TIDMNSCI

RNS Number : 8788K

NetScientific PLC

27 April 2020

27 April 2020

NetScientific plc

("NetScientific" or the "Group")

NetScientific Full Year Preliminary Results for the year ended

31 December 2019

London, UK - 27 April 2020 - NetScientific plc (AIM: NSCI), the

transatlantic healthcare IP commercialisation Group, announces its

full year preliminary results for the year ended 31 December

2019.

Financial highlights (including post-period end highlights)

-- Loss after tax of GBP4.9 million (2018: loss GBP9.4 million)

reflects the portfolio business model

o Core portfolio companies develop and commercialise their

proprietary technologies

o All portfolio companies are currently loss making

-- Cash used in operations reduced to GBP4.1 million (2018:

GBP8.3 million) due to sale of Vortex and Wanda and lower head

office costs

-- Cash and cash equivalents at HQ and portfolio companies of

GBP3.5 million (2018: GBP2.9 million)

-- There were several Board changes during the year and

post-period, including the Chairman and CEO.

Portfolio highlights (including post-period end highlights)

ProAxsis Ltd ("ProAxsis")

-- Continued strong progress with revenue growth up 234% to GBP735k; cashflow breakeven

o ProAxsis NEATstik ELISA kit sales up by 226%

o Contract with a large researcher conducting Phase 2 clinical

trials in the last quarter of 2019

-- NEATstik(R) featured in a high-profile bronchiectasis study

published in the European Respiratory Journal in 2019

-- Short term loan and interest repaid to NetScientific plc

-- Post-period, ProAxsis has revised its plans to take into

account COVID-19 related delays and the opportunities being

pursued.

Glycotest, Inc. ("Glycotest")

-- Completed $10.0 million series A funding round with Shanghai

Fosun Pharmaceutical Co. Ltd, a leading Chinese healthcare

group

o First and second tranches of $3.0 million each received on 14

February 2019 and 21 November 2019

-- Liver diagnostic test technology access granted to Fosun to

enable Chinese regulatory filings and eventual

commercialisation

-- Completed proprietary assay analytical validation for HCC Panel at NMS Labs

-- Initiated clinical validation trial for the HCC panel with 66

cases and 202 controls enrolled at year end

-- Post-period, Glycotest has revised its plans to take into account COVID-19 related delays

PDS Biotechnology Corporation ("PDS")

-- Completed merger with Edge Therapeutics on 18 March 2019,

creating a NASDAQ listed immune-oncology biotechnology company

developing novel products treating early-and late-stage cancer

-- Collaboration with Merck in Phase 2 studies for PDS0101

-- As part of a broader $12m raise, Net Scientific subscribed

$650,000 for a further 500,000 shares of PDS common stock, total

holding of 1,042,833 PDS common stock represents approximately

7.18% of the undiluted share capital.

-- Post-period, PDS announced an expanded infectious disease

pandemic development program, including exploring novel vaccines

for COVID-19 and universal influenza, in addition to its previously

announced tuberculosis development collaboration with Farmacore

Biotechnology

-- Post-period, PDS announced COVID-19 related delays to its

Phase 2 PDS0101 clinical trial programme.

Vortex Biosciences, Inc. ("Vortex")

-- Sold on 22 March 2019 to Deeptech Disruptive Growth

Investments Ltd ("Deeptech"), a special purpose vehicle "SPV" of

EMV Capital Ltd, for total consideration of GBP113,999.

Wanda, Inc. ("Wanda")

-- Sold on 22 March 2019 to Deeptech, for total consideration of GBP37,001.

Commenting on the Group's 2019 full year results, Ian

Postlethwaite, CEO/CFO of NetScientific, said:

" The Company's strategy remains to seek to maximise shareholder

value from its core and other portfolio companies, which continue

to perform and are making progress. During 2019, the Company

carried out a review of all areas and significantly reduced the

central function costs and headcount back to the essentials,

thereby extending the Company's cash runway and using as much of

the remaining cash as possible to maximise the value of the

portfolio companies."

For more information, please contact:

NetScientific Tel: +44 (0)20 3514 1800

Ian Postlethwaite , CEO/CFO

WHIreland (NOMAD, Financial Adviser Tel: +44 (0)20 7220 1666

and Broker)

Chris Fielding / Darshan Patel

MO PR ADVISORY (Press Contact) Tel: +44 (0)78 7644 4977

Mo Noonan

About NetScientific

NetScientific PLC is a transatlantic healthcare IP

commercialisation Group focused on technologies and companies that

have the potential to treat chronic disease and significantly

improve the health and well-being of people.

For more information, please visit the website at www.NetScientific.net

CHAIRMAN'S AND CHIEF EXECUTIVE OFFICER'S STATEMENT

NetScientific PLC ("NetScientific", the "Group" or the

"Company") is a transatlantic healthcare IP commercialisation group

focused on technologies and companies that have the potential to

treat chronic disease and significantly improve the health and

well-being of people.

As announced in November 2018, the Group conducted a strategic

review to maximise value for Shareholders, which included the

potential sale of the Group or of a portfolio company. In early

2019, the Company had not received any offers for any of its

portfolio companies nor was it in receipt of any approaches

regarding a sale of the Company. The Board assessed all of its

strategic options, including a potential cancellation from trading

on AIM in order to reduce the Company's costs and to prolong the

cash runway allowing for the maximum opportunity to realise cash

from shareholdings in its investee companies. However, the general

meeting to approve the cancellation was indefinitely adjourned.

Following this decision, in line with the circular sent to

Shareholders on 15 February 2019, the Company's strategy has

remained to seek to maximise shareholder value from its portfolio

companies. During 2019, the Company carried out a review of all

areas and significantly reduced the central function costs and

headcount to the essentials, thereby extending the Company's cash

runway and using as much of the remaining cash as possible to

maximise the value of the portfolio companies.

