TIDMROR

RNS Number : 8324I

Rotork PLC

31 July 2012

Rotork p.l.c.

2012 Half Year Results

HY 2012 HY 2011 % change OCC *(2)

% change

Revenue GBP245.9m GBP199.4m +23.3% +17.1%

Adjusted*(1) operating

profit GBP61.7m GBP50.3m +22.8% +17.0%

Profit before tax GBP58.1m GBP49.6m +17.2% +16.9%

Adjusted*(1) profit before

tax GBP61.7m GBP50.7m +21.9% +16.2%

Basic earnings per share 47.8p 40.9p +16.9% +17.1%

Adjusted*(1) basic earnings

per share 50.8p 41.7p +21.8% +16.5%

Interim dividend 16.40p 14.50p +13.1%

*(1) Adjusted figures are before the amortisation of acquired

intangible assets

*(2) OCC is organic constant currency

Key Points

-- Record first-half revenue and profit in each division

-- Order intake up 18.2%

-- Order book at a record high of GBP177.7m, up 13.0% from December

-- Successful integration of 2011 acquisitions

-- New product launches in each division, including IQ3 in Controls

-- Continued investment for growth

-- Interim dividend increased by 13.1%

Peter France, Chief Executive, commenting on the results,

said:

"Rotork has continued to perform well during these challenging

economic conditions. Order intake, revenue and profit are at record

levels. We continue to invest in our infrastructure, product

development and sales coverage to support the longer term growth

projections of the business and our continued expansion into the

wider flow control market.

Whilst recognising the challenging economic environment, our

record order book and diverse end market exposure provide the Board

with confidence of achieving further progress in the full year. We

are anticipating, as in previous years, that the Group's

performance in 2012 will be weighted towards the second half and

that margins will remain similar to those seen in 2011."

For further information, please contact:

Rotork p.l.c. Tel: 01225 733200

Peter France, Chief Executive

Jonathan Davis, Finance Director

FTI Consulting Tel: 020 7269 7291

Nick Hasell / Susanne Yule

Review of operations

Business Review

Rotork has performed well in the six months to 30 June 2012,

with each division achieving record order intake, revenue and

profit for a first half trading period. The order book is 13.0%

higher than last December at GBP177.7m. Order intake was 18.2%

higher than the comparator period, with the strongest growth in the

Gears division. Revenue at GBP245.9m was up 23.3% and adjusted

operating profit was 22.8% higher at GBP61.7m.

The global economic climate has impacted a number of our

businesses and we have seen a slowdown in order placement in

countries such as India and China. Nevertheless, we achieved record

order intake in the first half of 2012, with our diverse end-user

market and geographic coverage enabling us to focus on markets and

geographies where growth is the strongest. The visibility of

projects in the second half is good and we expect our markets in

the Middle East, South America, USA and Russia to remain

active.

Whilst revenues have been strong we have experienced some higher

costs. Continued upgrade and investment in facilities, product

launches and general inflationary pressures have all impacted the

profit margin. We have also experienced a headwind in terms of

currency in the period. This has been partially offset by

operational gearing and has resulted in an adjusted operating

margin of 25.1%. Revenue will be weighted to the second half of

2012 and for the full year we expect the adjusted operating margin

to be similar to 2011.

On 28 June 2012 we completed the purchase of a new factory in

Leeds that will house Rotork Gears and the main office of Rotork

UK, our sales and marketing operation. We are anticipating a total

capital cost, including purchase and fit-out of the building, to be

in the region of GBP6m, representing the major capital project in

the year. Due to this expansion, the refurbishment of our second

facility in Bath, and other projects, such as the roll out of our

new IT system, we anticipate capital spend for the year to be

higher than last year at GBP12-14m.

Rotork Site Services, our after-sales and support activity,

continues to grow. We have signed a number of preventative

maintenance contracts in the period and continue to pursue further

significant opportunities. We view investment in after-sales and

support as a key differentiator in our ability to provide our

customers with best in class products and services.

Rotork Instruments, the division created at the end of 2011

through the acquisition of Fairchild, has made a good start to the

year, and is performing in line with expectations.

Financial results

The impact of last year's acquisitions on these results is

significant, with GBP16m of incremental revenue in the period.

However currency has been a headwind, reducing reported revenue by

GBP4m. Our two main trading currencies have moved in opposite

directions compared with the first half of last year, with the euro

weakening 8% and the US dollar strengthening 2% relative to

sterling. Revenue growth excluding acquisitions and restated at the

exchange rates of the comparative period is therefore 17.1% rather

than the headline 23.3% reported. The combined impact of currency

and acquisitions on adjusted operating margin is minimal,

increasing it by 10 basis points to 25.2%.

Net cash balances of GBP56m are GBP8m higher than December 2011,

with the payment of the GBP20m final dividend the most significant

outflow. Capital expenditure is first half weighted this year with

GBP8m spent so far. Net working capital has increased GBP2m since

last December and represents 25% of annualised revenue compared

with 27% at the year end.

