TIDMMHN

Menhaden Resource Efficiency PLC

Half Year Report

for the six months ended 30 June 2023

.

Financial Highlights

Menhaden Resource Ef?ciency PLC (the "Company") is an investment trust. Its

shares are listed on the premium segment of the Of?cial List and traded on the

main market of the London Stock Exchange.

The Company's investment objective is to generate long-term shareholder returns,

predominantly in the form of capital growth, by investing in businesses and

opportunities that are demonstrably delivering or bene?ting signi?cantly from

the ef?cient use of energy and resources irrespective of their size, location or

stage of development.

Performance As at As at

30 June 2023 31 December 2022

Total net assets £119,675,000 £103,831,000

Net asset value ("NAV") per share 151.4p 129.8p

Share price 96.5p 89.0p

Share price discount to the NAV per share^ 36.3% 31.4%

Total returns Six months to Year to

30 June 2023 31 December 2022

NAV per share^ 16.9% (16.5%)

Share price^ 8.8% (20.3%)

RPI + 3% 5.9% 13.7%

Six months to Year to

30 June 2023 31 December 2022

Annualised ongoing charges ratio^ 1.8% 1.8%

^ Alternative Performance Measure. Please refer to the Glossary on page 21 for

de?nitions of these terms and the basis of their calculation.

.

Strategic Context

Over the ?rst six months of 2023 the level of investment in both the global

quoted and private capital markets was subdued. The main reasons include post

pandemic concerns, the dislocating impact of the Ukraine war on global energy

and other resource supply chains, in?ationary pressures and rising central bank

interest rates, and incidence of extreme weather events in North America,

Europe, and Asia.

At the same time the global demand for energy and resources continues to rise.

The World Meteorological Association has stated that 2023 is set to be the

hottest year ever recorded and the International Monetary Fund reported that

?nancial markets are under-pricing climate related risks. The need for

businesses to progressively reduce their use of fossil fuels and greenhouse gas

emissions has never been so critical.

Consequently, our investment thesis to invest in high quality businesses that

both enjoy strong market positions and are demonstrably delivering or

signi?cantly bene?tting from the ef?cient use of energy and resources is now

even more relevant and so should be bene?cial for long-term shareholders.

Financial Performance

The performance of our investment portfolio has been encouraging. Between 31

December 2022 and 30 June 2023 the Company's total net assets increased from

£103.8 million to £119.7 million. The NAV per share increased from 129.8p at 31

December 2022 to 151.4p at 30 June 2023, giving an NAV per share total return of

16.9%. The Company's share price over the same period rose from 89.0p per share

to 96.5p, giving a share price total return of 8.8%.

These metrics compare with a return over the six months of our primary

performance comparator, RPI+3% per annum, of 5.9%. At the end of June the share

price stood at a 36.3% discount to the NAV per share. Such share price discounts

are currently re?ected across much of the investment trust sector and does not

re?ect our NAV per share CAGR performance of 12.5%, 10.5% and 10.3 % over 1, 3

and 5 years.

Notable contributors to our performance included private equity clean energy

developer X-ELIO, which is expected to realise 2.2 times invested capital

following its proposed acquisition by Brook?eld Renewable, expected to conclude

by the end of 2023. Taken together, our three largest digitalisation

(decarbonisation) themed public equities (Microsoft, Alphabet and Amazon)

contributed 9.2% to NAV. The two largest detractors were two sustainable

infrastructure and transport companies, Union Paci?c and Canadian National

Railway, which reduced our NAV by 0.3%.

The most signi?cant changes to the portfolio in the period included investment

pro?ts being taken from reducing, by around half, the holding in Alphabet and re

-investment in Airbus (because of its focus on manufacturing more ef?cient

engines powered by sustainable aviation fuel). We also made a new large US$25

million private equity commitment into TCI Real Estate Partners Fund IV (because

of its focus on developing best in class energy ef?cient buildings).

Environmental Performance

Our Portfolio Manager actively monitors the energy and resource ef?ciency of our

investments in line with the carbon disclosure project and the Science Based

Targets initiative.

The focus of engagement with all quoted investee companies has been on their

alignment with the Paris Agreement to reduce global warming, deforestation and

biodiversity loss. The aim of this engagement is to encourage them to adopt and

use best practice environmental solutions and de?ne pathways to reduce their GHG

emissions and preserve tropical rain forests, together with associated

biodiversity. Some positive responses were received, which were welcomed. Where

a weak or no response was received further follow-up engagement is planned.

Our Portfolio Manager supported AGM resolutions seeking greater disclosures by

KLA of their Net Zero targets and the Canadian National Railway climate action

plan.

Share Price Discount

We had not previously favoured share buy backs for mitigation of the share price

discount and remain of the view that share buybacks are not usually in the best

interest of shareholders as they reduce the size of the Company and increase the

ongoing charges ratio. However, after a step-down in the share price in January

2023 the Board decided it would trial a very modest programme of share buybacks.

We considered that this might reduce the volatility of the share price, take

advantage of the accretion to NAV that buying back shares at a discount achieves

and provide a signal to the market of our con?dence in the value of the

Company's portfolio. Some 975,000 shares were bought back between February and

April 2023 at an average price of 94.35 pence per share. The exercise did

provide some additional liquidity in the volatile market conditions, was

accretive to our shareholders and the cost of execution was modest.

