TIDMIPO

RNS Number : 9947H

IP Group PLC

02 August 2023

FOR RELEASE ON 2 August 2023

("IP Group" or "the Group" or "the Company")

Half-yearly results

Continued progress in key portfolio companies, strong balance

sheet maintained, portfolio well-funded

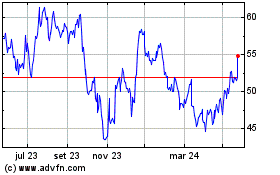

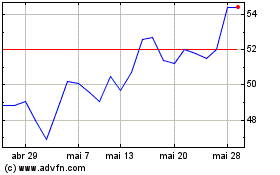

IP Group plc (LSE: IPO), which invests in breakthrough science

and innovation companies with the potential to create a better

future for all, today announces its financial results for the six

months ended 30 June 2023.

Half-year 2023 highlights

Portfolio well-funded, continued significant progress in key

themes & companies

-- Portfolio companies well-funded; total funds raised by

portfolio approximately GBP300m (HY22: c.GBP350m; FY22: GBP1.0bn)

including Quantum Motion (GBP42m), AccelerComm (GBP22m), OXCCU

(GBP18m), Garrison (GBP16m) and Mixergy (GBP9m)

-- Only 16% of our portfolio by value need to raise financing before the second half of 2024

-- Private portfolio company funding round valuations remained

robust with 86% of the 14 portfolio funding rounds completed in the

period taking place at or above previous funding round

valuations

-- Healthier future (Life Sciences): Istesso's Phase 2b trial

for its lead drug MBS2320 in rheumatoid arthritis continues to

recruit to plan and remains on target to read out in H1 2024.

Approval received to start additional Phase 2 trial in idiopathic

pulmonary fibrosis (IPF) in H2 2023. Group completed a GBP15m

investment and further GBP10m commitment to fully fund both trials.

Pulmocide - recruitment into Phase 3 efficacy study underway

-- Tech-enriched future (Deeptech): Featurespace, Garrison and

Ultraleap all posted double-digit revenue growth in H1, significant

fundraisings completed for Quantum Motion, AccelerComm &

Garrison

-- Regenerative future (Cleantech): Strong technical progress at

Hysata, key milestones achieved, triggering release of second

tranche of Series A funding, OXCCU completed GBP18m Series A

financing led by Clean Energy Ventures

Strong balance sheet maintained

-- Strong balance sheet and liquidity to support new and

follow-on investment in the portfolio with gross cash and deposits

at 30 June 2023 of GBP250.0m (HY22: GBP235.7m; FY22: GBP241.5m);

total potential liquidity including quoted shares of over

GBP450m

-- Cash proceeds in line with expectations at GBP32.2m, mainly

from the second tranche of consideration from the sale of

WaveOptics (HY22: GBP2.1m; FY22 GBP28.1m)

-- Investment into portfolio maintained: GBP59.8m into 23

companies across all three thematic areas (HY22: GBP52m; FY22:

GBP93.5m) including significant allocation to Istesso

(GBP15.0m)

-- Loss in the period of GBP54.5m (HY22: Loss of GBP309.8m;

FY22: Loss of GBP344.5m), partly driven by a reduction in the value

of Oxford Nanopore, which reduced by GBP27.8m, and negative

portfolio foreign exchange movements of GBP11.2m

-- Interim dividend of 0.51p per share (2022 interim dividend of

0.50pps; final dividend of 0.76pps)

Post period-end update

The fair value of the Group's holdings in listed companies

experienced a net fair value increase of GBP45m in the period since

30 June, including ONT increasing by GBP42m.

Summary financials

HY to 30 June 2022 FY 2022

HY to 30 June

2023 (unaudited) (unaudited) (audited)

----------------------- ---------------------- ---------------------- ----------------------

Net Asset Value (NAV) GBP1,313.6m; 126.7pps GBP1,414.0m; 136.7pps GBP1,376.1m; 132.9pps

----------------------- ---------------------- ---------------------- ----------------------

Loss (GBP54.5m) (GBP309.8m) (GBP344.5m)

----------------------- ---------------------- ---------------------- ----------------------

Loss/profit excluding

ONT (i) Loss of (GBP26.7m) Profit of GBP35.7m Profit of GBP25.2m

----------------------- ---------------------- ---------------------- ----------------------

Total portfolio (i) GBP1,276.1m GBP1,265.5m GBP1,258.5m

----------------------- ---------------------- ---------------------- ----------------------

Net portfolio loss

(i) (GBP44.4m) (GBP291.1m) (GBP309.1m)

----------------------- ---------------------- ---------------------- ----------------------

Gross cash and deposits

(i) GBP250.0m GBP235.7m GBP241.5m

----------------------- ---------------------- ---------------------- ----------------------

Cash proceeds(i) GBP32.2m GBP2.1m GBP28.1m

----------------------- ---------------------- ---------------------- ----------------------

Portfolio investment

(i) GBP59.8m GBP52.0m GBP93.5m

----------------------- ---------------------- ---------------------- ----------------------

Dividend 0.51 pps 0.50pps 1.26pps(ii)

----------------------- ---------------------- ---------------------- ----------------------

(i) Note 12 details the Alternative Performance Measures ("APM")

(ii) Amount shown for FY 2022 is total dividend including final

dividend approved and paid in 2023

Greg Smith, Chief Executive of IP Group, said: "IP Group is a

long-term investor in breakthrough science and innovation companies

that are addressing many of the world's unmet needs and, while the

current economic environment remains challenging, I am pleased with

portfolio progress in the period. The successful raising of more

than GBP300m of financing by our companies in the first half,

including GBP60m from the Group, is testament to their quality.

The Group has maintained its financial strength during the

period, the result of GBP32m cash realisations and having taken

pre-emptive action in light of the challenging investment

environment. This financial strength was highlighted as a strategic

asset as our portfolio navigated events such as the failure of

Silicon Valley Bank. We have also continued our approach of

dedicating a proportion of all cash realisations to supporting

capital returns for shareholders through an interim dividend.

The opportunity for value creation in our portfolio remains

compelling. Double-digit revenue growth in our largest deeptech and

healthcare companies is evidence of continued strong demand for

their products and services. Our therapeutics portfolio includes

twelve companies with products in clinical trials, seven of which

are targeting key inflection points in the next 18 months.

Breakthrough cleantech businesses, such as Hysata, have delivered

technical milestones and commercial demand. The Group is

well-positioned to support these businesses and deliver strong,

impactful returns for all stakeholders over time. "

Webinar

IP Group will host a webinar for analysts and investors today,

02 August, at 10:00am. For more details or to register as a

participant please visit

https://www.investormeetcompany.com/ip-group-plc/register-investor.

For more information, please contact:

IP Group plc www.ipgroupplc.com

Greg Smith, Chief Executive Officer +44 (0) 20 7444 0050

David Baynes, Chief Financial and Operating Officer

Liz Vaughan-Adams, Communications +44 (0) 20 7444 0062/+44 (0) 7967 312125

Portland

Tristan Peniston-Bird +44 (0) 7772 031 886

Alex Donaldson +44 (0) 7516 729702

Further information on IP Group is available on our website:

www.ipgroupplc.com

This half-yearly report may contain forward-looking statements.

These statements reflect the Board's current view, are subject to a

number of material risks and uncertainties and could change in the

future. Factors that could cause or contribute to such changes

include, but are not limited to, the general economic climate and

market conditions, as well as specific factors relating to the

financial or commercial prospects or performance of individual

portfolio companies within the Group's portfolio of investments.

Throughout this Half-Yearly Report, the Group's holdings in

portfolio companies reflect the undiluted beneficial equity

interest excluding debt, unless otherwise explicitly stated.

Interim Management Report

Summary

The Group, one of the largest investors in university and other

innovation-based companies in the world, has continued to make

excellent progress in its purpose of accelerating the impact of

science for a better future, building on our strong track record of

having helped create several billion-dollar companies (Oxford

Nanopore, Ceres Power, Hinge Health). We believe that an increased

focus of capital and resource on our thematic areas, where we have

experienced and specialist investment teams, will enable us to

replicate that success in supporting more businesses to values in

excess of $1bn.