The Group effective tax rate remains similar to last year at

28.7%. Adjusted basic earnings per share is 50.8p, a 21.8% increase

but due to the higher intangible amortisation charge following last

year's acquisitions, the basic earnings per share is 47.8p, a 16.9%

increase.

Operating Review

The first half of 2012 saw the launch of a number of important

products which will fuel future organic growth. We also continued

the integration of the six acquisitions we completed last year.

Acquisitions remain an important part of our growth strategy and we

continue to look for suitable companies or products that will

support our long-term strategic and financial goals.

Rotork Controls

GBPm H1 2012 H1 2011 Change OCC*(2) Change

Revenue 146.2 129.4 +13.0% +11.4%

Adjusted*(1) operating

profit 46.6 42.9 +8.7% +8.2%

Adjusted operating

margin 31.9% 33.1% -120 bps -90 bps

Order intake was a record in the first half, 7.1% higher than

the first half of last year, resulting in an order book of

GBP95.9m, 5.1% ahead of last December. Growth in Asia and the Far

East has slowed as activity in India and China remained subdued in

the second quarter. However, there was stronger growth in our

markets in the USA, Latin America and Russia, whilst Australia has

started to see the benefit of unconventional gas projects, leading

to increased sales of Rotork Process Control (RPC) actuators. China

and India are traditionally strong power markets for Rotork, and as

we have seen this market slow, sales efforts in those countries

have switched to the more active oil and gas and water markets. At

the same time, there has been good growth in the water market in

the UK and USA.

During the period, we launched our next generation flagship

electric actuator, the IQ3, which brings a number of enhancements

to this key product. The RPC range has also been expanded with the

launch of the CMA, extending the family of process control

actuators. We have received the first orders for both these

products and deliveries will start in the second half. We have also

moved into our new plant in Chennai, India, with both the factory

and RIDEC (Rotork Innovation Design and Engineering Centre) teams

now housed together in a world-class facility.

Our investment in product development and launches, facilities

and people to support further growth has led to a reduction in

divisional operating margin compared with the previous year. These

investments are important for the long-term growth of the division

and will enable us to maintain our market leadership and

technological advantage by combining the most innovative product

range with unmatched local support.

Rotork Fluid Systems

GBPm H1 2012 H1 2011 Change OCC*(2) Change

Revenue 71.4 53.1 +34.6% +31.3%

Adjusted*(1) operating

profit 9.2 4.9 +88.0% +91.3%

Adjusted operating

margin 12.9% 9.2% +370 bps +420 bps

This division had the highest revenue growth in the period, up

34.6%, partly because 2011 was very second half weighted. Order

intake was 26.2% ahead of the comparative period and 14.2% ahead of

the second half of last year with the order book a record at

GBP69.0m, 21.0% higher than December.

The growth has been geographically broad based, with oil and gas

still the dominant end market. Russia and Australia have been

positive as has China, where our RFS sales channels are less well

developed. In Mexico we have made the first deliveries on the large

pipeline order which we won last year and Flow-Quip, our US liquid

pipelines business, has had a strong start to the year. K-Tork, the

business in Dallas, USA, which we purchased last July, has made a

positive contribution in the period and its products have now been

launched to our global sales teams. Overall, North America and Asia

Pacific were the fastest growing regions, with Asia Pacific

overtaking the Middle East as the largest end destination.

The operating margin for RFS was 12.9%, a 370 basis points

improvement on the comparable period last year. Investment in

facilities, product development and product launches in the period

have added cost but our target margin for this division remains

15%.

Rotork Gears

GBPm H1 2012 H1 2011 Change OCC*(2) Change

Revenue 25.3 21.5 +18.1% +17.5%

Adjusted*(1) operating

profit 5.6 4.7 +19.7% +18.6%

Adjusted operating

margin 22.0% 21.7% +30 bps +20 bps

Gears order intake was a record half year increasing 29.7%, with

all of our Gears operations experiencing good growth. This resulted

in a closing order book of GBP11.8m, a 49.4% increase from

December. The highest growth was in the domestic Chinese market,

supplied by our Shanghai factory, and for the subsea and larger

gearboxes supplied by our factory in Italy.

In Houston, because the Gears operation has already outgrown its

facility, additional space has now been taken on to allow further

development of the stocking and finishing centre to serve the US

market. This will provide the capacity to target new key accounts

whilst maintaining service levels. Elsewhere Gears has also been

expanding its sourcing team, which will ensure continued close

control of material costs, and increasing the number of R&D

engineers, which will accelerate the rate of product development. A

new manual gearbox range was launched in the period which will

generate new business in the second half.

