the Company's risk management and internal

controls and periodically review the principal risks faced by the

Company at Board meetings. The Board may fulfil these

responsibilities through delegation to Canaccord Genuity Asset

Management Limited and Canaccord Genuity Wealth Limited as it

considers appropriate. The principal risks facing the Company,

together with mitigating actions taken by the Board, are set out

below:

Risk Potential consequence How the Board mitigates Changes During

risk the Year

Venture Capital Loss of VCT approval To reduce this No change.

Trust approval could lead to the risk, the Board

risk. The Company Company losing has appointed an

operates in a complex its exemption from investment manager

regulatory environment corporation tax with significant

and faces a number on capital gains, experience in the

of related risks. shareholders losing management of venture

A breach of Section their tax reliefs capital trusts.

259 of the Income and, in certain The Investment

Taxes Act 2007 circumstances, Manager regularly

could result in being required provides the Board

the disqualification to repay the initial with written and

of the Company tax relief on their verbal reports.

as a VCT. investment. The Board also

appointed Philip

Hare & Associates

LLP to monitor

compliance with

regulations and

provide half-yearly

compliance reports

to the Board.

Investment risk. Investment in poor The Board has appointed No change.

Many of the Company's quality companies an investment manager Changes in monetary

investments are could reduce the with significant or fiscal policy

held in small, capital and income experience of investing have undermined

high risk companies return to shareholders. in small companies. consumer, business

which are either Investments in The Investment and investor confidence

listed on AIM or small companies Manager maintains with negative impacts

privately held. are often illiquid a broad portfolio on profitability,

and may be difficult of investments investment and

to realise. across a wide range stock market performance.

of industries and The higher cost

sectors. Individual of borrowing is

Qualifying Investments starting to impact

rarely exceed 5% the cost of debt

of net assets. for companies and

The Investment consumers. Whilst

Manager holds regular still subdued,

company meetings UK consumer and

to monitor investments business confidence

and identify potential has recovered off

risk. The VCT's lows as energy

liquidity is monitored prices, inflation

on a regular basis and supply chain

by the Investment frictions all eased.

Manager and reported Whilst the economy

to the Board quarterly has outperformed

and as necessary. expectations for

this year, the

outlook remains

weak.

Compliance risk. Failure to comply Board members have No change.

The Company is with these regulations considerable experience

required to comply could result in of operating at

with the FCA Listing a delisting of senior levels within

Rules and the Disclosure the Company's shares, quoted businesses.

Guidance and Transparency financial penalties, They have access

Rules, the Companies a qualified audit to a range of advisors

Act, Accounting report or loss including solicitors,

Standards, the of shareholder accountants and

General Data Protection trust. other professional

Regulation and bodies and take

other legislation. advice when appropriate.

The Company is CGWL provides compliance

also a small registered oversight to both

Alternative Investment the Administrator

Fund Manager ("AIFM") and the Investment

and has to comply Manager and reports

with the requirements to the Board on

of the AIFM Directive. a quarterly basis.

Operational risk Failures could The Company has No change.

and outsourcing. put the assets in place a risk

Failure in the of the Company matrix and a set

Investment Manager, at risk or result of internal policies

Administrator, in reduced or inaccurate which are reviewed

Custodian, Company information being on a regular basis.

Secretary or other passed to the Board It has written

appointed third or shareholders. agreements in place

party systems and Quality standards with its third-party

controls or disruption may be reduced service providers.

to its business through lack of The Board, through

as a result of understanding or the Management

operational failure, loss of control. and Service Provider

environmental hazards Engagement Committee,

or cyber security receives regular

attacks. reports from the

Investment Manager,

Administrator and

custodian to provide

assurance that

they operate appropriate

control and oversight

systems and have

in place training

and other defence

measures to mitigate

the risk of cyber

attack. Additionally,

the Board receives

a control report

from the Company's

registrars on an

annual basis. Where

tasks are outsourced

to other third

parties, reputable

firms are used

and performance

is reviewed periodically

by the Management

and Service Provider

Engagement Committee

Key personnel risk. Potential impact The Board discusses No change.

A change in the on investment performance. key personnel risk

key personnel involved and resourcing

in the management with the Investment

of the portfolio. Manager periodically.

The VCT team within

the Investment

Manager comprises

two fund managers

and two investment

analysts, which

helps mitigate

this risk.

