TIDMMPL

RNS Number : 1803C

Mercantile Ports & Logistics Ltd

09 June 2023

THIS ANNOUNCEMENT (THE "ANNOUNCEMENT") AND THE INFORMATION

CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE

OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR

INTO THE UNITED STATES OF AMERICA, ITS STATES, TERRITORIES AND

POSSESSIONS ("UNITED STATES"), AUSTRALIA, CANADA, JAPAN, SINGAPORE,

THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH

SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE PROHIBITED BY

ANY APPLICABLE LAW.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR ISSUE

OR THE SOLICITATION TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY

SECURITIES.

THIS ANNOUNCEMENT WAS DEEMED BY THE COMPANY (DEFINED BELOW) TO

CONTAIN INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF

REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK LAW PURSUANT TO

THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS (SI 2019/310) ("UK

MAR").

9 June 2023

Mercantile Ports & Logistics Limited

("MPL" or the "Company" and, together with its subsidiaries, the

"Group")

Result of Placing and Subscription

Further to the announcement of 8 June 2023 regarding a proposed

placing, subscription and retail offer (the "Launch Announcement"),

Mercantile Ports & Logistics Limited (AIM: MPL) is pleased to

announce that it has conditionally raised gross proceeds of

approximately GBP 8.9 million (before expenses) under the Placing

and Subscription. In total, 101,949,999 Placing Shares have been

conditionally placed and 195,000,000 Subscription Shares have been

conditionally subscribed for, in each case at the Issue Price of 3

pence per share.

Other than where defined, capitalised terms used in this

announcement have the meanings given to them in the Launch

Announcement.

Cenkos Securities is acting as agent for and on behalf of the

Company in respect of the Placing. The Placing was conducted by way

of an accelerated book build process.

The Retail Offer was launched by way of a separate announcement

at 4.35 p.m. on 8 June 2023.

Related Party Transactions

The following directors of the Company (the " Directors ") and

their related parties have agreed to participate in the Equity

Fundraising by subscribing for Placing Shares or Subscription

Shares (as applicable) at the Issue Price:

Percentage

of Enlarged

Number Number Share

Number of Placing of Ordinary Capital

Existing of Subscription Shares Shares held following

Director/Related beneficial Shares subscribed subscribed following Admission

Party shareholdings for for Admission (1)

Hunch Ventures

(2) 11,819,712 125,000,000 - 136,819,712 36.2%

--------------- ------------------- ------------ ------------- -------------

Jay Mehta 205,780 3,333,333 - 3,539,113 0.9%

--------------- ------------------- ------------ ------------- -------------

Jeremy Warner

Allen 519,545 - 3,333,333 3,852,878 1.0%

--------------- ------------------- ------------ ------------- -------------

Lord Howard

Flight 230,538 - 400,000 630,538 0.2%

--------------- ------------------- ------------ ------------- -------------

TOTAL 12,775,575 128,333,333 3,733,333 144,842,241 38.3%

--------------- ------------------- ------------ ------------- -------------

(1) Assumes that there is full take up of the Retail Offer.

(2) Hunch Ventures is 100% owned by Karanpal Singh, a

non-executive Director, and his wife Ms. Himangini Singh.

Any subscriptions for Subscription Shares or Placing Shares by

Hunch Ventures or by the Directors above (as applicable) constitute

related party transactions for the purposes of Rule 13 of the AIM

Rules by virtue of such persons being: (i) Directors and (ii) a

substantial shareholder in the case of Hunch Ventures, and

therefore related parties (the " Related Party Transactions "). The

Directors who are independent of each Related Party Transaction

have consulted with Cenkos Securities, the Company's nominated

adviser for the purposes of the AIM Rules, and consider that the

terms of each Related Party Transaction are fair and reasonable in

so far as the Shareholders are concerned.

Admission, Settlement and Dealings

Application will be made to the London Stock Exchange for

admission of the New Ordinary Shares to trading on AIM, being the

market of that name operated by the London Stock Exchange ("

Admission ").

It is expected that admission of the New Ordinary Shares will

take place on or around 8.00 a.m. on 28 June 2023 and that dealings

in the New Ordinary Shares on AIM will commence at the same

time.

In addition to the passing of certain Resolutions at the General

Meeting , the Placing and Subscription, are conditional upon, inter

alia, Admission becoming effective. The Placing is not conditional

on the Subscription being completed, nor is any part of the Placing

subject to clawback from the Retail Offer.

