TIDMMILA

RNS Number : 3175H

Mila Resources PLC

27 July 2023

Mila Resources Plc / Index: LSE / Epic: MILA / Sector: Natural

Resources

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR") as applied in

the United Kingdom. Upon publication of this Announcement, this

information is now considered to be in the public domain.

27 July 2023

Mila Resources Plc

('Mila' or the 'Company')

Option Agreement with Liontown Resources to Explore for

Lithium

&

Amendments to Kathleen Valley Earn-In Agreement

Mila Resources Plc (LSE:MILA), the post-discovery gold

exploration accelerator is pleased to announce that, together with

the other owners of the Kathleen Valley licence ("Licence"), it has

entered into an option agreement with LBM (Aust) Pty Limited, a

subsidiary of Liontown Resources Limited (ASX: LTR) ('Liontown'),

granting Liontown the option to explore for lithium on the Kathleen

Valley Licence Area in Western Australia ('KV Project').

Simultaneously it has entered into a deed of amendment with

Trans Pacific Energy Group Pty Ltd ("TPE") and New Generation

Minerals Limited ("NGM"), the other owners of the Licence, making

certain amendments to the Earn-In Agreement between them dated 29

October 2021 ("Earn-In Agreement") as part of the re-listing of the

Company on the LSE in November 2021.

Overview

-- Liontown, the ASX lithium developer with a market

capitalisation of A$6.0 billion, expects to bring its proximal

Kathleen Valley Lithium Project into production in mid 2024, for

which it has offtake arrangements in place with LG, Ford and

Tesla.

-- Under the proposed transaction, Liontown will fund all

lithium exploration activities, mining costs and associated

Heritage Surveys.

-- Mila, TPE and NGM will maintain ownership over the gold and

other minerals on the Licence Area.

-- Following initial exploration, Liontown will have the option

to acquire the right to extract lithium from the Licence Area

("Lithium Rights").

-- Liontown has the option to acquire up to 80% of the Lithium

Rights from Mila and TPE for a total consideration of up to

A$2,200,000 through a phased investment programme.

-- By agreement with TPE and NGM, Mila currently has a 50%

interest, in the Lithium Rights, representing 10% of the Lithium

Rights following full exercise by Liontown of its option.

Transaction Rationale

-- Liontown has significant experience and expertise in lithium

exploration and development specific to the wider Kathleen Valley

area and has established itself as one of the most successful

lithium explorers in Australia.

-- All drill and assay analyses from Liontown's work at the KV

Project will be shared with Mila's exploration team, potentially

enabling a further acceleration of geological assessment across the

full KV Project at limited cost to Mila.

-- Liontown will be liable for all costs associated with the

Heritage Surveys over the relevant areas of the KV Licence and will

apply its significant expertise in Heritage Survey management

enabling Mila to leverage off the development of these studies for

the purposes of its own gold exploration and development

activities.

The Liontown Transaction

The transaction has granted Liontown the option to acquire the

Lithium Rights on the Licence in a phased programme as follows:

1. Liontown will fund the exploration and mining costs and bring

the benefit of its considerable knowledge of local geology to the

project.

2. Liontown may acquire a 50% interest in the lithium rights on

the Licence for a consideration of A$200,000; and

3. Liontown may acquire a further 30% interest in the lithium

rights for consideration of $2,000,000.

Liontown has also agreed, subject to completion of transaction

documentation, to invest A$100,000 in Mila through a convertible

loan on the following principal terms:

1. the Notes are repayable by conversion into Mila Shares at a

price to be determined on Mila's next fundraise;

2. Mila may repay the Notes without penalty after 31 December 2023;

3. Liontown may redeem the Notes following the occurrence of

usual events of default or if the Notes have not been converted

into Mila Shares by 30 November 2023; and

4. the Notes carry no interest except on the occurrence an event

of default, when interest at 10% per annum will become payable.

Amendment to the Earn-In Agreement

Mila, TPE and NGM have also entered into a deed of amendment

amending the Earn-In Agreement ("Deed of Amendment") pursuant to

which they have agreed that Mila may:

-- increase its Participating Interest in the Licence from its

current 30% to 80% on the issue of the Stage Two Consideration

Shares;

-- increase its ownership of the current Lithium rights from 50%

to 80% on the issue of the Stage Three Consideration Shares,

representing 16% of the Lithium Rights following full exercise by

Liontown of its option; and

-- at any time when the Parties are not conducting a physical

drilling campaign, reduce Mila's liability for expenditure to

maintain the Licence to its Participating Interest (currently

30%).

Mark Stephenson commented:

"This is a highly exciting development which adds a new and

potentially valuable dimension to the Kathleen Valley Project.

"Through this agreement with Liontown, we will see lithium

exploration underway at this area of the Licence, which has been

untested to date, and opened-up for exploration whilst being

insulated from costs. This lithium mineralisation has been shown to

have strategic importance on an international scale, most recently

evidenced by a proposed A$5.5 billion bid for Liontown by Albemarle

Corporation (ALB.N) one of the largest lithium producers worldwide.

In rejecting the Albemarle approach Liontown asserted its belief

that the bid substantially undervalued Liontown, highlighting the

significant commercial value of the lithium mineralisation

potentially on our doorstep.

"In addition to Liontown's work unlocking the lithium value from

this area of the Licence, we will also benefit from their funding

of supplementary development work including Heritage Surveys, which

are a significant undertaking. We expect there to be considerable

geological knowledge from Liontown's exploration data on this area

which we will apply to our own understanding of the gold

minerlisation at Kathleen Valley, as we look to expand our gold

resource inventory this year.

"Finally, the benefits and synergies of this work comes at no

incremental cost to Mila and allows us to leverage the deep local

experience from the Liontown team."

**ENDS**

For more information visit www.milaresources.com or contact:

Mark Stephenson info@milaresources.com

Mila Resources Plc

Jonathan Evans

Tavira Financial Limited +44 (0) 20 7100 5100

Nick Emerson

SI Capital +44 (0) 20 3143 0600

Susie Geliher

St Brides Partners Limited +44 (0) 20 7236 1177

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRFLFVRDVIRFIV

(END) Dow Jones Newswires

July 27, 2023 02:00 ET (06:00 GMT)

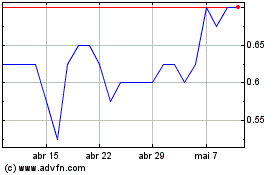

Mila Resources (LSE:MILA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Mila Resources (LSE:MILA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024