Exogenous risks Instability or Regular dialogue No change.

such as economic, changes arising with the manager The Bank of England

political, financial, from these risks provides the Board increased base

climate change could have an impact with assurance rates by 300bps

and health. Economic on stock markets that the Investment to 5.25% during

risks include recession and the value of Manager is following the financial year,

and sharp changes the Company's investments the investment significantly increasing

in interest rates. so reducing returns policy agreed by the cost of debt

Political risks to shareholders. the Board and appraises for companies and

include the terms A failure to renew the Board of the and households

of the UK's exit or replace the portfolio's current with floating rate

from the European relevant sections positioning in debt. Companies

Union or a change of the Finance the light of prevailing and households

in government policy (No 2) Act 2015 market conditions. with savings benefitted.

causing the VCT with similar or The Company's investment The full impact

scheme to be brought equivalent legislation portfolio is well of this is yet

to an end. A condition would make it more diversified and to be felt.

of the European difficult for the the Company has In the Autumn Statement

Commission's State Company to attract no gearing. 2023, the Government

aid approval of new capital whilst The Board regularly confirmed its intention

the UK's VCT and continuing to operate reviews investment to extend the sunset

EIS schemes in under its current test forecasts clause by 10 years

2015 was the introduction investment policy. and liquidity analysis, to 5 April 2035.

of a retirement Companies may face including under Legislation is

date for the current restrictions on stress scenarios, expected to be

schemes at midnight emissions, water to monitor current introduced through

on 5 April 2025 consumption and and anticipate the next Finance

(the 'Sunset Clause'). increased risk future performance Bill and passed

If the relevant of environmental against HMRC legislation into law in early

legislation is hazards. and to ensure the 2024.

not renewed or Company has, and The wars in Ukraine

replaced with similar will continue to and the Middle

or equivalent legislation, have, access to East present a

new investors will sufficient liquidity range of risks

not be able to and distributable that may have profound

claim income tax reserves to maintain economic and social

relief for investments compliance with consequences if

into new shares its key policies. they impact access

issued by VCTs The Board keeps to certain commodities

after 5 April 2025. abreast of current or much higher

Climate change thinking through prices.

presents environmental, contact with industry

geopolitical, regulatory associations and

and economic risks. its advisors.

In the long term, The Investment

some companies Manager undertakes

may have restrictions a review of ESG

imposed on their factors as part

operational model of the investment

that reduce revenues process. Climate

and profit margins change, or the

and increases their need to limit its

cost of capital. impact, will result

in technological

innovation as young

companies seek

to develop solutions

and create opportunities

for value creation

for existing or

new Qualifying

Companies.

Additional risks and further details of the above risks and how

they are managed are explained in note 15 of the financial

statements. Trends affecting future developments are discussed in

the Chair's statement and the Investment Manager's report.

Long term viability statement

--In accordance with provision 36 of the AIC Code of Corporate

Governance, the Directors have carried out a robust assessment of

the Company's current position and its emerging and principal

risks. This assessment has been carried out over a longer period

than the 12 months required by the 'Going Concern' provision. The

Board conducted this review for a period of five years, which was

selected because it:

-- is consistent with investors' minimum holding period to retain the 30% income tax relief;

-- exceeds the time allowed to deploy funds raised under the current offer in accordance with VCT legislation; and

-- is challenging to forecast beyond five years with sufficient accuracy to provide actionable insight.

The Board considers the viability of the Company as part of its

continuing programme of monitoring risk. The Company has a detailed

risk control framework, documented procedures and forecasting model

in place to reduce the likelihood and impact of risk taking that

exceeds the levels agreed by the Board. These controls are reviewed

by the Board and Investment Manager on a regular basis.

The Board has considered the Company's financial position and

its ability to meet its liabilities as they fall due over the next

five years. Forecasts and stress tests have been used to support

their assessment and the following factors have been considered in

relation to the Company's future viability:

-- the Company maintains a highly diversified portfolio of Qualifying Investments;

-- the Company is well invested against the HMRC investment test (91.65% at 30 September 2023) and the Board believes the Investment Manager will continue to have access to sufficient numbers of investment opportunities to maintain compliance with the HMRC investment test;

-- the Company held GBP19.2 million in cash at the year end;

-- the Company has distributable reserves of GBP134.4 million at 30 September 2023, equivalent to 41 pence per share;

