TIDMROR

RNS Number : 9872B

Rotork PLC

01 March 2011

Rotork p.l.c.

2010 Full Year Results

% change

(constant

2010 2009 % change currency)

Revenue GBP380.6m GBP353.5m +7.6% +6.5%

Operating profit GBP97.7m GBP91.5m +6.8% +2.6%

Profit before tax GBP97.9m GBP90.9m +7.6% +3.5%

Adjusted* profit before

tax GBP99.6m GBP91.5m +8.8% +4.7%

Basic earnings per share 80.5p 74.2p +8.4% +4.2%

Adjusted* basic earnings

per share 82.4p 74.9p +10.1% +6.0%

Final dividend 19.75p 17.25p +14.5%

Additional dividend 11.50p 11.50p

* Adjusted figures are before the amortisation of acquired

intangible assets and property disposal in 2009

Key Points

-- Record revenue and profit

-- Growth in all divisions and all market sectors

-- Record order intake, up 17.0%

-- Improving adjusted* margins, aided by currency

-- Cash generation strong, with period-end cash balances of

GBP97.9m

Peter France, Chief Executive, commenting on the results,

said:

"The long-term growth prospects continue to be positive for

Rotork as we benefit from infrastructure investment in both new and

existing plant. The need for automation is increasing as our

customers drive plant safety improvements through their

organisations and seek greater operating efficiencies.

Our wide geographic presence, especially in the countries

experiencing the greatest growth in demand, the breadth of our

product portfolio and strength of our customer relationships, puts

us in a strong position to benefit from a continued increase in

business activity.

Following several years of favourable movements in foreign

exchange, currency may provide a headwind in the current year.

However, the current order book and market activity support the

Board's expectation of making further progress in 2011."

For further information, please contact:

Rotork p.l.c. Tel: 01225 733200

Peter France, Chief Executive

Jonathan Davis, Finance Director

Financial Dynamics Tel: 020 7269 7291

Nick Hasell / Richard Mountain

Chairman's statement

I am pleased to report that 2010 was another year in which

Rotork delivered record revenue and profit, with progress being

made by all three divisions. Market conditions improved compared

with the previous year and this was reflected in the record order

intake. The broad base of our business and the level of emerging

market focus ensured that, whilst not all our geographic markets

grew in the year, each end-market, division, and the Group as a

whole, did. Through the year we have continued to invest in our

facilities, our people and our products to enable the Group to

capitalise on the long-term growth prospects in the markets we

currently serve. At the same time, investment in product

development and potential acquisitions will widen what we define as

our addressable market so that we continue to create value for our

shareholders.

Financial Highlights

Revenue of GBP380.6m was 7.6% higher than the previous year and

with profit before tax up 7.6% to GBP97.9m, Group return on sales

was in line with last year at 25.7%. Currency was a less

significant factor this year than it has been for several years but

remained a tailwind, with the majority of the impact arising in the

second half of the year. Cash balances of GBP97.9m at the end of

the year reflected strong cash generation throughout the year.

Divisional Highlights

Rotork Controls, the division which manufactures and sells our

range of market-leading electric actuators and includes the Rotork

Process Control products, reported revenue growth of 7.0% to

GBP243.4m. This division contributed 63.9% of Group revenue.

Operating profit rose to GBP78.8m, up 8.5% and the division

achieved a 32.4% operating margin compared with 31.9% in the prior

year. Some of the larger projects which were delayed through 2009

returned in 2010 and this was seen in a number of countries and

market sectors. Quotation levels remained positive as did the

number of active projects we are tracking globally, with the

medium-term prospects in each of the oil & gas, power and water

markets encouraging. In India, an important growth market for us,

we opened a new factory in Bangalore and also started work to

rebuild our existing factory in Chennai. This will increase our

manufacturing capacity and provide a platform to address the

increasing demand from India. Once completed in 2011, it will also

house our innovation, design and engineering centre ('RIDEC') that

was announced in August 2010 and which is currently operating from

temporary offices.

Rotork Fluid Systems, which manufactures and sells pneumatic and

hydraulic actuators, and is more focused on the oil & gas

market than the other parts of the Group, was the division most

affected by the slowdown in 2009 and, accordingly, saw the most

significant rebound in order input, up 35.1%. Revenue grew 7.1% to

GBP106.8m but operating profit fell 6.8% to GBP13.3m as operating

margins reduced from 14.3% last year to 12.4% in 2010. Margins

improved in the second half, as a result of higher volumes and the

return of competitive price pressures to more normal levels, but

over the year as a whole this did not offset lower first half

margins which were affected by the continuation of the difficult

trading environment in 2009, the slightly dilutive effect of an

acquisition and the higher amortisation charge. The division's

continued organic growth was augmented by Ralph A. Hiller

('Hiller'), purchased in May as part of our strategy of developing

our sales coverage and increasing our presence in the important

nuclear power market. The business has a distribution arm as well

as the nuclear actuator manufacturing arm and, whilst further

investment is needed to maximize the potential of the acquisition,

the addition of its nuclear-certified hydraulic actuators has

broadened Rotork's nuclear product offering. Integration of Hiller

is progressing well and its understanding of the nuclear industry

is already benefiting other parts of the Group.

Rotork Gears, which manufactures and sells manual and motorized

gearboxes, grew revenue by 6.5% to GBP39.2m. As a result of these

higher revenues and a continued focus on costs, operating margins

improved to 23.2%, reversing most of the reduction seen in 2009.

Operating profit was GBP9.1m, 13.4% higher than the prior year.

Rotork Gears remains the consolidator in what is a very fragmented

market and has built on its leading position in the year with the

launch of new products and by targeting new customers in countries

with the greatest potential for growth.

Cash generation

Cash balances have increased to GBP97.9m in the year as a result

of strong operating cash flows. The main outflows were tax and

dividends, as well as the GBP5.5m acquisition of Hiller. We remain

focused on working capital management but higher levels of revenue

towards the end of 2010 meant net working capital absorbed GBP14.0m

of cash during the year. Despite this, our cash generation key

performance indicator, which measures conversion of operating

profit into cash, was 96.5%. Going forward, we intend to use this

cash to generate incremental shareholder value, either through our

continued strategy to augment our business with acquisitions or via

special dividends.

Dividend

The Board recommends a final dividend of 19.75p per share which,

taken together with the interim dividend, gives a payment of 32.5p

per share (2009: 28.4p), representing a 14.4% increase. This

dividend will be payable on 6 May 2011 to shareholders on the

register on 8 April 2011. As a result of this increase, dividend

cover will reduce to 2.5 times (2009: 2.6). In addition, the

directors intend to pay a special dividend of 11.5p per share on 24

June 2011 to shareholders on the register on 27 May 2011. This

represents a further cash distribution of GBP10.0m.