In February and November 2019, Glycotest Inc. issued in total

11,822,605 shares to Fosun Pharmaceutical Co. Ltd ("Fosun Pharma"),

a leading healthcare group based in China as part of a $10 million

Series A financing deal , diluting the Group's interest in

Glycotest by 21.85% to 65.65%, a deemed disposal of a stake in a

subsidiary. Since receiving the funding, Glycotest has increased

expenditure on clinical trial preparations, administration and

research and development on the path to commercialisation.

In March 2019, the Company completed a GBP0.15m cash sale to

Deeptech Disruptive Growth Investments Ltd ("Deeptech"), a Special

Purpose Vehicle of EMV Capital Ltd, of its interests in Vortex and

Wanda, together with any outstanding loans and convertible loan

notes owed to the Company by Wanda or Vortex. Immediately prior to

completion, NetScientific was interested in approximately 95.0% and

70.8% of the issued shares of common stock of Vortex and Wanda,

respectively, and 100% of the Preferred Shares of Wanda. The

results of Vortex and Wanda included within the consolidated

accounts of NetScientific amounted, to a gain of GBP0.6 million and

a loss of GBP1.9 million, respectively, and the net assets of

Vortex and Wanda at the same date were GBP0.3 million and GBP0.1

million, respectively net of intercompany balances. The loss for

the year by the Vortex and Wanda discontinued operations was GBP1.3

million (2018: GBP5.4 million) reducing the operational funding

requirement of the Group substantially going forward as look to

preserve cash.

PDS has seen its fair value decline during 2018, 2019 and into

early 2020 due primarily to a weak market for smaller listed

companies and specifically to a stock overhang and a lack of new

clinical trial information to drive the value forward. At year end

PDS's share price was $2.65 per share valuing our investment at

GBP1.1 million (2018: GBP2.6 million). The Board continues to

believe that PDS has strong prospects and participated post year

end in a $12m raise to acquire a further 500,000 shares for

$650,000 taking its total holding to 1,042,000, representing

approximately 7.18% of the undiluted share capital. This provides

PDS with funding to initiate Phase 2 trials.

During the period there has been a significant reshaping of the

Board. Francois Martelet resigned as a Director on 30 April 2019.

On 14 October 2019, Dr. Ilian Iliev joined the Board as a

non-executive director. Barry Wilson retired from the Board on 13

December 2019 following seven years as Non-Executive Director and

John Clarkson joined the Board as Non-Executive Director. On the 15

January 2020, it was announced that Ian Postlethwaite had served

six months' notice to step down as CEO, CFO and Company Secretary

during April 2020. On 31 March 2020, it was announced that Sir

Richard Sykes would retire from the Board following nine years as

Chairman. John Clarkson, took over as the Chairman of the Board

with immediate effect. It is expected that Dr. Ilian Iliev,

currently a Non-Executive Director, will become a part time

Executive Director and interim CEO, and Stephen Crowe, currently

Financial Controller, will take over as interim CFO.

The Group is following the latest health authority and

government advice in light of Covid-19. T he primary focus is the

health, wellbeing and safety of all its employees and local

communities. The Group has reviewed all the major budgeted

assumptions and sensitivities and drawn up cash preservation plans

in case revenue does not continue as planned, or it faces delays in

planned payments from third parties. It has initiated further cost

saving plans across the Group and delayed expenditure where

possible, until there is more clarity on the financial impact of

the pandemic. In some cases, the crisis restrictions will delay

trials and programs, which will defer expenditure and thus extend

the cash runway. Also, there may be opportunities to take advantage

of the financial support measures and divert effort and resources

to address Covid-19 issues and generate new revenue streams,

further ensuring the Group has options and cash for at least the

next twelve months.

CHAIRMAN'S AND CHIEF EXECUTIVE OFFICER'S STATEMENT continued

Portfolio Review

ProAxsis Ltd ("ProAxsis")

ProAxsis is a medical diagnostics company, based in Northern

Ireland, developing a range of products for the capture, detection

and measurement of active protease biomarkers of disease. The

company is primarily focused on chronic respiratory diseases such

as COPD and bronchiectasis but has recently demonstrated the

adaptability of its technology for use in other clinical areas such

as oncology.

ProAxsis has made strong operational progress during 2019 and

has now reached cashflow breakeven based on higher revenue up 234%

at GBP735k versus 2018. This increase in revenue is mainly due to

the increase of ProAxsis NEATstik ELISA kit sales, up by 226%, and

a large researcher conducting Phase 2 clinical trials in the last

quarter of 2019. The outlook for the company in 2020 is positive,

with several contracts already in place with global pharmaceutical

companies.

The company's lead product, NEATstik(R), was featured in a

high-profile bronchiectasis study published in the European

Respiratory Journal in May 2019, which demonstrated encouraging

data on its ability to monitor bacterial infections in real time in

patients suffering from lung diseases.

In March 2020, ProAxsis repaid the GBP0.1 million loan to

NetScientific plus interest from 2019.

NetScientific's shareholding in ProAxsis is 56.5% (fully diluted

being 54.0%) and as at 31 December 2019, the Group had invested

GBP2.1 million (2018: GBP2.1 million).

Grant funding received to develop both the underlying technology

and new applications has exceeded GBP1.2 million (2018: GBP1.2

million).

Glycotest, Inc. ("Glycotest")

Glycotest is a US-based liver diagnostics start-up company

seeking to commercialise new and unique blood tests for life

threatening liver cancers and fibrosis-cirrhosis.