Rotork Instruments

GBPm H1 2012

Revenue 8.3

Adjusted*(1) operating

profit 2.7

Adjusted operating

margin 32.6%

Rotork Instruments was created at the end of 2011 with the

acquisition of Fairchild and has made a good start to the year,

performing in line with expectations. With sales into a number of

end markets not served by the other divisions, the introduction of

Instruments accounts for the increase in sales to the range of end

markets we classify as Other. Integration of the business is

proceeding to plan and progress is being made in developing the

sales channels and supporting purchasing and product development

initiatives.

Principal risks and uncertainties

The Group has an established risk management process as part of

the corporate governance framework set out in the 2011 Annual

Report & Accounts. We regularly review the principal risks and

uncertainties facing our businesses and examine the potential

impacts on our processes and procedures. The risk management

process is described in detail on pages 26 and 27 of the 2011

Annual Report & Accounts. We identify risks in the form of

strategic, operational and financial risks and set out mitigations

and improvements to our processes and procedures as necessary to

adapt to these.

The Group has reviewed these risks and concluded that they

remain applicable to the second half of the financial year. The

risks identified include volatility of exchange rates and political

instability in a key end-market and in this context the Board

continues to carefully monitor developments in the Eurozone. Whilst

we do not have a direct presence in Greece, we do have facilities

in many other Eurozone countries, including Spain and Italy, and

the Eurozone represents an important customer base, with

approximately 30% of our revenues euro denominated. Our hedging

policy in respect of the euro is unchanged and we continue to cover

up to 75% of our forecast currency exposure using forward

contracts. However, we have reduced the cash we hold in euros,

returning this to the UK and converting to sterling.

We believe that the broad spread of geographic markets which we

serve limits the risks associated with instability in any given

territory and we will continue to monitor developments to ensure

that we are well-placed to mitigate the effects of any instability

if it arises.

The Board

In May 2012 we welcomed Sally James to the board of Rotork plc.

as a non-executive director. Sally is also a non-executive director

of UBS Limited and UBS Securities France SA, Towry Ltd and a

Governor of the College of Law London. She is an independent Member

of Council of the University of Sussex and chairs its Audit

Committee. Previously Sally held a number of senior legal roles in

Investment Banks in London and Chicago including Managing Director

and General Counsel for UBS Investment Bank. She has also held the

position of Bursar at Corpus Christi College, Cambridge. Sally is a

member of the Audit, Remuneration and Nomination Committees.

Statement of Directors' Responsibilities

The Directors confirm that this condensed consolidated interim

financial information has been prepared in accordance with IAS 34

as adopted by the European Union and that the interim management

report includes a fair review of the information required by DTR

4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- material related party transactions in the first six months and any material changes in the related-party transactions described in the last annual report.

The Directors of Rotork p.l.c. are listed in the Rotork p.l.c.

Annual Report & Accounts for 31 December 2011 with the

exception of Sally James who joined the Board in May 2012. A list

of current directors is maintained in the About Us section of the

Rotork website: www.rotork.com.

Dividend

The interim dividend is to be increased by 13.1% to 16.4p per

ordinary share and will be paid on 28 September 2012 to

shareholders on the register at the close of business on 31 August

2012. Our dividend policy remains to grow core dividends generally

in line with earnings and then supplement core dividends with

additional dividends when projected cash requirements show we are

able to do so. The 2011 final dividend of 22.75p per ordinary share

was paid on 21 May at a cash cost of GBP19.7m.

Outlook

Whilst recognising the challenging economic environment, our

record order book and diverse end market exposure provide the Board

with confidence of achieving further progress in the full year. We

are anticipating as in previous years that the Group's performance

in 2012 will be weighted towards the second half and that margins

will remain similar to those seen in 2011.

By order of the Board

Peter France

Chief Executive

30 July 2012

Consolidated Income Statement

Unaudited

First half First half Full year

2012 2011 2011

Notes GBP000 GBP000 GBP000

---------- ---------- ---------

Revenue 2 245,871 199,415 447,833

Cost of sales (129,992) (104,846) (236,359)

---------- ---------- ---------

Gross profit 115,879 94,569 211,474

Other income 62 37 194

Distribution costs (2,395) (1,726) (4,020)

Administrative expenses (55,416) (43,651) (95,589)

Other expenses (13) (11) (59)

Operating profit before the amortisation

of

acquired intangible assets 61,745 50,273 115,921

Amortisation of acquired intangible

assets (3,628) (1,055) (3,921)

----------------------------------------- ----- ---------- ---------- ---------

Operating profit 2 58,117 49,218 112,000

Financial income 3 3,483 3,765 7,590

Financial expenses 3 (3,485) (3,381) (7,040)

Profit before tax 58,115 49,602 112,550

Income tax expense 4

UK (4,989) (3,939) (9,728)

Overseas (11,715) (10,324) (22,421)

---------- ---------- ---------

(16,704) (14,263) (32,149)