Despite what continues to be a challenging macroeconomic

backdrop for early-stage and growth companies, our portfolio has

made good progress in the period, raising GBP300m of funding of

which IP Group contributed GBP59.8m (HY22: GBP52m; FY22: GBP93.5m)

. This compares with total capital raised of GBP350m in the same

period in 2022, a decline of 17% which compares favourably with

market data suggesting broader venture deal activity declined

significantly year on year. Notable transactions included a GBP42m

fundraise by Quantum Motion, the largest ever UK quantum funding, a

GBP22m Series B financing for wireless communications company

AccelerComm, a GBP18m Series A at e-fuel company OXCCU and

financings for Garrison (GBP16m) and Mixergy (GBP9m).

Our portfolio's continued success in raising capital in this and

earlier periods means it is well funded. Among the larger holdings

in our portfolio, a third are fully funded to planned

profitability, and 51% are funded until the second half of 2024 or

later, with only 16% of the portfolio needing to raise financing

before the second half of 2024.

In terms of other progress within the portfolio, we are pleased

to report that recruitment into Istesso's Phase 2b trial for its

lead drug MBS2320 in rheumatoid arthritis is on schedule and we

continue to expect the trial to readout in the first half of 2024.

We are also delighted that the company has received regulatory

approval to start a second Phase 2 trial in IPF, which is scheduled

to start recruiting during the second half of 2023. Our novel

electrolyser company Hysata continues to make excellent progress,

demonstrating larger stacks operating at exceptionally high 95%

efficiency levels.

The Group has taken proactive steps to maintain financial

strength through the prevailing challenging economic environment

and geopolitical uncertainty by securing a private market debt

issue last year to provide additional funding flexibility and

reducing our planned investment level. In the current period, the

Group also benefited from GBP32.2m of cash proceeds, predominantly

from the second tranche of cash consideration from the sale of

WaveOptics. This allowed the Group to finish the first half of the

year with gross cash and deposits of GBP250.0m.

We see our financial strength as particularly important given

the difficult economic backdrop. This was highlighted during the

short period of heightened volatility around the failure of Silicon

Valley Bank, where a small number of our portfolio companies were

directly impacted and we were rapidly able to offer additional

liquidity in support. Fortunately, this support was not ultimately

required however it serves as a reminder of the importance of

capital availability to protect value and, more broadly in the

current environment, potentially access opportunities for future

value creation at attractive prices.

We also remain committed to narrowing the discount to our NAV

per share and maintained our approach of employing a proportion of

cash realisations to support capital returns, which, for this

period, will be in the form of an interim dividend. We have also

increased our investor relations activities by introducing

additional investor-focussed events as well as our flagship 'Scale

it up' event at London's Science Museum in May where we hosted a

debate on how the UK can help support more UK innovation to become

world-leading companies, showcasing a number of our portfolio

companies. We have also increased the number of roadshows the Group

undertakes, meeting with holders and non-holders in the UK and

Europe in the first half of the year with meetings planned in the

US, Middle East and Europe in the second half. To help raise the

Group's profile, we also refreshed our brand identity in the first

half of the year. This brand refresh, aimed at highlighting our

expertise and clearly aligning around our impactful purpose, has

been received positively by stakeholders.

Financial results: macroeconomic headwinds, strong cash

balance

As at 30 June 2023, IP Group had gross cash and deposits of

GBP250.0m (HY22: GBP235.7m; FY22: GBP241.5m), having invested

GBP59.8m in the period including notable investments into portfolio

companies Istesso Ltd (GBP15m), our North American platform

(GBP6.6m) and Hysata Pty Ltd (GBP4.7m) as well as a number of

smaller size investments into current and new opportunities across

all three of our thematic areas. Cash proceeds increased in line

with expectations at GBP32.2m, mainly from the second tranche of

consideration from the sale of WaveOptics (HY22: GBP2.1m; FY22

GBP28.1m).

As at 30 June 2023, the Group's Net Asset Value was GBP1,313.6,

or 126.7 pence per share (HY22: GBP1,414.0m, or 136.7pps; FY22:

GBP1,376.1m, or 132.9pps), a decline of 5.4pps (excluding the

impact of the 0.76pps final dividend paid in June 2023) resulting

from the loss of GBP54.5m (HY22: Loss of GBP309.8m; FY22: Loss of

GBP344.5m) in the period.

The Group's portfolio recorded a net fair value reduction of

GBP44.4m in the period, consisting of a GBP29.4m reduction in the

value of the quoted portfolio, GBP11.2m of portfolio foreign

exchange losses and an GBP8.3m reduction in the value of investment

in Limited Partnerships, offset by a GBP4.5m gain in the value of

private portfolio companies. The reduction in the quoted portfolio

was driven by Oxford Nanopore, which fell in value by GBP27.8m in

the period but which has recovered significantly since the period

end. Net overheads totalled GBP10.3m in the period (HY22: GBP10.9m;

FY22: GBP20.1m).

Overview of business performance including thematic focus &

holdings

The performance of the Group's business units is summarised

below with further detail on the performance of each in the

Portfolio Review.

Net portfolio Fair value Simple return on

All GBPm unless stated Invested Cash proceeds gain/(loss) at 30 June 2023 capital (%)

---------------------- ------------- ------------- --------------------- ---------------- ---------------------

Healthier future:

Oxford Nanopore - - (27.8) 177.7 (14%)

Healthier future: Life

Sciences 22.8 0.1 (7.9) 411.9 (2%)

Tech-enriched future:

Deeptech 10.6 31.0 (3.2) 206.4 (2%)

Regenerative future:

Kiko Ventures

(Cleantech) 12.8 - 6.1 262.4 3%

North America 6.6 - (12.6) 81.1 (14%)

Australia and New

Zealand 6.2 - 4.1 52.9 10%

Platform investments 0.4 0.7 0.7 44.0 2%

Organic and De minimis - 0.4 (2.5) 15.4 (14%)

---------------------- ------------- ------------- --------------------- ---------------- ---------------------

Subtotal 59.4 32.2 (43.1) 1,251.8 (3%)

---------------------- ------------- ------------- --------------------- ---------------- -----------------------

Attributable to third

parties 0.4 - (1.3) 24.3 (5%)

---------------------- ------------- ------------- --------------------- ---------------- ---------------------

Total Portfolio 59.8 32.2 (44.4) 1,276.1 (4%)

---------------------- ------------- ------------- --------------------- ---------------- ---------------------

Third-party fund management

The Group continues to view the management of third-party funds

as an important element of our business model, and we manage or

advise GBP690m in third-party capital across our Parkwalk,

Australian and UK business units.

Shareholder returns, interim dividend

Delivering returns for shareholders is the Group's financial

purpose and narrowing the discount to our NAV per share remains a

focus. The Board remains focussed on shareholder value creation and

has declared an interim dividend of 0.51 pence per share (HY22:

0.50pps). A final 2022 dividend of 0.76 pence per share was paid in

the period, bringing total dividend payments in respect of 2022 to

1.26 pence per share.

The Group aims to deliver returns to shareholders primarily in

the form of long-term capital appreciation. Subject to the Group's

capital allocation policy, the majority of cash proceeds will be

typically reinvested with a smaller proportion used to deliver a

cash return to shareholders. Since the introduction of this

approach in 2021, the Group has now delivered more than GBP70m of

cash returns to our shareholders.

Board changes

We were delighted to welcome Anita Kidgell to the Board with

effect from 18 January 2023. Anita brings a wealth of experience

gained at GSK plc, one of the leading global biopharma companies.

From her position as Head of Corporate Strategy at GSK, Anita

brings to the Board a rare combination of a scientific background

together with strategic, investor relations and communication

experience. Following her appointment, the Board comprises two

executive directors, five NEDs and the Chairman: equal

representation of both male and female.

Outlook

While the current macro environment remains challenging, IP

Group continues to be well financed and we are confident that our

portfolio will deliver strong returns with a number of key

milestones anticipated over the next 12-18 months. In Life

Sciences, seven companies are targeting key clinical milestones,

including Istesso, Akamis, Pulmocide and Crescendo. In Deeptech, a

number of companies, including Featurespace, Teya and Garrison are

targeting continued double-digit revenue growth, while in

Cleantech, through Kiko Ventures, the focus remains on driving

value from core holdings including First Light Fusion, Oxa and

Hysata, and investing for the future . We continue to believe that

IP Group is well placed to deliver value for shareholders through

capital appreciation supported by cash returns and is

well-positioned for a return of investor appetite towards growth

companies.