On 14 February 2019 and 21 November 2019, respectively Glycotest

received the first and second tranches of $3m each of the $10

million Series A financing from Fosun Pharmaceutical Co. Ltd

("Fosun Pharma"), a leading healthcare group based in China. As

part of the Series A raise Glycotest granted access to its liver

diagnostic test technology to Fosun during 2019 to enable the

preparation of regulatory filings and eventual commercialization in

China.

The company has continued to make good progress. During 2019,

Glycotest completed proprietary assay analytical validation at NMS

Labs for the HCC panel, and initiated clinical validation trial for

the Panel with 14 sites open to enrolling patients and with a

further six sites in the process of signing patients. As at 31

December 2019, 66 cases and 202 controls were enrolled. Glycotest

also initiated fibrosis and cholangiocarcinoma assay projects

during 2019. These development projects continue in 2020.

Glycotest also appointed a new reagent manufacturer, Rockland

Immunochemicals, in Q3 2019.

Grant funding received to develop the underlying technology,

prior to Glycotest's formation, was GBP5.9 million.

NetScientific's shareholding in Glycotest is 65.6% (2018:

87.5%), fully diluted being 51.5% (2018: 51.5%) and as at 31

December 2019, the Group had invested GBP3.9 million (2018: GBP3.9

million).

CHAIRMAN'S AND CHIEF EXECUTIVE OFFICER'S STATEMENT continued

PDS Biotechnology Corporation

PDS is a clinical stage immunotherapy company developing a next

generation of simpler, safer and more effective immunotherapies for

cancer and infectious diseases. It continued to see strong progress

with its T-cell activating technology platform, Versamune(R), which

combines three critical attributes for an effective immunotherapy:

T-cell induction, reduced tumour suppression and priming of a

potent anti-tumour response without the conventional associated

toxicities.

In November 2018, PDS entered into a merger agreement with Edge

Therapeutics, which completed on 14 March 2019, to form a

Nasdaq-Listed Clinical-Stage Cancer Immunotherapy company. The

merger created a publicly traded immune-oncology biotechnology

company (now re-named PDS Biotechnology Corporation) developing

novel products treating early-and late-stage cancer. This follows

positive phase I and 2 clinical data on its lead product candidate,

PDS0101, indicating immunotherapeutic anti-cancer activity and

favourable safety profile in early stage cervical cancer. PDS plans

to initiate multiple phase 2b and 3 clinical trials of PDS0101 in

HPV-associated cancers.

The year-end share price has been used to re-value the Group's

equity holding therein. The Company's ownership of the enlarged PDS

Biotechnology Corporation, trading on Nasdaq under the ticker PDSB,

on a fully diluted basis is 8.15%. At year end PDS's share price

was $2.65 per share valuing our investment at GBP1.1 million (2018:

GBP2.6 million). As at 22 April 2020 the share price is $0.91 per

share valuing the investment at GBP0.8m.

In May 2019, PDS announced a peer-reviewed publication

supporting the novel mechanisms of action of its proprietary

Versamune(R) platform in cancer immunotherapy. The article "Antigen

Priming with Enantiospecific Cationic Lipid Nanoparticles Induces

Potent Antitumor CTL Responses through Novel Induction of a Type I

IFN Response" was published online on 3 May 2019 in the Journal of

Immunology, and described the way PDS' Versamune(R) platform

recruits and activates killer T-cells to recognize and effectively

attack cancer cells while simultaneously making cancer cells more

susceptible to T-cell attack.

In October 2019, PDS announced that it would be collaborating

with Merck in Phase 2 studies for PDS0101 in combination with

Merck's anti-PD-1 therapy, KEYTRUDA(R) (pembrolizumab), as a first

line treatment in patients with recurrent or metastatic head and

neck cancer and high-risk human papillomavirus-16 (HPV16)

infection. The planned clinical trial is evaluating the efficacy

and safety of the combination as a first-line treatment and was

initiated in the first quarter of 2020.

The Group has invested GBP2.7 million in PDS to 31 December

2019. On the balance sheet the investment in PDS is shown as equity

investments classified as fair value through other comprehensive

income (FVTOCI).

On 12 February 2020, it was announced that PDS had issued new

shares of common stock to raise gross proceeds of approximately

US$12 million ("New Issue"). NetScientific plc subscribed $650,000,

for 500,000 shares of PDS common stock in the new issue.

NetScientific now owns approximately 7.18% of the undiluted share

capital.

On 9 April 2020 PDS appointed Dr. Ilian Iliev to its Board of

Directors.

On 16 April 2020 PDS announced an expanded infectious disease

pandemic development program, including novel vaccines for COVID-19

and universal influenza, in addition to its previously announced

tuberculosis development collaboration with Farmacore

Biotechnology. PDS also announced that initiation of its

multi-center Phase 2 VERSATILE-002 trial for PDS0101 in

advanced/metastatic head and neck cancer had been delayed due to

the severe adverse impact on clinical trial operations from the

COVID-19 pandemic.

Vortex Biosciences, Inc. ("Vortex")

Vortex Biosciences, Inc. was sold to Deeptech on 22 March 2019

for total consideration of GBP112,999, being GBP1 for the shares

and GBP112,998 for the transfer of the debt.

NetScientific shareholding in Vortex was 95.0%, fully diluted

being 66.1% and as of 31 December 2019, the Group had invested

GBP21.4 million (2018: GBP21.4 million).

Wanda, Inc. ("Wanda")

Wanda, Inc. was sold to Deeptech on 22 March 2019 for total

consideration of GBP37,001, being GBP1 for the shares and GBP37,000

for the preferred stock and debt.

NetScientific's shareholding in Wanda was 70.8%, fully diluted

being 61.8% and as at 31 December 2019, the Group had invested

GBP11.6 million (2018: GBP11.6 million).