We will continue to monitor closely the discount to NAV at which the Company's

shares trade. Any future action will be dependent on market conditions, the

Company's available liquid resources and the potential con?ict between accretive

share buybacks and the availability of attractive portfolio investment

opportunities. Buybacks will remain at the discretion of the Board.

As the Company can only issue new shares when the share price is at a premium to

NAV it remains the Board's goal to improve the share price through enhanced

investment performance and by having effective marketing strategies and

informative communications to potential new investors.

Dividend

In line with previous practice the Board has not declared an interim dividend in

respect of this half year. As shareholders will be aware a dividend of 0.4p per

share was recommended in respect of the year to 31 December 2022 and, following

shareholder approval in June 2023, was paid in July 2023.

Income generation is not part of the Company's investment objective and

shareholders are reminded that the Company's dividend policy is that the Company

will only pay dividends suf?cient to maintain investment trust status. If that

threshold is crossed once again for the current ?nancial year, to 31 December

2023, the Directors will recommend to shareholders, for approval at the next

AGM, a dividend suf?cient to achieve compliance with the investment trust status

requirements.

Outlook

Whilst ?nancial markets have generally been resilient overall so far in 2023,

and the Board hopes for an upturn for both quoted equities and private

investment opportunities, we cannot ignore background macro factors, including:

the continuing war in Ukraine; tension between the USA and China over trade;

in?ationary pressures and high interest rates, which may persist for some time;

nor the potential for further energy and resource price volatility; and climate

change impacts.

However, the Board considers the Company's portfolio to be well placed for

further capital growth because of its quality and the defensive and in?ation

resistant properties of many of the holdings. Moreover, the Board continues to

remain convinced of the validity of the premise that the world and all

businesses need to be more energy and resource ef?cient and the Company's

investment thesis should accordingly provide long-term bene?ts for our

investors.

Further Information

Our Portfolio Manager's report, starting on page 8 provides further details

about our investments and their contribution to the Company's performance during

the period. The Company's most recent 2022 annual environmental impact report

and monthly factsheets can be found on our website www.menhaden.com. Our 2023

annual report and environmental impact report will be published in mid 2024.

Howard Pearce

Chairman

14 September 2023

.

Investment Themes

Theme Description

Clean energy Companies involved in the production and

transmission of power from clean sources such as

solar or wind.

Industrial emissions Companies focused on improving energy efficiency

reduction (e.g. in buildings or manufacturing processes) or

creating emissions reduction products or services.

Sustainable Companies in the infrastructure and transport

infrastructure and sectors helping to reduce harmful emissions.

transportation

Water and waste Companies with products or services that enable

management reductions in usage/volumes and/or smarter ways to

manage water and waste.

Digitalisation Companies that facilitate reduced resource

consumption through digital technology.

Reporting Companies providing the means for environmental

reporting and evaluation.

.

Portfolio as at 30 June 2023

Investment Country Fair Value % of net assets

£'000

Airbus France 14,875 12.4

X-ELIO*1 Spain 13,588 11.4

Alphabet United States 13,181 11.0

Microsoft United States 13,115 11.0

Safran France 10,587 8.8

Canadian Pacific Kanas City Canada 10,291 8.6

VINCI France 9,595 8.0

Canadian National Railway Canada 8,953 7.5

Amazon.com United States 5,841 4.9

John Laing Group*2 UK 4,396 3.7

Ten largest investments 104,422 87.3

Ocean Wilsons Bermuda 3,456 2.9

TCI Real Estate Partners Fund III* United States 1,676 1.4

Union Pacific United States 869 0.7

Waste Management United States 859 0.7

ASML Netherlands 683 0.6

KLA United States 496 0.4

LAM Research United States 354 0.3

Total investments 112,815 94.3

Net current assets (including cash) 6,860 5.7

Total net assets 119,675 100.0

1 Investment made through Helios Co-Invest LP

2 Investment made through KKR Aqueduct Co-Invest LP

* Unquoted

Investment Business Theme

Description

Airbus Designs and Sustainable

manufactures infrastructure and

aircraft with transportation

the most fuel

-efficient

engines in the

industry

X-ELIO Develops and Clean energy

operates solar

energy assets

Alphabet Delivers a Digitalisation

range of

internet-based

products and

services for

users and

advertisers,

which are

powered by

renewable

energy with the

group being the

largest

corporate buyer

of renewable

power worldwide

Microsoft Provides cloud Digitalisation

infrastructure

and software

services which

deliver energy

efficiency

savings for

customers

versus legacy

solutions

Safran Designs, Industrial emissions

manufactures reduction

and services

next generation

aircraft

engines which

offer

significant

fuel efficiency

savings

Canadian Pacific Owns and Sustainable

Kanas City operates fuel infrastructure and

-efficient transportation

freight

railways in

Canada and the

USA

VINCI Builds and Sustainable

operates energy infrastructure and

efficient transportation

critical

infrastructure

assets

Canadian Operates rail Sustainable

National Railway freight infrastructure and

services across transportation

North America,

which represent

the most

environmentally

friendly way to

transport

freight over

land

Amazon.com An energy Digitalisation

efficient

ecommerce and

cloud computing

business aiming

to use only

renewable

energy by 2030

John Laing Group Portfolio of Sustainable

mostly infrastructure and

renewable rail transportation

and social

infrastructure

assets

Ocean Wilsons Operates ports Sustainable

and provides infrastructure and

lower climate transportation

impact maritime

services in

Brazil

TCI Real Estate Invests in Sustainable

Partners Fund energy infrastructure and

III -efficient real transportation

estate projects

Union Pacific Provides fuel Sustainable

-efficient rail infrastructure and

freight transportation

services across

the USA

Waste Management Provides waste Water and waste

management and management

environmental

services in

North America

ASML Develops, Digitalisation

manufactures

and services

advanced

lithography

systems used to

produce more

energy

efficient

semiconductor

chips

KLA Develops, Digitalisation

manufactures

and services

inspection and

metrology

equipment used

to increase the

efficiency of

semiconductor

manufacturing

LAM Research Develops, Digitalisation

manufactures

and services

etching and

deposition

equipment used

to produce more

energy

efficient

semiconductor

chips

.

