Interim Management Statement (4449W)

19 Novembro 2010 - 5:00AM

UK Regulatory

TIDMROR

RNS Number : 4449W

Rotork PLC

19 November 2010

19 November 2010

Rotork p.l.c.

Interim Management Statement

Rotork plc, the market leading actuator manufacturer, today

issues its Interim Management Statement covering the period from 1

July to 19 November 2010.

Order intake in the period remained strong, with the third

quarter 28% higher than the prior year, a new record. Cumulative

order intake to the 31 October was 17.3% ahead of 2009 with the

resultant order book standing at GBP151m on that date. Revenue and

margins have been consistent with management expectations and the

full year profit outlook remains in line with previous guidance and

market consensus.

Project and quotation activity continue to be robust, however,

there are some regional and end market variations. Oil and gas

infrastructure investment in upstream, midstream and downstream

markets is positive. Water and power are regionally focused and we

anticipate continued weakness in Europe with increased activity in

Asia.

Rotork Controls continues to see increased demand for its

products. Order intake for the third quarter was 18.5% higher than

the comparative period, a record quarter. Asia remains very active,

particularly China. We also benefited from increased activity in

India, Russia, USA and Holland.

Rotork Fluid Systems benefitted from the recent acquisitions of

Flow-Quip and Hiller to produce record input in the third quarter,

47.6% ahead of the same period in 2009. Excluding these

acquisitions, growth was 28.1%. A number of regions saw increased

order input driven mainly by activity in the Middle East although

we also saw improved performance from Russia, Sweden, Canada and

Venezuela. As expected, we have seen margin pressure in this

business in the period. However, as activity levels have increased,

pricing pressures have eased and returned to more normal

levels.

Rotork Gears has also seen increased activity, with input in the

third quarter up 50% on the prior year. Sourcing initiatives to

mitigate raw materials pricing pressure are ongoing and this is

having a positive impact on maintaining margins.

Financial Position

The Group continues to maintain a strong balance sheet and has

benefited from strong operating cash flows.

Material Events

There have been no material events or transactions during the

period.

Outlook

The strong order intake and current level of project and

quotation activity give us confidence in the full year outcome and

support expectations for further progress in 2011.

Notes

1. Third quarter refers to the period 30 June to 3 October.

2. 2010 figures quoted are at actual exchange rates and 2009 are

as previously reported.

3. Rotork will be announcing its preliminary results for the

year ending 31 December 2010 on 1 March 2011.

For further information, please contact:

Rotork p.l.c. Tel: 01225 733200

Peter France, Chief Executive

Jonathan Davis, Finance Director

Financial Dynamics Tel: 020 7831 3113

Jon Simmons

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSGGGWPGUPUGCR

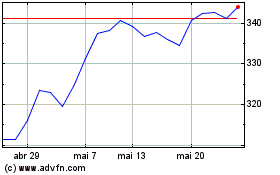

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024