CHAIRMAN'S AND CHIEF EXECUTIVE OFFICER'S STATEMENT continued

Early stage Investments Portfolio

During the year, the Group reviewed its five early stage

investments (the 'Early Stage Portfolio'). Limited investment has

been made to date, mostly in the form of convertible loans. The

five assets are in the following companies CytoVale, Inc., Epibone,

Inc., Longevity Biotech, Inc., G-Tech, Inc., and Nemitra, Inc. Only

two of the five early stage investments, CytoVale and Epibone

currently have any material value. Of note from the Early Stage

Portfolio:

Cytovale, a clinical stage company using cell mechanics and

machine learning to revolutionise diagnostics starting with sepsis,

announced a preferred Series B funding round in 2019 valuing the

company at $50m, decreasing slightly the value of the NetScientific

investment to GBP0.4m.

Epibone, a ground-breaking research company that transforms

skeletal repair by remodelling stem cells into a personalized bone

graft ready for implantation, announced a Series A funding round in

January 2020 raising $8 million. NetScientific's convertible loan

note and accrued interest valued at GBP0.3m at year end converted

into preferred shares valued at GBP0.3m on the closing of the

financing. and values the Company post investment at $35 million.

NetScientific is in active dialogue regarding developments.

On the balance sheet (as explained in note 3) the investment in

Cytovale is shown within equity investments classified as FVTOCI

whilst the other early stage investment portfolios are all shown

within financial assets classified as FVTPL as warrants and

convertible loan notes at a fair value of GBP0.3m which now relates

to a single convertible loan note investment in Epibone.

Finance

For the year, the Group made a loss of GBP4.9 million (2018:

GBP9.4 million), split between continuing and discontinued

operations as follows:

- Continuing operations GBP3.6 million (2018:

GBP4.0 million)

- Discontinued operations GBP1.3 million (2018:

GBP5.4 million)

The loss reflects the business model where the core portfolio

companies are mainly subsidiaries. These companies are

commercialising or still developing their technologies and are all

currently loss making.

Cash

Cash on the balance sheet as at 31 December 2019 was GBP3.5

million (2018: GBP2.9 million). Cash used in operations in 2019,

was GBP4.1 million (2018: GBP8.3 million). Group companies are not

expected to require any further funding hereafter in 2020. ProAxsis

required a short loan in January 2020 which has now been repaid.

GBP1.2m is held in the Company, giving it and the Group enough cash

to operate until the end of 2021. The cash held within subsidiary

Glycotest, Inc., of GBP2.2m (2018: GBP0.1m) is not freely available

for use within the wider group as it would need the consent of a

40% minority shareholder.

In February 2020, NetScientific plc subscribed for $650,000 of

PDS common stock in its new issue. Upon completion of the new

issue, NetScientific owns approximately 7.18% of the undiluted

share capital of PDS. NetScientific had cash to fund this

investment, however, on 7 April 2020 for prudent financial

management, the Group entered into an 18-month secured GBP700,000

line of credit with the Beckman Group. The facility, which incurs

interest of 10.0% pa on drawn amounts and 3.0% pa on undrawn

amounts and had an arrangement fee of 1%, can be extended by mutual

agreement for an additional six months and is secured on the whole

of NetScientific's interest in PDS.

Going concern

The Directors have prepared and reviewed budget cashflows which

were approved by the Board of Directors in the Board meeting of 5

December 2019, and further reviewed at the Board meeting on 18

March 2020 for the impact of Covid-19 and subsequently approved on

25 March 2020. The budgeted cash flows included a number of

implemented cash saving initiatives, including:

a) significantly reducing the Company's central cost base by

reductions in headcount, closing the office at 6 Bevis Marks London

at the end of March 2019 and reviewing all expenditure

commitments;

b) selling Vortex and Wanda for net proceeds of GBP0.15 million

on 22 March 2019 and consequently reducing the operational cost

base and funding requirement of the Group;

c) allocating the remaining cash to manage the remaining

portfolio companies which the board believes provide the most

realistic prospects of delivering shareholder returns within the

anticipated lifespan of the Company; and

d) making a planned partial drawdown of the GBP700k line of credit towards the end of 2020.

The Group has reviewed the major budgeted assumptions and

sensitivities in light of Covid-19 and drawn up cash preservation

plans in case revenue does not continue as planned, or it faces

delays in planned payments from third parties. It has initiated

further cost saving plans across the Group and delayed expenditure

where possible, until there is more clarity on the financial impact

of the pandemic. In some cases, the crisis restrictions will delay

trials and programs, which will defer expenditure and thus extend

the cash runway. Also, there may be opportunities to take advantage

of the financial support measures and divert resources to support

the Covid-19 effort and generate new revenue streams, further

ensuring the Group has options and cash for at least the next

twelve months.

The Going concern status of the group is dependent on meeting

its forecast including generating revenues, receiving planned

payments from third parties and achieving planned cost savings. In

the event the Group is unable to meet its forecasts it will need to

raise further finance. These events or conditions indicate that a

material uncertainty exists that may cast significant doubt on the

Group and the company's ability to continue as a going concern.

The financial statements do not include any adjustments that

would be necessary if the group or company was unable to continue

as a going concern.

CHAIRMAN'S AND CHIEF EXECUTIVE OFFICER'S STATEMENT continued

Board changes

There were four Board changes during the year (2018: 1).

Francois Martelet resigned as a Director on 30 April 2019. On 14

October 2019 Dr. Ilian Iliev joined the Board as a non-executive

director. Barry Wilson retired from the Board on 13 December 2019

following seven years as Non-Executive Director, and John Clarkson

joined the Board as Non-Executive Director. On 15 January 2020 it

was announced that Ian Postlethwaite had served six months' notice

to step down as CEO, CFO and Company Secretary. On 31 March 2020 it

was announced that Sir Richard Sykes would retire from the Board

following nine years as Chairman. John Clarkson, took over as the

Chairman of the Board with immediate effect. It is expected that

Dr. Ilian Iliev, currently a Non-Executive Director, will become a

part time Executive Director and interim CEO. Finally, it is

anticipated that Stephen Crowe, currently Financial Controller,

will take over as interim CFO during April 2020.

