TIDMJEDT

RNS Number : 7113W

JPMorgan European Discovery Trust

14 December 2023

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMorgan European DISCOVERY Trust plc

Half Year Report & FINANCIAL STATEMENTS for the six

months

ended 30TH September 2023

Legal Entity Identifier: 54930049CEWDI46Y3U28

Information disclosed in accordance with DTR 4.2.2

JPMorgan European Discovery Trust plc, the FTSE 250 trust

investing in European smaller companies, announces its

interim results for the six-month period ended 30 September 2023 (the "Reporting Period").

European small caps underperformed large caps during the period,

as small caps are particularly sensitive to 'risk off' conditions.

The Company was not immune to these conditions and the portfolio

underperformed its benchmark. However, the Manager has made

important enhancements to the portfolio selection process with

improved risk management. There has been improved performance over

recent months as the portfolio adjustments begin to pay off.

Financial highlights for the Reporting Period include:

-- NAV per Ordinary Share of 434.5 pence (as at 30 September

2023) down 12.8% from 31 March 2023

o European small caps underperformed large caps with the

benchmark index, MSCI Europe (ex UK) Small Cap Index, declining

5.7% v large cap MSCI Europe (ex UK) NR Index, which declined

2.0%

-- Shareholder total return of -10.7%, better than reported

return on NAV of -11.4% with the Company's discount narrowing from

-15.1% to -14.8%

-- Interim dividend increased to 2.5 p per share (2022: 1.2p)

o To be paid on 5 February 2024 to shareholders on the register

as at 29 December 2023

-- 50,000 shares were repurchased over the period and a further

3,384,539 shares have been repurchased since the period end. The

share price discount has narrowed to 11.3%, as at time of

writing.

Operational highlights for the Reporting Period include:

-- Enhancements to the investment process and risk management,

with increased exposure to Consumer Discretionary and Financials

sectors

o Added Technogym, manufacturer of premium gym equipment,

De'Longhi, the leading producer of espresso machines for households

and businesses, French reinsurer SCOR and Italian bank, BPER

Banca

-- Arun Sarwal joined the Board as an independent non-executive director.

o Arun has extensive experience developing technology businesses

and working in financial services, across a range of industry

segments and was previously CEO of Fund Communication Solutions at

Broadridge

Outlook:

-- The Company's performance has improved over recent months as

portfolio adjustments begin to pay off

-- Combination of low valuations of European small caps and

possible worldwide central bank easing should be positive for the

Company.

CHAIRMAN'S STATEMENT

Investment Performance

Investment companies have had a well-publicised 'tough year',

with high inflation and global macro-uncertainty taking its toll on

performance across many asset classes. Against this backdrop, the

Trust underperformed its benchmark over the six months to end of

September 2023. During the half year to 30th September 2023, the

Company recorded a total return on net assets of -11.4%, with the

Company's benchmark index, the MSCI Europe (ex UK) Small Cap NR

Index, returning -5.7% over the same period. The total return to

shareholders was -10.7%, slightly better than the reported return

on NAV due moderate narrowing of the discount at which the

Company's shares traded, from -15.1% to -14.8% over the six

months.

The Company's longer-term performance has been mixed. Over the

past five years, the total return on net assets was 2.0%, compared

the benchmark total return of 20.1%. However, over the past ten

years, the total return of 119.8% has been high in absolute terms

and close to the benchmark return of 124.7%.

The Investment Managers' Report that follows provides a review

of markets, and more detail on the performance drivers within the

portfolio, along with some discussion of the market outlook.

Revenue and Dividends

Gross revenue return for the six months to 30th September 2023

was higher than the corresponding period in 2022, at 12.62 pence

per share (2022: 12.32 pence). The Board has decided the interim

dividend of 2.5 pence (2022: 1.2 pence) per share which will be

paid on 5th February 2024 to shareholders on the register as at

29th December 2023 (the ex-dividend date will be 28th December

2023). The Board will keep this matter under review and take into

account the income received and the level of the Company's revenue

reserves when determining the final dividend for the year in

2024.

Discount Management and Share Repurchases

The Board continues to monitor closely the level of the discount

and believes that its ability to repurchase shares to minimise the

short-term volatility and the absolute level of the discount is of

prime importance. A total of 50,000 shares were repurchased in the

six months to 30th September 2023. A further 3,384,539 shares have

been repurchased since the period end. At the time of writing, the

share price discount had narrowed to 11.3%.