Board Composition

I am pleased to welcome Gary Bullard to the Board as a

non-executive director. Gary previously held sales director and

managing director roles at IBM and BT Group and now provides

management consultancy services to large IT and telecommunications

companies. He is a member of the Audit and Nomination Committees

and Chairman of the Remuneration Committee.

Corporate Governance

High standards of corporate governance are rightly expected of

the Board and we remain committed to those principles which ensure

we run our business in a responsible way. Following publication of

the UK Corporate Governance Code June 2010 by the Financial

Reporting Council, we intend to introduce annual re-election for

the Chairman and all the other Directors. We have always believed

that good governance stems from a quality Board with a breadth of

experience and skills and non-executives who are able to provide

the necessary level of question and debate in the Boardroom. The

purpose of our annual appraisal of Board effectiveness is to ensure

that our Board is able to participate meaningfully in discussion

and make objective and informed decisions. Following the latest

review, I am satisfied the composition of the Board enables it to

fulfil its expected role.

Outlook

The long-term growth prospects continue to be positive for

Rotork as we benefit from infrastructure investment in both new and

existing plant. The need for automation is increasing as our

customers drive plant safety improvements through their

organisations and seek greater operating efficiencies.

Our wide geographic presence, especially in the countries

experiencing the greatest growth in demand, the breadth of our

product portfolio and strength of our customer relationships, puts

us in a strong position to benefit from a continued increase in

business activity.

Following several years of favourable movements in foreign

exchange, currency may provide a headwind in the current year.

However, the current order book and market activity support the

Board's expectation of making further progress in 2011.

Roger Lockwood

Chairman

28 February 2011

Business Review

Rotork actuators are used to control the flow of liquids and

gases in many different applications across many different end-user

markets. Rotork's markets are often described as oil & gas,

power and water as these are the sectors with the greatest

requirement for actuators. However, our products can also be found

in many other industrial applications - including food and beverage

manufacturing, chemicals, mining and shipboard systems.

Our customers are located throughout the world and in order to

provide the local support our customers require, so are we. Rotork

has 105 offices across 30 countries, which are supplemented by a

further 254 sales outlets, bringing the total number of countries

with a Rotork presence to 87. From its foundation, Rotork has

brought new technology to actuators and continues to set new

standards in developing innovative, functionally-advanced, high

quality products within each of its divisions.

The final component of Rotork's business model is the method of

manufacture. We outsource component manufacture, so most of our

manufacturing plants buy components in a relatively finished form.

These are then assembled to meet the requirements of a particular

customer order. This provides the necessary flexibility in the

sourcing of components that supports our 17 worldwide manufacturing

operations and ensures we maintain a high return on capital

employed.

Year under review

In the same way that some parts of the world were more severely

affected than others by the economic disruption of 2009, the start

of the year saw a wide variation in the rate at which they

rebounded. In the first quarter, Rotork saw order intake return to

near the previous peak. However, the pattern of demand was uneven

and customers kept their budgets under tight control, this

particularly affected Rotork Fluid Systems where our competitors

were pricing most aggressively in order to rebuild their order

books. The fact that we continued to make progress is testament to

the tremendous hard work of our employees, and customers

appreciating the benefits of Rotork's products and services.

Although the cost of an actuator can be insignificant in the total

cost of a project, our customers understand the importance of

actuators to the overall running of their operations, and recognise

the need to use products that perform reliably, and most of all

safely.

Overall, order intake was GBP381.9m, up 17.0% compared with

2009. Particularly strong improvements were reported by our

businesses in the Netherlands (+123%), Italy (+32%) and China

(+27%), with all regions showing growth. Removing the positive

impacts of currency and the Hiller acquisition, order intake was

12.9% ahead of the prior year.

The revenue split between half years returned to a more

customary weighting in favour of the second half as the improvement

in orders took effect. In total, revenue advanced 7.6% to GBP380.6m

which, excluding the effects of currency and Hiller represented a

4.6% increase. The closing order book was GBP138.9m, up GBP9.9m

from the start of the year, including the GBP5.1m order book

acquired with Hiller. Operating margins reduced by 0.2 percentage

points to 25.7%, mainly as a result of higher amortisation costs.

Return on sales, as defined in our key performance indicators, was

maintained at 25.7% and profit before taxation rose 7.6% to

GBP97.9m.

The establishment of the Rotork Innovation Design and

Engineering Centre ('RIDEC'), based in India, supplements our

already-growing divisional engineering teams and provides the

opportunity to improve the capacity and speed of our product

development. India has also benefited from one new factory during

2010, in Bangalore, and we are now in the process of building

another in Chennai. The Bangalore plant has provided space for the

Gears division to start assembly in India. The factory in Chennai

will replace an ageing facility which has been making electric

actuators for over 30 years. Through these two world-class

facilities, our Indian operations will be even better placed to

tackle this large and still-growing market. Elsewhere, in China, we

have enlarged our factory in Shanghai and, in the US, will shortly

relocate to larger premises in Houston. Both businesses have

outgrown their existing sites. We have also expanded our operations

in the Middle East, moving to a new facility in Saudi Arabia and

increasing Rotork's presence in the region. We will look to develop

this further in 2011.

Looking at our main markets, and the underlying factors

supporting investment in oil & gas, power and water

infrastructure, there is reason to be confident in the prospects of

each - both in the medium and long-term. Through our broad

geographic coverage and product portfolio we remain focused on

meeting our customers' growing needs. However, we still see

opportunities to expand our direct presence in new territories -

whether through acquisition, as we recently have in Mexico, or

organically as in Brazil. Similarly, we continue to seek suitable

opportunities to expand our product offering, both organically and

through acquisition.

Rotork Controls

Rotork Controls, which manufactures and sells the electric

actuators on which Rotork originally built its name, still accounts

for 63.9% of the Group's sales and remains the highest margin

division. In the year, order intake increased by 9.1% and revenue

grew by 7.0% to GBP243.4m. The closing order book was GBP85.8m, up

1.2%.

Controls has the widest end-market exposure and improved

activity levels were seen across all sectors. Within oil & gas,

electric actuators are found in greater numbers on downstream and

transmission applications, and tank storage was particularly strong

in the year. We also saw an improving trend in the water market,

reversing the position at the half year.

Operating profit increased by 8.5% to GBP78.8m with margins

fractionally higher at 32.4%. This division was less affected by

the pricing pressure felt earlier in the year and has been able to

use the benefit of operational gearing to offset the costs of

investing in new facilities and people. These investments position

the division for further growth. At the same time, our outsourced

manufacturing model has meant that modest cost increases from

commodity price rises have been mostly offset by sourcing

initiatives.