Portfolio Manager's Review

Performance

During the ?rst half of 2023, the Company's NAV per share increased from 129.8p

to 151.4p. This represents a total return of 16.9% and compares to the benchmark

return of 5.9%. The Company's share price traded at a 36.3% discount to NAV as

at 30 June 2023. The contributions to the NAV per share total return over the

period are summarised below:

Asset Category 30 June Return

2023 Contribution

NAV % %

Public Equities 77.8 13.1

Private Investments 16.4 2.7

Cash 5.3 -

Foreign exchange forwards 1.1 2.1

Dividend Paid (0.3)

Expenses (including accruals) (0.6) (1.8)

Net Assets 100.0

Net Return 15.8

Reinvested dividend 0.3

Impact of share repurchases 0.8

Total Return 16.9

Net Assets 100.0

The easing of in?ation and hope for a soft landing in the higher interest rate

environment have buoyed equity markets this year. The consumer remains resilient

so far and dislocations in the United States regional banking sector seem to

have been successfully contained. We continue to actively look for attractive

private opportunities with better risk-reward pro?les than those in our quoted

portfolio. There is some evidence of increasing deal ?ow and a more sensible

approach to pricing which will satisfy our requirements. The global move towards

Net Zero by 2050 continues to gain momentum. More and more companies from all

sectors of the economy are establishing frameworks to reduce their greenhouse

gas (GHG) emissions. We believe our thesis of investing in businesses bene?tting

from the ef?cient use of energy and resources remains more relevant than ever.

In the current environment, the portfolio continues to prioritise quoted

equities, which represented 77.8% of the NAV at the period end. Our quoted

equities span a number of energy and resource ef?ciency themes, namely: clean

energy; digitalisation; industrial emissions reduction; sustainable

infrastructure and transport; water and waste management. These all offer

secular growth and their industry structures provide the incumbents with

formidable competitive positions. Commitments to deliver the more ef?cient use

of energy and resources are now widely recognised as adding to the shareholder

value of those companies.

Investment performance was led by our biggest digitalisation holdings

(Microsoft, Alphabet and Amazon), in a reversal of their poor performance in

2022. Within the private portfolio, KKR agreed a deal to sell its 50% stake in

Spanish solar developer, X-ELIO, to joint venture partner, Brook?eld Renewable.

We expect the transaction to complete in the second half of this year and

deliver a compounded rate of return of 13% over 8 years in US dollars. This will

be our fourth successful exit from a private investment, which, in aggregate,

will have realised gains of approximately £21 million.

Investment performance was negatively affected by the appreciation of sterling,

although this was partly offset by our forward currency contract hedges. We

realised net cash proceeds of £5.2 million from our currency hedging over the

period.

Key investment decisions during the period included the reduction of our

Alphabet position by one half and the partial redeployment of the proceeds into

a new position in Airbus in February. We continued to increase the size of the

position over the subsequent months. We regularly monitor valuation and adjust

positions accordingly where appropriate. We opted to take some pro?ts on our

Microsoft holding in June, following very strong performance. We then added the

proceeds, and some excess cash, to our Airbus, Canadian National Railway and

VINCI holdings.

Our private investment activity was limited, with no new transactions in the

period. However, we were pleased to make a new commitment to the fourth vintage

of the TCI Real Estate Partners strategy in March. This fund will follow the

same strategy, and offer similar environmental bene?ts, as the TCI Real Estate

Partners Fund III into which we made a US$15 million commitment in 2018. The

fund helps to ?nance developments which are best in class in terms of energy

ef?ciency and environmental standards.

The Company's share price has continued to trade at a signi?cant discount to its

net asset value. Following a widening of the discount in January, the Board of

Directors authorised the deployment of up to £1 million for a share buyback

program. 975,000 shares (1.2% of the total issued) costing a total of £929,000

were purchased between mid-February to early April.

We maintain a proactive stance on stewardship. We carefully assess shareholder

resolutions and engage with portfolio companies on environmental issues, while

remaining mindful of our size. We seek to promote energy transition plans to

progress towards net zero targets and greater disclosure of greenhouse gas

emission reduction and mitigation strategies. During the period we voted against

the recommendation of Amazon's management to support a resolution requesting

disclosure on how the company is protecting the retirement plan's bene?ciaries

from climate risk.

Public Equities

Quoted public equities represented 77.8% of total NAV at 30 June 2023, and

delivered a total return of 16.9% over the period, adding 13.0% to the NAV per

share.