The Board

In line with the Board's succession planning and the retirement

of Ashok Gupta at the 2023 Annual General meeting, the Board

undertook a search to identify a new Director. Following the

successful conclusion of this search, and as announced on 9th May

2023, Arun Sarwal was appointed as an independent non-executive

director with effect from the conclusion of the Annual General

Meeting 2023. Arun has extensive experience developing technology

businesses and working in financial services, across a range of

industry segments including commercial & investment banking,

and asset and wealth management across the globe. Some of his

previous roles include his position as the CEO of Fund

Communication Solutions at Broadridge.

Environmental, Social and Governance ('ESG')

As highlighted in the 2023 Annual Report, the Board has

continued to engage with the Manager on the integration of ESG

factors into its investment process. These issues are considered at

every stage of the investment decision. The Board shares the

Investment Managers' view of the significance of ESG factors, both

when making initial investment decisions and during ongoing

engagement with investee companies throughout the period of the

investment. For more details, please refer to pages 23 to 26 of the

2023 Annual Report, which can be found on the Company's website at:

www.jpmeuropeandiscovery.co.uk .

TCFD

JPMorgan Asset Management (JPMAM) published its first UK Task

Force on Climate-related Financial Disclosures ('TCFD') Report for

the Company in respect of the year ended 31 December 2022 on 30th

June 2023. The report is designed to provide investors with

transparency into the portfolio's climate-related risks and

opportunities according to the Financial Conduct Authority (FCA)

Environmental, Social and Governance (ESG) Sourcebook and the Task

Force on Climate related Financial Disclosures (TCFD)

Recommendations. The report is available on the Company's website

under the ESG documents section www.jpmeuropeandiscovery.co.uk

.

Outlook

Higher interest rates are beginning to bite and economic

activity seems to be slowing, which is likely to put earnings and

share prices under pressure as we head into 2024. However, there

are reasons to be optimistic; rates are at, or near, their peaks in

the major developed economies and may begin to fall next year.

The Manager has made changes to the investment process and has

enhanced risk management to protect the portfolio on the downside

in volatile markets and better position it to capture the upside.

Relative performance has improved in recent months, suggesting that

these recent portfolio changes are beginning to pay off. The Board

welcomes the Managers' ongoing efforts to further enhance returns

by taking advantage of current low valuations to acquire other

interesting hidden gems, at attractive prices.

History shows that while European markets have been through

challenging periods, performance has subsequently rebounded

strongly as these challenges abate. European small cap companies

tend to outperform as the broader market rallies. Looking ahead,

any signs that central banks are considering lower interest rates

should provide a significant boost to investor confidence and

equity markets. If history is any guide, European small caps in

general, and your Company in particular, should do even better. On

this basis, the Board is optimistic about the Company's prospects

over 2024 and beyond.

Marc van Gelder

Chairman

13th December 2023

INVESTMENT MANAGERS' REPORT

Review

Investor sentiment remained risk adverse as government bond

yields continued to move higher. While inflationary pressures began

to ease, concerns around unsustainably large government fiscal

deficits grew. European small caps underperformed large caps, as

small caps are particularly sensitive to such 'risk off'

conditions.

The benchmark MSCI Europe (ex UK) Small Cap NR Index fell by 5.7

per cent over the review period versus the large cap MSCI Europe

(ex UK) NR Index that fell 2.0 per cent.

Portfolio performance

The portfolio's NAV declined by 11.4 per cent, underperforming

its benchmark by 5.7 percentage points, as the Company's investment

process tends to struggle during periods of high volatility. A

detailed overview of the Company's investment process follows this

report.

Contributors to performance included French professional

installations company, Spie, due to continued high demand driven by

the energy transition towards electrification. Scout24, the leading

German real estate digital classifieds platform, contributed due to

strong growth even as the real estate market remained under

pressure. Dutch engineering services provider, Arcadis,

outperformed due to increasing demand driven by climate change, the

energy transition, and urbanisation.

Over the period, detractors from performance included Bravida,

the Swedish commercial building installation company. Its share

price came under pressure as cost inflation depressed margins, even

though orders held up well. Melexis, a Belgium provider of

semiconductor chips primarily for the automotive end market,

underperformed due to concerns that high inventories at their

customers could temporarily depress demand. Swedish engineering

services provider, AFRY, detracted as weaker demand impacted their

utilisation rate which depressed margins.