Rotork Fluid Systems

Since its formation as a stand-alone division in 2001, revenue

in Rotork Fluid Systems ('RFS') has risen to GBP106.8m, up 7.1% in

the year. Although this growth has been assisted by acquisitions,

the more significant benefits have been derived from the

integration of each acquired business into the Group, and their use

of our existing sales channels. RFS supplies pneumatic and

hydraulic powered actuators and control systems from its seven

factories and through a further seven Centres of Excellence, where

added value services can be provided to the local customer.

RFS is the division most focused on the oil & gas market,

and having felt the biggest decline in orders in 2009, it has now

seen the biggest rebound, with order intake up 35.1% in 2010 and

the order book increasing to GBP45.9m. We have continued to

strengthen our engineering and R&D infrastructure and at the

same time invest in improving our facilities. When the cost of

these initiatives are combined with the pricing pressure

experienced earlier in the year, they outweighed the benefits

gained through operational gearing and material cost control,

resulting in a reduction in operating margins to 12.4%, down 1.9

percentage points. RFS is now better placed to capitalise on

project opportunities and operational gearing remains a key

determinant of the division's margins.

Rotork Gears

Rotork Gears supplies manual and motorized gearboxes and

ancillaries to the valve industry. Unlike the Controls and RFS

divisions, where sales are project-focused, this division sells

direct to valvemakers through long-term supply agreements, and with

deliveries at regular intervals. These customers buy from Rotork

due to the guarantee of quality and reliability of supply, as the

alternative is often their own small-scale gearbox production or

local independent vendors. We can also typically provide cost

savings due to the scale of our operations and worldwide delivery

from the six Gears factories.

Revenue from third party sales rose 14.8% in the year to

GBP30.4m as a result of an increased sales effort in a number of

developing markets and the successful launch of new products. Total

revenue for this division increased at a lesser rate, up 6.5% to

GBP39.2m, reflecting lower sales to other Rotork divisions.

Operating margins had been under pressure in 2009 but the

combination of higher revenue and the drive to reduce material

costs, even against a commodity cost headwind, saw margins improve

to 23.2%.

Rotork Site Services

Our after sales and service business, Rotork Site Services

('RSS') operates through each of the three divisions and is

reported within their results. Growing this business forms a key

part of the Group's strategy and during the year we have opened

service centres in six new locations, from New Zealand to Southern

France, although many of the activities RSS performs are carried

out on customers' sites. Our continued investment in RSS will

ensure that we are able to respond to customer's requirements

promptly, and underlines our commitment to supporting our products

in the field from a local base.

RSS activities are divided into a number of revenue streams and,

whilst we do not report the financial results of these, we are able

to monitor other metrics to assess growth. During the year we have

increased the number of service engineers by 8% - perhaps the best

indication of overall activity levels. These service engineers have

responded to 33% more service calls, fitted 18% more actuators to

valves at customers' plants and 17% more actuators to new valves in

our workshops. We also have 4% more actuators on preventative

maintenance contracts, where customers have outsourced their

maintenance requirements to Rotork.

Strategy

Rotork's vision is to be the recognised global leader in

electric, fluid power, manual valve actuation and associated

products and services. We focus on valve actuation and associated

products and services, principally wherever there is a need to

control the movement of fluids or gases. As world market leader,

our aim is to provide high quality, technically advanced,

innovative products and services that support our customers'

activities around the world through our extensive and continually

expanding network of offices and manufacturing plants.

We operate an asset-light business model which is highly cash

generative. We seek to deliver quality margins, consistent year on

year growth in revenues, profit and core dividends through organic

growth and acquisitions.

We develop and train our people to deliver our strategy and

satisfy our customers' requirements, while maintaining high ethical

and safety standards across the Group and acting as a responsible

international corporate entity.

To provide short-term focus, we agree a set of key objectives,

the broad areas of which are the same for 2011 as they were for

2010 although all parts relating to corporate and social

responsibility have now been grouped together under one objective.

In addition, the initiatives within each area have progressed.

The key objectives are:

1. Sales growth - The drive for organic growth requires

subsidiaries to sell all the products available to them and target

all end-markets within their geographies.

-- 2010 - New Middle East sales subsidiary, new Bangalore

factory, establishment of RFS China, growth of sales force

worldwide.

-- 2011 - Move to larger premises in Houston, restructuring of

US sales offices, new Chennai factory, expansion of China

factory.

2. Product development - This investment will continue in 2011

and will result in enhancements to existing products and new

products entering the market.

-- 2010 - Expansion of wireless capabilities, new gearbox

ranges, start up of Rotork Innovation Design and Engineering Centre

('RIDEC'), nuclear qualification of products.

-- 2011 - Growth of RIDEC, expansion of RPC ranges, investment

in nuclear products and other projects that will benefit Rotork in

2012 and beyond.

3. Acquisitions - These are a core part of our growth strategy

and we continue to seek suitable opportunities. We require an

acquisition to bring Rotork either a new product, a new

geographical market or a new market sector. Often the target will

satisfy two or even three of these criteria. The size of the

acquisitions we are prepared to undertake is limited by

opportunity, rather than by our financial capacity but we retain a

rigorous and disciplined approach to acquisition pricing.

-- 2010 - Acquisition of Hiller.

-- 2011 - Acquisition of Rotork Mexico.

4. Manufacturing and facilities - Rotork has invested in a

number of factories and sales offices to develop world class

facilities from which to work. The investment programme will

continue into 2011.

-- 2010 - New factory in Bangalore, investment in Bath

factory

-- 2011 - New factory in Chennai, expansion of Shanghai factory,

new Houston sales and service facility, new offices in Saudi

Arabia

5. Material cost management - Rotork's outsourced manufacturing

model means that material costs are the most significant component

of direct costs. We have always sought to control these costs and

wherever possible leverage our global presence to source

materials.

-- 2010 - Gross margin increased in the year as rising commodity

costs were mitigated through a combination of sourcing initiatives

and passing through the increases.

-- 2011 - Continue to look for opportunities to take costs out

of our products through sourcing or product development. This will

include expanding our sourcing network through teams based in each

of our factories.

6. Development of Rotork Site Services ('RSS') - RSS has grown

over the last few years to become a revenue generator as well as a

key differentiator for Rotork.

-- 2010 - Increased the number of service engineers by 8%,

invested in the service workshops in six locations, three of which

are new facilities.

-- 2011 - Continue to expand the service team and establish new

workshops where there is customer demand.

7. IT - Develop a global system for the sales and service

offices.

-- 2010 - Commenced the design of the solution.

-- 2011 - Finalise the design and begin roll-out.

8. Nuclear - Expand our nuclear-certified product offering and

ensure we are positioned to take advantage of increased activity in

this market.

-- 2010 - The purchase of Ralph A. Hiller was central to

achieving this objective. Re-qualification of our nuclear electric

actuators was also achieved during the year.

-- 2011 - We will continue to develop our traditional products

for use in nuclear applications as well as working with Hiller to

enhance their products.