Profit for the period 41,411 35,339 80,401

========== ========== =========

pence pence pence

Basic earnings per share 6 47.8 40.9 93.0

Adjusted basic earnings per share 6 50.8 41.7 96.2

Diluted earnings per share 6 47.6 40.8 92.6

Consolidated Statement of Comprehensive Income and Expense

Unaudited

First half First half Full year

2012 2011 2011

GBP000 GBP000 GBP000

Profit for the period 41,411 35,339 80,401

Other comprehensive income and expense

Foreign exchange translation differences (3,015) 2,894 (2,484)

Actuarial loss in pension scheme net of tax - - (8,499)

Effective portion of changes in fair value

of cash flow hedges 591 (803) 207

---------- ---------- ---------

Income and expenses recognised directly in

equity (2,424) 2,091 (10,776)

Total comprehensive income for the period 38,987 37,430 69,625

========== ========== =========

Consolidated Balance Sheet

Unaudited

30 June 30 June 31 Dec

2012 2011 2011

Notes GBP000 GBP000 GBP000

------- ------- -------

Property, plant and equipment 36,379 27,143 31,954

Intangible assets 102,499 46,717 106,784

Deferred tax assets 12,993 11,594 13,244

Derivative financial instruments 545 - 315

Other receivables 1,490 1,339 1,556

Total non-current assets 153,906 86,793 153,853

Inventories 7 72,239 58,121 62,928

Trade receivables 91,558 76,126 96,734

Current tax 1,841 1,899 988

Derivative financial instruments 1,592 521 677

Other receivables 9,814 8,723 8,461

Cash and cash equivalents 56,185 90,202 48,557

------- ------- -------

Total current assets 233,229 235,592 218,345

Total assets 387,135 322,385 372,198

======= ======= =======

Ordinary shares 8 4,338 4,335 4,338

Share premium 7,905 7,431 7,835

Reserves 11,500 18,292 13,924

Retained earnings 220,793 184,518 198,072

------- ------- -------

Total equity 244,536 214,576 224,169

------- ------- -------

Interest-bearing loans and borrowings 160 125 229

Employee benefits 24,798 16,920 28,142

Deferred tax liabilities 12,305 3,719 12,782

Provisions 2,246 1,796 2,218

------- ------- -------

Total non-current liabilities 39,509 22,560 43,371

Bank Overdraft - - 38

Interest-bearing loans and borrowings 86 23 85

Trade payables 40,518 31,431 38,742

Employee benefits 6,502 5,005 9,624

Current tax 16,427 15,186 13,225

Derivative financial instruments 177 1,001 614

Other payables 34,979 28,610 38,360

Provisions 4,401 3,993 3,970

------- ------- -------

Total current liabilities 103,090 85,249 104,658

Total liabilities 142,599 107,809 148,029

Total equity and liabilities 387,135 322,385 372,198

======= ======= =======

Consolidated Statement of Changes in Equity

Unaudited

Issued Capital

equity Share Translation redemption Hedging Retained

capital premium reserve reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- --------- ------------- ------------ --------- ---------- ---------

Balance at 31 December

2010 4,334 7,389 14,100 1,644 457 175,927 203,851

Profit for the period - - - - - 35,339 35,339

Other comprehensive

income

--------- --------- ------------- ------------ --------- ---------- ---------

Foreign exchange translation

differences - - 2,894 - - - 2,894

Effective portion of

changes in fair value

of cash flow hedges - - - - (803) - (803)

Total other comprehensive

income - - 2,894 - (803) - 2,091

--------- --------- ------------- ------------ --------- ---------- ---------

Total comprehensive

income - - 2,894 - (803) 35,339 37,430

Transactions with owners,

recorded directly in

equity

Equity settled share

based payment transactions

net of tax - - - - - (671) (671)

Share options exercised

by employees 1 42 - - - - 43

Own ordinary shares

acquired - - - - - (2,184) (2,184)

Own ordinary shares

awarded under share

schemes - - - - - 3,157 3,157

Dividends - - - - - (27,050) (27,050)

--------- --------- ------------- ------------ --------- ---------- ---------

Balance at 30 June

2011 4,335 7,431 16,994 1,644 (346) 184,518 214,576

Profit for the period - - - - - 45,062 45,062

Other comprehensive

income

--------- --------- ------------- ------------ --------- ---------- ---------

Foreign exchange translation

differences - - (5,378) - - - (5,378)

Effective portion of

changes in fair value

of cash flow hedges - - - - 1,010 - 1,010

Actuarial loss on defined

benefit pension plans

net of tax - - - - - (8,499) (8,499)

--------- --------- ------------- ------------ --------- ---------- ---------

Total other comprehensive

income - - (5,378) - 1,010 (8,499) (12,867)

--------- --------- ------------- ------------ --------- ---------- ---------

Total comprehensive

income - - (5,378) - 1,010 36,563 32,195

Transactions with owners,

recorded directly in

equity

Equity settled share

based payment transactions

net of tax - - - - - 476 476

Share options exercised

by employees 3 404 - - - - 407

Own ordinary shares

acquired - - - - - (1,001) (1,001)