Portfolio changes

During the year, we have made some important enhancements to our

process and risk management in the portfolio, seeking to minimise

downside risk during periods of volatility and capture upside risk

when volatility reduces. The changes made have led to improved

portfolio construction and include an increase in the number of

holdings, thereby reducing thematic and sector concentration during

periods of global stress.

Among other things, we increased the portfolio's exposure to the

Consumer Discretionary sector. Valuations are attractive, inventory

levels are normalising, and there is potential for real wage growth

as wage increases feed through and inflation moderates. Falling

input costs are a further tailwind to earnings. For instance, we

added Technogym, the Italian manufacturer of premium gym equipment,

and De'Longhi, a leading producer of espresso machines for

households and businesses. We increased the portfolio's Financials

holdings, including via French reinsurer, Scor, as operational

momentum began to improve following a business restructuring, and

Italian bank, BPER Banca, due to its very attractive valuation and

better-than-expected profit growth.

To fund these purchases, we reduced our exposure to construction

related industrials, as high bond yields are adversely impacting

demand for new construction, and cost inflation is putting pressure

on margins. For example, we sold Swiss listed Georg Fischer and

Dutch Aalberts. We also sold or reduced companies whose market caps

had risen due to outperformance to the point where they were no

longer small caps. These sales included D'ieteren, a Belgium

holding company focused primarily on automotive related end

markets, and Prysmian, an Italian manufacturer of high voltage

cables which are vital to support the transition towards renewable

energy.

As a result of these changes Consumer Discretionary became the

portfolio's largest sector overweight and Financials became the

second largest overweight. Healthcare and Real Estate remained the

largest underweights due to a combination of poor momentum and

expensive valuations. France and Italy remained the two largest

country overweights, while Norway and Switzerland remained the two

most significant underweights.

At the end of September 2023, portfolio gearing was 3.8%.

Outlook

The long-anticipated global slowdown appears to have finally

arrived, and with it the likelihood that central bank rates have

peaked. This makes the near-term outlook for equities very hard to

anticipate. On the one hand, company earnings are slowing, on the

other, the headwinds created by higher rates are starting to show

signs of abating. We suspect that earnings will dominate in the

near term, keeping equities under pressure, while expectations of

lower interest rates may play an increasingly supportive role next

year.

Top-down macroeconomic uncertainty has been dominating the

performance of stock markets for some time. As a result we have

transitioned towards a more diversified portfolio comprising

companies that are benefitting from the current high interest rate

environment, while adding attractively valued companies that should

do well as interest rates begin to fall. While this is a difficult

balancing act, the Trust's performance has improved over recent

months as portfolio adjustments are beginning to pay off. Looking

to next year, the combination of extremely low valuations for

European small caps, and possible central bank easing around the

world, should be very positive for markets in general and even more

so for our asset class.

Francesco Conte

Edward Greaves

Investment Managers

13th December 2023

INTERIM MANAGEMENT REPORT

The Company is required to make the following disclosures in its

half year report:

Principal Risks and Uncertainties

The principal and emerging risks and uncertainties faced by the

Company fall into the following broad categories: investment

underperformance and strategy; market and currency; accounting,

legal and regulatory; operational; cyber-crime, financial,

corporate governance and shareholder relations, climate change,

pandemic risk, artificial intelligence, geopolitical and global

recession. The Board has reviewed the principal risks and

uncertainties, reported in the Annual Report and Financial

Statements for the year ended 31st March 2023, and concluded that

it does not believe that currently there are any emerging risks

facing the Company. In the view of the Board, these principal risks

and uncertainties are as much applicable to the remaining six

months of the financial year as they were to the six months under

review.

Related Parties Transactions

During the first six months of the current financial year, no

transactions with related parties have taken place which have

materially affected the financial position or the performance of

the Company.

Going Concern

The Directors believe, having considered the Company's

investment objectives, risk management policies, capital management

policies and procedures, nature of the portfolio and expenditure

projections, that the Company has adequate resources, an

appropriate financial structure and suitable management

arrangements in place to continue in operational existence for the

foreseeable future. More specifically, that there are no material

uncertainties pertaining to the Company that would prevent its

ability to continue in such operational existence for at least 12

months from the date of the approval of this half yearly financial

report. For these reasons, they consider that there is reasonable

evidence to continue to adopt the going concern basis in preparing

the financial statements.