9. Corporate and Social Responsibility - Our consideration of

Corporate and Social responsibility ('CSR') and objectives cover

three distinct areas. The Rotork approach to health and safety is

to disseminate best practice around the Group, training those

responsible and then verify adoption through auditing each

subsidiary.

-- 2010 - The improvement in audit scores and reduction in the

Accident Frequency Rate KPI show we are making progress.

-- 2011 - Continue the initiatives which have already delivered

improvements.

People development - Throughout the Group we look to develop

internal talent and promote from within where possible. Encouraging

people to build their career within Rotork and helping them

identify their training needs allows each individual to reach their

full potential. Feedback on our success in this is obtained through

our Employee Satisfaction Survey.

Processes and ethics - We continue to embed a high-performance

culture and the delivery of our Corporate Social Responsibility

agenda. Communication of Rotork's Ethics and Values is now part of

the induction process for new employees and new agents and takes

due account of the Bribery Act 2010 and the associated draft

guidelines. These core ethical values will ensure each individual

employee acts at all times with integrity, honesty and fairness

towards those whom they engage. 2010 saw greater employee

participation in supporting local charities, as well as WaterAid,

the nominated Group charity.

Research & Development

A major initiative during 2010 has been the setting up of the

Rotork Innovation and Design Engineering Centre ('RIDEC') in

Chennai, India. This facility became operational in the last

quarter and is intended to provide a multi-disciplinary technical

resource to all business units within the Group. RIDEC will help

with both the engineering integration of acquired businesses that

may employ different CAD systems and processes, and the development

of new and enhanced products across the Group. It will continue to

recruit through the year, aiming to be at full strength by the end

of 2011.

The key differentiating features of an electric actuator are

motor control, robust communications links, and sensor technology,

and our Bath-based engineers remain active in all of these areas.

At the end of the year we commenced production of a variant of our

IQ series using a novel valve position sensor. This represents the

conclusion of several years' research into position measurement

techniques and the search for a cost-effective alternative to our

existing technology. In addition, we have continued the development

of our wireless network and are now ready to move from pilot

installations to deployment within an operational environment.

There are still challenges ahead but this represents an exciting

step forward.

As in previous years we have continued our efforts to gain

leverage by applying our IQ technology to other products within the

Group. Products scheduled for release by the RFS division during

2011 mark the culmination of this activity. Work has continued on

the control valve actuator ('CVA') to increase the range of options

available and to extend the torque and thrust capability of the

family. A larger size is now planned for introduction in 2011.

Throughout 2010, the Process Controls division ('RPC') has been

working on the development of a new family of linear, rotary and

quarter-turn actuators that will complement the CVA range and

replace some of its older products. The first sizes of this new

family are due for release during 2011.

In tandem with the acquisition of Hiller, we have substantially

increased our resources committed to the development of our nuclear

product portfolio. We have completed re-qualification of the

existing nuclear electric actuator range to IEEE382 1996, together

with seismic qualification of the 90NA/ISN19 actuator/gearbox

combination; the 90NA/ISN19 being the largest combination that we

produce. We are also actively engaged in the design and

qualification of electric and fluid power actuators suitable for

use within Westinghouse-designed AP1000 and Areva EPR nuclear power

stations.

Quality

Commitment to product excellence and exceeding customer

expectations is a fundamental part of Rotork's strategy. A

quality-driven focus is embedded in all our business processes,

from procurement and vendor approval, through to manufacture and

delivery, and extends into our site service activities. All Rotork

manufacturing sites are required to be registered with a Quality

Management Approval System to ISO9000 standards, and are required

to adopt Rotork systems and working practices.

Our divisional structure and decentralised procurement &

manufacturing hubs allow us to disseminate best practice between

our businesses, and foster a culture of continuous improvement at

all levels, which is reviewed in quality audits. KPIs allow us to

target, monitor and improve our performance and instil an approach

that is focused on the customer. Techniques such as six sigma and

lean manufacturing principles are used extensively and allow us to

leverage world-class standards and place ourselves at the leading

edge of product quality and performance.

Peter France

Chief Executive

28 February 2011

Consolidated Income Statement

for the year ended 31 December 2010

Notes 2010 2009

GBP'000 GBP'000

Revenue 2 380,560 353,521

Cost of sales (199,742) (187,600)

______ ______

Gross profit 180,818 165,921

Other income 83 688

Distribution costs (3,604) (3,428)

Administrative expenses (79,513) (71,585)

Other expenses (60) (59)

Operating profit before the amortisation

of acquired intangible assets and the

disposal of property 99,442 92,103

Amortisation of acquired intangible assets (1,718) (1,153)

Disposal of property - 587

Operating profit 97,724 91,537

Financial income 3 6,931 5,784

Financial expenses 3 (6,800) (6,405)

______ ______

Profit before tax 97,855 90,916

Income tax expense 4 (28,334) (26,884)

______ ______

69,521 64,032

Profit for the year ===== =====

Pence Pence

Basic earnings per share 10 80.5 74.2

Diluted earnings per share 10 80.2 73.9

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2010

2010 2009

GBP'000 GBP'000

Profit for the year 69,521 64,032

Other comprehensive income

Foreign exchange translation differences 1,119 (11,928)

Actuarial gain / (loss) in pension scheme 1,095 (11,290)

Effective portion of changes in fair value

of cash flow hedges 674 5,046

______ ______

Income and expenses recognised directly

in equity 2,888 (18,172)

Total comprehensive income for the year 72,409 45,860

===== =====

Consolidated Balance Sheet

at 31 December 2010

Notes 2010 2009

GBP'000 GBP'000

Assets

Property, plant and equipment 25,780 23,521

Intangible assets 5 43,990 40,780

Deferred tax assets 11,480 11,631

Other receivables 7 1,290 1,119

______ ______

Total non-current assets 82,540 77,051

Inventories 6 48,241 46,712

Trade receivables 7 70,362 53,791

Current tax 7 2,398 1,818

Derivative financial instruments 918 942

Other receivables 7 6,684 6,197

Cash and cash equivalents 8 97,881 78,676

______ ______

226,484 188,136

Total current assets ______ ______

309,024 265,187

Total assets ===== =====

Equity

Issued equity capital 9 4,334 4,330

Share premium 7,389 7,033

Reserves 16,201 14,406

Retained earnings 175,927 140,402

______ ______

203,851 166,171

Total equity ===== =====

Liabilities

Interest bearing loans and borrowings 127 162

Employee benefits 19,752 22,549

Deferred tax liabilities 3,165 1,970

Derivative financial instruments - 127

Provisions 11 1,968 1,664

______ ______

Total non-current liabilities 25,012 26,472

Interest bearing loans and borrowings 49 104

Trade payables 12 30,447 26,350

Employee benefits 8,220 7,252

Current tax 12 10,821 9,768

Derivative financial instruments 294 1,130

Other payables 12 26,334 24,690

Provisions 11 3,996 3,250

______ ______

Total current liabilities 80,161 72,544

Total liabilities 105,173 99,016

______ ______

Total equity and liabilities 309,024 265,187

===== =====

Consolidated Statement of Changes in Equity

Issued Capital

equity Share Translation redemption Hedging Retained

capital premium reserve reserve reserve earnings Total

Balance at 31

December

2008 4,325 6,666 24,909 1,642 (5,263) 112,117 144,396

Profit for the

year - - - - - 64,032 64,032

Other

comprehensive

income

-------- -------- ------------ ----------- -------- --------- ---------

Foreign

exchange

translation

differences - - (11,928) - - - (11,928)