Following Admission of the Placing Shares and the Subscription

Shares and assuming the full take up of the Retail Offer, the

Company will have 378,449,698 Ordinary Shares in issue. The New

Ordinary Shares to be issued, when issued, will be fully paid and

will rank pari passu in all respects with the Existing Ordinary

Shares, including the right to receive all dividends and other

distributions declared, made or paid after the date of issue.

A further announcement will be made in relation to total voting

rights in the Company's share capital following the allotment and

issue of the New Ordinary Shares.

The Circular, containing further details of the Equity

Fundraising and notice of the General Meeting to be held on or

around 11.00 a.m. on 27 June 2023 to, inter alia, approve the

resolutions required to implement the Equity Fundraising, is

expected to be published and despatched to Shareholders today.

Following its publication, the Shareholder Circular will be

available on the Group's website at

https://www.mercpl.com/article/investor-relations/shareholder-circulars/9

.

For the purposes of UK MAR, the person responsible for arranging

release of this announcement on behalf of the Company is Jay Mehta,

Managing Director.

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notice" section of this Announcement.

For further information, please visit www.mercpl.com or

contact:

MPL C/O SEC Newgate

+44 (0) 20 3757 6880

Cenkos Securities plc Stephen Keys

(Nomad and Broker) +44 (0) 20 7397 8900

------------------------------

SEC Newgate Elisabeth Cowell/ Bob Huxford

(Financial Communications) +44 (0) 20 3757 6880

mpl@newgatecomms.com

------------------------------

IMPORTANT NOTICE

This Announcement, and the information contained herein is not

for release, publication or distribution, directly or indirectly,

in whole or in part, in or into or from any Restricted

Jurisdiction.

This Announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The New Ordinary Shares referred to herein have not

been and will not be registered under the Securities Act and may

not be offered or sold in the United States, expect pursuant to an

applicable exemption from registration. No public offering of New

Ordinary Shares is being made in the United States.

This Announcement does not constitute or form part of an offer

to sell or issue or a solicitation of an offer to buy, subscribe

for or otherwise acquire any securities in any jurisdiction

including, without limitation, the Restricted Jurisdictions or any

other jurisdiction in which such offer or solicitation would be

unlawful. This Announcement and the information contained in it is

not for publication or distribution, directly or indirectly, to

persons in a Restricted Jurisdiction, unless permitted pursuant to

an exemption under the relevant local law or regulation in any such

jurisdiction.

No action has been taken by the Company or Cenkos Securities or

any of their respective directors, officers, partners, agents,

employees or affiliates that would permit an offer of the New

Ordinary Shares or possession or distribution of this Announcement

or any other publicity material relating to such New Ordinary

Shares in any jurisdiction where action for that purpose is

required. Persons receiving this Announcement are required to

inform themselves about and to observe any restrictions contained

in this Announcement.

This Announcement is directed only at persons in Member States

of the EEA who are "qualified investors" in such Member State

within the meaning of Article 2 (e) of the EU Prospectus Regulation

or the United Kingdom within the meaning of the UK Prospectus

Regulation. In addition, in the United Kingdom, this Announcement

is directed only at Relevant Persons. No other person should act on

or rely on this Announcement and persons distributing this

Announcement must satisfy themselves that it is lawful to do so. By

accepting the terms of this Announcement, investors represent and

agree that they are a Relevant Person.

This Announcement must not be acted on or relied on by persons

who are not Relevant Persons. Any investment or investment activity

to which this Announcement or the Equity Fundraising relate is

available only to Relevant Persons and will be engaged in only with

Relevant Persons. As regards all persons other than Relevant

Persons, the details of the Equity Fundraising set out in this

Announcement are for information purposes only.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement should seek appropriate advice before taking

any action.

This Announcement has not been approved by the London Stock

Exchange or any other securities exchange.

This Announcement is not being distributed by, nor has it been

approved for the purposes of section 21 of FSMA by Cenkos

Securities or any other person authorised under FSMA. This

Announcement is being distributed and communicated to persons in

the United Kingdom only in circumstances in which section 21(1) of

FSMA does not apply.

No prospectus or offering document will be made available in

connection with the matters contained in this Announcement and no

such prospectus is required (in accordance with the EU Prospectus

Regulation or the UK Prospectus Regulation) to be published.

Certain statements in this Announcement are forward-looking

statements which are based on the Company's expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts. These forward-looking statements, which may use

words such as "aim", "anticipate", "believe", "could", "intend",

"estimate", "expect" and words of similar meaning, include all

matters that are not historical facts. These forward-looking

statements involve risks, assumptions and uncertainties that could

cause the actual results of operations, financial condition,

liquidity and dividend policy and the development of the industries

in which the Group's businesses operate to differ materially from

the impression created by the forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties and other factors that

could cause actual results to differ materially from those

expressed or implied by such forward-looking statements. Given

those risks and uncertainties, prospective investors are cautioned

not to place undue reliance on forward-looking statements.