Dividends - - - - - (22,484) (22,484)

--------- --------- ------------- ------------ --------- ---------- ---------

Balance at 31 December

2011 4,338 7,835 11,616 1,644 664 198,072 224,169

========= ========= ============= ============ ========= ========== =========

Consolidated Statement of Changes in Equity (continued)

Unaudited

Issued Capital

equity Share Translation redemption Hedging Retained

capital premium reserve reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- --------- ------------- ------------ --------- ---------- ---------

Balance at 31 December

2011 4,338 7,835 11,616 1,644 664 198,072 224,169

Profit for the period - - - - - 41,411 41,411

Other comprehensive

income

--------- --------- ------------- ------------ --------- ---------- ---------

Foreign exchange translation

differences - - (3,015) - - - (3,015)

Effective portion of

changes in fair value

of cash flow hedges - - - - 591 - 591

Total other comprehensive

income - - (3,015) - 591 - (2,424)

--------- --------- ------------- ------------ --------- ---------- ---------

Total comprehensive

income - - (3,015) - 591 41,411 38,987

Transactions with owners,

recorded directly in

equity

Equity settled share

based payment transactions

net of tax - - - - - (36) (36)

Share options exercised

by employees - 70 - - - - 70

Own ordinary shares

acquired - - - - - (2,050) (2,050)

Own ordinary shares

awarded under share

schemes - - - - - 3,114 3,114

Dividends - - - - - (19,718) (19,718)

--------- --------- ------------- ------------ --------- ---------- ---------

Balance at 30 June

2012 4,338 7,905 8,601 1,644 1,255 220,793 244,536

========= ========= ============= ============ ========= ========== =========

Consolidated Statement of Cash Flows

Unaudited

First half First half Full year

2012 2011 2011

GBP000 GBP000 GBP000

---------- ---------- ---------

Profit for the period 41,411 35,339 80,401

Amortisation of acquired intangible assets 3,628 1,055 3,921

Amortisation of development costs 464 366 732

Depreciation 2,567 2,139 4,479

Equity settled share based payment expense 877 609 1,251

Net profit on sale of property, plant and

equipment (38) (26) (129)

Financial income (3,483) (3,765) (7,590)

Financial expenses 3,485 3,381 7,040

Income tax expense 16,704 14,263 32,149

65,615 53,361 122,254

Increase in inventories (10,456) (8,625) (11,402)

Decrease / (increase) in trade and other receivables 2,075 (5,538) (26,791)

Increase in trade and other payables 1,183 2,812 18,537

Difference between pension charge and cash

contribution (3,242) (2,490) (2,929)

Increase / (decrease) in provisions 494 (614) (436)

(Decrease) / increase in employee benefits (3,224) (4,365) 1,692

---------- ---------- ---------

52,445 34,541 100,925

Income taxes paid (14,442) (9,307) (27,754)

---------- ---------- ---------

Cash flows from operating activities 38,003 25,234 73,171

Purchase of property, plant and equipment (7,649) (3,319) (10,143)

Development costs capitalised (924) (492) (1,328)

Proceeds from sale of property, plant and

equipment 74 169 274

Acquisition of subsidiaries, net of cash acquired 280 (2,070) (59,876)

Contingent consideration paid (150) - (41)

Interest received 403 338 694

---------- ---------- ---------

Cash flows from investing activities (7,966) (5,374) (70,420)

Issue of ordinary share capital 70 42 450

Purchase of ordinary share capital (2,050) (2,184) (3,185)

Interest paid (20) (20) (117)

Repayment of amounts borrowed (49) - (421)

Repayment of finance lease liabilities (25) (35) (54)

Dividends paid on ordinary shares (19,718) (27,050) (49,534)

Cash flows from financing activities (21,792) (29,247) (52,861)

Net increase in cash and cash equivalents 8,245 (9,387) (50,110)

Cash and cash equivalents at 1 January 48,519 97,881 97,881

Effect of exchange rate fluctuations on cash

held (579) 1,708 748

---------- ---------- ---------

Cash and cash equivalents at end of period 56,185 90,202 48,519

========== ========== =========

Notes to the Half Year Report

1. Status of condensed consolidated interim statements,

accounting policies and basis of significant estimates

General information

Rotork p.l.c. is a company domiciled in England.

The Company has its primary listing on the London Stock

Exchange.

The condensed consolidated interim financial statements for the

6 months ended 30 June 2012 and 30 June 2011 are unaudited and the

auditors have not reported in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity'.

The information shown for the year ended 31 December 2011 does

not constitute statutory accounts within the meaning of Section 435

of the Companies Act 2006, statutory accounts for the year ended 31

December 2011 were approved by the Board on 27 February 2012 and

delivered to the Registrar of Companies. The Auditors' report on

those financial statements was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under Section 498 of the Companies Act 2006.

