Portfolio Update

20 Setembro 2024 - 1:00PM

UK Regulatory

Portfolio Update

Octopus AIM VCT 2 plc

Portfolio Update

The investment portfolio of Octopus AIM VCT 2 plc (the

"Company") as at 20 September 2024 is as follows (the valuations

being the unaudited valuations, at bid price, as at 31 July

2024):

|

Portfolio Company |

Sector |

Book cost (£’000) |

Movement in valuation (£’000) |

Fair Value

(£’000) |

|

Hasgrove plc1 |

Unquoted Investment |

153 |

5,400 |

5,553 |

|

Breedon Group plc |

Construction & Building |

573 |

3,547 |

4,120 |

|

Craneware plc |

Software & Computer Services |

479 |

3,084 |

3,563 |

|

Judges Scientific plc |

Electronic & Electrical |

171 |

2,491 |

2,662 |

|

Animalcare Group plc |

Food Producers & Processors |

824 |

1,609 |

2,433 |

|

IDOX plc |

Software & Computer Services |

356 |

2,020 |

2,376 |

|

Learning Technologies Group plc |

Support Services |

701 |

1,525 |

2,226 |

|

Popsa Holdings Ltd1 |

Unquoted Investment |

1,060 |

1,064 |

2,124 |

|

Netcall plc |

Telecommunication Services |

356 |

1,653 |

2,009 |

|

GB Group plc |

Software & Computer Services |

337 |

1,573 |

1,910 |

|

Intelligent Ultrasound Group plc |

Engineering & Machinery |

1,437 |

33 |

1,470 |

|

PCI-Pal plc |

Software & Computer Services |

863 |

606 |

1,469 |

|

Equipmake Holdings plc |

Electronic & Electrical |

1,414 |

28 |

1,442 |

|

Brooks Macdonald Group plc |

Specialty & Other Finance |

610 |

823 |

1,433 |

|

Beeks Financial Cloud Group plc |

Software & Computer Services |

302 |

1,121 |

1,423 |

|

Vertu Motors plc |

General Retailers |

777 |

560 |

1,337 |

|

Next Fifteen Communications Group plc |

Media & Entertainment |

302 |

935 |

1,237 |

|

Maxcyte Inc |

Pharmaceuticals & Biotech |

690 |

463 |

1,153 |

|

Diaceutics plc |

Pharmaceuticals & Biotech |

620 |

432 |

1,052 |

|

EKF Diagnostics Holdings plc |

Health |

737 |

250 |

987 |

|

Scientific Digital Imaging plc |

Technology Hardware |

119 |

833 |

952 |

|

Pulsar Group plc |

Software & Computer Services |

501 |

348 |

849 |

|

Abingdon Health plc |

Medical Equipment and Services |

1,077 |

(311) |

766 |

|

GENinCode plc |

Medical Equipment and Services |

1,334 |

(584) |

750 |

|

Gamma Communications plc |

Telecommunication Services |

183 |

526 |

709 |

|

Itaconix plc |

Industrial |

1,059 |

(353) |

706 |

|

Eden Research plc |

Industrial |

1,080 |

(382) |

698 |

|

Sosandar plc |

General Retailers |

1,235 |

(551) |

684 |

|

Verici Dx plc |

Pharmaceuticals & Biotech |

1,044 |

(397) |

647 |

|

Nexteq plc |

Technology Hardware |

338 |

286 |

624 |

|

Strip Tinning Holdings plc Loan Notes |

Electronic & Electrical |

600 |

- |

600 |

|

Cambridge Cognition Holdings plc |

Health |

717 |

(145) |

572 |

|

Haydale Graphene Industries plc |

Chemicals |

1,238 |

(683) |

555 |

|

Gear4music Holdings plc |

General Retailers |

353 |

98 |

451 |

|

TPXimpact Holdings plc |

Support Services |

653 |

(212) |

441 |

|

Oberon Investments Group plc |

Investment Banking & Brokerage Services |

576 |

(147) |

429 |

|

Cranswick plc |

Food Producers & Processors |

404 |

24 |

428 |

|

Ricardo |

Construction & Building |

402 |

21 |

423 |

|

WISE |

Industrial |

404 |

4 |

408 |

|

Feedback plc |

Software & Computer Services |

1,000 |

(597) |

403 |

|

GSK plc |

Pharmaceuticals & Biotech |

402 |

(21) |

381 |

|

Mattioli Woods plc |

Specialty & Other Finance |

101 |

278 |

379 |

|

llika plc |

Energy |

706 |

(340) |

366 |

|

DP Poland plc |

Leisure & Hotels |

678 |

(347) |

331 |

|

Restore plc |

Support Services |

171 |

155 |

326 |

|

Gooch & Housego plc |

Electronic & Electrical |

281 |

41 |

322 |

|

RWS Holdings plc |

Support Services |

99 |

219 |

318 |

|

MyCelx Technologies Corporation |

Oil Services |

980 |

(676) |

304 |

|

Bytes Technology Group plc |

Software & Computer Services |

326 |

(28) |

298 |

|

Advanced Medical Solutions Group plc |

Health |

190 |

98 |

288 |

|

Velocity Composites plc |

Engineering & Machinery |

533 |

(270) |

263 |

|

Creo Medical Group plc |

Pharmaceuticals & Biotech |

981 |

(746) |

235 |

|

Northcoders Group plc |

