Final Results - Replacement

04 Abril 2001 - 8:10AM

UK Regulatory

RNS Number:6101B

Rotork PLC

4 April 2001

The issuer advises that the Final Results announcement released at 07:00 on 22

March 2001 under RNS Number 8742A has been amended.

The payment date for the final dividend should read 29 May 2001 and not 21 May

2001 as previously stated.

All other details remain unchanged. The full corrected version is shown

below.

Rotork p.l.c.

Preliminary Announcement

Rotork p.l.c., the international specialist engineering group, announces

audited results for the year ended 31 December 2000.

2000 1999

Turnover #107.9m #117.5m

Operating profit #19.8m #26.0m

Profit before taxation #20.6m #26.9m

- before goodwill

amortisation #21.6m #27.8m

Earnings per share

- basic 15.6p 20.3p

- diluted 15.6p 20.3p

- basic before goodwill

amortisation 16.8p 21.3p

Dividend per share 12.2p 12.2p

Highlights of the year included:

* Gross margin maintained near 1999 levels

* New IQ actuator launched; well received by customers

* Move to new US production facility completed on time and under

budget

* Order book up 19% on previous year

* Performance reflects reduced capital expenditure in the hydrocarbon

sector

Chief Executive, Bill Whiteley, said:

"Following a difficult eighteen months, activity in the hydrocarbon sector has

returned to more normal levels. With the new IQII actuator now in full

production and our closing order book up nearly 20% on last year the outlook

for the current year is more promising."

For further information, please contact:

Rotork p.l.c. Tel: 01225

733200

Bill Whiteley, Chief Executive

Bob Slater, Finance Director

Financial Dynamics Tel: 0207 831

3113

Tom Baldock

PRELIMINARY STATEMENT

Introduction

Lower investment in the hydrocarbon sector and consolidation within the

industry over the last eighteen months resulted in reduced levels of capital

investment and therefore contributed to lower demand for actuators and

associated products. Over 40% of Rotork actuators are shipped to customers in

these sectors and the result of this reduced spend was that the order book at

the beginning of 2000 was lower than at the previous year-end. Nevertheless,

gross margin in 2000 was maintained at 1999 levels underlining the quality of

our products and customer support. In addition activity in this sector now

appears to be returning to more normal levels and I am pleased to report that

our closing order book was nearly 20% higher than at the end of the previous

year.

Operating Review

The most significant development programme undertaken to date at Rotork is now

complete and the latest version of the IQ intelligent actuator is in full

production at our Bath and Rochester facilities. The increased functionality

obtained by utilising advanced electronic techniques is meeting with

widespread customer approval. During the development programme the

opportunity was taken to identify lower cost overseas sources for some of the

more significant electronic and mechanical assemblies. We intend to make

greater use of these and other low cost sources in the future to further

reduce costs across our complete product range.

The new production facility for our American operations situated in Rochester

New York was completed on schedule and under budget in May. We took the

opportunity to introduce the modern production methods that had already been

successfully installed at our Bath plant to improve the efficiency and

capacity of this operation. Rotork Gears are also using this facility as a

base for their expanding American operations and the resulting improved

service levels to US customers have already created further business

opportunities for these products.

Rotork Gears now contributes significantly to our profitability and this is

due in part to the successful integration of acquisitions made in recent

years. The latest of these was the purchase in October of the business and

assets of the actuator division of Skil Controls Limited previously located in

Skelmersdale. This business had a specialised product, which is capable of

being marketed through our existing international sales network. Although

currently relatively small, we believe that potential exists for significant

growth.

The year saw the opening of our wholly owned company in the People's Republic

of China and business levels there to date have been encouraging. The rest of

our Far East operations experienced a mixed year but all have had acceptable

returns and the outlook in most of these territories is now more positive than

it had been for some time.

Our Fluid Power plants in the USA and Italy are particularly dependent of oil

industry business and as a result experienced a difficult trading environment

during the year.

We have redesigned our processes in both plants and have an ambitious product

development programme. As a result of restructuring, a new Fluid Power

management team has been put in place. I am pleased to report that the fluid

power order book at the end of the year was higher than it has been in the

recent past and there is currently much more optimism about our prospects.

Dividend

In view of the current trading position the directors are recommending that

the dividend be held at last year's level with a final dividend of 7.8p

bringing the total for the year to 12.2p. This will be paid on 29 May to

shareholders on the register on 30 March.