PORTFOLIO REVIEW

Overview

As of 30 June 2023, the value of the Group's portfolio was

GBP1,276.1m (HY22: GBP1,265.5m; FY22: GBP1,258.5m) reflecting a net

portfolio loss of GBP44.4m (HY22: loss GBP291.1m; FY22: loss

GBP309.1m). Cash invested during the period totalled GBP59.8m

(HY22: GBP52.0m; FY22: GBP93.5m) and cash proceeds totalled

GBP32.2m (HY22: GBP2.1m; FY22: GBP28.1m).

The portfolio consists of interests in 93 companies (excluding

de minimis and organic holdings), of which the top 20 by value

comprise 70% of the portfolio value (HY22: 103, 70%; FY22: 95,

76%).

Fair value movements

A summary of the unrealised and realised fair value gains and

losses is as follows:

Six months Year ended

Six months ended 31 December

ended 30 June 2022 2022

30 June 2023 GBPm GBPm GBPm

------------------------------------ ------------------ ------------- ------------

Quoted equity investments (29.4) (397.5) (428.5)

Private equity & debt investments 4.5 82.2 101.4

Investments in Limited Partnerships (8.3) 8.8 (6.4)

Foreign exchange movements (11.2) 15.4 24.4

------------------------------------ ------------------ ------------- ------------

Net portfolio losses (44.4) (291.1) (309.1)

------------------------------------ ------------------ ------------- ------------

A summary of the largest unrealised and realised fair value

gains and losses by portfolio investment (excluding fx movements)

is as follows:

Gains GBPm Losses GBPm

------------------------- ---- ---------------------------- ------

Oxford Nanopore Technologies

Hysata Pty Ltd 9.2 plc (27.8)

Centessa Pharmaceuticals North American Platform

plc 6.2 (Longview Innovation) (9.1)

Athenex, Inc. (realised

Istesso Limited 3.1 loss) (6.5)

AMSL Innovations Pty

Ltd 2.6 Oxehealth Limited (5.2)

OXCCU Tech Limited 2.0 Teya Holdings Ltd (2.7)

Other quoted 1.0 Other quoted (2.3)

Other private 6.6 Other private (10.3)

------------------------- ---- ---------------------------- ------

Total 30.7 Total (63.9)

------------------------- ---- ---------------------------- ------

Investments and cash proceeds

The Group deployed a total of GBP59.8m across 23 new and

existing investments during the period (HY22: GBP52.0m, 22, FY22:

GBP93.5m, 46), versus cash proceeds of GBP32.2m (HY22: GBP2.1m,

FY22: GBP28.1m).

Largest investments and cash proceeds by portfolio company :

Investments GBPm Cash proceeds GBPm

---------------------------- ---- ------------------------ ----

Istesso Limited 15.0 Wave Optics Limited(1) 30.8

North American Platform

(Longview Innovation) 6.6 UCL Technology Fund L.P. 0.7

Hysata Pty Ltd 4.7 Lixea Limited 0.3

Tado GmbH 4.4 Athenex, Inc 0.1

Garrison Technology Limited 3.9 Perpetuum Limited 0.1

Other 25.2 Other 0.2

---------------------------- ---- ------------------------ ----

Total 59.8 Total 32.2

---------------------------- ---- ------------------------ ----

1 Deferred consideration in relation to exit in 2021.

Deferred consideration estimated at GBP12.5m was outstanding at

30 June 2023 (HY22: GBP44.3m, FY22: GBP48.2m), relating to the

Group's realisation of Enterprise Therapeutics (GBP11.4m, exited in

2020) and Reinfer (GBP1.1m, exited in 2022).

Number of Investments

United Kingdom North America Australia & New Zealand Total

--------------------------- -------------- ------------- ----------------------- -----

1 January 2023 81 1 13 95

Additions 1 - 1 2

Exited (1) - - (1)

Being closed/liquidated - - (1) (1)

Reclassified to de minimis (2) - - (2)

--------------------------- -------------- ------------- ----------------------- -----

30 June 2023 79 1 13 93

--------------------------- -------------- ------------- ----------------------- -----

Co-investment analysis

Including the GBP59.8m of primary capital invested by the Group

(the Group invested GBPnil via secondary purchases (HY22: GBP0.3m,

FY22: GBP3.7m), the Group's portfolio raised approximately GBP300m

during the half year to 30 June 2023 (HY22: approx. GBP350m, FY22:

approx. GBP1.0bn). Co-investment from parties or funds with a

greater than 1% shareholding in IP Group plc was GBPnil (HY22:

GBP9.5m, FY22: GBP24.9m). An analysis of this co-investment by

source is as follows:

Six months ended Six months ended

30 June 2023 30 June 2022

Portfolio capital raised GBPm % GBPm %

IP Group(1) 59.8 20% 51.6 14%

IP Group managed funds(2) 9.9 3% 19.6 5%

IP Group plc shareholders (>1% holdings) - 0% 9.5 3%

Institutional investors 69.9 24% 90.3 25%

Corporate, other EIS, individuals, universities and other 158.7 53% 186.8 53%

Total 298.3 100% 357.8 100%

--------- --------- -------

(1) Reflects primary investment only; during the six months to

30 June 2023 the Group invested GBPnil via secondary purchase of

shares (HY22: GBP0.3m, FY22: GBP3.7m).

(2) Includes Parkwalk Advisors and other funds managed by IP Group.

Portfolio funding position

The following table lists information on the expected cash-out

dates for portfolio companies with an IP Group investment holding

value greater than GBP4m

Fair value of

Group holding %

at 30 June 2023

Company name GBPm

----------------------------------------------- ---------------- ----

Trade to profitability 354.2 33%

2023 59.5 6%

2024 H1 109.4 10%

2024 H2 292.3 27%

2025 240.2 22%

2026 18.1 2%

----------------------------------------------- ---------------- ----

Total companies > GBP4m value 1,073.7 100%

----------------------------------------------- ---------------- ----

Companies < GBP4m value 83.7

----------------------------------------------- ---------------- ----

Interest in Limited Partnerships and Platforms 118.7

----------------------------------------------- ---------------- ----

Total portfolio 1,276.1

----------------------------------------------- ---------------- ----

Portfolio analysis by sector

The Group splits its core opportunity evaluation, investment and

business-building team into specialist divisions, Life Sciences,

Deeptech and Cleantech within the UK, with geographically focused

investment teams based in the United States and Australia. A small

number of investments are categorised as platform investments,

which are portfolio companies which also invest in other

opportunities.

As at 30 June 2023 As at 31 December 2022

------------------------ ----------------------------

Fair value Number Fair value Number

-------------- ----------------- ---------

Sector GBPm % % GBPm % %

--------------------------- -------- ---- ---- ---------- ----- -----

Healthier future:

Oxford Nanopore 177.7 14% 1 1% 205.5 17% 1 1%

Healthier future:

Life Sciences 411.9 33% 31 34% 390.8 32% 33 35%

Tech-enriched future:

Deeptech 206.4 17% 29 31% 201.0 17% 28 29%

Regenerative future:

Kiko Ventures (Cleantech) 262.4 21% 14 15% 243.8 20% 15 16%

North America 81.1 7% 1 1% 87.1 7% 1 1%

Australia and New

Zealand 52.9 4% 13 14% 42.8 3% 13 14%

Platform investments 44.0 4% 4 4% 43.6 4% 4 4%

--------------------------- -------- ---- ---- ---------- ----- -----

Subtotal 1,236.4 100% 93 100% 1,214.6 100% 95 100%

De minimis and

organic holdings 15.4 17.0

--------------------------- -------- ---- ---- ---------- ----- -----

Subtotal 1,251.8 1,231.6

--------------------------- -------- ---- ---- ---------- ----- -----

Attributable to

third parties(1) 24.3 26.9

--------------------------- -------- ---- ---- ---------- ----- -----

Total portfolio 1,276.1 1,258.5

--------------------------- -------- ---- ---- ---------- ----- -----

1 Amounts attributable to third parties consist of GBP12.8m

attributable to minority interests represented by third-party

limited partners in the consolidated fund, IP Venture Fund II

(HY22: GBP14.9m, FY22: GBP13.9m), GBP10.7m attributable to Imperial

College London (HY22: GBP12.6m, FY22: GBP12.2m) and GBP0.8m

attributable to other third parties (HY22: GBP1.5m, FY22:

GBP0.8m).