Software & Computer Services |

253 |

(42) |

211 |

|

Alusid Limited1 |

Unquoted Investment |

200 |

- |

200 |

|

Crimson Tide plc |

Software & Computer Services |

378 |

(189) |

189 |

|

JTC plc |

Investment Banking & Brokerage Services |

165 |

24 |

189 |

|

Ixico plc |

Health |

697 |

(529) |

168 |

|

Rosslyn Data Technologies plc |

Software & Computer Services |

646 |

(506) |

140 |

|

Tan Delta Systems plc |

Electronic & Electrical |

302 |

(168) |

134 |

|

Libertine Holdings plc |

Industrial Engineering |

2,000 |

(1,870) |

130 |

|

Gelion plc |

Electronic & Electrical |

760 |

(634) |

126 |

|

Rosslyn Data Technologies plc (Loan) |

Software & Computer Services |

120 |

- |

120 |

|

KRM22 plc |

Software & Computer Services |

454 |

(341) |

113 |

|

ENGAGE XR Holdings |

Software & Computer Services |

1,253 |

(1,140) |

113 |

|

LungLife AI Inc |

Pharmaceuticals & Biotech |

1,386 |

(1,284) |

102 |

|

Strip Tinning Holdings plc |

Electronic & Electrical |

337 |

(264) |

73 |

|

XP Factory PLC |

Leisure & Hotels |

659 |

(588) |

71 |

|

Mears Group plc |

Support Services |

51 |

15 |

66 |

|

TheraCryf plc |

Pharmaceuticals, Biotechnology and Marijuana Producers |

700 |

(634) |

66 |

|

Enteq Upstream plc |

Oil Services |

687 |

(639) |

48 |

|

1Spatial plc |

Support Services |

200 |

(157) |

43 |

|

DXS International plc |

Software & Computer Services |

200 |

(170) |

30 |

|

Fusion Antibodies plc |

Pharmaceuticals & Biotech |

497 |

(479) |

18 |

|

Tasty plc |

Leisure & Hotels |

336 |

(320) |

16 |

|

Genedrive Plc |

Pharmaceuticals & Biotech |

145 |

(138) |

7 |

|

Microsaic Systems plc |

Engineering & Machinery |

922 |

(922) |

- |

|

Sorted Group Holdings Plc |

Software & Computer Services |

509 |

(509) |

- |

|

Airnow plc1 |

Unquoted Investment |

838 |

(838) |

- |

|

The British Honey Company plc |

General Retailers |

880 |

(880) |

- |

|

Cloudified Holdings Limited |

Software & Computer Services |

600 |

(600) |

- |

|

Rated People Ltd1 |

Unquoted Investment |

236 |

(236) |

- |

|

ReNeuron Group plc |

Pharmaceuticals & Biotech |

990 |

(990) |

- |

|

Trackwise Designs plc |

Electronic & Electrical |

1,289 |

(1,289) |

- |

|

The Food Marketplace Ltd1 |

Retailers |

200 |

(200) |

- |

|

Eluceda Limited1 |

Pharmaceuticals & Biotech |

200 |

(200) |

- |

Since 31 July 2024 Octopus AIM VCT 2 plc has made £0.8 million

investments and £0.1 million disposals.

Unless otherwise stated, all the investments set out

above:

– are not quoted on regulated markets;

– represent equity investments except in the case of Osirium which

include investment through loan stock; and

– are in portfolio companies incorporated in the UK with the

exception of:

Cloudified Holdings Limited - British Virgin Islands

ENGAGE XR Holdings plc - Republic of Ireland

JTC plc - Jersey

LungLife AI Inc – USA

MyCelx Technologies Corporation - USA

Breedon Group plc - Jersey

MaxCyte Inc - USA

1 Denotes unlisted company

Current Asset Investments (unaudited)

|

Portfolio Company |

Book cost (£’000) |

Fair Value (£’000) |

|

FP Octopus Microcap Growth Fund |

5,012 |

6,155 |

|

FP Octopus Multi Cap Income Fund |

2,701 |

3,352 |

|

FP Octopus Future Generations Fund |

1,252 |

1,271 |

|

BlackRock ICS Sterling Liquidity Fund |

3,847 |

3,847 |

|

JPMorgan Sterling Liquidity Fund |

3,813 |

3,813 |

|

HSBC Sterling Liquidity Fund |

3,842 |

3,842 |

Since 31 July 2024 there has been no investments or disposals

from the current asset investments.

The capitalisation of Octopus AIM VCT 2 plc as at 31 July 2024

was as follows:

| Shareholders'

Equity |

|

£’000s |

| Called up Equity

Share Capital |

19 |

| Legal

Reserves |

13,804 |

| Other

reserves |

69,916 |

|

Total |

83,739 |

There has been no material change to the capitalisation since 31

July 2024.

For further information please contact:

Rachel Peat

Octopus Company Secretarial Services Limited

Tel: +44 (0)80 0316 2067

LEI: 213800BW27BKJCI35L17

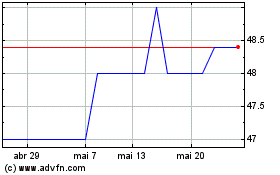

Octopus Aim Vct 2 (LSE:OSEC)

Gráfico Histórico do Ativo

De Mar 2025 até Abr 2025

Octopus Aim Vct 2 (LSE:OSEC)

Gráfico Histórico do Ativo

De Abr 2024 até Abr 2025