TIDMNSCI

RNS Number : 3136S

NetScientific PLC

23 September 2014

NetScientific plc

('NetScientific' or 'the Company' or 'the Group')

Half-Yearly Report

23 September 2014: NetScientific (AIM: NSCI), the global

biomedical and healthcare technology group today announces its half

yearly report for the six months ended 30 June 2014.

Highlights

-- Significant progress made in advancing the technologies in

two core subsidiaries, WandaHealth and Vortex Biosciences.

-- New commercial partnership with Peter Thiel's Breakout Labs

which provides

NetScientific with direct access to cutting-edge technologies in

Silicon Valley.

-- Post period end investments were made in two new later-stage

companies, G-Tech Medical and Longevity Biotech.

-- Strict expenditure controls and rigorous criteria for new

investments resulted in higher than budget closing cash balance of

GBP22.5 million.

Farad Azima, CEO of NetScientific, said:

"The Group has made significant progress so far this year in

bringing our subsidiaries closer to achieving value inflection

points which will allow a series of high performance exits. At

NetScientific our view is that, science knows no borders.

Therefore, we anticipate securing further additional strategic

alliances, which will give us worldwide access to other

transformative technologies."

-Ends-

For more information, please visit the website at

www.netscientific.net.

Contact Details

NetScientific plc Tel: +44 (0) 20 3290

Farad Azima 8877

Peter Thoms

Liberum (NOMAD and Broker) Tel: +44 (0)20 3100 2000

Chris Bowman / Christopher Britton

/ Thomas Bective

Instinctif Partners Tel: +44 (0) 20 7457

Melanie Toyne-Sewell / Tim Watson 2020

Email: netscientific@instinctif.com

Copies of the unaudited interim results for the six months ended

30 June 2014 are available on the Group's website at

www.netscientific.net.

Overview

Over the six-month period under review, the Group made

significant progress, in particular in two of its core

subsidiaries, WandaHealth and Vortex Biosciences. Strict

expenditure controls and rigorous criteria for new investments

resulted in higher than budget closing cash balance of GBP22.5

million.

In the same period, the Group evaluated new enabling

technologies to underpin its pipeline. Validated opportunities are

being secured from both research institutes and new commercial

alliances, as per our March announcement relating to Peter Thiel's

Breakout Labs. This unique relationship provides NetScientific with

direct access to cutting-edge technologies in Silicon Valley.

Post period end, the Group announced an important research

programme in DNA sequencing, and investments in two later-stage

BioMed companies, G-Tech Medical and Longevity Biotech.

Strategy

NetScientific's goal is to build a group of subsidiaries and

portfolio investments based on transformative technologies in i)

digital health, ii) advanced medical diagnostics and iii) novel

therapeutics in regenerative medicine. For the most part, these

technologies have faster development timelines; lower capital

requirements and shorter regulatory pathways.

At NetScientific, 'science knows no borders' and the Group will

seek to secure further valuable technologies through privileged

access to global centres of excellence which have been

painstakingly developed over many years.

The Group has assembled experienced management teams, eminent

scientific advisors and solid infrastructures in the UK and the

United States. In addition, it operates a centralised shared

ecosystem of finance, banking, legal, marketing, patenting and

licensing - saving huge costs to the subsidiaries. NetScientific

also encourages its subsidiaries to leverage potential synergies

among themselves.

NetScientific is an active investor, taking leadership roles and

providing extensive management support to drive its investments to

value inflection points, to allow a series of high performance

exits.

Key Subsidiaries

WandaHealth is cloud-based predictive big-data analytics for the

remote monitoring of patients with chronic disease - the first

application of which is in congestive heart failure, the leading

cause of hospital re-admission. Successful clinical trials were

completed ahead of time and regulatory approvals are expected in

Q1, 2015. Discussions have commenced with a major US hospital group

in preparation for commercial roll-out.