Portfolio Review: Healthier future: Oxford Nanopore

Following the disappointing share price performance at the end

of 2022, Oxford Nanopore's share price continued to underperform in

the first half, trading as low as 176p in March 2023. This was due

to the poor performance of Life Sciences Research Tools ("LSRT")

companies and some specific disappointment around the company's

reduced 2023 revenue guidance. That said, Oxford Nanopore's growth

remains amongst the strongest in the LSRT space and this was

reflected in the post-results share price rally. The company's

recent trading update for the first half of 2023 underlined this,

with expected 22% revenue growth falling in the middle of its FY

2023 guidance range (16-30% growth). The company continues to

target adjusted EBITDA breakeven by the end of 2026.

In addition to delivering double-digit revenue growth, Oxford

Nanopore made a number of updates to its core technology platform

and launched a number of new products. It also announced a number

of significant collaborations in various applied and clinical

markets, which potentially offer upside from a growth perspective.

We remain bullish on the company's long-term prospects, and it

therefore remains a core, strategic holding.

Fair value

of Group

Net holding

Group Unrealised

Stake at + realised

30 June investment/ fair value at 30

2023 (divestment) movement June 2023

Company name Description % GBPm GBPm GBPm

-------------------------------- ------------------------------- --------- -------------- ----------- -----------

Enabling the analysis of any

living thing, by any person,

Oxford Nanopore Technologies plc in any environment 10.1% - (27.7) 177.7

-------------------------------- ------------------------------- --------- -------------- ----------- -----------

Portfolio Review: Healthier future: Life sciences

IP Group's Life Sciences portfolio comprises holdings in 31

companies valued at GBP411.9m at 30 June 2023.

Fair value

of Group

Net holding

Group Stake at 30 June 2023 (1) investment/ (divestment) Unrealised + realised fair value movement at 30 June 2023

Company name Description % GBPm GBPm GBPm

---------------- ------------------- --------------------------------- -------------------------- ------------------------------------------ ------------------

From disease

modification to

disease

Istesso Limited resolution 56.5% 15.0 3.1 113.8

The world's first

digital clinic

Hinge Health, for back and

Inc. joint pain 1.8% - (2.2) 51.4

Digital

Ieso Digital therapeutics for

Health Limited psychiatry 32.1% - - 21.8

Gene and viral

Akamis Bio therapies for

Limited(2) cancer 24.5% - - 21.2

Targeting

deubiquitylating

enzymes for the

Mission treatment of CNS

Therapeutics and mitochondrial

Limited disorders 18.4% 2.0 - 20.2

Treatments and

delivery

technology for

sight-threatening

Oxular Limited diseases 25.4% 2.9 - 18.8

Biologic

therapeutics

eliciting the

Crescendo immune system

Biologics against solid

Limited tumours 14.5% - - 18.7

Artios Pharma Novel oncology

Limited therapies 7.1% - (0.2) 18.1

Gut-microbiome

based

Microbiotica therapeutics and

Limited diagnostics 17.7% - - 16.1

Novel inhaled

treatment for

life-threatening

Pulmocide fungal lung

Limited infections 12.2% - (0.4) 14.3

Other companies (21 companies) - 1.7 (8.2) 97.5

------------------------------------- --------------------------------- -------------------------- ------------------------------------------ ------------------

Total - 21.6 (7.9) 411.9

------------------------------------- --------------------------------- -------------------------- ------------------------------------------ ------------------

1 Represents the Group's undiluted beneficial economic equity

interest (excluding debt), including only the Group's portion of

IPVF II. Voting interest is below 50%.

2 Previously called PsiOxus Therapeutics Limited.

The largest transaction in the first half of 2023 was a GBP15.0m

investment into Istesso, primarily by way of a convertible note. We

continue to see good progress at Istesso with its Phase 2b study of

MBS2320 in rheumatoid arthritis ("RA") running according to plan

and the start of a Phase 2 study in idiopathic pulmonary fibrosis

due in the second half of the year.

In terms of performance, the value of the portfolio declined by

2% in the first half, driven by a realised loss at NASDAQ-listed

Athenex (GBP(6.6)m including de-recognition of deferred

consideration), which eventually went into administration during

the period, and a GBP(5)m write-down in the holding value of

Oxehealth Ltd following a financing round at a depressed price

despite good progress at the business. On the positives, we saw

some appreciation in the Centessa share price, providing for a

GBP5.8m uplift.

We continue to see good fundamental progress across the

portfolio with each of Artios, Kynos and Oxular announcing the

initiation of important clinical studies for their lead assets.

Moreover, Mission Therapeutics and Akamis announced positive safety

data from Phase 1 studies, with some evidence of effect for Akamis'

novel gene therapy agent.

Hinge Health continues to significantly grow revenues and expand

its customer base. As for the full-year 2022 valuation process, we

engaged a third-party valuation specialist to assess the company's

current value, which resulted in no change in the value of our

holding with the fair value movement in the period relating only to

FX.

Our companies continue to make good clinical, regulatory and

commercial progress, some of which cannot be disclosed for

competitive reasons, and we believe that 2023 will lay the

foundations for significant NAV and liquidity outperformance during

the coming few years.

Portfolio Review: Tech-enriched future: Deeptech

IP Group's Technology portfolio comprises holdings in 29

companies valued at GBP206.4m at 30 June 2023.

Deeptech Portfolio

The IP Group Deeptech portfolio covers a breadth of areas aimed

at delivering value through growing innovative companies that

enable and secure the digital economy, create new human capability

and generate prosperity for all in four key focus areas: Applied

Artificial Intelligence, Next Generation Networks, Human-Machine

Interfaces and Future Computing.

Fair value

of Group

Net holding

Group Unrealised

Stake at + realised

30 June investment/ fair value at 30

2023 (1) (divestment) movement June 2023

Company name Description % GBPm GBPm GBPm

--------------------- ----------------------- --------- -------------- ----------- -----------

Leading predictive

Featurespace Limited analytics company 20.4% - - 64.1

Anti-malware solutions

Garrison Technology for enterprise cyber

Limited defences 23.6% 3.9 - 31.6

Contactless haptic

technology

Ultraleap Holdings "feeling without

Limited touching" 17.0% - - 31.0

Other companies (26

companies) - 6.7 (3.2) 79.7

---------------------------------------------- --------- -------------- ----------- -----------

Total - 10.6 (3.2) 206.4

---------------------------------------------- --------- -------------- ----------- -----------

(1) Represents the Group's undiluted beneficial economic equity

interest (excluding debt), including only the Group's portion of

IPVF II. Voting interest is below 50%.

The first half of 2023 has been a busy period with several key

transactions completing.

The top three assets by value in the Deeptech portfolio -

Featurespace, Ultraleap, and Garrison - which account for more than

60% of the Deeptech portfolio value, all progressed well in the

first half of the year. Featurespace continues to deliver

attractive revenue growth on the back of its strong customer value

proposition, exemplified by the recent revelation that the high

street bank Natwest has improved its scam detection rate by 135%

using Featurespace's technology. Ultraleap launched the next

generation of its hand tracking camera product, the Leap Motion 2,

which elicited an enthusiastic response from customers at the

Augmented World Expo in June. Ultraleap has seen a notable increase

in interest as the eXtended Reality (XR) market 'heats up' and we

envisage good commercial progress for the asset this year.

Garrison Technologies, which eliminates cyber threats whilst

delivering full web access without putting an organisation's

sensitive data and systems at risk, hit its revenue targets to the

year ended March 2023 and raised GBP15.5m of new investment from

Legal and General and British Patient Capital, alongside existing

investors including IP Group. The company has grown rapidly over

the last 4 years, compounding revenues at 64% YoY over this period,

with continued attractive growth expected this year.

We were delighted to see University of Oxford spin-out Quantum

Motion Technologies close a GBP42m funding round, the largest ever

single investment into a quantum computing startup in the UK. The

investment, which the company will use to develop its silicon-based

approach to building a cost-effective and scalable quantum

computer, was provided by Robert Bosch Venture Capital alongside

Porsche SE and British Patient Capital. All of the company's

existing investors (Inkef, IP Group, NSSIF, Octopus Ventures,

Oxford Sciences Enterprises and Parkwalk Advisors) also

participated.