Directors' Responsibilities

The Board of Directors confirm that, to the best of its

knowledge:

(i) the condensed set of financial statements contained within

the half-yearly financial report has been prepared in accordance

with FRS 104 'Interim Financial Reports' and gives a true and fair

view of the state of affairs of the Company and of the assets,

liabilities, financial position and net return of the Company, as

at 30th September 2023, as required by the UK Listing Authority

Disclosure Guidance and Transparency Rules 4.2.4R; and

(ii) the interim management report includes a fair review of the

information required by 4.2.7R and 4.2.8R of the UK Listing

Authority Disclosure Guidance and Transparency Rules.

In order to provide these confirmations, and in preparing these

financial statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether applicable UK Accounting Standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business;

and the Directors confirm that they have done so.

For and on behalf of the Board

Marc van Gelder

Chairman

13th December 2023

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30th SEPTEMBER 2023

(Unaudited)

(Unaudited) Six months ended (Audited)

Six months ended 30th September Year ended

30th September 2023 2022 31st March 2023

------------------ -------------------------------- -------------------------------- ------------------------------

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------- ---------- ---------- -------- ---------- ---------- -------- --------- ---------

Losses on

investments

held at fair

value

through profit

or loss - (102,583) (102,583) - (164,778) (164,778) - (45,535) (45,535)

Foreign exchange

gains

on liquidity fund - 235 235 - 1,819 1,819 - 2,265 2,265

Net foreign

currency

gains/(losses) - 1,166 1,166 - (1,455) (1,455) - (2,366) (2,366)

Income from

investments 19,519 - 19,519 19,359 - 19,359 22,389 - 22,389

Interest

receivable

and similar

income 351 - 351 70 - 70 113 - 113

------------------ -------- ---------- ---------- -------- ---------- ---------- -------- --------- ---------

Gross

return/(loss) 19,870 (101,182) (81,312) 19,429 (164,414) (144,985) 22,502 (45,636) (23,134)

Management fee (944) (2,202) (3,146) (989) (2,308) (3,297) (1,925) (4,491) (6,416)

Other

administrative

expenses (355) - (355) (312) - (312) (690) - (690)

------------------ -------- ---------- ---------- -------- ---------- ---------- -------- --------- ---------

Net return/(loss)

before finance

costs

and taxation 18,571 (103,384) (84,813) 18,128 (166,722) (148,594) 19,887 (50,127) (30,240)

Finance costs (657) (1,532) (2,189) (138) (321) (459) (530) (1,237) (1,767)

------------------ -------- ---------- ---------- -------- ---------- ---------- -------- --------- ---------

Net return/(loss)

before taxation 17,914 (104,916) (87,002) 17,990 (167,043) (149,053) 19,357 (51,364) (32,007)

Taxation (1,509) - (1,509) (1,548) - (1,548) (1,845) - (1,845)

------------------ -------- ---------- ---------- -------- ---------- ---------- -------- --------- ---------

Net return/(loss)

after taxation 16,405 (104,916) (88,511) 16,442 (167,043) (150,601) 17,512 (51,364) (33,852)

------------------ -------- ---------- ---------- -------- ---------- ---------- -------- --------- ---------

Return /(loss) per

share (note 3) 10.42p (66.62)p (56.20)p 10.43p (105.95)p (95.52)p 11.11p (32.60)p (21.49)p

------------------ -------- ---------- ---------- -------- ---------- ---------- -------- --------- ---------

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or

discontinued in the period.

The 'Total' column of this statement is the profit and loss

account of the Company and the 'Revenue' and 'Capital' columns

represent supplementary information prepared under guidance

issued by the Association of Investment Companies.

The net return/(loss) after taxation represents the

profit/(loss) for the period/year and also the total comprehensive

income.