Investment Increase/ Contribution

(Decrease) % to NAV %

Microsoft 42.0 3.9

Alphabet 35.7 3.5

Amazon 55.2 1.8

Safran 22.7 1.7

VINCI 14.0 0.8

Airbus 5.3 0.5

Ocean Wilsons 3.2 0.4

ASML 31.6 0.1

Canadian Paci?c Kansas City 8.3 0.1

LAM Research 53.0 0.1

KLA 28.6 0.1

Waste Management 10.5 -

Union Paci?c (1.2) (0.1)

Canadian National Railway 1.8 (0.2)

Note: Percentage increase/(decrease) for individual holdings is calculated on

their local currency and based over the holding period if bought or sold during

the year.

Microsoft remains the key technology partner for all enterprises and its

software products are ubiquitous. Customers can depend on Microsoft to ensure

their technology infrastructure is fully sustainable, with the company aiming to

operate on carbon-free energy everywhere, at all times, by 2030. Microsoft is

also set to be one of the prime bene?ciaries of Arti?cial Intelligence. The new

Copilot products will enable customers to harness the power of Generative AI.

The rate of adoption may be gradual, but we believe that the productivity gains

from it will support signi?cant future revenue growth. The core pro?t drivers,

Of?ce 365 Commercial and the Azure Cloud business are performing well. Of?ce 365

now has more than 380 million users and continues to grow. Azure is still

gaining market share. Percentage revenue growth has remained in the high 20s on

a year-over-year basis, even as customers have focused on optimising workloads

to reduce costs. Positively, the weaker PC market should cease to be a headwind

going forwards. With the shares up more than 40% year-to-date in US dollars, we

opted to take some pro?ts in June and reduced our position by 2.0% of NAV.

Alphabet continues to step up its response to the competitive threat posed by

Open AI/Microsoft and ChatGPT. Management is focused on using Generative AI to

enhance Google's products and services for both users and advertisers. The

launch of a new beta search experience in the US (as part of "Search Labs")

provides an AI powered snapshot of key information to consider, then suggested

next steps and has chat capabilities. The tempo of iterative product development

appears to be increasing. We welcome the new sense of urgency. The company

continues to push forward on its sustainability agenda with aims to achieve net

-zero emissions, run on 24/7 carbon-free energy and to replenish more water than

it consumes. Progress is also being made on costs, with headcount now falling

and operating margins improving. The company should be able to accelerate

revenue growth once the economy improves.

We opted to reduce our position materially in February due to concerns stemming

from heightened competition in Search, following Microsoft's launch of its new

Bing search engine. Whilst we thought that Alphabet was well positioned to fend

off this new challenge, we realised that the level of risk and range of outcomes

had widened. We sold approximately one half of our position, leaving it equal to

the pro?t we made on our original holding. We have been happy to maintain the

position since then but do continue to monitor the various anti-trust actions

against the company.

The turnaround at Amazon is gaining momentum. Pro?tability and free cash ?ow

generation have in?ected. The Retail business' operating margins have bene?ted

from lower fuel prices, falling freight rates and the switch to a regional

ful?lment model in the US. The latter translates into shorter delivery distances

and faster delivery speeds. Amazon Web Services' growth rate is also picking up

following a softer Cloud environment focused on workload optimisations. CEO

Jassy has always been adamant on the future for AWS, outlining how 90% of IT

spend is still on-premises. We were disappointed to see that Amazon recently

failed to meet the Science Based Targets initiative's (SBTi) deadline to submit

their emissions reduction targets for validation. We intend to raise this matter

during our engagement with the company.

French aircraft engine manufacturer, Safran, has continued to pro?t from the

commercial aviation industry's resurgence. The reopening of China in January

removed the last major obstacle to a full recovery. We believe air travel

remains a secular growth story, with most people still never having travelled on

a plane.

Flight cycles are the key driver of the company's ?nancial performance, with

most of its pro?ts coming from aftermarket sales of spare parts. Safran

continues to lead the way towards the decarbonisation of the aviation sector. We

were pleased to see that its emission reduction targets were independently

approved by the SBTi. These include targets to reduce Scope 1 and 2 emissions by

50% by 2030 and reduce Scope 3 emissions by 42.5% by 2035 (versus 2018).

Holding company, Ocean Wilsons, owns a controlling interest in publicly listed

Brazilian port operator, Wilson Sons, alongside a diversi?ed investment

portfolio. Wilson Sons' asset base enjoys high barriers to entry and substantial

operating leverage for growth in Brazil's international trade shipping sector.

Shipping has the lowest climate impact of any freight method, on a per unit

basis, producing between 10-40 grams of CO2 per metric ton of freight per

kilometre of transportation, which is around half that even of rail freight.

Ocean Wilsons recently con?rmed that it is undertaking a strategic review of its

investment in Wilson Sons. We believe that the company could unlock signi?cant

value, with the shares trading at more than a 50% discount to NAV at the period

end.

French infrastructure group, VINCI, bene?ted from the recovery of its Airports

business and the good performance of its Energies and Cobra contracting

businesses. Traf?c at the former is now above 90% of 2019 levels. The management

team continues to make progress on its targets to reduce Scope 1 and 2 emissions

by 40% and Scope 3 emissions by 20% by 2030. This includes the company's

construction business increasing the use of low carbon concrete for 90% of its

needs. The recent completion of the Belmonte solar farm in Brazil marks VINCI's

?rst foray into renewable power generation. The company is currently waiting for

the publication of the French government's opinion on the possibility of

changing taxes levied on motorway concessions in the country.