Summary and Outlook

The Board believes that the portfolio companies continue to hold

great potential which the Group will look to unlock. The Company's

strategy remains to maximise shareholder value from the portfolio

companies by:

a) reducing the Company's central functions and costs

significantly such that as much of the remaining cash as possible

can be allocated to the portfolio companies and their active

management; and

b) assessing the funding requirements of each portfolio company

against its prospects of generating a shareholder return.

John Clarkson Ian Postlethwaite

Non-Executive Director and Chairman Chief Executive Officer/Chief Financial

Officer

24 April 2020 24 April 2020

Consolidated Income Statement

For the year ended 31 December 2019

2019 2018

Continuing Operations Notes GBP000's GBP000's

Revenue 735 245

Cost of sales (117) (78)

------------------------------------- ------ ---------- ----------

Gross profit 618 167

Other operating income 76 101

Research and development costs (1,979) (524)

General and administrative costs (2,079) (2,821)

Other costs (269) (1,029)

Loss from operations (3,633) (4,106)

Finance income 21 47

Finance expense (22) (12)

Loss before taxation (3,634) (4,071)

Income tax credit 88 73

------------------------------------- ------ ---------- ----------

Loss for the year from continuing

operations (3,546) (3,998)

Discontinued Operations

------------------------------------- ------ ---------- ----------

Loss for the year from discontinued

operations (1,326) (5,405)

------------------------------------- ------ ---------- ----------

Total loss for the year (4,872) (9,403)

------------------------------------- ------ ---------- ----------

Owners of the parent (4,491) (8,328)

Non-controlling interests (381) (1,075)

------------------------------------- ------ ---------- ----------

(4,872) (9,403)

Basic and diluted loss per share

from continuing and discontinued

operations attributable to owners

of the parent during the year: 5

Continuing operations (4.3p) (4.8p)

Discontinued operations (1.4p) (6.2p)

From loss for the year (5.7p) (11.0p)

------------------------------------- ------ ---------- ----------

Consolidated Statement OF Comprehensive Income

For the year ended 31 December 2019

Notes 2019 2018

GBP000's GBP000's

-------------------------------------------- ------- ---------- -----------

Loss for the year (4,872) (9,403)

Other comprehensive income:

Exchange differences on translation

of foreign operations (56) 94

Change in fair value of equity investments

classified as FVTOCI (1,340) (3,863)

Total comprehensive loss for the year (6,268) (13,172)

----------------------------------------------------- ---------- -----------

Attributable to:

Owners of the parent (5,891) (11,810)

Non-controlling interests (377) (1,362)

---------------------------- ---------- -----------

(6,268) (13,172)

--------------------------- ---------- -----------

Consolidated Statement of Financial Position

As at 31 December 2019

Notes 2019 2018

GBP000's GBP000's

-------------------------------------------- ------ ---------- ----------

Assets

Non-current assets

Property, plant and equipment 128 169

Right-of-use assets 6 221 -

Equity investments classified as

FVTOCI* 8 1,468 2,768

Financial assets classified as FVTPL** 9 262 297

Total non-current assets 2,079 3,234

-------------------------------------------- ------ ---------- ----------

Current assets

Inventory 30 37

Trade and other receivables 603 445

Cash and cash equivalents 3,453 2,911

-------------------------------------------- ------ ---------- ----------

4,086 3,393

Assets in disposal groups classified

as held for sale - 569

-------------------------------------------- ------ ---------- ----------

Total current assets 4,086 3,962

-------------------------------------------- ------ ---------- ----------

Total assets 6,165 7,196

-------------------------------------------- ------ ---------- ----------

Liabilities

Current liabilities

Trade and other payables (623) (668)

Lease liabilities 6 (30) -

Loans and borrowings (163) (140)

-------------------------------------------- ------ ---------- ----------

(816) (808)

Liabilities directly associated

with assets in disposal groups classified

as held for sale - (158)

-------------------------------------------- ------ ---------- ----------

Total current liabilities (816) (966)

-------------------------------------------- ------ ---------- ----------

Non-current liabilities

Lease liabilities 6 (194) -

Loans and borrowings (50) (60)

Total non-current liabilities (244) (60)

-------------------------------------------- ------ ---------- ----------

Total liabilities (1,060) (1,026)

-------------------------------------------- ------ ---------- ----------

Net assets 5,105 6,170

-------------------------------------------- ------ ---------- ----------

Issued capital and reserves

Attributable to the parent

Called up share capital 3,928 3,928

Share premium account 58,006 58,006

Capital reserve account 237 237

Equity investment reserve (1,408) (68)

Foreign exchange reserve 1,384 1,444

Retained earnings (56,681) (51,442)

-------------------------------------------- ------ ---------- ----------

Equity attributable to the owners

of the parent 5,466 12,105

Non-controlling interests (361) (5,935)

-------------------------------------------- ------ ---------- ----------

Total equity 5,105 6,170

-------------------------------------------- ------ ---------- ----------

*Fair value through other comprehensive income

**Fair value through profit and loss

Consolidated Statement of Changes in Equity

As at 31 December 2019

Shareholders' equity

Foreign

exchange

Equity and

Share Share Capital investment Retained capital Non-controlling Total

capital premium reserve reserve earnings reserve Total interests equity

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

1 January

2018 3,452 53,839 237 - (43,220) 1,063 15,371 (4,573) 10,798

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

Change on

initial

application

of IFRS 9

Financial

Instruments

(see note

1) - - - 3,795 - - 3,795 - 3,795

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

Balance at

1 January

2018 (as

restated) 3,452 53,839 237 3,795 (43,220) 1,063 19,166 (4,573) 14,593

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

Loss for the

period - - - - (8,328) - (8,328) (1,075) (9,403)