Forward-looking statements speak only as of the date of such

statements and, except as required by the FCA, the London Stock

Exchange or applicable law, the Company undertakes no obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events or otherwise.

Any indication in this Announcement of the price at which the

Ordinary Shares have been bought or sold in the past cannot be

relied upon as a guide to future performance. Persons needing

advice should consult an independent financial adviser. No

statement in this Announcement is intended to be a profit forecast

and no statement in this Announcement should be interpreted to mean

that earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings per share of the Group.

Cenkos Securities, which is authorised and regulated in the

United Kingdom by the FCA, is acting for the Company and for no one

else in connection with the Equity Fundraising and will not be

responsible to anyone other than the Company for providing the

protections afforded to clients of Cenkos Securities or for

providing advice in relation to the New Ordinary Shares, or any

other matters referred to in this Announcement.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by or on behalf of the Company, Cenkos

Securities, or by their affiliates or their respective agents,

directors, officers and employees as to, or in relation to, the

accuracy or completeness of this Announcement or any other written

or oral information made available to or publicly available to any

interested party or its advisers, and any liability therefor is

expressly disclaimed.

The New Ordinary Shares to be issued pursuant to the Equity

Fundraising will not be admitted to trading on any stock exchange

other than to trading on AIM, being the market of that name

operated by the London Stock Exchange.

The Appendix to the Launch Announcement sets out the terms and

conditions of the Placing. By participating in the Placing, each

person who is invited to and who chooses to participate in the

Placing by making or accepting an oral and legally binding offer to

acquire Placing Shares will be deemed to have read and understood

this Announcement and the Launch Announcement in their entirety and

to be making such offer on the terms and subject to the conditions

set out in the Launch Announcement and to be providing the

representations, warranties, undertakings and acknowledgements

contained in the Appendix to the Launch Announcement.

Members of the public are not eligible to take part in the

Equity Fundraising, and no public offering of New Ordinary Shares

is being or will be made.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

UK Product Governance Requirements

Solely for the purposes of the UK Product Governance Rules, and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the UK Product Governance Rules) may otherwise have with respect

thereto, the Placing Shares have been subject to a UK Target Market

Assessment. Notwithstanding the UK Target Market Assessment,

distributors should note that: the price of the Placing Shares may

decline and investors could lose all or part of their investment;

the Placing Shares offer no guaranteed income and no capital

protection; and an investment in the Placing Shares is compatible

only with investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The UK

Target Market Assessment is without prejudice to the requirements

of any contractual, legal or regulatory selling restrictions in

relation to the Placing. Furthermore, it is noted that,

notwithstanding the UK Target Market Assessment, Cenkos Securities

will only procure investors who meet the criteria of professional

clients and eligible counterparties.

For the avoidance of doubt, the UK Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of COBS 9A and COBS 10A, respectively; or (b) a

recommendation to any investor or group of investors to invest in,

or purchase or take any other action whatsoever with respect to the

Placing Shares. Each distributor is responsible for undertaking its

own UK target market assessment in respect of the Placing Shares

and determining appropriate distribution channels.

EU Product Governance Requirements

Solely for the purposes of the MiFID II Product Governance

Requirements, and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any "manufacturer"

(for the purposes of the MiFID II Product Governance Requirements)

may otherwise have with respect thereto, the Placing Shares have

been subject to a Target Market Assessment. Notwithstanding the

Target Market Assessment, distributors should note that: the price

of the Placing Shares may decline and investors could lose all or

part of their investment; the Placing Shares offer no guaranteed

income and no capital protection; and an investment in the Placing

Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without

prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Placing.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, Cenkos Securities will only procure investors who meet

the criteria of professional clients and eligible

counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

ROIFFFILRSITIIV

(END) Dow Jones Newswires

June 09, 2023 02:00 ET (06:00 GMT)

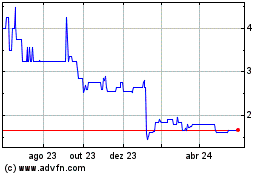

Mercantile Ports & Logis... (LSE:MPL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

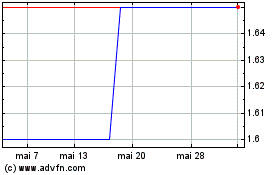

Mercantile Ports & Logis... (LSE:MPL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024