Our North American railroad holdings, Canadian National Railway, Canadian Paci?c

Kansas City and Union Paci?c, are currently facing a slowing economy. We view

the headwinds as only cyclical in nature. Rail retains a signi?cant cost

advantage over trucks on longer haul routes and no one is building railroads

today. Rail remains the most environmentally friendly way of transporting

freight over land, with current locomotives four times more fuel ef?cient than

trucking on a per unit basis.

We opted to add incrementally to our position in Canadian National Railway in

June. We believed the shares offered good value compared to the company's

midterm organic growth pro?le. Canadian Paci?c ?nally completed its merger with

Kansas City Southern in April. Canadian Paci?c Kansas City has multiple

opportunities to grow volumes, including by converting truck traf?c to rail. We

consider the published earnings per share guidance to be overly conservative. We

believe new Union Paci?c CEO, Jim Vena, should be able to help the company ful?l

its potential and deliver meaningful improvements in operations and pro?ts.

Signs are emerging that the semiconductor industry is ?nding a bottom to its

current cycle. A return to growth should translate into higher capital spending.

This should bene?t our semiconductor capital equipment companies, ASML, Lam

Research and KLA. Each company dominates its respective niche in the value chain

and plays a critical role in helping the wider industry both maximise

semiconductor production from ?nite resources and develop and produce more

advanced and energy ef?cient chips. We believe the fundamental drivers of

semiconductor demand remain as clear as ever: cloud computing, arti?cial

intelligence, 5G, the Internet of Things (IoT) and the digitalisation of the

automotive industry. Semiconductor manufacturers' capital intensity also

continues to increase. We expect all these companies to have very bright

futures.

Solid waste pricing is moderating as in?ation eases, but Waste Management

continues to drive forwards on its sustainability agenda. Growth investments in

new automated recycling facilities and renewable natural gas plants at land?ll

sites should help to drive double digit earnings growth going forward. The

company provides essential services and bene?ts from a high proportion of

annuity-like revenue streams, with the cost of its services representing a very

small portion (circa 0.5%) of customers' total expenses.

We opened a new position in aircraft manufacturer, Airbus, in February and

increased its size over the subsequent months to 12.4% of NAV at the period end.

We previously held the company's shares but exited in April 2021, believing that

the post Covid recovery would take signi?cantly longer than implied by the

price. Now commercial aviation's recovery from the global reaction to the Covid

pandemic is nearly complete and the secular growth of air travel appears set to

resume. Fleet renewal requirements and the need for the global aviation sector

to accelerate their decarbonisation are key drivers. By upgrading to Airbus'

latest generation aircraft, customers can reduce carbon emissions by 20-30%.

Airbus' aircraft are also certi?ed to operate on 50% sustainable aviation fuel

(SAF), with a target to reach 100% by the end of the decade.

Airbus' A320 program is the most successful aircraft family ever. Production is

sold out until 2029. Deliveries should increase from a target of 720 this year

to more than 1,000 in the coming years and underpin signi?cant earnings growth.

We were also pleased to see the company receive approval from the SBTi for its

greenhouse gas emissions near-term reduction targets. These include plans to

reduce scope 1 and 2 emissions by 63% by 2030 and reduce scope 3 emissions by

46% by 2035.

Private Investments

Our portfolio of private investments represented 16.4% of the total NAV as at 30

June 2023, and delivered a total return of 16.6% during the period, adding 2.7%

to the NAV per share.

Investment Increase/ Contribution

(Decrease) % to NAV %

X-ELIO 52.0 2.8

John Laing (2.5) (0.1)

TCI Real Estate Partners Fund III 4.5 -

Note: Percentage increase/(decrease) for individual holdings is calculated on

their local currency and based over the holding period if bought or sold during

the year.

KKR agreed a deal to sell its 50% stake in Spanish solar energy developer, X

-ELIO, to joint venture partner, Brook?eld Renewable in March. We marked up our

valuation to align with the sale price. We expect the transaction to complete in

the second half of this year and deliver a return of 2.2 times invested capital

in US dollars, equivalent to an IRR of 13% over 8 years.

TCI Real Estate Partners Fund III currently comprises three loans to separate

real estate developments in the United States. They are ?rst mortgages and have

low loan-to-value ratios (less than 60%). These developments are best in class

in terms of energy ef?ciency and environmental standards. Buildings contribute

more than 30% of GHG emissions in the United States and raising their ef?ciency

levels is vital to reducing emissions. Whilst the Fund did not manage to commit

the level of capital we originally hoped, investment returns have remained in

line with expectations. The Fund has continued to draw down from its remaining

commitment (circa US$3.2 million) in line with the schedules of its existing

loans. We expect the last loan to be repaid in 2026.

John Laing is an active manager of public-private partnerships and similar

concession-based assets. The company makes both green and brown?eld investments.

Environmental impacts are managed on an asset by asset basis and the ?rm is

seeking to achieve a net zero transition for its direct operations by 2050 or

before. We marked down our valuation to align with the manager's latest

valuation, with the downgrade being primarily driven by losses on currency

translation. KKR's overhaul of the company's operations continues, with the

appointment of Andrew Truscott as CEO in March. Recent investments include the

acquisition of a majority stake in National Road RV555, Norway's largest PPP,

and the purchase of three Irish infrastructure assets from AMP Capital. The

latter consisting of Valley Healthcare, a portfolio of primary care centres, the

Convention Centre Dublin and Towercom, a mobile tower operator.