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

Other

comprehensive

income -

Foreign

exchange

differences - - - - - 381 381 (287) 94

Change in

fair value

during the

year - - - (3,863) - - (3,863) - (3,863)

Total

comprehensive

income - - - (3,863) (8,328) 381 (11,810) (1,362)) (13,172)

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

Share capital

issued 476 4,524 - - - - 5,000 - 5,000

Change in

fair value

of equity

investments

classified

as FVTOCI - (357) - - - - (357) - (357)

Share-based

payments - - - - 106 - 106 - 106

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

31 December

2018 3,928 58,006 237 (68) (51,442) 1,444 12,105 (5,935) 6,170

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

Loss for the

period - - - - (4,491) - (4,491) (381) (4,872)

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

Other

comprehensive

income -

Foreign

exchange

differences - - - - - (60) (60) 4 (56)

Change in

fair value

of equity

investments

classified

as FVTOCI - - - (1,340) - - (1,340) - (1,340)

Total

comprehensive

income - - - (1,340) (4,491) (60) (5,891) (377) (6,268)

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

Decrease in

subsidiary

shareholding - - - - 2,668 - 2,668 1,677 4,345

Disposal of

subsidiaries - - - - (3,469) (3,469) 4,274 805

Share-based

payments - - - - 53 - 53 - 53

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

31 December

2019 3,928 58,006 237 (1,408) (56,681) 1,384 5,466 (361) 5,105

--------------- --------- --------- --------- ----------- --------- --------- ------------ ---------------- ---------

Consolidated Statement of Cash Flows

As at 31 December 2019

Notes 2019 2018

GBP000's GBP000's

--------------------------------------- ------- ---------- ----------

Cash flows from operating activities

Loss after income tax including

discontinued operations (4,872) (9,403)

Adjustments for:

Depreciation of property, plant

and equipment 42 262

Depreciation of right-of-use assets 32 -

Estimated credit losses on trade 56 -

receivables

Impairment of property, plant &

equipment and inventories - 977

Loss on disposal of property, plant 4 -

and equipment

Loss on disposal of subsidiaries 703 -

Fair value movement during the year

on convertible debt - 230

Release of loan provision - (40)

Share-based payments 53 132

Foreign exchange gains 23 (65)

Finance income (21) (47)

Finance costs 22 12

Tax credit (88) (73)

(4,046) (8,015)

Changes in working capital

Decrease/(increase) in inventory 7 (296)

(Increase)/decrease in trade and

other receivables (130) (136)

Increase/(decrease) in trade and

other payables (26) 24

------------------------------------------------ ---------- ----------

Cash used in operations (4,195) (8,423)

------------------------------------------------ ---------- ----------

Income tax received 72 142

------------------------------------------------ ---------- ----------

Net cash used in operating activities (4,123) (8,281)

------------------------------------------------ ---------- ----------

Cash flows from investing activities

Disposal of discontinued operations, 34 -

net of cash disposed of

Purchase of property, plant and

equipment (6) (112)

Proceeds from sale of property,

plant and equipment - 1

Interest received 7 23

Net cash from/(used in) investing

activities 35 (88)

------------------------------------------------ ---------- ----------

Cash flows from financing activities

Proceeds received on change in stake 4,345 -

in subsidiary

Lease payments 6 (38) -

Repayment from borrowings - (10)

Proceeds from loans - 39

Proceeds from share issue - 5,000

Share issue cost - (357)

---------------------------------------- -------- --------

Net cash from financing activities 4,307 4,672

---------------------------------------- -------- --------

Increase/(decrease) in cash and

cash equivalents 219 (3,697)

Cash and cash equivalents at beginning

of year 3,316 6,868

Cash in disposal groups classified

as held for sale - (405)

Exchange differences on cash and

cash equivalents (82) 145

---------------------------------------- -------- --------

Cash and cash equivalents at end

of year 3,453 2,911

---------------------------------------- -------- --------

Notes to the Financial Information for the Year Ended 31

December 2018

1. GENERAL INFORMATION

The Company is a public limited company incorporated on 12 April

2012 and domiciled in England with registered number 08026888 and

its shares are listed on the Alternative Investment Market (AIM) of

the London Stock Exchange. The address of the registered office is

Anglo House, Bell Lane Office Village, Bell Lane, Amersham,

Buckinghamshire HP6 6FA.

2. BASIS OF PREPARATION

The preliminary results of the year ended 31 December 2019 have

been extracted from audited accounts which have not yet been

delivered to Companies House.

The financial information set out in this announcement does not

constitute statutory accounts for the year ended 31 December

2019.

The report of the auditors on the statutory accounts for the

year ended 31 December 2019 did not contain a statement under

Section 498 of the Companies Act 2006 but drew attention to a

material uncertainty in respect of going concern and included the

following wording in that respect;

Material uncertainty related to going concern

As set out in note 3, the group is loss generating and is

reliant upon fundraising and cost savings in order to obtain the

resources necessary to continue. The Going concern status of the

group is dependent on meeting its forecast including generating

revenues, receiving planned payments from third parties and

achieving planned cost savings. In the event the group is unable to

meet its forecasts it will need to raise further finance. These

events or conditions indicate that a material uncertainty exists

that may cast significant doubt on the group and the company's

ability to continue as a going concern.

These events or conditions, along with other matters as set out

in Note 3, indicate that a material uncertainty exists which may

cast significant doubt over the Group's ability to continue as a

going concern. Our opinion is not modified in respect of this

matter.