CONDENSED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30th SEPTEMBER 2023

Called

up Capital

share Share redemption Capital Revenue

capital premium reserve reserves(1) reserve(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- -------- -------- ----------- ------------ ----------- ----------

Six months ended 30th September

2023

(Unaudited)

At 31st March 2023 7,874 1,312 7,762 749,999 18,115 785,062

Repurchase of shares

into Treasury - - - (185) - (185)

Net (loss)/return on

ordinary shares - - - (104,916) 16,405 (88,511)

Dividends paid in the

period (note 4) - - - - (12,283) (12,283)

---------------------------- -------- -------- ----------- ------------ ----------- ----------

At 30th September 2023 7,874 1,312 7,762 644,898 22,237 684,083

---------------------------- -------- -------- ----------- ------------ ----------- ----------

Six months ended 30th September

2022

(Unaudited)

At 31st March 2022 7,924 1,312 7,712 805,617 11,154 833,719

Repurchase and cancellation

of Company's own shares (50) - 50 (4,254) - (4,254)

Net (loss)/return on

ordinary shares - - - (167,043) 16,442 (150,601)

Dividends paid in the

period (note 4) - - - - (8,661) (8,661)

---------------------------- -------- -------- ----------- ------------ ----------- ----------

At 30th September 2022 7,874 1,312 7,762 634,320 18,935 670,203

---------------------------- -------- -------- ----------- ------------ ----------- ----------

Year ended 31st March 2022

(Audited)

At 31st March 2022 7,924 1,312 7,712 805,617 11,154 833,719

Repurchase and cancellation

of Company's own shares (50) - 50 (4,254) - (4,254)

Net (loss)/return on

ordinary activities - - - (51,364) 17,512 (33,852)

Dividends paid in the

year (note 4) - - - - (10,551) (10,551)

---------------------------- -------- -------- ----------- ------------ ----------- ----------

At 31st March 2023 7,874 1,312 7,762 749,999 18,115 785,062

---------------------------- -------- -------- ----------- ------------ ----------- ----------

(1) These reserves form the distributable reserves of the

Company and may be used to fund distribution of profits to

investors via dividend payments.

CONDENSED STATEMENT OF FINANCIAL POSITION

AT 30th SEPTEMBER 2023

(Unaudited) (Unaudited) (Audited)

30th September 30th September 31st March

2023 2022 2023

GBP'000 GBP'000 GBP'000

-------------------------------------- ---------------- ---------------- ------------

Fixed assets

Investments held at fair value

through profit or loss 710,083 642,346 839,582

-------------------------------------- ---------------- ---------------- ------------

Current assets

Debtors 5,966 5,482 16,100

Cash and cash equivalents 43,530 57,729 47,000

-------------------------------------- ---------------- ---------------- ------------

49,496 63,211 63,100

Current liabilities

Creditors: amounts falling due

within one year (75,496) (35,354) (117,620)

-------------------------------------- ---------------- ---------------- ------------

Net current (liabilities)/assets (26,000) 27,857 (54,520)

-------------------------------------- ---------------- ---------------- ------------

Total assets less current liabilities 684,083 670,203 785,062

-------------------------------------- ---------------- ---------------- ------------

Net assets 684,083 670,203 785,062

-------------------------------------- ---------------- ---------------- ------------

Capital and reserves

Called up share capital 7,874 7,874 7,874

Share premium 1,312 1,312 1,312

Capital redemption reserve 7,762 7,762 7,762

Capital reserves 644,898 634,320 749,999

Revenue reserve 22,237 18,935 18,115

-------------------------------------- ---------------- ---------------- ------------

Total shareholders' funds 684,083 670,203 785,062

-------------------------------------- ---------------- ---------------- ------------

Net asset value per share (note

5) 434.5p 425.6p 498.5p

-------------------------------------- ---------------- ---------------- ------------

CONDENSED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30th SEPTEMBER 2023

(Unaudited) (Unaudited)

Six months Six months

ended ended (Audited)

30th September 30th September Year ended

2023 2022(1) 31st March 2023

GBP'000 GBP'000 GBP'000

-------------------------------------- --------------- --------------- ----------------

Cash flows from operating activities

Net loss before finance costs and

taxation (84,813) (148,594) (30,240)

Adjustment for:

Net losses on investments held

at fair value through profit or

loss 102,583 164,778 45,535

Foreign exchange gains on liquidity

fund (235) (1,819) (2,265)

Net foreign currency (gains)/losses (1,166) 1,455 2,366

Dividend income (19,519) (19,171) (22,201)

Interest income (246) - -

Scrip Dividends received as income - (188) (188)

Realised loss on foreign exchange

transactions (494) (59) (567)

Realised exchange loss/(gains)

on liquidity (123) 738 2,897

Decrease/(increase) in accrued

income and other debtors 23 (2) (40)