We were pleased to ?nalise a new US$25 million commitment to the TCI Real Estate

Partners Fund IV. This fund will follow the same strategy, and offer similar

environmental bene?ts, as the TCI Real Estate Partners Fund III. The coronavirus

epidemic provided a stress test for Fund III. We were very pleased that while

certain developments were affected by construction delays, return expectations

on the loans remained unchanged. Each loan has several elements of downside

protection such as credit seniority, loan-to-value ratios of up to 65% and

completion and carry guarantees. The strategy has only ever recorded one loss

out of 37 loans. The manager believes that stress is starting to permeate real

estate credit markets and that the emerging conditions should underpin strong

demand for its differentiated ?nancing. Furthermore, the rise in interest rates

has increased the relative attractiveness of their traditionally premium rates.

The manager is targeting gross returns of 11-14%. We believe this level of

return represents an exceptional balance between risk and reward. We expect the

fund to start drawing down this year. We expect our net invested amount, on a

cost basis, to peak at approximately 70% of the total commitment in mid-2026.

FX Hedges

The aim of our currency hedging policy, to date, has been to address volatility

inherent in the portfolio's exposure to both the US dollar and the euro. While

in this period we realised proceeds of £5.2 million, we continue to keep the

policy under review.

Outlook

We continue to focus on what we can control. Our preference remains for

investments which require us to make as few predictions as possible. We believe

our criteria of investing in energy and resource ef?ciency businesses offering

quality and value should leave the portfolio well placed to generate superior

risk adjusted returns over time in most market conditions.

Private investment opportunities are becoming more interesting, with higher

expected returns. We believe that the balance between risk and reward on

proposed transactions is improving but we will take a considered approach to

committing capital. We continue to evaluate new transactions with a critical

lens. We will only make private investments when they offer a more attractive

balance between risk and reward compared to public markets. We believe the next

vintage of TCI Real Estate Partners' strategy met this criteria and were very

happy to make a substantial commitment (US$25 million) in March. We expect to

earn comparable returns to equity markets, whilst incurring substantially less

risk due to our more senior position in the capital structure.

Following the strong year to date returns, the Company's net asset value per

share has now compounded at over 10%, after fees, for the ?ve years ended 30

June 2023. Share price performance continues to trail net asset value returns.

We believe the two should converge in time. We remain optimistic on both our

energy and resource ef?ciency investment thesis and our current portfolio's

prospects.

Performance 30/06/22 - 30/06/20 - 30/06/18 - 30/06/16 - 31/07/15 -

CAGR % 30/06/23 30/06/23 30/06/23 30/06/23 30/06/23

1Yr 3Yr 5Yr 7Yr Inception

NAV per share 12.5% 10.5% 10.3% 9.6% 5.8%

Share Price (2.4%) 4.9% 6.6% 6.8% (0.2%)

RPI+3% 11.2% 9.8% 7.6% 7.1% 6.9%

Note: Figures are adjusted for cumulative dividend reinvestments

Menhaden Capital Management LLP

Portfolio Manager

14 September 2023

.

Regulatory Disclosures

Principal Risks and Uncertainties

The principal risks and uncertainties faced by the Company are explained in

detail in the Company's Annual Report for the year ended 31 December 2022 (the

"Annual Report"). The Board believes that the Company's principal risks and

uncertainties have not changed materially since the date of the Annual Report

and are not expected to change materially for the remaining six months of the

Company's ?nancial year.

Related Parties Transactions

During the ?rst six months of the current ?nancial year, no transactions with

related parties have taken place which have materially affected the ?nancial

position or the performance of the Company.

Going Concern

The Directors believe, having considered the Company's investment objective,

risk management policies, capital management policies and procedures, the nature

of the portfolio and the expenditure projections, that the Company has adequate

resources, an appropriate ?nancial structure and suitable management

arrangements in place to continue in operational existence for the foreseeable

future and, more speci?cally, that there are no material uncertainties

pertaining to the Company that would prevent its ability to continue in such

operational existence for at least twelve months from the date of the approval

of this half year report. For these reasons, the Directors consider it is

appropriate to continue to adopt the going concern basis in preparing the

?nancial statements.

.

Directors' Responsibilities Statement

The Board con?rms that, to the best of the Directors' knowledge:

(i)the condensed set of ?nancial statements contained within the half year

report has been prepared in accordance with FRS 104 `Interim Financial

Reporting' and gives a true and fair view of the assets, liabilities, ?nancial

position and return of the Company; and

(ii) the interim management report includes a fair review of the information

required by sections 4.2.7R and 4.2.8R of the UK Listing Authority Disclosure

Guidance and Transparency Rules.

In order to provide these con?rmations, and in preparing these ?nancial

statements, the Directors are required to:

· select suitable accounting policies and then apply them consistently;

· make judgements and accounting estimates that are reasonable and prudent;

· state whether applicable UK Accounting Standards have been followed, subject

to any material departures disclosed and explained in the ?nancial statements;

and

· prepare the ?nancial statements on the going concern basis unless it is

inappropriate to presume that the Company will continue in business;

and the Directors con?rm that they have done so.

This half year report contains certain forward-looking statements. These

statements are made by the Directors in good faith based on the information

available to them up to the date of this report and such statements should be

treated with caution due to the inherent uncertainties, including both economic

and business risk factors, underlying any such forward-looking information.

Howard Pearce

Chairman

14 September 2023

.

