TIDMPSN

RNS Number : 1548Z

Persimmon PLC

10 January 2024

10 January 2024

Trading Statement

Persimmon Plc today announces the following update ahead of its

Final Results for the year ended 31 December 2023, which will be

released on 12 March 2024.

Dean Finch, Group Chief Executive, commented:

"Persimmon performed well in challenging market conditions,

delivering completions ahead of expectations in 2023 alongside

enhanced quality metrics of our already five-star homes.

Persimmon's offering is resonating well with customers with sales

rates relatively robust throughout the year. We have successfully

balanced our need to control costs, whilst investing in the

business to position it for sustainable growth when conditions

improve.

"I would like to thank our colleagues, sub-contractors and

suppliers for their commitment and support. Their hard work has

helped ensure that Persimmon remains well positioned to serve

customers across the UK who seek high quality, sustainable homes at

a price they can afford."

Highlights

2023 2022 % change

New home completions 9,922 14,868 -33%

Average selling price c.GBP255,750 GBP248,616 +3%

Average open sales outlets 266 259 +3%

Cash at 31 December GBP420m GBP862m

Current forward sales position GBP1,060m GBP1,040m +2%

Of which private forward sales GBP499m GBP478m +4%

Land holdings (plots owned and

under control) c.82,200 87,190

Trading

The Group successfully navigated challenging market conditions

in 2023 and completed the sale of 9,922 new homes, ahead of

previous guidance, with a particularly strong delivery in Q4. This

was achieved while providing exceptional service to our customers

and we are proud to have maintained our 5-star HBF rating. We have

further improved our quality metrics in the year to what we believe

are our best ever, with a 43% improvement in reportable items per

home in 2023, as measured by the NHBC.

The Group's private average selling price increased by c.5% to

c.GBP285,770 (2022: GBP272,206) which largely reflects the mix of

developments and house types sold. Pricing was firm in the first

half of the year, with some softness and increased use of

incentives experienced during the second half. Overall, incentive

use was c.4% in the year (2022: c.2%). Our partnerships average

selling price increased by 8% to c.GBP152,850 (2022: GBP 142,017)

.

As previously indicated, full year operating margins are

expected to be in line with those delivered in the first half at

c.14%. This reflects the impact of build cost inflation, coupled

with the effects of lower volume, one-off costs associated with the

remediation of a small number of completed sites and accelerated

exit from two sites, along with further investment to position the

business for future success.

Our vertically integrated manufacturing facilities continue to

support delivery and efficiency across the business. Brickworks,

Tileworks and Space4 all performed well, aligning output with the

lower completions in the year and operating with a low level of

fixed costs. We controlled our work in progress closely to match

demand and overall build rates in the year tracked c.28% lower than

the prior year, with an average of 198 equivalent units built per

week (2022: 276).

We saw a sustained pick up in interest in our homes throughout

the year from the lows of Q4 2022, albeit with demand lower than

previous years as a result of high interest rates and the removal

of Help-to-Buy. Overall, average private net sales were 0.58 per

outlet per week for the year (2022: 0.69). This includes a strong

improvement in private net sales rates in the fourth quarter at

0.41 per outlet per week (excluding investor deals) compared with

0.28 in Q4 2022. Our forward sales position is up 2% on the prior

year at GBP1,060m (2022: GBP1,040m), of which GBP499m relates to

private forward sales, up 4% (2022: GBP478m).

Land and planning

Land spend for the year was c.GBP430m (2022: GBP664m) of which

c.GBP260m was the settlement of land creditors (2022: GBP207m). Our

owned and under control land holdings stood at c.82,200 plots at 31

December 2023 (2022: 87,190 plots) and the embedded margin of the

land portfolio remains industry-leading.

As a result of our proactive approach to planning, we made good

progress in 2023 with detailed planning achieved on c.11,000 plots

in the year. This, combined with new land brought into our

pipeline, will underpin our target of opening a gross 30 outlets

for the spring selling season supporting our ambition to grow

outlets back to pre-covid levels over the medium-term.

WIP and cash

We ended the year with a strong and well capitalised balance

sheet with c.GBP420m of cash and c.GBP380m of land creditors. We

also start 2024 with a healthy level of work in progress with

c.4,100 equivalent units built. Disciplined management of both cash

and costs remains a key focus for the Group .