Vortex is developing a simplified, high-speed blood test for a

wide range of metastatic cancers - a 'liquid biopsy' with no

requirements for sample prep. Important applications include

diagnostics, prognosis during treatment, and 'personalised'

therapeutics. Early research collaborators include UCLA, Harvard

University and Stanford Cancer Institute. Commercial product launch

is expected in 2015.

Financial Results

Research and development expenditure, which was largely in the

core subsidiaries, for the period was GBP1.4m (H1 2013:

GBP0.3m).

The pre-tax loss was GBP2.6m (H1 2013: GBP1.0m) reflecting the

expenditure in R&D.

Cash and deposit balances as at 30 June 2014 were GBP22.5m (H1

2013: GBP0.1m) and the cash outflow for the period was GBP2.8m (H1

2013: GBP0.3m).

Outlook

In summary, the Group has made significant progress in the

development of its existing subsidiaries and will continue to drive

its investments to specific value inflection points. In addition,

the Group anticipates adding further strategic alliances to provide

access to investment opportunities in our areas of interest.

NetScientific plc

Unaudited Consolidated Statement of Comprehensive Income

For six months ended 30 June 2014

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2014 June 2013 2013

GBP GBP GBP

Other operating income 175,218 10,000 177,667

------------------------------------------ ------------- ------------- --------------

Research and development expenditure (1,389,622) (259,772) (762,624)

Other administrative expenses (952,866) (757,640) (1,900,242)

Share based payment (425,198) - (717,234)

Reorganisation and AIM listing

costs - - (1,123,508)

------------------------------------------ ------------- ------------- --------------

Total administrative expenses (2,767,686) (1,017,412) (4,503,608)

------------- ------------- --------------

Loss from operations (2,592,468) (1,007,412) (4,325,941)

Share of loss of joint venture (11,889) (22,051) (27,832)

------------- ------------- --------------

(2,604,357) (1,029,463) (4,353,773)

Finance income 36,316 17,603 37,566

Finance expense (19,588) (28,396) (35,210)

------------- ------------- --------------

Loss before taxation (2,587,629) (1,040,256) (4,351,417)

Taxation 3,616 - 14,153

------------- ------------- --------------

Loss for the period (2,584,013) (1,040,256) (4,337,264)

Other comprehensive income:

Items that will or may be reclassified

to profit or loss in subsequent

periods

Exchange differences on translation

of foreign operations (197,807) (29,796) 87,377

------------- ------------- --------------

Total comprehensive expense for

the period (2,781,820) (1,070,052) (4,249,887)

============= ============= ==============

Loss for the period attributable

to:

Owners of the parent (2,260,103) (895,949) (4,112,565)

Non-controlling interest (323,910) (144,307) (224,699)

------------- ------------- --------------

(2,584,013) (1,040,256) (4,337,264)

============= ============= ==============

Total comprehensive expense attributable

to:

Owners of the parent (2,457,910) (925,745) (4,025,188)

Non-controlling interest (323,910) (144,307) (224,699)

------------- ------------- --------------

(2,781,820) (1,070,052) (4,249,887)

============= ============= ==============

Loss per Ordinary Share attributable

to the ordinary equity holders

of the parent: (0.06) (0.08) (0.21)

============= ============= ==============

NetScientific plc

Unaudited Consolidated Interim Statement of Financial Position

As at 30 June 2014

Unaudited Unaudited Audited

30 June 30 June 31 December

2014 2013 2013

GBP GBP GBP

Assets

Non-current assets

Intangible assets 628,211 427,494 638,492

Property, plant and equipment 208,711 9,746 67,101

Investments in equity-accounted

joint ventures 76,834 62,099 69,872

Available for sale investments 149,578 2 2

1,063,334 499,341 775,467

Current assets

Trade and other receivables 452,788 170,147 325,651

Cash and cash equivalents 22,512,191 116,544 25,546,951

------------- ------------- ---------------

22,964,979 286,691 25,872,602

------------- ------------- ---------------

Total assets 24,028,313 786,032 26,648,069

------------- ------------- ---------------

Liabilities

Current liabilities

Trade and other payables (796,107) (1,578,739) (1,113,490)