Increase/(decrease) in accrued

expenses 32 (20) 17

-------------------------------------- --------------- --------------- ----------------

Net cash outflow from operations

before dividends and interest (3,958) (2,882) (4,686)

-------------------------------------- --------------- --------------- ----------------

Dividends received 16,517 16,084 17,806

Interest received 147 - 1

Overseas withholding tax recovered 1,227 531 820

-------------------------------------- --------------- --------------- ----------------

Net cash inflow from operating

activities 13,933 13,733 13,941

-------------------------------------- --------------- --------------- ----------------

Purchases of investments (350,432) (258,862) (733,345)

Sales of investments 381,566 282,414 675,882

Settlement of forward currency

contracts - 184 2

-------------------------------------- --------------- --------------- ----------------

Net cash inflow/(outflow) from

investing activities 31,134 23,736 (57,461)

-------------------------------------- --------------- --------------- ----------------

Equity dividends paid (12,283) (8,661) (10,551)

Repurchase and cancellation of

the Company's own shares - (4,412) (4,412)

Repayment of bank loans (34,447) (42,528) (42,528)

Drawdown of bank loans - - 74,509

Interest paid (2,169) (536) (1,184)

-------------------------------------- --------------- --------------- ----------------

Net cash (outflow)/inflow from

financing activities (48,899) (56,137) 15,834

-------------------------------------- --------------- --------------- ----------------

Decrease in cash and cash equivalents (3,832) (18,668) (27,686)

-------------------------------------- --------------- --------------- ----------------

Cash and cash equivalents at start

of period/year 47,000 75,318 75,318

Exchange movements 362 1,079 (632)

-------------------------------------- --------------- --------------- ----------------

Cash and cash equivalents at end

of period/year 43,530 57,729 47,000

-------------------------------------- --------------- --------------- ----------------

Cash and cash equivalents consist

of:

Cash and short term deposits 497 266 447

Cash held in JPMorgan Euro Liquidity

Fund 43,033 57,463 46,553

-------------------------------------- --------------- --------------- ----------------

Total 43,530 57,729 47,000

-------------------------------------- --------------- --------------- ----------------

(1) The presentation of the Cash Flow Statement, as permitted

under FRS 102, has been changed so as to present the reconciliation

of 'net return/(loss) before finance costs and taxation' to 'net

cash inflow from operating activities' on the face of the Cash Flow

Statement. Previously, this was shown by way of note. Interest paid

has also been reclassified to financing activities, previously

shown under operating activities, as this relates to the loans

drawndown.

Other than consequential changes in presentation of the certain

cash flow items, there is no change to the cash flows as presented

in previous periods.

Analysis of change in net debt

As at Other As at

31st March non-cash 30th September

2023 Cash flows charges 2023

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ----------- ---------- --------- ---------------

Cash and cash equivalents:

Cash 447 46 4 497

Cash equivalents 46,553 (3,878) 358 43,033

--------------------------- ----------- ---------- --------- ---------------

47,000 (3,832) 362 43,530

Borrowings

Debt due within one year (109,836) 34,447 1,657 (73,732)

--------------------------- ----------- ---------- --------- ---------------

(109,836) 34,447 1,657 (73,732)

--------------------------- ----------- ---------- --------- ---------------

Net debt (62,836) 30,615 2,019 (30,202)

--------------------------- ----------- ---------- --------- ---------------

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30th SEPTEMBER 2023

1. Financial statements

The information contained within the financial statements in

this half year report has not been audited or reviewed by the

Company's auditors.

The figures and financial information for the year ended 31st

March 2023 are extracted from the latest published financial

statements of the Company and do not constitute statutory accounts

for that year. Those financial statements have been delivered to

the Registrar of Companies, including the report of the auditors

which was unqualified and did not contain a statement under either

section 498(2) or 498(3) of the Companies Act 2006.

2. Accounting policies

The condensed financial statements have been prepared in

accordance with the Companies Act 2006, FRS 102 'The Financial

Reporting Standard applicable in the UK and Republic of Ireland' of

the United Kingdom Generally Accepted Accounting Practice ('UK

GAAP') and with the Statement of Recommended Practice 'Financial

Statements of Investment Trust Companies and Venture Capital

Trusts' (the revised 'SORP') issued by the Association of

Investment Companies in July 2022.