Outlook

We enter 2024 with private forward sales ahead of last year

driven by the year-on-year improvement in Q4 sales rates. Private

sales in the forward order book have increased by c.11% with a c.4%

increase in value to GBP499m. The private average selling price in

the forward order book is c.GBP266,100 predominantly reflecting the

mix effect of sites and homes sold, along with some targeted

investor sales. We anticipate market conditions will remain highly

uncertain during 2024, particularly for first-time buyers and with

an election likely this year. However, mortgage rates are beginning

to ease, and the response to our recent Boxing Day campaign has

been positive, generating a substantial number of leads for our

sales teams. Encouragingly, build costs continue to moderate which

will benefit completions in 2024.

The longer-term demand outlook for new homes remains favourable

. As a five-star builder, with private average selling prices below

the market average(1) , high quality land holdings, and a robust

balance sheet, Persimmon is well-positioned for sustainable growth

when conditions improve.

Persimmon will host a conference call with analysts at 08.30am

today.

A ll participants must pre-register to join this conference

using the Participant Registration link. Once registered, an email

will be sent with important details for this conference, as well as

a unique Registrant ID.

Participant registration page:

https://register.vevent.com/register/BI1cfa6ccbd82f4f38a6b0f4a7f1ff5d35

For further information please contact:

Vicky Prior, Group IR Director Olivia Peters

Anthony Vigor, Group Director of Policy Teneo

and External Affairs

Persimmon Plc persimmon@teneo.com

+44 (0) 1904 642 199 +44 (0) 7902 771

008

(1) Based on the Group's private average selling price of

c.GBP285,770 for the year to 31 December 2023 compared with the

national average selling price for new built homes sourced from the

UK House Price Index, as calculated by the Office for National

Statistics from data provided by HM Land Registry.

Appendices:

1. 2023 quarterly Q1 Q2 HY Q3 Q4 FY

performance

----------------------------- ------ ------ ------ ------ ------ ------

Completions 1,136 3,113 4,249 1,439 4,234 9,922

Net private sales

rate 0.62 0.58 0.59 0.48 0.69 0.58

FTB % (private completions) 38% 33% 34% 32% 26% 31%

Average sales outlets 266 268 267 271 257 266

2. Completions (homes) 2023 2022 Variance

------------------------ ------------- ----------- ---------

Private 7,681 12,174 -37%

Housing Association 2,241 2,694 -17%

------------------------ ------------- ----------- ---------

Total 9,922 14,868 -33%

------------------------ ------------- ----------- ---------

3. ASP 2023 2022 Variance

------------------------ ------------- ----------- ---------

Private c.GBP285,770 GBP272,206 5%

Housing Association c.GBP152,850 GBP142,017 8%

------------------------ ------------- ----------- ---------

Total c.GBP255,750 GBP248,616 3%

------------------------ ------------- ----------- ---------

31 December 2023 31 December 2022 Variance

4. Forward Value Homes Value Homes Value Homes

sales

--------------------- ------------ ------ ----------- ------ ------ ------

Private GBP499m 1,877 GBP478m 1,696 4% 11%

Housing Association GBP561m 3,530 GBP562m 3,966 - -11%

--------------------- ------------ ------ ----------- ------ ------ ------

Total GBP1,060m 5,407 GBP1,040m 5,662 2% -5%

--------------------- ------------ ------ ----------- ------ ------ ------

Cautionary statements

Some of the information in this document may contain projections

or other forward-looking statements regarding future events or the

future financial performance of Persimmon Plc and its subsidiaries

(the Group). You can identify forward-looking statements by the

terms such as "expect", "believe", "anticipate", "estimate",

"intend", "will", "could", "may" or "might", the negative of such

terms or similar expressions. Persimmon Plc (the Company) wishes to

caution you that these statements are only predictions and that

actual events or results may differ materially and as such undue

reliance should not be placed on these statements. The Company does

not intend to update these statements to reflect events and

circumstances occurring after the date hereof or to reflect the

occurrence of unanticipated events. Many factors could cause the

actual results to differ materially from those contained in

projections or forward-looking statements of the Group, including

among others, general economic conditions, the competitive

environment as well as many other risks specifically related to the

Group and its operations. Past performance of the Group cannot be

relied on as a guide to future performance.

Please see the most recent Annual Report and Accounts of

Persimmon plc and other disclosures through the Regulatory News

Service ("RNS") for further details of risks, uncertainties and

other factors relevant to the business and its securities .

The information in this trading statement is unaudited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBLMRTMTJMBTI

(END) Dow Jones Newswires

January 10, 2024 02:00 ET (07:00 GMT)

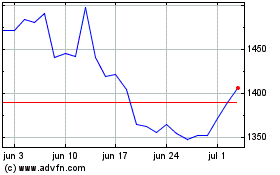

Persimmon (LSE:PSN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Persimmon (LSE:PSN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025