In a similar vein, we were equally pleased to see the completion

of a GBP21.5m series B investment round at our portfolio company

AccelerComm, which is supercharging the world's wireless

infrastructure. The round was led by Swisscom Ventures and Parkwalk

Advisors alongside Hostplus with follow-on funding providing by all

the existing investors. AccelerComm's technology, which can halve

the cost of spectrum and power in 5G networks by increasing

throughput and reducing latency, is already being used by several

of the world's largest corporates, and the company continues to

grow through evolving partnerships with the likes of Intel, AMD and

Xilinx.

The Deeptech team has backed one brand new opportunity so far

this year, a GBP3m investment into DeepRender which is developing

the next generation of image and video compression technology using

an AI-first approach. This investment was made alongside existing

investor Pentech, our fourth deal with this fund. Previous

investments include Acunu and Semetric, both sold to Apple, and

existing portfolio company Monolith.ai. DeepRender already has

commercial engagement with several of the world's top technology

companies and we have high hopes for rapid progress in that

asset.

On the less positive side, we have taken an impairment in the

value of our holding in Navenio after slower than hoped for

commercial progress, and our holding in Mirriad has continued to

lose value as its share price declined, albeit the company raised

GBP6.3 million through a placing and open offer during the

period.

Portfolio Review: Regenerative future: Kiko Ventures

(Cleantech)

Fair value

of Group

Net holding

Group Unrealised

Stake at + realised

30 June investment/ fair value at 30

2023 (1) (divestment) movement June 2023

Company name Description % GBPm GBPm GBPm

----------------------- ------------------------- --------- -------------- ----------- -----------

Solving fusion with

First Light Fusion the simplest possible

Limited machine 27.5% - - 114.5

Software to enable

Oxa Autonomy Ltd every vehicle to become

(2) autonomous 12.1% - (0.2) 65.7

The fuel cell company

Bramble Energy Limited with Gigafactories 31.5% - - 20.7

Silicon anodes for

next generation

Nexeon Limited lithium-ion batteries 5.5% - - 16.3

Other companies (10

companies) - 12.9 6.3 45.2

-------------------------------------------------- --------- -------------- ----------- -----------

Total - 12.9 6.1 262.4

-------------------------------------------------- --------- -------------- ----------- -----------

(1) Represents the Group's undiluted beneficial economic equity

interest (excluding debt), including only the Group's portion of

IPVF II. Voting interest is below 50%.

(2) Previously called Oxbotica Limited.

The Kiko Ventures portfolio comprises holdings in 14 companies

valued at GBP262.4m as at 30 June 2023.

In the first half of 2023, there have been signs that the wider

venture market slowdown has started to impact Cleantech. While

First Light Fusion has seen good interest in its post-fusion Series

C round (launched last year with UBS) the fund raise has not yet

completed, impacted by this softening of the funding environment.

We still believe, however, that it will be possible to complete the

round this year and have therefore not altered the valuation of our

holding in the company. As part of our normal valuation process, we

will review this position at year end. First Light continues to

progress plans for its gain scale device, Machine 4, and in June

2023 entered into an agreement with the UKAEA Centre for Fusion

Energy at Culham to construct Machine 4 on the Culham campus, with

UKAEA jointly developing a new building to house the facility.

Electrolyser company Hysata, which is backed jointly by Kiko and

IP Group Australia, made good technical progress this year,

achieving its Series A technical milestone several months ahead of

schedule, which triggered the second tranche of last year's Series

A investment, bringing the total invested by Kiko into the company

to GBP6.2m. The technical progress was impressive, with Hysata

demonstrating stacks operating at the same exceptionally high 95%

efficiency as the single cell experiment reported in Nature in

2021. It is normally difficult to repeat 'hero' single cell data in

larger systems, making this a significant achievement. Hysata has

now launched a Series B funding round, which could complete this

year. Given the technical progress and input from Hysata's advisors

on funding valuation we have taken a c50% uplift in our holding

value for the asset.

Despite the weaker funding environment, there were good funding

rounds in two earlier stage businesses, both Oxford University

spin-outs. In January, smart home heating company Mixergy completed

a GBP9m Series B raise, led by OSE, with new investors Nesta and

EDP Ventures, joining the share register. Mixergy has continued to

make good progress and has doubled revenue for the past two years.

The new funding will help the company with international expansion

(supported by EDP, one of the biggest energy suppliers in Southern

Europe) and to develop heat pump products. In May, OXCCU, which has

breakthrough technology for the catalytic synthesis of sustainable

aviation fuels (SAFs), raised an oversubscribed GBP18m Series A.

The round was led by well-established US cleantech VC Clean Energy

Ventures and was their first investment in a UK company. Attracting

a wider diversity of high quality cleantech co-investment was one

of the brand objectives for Kiko, and this deal, the first time we

have had a US venture fund lead a deal in the cleantech portfolio,

provides validation of that benefit. OXCCU was founded by academics

behind Oxford Catalysts Group, IP Group's first cleantech

investment in 2004. That company successfully floated on AIM, and

it has been great to work again with an experienced and successful

founding team. The company's CEO and chair also come from the IP

Group stable, with Andrew Symes leaving the Kiko investment team to

become CEO and Alan Aubrey joining as chair. OXCCU thus has a very

high-quality team, and its breakthrough new technology, published

in Nature, has the potential to halve the cost of so called

'e-fuels' produced from power and CO(2) .

We have also continued marketing development of the Kiko brand,

building the reputation as the leading cleantech venture investor

in the UK. A highlight for the year was the role we played in

establishing Cleantech for UK, in partnership with Bill Gates'

Breakthrough Energy and the Cleantech Group. Cleantech for UK is a

policy body with the aim of advocating for support for climate

technology development and deployment. We were invited by Cleantech

Group to help establish the founding membership, using our network

to bring in other leading cleantech accelerators and investors, and

achieved a group with combined funds of over GBP6 billion.

Cleantech for UK was launched on 15th February at a ceremony

attended by Bill Gates and Prime Minister Rishi Sunak. The body

published its first report in June: "Building the Next Generation

of Cleantech Champions" a landscape overview which highlighted both

the opportunities and current challenges for the sector in the UK.

We continue to be closely involved, alongside other thought

leadership work with the Energy Transitions Commission and regular

interviews in the media.

Portfolio Review: North America (Longview Innovation)

The Group's activities in North America are carried out through

a 58% strategic holding in a dedicated evergreen fund, Longview

Innovation (previously IP Group, Inc. prior to its rebranding in

March 2023). In the first half of 2023, the Longview Innovation

portfolio continued to make progress, achieving operational and

financial milestones despite economic headwinds.

Carisma Therapeutics, a company focused on developing novel

cancer immunotherapies, completed the merger with Sesen Bio and

commenced trading on the NASDAQ market under the symbol CARM. Exyn

Technologies closed its Series B round adding two additional

strategic investors across the mining and inspection market

verticals. Optimeos Life Sciences successfully raised a seed round

led by JRS Life Sciences and 7G Bioventures. The funds will be used

to further drive validating engagements, expand the platform and

build out the team. Taktos Therapeutics closed an external Seed

financing with a new investor Washington Research Foundation.

Advanced diagnostics company MOBILion announced partnerships with

Rilas Technologies and Switzerland-based TOFWERK AG to expand the

capabilities and reach of its MOBIE analytics platform.

As it looks to the remainder of 2023, Longview Innovation is

seeking further funding for its platform from institutional

investors and continues to identify transformative technologies at

their partners.