Outlook

Our strategic focus has continued to be the design, manufacture and marketing

of actuator, system and related products. Our Product development programme

in the three main activities, Electric Actuators, Fluid System and Rotork

Gears is providing a greater breadth of solutions to customers across our

market sectors, supported by acquisition where appropriate.

Activity levels are steadily improving and our marketing companies view the

year ahead with greater confidence. The second half of 2000 saw an

improvement in order intake into our plants, and this trend has continued into

the early part of the current year. The introduction of our new IQ actuator

is strengthening our market position and we will build on this success with

further product developments that will incorporate its innovative concepts.

The strength of sterling, particularly against the Euro, continues to cause

difficulties for us but with some signs of favourable movement this year,

together with improvements in activity from our main customer sectors, the

outlook for the current year is more promising.

Audited Consolidated Profit and Loss Account

for the year ended 31 December 2000

Group Group

2000 1999

#'000 #'000

Turnover

Cost of sales 107,880 117,535

(59,021) (63,626)

_______ ______

Gross profit 48,859 53,909

Distribution costs (2,286) (2,023)

Administrative expenses (27,502) (26,021)

Other operating income 680 95

Operating profit 19,751 25,960

Operating profit before

amortisation of goodwill 20,787 26,855

Amortisation of goodwill (1,036) (895)

______ _______

Operating profit 19,751 25,960

Net interest receivable and

similar items 831 987

_______ _______

Profit on ordinary activities

before taxation 20,582 26,947

Tax on profit on ordinary

activities (7,110) (9,477)

Profit for the financial year 13,472 17,470

Dividends including non equity (10,504) (10,546)

_______ ______

Retained profit for the

financial year 2,968 6,924

_______ ______

pence pence

Basic earnings per share 15.6 20.3

Basic earnings per share before

goodwill amortisation 16.8 21.3

Diluted earnings per share 15.6 20.3

All results relate to continuing operations

Audited Balance Sheet

at 31 December 2000

Group Group

2000 1999

#'000 #'000

Fixed assets

Intangible assets 18,166 19,175

Tangible assets 15,763 14,412

33,929 33,587

Current assets

Stocks 14,553 13,790

Debtors due within one year 32,562 27,806

Debtors due after more than one

year 384 581

Cash at bank and in hand 16,820 25,788

64,319 67,965

Creditors:

Amounts falling due within one year (31,491) (35,824)

Net current assets 32,828 32,141

Total assets less current liabilities 66,757 65,728

Creditors:

Amounts falling due after more

than one year (1,011) (1,758)

Provisions for liabilities and

charges (3,293) (4,221)

______ ______

Net assets 62,453 59,749

===== =====

Rotork shareholders' funds

Equity 62,394 59,690

Non-equity 59 59

_______ _______

Capital employed 62,453 59,749

===== =====

Note:

The financial information set out above does not constitute the company's

statutory accounts for the years ended 31 December 2000 or 1999. The

financial information for 1999 is derived from the statutory accounts for 1999

which have been delivered to the Registrar of Companies. The auditors have

reported on the 1999 and 2000 accounts; their reports were unqualified and did

not contain a statement under section 237 (2) or (3) of the Companies Act

1985. The statutory accounts for 2000 will be delivered to the Registrar of

Companies following the company's annual general meeting.

Audited Statement of Group Cash Flow

for the year ended 31 December 2000

Group Group

2000 1999

#'000 #'000

Operating profit 19,751 25,960

Depreciation and amortisation 2,995 2,758

Profit on sale of fixed assets (101) -

Movement in working capital (6,236) (2,772)

______ ______

Net cash inflow from operating

activities 16,409 25,946

Returns on investments and

servicing of finance 863 894

Taxation (8,539) (10,268)

Capital expenditure (3,057) (2,497)

Acquisitions and disposals (394) (14,893)

Dividends paid on equity

ordinary shares (10,543) (9,817)

Financing (1,615) 903

_______ ______

Decrease in cash and term

deposits in the period (6,876) (9,732)

====== =====

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

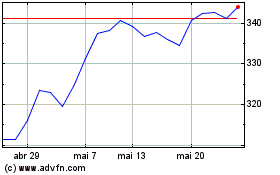

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024