TIDMROR

RNS Number : 0015L

Rotork PLC

06 August 2013

Rotork plc

2013 Half Year Results

HY 2013 HY 2012 % change OCC *(2)

% change

Revenue GBP276.1m GBP245.9m +12.3% +5.2%

Adjusted*(1) operating

profit GBP70.2m GBP61.7m +13.7% +5.6%

Adjusted operating margin 25.4% 25.1% +30 bps +10 bps

Profit before tax GBP63.6m GBP58.1m +9.5% +5.5%

Adjusted*(1) profit before

tax GBP69.4m GBP61.7m +12.3% +4.4%

Basic earnings per share 52.8p 47.8p +10.5% +6.5%

Adjusted*(1) basic earnings

per share 57.6p 50.8p +13.4% +5.5%

Interim dividend 18.05p 16.40p +10.1%

*(1) Adjusted figures are before the amortisation of acquired

intangible assets

*(2) OCC is organic constant currency

Highlights

-- Record first-half revenue and profit in each division

-- Order intake up 9.4%

-- Order book of GBP208m, up 15.1% from December

-- Successfully integrating Soldo and Schischek

-- Acquisitions of Flowco, GTA and Renfro

-- Continued expansion of product portfolio

-- Interim dividend increased by 10.1%

Peter France, Chief Executive, commenting on the results,

said:

"Our strategy of broadening our product offering and investing

in our infrastructure has enabled us to grow order intake, revenue

and profit all to record levels despite the weak economic

conditions in some of our regions.

We continue to invest for further growth and anticipate that, as

in previous years, the Group's performance in 2013 will be weighted

towards the second half. The order book, project activity in the

broad geographic regions we serve and our diverse end market

exposure provide the Board with confidence of achieving further

progress in the full year."

For further information, please contact:

Rotork plc Tel: 01225 733200

Peter France, Chief Executive

Jonathan Davis, Finance Director

FTI Consulting Tel: 020 7269 7291

Nick Hasell / Susanne Yule

Review of operations

Business Review

Rotork has performed well in the six months to 30 June 2013.

Order intake has continued to exceed revenue, resulting in a record

half year order book of GBP208.2m, 15.1% higher than last December.

Order intake was 9.4% higher than the comparative period, with

Rotork Fluid Systems showing the strongest growth (20.2%). Revenue

at GBP276.1m was up 12.3% and adjusted operating profit was 13.7%

higher at GBP70.2m.

Across the divisions, North America and parts of Asia have

performed particularly well, and this has resulted in record order

intake in the first half of 2013. Project visibility remains good

and quote activity in the second quarter was encouraging. Whilst

activity levels remain high for Rotork Fluid Systems, ongoing weak

economic conditions in certain markets have impacted Controls, our

electric actuator business, with weakness in some European markets

and the Indian power market being particularly affected.

We have managed our cost base effectively through the period,

the higher costs associated with product introductions, product

development and the investment in facilities being offset by lower

material costs and operational gearing. As a result, margins were

slightly ahead of the prior year.

The development of our new facility in Bath is on track and we

expect to move in during September. We are also expanding our

facilities in Singapore and moving to new sites in Spain, Mexico

and Malaysia in the second half of the year. Our Leeds based

business has experienced a delay in the development of the new site

and some of the costs are now likely to fall into 2014.

The integration of Schischek, acquired in January 2013, and

Soldo acquired in November 2012, is going well and both businesses

have made a positive contribution in the period. We have announced

two further acquisitions today. GT Attuatori Group expands our

pneumatic actuator portfolio, whilst Renfro Associates Inc provides

a US based valve adaption manufacturer, mirroring the service our

UK based Valvekits business offers in Europe.

Rotork Site Services, our after-sales and support activity,

continues to grow. Subsequent to the period-end, we also completed

the small acquisition of Flowco Ltd, a UK-based valve and actuator

service company, which will strengthen our presence in the water

utilities market in the south of England.

Financial results

Reported revenue rose by 12.3% to GBP276.1m, which included a

2.9% (GBP7.2m) benefit from currency and a 4.2% (GBP10.4m) benefit

from the acquisitions of Soldo and Schischek. Adjusted operating

profit grew 5.6% on an organic constant currency (OCC) basis to

GBP65.2m, with the acquisitions adding a further GBP3.5m between

them, and currency a benefit of GBP1.5m. This represents an OCC

margin of 25.2%, a 10 basis points improvement over the same point

last year. With the benefit of acquisitions and currency included,

adjusted operating profit is 13.7% higher at GBP70.2m, a 25.4%

margin.