-- the Company has a portfolio of Non-Qualifying Investments, most of which are listed in the FTSE 350 and offer good levels of liquidity should the need arise;

-- the financial position of the Company at 30 September 2023 was strong with no debt or gearing;

-- the offer for subscription launched on 7 September 2023 has provided further liquidity for deployment in line with the Company's policies and to meet future expenses;

-- the ongoing charges ratio of the Company at the year end was 2.24%;

-- the Company has procedures and forecast models in place to identify, monitor and control risk, portfolio liquidity and other factors relevant to the Company's status as a VCT; and

-- the Investment Manager and the Company's other key service providers have contingency plans in place to manage operational disruptions.

In assessing the Company's future viability, the Board has

assumed that investors will wish to continue to have exposure to

the Company's activities, that performance will be satisfactory and

the Company will continue to have access to sufficient capital.

Based on this assessment, the Directors have a reasonable

expectation that the Company will be able to continue in operation

and meet its liabilities as they fall due over the next five

years.

Other matters

Dividend policy

The Company's dividend policy is to target a tax free dividend

yield equivalent to 5% of the year end NAV per share. The ability

to pay dividends is dependent on the Company's available

distributable reserves and cash resources, the Act, the Listing

Rules and the VCT Rules. The policy is non-binding and at the

discretion of the Board. Dividend payments may vary from year to

year in both quantum and timing. The level of dividend paid each

year will depend on the performance of the Company's portfolio. In

years where there is strong investment performance, the Directors

may consider a higher dividend payment, including the payment of

special dividends. In years where investment performance is not as

strong, the Directors may reduce or even pay no dividend.

Discount control policy and management of share liquidity

The Company aims to improve liquidity and to maintain a discount

of approximately 5 per cent. to the last published NAV per share

(as measured against the mid-price) by making secondary market

purchases of its shares in accordance with parameters set by the

Board.

This policy is non-binding and at the discretion of the Board.

Its operation depends on a range of factors including the Company's

liquidity, shareholder permissions, market conditions and

compliance with all laws and regulations. These factors may

restrict the effective operation of the policy and prevent the

Company from achieving its objectives.

Diversity

The Board comprises three male non-executive directors and three

female non-executive directors with a diverse range of experience,

skills, length of service and backgrounds. The Board considers

diversity when reviewing Board composition and has made a

commitment to consider diversity when making future appointments.

The Board will always appoint the best person for the job. It will

not discriminate on the grounds of gender, race, ethnicity,

religion, sexual orientation, age or physical ability.

Environmental Social and Governance (ESG) and Considerations

The Board seeks to maintain high standards of conduct with

respect to environmental, social and governance issues and to

conduct the Company's affairs responsibly.

The Company does not have any employees or offices and so the

Board does not maintain any specific policies regarding employee,

human rights, social and community issues but does expect the

Investment Manager to consider them when fulfilling their role. As

the Company used less than 40MWh of energy during the period it is

exempt from the Streamlined Energy and Carbon Reporting

requirements.

The Company, whilst exempt, continues to monitor and develop its

approach to the recommendations of the Task Force on Climate

related Financial Disclosures.

The management of the Company's investment portfolio has been

delegated to its Investment Manager Canaccord Genuity Asset

Management Ltd. The Company has adopted specific policies on

divestment and excluded activities and it expects the Investment

Manager to take account of ESG considerations in its investment

process for the selection and ongoing monitoring of underlying

investments. The Board has also given the Investment Manager

discretion to exercise voting rights on resolutions proposed by

investee companies.

The Investment Manager continues to strengthen its approach to

ESG issues.

To minimise the direct impact of its activities the Company

offers electronic communications where acceptable to reduce the

volume of paper it uses and uses Carbon Balanced paper manufactured

at a FSC accredited mill to print its financial reports. Vegetable

based inks are used in the printing process where appropriate.

Prospects

The prospects and future development of the Company are

discussed in detail in the outlook section of the Chair's

statement.

The strategic report is approved, by order of the Board of

Directors.