The financial statements for the year ended 31 December 2019

included in this announcement were authorised for issue in

accordance with a resolution of the Board of Directors on 24 April

2020.

3. GOING CONCERN

The Directors have prepared and reviewed budget cashflows which

were approved by the Board of Directors in the Board meeting of 5

December 2019, and further reviewed at the Board meeting on 18

March 2020 for the impact of Covid-19 and subsequently approved on

25 March 2020. The budgeted cash flows included a number of

implemented cash saving initiatives, including:

a) significantly reducing the Company's central cost base by

reductions in headcount, closing the office at 6 Bevis Marks London

at the end of March 2019 and reviewing all expenditure

commitments;

b) selling Vortex and Wanda for net proceeds of GBP0.15 million

on 22 March 2019 and consequently reducing the operational cost

base and funding requirement of the Group;

c) allocating the remaining cash to manage the remaining

portfolio companies which the board believes provide the most

realistic prospects of delivering shareholder returns within the

anticipated lifespan of the Company; and

d) making a planned partial drawdown of the GBP700k line of credit towards the end of 2020.

The Group has reviewed the major budgeted assumptions and

sensitivities in light of Covid-19 and drawn up cash preservation

plans in case revenue does not continue as planned, or it faces

delays in planned payments from third parties. It has initiated

further cost saving plans across the Group and delayed expenditure

where possible, until there is more clarity on the financial impact

of the pandemic. In some cases, the crisis restrictions will delay

trials and programs, which will defer expenditure and thus extend

the cash runway. Also, there may be opportunities to take advantage

of the financial support measures and divert resources to support

the Covid-19 effort and generate new revenue streams, further

ensuring the Group has options and cash for at least the next

twelve months.

The Going concern status of the group is dependent on meeting

its forecast including generating revenues, receiving planned

payments from third parties and achieving planned cost savings. In

the event the Group is unable to meet its forecasts it will need to

raise further finance. These events or conditions indicate that a

material uncertainty exists that may cast significant doubt on the

Group and the company's ability to continue as a going concern.

The financial statements do not include any adjustments that

would be necessary if the group or company was unable to continue

as a going concern.

4. SIGNIFICANT ACCOUNTING POLICIES

The Group financial statements have been prepared in accordance

with International Financial Reporting Standards as adopted by the

European Union as they apply to the financial statements of the

Group for the year ended 31 December 2019. The principal accounting

policies adopted in the preparation of the financial information

are set out below. The policies have been consistently applied to

all the years presented.

While the financial information included in this preliminary

announcement has been prepared in accordance with IFRS, this

announcement does not in itself contain sufficient information to

comply with IFRS. The Group expects to publish full financial

statements that comply with IFRS by 1 May 2020.

5. LOSS PER SHARE

The basic and diluted loss per share is calculated by dividing

the loss for the financial year by the weighted average number of

ordinary shares in issue during the year. Potential ordinary shares

from outstanding options at 31 December 2019 of 3,475,984 (2018:

2,782,651) are not treated as dilutive as the entity is loss

making.

2019 2018

GBP000's GBP000's

------------------------------------- ----------- -----------

Loss attributable to equity holders

of the Company

Continuing operations 3,409 3,648

Discontinued operations 1,082 4,680

----------- -----------

Total 4,491 8,328

----------- -----------

Number of shares

Weighted average number of ordinary

shares in issue 78,561,866 75,796,048

6. IFRS 16 LEASES

Effective 1 January 2019, IFRS 16 has replaced IAS 17 Leases and

IFRIC 4 Determining whether an Arrangement Contains a Lease.

IFRS 16 provides a single lessee accounting model, requiring the

recognition of assets and liabilities for all leases, together with

options to exclude leases where the lease term is 12 months or

less, or where the underlying asset is of low value. The Group does

not have significant leasing activities acting as a lessor.

Transition Method and Practical Expedients Utilised

On adoption of IFRS 16, the Group recognised right-of-use assets

and lease liabilities in relation to leases of office space, which

had previously been classified as operating leases.

The judgement that the Group was reasonably certain to extend

for the full term of the lease beyond the contractual breaks in the

third, fifth and seventh years of the lease have made a material

difference to the carrying value of the asset/liability. The impact

of this judgement is to increase the initial asset/liability

amounts by GBP216k, GBP181k and GBP114k respectively.

The lease liabilities were measured at the present value of the

remaining lease payments, discounted using the incremental

borrowing rate as at 1 January 2019. The incremental borrowing rate

is the rate at which a similar borrowing could be obtained from an

independent creditor under comparable terms and conditions. The

rate applied was 3.5%.

Transition to IFRS 16

The table below shows the impact due to the transition to IFRS

16 and the initial effect on the balance sheet as at 1 January

2019.

2019 2018

GBP000's GBP000's

----------------------------------- ---------- ----------

Right-of-use asset

Addition 1 January 2019 253 -

Less:

Amortisation during the period (32) -

---------- ----------

Balance at 31 December 2019 221 -

---------- ----------

Lease Liability

Initial recognition 1 January 2019 (253) -

Add:

Payments 38 -

Less:

Interest charge during the period (9) -

Balance at end of period (224) -

---------- ----------

Split as follows:

Current Liability (30) -

Long Term Liability (194) -

(224) -

---------- ----------

Instead of recognising an operating expense for its operating

lease payments, the Group will instead recognise interest on its

lease liabilities and amortisation on its right-of-use assets. This

will increase the reported total loss for the year by the amount of

its current operating lease cost, which for the year ended 31

December 2018 was GBP54k for continuing operations. Due to the

short terms of the Group's leases, approximately there will only be

a nominal charge to interest of approximately GBP9k with the rest

of the charge being recognised as depreciation of GBP32k. There are

several short-term leases where the lease commitment is under six

months in length where the Group will continue to spread the lease

payments on a straight-line basis over the lease term.