Fair value

of Group

holding

at 30 June 2023(1)

Company name Description GBPm

------------------------------- ---------------------------------------------------------------- -------------------

A platform technology for conducting ion mobility separations

with lossless ion transfer and

MOBILion Systems, Inc. manipulation 19.5

Uniformity Labs, Inc. Equipment, materials, and software for additive manufacturing 13.7

Exyn Technologies, Inc. Unmanned aerial systems 12.8

Carisma Therapeutics, Inc. Cancer immunotherapy treatments 10.9

Other companies (26 companies) 24.2

------------------------------------------------------------------------------------------------- -------------------

Total 81.1

------------------------------------------------------------------------------------------------- -------------------

Portfolio Review: Australia and New Zealand

Our portfolio in Australia and New Zealand continues to scale

and make significant progress. The portfolio now stands at 15

companies valued at GBP52.9m. In the first half, the portfolio

delivered a net fair value uplift of GBP4.1m which included

follow-on funding at Hysata and AMSL Aero. The pipeline of

opportunities from our university partners at the Group of Eight

and Auckland universities continues to be strong, positioning the

platform well for growth and returns over the coming 3-5 years.

Joint Australian/Kiko investment Hysata continues to be a

highlight in the portfolio. As described in further detail in the

Kiko section, the company is making strong progress on its mission

to deliver the world's most efficient, simple and reliable

electrolyser.

Canopus Networks announced an investment from Konvoy Ventures in

March, as it continues to grow commercial traction for its

terabit-scale encryption-proof customer insights platform.

In our life sciences portfolio, RAGE Biotech is making strong

progress with the development of its lead RNA therapeutic for the

treatment of chronic respiratory disease. Alimetry announced the

appointment of Erik Engelson as Chair, and was named in the top 16

of New Zealand's Callaghan 100 report. We welcomed Resseptor

Therapeutics to the portfolio, a new company developing new

technologies aimed at revolutionising the treatment of autoimmune

diseases and cancer.

Portfolio review: Platform Investments

IP Group's Platform Investments portfolio comprises holdings in

two companies and two interests in Limited Partnerships, valued at

GBP44.0m at 30 June 2023.

The Platform Investments portfolio contains holdings in

multi-sector platform companies that operate in a similar way to IP

Group, but focus on a specific university, such as OSE and CIC, and

the UCL Technology Fund ("UCL") all three of which IP Group is a

founding investor of. As at 30 June 2023, IP Group has a 1.8%

holding in OSE valued at GBP20.6m and a 1.0% holding in CIC valued

at GBP3.4m (HY22: 2.3%, GBP20.6m, 1.0%, GBP4.0m, FY22: 1.8%,

GBP20.6m, 1.0%, GBP3.5m), and a 46.4% stake in the UCL fund, valued

at GBP17.1m (HY22: 46.7%, GBP17.7m, FY22: 46.7%, GBP16.9m).

Fair value

of Group

Net holding

Group Unrealised

Stake at + realised

30 June investment/ fair value at 30

2023(1) (divestment) movement June 2023

Company name Description % GBPm GBPm GBPm

--------------------------- ------------------------- --------- -------------- ----------- -----------

University of Oxford

preferred IP partner

Oxford Science under 15-year framework

Enterprises plc agreement 1.8 - - 20.6

Commercialising

Interest in UCL Technology world class research

Fund L.P. from UCL 46.4 (0.3) 0.5 17.1

Other companies (2

companies/LPs) - - 0.2 6.3

------------------------------------------------------ --------- -------------- ----------- -----------

Total - (0.3) 0.7 44.0

------------------------------------------------------ --------- -------------- ----------- -----------

(1) Represents the Group's undiluted beneficial economic equity

interest (excluding debt), including only the Group's portion of

IPVF II. Voting interest is below 50%.

Third-party fund management

We are aiming to continue growing the level of funds under

management in the coming years. As of 1 January 2023, we appointed

Joyce Xie as Managing Director, Global Capital, to lead the Group's

strategic capital initiatives with global capital partners and

further build our third-party funds platform.

PARKWALK ADVISORS

Parkwalk, the Group's specialist EIS fund management subsidiary,

now has assets under management of GBP497m (HY22: GBP450m; FY22:

GBP477m) including funds managed in conjunction with the

universities of Oxford, Cambridge, Bristol and Imperial College

London. In May 2023 Parkwalk received their FCA approval to be a

full-scope AIFM (alternative investment fund manager) as assets

passed EUR500m in 2022.

Parkwalk invested GBP24.0m in the first six months of 2023

(HY22: GBP38.0m; FY22: GBP57.4m) in the university spin-out sector

across 16 companies (HY21: 19 investments). Again, market data

provider Beauhurst named Parkwalk as the most active investor in

the sector.

Six new companies joined the Parkwalk portfolio, and one partial

exit was achieved at a modest uplift in value. Six portfolio

companies closed funding rounds at uplifts in valuation, three

unchanged and none at lower valuations than the previously held

value. These companies raised c.GBP95m in funding in H1 this year.

We expect some further uplifts and some write-downs in the second

half of the year.

Parkwalk liaised closely with BEIS, the newly formed DSIT, HMT

and HMRC on the financial ecosystem for knowledge-intensive spinout

companies and the UK Government's 'science superpower' agenda.

Within Parkwalk, and more broadly, the Group continues to

explore further fund management opportunities.

AUSTRALIA

In Australia, the IP Group Hostplus Innovation Fund now totals

A$310M (GBP163m) and has invested in several of IP Group's

portfolio companies around the world including Oxford Nanopore,

Wave Optics, Oxa and Hysata, providing additive growth capital for

companies as they scale. TelstraSuper is also investing alongside

IP Group through a co-investment mandate.

GREATER CHINA

In China, the first close of Fund I from ICCV, our Joint Venture

with China Everbright, has been delayed due to ongoing negotiations

with limited partners.

FINANCIAL REVIEW

-- Loss for the period of 54.5m (HY22: Loss of (GBP309.8m), 2022: Loss of (GBP344.5m))

-- Net assets were GBP1,313.6m (HY22: GBP1,414m, FY22: GBP1,376.1m)

-- Net assets per share were 126.7p (HY22: 136.7p, FY22: 132.9p)

-- Final 2022 dividend of 0.76pps paid and 2023 interim dividend proposed of 0.51pps

-- Second tranche debt funding of GBP60m drawn in the period.

Consolidated statement of comprehensive income

A summary analysis of the Group's performance is provided

below:

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

GBPm GBPm GBPm

------------------------------------------------- ----------- ----------- ------------

Net portfolio loss (1) (44.4) (291.1) (309.1)

Net overheads (2) (10.3) (10.9) (20.1)

Non-portfolio foreign exchange gains and losses 1.2 (0.2) (0.1)

Administrative expenses - consolidated portfolio

companies - - (0.1)

Administrative expenses - share-based payments

charge (1.0) (1.4) (2.9)

Carried interest plan provision charge (0.5) (6.0) (12.0)

Net finance income/(expense) 1.6 (0.2) 0.8

Taxation (1.1) - (1.0)

------------------------------------------------- ----------- ----------- ------------

Loss after tax for the period (54.5) (309.8) (344.5)

------------------------------------------------- ----------- ----------- ------------

Other comprehensive income (0.8) (0.1) 0.5

------------------------------------------------- ----------- ----------- ------------

Total comprehensive loss for the period (55.3) (309.9) (344.0)

------------------------------------------------- ----------- ----------- ------------

Exclude:

Share-based payment charge 1.0 1.4 2.9

------------------------------------------------- ----------- ----------- ------------

Return on NAV (1) (54.3) (308.5) (341.1)

------------------------------------------------- ----------- ----------- ------------

(1) Defined in note 12 Alternative Performance Measures.

(2) See net overheads table below and definition in note 12

Alternative Performance Measures.

Net portfolio gains/(losses) consist primarily of realised and

unrealised fair value gains and losses from the Group's equity and

debt holdings in spin-out businesses, which are analysed in detail

in the portfolio analysis above.

Net overheads

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

GBPm GBPm GBPm

---------------------------------------------- ----------- ----------- ------------

Other income 3.1 3.1 7.1

Administrative expenses - all other expenses (12.3) (12.3) (24.2)

Administrative expenses - annual incentive

scheme (1.1) (1.7) (3.0)

---------------------------------------------- ----------- ----------- ------------

( 10 (20.

Net overheads (10.3) .9) 1 )

---------------------------------------------- ----------- ----------- ------------

Other income comprises fund management fees and licensing and

patent income. In the current period other income totalled GBP3.1m

(HY22: GBP3.1m, FY22: GBP7.1m), and was largely unchanged from the

first half of the previous year.

Other central administrative expenses, excluding

performance-based staff incentives, share-based payments charges

and the impact of foreign exchange movements, have remained in line

with the prior year at GBP12.3m (HY22: GBP12.3m, FY22:

GBP24.2m).

