Mothercare PLC Pre-close Trading Update

04 Maio 2023 - 3:00AM

UK Regulatory

TIDMMTC

Mothercare plc

Pre-close trading update

Mothercare plc ("Mothercare" or "the Company"), the global

specialist brand for parents and young children, today issues a

pre-close trading update for the financial year ended 25 March 2023

("FY23"). This update is based upon draft figures pending

finalisation of the year end audit.

Highlights

-- Unaudited net worldwide retail sales by franchise partners of GBP322

million for the year, includes no contribution from the Russian market,

which was suspended at the end of our previous financial year,

representing an increase of 8% in continuing markets.

-- Adjusted EBITDA of GBP6.5 to GBP7 million for FY23, ahead of analysts'

expectations

-- Net debt of GBP12.3 million at the year end

-- Pension scheme deficit materially reduced to GBP39 million (March 2020:

GBP124.6 million, March 2022 GBP78 million)

EBITDA before adjusting items is now expected in the range of

GBP6.5 to

GBP7 million for the financial year to 25 March 2023. For the prior year to March 2022 our Russian territory directly contributed some GBP5.5 million to our adjusted EBITDA, which coupled with some margin benefit due to shipping delays in last year's results, means there is a year on year improvement in the underlying profitability of the business, once these elements are excluded.

Unaudited net worldwide retail sales by franchise partners were

GBP322 million, compared to GBP385 million for the previous

financial year which included GBP88 million from Russia. Hence

total retail sales for the year to March 2023 were 8% higher than

the levels for the previous financial year with the Russian retail

sales excluded. Excluding our Middle East markets, as well as

Russia, the increase was 17% and our Middle East markets (43% of

our total retail sales) reduced by 1%, with Saudi Arabia weakest of

these markets reflecting certain local factors some of which are

transitory. As previously reported, in many of our territories our

partners still need to clear old inventory due to the suppressed

demand during Covid-19. These factors will continue to impact the

Group results for the financial year to March 2024, which will

defer previously anticipated growth notwithstanding ongoing

improvements in product and service.

Our medium-term guidance is unchanged for the steady state

operation in more normal circumstances and we believe our

continuing franchise operations remain capable of exceeding GBP10

million operating profit and we are now focused on accelerating our

growth in both existing and new markets.

Financing

At the year-end Mothercare had total cash of GBP7.2 million

(March 2022: GBP9.2 million), reflecting ongoing tight control of

cash, against the GBP19.5 million (March 2022: GBP19.1 million) of

the Group's existing loan facility, which remained fully drawn

across the year.

With recent increases in interest rates, the interest rate on

this loan is currently approximately 18.2%, which coupled with the

extended time to return to pre-pandemic retail sales levels,

particularly in our Middle Eastern markets, highlighted above,

means the Board's current forecasts for continuing operations show

the Group may require waivers to future periods' covenant tests. We

have therefore commenced refinancing discussions with our lender to

vary, renegotiate or refinance this debt facility. Additionally we

are looking at various financing alternatives (including equity and

equity linked structures) to give us both additional flexibility

and reduced cash financing costs. For the avoidance of doubt the

Group does not require (and is not seeking through this

refinancing) additional liquidity.

Pension Schemes

The last full actuarial valuation of the schemes was at 31 March

2020 and showed a deficit of GBP124.6 million. The Trustees are

currently undertaking a triennial actuarial valuation as at 31

March 2023, the results of which will be available later this year.

As part of this valuation, the Trustees will review the assumptions

used to determine the liabilities, including the mortality

assumption. Recent mortality experience for the UK suggests that

longevity improvements are not as high as previously expected and

this is generally leading to a reduction in pension scheme

liabilities. The latest analysis of the pension schemes, including

an adjustment for the expected reduction in life expectancies,

suggests a deficit of approximately GBP39 million at 31 March 2023

resulting from total assets at GBP198 million and total liabilities

of GBP237 million. The results of the formal valuations currently

underway may materially differ once the Trustees have completed

their assessment.

The current recovery plan is based on the deficit at March 2022

of GBP78 million with annual contributions for the years ending in

March of: 2024 - GBP4 million; 2025 - GBP7 million; 2026 - GBP8

million; 2027 to 2032 - GBP9 million; 2033 - GBP0.7 million. These

contributions will be reviewed once the actuarial valuation as at

31 March 2023 is completed. Additionally, the Trustees in

determining the amount of ongoing cash contributions, recognise the

current level of borrowings and would be prepared to look afresh at

the valuation assumptions if the covenant improves after the

valuation date, for example via an equity linked structure, which

could reduce the deficit further.

Clive Whiley, Chairman of Mothercare, commented:

"Once again our results demonstrate the resilience we have

introduced to the business over recent years, where we continue to

generate both profit and cash. This would not have been possible

without the support of all of our colleagues, franchisees and

manufacturing partners whom I would like to thank on behalf of the

board.

Although our immediate priority remains to support our franchise

partners as they emerge from a period of suppressed demand,

ultimately for the benefit of our own business, we have also

redoubled our efforts to restore critical mass.

Accordingly we are engaged in discussions to drive the

Mothercare brand globally by widening the bandwidth of our product

offering, alongside penetration into new territories via a variety

of routes to market."

Investor and analyst enquiries to:

Mothercare plc

Email: investorrelations@mothercare.com

https://www.globenewswire.com/Tracker?data=TCDrdr7boaJhQQyGPvGVeGZZJeZIva-o3Ac0nLf3MNBdZHpl5G1LAp8Ji3LCJhnqUgo5EQJh5Bo--QTXRsVVfVMMVQZjvdF86rwjWueMRajUzydetUBxXQEsXQM_CCIP

Clive Whiley, Chairman

Andrew Cook, Chief Financial Officer

Numis (Nominated Advisor & Joint Corporate Broker)

Tel: 020 7260 1000

Luke Bordewich

Henry Slater

finnCap (Joint Corporate Broker)

Tel: 020 7220 0500

Christopher Raggett

MHP

Tel: 020 3128 8789

Email: mothercare@mhpc.com

https://www.globenewswire.com/Tracker?data=xHCgulmDVJTMKVdPxiDS4c0n6mhZFMkCHj3SetVrMu1R4cpVsaOOAhAHxZO_spbxS_PPJmj0mON7AYpAZfPIq9KMwBvps2QxjeQF3mxlno0=

Simon Hockridge

Tim Rowntree

(END) Dow Jones Newswires

May 04, 2023 02:00 ET (06:00 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

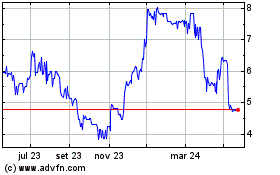

Mothercare (LSE:MTC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

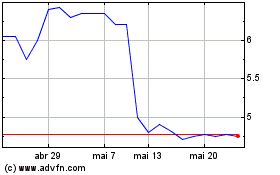

Mothercare (LSE:MTC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024