The consolidated financial statements of the Group for the year

ended 31 December 2011 are available from the Company's registered

office or website, see note 15.

Basis of preparation

The condensed consolidated interim financial statements of the

Company for the six months ended 30 June 2012 comprise the Company

and its subsidiaries (together referred to as 'the Group').

These condensed consolidated interim financial statements have

been prepared in accordance with the Disclosure and Transparency

Rules of the Financial Services Authority and with International

Accounting Standard 34, 'Interim Financial Reporting' as adopted by

the European Union. They do not include all of the information

required for full annual financial statements and should be read in

conjunction with the consolidated financial statements of the Group

for the year ended 31 December 2011, which have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union.

Going concern

After making enquiries, the directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. For this reason,

they continue to adopt the going concern basis in preparing the

condensed consolidated interim financial information. In forming

this view, the directors have considered trading and cash flow

forecasts, financial commitments, the significant orderbook with

customers spread across different geographic areas and industries

and the significant net cash position.

1. Status of condensed consolidated interim statements,

accounting policies and basis of significant estimates

(continued)

Critical accounting estimates and judgements

The Group makes estimates and assumptions regarding the future.

Estimates and judgements are continually evaluated based on

historical experience, and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances.

In the future, actual experience may deviate from these

estimates and assumptions. The estimates and assumptions that have

a significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the current financial year

are discussed in the financial statements for the year ended 31

December 2011.

Accounting policies

The accounting policies applied and significant estimates used

by the Group in these condensed consolidated interim financial

statements are the same as those applied by the Group in its

consolidated financial statements for the year ended 31 December

2011.

New accounting standards and interpretations

The amendments to IFRS 7 Financial Instruments: disclosures are

applicable for the financial year ending 31 December 2012.

Application of this standard has not had any material impact on the

disclosures, net assets or results of the Group.

Recent accounting developments

The following standards and interpretations were issued but are

not yet effective and have not been adopted as application was not

mandatory for the year (and in some cases not yet endorsed for use

in the EU):

-- IFRS 9 Financial Instruments

-- IFRS 10 Consolidated Financial Statements

-- IFRS 11 Joint Arrangements

-- IFRS 12 Disclosure of Interests in Other Entities

-- IFRS 13 Fair Value Measurement

-- IAS 19 (amendment) - Employee benefits

-- IAS 1 Financial Statement presentation (amendments)

The directors anticipate that the adoption of these standards

and interpretations will not have a material impact on the net

assets or results of the Group.

2. Analysis by Operating Segment:

Half year to 30 June 2012

Fluid

Controls Systems Gears Instruments Elimination Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------- --------- -------- ------------- ------------- ------------- ---------

Revenue from

external customers 146,221 71,438 19,915 8,297 - - 245,871

Inter segment

revenue - - 5,419 - (5,419) - -

---------- --------- -------- ------------- ------------- ------------- ---------

Total revenue 146,221 71,438 25,334 8,297 (5,419) - 245,871

---------- --------- -------- ------------- ------------- ------------- ---------

Operating profit

before amortisation

of acquired

intangible assets 46,611 9,182 5,575 2,702 - (2,325) 61,745

Amortisation

of acquired

intangibles

assets (368) (1,196) (109) (1,955) - - (3,628)

Operating profit 46,243 7,986 5,466 747 - (2,325) 58,117

---------- --------- -------- ------------- ------------- ------------- ---------

Net financing

expense (2)

Income tax expense (16,704)

---------

Profit for the

period 41,411

---------

Half year to 30 June 2011

Fluid

Controls Systems Gears Instruments Elimination Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------- --------- -------- ------------- ------------- ------------- ---------

Revenue from

external customers 129,438 53,061 16,916 - - - 199,415

Inter segment

revenue - - 4,543 - (4,543) - -

---------- --------- -------- ------------- ------------- ------------- ---------

Total revenue 129,438 53,061 21,459 - (4,543) - 199,415

---------- --------- -------- ------------- ------------- ------------- ---------

Operating profit

before amortisation

of acquired

intangible assets 42,861 4,885 4,658 - - (2,131) 50,273

Amortisation

of acquired

intangibles

assets (80) (975) - - - - (1,055)

Operating profit 42,781 3,910 4,658 - - (2,131) 49,218

---------- --------- -------- ------------- ------------- ------------- ---------

Net financing

income 384

Income tax expense (14,263)

---------

Profit for the

period 35,339

---------

Year to 30 December 2011

Fluid

Controls Systems Gears Instruments Elimination Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------- --------- -------- ------------- ------------- ------------- ---------

Revenue from

external customers 277,957 132,624 35,816 1,436 - - 447,833

Inter segment

revenue - - 10,777 - (10,777) - -

---------- --------- -------- ------------- ------------- ------------- ---------

