IFRS - Part 1

21 Junho 2005 - 4:00AM

UK Regulatory

RNS Number:7856N

Rotork PLC

21 June 2005

PART 1

Embargoed until 7.00am, 21 June 2005

Rotork p.l.c.

2004 accounts restated and audited as compliant with International Financial

Reporting Standards

Rotork, the specialist engineer, today notifies its 2004 accounts restated and

audited as compliant with International Financial Reporting Standards ("IFRS").

The adoption of IFRS will first apply to the Group's financial results for the

six months ending 30 June, 2005. Previously Rotork reported under UK generally

accepted accounting principles (UK GAAP).

The new accounting standards change the basis on which many of the figures in

the accounts are calculated, and this statement should be read in conjunction

with the full audited restatement also announced today. The adoption of IFRS

results in changes to the Company's income statement for the 12 months ended 31

December 2004, announced on 3 March, 2005.

These restated accounts for 2004 will also be used as the comparative figures

when the results for 2005 are released.

The major impacts of IFRS accounting standards on income are shown below.

* Cost of share schemes - This relates to all employee share schemes

operated by the Group. Previously only the performance related share scheme

"LTIP" resulted in a charge to income, the share option scheme being

satisfied by the issue of new shares with no income statement charge. The

new standard requires that all share schemes result in a charge against

profits and prescribes a method for calculating the LTIP charge. This

creates an overall reduction in the charge to profit of #12k in 2004.

* Treatment of intangibles - IFRS requires a new approach to the allocation

of purchase price on an acquisition to reduce the amount of the carrying

value of goodwill by allocating purchase price to amortisable intangibles.

As a result, an additional charge of #70k against profit appears in relation

to the 2004 acquisition of Deanquip.

* Goodwill amortisation - The 2004 goodwill amortisation of #1,293k is

reversed as goodwill on earlier acquisitions are fixed at the 1 January 2004

value and subject to annual impairment tests.

* Capitalised development costs - This relates to the requirement to

attribute value to the development of products under a prescribed formula.

An additional charge against profit of #220k appears in the 2004 accounts.

The Balance Sheet has an additional net asset of #772k relating to historic

development costs now capitalised.

* Treatment of exchange gains. This standard requires exchange gains, mainly

on the conversion of foreign currency cash balances, to be shown after the

definition of operating income, rather than within it. 2004 had an exchange

gain relating to foreign cash held, credited within administration costs.

This now comes out of operating income into financial income. The result is

that operating income drops by #440k, but Profit before Tax is unchanged.

* Basic EPS as reported was 23.2p, under the restated accounts it is 24.5p.

* Balance sheet reclassification - IFRS requires a number of assets and

liabilities to be presented differently. The most significant change is the

presentation of all deferred tax assets as non-current assets rather than as

current assets or a reduction in the defined benefit pension liability.

Furthermore, employee related accruals, previously shown in current

liabilities, are now disclosed within employee benefits which is within

non-current liabilities and there is some reanalysis between the lines

within equity.

Attached to this statement are the 2004 income statement reconciliation and

balance sheet reconciliation at 31 December 2004 to the IFRS accounts now

released.

A second statement notified today provides the full restated accounts for 2004.

Additionally, Rotork announces that today a meeting will be held with analysts

at the Lucca plant in Italy, the main factory operated by the Rotork Fluid

System division which is one of the main growth areas for the Group. No new

trading information will be provided by the Company at this event. Trading

remains in line with the Trading Update made at the Annual General Meeting on 22

April 2005.

The Company's announcement of its interim 2005 results will be made on 3 August

2005.

For further information on this please contact:

For further information, please contact:

Rotork p.l.c. Tel: 01225 733200

Bill Whiteley, Chief Executive

Bob Slater, Finance Director

Financial Dynamics Tel: 020 7269 7224

Sally Lewis

IFRS restated 2004 audited accounts

Income statement

UK Share Amortisation Capitalised Disclosure Reverse IFRS

GAAP based of acquired development of exchange goodwill

payments intangibles costs gains write down

Revenue 146,883 146,883

Cost of sales (79,030) (17) (50) (79,097)

Gross profit 67,853 (17) (50) 0 0 0 67,786

Overheads (37,996) 29 (20) (220) (440) 1,293 (37,354)

Profits from

operations 29,857 12 (70) (220) (440) 1,293 30,432

Net financing

income 634 440 1,074

Profit before tax 30,491 12 (70) (220) 0 1,293 31,506

Tax expense (10,591) (4) 21 66 (10,508)

Net profit for the

year 19,900 8 (49) (154) 0 1,293 20,998

IFRS restated 2004 audited accounts

Balance sheet

UK Share Intangibles Capitalised Reverse Reverse Presentation IFRS

GAAP based acquired development goodwill declared adjustment

payments write down dividend

PP&E 13,877 13,877

Intangible assets 18,174 (70) 772 1,293 20,169

Deferred tax assets 173 21 6,794 6,988

Other receivables 489 489

Total non-current

assets 32,540 173 (49) 772 1,293 0 6,794 41,523

Inventories 21,015 21,015

Trade receivables 34,060 34,060

Current tax 2,176 2,176

receivable

Other receivables 3,442 (917) 2,525

Cash and cash

equivalents 25,298 25,298

Total current 85,991 0 0 0 0 0 (917) 85,074

assets

Total assets 118,531 173 (49) 772 1,293 0 5,877 126,597

Issued capital 4,300 4,300

Preference shares 47 47

Share premium 4,993 4,993

Reserves 4,042 (3,617) 425

Retained earnings 44,753 716 (49) 541 1,293 8,342 2,893 58,489

Total equity 58,135 716 (49) 541 1,293 8,342 (724) 68,254

Loans and 268 268

borrowings

Employee benefits 13,885 (543) 10,227 23,569

Deferred tax 275 231 649 1,155

liabilities

Provisions 1,159 (638) 521

Total non-current

liabilities 15,587 (543) 0 231 0 0 10,238 25,513

Bank overdraft 473 473

Loans and 253 253

borrowings

Trade payables 15,609 15,609

Current tax 5,779 5,779

Other payables 21,653 (8,342) (3,637) 9,674

Provisions 1,042 1,042

Total current 44,809 0 0 0 0 (8,342) (3,637) 32,830

liabilities

Total liabilities 60,396 (543) 0 231 0 (8,342) 6,601 58,343

Total equity and

liabilities 118,531 173 (49) 772 1,293 0 5,877 126,597

This information is provided by RNS

The company news service from the London Stock Exchange

MORE TO FOLLOW

FR SESFDSSISEDM

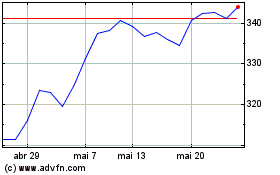

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024