Loans and borrowings (3,250) (165,646) (3,250)

------------- ------------- ---------------

(799,357) (1,744,385) (1,116,740)

Non-current liabilities

Trade and other payables (47,962) (87,429) (49,723)

Loans and borrowings (484,760) (223,363) (475,109)

Deferred tax liability (103,176) - (106,965)

------------- ------------- ---------------

(635,898) (310,792) (631,797)

------------- ------------- ---------------

Total liabilities (1,435,255) (2,055,177) (1,748,537)

------------- ------------- ---------------

Total net assets/(liabilities) 22,593,058 (1,269,145) 24,899,532

============= ============= ===============

NetScientific plc

Unaudited Consolidated Interim Statement of Financial Position

As at 30 June 2014

Unaudited Unaudited Audited

30 June 30 June 31 December

2014 2013 2013

GBP GBP GBP

Issued capital and reserves

attributable

to the parent

Called up share capital 1,795,101 857,501 1,795,101

Share premium account 30,844,552 3,217,497 30,844,552

Capital reserve account 236,745 236,745 236,745

Foreign exchange reserve (47,676) 32,958 150,131

Retained earnings reserve (9,774,684) (4,960,344) (7,459,726)

----------- ----------- ------------

Equity attributable to the parent 23,054,038 (615,643) 25,566,803

Non-controlling interests (460,980) (653,502) (667,271)

----------- ----------- ------------

Total equity 22,593,058 (1,269,145) 24,899,532

=========== =========== ============

NetScientific plc

Unaudited Consolidated Interim Statement of Changes in Equity

As at 30 June 2014

Share Share Capital Retained Foreign Total Non- Total

Capital Premium Reserve Earnings Exchange Attributable Controlling Equity

Reserved Reserve To equity Interest

Holders

of

Parent

GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January 2013 1 - - (4,064,395) 62,754 (4,001,640) (242,036) (4,243,676)

Comprehensive Income

Loss for the period - - - (895,949) - (895,949) (144,307) (1,040,256)

Other comprehensive

income - - - - (29,796) (29,796) - (29,796)

Acquisition of

subsidiary - - - - - - (267,159) (267,159)

Issue of share

capital 857,500 3,217,497 - - - 4,074,997 - 4,074,997

Capital

contribution - - 236,745 - - 236,745 - 236,745

---------- ------------ -------- -------------- --------- -------------- ------------ ---------------------

Total comprehensive

income 857,500 3,217,497 236,745 (895,949) (29,796) 3,385,997 (411,466) 2,974,531

---------- ------------ -------- -------------- --------- -------------- ------------ ---------------------

Balance at 30 June

2013 857,501 3,217,497 236,745 (4,960,344) 32,958 (615,643) (653,502) (1,269,145)

========== ============ ======== ============== ========= ============== ============ =====================

Balance at 1 July

2013 857,501 3,217,497 236,745 (4,960,344) 32,958 (615,643) (653,502) (1,269,145)

Comprehensive income

Loss for the period - - - (3,216,616) - (3,216,616) (80,392) (3,297,008)

Other comprehensive

income - - - - 117,173 117,173 - 117,173

Increase in

subsidiary

shareholdings - - - - - - (6,772) (6,772)

Dilution in

subsidiary

shareholdings - - - - - - 9,593 9,593

Revision to

acquisition

of subsidiary - - - - - - 63,802 63,802

Issue of share

capital 937,600 29,062,501 - - - 30,000,101 - 30,000,101

Transaction costs

in respect

of share issue - (1,435,446) - - - (1,435,446) - (1,435,446)

Share based

payments - - - 717,234 - 717,234 - 717,234

---------- ------------ -------- -------------- --------- -------------- ------------ ---------------------

Total

comprehensive

income 937,600 27,627,055 - (2,499,382) 117,173 26,182,446 (13,769) 26,168,677

---------- ------------ -------- -------------- --------- -------------- ------------ ---------------------