7. INVESTMENTS IN SUBSIDIARY UNDERTAKINGS

The Group had the following subsidiaries at 31 December

2019:

Proportion Proportion

of ownership of ownership

Proportion Proportion interest interest

of of held by held by

ownership ownership non-controlling non-controlling

Primary Country of interest interest interests Interests

trading incorporation at 31 December at 31 December at 31 December at 31 December

Name address or registration 2019 2018 2019 2018

------------------ --------- ----------------- --------------- --------------- ---------------- ----------------

NetScientific

UK Limited (a) UK 100% 100% - -

ProAxsis Ltd *

(i) (b) UK 56.5% 56.5% 43.5% 43.5%

NetScientific

America, Inc. (c) USA 100% 100% - -

Vortex

BioSciences,

Inc. ** (i) (d) USA - 95% - 5%

Wanda, Inc. **

(i) (e) USA - 70.8% - 29.2%

Glycotest, Inc.

(i), (ii) (f) USA 65.6% 87.5% 34.4% 12.5%

For all undertakings listed above, the country of operation is

the same as its country of incorporation or registration.

* Held via an intermediate holding company.

** Sold to Deeptech in March 2019, a SPV of EMV Capita Ltd for total consideration of GBP150k.

All of the ownerships shown above relate to ordinary

shareholdings.

(i) Options have been issued by ProAxsis Ltd and Glycotest, Inc.

which if exercised would dilute the Company's shareholding by 3%

and 14% respectively.

(ii) Following issue of further shares during the year the

Group's interest was reduced to 77.5% on 14 February 2019 and then

to 65.6% on the 21 November 2019.

(a) Anglo House, Bell Lane Office Village, Bell Lane, Amersham, Buckinghamshire, HP6 6FA

(b) Unit 1B, Concourse Building, 3, Catalyst Inc, Titanic

Quarter, 6 Queens Road, Belfast, BT3 9DT, Northern Ireland

(c) 1650 Market Street, Suite 4900, Philadelphia, Pennsylvania,

19103-7300, United States of America

(d) 5627 Stoneridge Drive, Suite 312, Pleasanton, CA 94588, United States of America

(e) 350 Sansome Street, Unit 800, San Francisco, CA 94104, United States of America

(f) 77 Water Street, Suite 817, New York, NY 10005, United States of America

The addresses listed above are also the registered offices of

the relevant entities.

8. EQUITY INVESTMENTS CLASSIFIED AS FVTOCI

Represent equity securities classified

as FVTOCI

2019 2018

GBP000's GBP000's

---------------------------------------- ---------- ----------

At 1 January 2,768 2,863

Remeasurement to fair value on initial

application of IFRS 9 - 3,744

Change in fair value during the year (1,300) (3,839)

At 31 December 1,468 2,768

---------------------------------------- ---------- ----------

% of issued

Name Country of incorporation share capital Currency denomination GBP000's

------------------------------ ------------------------- -------------- --------------------- --------

PDS Biotechnology Corporation USA 10.28% US$ 1,089

CytoVale, Inc. USA 1.00% US$ 379

1,468

-------------------------------------------------------- -------------- --------------------- --------

The Company's ownership of the enlarged PDS Biotechnology

Corporation, now trading on Nasdaq under the ticker PDSB, on a

fully diluted basis is 8.15% (2018: 9.12%), which at the year-end

listing price of $2.65 values NetScientific's holding in PDS at

GBP1,097k (2018: GBP2,380k). It is the Company's intention to hold

the shares and to make a decision on its position in due course.

The Group's interest in PDS Biotechnology is non-controlling.

The fair value for the prior year end was derived from the

listed entity Edge Therapeutics, Inc. and using its share price as

a proxy to value PDS. On the 18 March 2019 PDS announced the

closing of its merger with Edge Therapeutics, Inc. following the

approval of Edge stockholders on 14 March 2019.

CytoVale Inc. remains not quoted on an active market at year end

and fair value has been established initially using inputs from

other than quoted prices that are observable; i.e. the price of

recent investments by third parties during December 2019. CytoVale

raised $15.0m all at the same valuation per share, the fundraise

was restricted to a small group of sophisticated investors. At the

time this was the only observable valuation on which to value

CytoVale.

9. FINANCIAL ASSETS CLASSIFIED AS FVTPL

Warrants & Convertible Loans classified Restated

as FVTPL 2019 2018

GBP000's GBP000's

---------------------------------------------- ----------- ----------

Balance at 1 January 297 460

Change in fair value on initial application

of IFRS 9 - 51

Change in fair value during the year (35) (214)

---------------------------------------------- ----------- ----------

Balance at 31 December 262 297

---------------------------------------------- ----------- ----------

The warrant has been valued using the Black-Scholes Model and a

level 3 fair value hierarchy, given the unobservable data for

volatility and its fair value. These warrants may be exercised at

any time prior to May 2021.

The Epibone convertible loan note is the only financial asset to

have a material value individually or collectively the rest have

been fully impaired.

Convertible loans FVTPL of GBP253k in the prior year have been

moved out of trade and other receivables to financial assets

classified as FVTPL. The amount was not material at 1 January 2018

and there is no impact on net assets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR MZGZDLVZGGZG

(END) Dow Jones Newswires

April 27, 2020 02:00 ET (06:00 GMT)

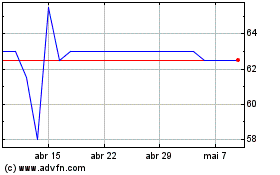

Netscientific (LSE:NSCI)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Netscientific (LSE:NSCI)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024