Effective

portion of

changes in

fair value of

cash flow

hedges - - - - 5,046 - 5,046

Actuarial

gains and

losses on

defined

benefit

pension plans

net of tax - - - - - (11,290) (11,290)

-------- -------- ------------ ----------- -------- --------- ---------

Total other

comprehensive

income - - (11,928) - 5,046 (11,290) (18,172)

-------- -------- ------------ ----------- -------- --------- ---------

Total

comprehensive

income - - (11,928) - 5,046 52,742 45,860

Transactions

with owners,

recorded

directly in

equity

Equity settled

share-based

payment

transactions

net of tax - - - - - 48 48

Share options

exercised by

employees 5 367 - - - - 372

Own ordinary

shares

acquired - - - - - (3,700) (3,700)

Own ordinary

shares

awarded under

share

schemes - - - - - 3,297 3,297

Dividends - - - - - (24,102) (24,102)

-------- -------- ------------ ----------- -------- --------- ---------

Balance at 31

December

2009 4,330 7,033 12,981 1,642 (217) 140,402 166,171

Profit for the

year - - - - - 69,521 69,521

Other

comprehensive

income

-------- -------- ------------ ----------- -------- --------- ---------

Foreign

exchange

translation

differences - - 1,119 - - - 1,119

Effective

portion of

changes in

fair value of

cash flow

hedges - - - - 674 - 674

Actuarial

gains and

losses on

defined

benefit

pension plans

net of tax - - - - - 1,095 1,095

-------- -------- ------------ ----------- -------- --------- ---------

Total other

comprehensive

income - - 1,119 - 674 1,095 2,888

-------- -------- ------------ ----------- -------- --------- ---------

Total

comprehensive

income - - 1,119 - 674 70,616 72,409

Transactions

with owners,

recorded

directly in

equity

Equity settled

share-based

payment

transactions

net of tax - - - - - 195 195

Share options

exercised by

employees 4 356 - - - - 360

Own ordinary

shares

acquired - - - - - (2,876) (2,876)

Own ordinary

shares

awarded under

share

schemes - - - - - 3,506 3,506

Preference

shares

redeemed - - - 2 - (4) (2)

Dividends - - - - - (35,912) (35,912)

-------- -------- ------------ ----------- -------- --------- ---------

Balance at 31

December

2010 4,334 7,389 14,100 1,644 457 175,927 203,851

-------- -------- ------------ ----------- -------- --------- ---------

Detailed explanations for equity capital, translation reserve,

capital redemption reserve and hedging reserve can be seen in note

9. Consolidated Statement of Cash Flows

for the year ended 31 December 2010

Notes 2010 2010 2009 2009

GBP'000 GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Profit for the year 69,521 64,032

Adjustments for:

Amortisation of intangibles 1,718 1,153

Amortisation of development costs 639 402

Depreciation 3,972 3,549

Equity settled share-based

payment expense 1,086 872

Profit on sale of property, plant

and equipment (12) (598)

Financial income (6,931) (5,784)

Financial expenses 6,800 6,405

Income tax expense 28,334 26,884

______ ______

105,127 96,915

Decrease in inventories 489 9,680

(Increase) / decrease in trade

and other receivables (14,503) 5,967

Increase / (decrease) in trade

and other payables 3,189 (4,032)

Difference between pension charge

and cash contribution (844) (1,350)

Increase / (decrease) in

provisions 385 (257)

Increase in other employee

benefits 507 272

______ ______

94,350 107,195

Income taxes paid (26,186) (27,548)

______ ______

Cash flows from operating

activities 68,164 79,647

Investing activities

Purchase of property, plant and

equipment (5,034) (4,238)

Development costs capitalised (1,018) (768)

Sale of property, plant and

equipment 154 908

Acquisition of businesses (5,621) (4,892)

Interest received 483 270

______ ______

Cash flows from investing

activities (11,036) (8,720)

Financing activities

Issue of ordinary share capital 360 372

Purchase of ordinary share

capital (2,876) (3,700)

Purchase of preference shares

treated as debt (4) -

Interest paid (88) (176)

Repayment of amounts borrowed (464) (27)

Repayment of finance lease

liabilities (102) (94)

Dividends paid on ordinary shares (35,912) (24,102)

______ ______

Cash flows from financing

activities (39,086) (27,727)

______ ______

Increase in cash and cash

equivalents 18,042 43,200

Cash and cash equivalents at 1

January 78,676 41,390

Effect of exchange rate 1,163 (5,914)

fluctuations on cash held _____ ______

Cash and cash 8 97,881 78,676

equivalents at 31 ===== =====

December

Notes to the Financial Statements

for the year ended 31 December 2010

Except where indicated, values in these notes are in

GBP'000.

Rotork p.l.c. is a company domiciled in England. The

consolidated financial statements of the Company for the year ended

31 December 2010 comprise the Company and its subsidiaries

(together referred to as the 'Group').

1. Accounting policies

Basis of preparation

The consolidated financial statements of Rotork p.l.c. have been

prepared and approved by the directors in accordance with

International Financial Reporting Standards as adopted by the

European Union (IFRSs as adopted by the EU), IFRIC Interpretations

and the Companies Act 2006 applicable to companies reporting under

IFRS.

The consolidated financial statements have been prepared under

the historical cost convention subject to the items referred to in

the derivative financial instruments accounting policy below.

New accounting standards and interpretations

The following standards and interpretations became effective for

the current reporting period:

IFRS3, 'Business combinations (revised)', was adopted from 1

January 2010. The main difference to Rotork is that previously

capitalised acquisition costs are now being expensed. The change

has not had a material impact on the financial statements.

Amendments to IFRS 2, Group Cash-settled Share-based Payment

Transactions, IAS 27 Consolidated and Separate Financial

Statements, IAS 39 'Financial Instruments: Recognition and

Measurement: Eligible Hedged Items', and IAS 39 'Reclassification

of Financial Assets: Effective Date and Transition' did not have a

material impact on the financial statements.