The charge of GBP1.1m in respect of the Group's Annual Incentive

Scheme reflects a provisional assessment of performance against

2023 AIS targets which include Group, Team, and Individual

performance elements (HY22: GBP1.7m, FY22: GBP3.0m).

Other income statement items

The share-based payments charge of GBP1.0m (HY22: GBP1.4m, FY22:

GBP2.9m) reflects the accounting charge for the Group's Restricted

Share Plan, Long-Term Incentive Plan and Deferred Bonus Share Plan.

This non-cash charge reflects the fair value of services received

from employees, measured by reference to the fair value of the

share-based payments at the date of award, but has no net impact on

the Group's total equity or net assets.

Carried interest plan charge

The carried interest plan charge of GBP0.5m (HY22: GBP6.0m

charge, FY22: GBP12.0m charge) relates to the recalculation of

liabilities under the Group's carry schemes. As at 30 June 2023,

70% of the Group's equity & debt investments were included

within carry scheme arrangements (HY22: 63%, FY22: 67%). The

liabilities are calculated based upon any excess of current fair

value above cost and hurdle rate of return within each scheme or

vintage. Any payments will only be made following the full

achievement of cost and hurdle via cash proceeds and are only paid

on the event of a cash realisation.

Consolidated statement of financial position

A summary analysis of the Group's assets and liabilities is

provided below:

Unaudited Unaudited

six months six months Audited

ended ended year ended

30 June 30 June 31 December

2023 2022 2022

GBPm GBPm GBPm

------------------------------------ ----------- ----------- ------------

Portfolio 1,276.1 1,265.5 1,258.5

Other non-current assets 5.3 9.2 7.7

Other net current assets 4.0 24.8 33.2

Cash and deposits 250.0 235.7 241.5

Borrowings (138.3) (44.1) (81.4)

Other non-current liabilities (83.5) (77.1) (83.4)

------------------------------------ ----------- ----------- ------------

Total Equity or Net Assets ("NAV") 1,313.6 1,414.0 1,376.1

------------------------------------ ----------- ----------- ------------

NAV per share 126.7p 136.7 132.9p

------------------------------------ ----------- ----------- ------------

The composition of, and movements in, the Group's portfolio are

described in the portfolio review above.

Portfolio valuations

Given continued volatility in public markets and uncertainty

over the extent of the impact on private valuations, we have

continued to seek third party valuation advice across a number of

the larger companies in our portfolio which were assessed as having

a higher degree of valuation uncertainty. These were First Light

Fusion, Featurespace, Hinge Health, Ultraleap, and MOBILion.

In a continuation of the trend observed in 2022, the first half

of 2023 saw a relatively low level of capital raised by the

portfolio of just under GBP300m (HY22: GBP350m). As in 2022, the

majority of these funding transactions took place at or above

previous funding round prices indicating that we are not yet seeing

evidence of reductions in private valuations from financing

transactions in our portfolio:

Unaudited Unaudited Audited

six months ended six months ended year ended

30 June 2023 30 June 2022 31 December 2022

GBPm GBPm GBPm

--------------------------------- --------------------- ---------------------

No. % No. % No. %

------------------ ------- ---------- ---------- ---------- ------- ---------

Up round 10 72% 7 59% 18 62%

Flat round 2 14% 4 33% 8 28%

Down round 2 14% 1 8% 3 10%

------------------ ------- ---------- ---------- ---------- ------- ---------

Total 14 100% 12 100% 29 100%

------------------ ------- ---------- ---------- ---------- ------- ---------

Most of our portfolio remains well funded, with many of our more

mature companies evidencing commercial progress or anticipating

technical or funding milestones in the next 12-18 months, therefore

we remain confident around the resilience of our portfolio.

The table below summarises the valuation basis for the Group's

portfolio. Further details on the Group's valuation policy and

approach can be found in notes 3 and 4.

Unaudited Unaudited

six months six months Audited

ended ended year ended

30 June 30 June 31 December

2023 2022 2022

GBPm GBPm GBPm

------------------------------------------- ----------- ----------- ------------

Quoted 206.4 269.2 228.7

Funding transaction (<12 months) 268.1 285.3 289.8

Funding transaction (>12 months) 191.0 112.2 117.8

Other: Future market/commercial events 15.8 37.8 40.7

Other: Adjusted financing price based on

past performance - upwards 178.3 128.4 151.8

Other: Adjusted financing price based on

past performance - downwards 129.2 123.4 154.5

Other: DCF 115.8 99.1 97.7

Other: Revenue Multiple 76.8 105.5 77.9

Statements from LP 94.7 104.6 99.6

------------------------------------------- ----------- ----------- ------------

Total Portfolio 1,276.1 1,265.5 1,258.5

------------------------------------------- ----------- ----------- ------------

Other assets

The majority of other long-term and short-term assets relate to

amounts receivable on sale of equity and debt investments,

representing deferred and contingent consideration amounts to be

received in more than one year.

Other long-term liabilities relate to carried interest and

revenue share payables, and loans from LPs of consolidated funds.

The Group consolidates the assets of a fund in which it has a

significant economic interest, IP Venture Fund II LP. Loans from

third parties of consolidated funds represent third-party loans

into this partnership. These loans are repayable only upon these

funds generating sufficient cash proceeds to repay the Limited

Partners.

Borrowings

On 2 August 2022, the Group signed a Note Placing Agreement

("NPA") to issue a GBP120m debt private placement to London-based

institutional investors (primarily Phoenix Group). GBP60m of this

was drawn in December 2022 and the balance was drawn in June 2023,

with three equal maturities in December in 2027, 2028 and 2029. The

interest rate is fixed at an average of 5.25%. Approximately GBP15m

of the proceeds was used to repay early the shorter-dated portion

of our EIB debt, leaving GBP22m of EIB debt to be progressively

repaid between now and January 2026 (GBP6.3m of the EIB debt will

be repaid within twelve months of the period end).

Under the terms of the NPA, the Group is required to maintain a

minimum cash balance of GBP25m at any time, equity must be at least

GBP500m and gross debt less restricted cash must not exceed 25% of

total equity as at the Group's 30 June and 31 December reporting

dates. The NPA also includes 'Cash Trap' provisions which stipulate

that the Group is required to maintain cash and cash equivalents of

no less than GBP50m at any time equity must be at least GBP750m,

gross debt less restricted cash must not exceed 20% of total equity

as at the Group's 30 June and 31 December reporting dates. In the

event of the Cash Trap being triggered, the Group is not permitted

to pay or declare a dividend or purchase any of its shares. In

addition, investments are restricted to GBP2.5m per calendar

quarter other than those legally committed to. The Group is also

required to place the net proceeds of all cash proceeds (over a

threshold of GBP1m) into a blocked bank account. Entering a Cash

Trap does not constitute a default under the NPA.

For further details of the Group's loans including covenant

details see note 18 to the 2022 Annual Report.

Cash and deposits

At 30 June 2023, the Group's cash and deposits totalled

GBP250.0m, an increase of GBP8.5m from a total of GBP241.5m at 31

December 2022, predominantly due to outflows of investing

activities of GBP59.9m, a GBP12.0m net cash outflow from operations

and a GBP3.1m cash outflow from the repayment of debt, GBP7.7m of

dividend payments, offset by a drawdown of loan notes of GBP60m and

cash proceeds of GBP32.2m.

It remains the Group's policy to place cash that is surplus to

near-term working capital requirements on short-term and overnight

deposits with financial institutions that meet the Group's treasury

policy criteria or in low-risk treasury funds rated prime or above.

The Group's treasury policy is described in detail in note 2 to the

2022 Group financial statements alongside details of the credit

ratings of the Group's cash and deposit counterparties.

