JZ Capital Partners Ltd Update in relation to Secondary Sale

14 Dezembro 2023 - 4:00AM

UK Regulatory

TIDMJZCP

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-ended investment company incorporated with limited liability under the

laws of Guernsey with registered number 48761)

LEI 549300TZCK08Q16HHU44

Update in relation to Secondary Sale

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET

ABUSE REGULATION (EU) NO. 596/2014, WHICH FORMS PART OF UK LAW BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

14 December 2023

JZ Capital Partners Limited, the London listed fund that has investments in US

and European microcap companies and US real estate, is pleased to provide an

update in relation to its interest in the secondary fund, JZHL Secondary Fund LP

(the "Secondary Fund"), to which JZCP earlier sold its interests in certain US

microcap portfolio companies (the "Secondary Sale"). The Secondary Sale was

announced on 19 October 2020, with further details of the sale being included in

a circular sent to shareholders of the Company dated 29 October 2020.

JZCP is pleased to announce that the Secondary Fund has sold its interest in

Felix Storch Holdings, LLC ("Felix Storch") for consideration of approximately

US$167.7 million.

Shareholders are reminded that, as detailed in the aforementioned announcement

and circular, JZCP received as consideration for the Secondary Sale, and in

addition to the previously received approximately US$90 million in cash, a

special limited partner interest in the Secondary Fund entitling JZCP to certain

distributions and other rights and obligations from the Secondary Fund (the

"Special LP Interest"). Any distributions to be received by JZCP as a result of

its Special LP Interest are subject to an agreed distribution waterfall as

detailed in the aforementioned announcement and circular which provides that,

once the other investors in the Secondary Fund have received their initial

required distributions determined by reference to their respective contributions

to the Secondary Fund and amounting to approximately US$132.6 million, in

aggregate, JZCP is entitled to receive as distributions from the Secondary Fund:

(i) 95 per cent. of all distributions until it has received distributions equal

to US$67.6 million; and (ii) thereafter, 37.5 per cent. of all distributions.

In accordance with the agreed distribution waterfall described above, JZCP will

receive a distribution from the Secondary Fund of approximately US$62.5 million

in connection with the sale of Felix Storch, which would correspond to a NAV

uplift to JZCP of approximately 19 cents per ordinary share. JZCP's remaining

interest in the Secondary Fund, based on pro forma financials as at 31 August

2023, is valued at approximately US$32.5 million.

The sale of Felix Storch follows the previously announced disposals of certain

interests in the Secondary Fund, in connection with which JZCP received

aggregate distribution proceeds of US$97.4 million. The Company will make

further announcements in relation to any further distributions of the Secondary

Fund as and when appropriate.

The Company notes that its only outstanding debt obligation is approximately

US$45.0 million (plus accrued interest) under the Company's senior facility

provided by WhiteHorse Capital Management, LLC due on 26 January 2027. The

Company remains focused on the implementation of the new investment policy to

realise maximum value from the Company's investments and, after the repayment of

all debt, to return capital to shareholders. To that end and in accordance with

the investment policy, the Company intends to use the proceeds from the sale of

Felix Storch to repay its senior facility in full. This repayment will, subject

to retaining sufficient funds to cover existing obligations and support certain

existing investments to maximise their value, enable the Company to plan to

commence making distributions to shareholders, as previously announced in the

Company's interim report and financial statements released on 9 November 2023.

The Company will make further announcements regarding the repayment of the

senior facility as and when appropriate.

Market Abuse Regulation

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under MAR. Upon the publication

of this announcement, this inside information is now considered to be in the

public domain.

The person responsible for arranging the release of this announcement on behalf

of the Company is Sharon Parr, Board member of JZCP.

_________________________________________________________________________________

_____

For further information:

Kit Dunford / Ed Berry +44 (0)7717 417 038

FTI Consulting / +44 (0)7703 330

199

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers, Inc.

Hannah Hayward +44 (0) 1481 745417

Northern Trust International Fund

Administration Services (Guernsey)

Limited

Important Notice

This announcement includes statements that are, or may be deemed to be, "forward

-looking statements". These forward-looking statements can be identified by the

use of forward-looking terminology, including the terms "believes", "estimates",

"anticipates", "expects", "intends", "may", "will" or "should" or, in each case,

their negative or other variations or comparable terminology. These forward

-looking statements relate to matters that are not historical facts. By their

nature, forward-looking statements involve risks and uncertainties because they

relate to events and depend on circumstances that may or may not occur in the

future. Forward-looking statements are not guarantees of future performance. The

Company's actual investment performance, results of operations, financial

condition, liquidity, policies and the development of its strategies may differ

materially from the impression created by the forward-looking statements

contained in this announcement. In addition, even if the investment performance,

result of operations, financial condition, liquidity and policies of the Company

and development of its strategies are consistent with the forward-looking

statements contained in this announcement, those results or developments may not

be indicative of results or developments in subsequent periods. These forward

-looking statements speak only as at the date of this announcement. Subject to

their legal and regulatory obligations, each of the Company, Jordan/Zalaznick

Advisers, Inc. and their respective affiliates expressly disclaims any

obligations to update, review or revise any forward-looking statement contained

herein whether to reflect any change in expectations with regard thereto or any

change in events, conditions or circumstances on which any statement is based or

as a result of new information, future developments or otherwise.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

December 14, 2023 02:00 ET (07:00 GMT)

Jz Capital Partners (LSE:JZCP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

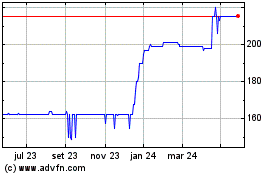

Jz Capital Partners (LSE:JZCP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025