Condensed Income Statement

Six months Six months

to 30 June to 30 June

2023 2022

(unaudited) (unaudited)

Note Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000

Gains/(losses) - 17,492 17,492 - (17,838) (17,838)

on investments

at

fair value

through profit

or loss

Income from 5 1,129 - 1,129 761 - 761

investments

Management and 6,9 (161) (1,079) (1,240) (164) 1,021 857

performance fees

Other expenses (193) - (193) (221) - (221)

Net 775 16,413 17,188 376 (16,817) (16,441)

returns/(losses)

before

taxation

Taxation (99) - (99) (57) - (57)

Net 676 16,413 17,089 319 (16,817) (16,498)

returns/(losses)

after

taxation

Basic and 7 0.8p 20.7p 21.5p 0.4p (21.0)p (20.6)p

diluted

returns/(losses)

per share

The total column of this statement is the profit and loss account of the

Company. The supplementary revenue and capital columns are prepared under

guidance issued by the Association of Investment Companies' Statement of

Recommended Practice.

All revenue and capital items in the above statement derive from continuing

operations.

There are no recognised gains or losses other than those shown above and

therefore no Statement of Total Comprehensive Income has been presented.

.

Condensed Statement of Changes in Equity

Called Special Capital Capital Revenue Total

up reserve redemption reserve reserve £'000

share £'000 Reserve £'000 £'000

capital £'000

£'000

Six months

to 30 June

2023

(unaudited)

Balance at 800 77,371 - 24,970 690 103,831

31 December

2022

Net returns - - - 16,413 676 17,089

after

taxation

Repurchase (10) (929) 10 - - (929)

of ordinary

shares for

cancellation

Dividends - - - - (316) (316)

paid

Balance at 790 76,442 10 41,383 1,050 119,675

30 June 2023

Six months

to 30 June

2022

(unaudited)

Balance at 800 77,371 - 45,996 364 124,531

31 December

2021

Net - - - (16,817) 319 (16,498)

(losses)/retu

rns

after

taxation

Dividends - - - - (160) (160)

paid

Balance at 800 77,371 - 29,179 523 107,873

30 June 2022

.

Condensed Statement of Financial Position

Note As at As at

30 June 2023 31 December 2022

(unaudited) (audited)

£'000 £'000

Fixed assets

Investments at fair 8 112,815 93,809

value through pro?t or

loss

Current assets

Debtors 76 104

Derivative ?nancial 8 1,259 4,200

instruments

Cash 6,249 6,061

7,584 10,365

Current liabilities

Creditors: amounts (291) (343)

falling due within one

year

Performance fee 9 (433) -

provisions

Net current assets 6,860 10,022

Net assets 119,675 103,831

Capital and reserves

Called up share capital 790 800

Special reserve 76,442 77,371

Capital redemption 10 -

reserve

Capital reserve 41,383 24,970

Revenue reserve 1,050 690

Total shareholders' 119,675 103,831

funds

Net asset value per 151.4p 129.8p

share

.

Condensed Cash Flow Statement

Six months to Six months to

30 June 2023 30 June 2022

(unaudited) (unaudited)

£'000 £'000

Net cash inflow/(outflow) 6 (299)

from operating activities

Investing activities

Purchases of investments (18,982) (10,049)

Sales of investments 15,172 20,017

Settlement of derivatives 5,237 (3,618)

Net cash inflow from 1,427 6,350

investing activities

Financing activities

Dividends paid (316) (160)

Repurchase of ordinary (929) -

shares for cancellation

Net cash outflow from (1,245) (160)

financing activities

Increase in cash and cash 188 5,891

equivalents

Cash and cash equivalents 6,061 878

at beginning of period

Cash and cash equivalents 6,249 6,769

at end of period

.

Notes to the Financial Statements

1FINANCIAL STATEMENTS

The condensed ?nancial statements contained in this interim ?nancial report do

not constitute statutory accounts as de?ned in s434 of the Companies Act 2006.

The ?nancial information for the six months to 30 June 2023 and 30 June 2022 has

not been audited or reviewed by the Company's external auditor.

The information for the year ended 31 December 2022 has been extracted from the

latest published audited ?nancial statements. Those statutory ?nancial

statements have been ?led with the Registrar of Companies and included the

report of the auditor, which was unquali?ed and did not contain a statement

under Sections 498(2) or (3) of the Companies Act 2006.

No statutory accounts in respect of any period after 31 December 2022 have been

reported on by the Company's auditor or delivered to the Registrar of Companies.

Earnings for the ?rst six months should not be taken as a guide to the results

for the full year.

2ACCOUNTING POLICIES

These condensed ?nancial statements have been prepared on a going concern basis

in accordance with the Disclosure Guidance and Transparency Rules of the

Financial Conduct Authority, FRS 104 `Interim Financial Reporting', the April

2021 Statement of Recommended Practice `Financial Statements of Investment Trust

Companies and Venture Capital Trusts' and using the same accounting policies as

set out in the Company's Annual Report for the year ended 31 December 2022.

3GOING CONCERN

After making enquiries, and having reviewed the investments, Statement of

Financial Position and projected income and expenditure for the next 12 months,

the Directors have a reasonable expectation that the Company has adequate

resources to continue in operation for the foreseeable future. The Directors

have therefore adopted the going concern basis in preparing these ?nancial

statements.

4PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks facing the Company together with an explanation of these

risks and how they are managed is contained in the Strategic Report and note 17

of the Company's Annual Report for the year ended 31 December 2022.