The principal constituents of the movement in cash and deposits

during the period are as follows:

Unaudited Unaudited

six months six months ended Audited

ended 30 June 2022 year ended

30 June 2023 GBPm 31 December 2022

GBPm GBPm

------------------------------------------------------ ------------- ----------------- -----------------

Net cash (used)/generated in operating activities (12.2) (12.4) (23.5)

Investments (59.8) (52.0) (93.5)

Cash proceeds 32.2 2.1 28.1

Other investing (0.6) (0.5) (0.3)

Cash disposed via disposal of subsidiary undertaking - - -

------------------------------------------------------ ------------- ----------------- -----------------

Net cash (outflow)/inflow from investing activities (28.2) (62.7) (65.7)

------------------------------------------------------ ------------- ----------------- -----------------

Dividends paid (7.7) (7.1) (12.3)

Purchase of treasury shares - (8.5) (8.0)

Repayment of debt facility (3.1) (7.7) (30.4)

Drawdown of loan notes 60.0 - 60.0

Other financing activities (0.3) - (0.5)

Net cash inflow/(outflow) from financing activities 48.9 (86.0) 8.8

------------------------------------------------------ ------------- ----------------- -----------------

Effect of foreign exchange rate changes - (0.1) -

------------------------------------------------------ ------------- ----------------- -----------------

Movement during period 8.5 (86.1) 8.8

------------------------------------------------------ ------------- ----------------- -----------------

Dividend

During the period the Group paid a final 2022 dividend of 0.76p

per share, bringing total dividends paid in respect of FY22 to

1.26p per share. The Board has declared an interim dividend in

respect of the period from 1 January 2023 to 30 June 2023 of 0.51p

per ordinary share (the "Interim Dividend").

The Interim Dividend will be payable on or around 4 September

2023. The ex-dividend date will be 10 August 2023 with a record

date of 11 August 2023. The proposed dividend has not been included

as a liability as at 30 June 2023, in accordance with IAS 10

"Events after the reporting period".

Taxation

The Group's business model seeks to deliver long-term value to

its stakeholders through the commercialisation of fundamental

research carried out at its partner universities. To date, this has

been largely achieved through the formation of, and provision of

services and development capital to, spin-out companies formed

around the output of such research. The Group primarily seeks to

generate capital gains from its holdings in spin-out companies over

the longer term but has historically made annual net operating

losses from its operations from a UK tax perspective. Capital gains

achieved by the Group would ordinarily be taxed upon realisation of

such holdings; however, since the Group typically holds more than

10% in its portfolio companies and those companies are themselves

trading, the majority of the portfolio will qualify for the

Substantial Shareholdings Exemption ("SSE") on disposal.

This exemption provides that gains arising on the disposal of

qualifying holdings are not chargeable to UK corporation tax and,

as such, the Group has continued not to recognise a provision for

deferred taxation in respect of uplifts in value on those equity

holdings that meet the qualifying criteria. Gains arising on sales

of holdings which do not qualify for SSE will ordinarily give rise

to taxable profits for the Group, to the extent that these exceed

the Group's ability to offset gains against current and brought

forward tax losses (subject to the relevant restrictions on the use

of brought-forward losses). In such cases, a deferred tax liability

is recognised in respect of estimated tax amount payable.

The Group complies with relevant global initiatives including

the US Foreign Account Tax Compliance Act ("FATCA") and the OECD

Common Reporting Standard.

Alternative Performance Measures ("APMs")

The Group discloses alternative performance measures, such as

NAV per share and Return on NAV, in this Half-Yearly Report. The

Directors believe that these APMs assist in providing additional

useful information on the underlying trends, performance, and

position of the Group. Further information on APMs utilised by the

Group is set out in note 12.

Principal risks and uncertainties

A detailed explanation of the principal risks and uncertainties

faced by the Group, and the steps taken to manage them, is set out

in the Corporate Governance section of the Group's 2022 Annual

Report and Accounts. The principal risks and uncertainties are

summarised as follows:

-- it may be difficult for the Group to maintain the required

level of capital to continue to operate at optimum levels of

investment, activity and overheads;

-- it may be difficult for the Group's portfolio companies to attract sufficient capital;

-- the returns and cash proceeds from the Group's early-stage companies can be very uncertain;

-- universities or other research-intensive institutions may

terminate the collaborative relationships with the Group;

-- the Group may lose key personnel or fail to attract and integrate new personnel;

-- macroeconomic conditions may negatively impact the Group's

ability to achieve its strategic objectives;

-- there may be changes to, impacts from, or failure to comply

with, legislation, government policy and regulation;

-- the Group may be subjected to Phishing and Ransomware attacks, data leakage and hacking;

-- the Group may be negatively impacted operationally as a

result of its recent international expansion.

The Group reviewed its operational, strategic and principal risk

registers in the period and has concluded that it is not aware of

any significant changes in the nature of the principal risks that

would result in a change to the Group's principal risks as set out

above in the forthcoming six months.

Consolidated statement of comprehensive income

For the six months ended 30 June 2023

Unaudited Unaudited

six months six months Audited

ended ended year ended

30 June 30 June 31 December

2023 2022 2022

Note GBPm GBPm GBPm

-------------------------------------------- ---- ----------- ----------- ------------

Portfolio return and revenue

Change in fair value of equity and

debt investments 3 (27.5) (304.1) (303.4)

(Loss)/gain on disposal of equity

and debt investments 3 (5.7) 4.2 (7.8)

Change in fair value of limited partnership

interests 4 (11.2) 8.8 2.1

Revenue from services and other income 3.1 3.1 7.1

-------------------------------------------- ---- ----------- ----------- ------------

(41.3) (288.0) (302.0)

Administrative expenses

Carried interest plan charge 9 (0.5) (6.0) (12.0)

Share-based payment charge (1.0) (1.4) (2.9)

Other administrative expenses (12.2) (14.2) (27.4)

-------------------------------------------- ---- ----------- ----------- ------------

(13.7) (21.6) (42.3)

Operating loss (55.0) (309.6) (344.3)

Finance income 3.8 0.6 2.2

Finance costs (2.2) (0.8) (1.4)

-------------------------------------------- ---- ----------- ----------- ------------

Loss before taxation (53.4) (309.8) (343.5)

Taxation (1.1) - (1.0)

-------------------------------------------- ---- ----------- ----------- ------------

Loss after taxation for the period (54.5) (309.8) (344.5)

-------------------------------------------- ---- ----------- ----------- ------------

Other comprehensive income

Exchange differences on translating

foreign operations (0.8) (0.1) 0.5

-------------------------------------------- ---- ----------- ----------- ------------

Total comprehensive loss for the period (55.3) (309.9) (344.0)

-------------------------------------------- ---- ----------- ----------- ------------

Attributable to:

Equity holders of the parent (53.9) (308.7) (341.5)

Non-controlling interest (1.4) (1.2) (2.5)

-------------------------------------------- ---- ----------- ----------- ------------

(55.3) (309.9) (344.0)

Loss per share

Basic (p) 2 (5.20) (29.85) (33.01)

Diluted (p) 2 (5.20) (29.85) (33.01)

-------------------------------------------- ---- ----------- ----------- ------------

The accompanying notes form an integral part of the financial

statements.

Consolidated statement of financial position

As at 30 June 2023

Unaudited

six months Unaudited Audited

ended six months ended year ended

30 June 2023 30 June 2022 31 December 2022

Note GBPm GBPm GBPm

--------------------------------------------------- ----- -------------- ------------------ ------------------

ASSETS

Non-current assets

Goodwill 0.4 0.4 0.4

Property, plant and equipment 0.3 0.5 0.4

Investment in Joint venture 0.6 -- --

Portfolio:

Equity investments 3 1,123.8 1,123.4 1,120.8

Debt investments 3 57.6 37.5 38.1

Limited partnership interests 4 94.7 104.6 99.6

Receivable on sale of debt and equity investments 6 4.0 8.3 6.9

--------------------------------------------------- ----- -------------- ------------------ ------------------

Total non-current assets 1,281.4 1,274.7 1,266.2

--------------------------------------------------- ----- -------------- ------------------ ------------------

Current assets

Trade and other receivables 7.3 5.7 8.8

Receivable on sale of debt and equity investments 6 8.5 36.0 41.3

Deposits 166.8 141.3 152.8

Cash and cash equivalents 83.2 94.4 88.7

--------------------------------------------------- ----- -------------- ------------------ ------------------

Total current assets 265.8 277.4 291.6

--------------------------------------------------- ----- -------------- ------------------ ------------------

Total assets 1,547.2 1,552.1 1,557.8

--------------------------------------------------- ----- -------------- ------------------ ------------------

EQUITY AND LIABILITIES

Equity attributable to owners of the parent