Amendments to IFRS 1, Additional Exemptions for First-time

Adopters is not applicable to the Group.

No interpretations which became effective in 2010 were relevant

to the Group.

Recent accounting developments

Standards, amendments or interpretations which have been issued

by the International Accounting Standards Board or by the IFRIC,

and application was not mandatory in the period are not expected to

have a material impact on the Group. Subject to endorsement by the

European Union, these standards, amendments or interpretations will

be adopted in future periods.

Going concern

The Company has considerable financial resources together with a

significant order book, with customers across different geographic

areas and industries. As a consequence, the directors believe that

the Company is well placed to manage its business risks

successfully despite the current uncertain economic outlook.

The directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future. Thus the going concern basis is adopted in

preparing the annual financial statements.

Consolidation

The consolidated financial statements incorporate the financial

statements of the Company and its subsidiaries for the year to 31

December 2010. The financial statements of subsidiaries are

included in the consolidated financial statements from the date

that control commences until the date control ceases. Intragroup

balances and any unrealised gains or losses or income and expenses

arising from intragroup transactions are eliminated in preparing

the consolidated financial statements.

Status of this preliminary announcement

The financial information contained in this preliminary

announcement does not constitute the Company's statutory accounts

for the years ended 31 December 2010 or 2009. Statutory accounts

for 2009, which were prepared under International Financial

Reporting Standards as adopted by the EU, have been delivered to

the registrar of companies, and those for 2010 will be delivered in

due course. The auditors have reported on those accounts; their

reports were (i) unqualified, (ii) did not include a reference to

any matters to which the auditors drew attention by way of emphasis

without qualifying their report and (iii) did not contain a

statement under section 498 (2) or (3) of the Companies Act 2006.

Full financial statements for the year ended 31 December 2010, will

shortly be posted to shareholders, and after adoption at the Annual

General Meeting on 21 April 2011 will be delivered to the

registrar.

2. Operating segments

The Group has chosen to organise the management and financial

structure by the grouping of related products. The three

identifiable operating segments where the financial and operating

performance is reviewed monthly by the chief operating decision

maker are as follows:

Controls - the design, manufacture and sale of electric valve

actuators

Fluid Systems - the design, manufacture and sale of pneumatic

and hydraulic valve actuators

Gears - the design, manufacture and sale of gearboxes, adaption

and ancillaries for the valve industry

Unallocated expenses comprise corporate expenses.

Geographic analysis

Rotork has a worldwide presence in all three operating segments

through its subsidiary selling offices and through an agency

network. A full list of locations can be found at www.rotork.com or

in the directory on pages 94 to 96 of the Rotork 2009 Annual Report

& Accounts.

Analysis by Operating Segment:

Fluid

Controls Systems Gears Elimination Unallocated Group

2010 2010 2010 2010 2010 2010

--------- -------- ------- ------------ ------------ ---------

Revenue from

external

customers 243,361 106,838 30,361 - - 380,560

Inter segment

revenue - - 8,844 (8,844) - -

--------- -------- ------- ------------ ------------ ---------

Total revenue 243,361 106,838 39,205 (8,844) - 380,560

--------- -------- ------- ------------ ------------ ---------

Operating

profit

before

amortisation

of acquired

intangibles 78,786 14,911 9,161 - (3,416) 99,442

Amortisation

of acquired

intangibles - (1,659) (59) - - (1,718)

Operating

profit 78,786 13,252 9,102 - (3,416) 97,724

--------- -------- ------- ------------ ------------ ---------

Net financing

income 131

Income tax

expense (28,334)

---------

Profit for

the year 69,521

---------

Fluid

Controls Systems Gears Elimination Unallocated Group

2009 2009 2009 2009 2009 2009

--------- -------- ------- ------------ ------------ ---------

Revenue from

external

customers 227,344 99,726 26,451 - - 353,521

Inter segment

revenue - - 10,373 (10,373) - -

--------- -------- ------- ------------ ------------ ---------

Total revenue 227,344 99,726 36,824 (10,373) - 353,521

--------- -------- ------- ------------ ------------ ---------

Operating

profit

before

amortisation

of acquired

intangibles

and disposal

of property 72,033 15,313 8,086 - (3,329) 92,103

Amortisation

of acquired

intangibles - (1,093) (60) - - (1,153)

Disposal of

property 587 - - - - 587

--------- -------- ------- ------------ ------------ ---------

Operating

profit 72,620 14,220 8,026 - (3,329) 91,537

--------- -------- ------- ------------ ------------ ---------

Net financing

expense (621)

Income tax

expense (26,884)

---------

Profit for

the year 64,032

---------

Fluid

Controls Systems Gears Unallocated Consolidated

2010 2010 2010 2010 2010

Depreciation 2,634 1,124 214 - 3,972

Amortisation:

Other

intangibles

Development - 1,659 59 - 1,718

costs 639 - - - 639

Non-cash items :

equity settled

share-based

payments 609 129 111 237 1,086

Net financing income - - - 131 131

Intangible assets

acquired as part of

a business

combination - 4,102 - - 4,102

Capital expenditure 3,953 940 179 - 5,072

Fluid

Controls Systems Gears Unallocated Consolidated

2009 2009 2009 2009 2009

Depreciation 2,262 1,040 247 - 3,549

Amortisation:

Other

intangibles

Development - 1,093 60 - 1,153

costs 402 - - - 402

Non-cash items :

equity settled

share-based

payments 458 72 79 263 872

Net financing

expense - - - (621) (621)

Intangible assets

acquired as part of

a business

combination - 3,595 - - 3,595

Capital expenditure 3,083 1,094 135 - 4,312

Balance sheets are reviewed by operating subsidiary and

operating segment balance sheets are not prepared, as such no

further analysis of operating segments assets and liabilities are

presented.

Geographical analysis:

Rest of

Rest of Other the

UK Europe USA Americas World Consolidated

2010 2010 2010 2010 2010 2010

Revenue

from

external

customers

by

location

of

customer 24,277 121,595 71,036 39,488 124,164 380,560

Non-

current

assets

-

Intangible

assets 7,248 18,621 13,564 213 4,344 43,990

- Property,

plant and

equipment 6,423 10,618 4,363 230 4,146 25,780

Rest of

Rest of Other the

UK Europe USA Americas World Consolidated

2009 2009 2009 2009 2009 2009

Revenue

from

external

customers

by

location

of

customer 29,314 117,098 65,370 33,081 108,658 353,521

Non-

current

assets

-

Intangible

assets 6,869 19,217 10,207 213 4,274 40,780

- Property,

plant and

equipment 5,200 11,060 3,360 220 3,681 23,521

3. Net financing income

Recognised in the income statement 2010 2009

Interest income 540 226

Expected return on assets in the pension schemes 6,141 5,408

250 150

Foreign exchange gains ______ ______

6,931 5,784

===== =====

Interest expense 79 167

Interest charge on pension scheme liabilities 6,289 5,449

432 789

Foreign exchange losses ______ ______

6,800 6,405

===== =====

Recognised in equity

Effective portion of changes in fair value of

cash flow hedges 457 (217)