5INCOME

Six months to Six months to

30 June 2023 30 June 2022

(unaudited) (unaudited)

£'000 £'000

Income from investments

Overseas dividends 1,103 761

Total income from investments 1,103 761

Other income

Interest income 26 -

Total income 1,129 761

6AIFM AND PORTFOLIO MANAGEMENT FEES

Six months Six months

to 30 June to 30 June

2023 2022

(unaudited) (unaudited)

Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000

AIFM fee 25 99 124 25 101 126

Portfolio 136 546 682 139 555 694

management fee

Provision for - 434 434 - (1,677) (1,677)

performance

fee

161 1,079 1,240 164 (1,021) (857)

7RETURNS/(LOSSES) PER SHARE

The revenue and capital returns/(losses) per share are based on the weighted

average number of Ordinary shares in issue during the six months to 30 June

2023, 79,375,968, and 30 June 2022, 80,000,001. The calculation of the total,

revenue and capital returns/(losses) per share is carried out in accordance with

IAS 33, "Earnings per Share".

There are no dilutive instruments in the Company and so basic and diluted

returns/(losses) are the same.

8FAIR VALUE HIERARCHY

The methods of fair value measurement are classi?ed into a hierarchy based on

reliability of the information used to determine the valuation.

Level 1-Quoted prices in active markets.

Level 2-Inputs other than quoted prices included within Level 1 that are

observable (i.e. developed using market data), either directly or indirectly.

Level 3-Inputs are unobservable (i.e. for which market data is unavailable).

The table below sets out the Company's fair value hierarchy investments as at 30

June 2023.

Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

As at 30 June 2023 (unaudited)

Investments 93,155 - 19,660 112,815

Derivatives - 1,259 - 1,259

As at 31 December 2022 (audited)

Investments 76,945 - 16,864 93,809

Derivatives - 4,200 - 4,200

9PROVISIONS

Provisions are recognised when a present obligation arises from past events, it

is probable that the obligation will materialise and it is possible for a

reliable estimate to be made, but the timing of settlement or the exact amount

is uncertain.

Full details of the performance fee arrangement can be found in the Company's

Annual Report for the year ended 31 December 2022.

.

Glossary of Terms

Alternative Performance Measures ("APMs") Measures not speci?cally de?ned under

the International Financial Reporting Standards but which are viewed as

particularly relevant for investment trusts and which the

Board of Directors uses to assess the Company's performance. De?nitions of the

terms used and the basis of calculation are set out in this Glossary.

Discount/Premium (APM)

A description of the difference between the share price and the net asset value

per share. The size of the discount or premium is calculated by subtracting the

share price from the net asset value per share and is usually expressed as a

percentage (%) of the net asset value per share. If the share price is higher

than the net asset value per share the result is a premium. If the share price

is lower than the net asset value per share the shares are trading at a

discount.

Net Asset Value ("NAV") Per Share

The value of the Company's assets, principally investments made in other

companies and cash held, minus any liabilities. The NAV is also described as

"shareholders' funds". The NAV is often expressed in pence per share after being

divided by the number of shares that have been issued. The NAV per share is

unlikely to be the same as the share price, which is the price at which the

Company's shares can be bought or sold by an investor. The share price is

determined by the relationship between the demand for and supply of the shares.

NAV Total Return (APM)

The theoretical total return on shareholders' funds per share, re?ecting the

change in NAV assuming that dividends paid to shareholders were reinvested at

NAV at the time the shares were quoted ex-dividend. A way of measuring

investment management performance of investment trusts which is not affected by

movements in the share price.

30 June 31 December

2023 2022

(unaudited) (audited)

Opening NAV 129.8p 155.7p

Increase/(decrease) in NAV 21.7p (25.9)p

Closing NAV 151.4p 129.8p

% Increase/(decrease) in NAV 16.6% (16.6)%

Impact of dividend reinvested 0.3% 0.1%

NAV Total Return 16.9% (16.5)%

Share Price Total Return (APM)

Share price total return to a shareholder, on a last traded price to a last

traded price basis, assuming that all dividends received were reinvested,

without transaction costs, into the shares of the Company at the time the shares

were quoted ex-dividend.

30 June 31 December

2023 2022

(unaudited) (audited)

Opening share price 89.0p 112.0p

Increase/(decrease) in share price 7.5p (23.0)p

Closing share price 96.5p 89.0p

% Increase/(decrease) in share price 8.4% (20.5)%

Impact of reinvested dividends 0.4% 0.2%

Share Price Total Return 8.8% (20.3)%

Ongoing Charges (APM)

Ongoing charges are calculated by taking the Company's annualised operating

expenses excluding ?nance costs, taxation and exceptional items, and expressing

them as a percentage of the average daily net asset value of the Company over

the period. The costs of buying and selling investments and performance fees are

excluded, as are interest costs, taxation, costs of buying back or issuing

shares and other non-recurring costs. These items are excluded because if

included, they could distort the understanding of the Company's performance for

the period and the comparability between periods.

30 June 31 December

2023 2022

(unaudited) (audited)

£'000 £'000

Total operating expenses 1,000 2,018

Total operating expenses (annualised) 2,000 2,018

Average NAV during the period/year 112,658 111,560

Ongoing Charges 1.8% 1.8%

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

September 15, 2023 02:00 ET (06:00 GMT)

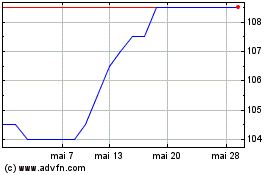

Menhaden Resource Effici... (LSE:MHN)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Menhaden Resource Effici... (LSE:MHN)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024