FRS 104, 'Interim Financial Reporting', issued by the Financial

Reporting Council ('FRC') in March 2015 has been applied in

preparing this condensed set of financial statements for the six

months ended 30th September 2023.

All of the Company's operations are of a continuing nature.

The accounting policies applied to this condensed set of

financial statements are consistent with those applied in the

financial statements for the year ended 31st March 2023.

3. Return/(loss) per share

(Unaudited) (Unaudited)

Six months ended Six months ended (Audited)

30th September 30th September Year ended

2023 2022 31st March 2023

GBP'000 GBP'000 GBP'000

-------------------------- ----------------- ----------------- ----------------

Return per share is based

on the following:

Revenue return 16,405 16,442 17,512

Capital loss (104,916) (167,043) (51,364)

-------------------------- ----------------- ----------------- ----------------

Total loss (88,511) (150,601) (33,852)

-------------------------- ----------------- ----------------- ----------------

Weighted average number

of shares

in issue 157,474,385 157,662,663 157,569,054

Revenue return per share 10.42p 10.43p 11.11p

Capital loss per share (66.62)p (105.95)p (32.60)p

-------------------------- ----------------- ----------------- ----------------

Total loss per share (56.20)p (95.52)p (21.49)p

-------------------------- ----------------- ----------------- ----------------

4 . Dividends paid

(Unaudited) (Unaudited)

Six months ended Six months ended (Audited)

30th September 30th September Year ended

2023 2022 31st March 2023

GBP'000 GBP'000 GBP'000

---------------------------- ----------------- ----------------- ----------------

2023 final dividend of 7.8p

(2022: 5.5p) per share 12,283 8,661 8,661

2023 interim dividend of

1.2p per share - - 1,890

---------------------------- ----------------- ----------------- ----------------

Total dividends paid in

the period/year 12,283 8,661 10,551

---------------------------- ----------------- ----------------- ----------------

All dividends paid in the period have been funded from the

revenue reserve.

An interim dividend of 2.5p (2022:1.2p) has been declared in

respect of the six months ended 30th September 2023, amounting to

GBP3,937,000.

5 . Net asset value per share

(Unaudited) (Unaudited)

Six months ended Six months ended (Audited)

30th September 30th September Year ended

2023 2022 31st March 2023

-------------------------- ----------------- ----------------- ----------------

Net assets (GBP'000) 684,083 670,203 785,062

Number of shares in issue 157,424,931 157,474,931 157,474,931

-------------------------- ----------------- ----------------- ----------------

Net asset value per share 434.5p 425.6p 498.5p

-------------------------- ----------------- ----------------- ----------------

6. Fair valuation of investments

The fair value hierarchy analysis for financial instruments held

at fair value at the period end is as follows:

(Unaudited) (Unaudited)

Six months ended Six months ended (Audited)

30th September 30th September Year ended

2023 2022 31st March 2023

-------- --------------------- --------------------- ---------------------

Assets Liabilities Assets Liabilities Assets Liabilities

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Level 1 710,083 - 642,346 - 839,582 -

-------- -------- ----------- -------- ----------- -------- -----------

Total 710,083 - 642,346 - 839,582 -

-------- -------- ----------- -------- ----------- -------- -----------

13th December 2023

For further information, please contact:

Priyanka Vijay Anand

For and on behalf of JPMorgan Funds Limited,

Company Secretary

0800 20 40 20 or +44 1268 44 44 70

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Upon the

publication of this announcement via Regulatory Information Service

this inside information is now considered to be in the public

domain.

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

ENDS

A copy of the half year report will be submitted to the FCA's

National Storage Mechanism and will shortly be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

The half year will also shortly be available on the Company's

website at www.jpmeuropeandiscovery.co.uk where up to date

information on the Company, including daily NAV and share prices,

factsheets and portfolio information can also be found.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIBDDSXBDGXX

(END) Dow Jones Newswires

December 14, 2023 02:00 ET (07:00 GMT)

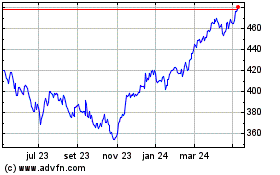

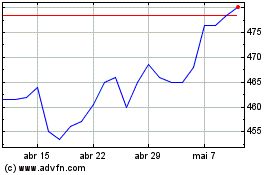

Jpmorgan European Discov... (LSE:JEDT)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Jpmorgan European Discov... (LSE:JEDT)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024