David Brock

Chair

18 December 2023

Summary of VCT regulations

To maintain its status as a VCT, the Company must be approved by

HMRC and comply with a number of conditions. A summary of the most

important conditions are detailed below:

VCTs' obligations

VCTs must:

-- have 80 per cent. (by VCT tax value) of all funds raised from the issue of shares invested in Qualifying Investments throughout accounting periods of the VCT beginning no later than three years after the date on which those shares are issued;

-- have at least 70 per cent. by VCT tax value of Qualifying Investments in Eligible Shares which carry no preferential rights (unless permitted under VCT Rules);

-- have at least 30 per cent. of all new funds raised by the Company invested in Qualifying Investments within 12 months of the end of the accounting period in which the Company issued the shares;

-- have no more than 15 per cent. by VCT tax value of its investments in a single company (as valued in accordance with the VCT Rules at the date of investment);

-- derive most of its income from shares and securities, and, must not retain more than 15 per cent. of its income derived from shares and securities in any accounting period; and

-- have their shares listed on the main market of the London Stock Exchange or a European regulated Stock Exchange.

VCTs must not:

-- make a Qualifying Investment in any company that:

-- has (as a result of the investment or otherwise) received more than GBP5 million from State aid investment sources in the 12 months prior to the investment (GBP10 million for Knowledge Intensive Companies);

-- has (as a result of the investment or otherwise) received more than GBP12 million from State aid investment sources in its lifetime (or GBP20 million for Knowledge Intensive Companies);

-- in general has been generating commercial revenues for more than 7 years (or 10 years for Knowledge Intensive Companies); or

-- will use the investment to fund an acquisition of another company (or its trade and assets).

-- make any investment which is not a Qualifying Investment unless permitted by section 274 ITA; and/or

-- return capital to shareholders before the third anniversary of the end of the accounting period during which the subscription for shares occurs.

Qualifying Investments

A Qualifying Investment consists of new shares or securities

issued directly to the VCT by a Qualifying Company that at the

point of investment:

-- has gross assets not exceeding GBP15 million prior to investment and GBP16 million post investment;

-- carries out activities which are regarded as a Qualifying Trade;

-- is a private company or is listed on AIM or the AQSE Growth Market;

-- has a permanent UK establishment;

-- is not controlled by another company;

-- will deploy the money raised for the purposes of the organic growth and development of a Qualifying Trade within 2 years;

-- has fewer than 250 employees (or fewer than 500 employees in the case of certain Knowledge Intensive Companies);

-- in general, has not been generating commercial sales for more than 7 years (ten years for Knowledge Intensive Companies);

-- has not received more than the permitted annual and lifetime limits of risk finance State aid investment; and

-- has not been set up for the purpose of accessing tax reliefs or is in substance a financing business.

The Finance Act 2018 introduced a principles-based approach

known as the risk to capital condition to establish whether the

activities or investments of an investee company can qualify for

VCT tax reliefs. This condition has two parts:

-- whether the investee company has an objective to grow and develop over the long term; and

-- whether there is a significant risk that there could be a loss of capital to the investor of an amount exceeding the net return.

Investment Manager's report

Introduction

This report covers the 2022/23 financial year, 1 October 2022 to

30 September 2023. The Investment Manager's report contains

references to movements in the NAV per share and NAV total return

per share. Movements in the NAV per share do not necessarily mirror

the earnings per share reported in the accounts and elsewhere,

which convey the profit after tax of the Company within the

reported period as a function of the weighted average number of

shares in issue for the period.

Investment performance measures contained in this report are

calculated on a pence per share basis and include realised and

unrealised gains and losses.

Investment report

Starting from a very low base, investor sentiment showed

tentative signs of recovery as investors became more confident that

inflation was close to peaking and, with it, the interest rate

tightening cycle that had done so much damage to risk assets in

2022. The failure in March 2023 of Silicon Valley Bank, several US

regional banks and Credit Suisse challenged the developing thesis

and the markets swiftly moved to price in a series of rate cuts by

the Federal Reserve throughout the second half of the year. A

series of subsequent data points highlighted a substantially more

robust US economy which would require US interest rates to remain

higher for longer. This dynamic had implications for risk assets

globally.

The UK economy has experienced something similar, proving to be

substantially stronger this year than most predicted. Inflation has

remained disappointingly high, forcing the Bank of England ("BoE")

into a more hawkish position with many homeowners protected by

fixed rate mortgages and now benefitting from higher interest

payments on their savings. UK inflation ("CPI") peaked at 11.1% in

October 2022 but has since steadily declined, reaching 6.7% in

September.

UK consumer confidence remains low, albeit substantially better

than at the start of the financial year. The September reading did,