Fair value of cash flow hedges transferred to

income statement 217 5,263

Foreign currency translation differences for foreign 1,119 (11,928)

operations ______ ______

1,793 (6,882)

===== =====

Recognised in:

Hedging reserve 674 5,046

Translation reserve 1,119 (11,928)

______ ______

1,793 (6,882)

===== =====

4. Income tax expense

2010 2010 2009 2009

Current tax:

UK corporation tax on profits

for the year 8,645 13,757

Double tax relief - (6,074)

Adjustment in respect of prior (417) (146)

years ______ ______

8,228 7,537

Overseas tax on profits for the

year 18,787 18,560

Adjustment in respect of prior 42 (9)

years ______ ______

18,829 18,551

______ ______

Total current tax 27,057 26,088

Deferred tax:

Origination and reversal of other

temporary differences 1,477 704

Adjustment in respect of prior (200) 92

years ______ ______

Total deferred tax 1,277 796

_____ _____

Total tax charge for year 28,334 26,884

===== =====

Effective tax rate (based on profit

before tax) 29.0% 29.6%

Profit before tax 97,855 90,916

Profit before tax multiplied by

standard rate of corporation tax

in the UK of 28.0% (2009: 28.0%) 27,399 25,456

Effects of:

Non deductible items 785 1,468

Utilisation of overseas tax holidays

and losses (1,127) (898)

Different tax rates on overseas

earnings 1,852 921

Adjustments to tax charge in respect (575) (63)

of prior years ______ ______

Total tax charge for year 28,334 26,884

===== =====

A tax credit of GBP926,000 (2009: credit GBP670,000) in respect

of share-based payments has been recognised directly in equity in

the year.

The Group continues to expect its effective rate of corporation

tax to be slightly higher than the standard UK rate due to higher

rates of tax in the US, Canada, France, Germany, Italy, Japan and

India.

There is an unrecognised deferred tax liability for temporary

differences associated with investments in subsidiaries. Rotork

p.l.c. controls the dividend policies of its subsidiaries and

subsequently the timing of the reversal of the temporary

differences. It is not practical to quantify the unprovided

temporary differences as acknowledged within paragraph 40 of IAS

12.

5. Intangible assets

Development Other Development Other

Goodwill costs intangibles Total Goodwill costs intangibles Total

2010 2010 2010 2010 2009 2009 2009 2009

Cost

Balance at 1

January 33,204 4,647 8,409 46,260 32,792 3,879 6,941 43,612

Exchange

differences 230 - 468 698 (1,696) - (19) (1,715)

Internally

developed

during the

year - 1,018 - 1,018 - 768 - 768

Acquisition

through

business 2,473 - 1,629 4,102 2,108 - 1,487 3,595

combinations ______ ______ ______ _____ ______ ______ ______ _____

Balance at 31

December 35,907 5,665 10,506 52,078 33,204 4,647 8,409 46,260

Amortisation

Balance at 1

January - 2,555 2,925 5,480 - 2,153 1,763 3,916

Exchange

differences - - 251 251 - - 9 9

Amortisation

for the year - 639 1,718 2,357 - 402 1,153 1,555

______ ______ ______ _____ ______ ______ ______ _____

Balance at 31 - 3,194 4,894 8,088 - 2,555 2,925 5,480

December ----------------------------_____ _____ _____ _____ ----------------------------_____ _____ _____ _____

Net book 35,907 2,471 5,612 43,990 33,204 2,092 5,484 40,780

value at 31 ===== ===== ===== ===== ===== ===== ===== =====

December Net 32,792 1,726 5,178 39,696

book value

at 31

December

2008

The amortisation charge in both years is recognised within

administrative expenses in the income statement. Other intangibles

include customer relationships, order books, intellectual property,

agency agreements and trading names of acquired companies.

Impairment tests for goodwill

Goodwill is allocated to the Group's cash generating units

('CGUs') identified according to business segment. A segment level

summary of goodwill allocation is presented below.

2010 2009

Controls 6,828 6,687

Fluid Systems 21,436 18,753

Gears 7,643 7,764

_____ _____

35,907 33,204

===== =====

The recoverable amounts of all CGUs are based on value in use

calculations. These calculations use cash flow projections and are

based on actual operating results and the latest Group three year

plan. The three year plan is based on management's view of the

future and experience of past performance. Cash flows for the

remainder of the next twenty years are extrapolated using a 2%

growth rate which reflects the long-term nature of many of the

markets the Group serves. This rate has been consistently bettered

in the past so is believed to represent a prudent estimate. The

discount rate used is 12.1% (2009: 9.8%), this represents a

reasonable rate for a market participant in this sector. The

discount rate of each business segment is not materially different

to 12.1%. For the Goodwill to become impaired in the CGU with the

minimum headroom, the discount rate would have to increase by 24%.

On this basis each business segment has sufficient headroom and

therefore no impairment write downs are required.

6. Inventories

2010 2009

Raw materials and consumables 30,345 26,998

Work in progress 11,411 13,692

Finished goods 6,485 6,022

______ ______

48,241 46,712

===== =====

Included in cost of sales was GBP147,651,000 (2009:

GBP140,728,000) in respect of inventories consumed in the year.

7. Trade and other receivables

2010 2009

Non-current assets:

Insurance policy 1,158 995

132 124

Other _____ _____

1,290 1,119

Other receivables ===== =====

Current assets:

Trade receivables 72,208 55,384

(1,846) (1,593)

Less provision for impairment of receivables ______ ______

70,362 53,791

Trade receivables - net ===== =====

2,398 1,818

Corporation tax ______ ______

2,398 1,818

Current tax ===== =====

Other non-trade receivables 3,943 3,729

Prepayments and accrued income 2,741 2,468

______ ______

Other receivables 6,684 6,197

===== =====

8. Cash and cash equivalents

2010 2009

Bank balances 40,865 29,704

Cash in hand 95 89

Short-term deposits 56,921 48,883

______ ______

Cash and cash equivalents 97,881 78,676

in the consolidated statement ===== =====

of cash flows

9. Capital and reserves

Share capital and share premium

5p 5p

Ordinary Ordinary

shares shares

5p Issued GBP1 5p Issued GBP1

Ordinary and Non-redeemable Ordinary and Non-redeemable

shares fully preference shares fully preference

Authorised paid up shares Authorised paid up shares

2010 2010 2010 2009 2009 2009

At 1

January 5,449 4,330 42 5,449 4,325 42

Preference

shares

redeemed - - (2) - - -

Issued

under

employee

share - 4 - - 5 -

schemes _____ _____ _____ _____ _____ _____

At 31

December 5,449 4,334 40 5,449 4,330 42

===== ===== ===== ===== ===== =====

108,990 86,682 108,990 86,613

===== ===== ===== =====

The ordinary shareholders are entitled to receive dividends as

declared and are entitled to vote at meetings of the Company.