Balance at 31

December

2013 1,795,101 30,844,552 236,745 (7,459,726) 150,131 25,566,803 (667,271) 24,899,532

========== ============ ======== ============== ========= ============== ============ =====================

NetScientific plc

Unaudited Consolidated Interim Statement of Changes in

Equity

As at 30 June 2014

Share Share Capital Retained Foreign Total Non- Total

Capital Premium Reserve Earnings Exchange Attributable Controlling Equity

Reserved Reserve To equity Interest

Holders

of

Parent

GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January 2014 1,795,101 30,844,552 236,745 (7,459,726) 150,131 25,566,803 (667,271) 24,899,532

Comprehensive

income

Loss for the

period - - - (2,260,103) - (2,260,103) (323,910) (2,584,013)

Other

comprehensive

income - - - - (197,807) (197,807) - (197,807)

Acquisition of

subsidiary - - - - - - 52,000 52,000

Increase in

subsidiary

shareholding - - - (489,893) - (489,893) 489,893 -

Dilution in

subsidiary

shareholding - - - 9,840 - 9,840 (9,840) -

Foreign

exchange

differences - - - - - - (1,852) (1,852)

Share based

payments - - - 425,198 - 425,198 - 425,198

---------- ----------- -------- ------------ ---------- ------------- ------------ ------------

Total

comprehensive

income - - - (2,314,958) (197,807) (2,512,765) 206,291 (2,306,474)

---------- ----------- -------- ------------ ---------- ------------- ------------ ------------

Balance at 30

June 2014 1,795,101 30,844,552 236,745 (9,774,684) (47,676) 23,054,038 (460,980) 22,593,058

========== =========== ======== ============ ========== ============= ============ ============

NetScientific Plc

Unaudited Consolidated Interim Statement of Cash Flows

For the six months ended 30 June 2014

Unaudited Unaudited Audited

six months six months Year ended

ended 30 ended 30 31 December

June June 2013

2014 2013

GBP GBP GBP

Cash flows from operating activities

Loss before tax (2,587,629) (1,040,256) (4,351,417)

Adjustments for:

Depreciation 24,376 2,001 5,508

Amortisation 807 808 1,616

Share of loss in joint venture 11,889 22,051 27,832

Share based payment expense 425,198 - 717,234

Tax credit received 14,153 - -

Finance income (36,316) (17,603) (37,566)

Finance expense 19,588 28,396 35,210

------------- -------------- --------------

Cash flows from operations before

changes

in working capital (2,127,934) (1,004,603) (3,601,583)

Change in trade and other receivables (141,883) (104,147) (245,100)

Change in trade and other payables (293,034) 491,699 167,977

------------- -------------- --------------

Cash used in operations (2,562,851) (617,051) (3,678,706)

------------- -------------- --------------

Cash flows from investing activities

Investment in joint venture (21,413) (46,800) (60,354)

Purchase of available for sale investment (149,576) - -

Purchase of property, plant and

equipment (169,382) - (60,861)

Interest received 36,517 17,603 37,566

Increase in subsidiary shareholding - - (6,772)

------------- -------------- --------------

Net cash used in investing activities (303,854) (29,197) (90,421)

Cash flows from financing activities

Cash acquired from acquisition of

subsidiary 52,000 2,013 1,973

Proceeds from loans - 333,749 428,457

Proceeds from share issue - - 29,912,750

Share issue cost - - (1,435,446)

------------- -------------- --------------

Net cash from financing activities 52,000 335,762 28,907,734

------------- -------------- --------------

Net (decrease)/increase in cash

and cash equivalents (2,814,705) (310,486) 25,138,607

Exchange (losses)/gains on cash

and cash equivalents (220,055) 16,242 (2,444)

Cash and cash equivalents at beginning

of period 25,546,951 410,788 410,788

------------- -------------- --------------

Cash and cash equivalents at end

of period 22,512,191 116,544 25,546,951

============== ==============

1. Accounting Polices

Basis of preparation

The interim financial statements, which are unaudited, have been

prepared on the basis of the accounting policies expected to apply

for the financial year to 31 December 2014 and in accordance with

recognition and measurement principles of International Financial

Reporting Standards (IFRSs) as endorsed by the European Union. The

accounting policies applied in the preparation of these interim

financial statements are consistent with those used in the

financial statements for the year ended 31 December 2013.

