TIDMPTRO

RNS Number : 1430J

Pelatro PLC

14 August 2023

14 August 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018). Upon the publication of this announcement via a Regulatory

Information Service ("RIS"), this inside information is now

considered to be in the public domain.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM

AUSTRALIA, CANADA, JAPAN, NEW ZEALAND, THE REPUBLIC OF IRELAND, THE

REPUBLIC OF SOUTH AFRICA OR THE UNITED STATES OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN PELATRO PLC OR ANY OTHER ENTITY IN

ANY JURISDICTION.

Pelatro Plc

("Pelatro", the "Group" or the "Company")

Subscription to raise GBP1.1m & Issue of Equity

Introduction

As announced on 18 July, the Group has been experiencing delays

in collection of a number of significant receivables with a

resulting impact on working capital such that, based on certain

assumptions (including over what time frame these receivables were

collected) and management forecasts, the Group would require

additional external funding in the final quarter of this financial

year. Consequently the Board was prudently exploring financing

options to raise working capital.

The Board is pleased to announce that it has raised GBP1.1m by

way of a direct subscription ("Subscription") of 44.7m new ordinary

shares (New Ordinary Shares or Subscription Shares) in the Company

with a number of new investors based in the Middle East. This

funding will support the Company's working capital as it seeks to

collect receivables as well as add new customers.

Details of the Subscription

The Company is proposing to raise approximately GBP1.1 million

(before expenses) pursuant to the Subscription by way of the issue

of 44,700,000 New Ordinary Shares at an issue price of 2.5 pence

per Ordinary Share (the "Issue Price").

The Issue Price equates to a discount of 30 per cent. to the

closing price of 3.25 pence on 11 August 2023, the latest Business

Day prior to the announcement of the Subscription.

The Company is utilising its existing share authority approved

by the Company's existing shareholders at the time of its AGM on 23

July 2023. Therefore, the Company is not required to seek

shareholder approval or authority to complete the Subscription.

The Subscription has been arranged by Divit Advisors, an

investment bank based in Dubai. The new investors participating in

the Subscription comprise a number of high net worth individuals

who are clients of Divit Advisors, based in the Middle East. None

of the subscribers will individually hold in excess of 10 per cent.

of the enlarged issued share capital.

Application for Admission

Application has been made for the New Ordinary Shares to be

admitted to trading on AIM and dealings are expected to commence on

17 August 2023 ("Admission").

The New Ordinary Shares will rank pari passu with the Company's

existing Ordinary Shares. The total number of Ordinary Shares in

issue following Admission will be 93,562,431. The Company does not

hold any shares in treasury. Accordingly, the figure of 93,562,431

may be used by shareholders as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in the Company under the

FCA's Disclosure Guidance and Transparency Rules.

Details of Concert Party Holdings and Director Holdings

Certain existing shareholders have been deemed to be acting in

concert under the rules of the Takeover Code (the "Concert Party").

No members of the Concert Party are participating in the fundraise.

Full details of the Concert Party shareholdings can be found in the

table below:

Name Number % of Number Amount Interest % of

of existing of Subscription Subscribed in Ordinary Enlarged

Ordinary Issued Shares Shares Issued

Shares Share being subscribed post Subscription Share

held Capital for Capital

------------------- ----------- ---------- ------------------ ------------ ------------------- ----------

Bannix Management

LLP* 12,933,553 26.47% - - 12,933,553 13.82%

Ravi Shanmugam 716,240 1.47% - - 716,240 0.77%

------------------- ----------- ---------- ------------------ ------------ ------------------- ----------

Total 13,724,406 27.94% - - 14,724,406 14.59%

*Bannix Management LLP consists of Subash Menon, (9,684,244

Ordinary Shares), Sudeesh Yezhuvath (3,309,309 Ordinary Shares) and

Suresh Yezhuvath (14,613 Ordinary Shares)

The Admission of the Subscription Shares will result in the

combined concert party shareholding being diluted from 27.9% to

14.6%.

Use of proceeds and impact of the Subscription

The funding will support the Company's near term working capital

requirements as it seeks to collect receivables as well as add new

customers.

Subash Menon, CEO of Pelatro Plc, said : "We are delighted to

obtain support from new investors who believe in the long term

potential of the company. These funds will help us to continue our

growth and help improve our working capital. "

For further information contact:

Pelatro Plc

Subash Menon, Managing Director c/o finnCap

Nic Hellyer, CFO

finnCap Limited (Nominated Adviser and

Broker) +44 (0)20 7220 0500

Carl Holmes/Milesh Hindocha (Corporate

Finance)

For more information about Pelatro, visit www.pelatro.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEGPUWGRUPWGPW

(END) Dow Jones Newswires

August 14, 2023 02:00 ET (06:00 GMT)

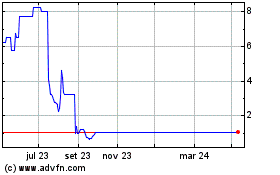

Pelatro (LSE:PTRO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Pelatro (LSE:PTRO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024