The Group received proceeds of GBP360,000 (2009: GBP372,000) in

respect of the 68,955 (2009: 102,861) ordinary shares issued during

the year: GBP4,000 (2009: GBP5,000) was credited to share capital

and GBP356,000 (2009: GBP367,000) to share premium.

The preference shareholders take priority over the ordinary

shareholders when there is a distribution upon winding up the

Company or on a reduction of equity involving a return of capital.

The holders of preference shares are entitled to vote at a general

meeting of the Company if a preference dividend is in arrears for

six months or the business of the meeting includes the

consideration of a resolution for winding up the Company or the

alteration of the preference shareholders' rights.

Within the retained earnings reserve are own shares held. The

investment in own shares represents 262,528 (2009: 363,196)

ordinary shares of the Company held in trust for the benefit of

directors and employees for future payments under the Share

Incentive Plan and Long Term Incentive Plan. The dividends on these

shares have been waived.

Translation reserve

The translation reserve comprises all foreign exchange

differences arising from the translation of the financial

statements of foreign operations.

Capital redemption reserve

The capital redemption reserve arises when the Company redeems

shares wholly out of distributable profits.

Hedging reserve

The hedging reserve comprises the effective portion of the

cumulative net change in the fair value of cash flow hedging

instruments that are determined to be an effective hedge.

Dividends

The following dividends were paid in the year per qualifying

ordinary share:

2010 2009

17.25p final dividend (2009: 16.75p) 14,928 14,470

12.75p interim dividend (2009: 11.15p) 11,033 9,632

2010 additional interim dividend 11.5p (2009: 9,951 -

nil) _____ _____

35,912 24,102

===== =====

After the balance sheet date the following dividends per

qualifying ordinary share were proposed by the directors. The

dividends have not been provided for and there are no corporation

tax consequences.

2010 2009

Final proposed dividend per qualifying ordinary

share

19.75p 17,120

=====

17.25p 14,943

=====

Additional interim dividend of 11.5p per qualifying 10,000

ordinary share proposed for 2011 =====

Additional interim dividend of 11.5p per qualifying 9,960

ordinary share proposed for 2010 =====

10. Earnings per share

Basic earnings per share

Earnings per share is calculated for both the current and

previous years using the profit attributable to the ordinary

shareholders for the year. The earnings per share calculation is

based on 86.4m shares (2009: 86.3m shares) being the weighted

average number of ordinary shares in issue (net of own ordinary

shares held) for the year.

2010 2009

69,521 64,032

Net profit attributable to ordinary shareholders ===== =====

Weighted average number of ordinary shares

Issued ordinary shares at 1 January 86,250 86,096

Effect of own shares held 131 172

Effect of shares issued under Share option schemes 24 13

/ Sharesave plans _____ _____

Weighted average number of ordinary shares for 86,405 86,281

the year ===== =====

Basic earnings per share 80.5p 74.2p

Diluted earnings per share

Diluted earnings per share is based on the profit for the year

attributable to the ordinary shareholders and 86.7m shares (2009:

86.7m shares). The number of shares is equal to the weighted

average number of ordinary shares in issue (net of own ordinary

shares held) adjusted to assume conversion of all potentially

dilutive ordinary shares. The Company has three categories of

potentially dilutive ordinary shares: those share options granted

to employees under the Share option scheme and Sharesave plan where

the exercise price is less than the average market price of the

Company's ordinary shares during the year and contingently issuable

shares awarded under the Long Term Incentive Plan ('LTIP').

2010 2009

69,521 64,032

Net profit attributable to ordinary shareholders ===== =====

Weighted average number of ordinary shares

(diluted)

Weighted average number of ordinary shares for

the year 86,405 86,281

Effect of share options in issue 9 11

Effect of Sharesave options in issue 108 68

Effect of LTIP shares in issue 145 327

----_____ ----_____

Weighted average number of ordinary shares 86,667 86,687

(diluted) for the year ===== =====

Diluted earnings per share 80.2p 73.9p

11. Provisions

Warranty

Provision

Balance at 1 January 2010 4,914

Exchange differences 295

Provisions used during the year (1,078)

Acquired as part of a business combination 664

1,169

Charged in the year _____

Balance at 31 December 2010 5,964

=====

Maturity at 31 December 2010

Non-current 1,968

3,996

_____

5,964

Current =====

Maturity at 31 December 2009

Non-current 1,664

Current 3,250

_____

4,914

=====

The warranty provision is based on estimates made from

historical warranty data associated with similar products and

services. The provision relates mainly to products sold during the

last 12 months, the typical warranty period is now 18 months.

12. Trade and other payables

2010 2009

Trade payables 30,447 26,031

- 319

Bills of exchange ______ ______

30,447 26,350

Trade payables ===== =====

10,821 9,768

Corporation tax ______ ______

10,821 9,768

Current tax ===== =====

Other taxes and social security 4,066 3,627

Non-trade payables and accrued expenses 22,268 21,063

______ ______

Other payables 26,334 24,690

===== =====

13. Related parties

The Group has a related party relationship with its subsidiaries

and with its directors and key management. A list of subsidiaries

is shown in the directory on pages 94 to 96 of the Rotork 2009

Annual Report & Accounts. Transactions between two subsidiaries

for the sale and purchase of products or the subsidiary and parent

Company for management charges are priced on an arms length

basis.

Sales to subsidiaries and associates of BAE Systems plc, a

related party by virtue of non-executive director IG King's

directorship of that company, totalled GBP21,000 during the year

(2009: GBP20,000) and no amount was outstanding at 31 December 2010

(2009: GBP19,000).

Key management emoluments

The emoluments of those members of the management team,

including directors, who are responsible for planning, directing

and controlling the activities of the Group were:

2010 2009

Emoluments including social security costs 2,990 2,455

Post employment benefits 370 424

Share-based payments 755 843

_____ _____

4,115 3,722

===== =====

14. Post balance sheet event

On 23 February 2011 the Group signed a contract to acquire all

the outstanding issued share capital of Rotork Servo Controles de

Mexico S.A. de C.V. ('RSCM'), its Mexican sales and service agent.

Formal completion will take place following certain share transfer

formalities being finalised. Gross assets of RSCM are approximately

GBP1.6 million.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR DKFDQBBKDDBB

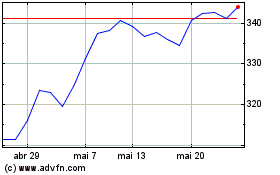

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024