The interim financial statements do not include all of the

information required for full annual financial statements and do

not comply with all the disclosures in IAS 34 'Interim Financial

Reporting'. Accordingly, whilst the interim statements have been

prepared in accordance with IFRSs, they cannot be construed as

being in full compliance with IFRSs.

The financial information for the year ended 31 December 2013

does not constitute the full statutory accounts for that period.

The Annual Report and Financial Statements for the year ended 31

December 2013 have been filed with the Registrar of Companies. The

Independent Auditor's Report on the Report and Financial Statements

for the year ended 31 December 2013 was unqualified, did not draw

attention to any matters by way of emphasis, and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

Going Concern

The directors have prepared and reviewed financial forecasts.

After due consideration of these forecasts and current cash

resources, the directors consider that the Company and Group have

adequate financial resources to continue in operational existence

for the foreseeable future (being at least twelve months from the

date of this report), and for this reason the financial statements

have been prepared on a going concern basis.

2. Acquisitions

During the period the Group acquired a minority holding of 2.18%

in Cytovale, Inc. an early stage life sciences company based in San

Francisco, USA commercialising microfluidic technologies that

enable high through put single cell analysis.

Subsidiaries

During the period the Group acquired a controlling interest of

57% in Proaxsis Limited, a recently formed company involved in the

development of a range of novel medical diagnostic tests to enable

routine monitoring of patients with Cystic Fibrosis and other

chronic respiratory conditions such as Chronic Obstructive

Pulmonary Disease.

3. Tax Credit

The tax credit of GBP3,616 (six months ended 30 June 2013:

GBPNil: year ended 31 December 2013: GBP14,153) is in relation to a

research and development tax credit receivable in respect of a

subsidiary company for a prior period.

4. Loss per Ordinary Share

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2014 2013 2013

GBP GBP GBP

Loss attributable to equity

holders of the

Company (2,260,103) (895,949) (4,112,565)

Weighted average number of

ordinary

shares in issue 35,902,020 10,899,692 19,558,458

The loss attributable to ordinary shareholders and weighted

average number of ordinary shares for the purpose of calculating

the diluted earnings per ordinary share are identical to those used

for basic earnings per share, as whilst the parent company has

share options in existence they are not dilutive as their exercise

would have the effect of reducing the loss per ordinary share. At

30 June 2014 there were 2,782,405 options outstanding (30 June

2013: Nil options outstanding: 31 December 2013: 2,513,140 options

outstanding).

INDEPENDENT REVIEW REPORT TO NETSCIENTIFIC PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2014 which comprises the Consolidated

Interim Statement of Comprehensive Income, the Consolidated Interim

Statement of Financial Position, the Consolidated Interim Statement

of Changes in Equity, the Consolidated Interim Statement of Cash

Flows and the related notes 1 to 4.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of and has been approved

by the directors. The directors are responsible for preparing the

interim report in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the Company's annual

accounts having regard to the accounting standards applicable such

accounts.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Our report has been prepared in accordance with the terms of our

engagement to assist the company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2014 is not prepared, in all material respects, in accordance

with the rules of the London Stock Exchange for companies trading

securities on AIM.

BDO LLP

Chartered Accountants and Registered Auditors

Southampton

United Kingdom

22 September 2014

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KLLFLZKFBBBB

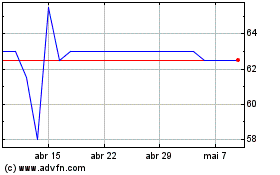

Netscientific (LSE:NSCI)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Netscientific (LSE:NSCI)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024