Infrastructure India plc Transaction Update

15 Fevereiro 2024 - 12:50PM

RNS Regulatory News

RNS Number : 3376D

Infrastructure India plc

15 February 2024

15 February 2024

Infrastructure India

plc

("IIP" or

the "Company" and, together with its subsidiaries, the

"Group")

DLI Transaction

Update

Infrastructure India plc, an AIM

quoted infrastructure fund investing directly into assets in India,

announces that it will not be proceeding with the conditional sale

of the Group's interest in 99.99% of Distribution Logistics

Infrastructure Private Limited ("DLI") to Pristine Malwa Logistics

Park Private Limited ("Pristine Malwa"), announced on 6 September

2023.

Some key areas of the conditional

share purchase and shareholders' agreement were subject to final

agreement, which could not be reached in a manner satisfactory to

the IIP Board, in the best interests of IIP shareholders, and

potentially materially undervalued DLI in the Board's

view. Consequently, Distribution Logistics Infrastructure

Limited (Mauritius), IIP's wholly-owned subsidiary, has issued a

termination notice to Pristine Malwa. Neither Pristine Malwa nor

DLI had fulfilled all conditions precedent and the long stop date

has expired without a mutually agreed extension.

DLI is a supply chain transportation

and container infrastructure company headquartered in Bangalore and

Gurgaon with a material presence in central, northern and southern

India. DLI provides a broad range of logistics services including

rail freight, trucking, handling, customs clearing and bonded

warehousing with terminals located in the strategic locations of

Nagpur, Bangalore, Palwal in the National Capital Region and

Chennai. DLI is the largest asset in the Group's portfolio.

DLI was valued at £176.2 million in IIP's unaudited interim

results for the period ended 30 September 2022, representing 88% of

the Group's portfolio at that date.

The Company is actively exploring

alternatives and will provide an update to shareholders, as

appropriate, in due course.

The

information contained within this announcement is deemed by the

Company to constitute inside information as stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018 (as amended).

- Ends -

Enquiries:

|

Infrastructure India plc

Sonny Lulla

|

www.iiplc.com

Via Novella

|

|

|

|

|

Strand Hanson Limited

Nominated Adviser

Richard Johnson / James

Dance

|

+44 (0) 20 7409 3494

|

|

Singer Capital Markets

Broker

James Maxwell - Corporate

Finance

James Waterlow - Investment Fund

Sales

|

+44 (0) 20 7496 3000

|

|

Novella

Financial PR

Tim Robertson / Safia

Colebrook

|

+44 (0) 20 3151 7008

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

UPDGPUQCPUPCGAA

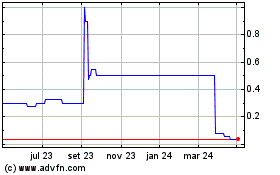

Infrastructure India (LSE:IIP)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

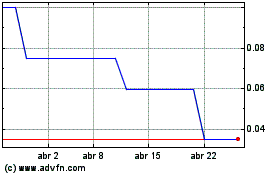

Infrastructure India (LSE:IIP)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025