Total revenue 277,957 132,624 46,593 1,436 (10,777) - 447,833

---------- --------- -------- ------------- ------------- ------------- ---------

Operating profit

before amortisation

of acquired

intangible assets 92,085 17,077 10,336 394 - (3,971) 115,921

Amortisation

of acquired

intangibles

assets (890) (2,277) (18) (736) - - (3,921)

Operating profit 91,195 14,800 10,318 (342) - (3,971) 112,000

---------- --------- -------- ------------- ------------- ------------- ---------

Net financing

income 550

Income tax expense (32,149)

---------

Profit for the

year 80,401

---------

2. Operating segments (continued)

Revenue from external customers by location of customer

First half First half Full year

2012 2011 2011

GBP000 GBP000 GBP000

UK 19,337 15,033 25,703

Rest of Europe 70,228 60,326 148,513

USA 54,869 38,082 87,144

Other Americas 21,784 16,609 38,256

Rest of the World 79,653 69,365 148,217

----------- ----------- ----------

245,871 199,415 447,833

----------- ----------- ----------

3. Net financial (expense) / income

First half First half Full year

2012 2011 2011

GBP000 GBP000 GBP000

Interest income 349 359 746

Expected return on assets in the pension

schemes 3,005 3,338 6,739

Foreign exchange gain 129 68 105

----------- ----------- ----------

3,483 3,765 7,590

----------- ----------- ----------

Interest expense (59) (29) (116)

Interest charge on pension scheme liabilities (3,197) (3,240) (6,468)

Foreign exchange loss (229) (112) (456)

----------- ----------- ----------

(3,485) (3,381) (7,040)

----------- ----------- ----------

4. Income taxes

Income tax expense is recognised based on management's best

estimate of the weighted average annual income tax rate expected

for the full financial year. The estimated average annual tax rate

used for the year ended 31 December 2012 is 28.7% (the effective

tax rate for the year ended 31 December 2011 was 28.6%).

The Group continues to expect its effective corporation tax rate

to be higher than the standard UK rate due to higher tax rates in

the US, China, Canada, France, Germany, Italy, Japan and India.

5. Dividends

First half First half Full year

2012 2011 2011

GBP000 GBP000 GBP000

---------- ---------- ---------

The following dividends were paid in

the period per

qualifying ordinary share:

22.75p final dividend (2011: 19.75p) 19,718 17,065 17,097

14.5p interim dividend - - 12,543

Additional interim dividend of 11.5p

paid June 2011 - 9,985 9,948

Additional interim dividend of 11.5p

paid December 2011 - - 9,946

---------- ---------- ---------

19,718 27,050 49,534

---------- ---------- ---------

The following dividends per qualifying

ordinary share were declared / proposed

at the balance sheet date:

22.75p final dividend - - 19,736

16.4p interim dividend declared (2011:

14.5p) 14,229 12,571 -

Additional dividend of 11.5p to be paid

in December 2011 - 10,000 -

---------- ---------- ---------

14,229 22,571 19,736

---------- ---------- ---------

The interim dividend of 16.4 pence will be payable to

shareholders on 28 September 2012 to those on the register on 31

August 2012.

6. Earnings per share

Earnings per share is calculated using the profit attributable

to the ordinary shareholders for the period and 86.6m shares (six

months to 30 June 2011: 86.5m; year to 31 December 2010: 86.5m)

being the weighted average ordinary shares in issue.

Diluted earnings per share is calculated using the profit

attributable to the ordinary shareholders for the period and the

weighted average ordinary shares in issue adjusted to assume

conversion of all potentially dilutive ordinary shares under the

Group's option schemes, Sharesave plan and Long-term incentive

plan.

Adjusted basic earnings per share is calculated using the profit

attributable to the ordinary shareholders for the year after adding

back the after tax amortisation charge.

First half First half Full year

2012 2011 2011

GBP000 GBP000 GBP000

---------- ---------- ---------

Net profit attributable to ordinary

shareholders 41,411 35,339 80,401

Amortisation 3,628 1,055 3,921

Tax effect on amortisation at effective

rate (1,043) (303) (1,120)

---------- ---------- ---------

Adjusted net profit attributable to

ordinary shareholders 43,996 36,091 83,202

---------- ---------- ---------

Weighted average number of ordinary

shares

during the year 86,571 86,476 86,486

---------- ---------- ---------

Adjusted basic earnings per share 50.8p 41.7p 96.2p

---------- ---------- ---------

7. Inventories

30 June 30 June 31 Dec

2012 2011 2011

GBP000 GBP000 GBP000

Raw materials and consumables 43,832 35,075 40,609

Work in progress 12,146 10,131 13,209

Finished goods 16,261 12,915 9,110

-------- -------- --------

72,239 58,121 62,928

-------- -------- --------

8. Share capital and reserves

The number of ordinary 5p shares in issue at 30 June 2012 was

86,763,000 (30 June 2011: 86,690,000; 31 December 2011:

86,750,000).

