IMC Exploration Group Plc Update: Proposed Acquisition of Karaberd Mine

31 Outubro 2022 - 4:02AM

UK Regulatory

TIDMIMC

THE DIRECTORS OF IMC EXPLORATION GROUP PLC CONSIDER THIS ANNOUNCEMENT TO

CONTAIN INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF REGULATION (EU) NO.

596/2014 OF THE EUROPEAN PARLIAMENT AND THE COUNCIL OF 16 APRIL 2014 ON MARKET

ABUSE AS IT FORMS PART OF RETAINED EU LAW AS DEFINED IN THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 (THE "MARKET ABUSE REGULATION"). UPON THE PUBLICATION OF

THIS ANNOUNCEMENT THE INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

IMC Exploration Group Public Limited Company

("IMC" or the "Company")

Proposed Acquisition of Karaberd Mine - Update

IMC Exploration Group plc ("IMC"), the London-listed exploration company based

in Ireland, is pleased to announce the following update in relation to the

previously announced (15th April 2021) Framework Agreement dealing with the

proposed acquisition from MVI Invests ("MVI") of MVI Ireland s.r.o. ("MVI

Ireland"), a special purpose company established to own 100% of Assat LLC

("Assat"), an Armenian-registered company that holds the mining licence for the

Karaberd Mine, located in Lori Marz, northern Armenia (the "Acquisition").

This transaction, as previously announced, is classified as a reverse takeover

("RTO") pursuant to the Listing Rules of the Financial Conduct Authority of the

United Kingdom ("FCA") (the "Listing Rules") to which the Company is subject,

and under the Irish Takeover Panel Act 1997, Takeover Rules 2013 (the "Takeover

Rules").

Following delays attributable primarily to the Covid-19 pandemic, MVI decided

early in 2021 to commence the preparation works for mining operations at the

Karaberd Mine. These works included preparation of 450m of new soil road,

cleaning and servicing of a further 1,300m of soil roads and 140,000m3 of

stripping work.

It had become apparent that, also as a result of disruptions caused by

Covid-19, the building of a production facility for extraction of metals

including gold and silver with 100,000 tons' per annum capacity, which MVI had

earlier negotiated, would be severely delayed. Assat therefore negotiated

interim arrangements with a local refiner to process ore from the Karaberd

Mine. During the year ended 31st December 2021, a total of 46.2 kg of 0.999

purity fine gold had been extracted at that plant from Karaberd Mine crushed

ore output.

At the beginning of 2022 Assat, satisfied that there were in place economically

mineable quantities of gold and silver at the Karaberd Mine, decided to start

stockpiling its crushed ore for processing in the new production facility

discussed above, which is expected to be completed by May or June of 2023.

This policy should yield a higher marginal return and will also allow for the

extraction of silver from mined ore. Currently, there are over 20,000 tons of

crushed ore stockpiled and the rate of ore-crushing will increase once the

production facility is completed.

Although the developments described above are positive from IMC's perspective,

they have meant that the character of the Acquisition has changed from that

originally conceived. IMC, rather than acquiring a company possessed of a

mining licence, is now acquiring the owner of an operating gold mine.

The restrictions on international movements imposed as a result of Covid-19

meant that IMC's first possibility to visit the Karaberd Mine site at Lori Marz

arose in August of last year.

The altered character of the Acquisition, the attenuation of timetables owing

to factors beyond the control of IMC and MVI and the recent emergence of new

geological data from additional exploration works, both on the Company's extant

licence areas in Ireland and on Assat's Karaberd licence in Armenia, led IMC

and MVI to agree on the necessity for more recent, audited financial

information and for the updating and positive revision of the Competent

Persons' Reports on their respective assets.

The FCA in December 2021 increased the market capitalisation threshold from £

700,000 to £30,000,000 for companies being listed on the standard segment of

the FCA's Official List. For this reason, IMC and MVI decided it would be

prudent to commission in advance an independent valuation of the enlarged

Company's combined assets post- RTO in order to assist in meeting this

threshold. This process is now underway.

For the avoidance of doubt, the Acquisition remains on the terms of the

Framework Agreement announced on 15th April 2021 with the exceptions of

extensions already announced to the long-stop dates and of the share 'clawback'

clause requiring a specified quantity of gold to have been refined after a

'Karaberd Commencement of Mining'. This clause, already having been satisfied,

has accordingly fallen away.

IMC would like to thank shareholders for their patience in supporting the

Company during the protracted progress of the Acquisition. Further updates

will be issued as and when required.

Eamon P. O'Brien,

Executive Chairman,

Dublin, 28th October 2022

The Directors of IMC, after due and careful enquiry, accept responsibility for

the content of this announcement.

REGULATORY ANNOUNCEMENT ENDS.

Enquiries:

Keith, Bayley, Rogers & Co. Limited

Graham Atthill-Beck: +44 7506 43 41 07 / Graham.Atthill-Beck@kbrl.co.uk;

blackpearladvisers@gmail.com

Brinsley Holman: +44 7776 30 22 28/ Brinsley.Holman@kbrl.co.uk

IMC Exploration Group plc

Kathryn Byrne: +353 85 233 6033

END

(END) Dow Jones Newswires

October 31, 2022 03:02 ET (07:02 GMT)

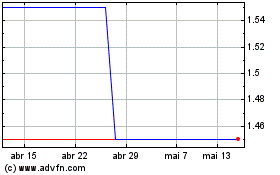

Imc Exploration (LSE:IMC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Imc Exploration (LSE:IMC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024