The Group acquired 101,010 of its own shares through purchases

on the London Stock Exchange during the period, (30 June 2011:

128,162; 31 December 2011: 193,261). The total amount paid to

acquire the shares was GBP2,050,000 (30 June 2011: GBP2,184,000; 31

December 2011: GBP3,185,000), and this has been deducted from

shareholders equity. The shares are held in trust for the benefit

of Directors and employees for future payments under the Share

Incentive Plan and Long-term incentive plan. All issued shares are

fully paid.

Awards under the Group's long-term incentive plan and share

investment plan vested during the period and 55,539 and 138,493

shares respectively were transferred to employees.

Employee share options schemes: options exercised during the

period to 30 June 2012 resulted in 12,817 ordinary 5p shares being

issued (30 June 2011: 8,731 shares), with exercise proceeds of

GBP70,000 (30 June 2011: GBP43,000). The weighted average market

share price at the time of exercise was GBP20.14 (30 June 2011:

GBP17.19) per share.

9. Interest-bearing loans and borrowings

The following loans and borrowings were issued and repaid during

the six months ended 30 June 2012:

Carrying

Year of Interest value

maturity rate GBP000

Balance at 1 January 2012 314

Movement in the period:

Loans 2012-16 0% (49)

Repayment of finance leases 2012-15 3% - 8% (25)

Exchange differences 6

Balance at 30 June 2012 246

---------

10. Related parties

The Group has a related party relationship with its subsidiaries

and with its directors and key management. A list of subsidiaries

is shown in the 2011 Annual Report & Accounts. Transactions

between key subsidiaries for the sale and purchase of products or

between the subsidiary and parent for management charges are priced

on an arms length basis.

Sales to subsidiaries and associates of BAE Systems plc, a

related party by virtue of non-executive director IG King's

directorship of that company, totalled GBP2,000 during the period

to 30 June 2012 (First half 2011: GBPnil; Full year 2011:

GBP29,000) and GBP2,000 was outstanding at 30 June 2012 ( 30 June

2011: GBPNil; 31 December 2011: GBPNil).

11. Key management emoluments

The emoluments of those members of the management team,

including directors, who are responsible for planning, directing

and controlling the activities of the Group are:

First half First half Full year

2012 2011 2011

GBP000 GBP000 GBP000

Emoluments including social security

costs 2,138 1,852 3,782

Post employment benefits 227 199 392

Share based payments 591 451 844

----------- ----------- ----------

2,956 2,502 5,018

----------- ----------- ----------

12. Share-based payments

A grant of shares was made on 1 March 2012 to selected members

of senior management at the discretion of the Remuneration

Committee. The key information and assumptions from this grant

were:

Equity Settled Equity Settled

TSR condition EPS condition

Grant date 1 March 2012 1 March 2012

Share price at grant date GBP20.71 GBP20.71

Shares / Share equivalents under scheme 59,993 59,993

Vesting period 3 years 3 years

Expected volatility 27.6% 27.6%

Risk free rate 0.5% 0.5%

Expected dividends expressed as a dividend

yield 2.4% 2.4%

Probability of ceasing employment before

vesting 5% p.a. 5% p.a.

Fair value GBP12.49 GBP19.36

The basis of measuring fair value is consistent with that

disclosed in the 2011 Annual Report & Accounts.

13. Events Post Balance Sheet Date

There have been no significant events after the 30 June 2012

which would materially impact either the Consolidated Income

statement or the Consolidated Balance Sheet.

14. Shareholder information

This interim report is being sent to shareholders who requested

it and copies are available to the public from the Registered

Office at the address below. The interim report is also available

on the Rotork website at www.rotork.com.

General shareholder contact numbers:

Shareholder General Enquiry Number (UK): 0871 384 2030

International Shareholders - General Enquiries: (00) 44 121 415 7047

For enquires regarding the Dividend Reinvestment Plan (DRIP)

contact:

The Share Dividend Team Equiniti Aspect House Spencer Road

Lancing West Sussex BN99 6DA

Tel: 0871 384 2268

15. Group information

Secretary and registered office:

Stephen Rhys Jones

Rotork plc

Rotork House

Brassmill Lane

Bath

BA1 3JQ

Company website:

www.rotork.com

Investor Section:

http://www.rotork.com/en/investors/index/

16. Financial Calendar

31 July 2012 Announcement of half year financial results for 2012

29 August 2012 Ex-dividend date for 2012 interim dividend

31 August 2012 Record date for 2012 interim dividend

28 September 2012 Payment date for 2012 interim dividend

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR WGUAAMUPPGWU

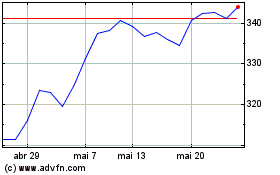

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024