The Group effective tax rate remains similar to full year 2012

at 28.0%. Adjusted basic earnings per share is 57.6p, a 13.4%

increase. The higher intangible amortisation charge following the

acquisition of Soldo and Schischek results in basic earnings per

share of 52.8p, an increase of 10.5%.

Net cash balances of GBP41.6m were GBP18.3m lower than December

2012, with the acquisitions of Schischek (GBP34.3m) and payment of

the final dividend (GBP23.1m) representing the largest outflows in

the period. Net working capital increased by GBP17.3m since

December 2012, a rise of 14.0%, of which GBP5.3m is currency

related. Net working capital represents 26.8% of annualised revenue

compared with 25.5% last year end and, given the anticipated

weighting of revenue to the second half of the year, this increase

is to be expected.

Operating Review

Delivery against our twin-track growth strategy is reflected in

these results with the benefit of the Soldo and Schischek

acquisitions supplementing the organic growth of our divisions. We

continue to look for opportunities to grow both organically and by

acquisition that will support our long-term strategic and financial

goals.

Rotork Controls

GBPm H1 2013 H1 2012 Change OCC*(2) Change

Revenue 152.6 146.2 +4.4% -3.3%

Adjusted*(1) operating

profit 49.0 46.6 +5.2% -2.2%

Adjusted operating

margin 32.1% 31.9% +20 bps +30 bps

Order intake rose by 2.3% against a strong prior year that

benefited from the active unconventional gas market in Australia

and shale oil and gas market in America. The lack of projects to

replace the large Australian orders will have an impact on order

intake in the year although revenue will benefit in the second half

as product is supplied. India has remained subdued due to the lack

of activity in the power sector. The USA market remains active with

the UK also performing well. The order book rose 7.9% to

GBP111.1m.

The new products introduced last year are gaining traction and

have been well received by customers. We continue to move

production from IQ2 to IQ3 as more model sizes within the IQ3 range

are launched and we gain certification in more geographic markets.

This transition is expected to gather pace in the second half of

2013 and the first half of 2014.

The integration of Schischek is going to plan and we are already

benefiting from an increased exposure to the heating, ventilation

and air conditioning market.

Rotork Fluid Systems

GBPm H1 2013 H1 2012 Change OCC*(2) Change

Revenue 89.2 71.4 +24.9% +21.1%

Adjusted*(1) operating

profit 14.2 9.2 +54.2% +50.0%

Adjusted operating

margin 15.9% 12.9% +300 bps +300 bps

Following on from a very strong performance last year Fluid

Systems has continued to grow at the fastest rate of all our

divisions. Revenue growth was 24.9% and order intake was 20.2%

ahead of the comparative period. The order book is a new high of

GBP82.3m, up 23.8% from December 2012.

Most regional businesses have seen strong demand for fluid

systems products with oil and gas still the dominant end-market.

Europe has been very strong and has been supported by the European

valve industry supplying global oil and gas infrastructure

projects. The USA and Latin America markets are also positive and

we are starting to make good progress in Asia, a target market for

Fluid Systems.

The operating margin was 15.9%, a 300 basis points improvement

on the comparable period, reflecting the benefit of operational

gearing and effective material cost management.

Rotork Gears

GBPm H1 2013 H1 2012 Change OCC*(2) Change

Revenue 27.1 25.3 +7.1% +4.5%

Adjusted*(1) operating

profit 6.1 5.6 +8.8% +7.0%

Adjusted operating

margin 22.3% 22.0% +30 bps +50 bps

Gears order intake was broadly flat compared with the record

first half of last year but did exceed output in the period. Our

sales effort remains focused on winning new customers in those

parts of the world with strong domestic valvemaker industries and

we have seen some success in this regard. With revenue 7.1% higher

at GBP27.1m, the order book increased by 28.3% to GBP12.7m.

Our European operations performed well, with our Italian

factory, where our subsea range is made, making progress and our

Spanish subsidiary growing as a result of more business from a key

account. Deliveries of subsea gearboxes ordered last year were one

of the drivers behind the growth in revenue in Europe whilst China

also saw a good improvement in revenue. We continue to invest in

our sourcing and R&D teams within the division. Material costs

are our largest expense and ensuring that these are controlled and,

where possible reduced, remains a key focus and, in this regard, we

continue to make progress in establishing our Indian supply chain.

The increase in our R&D resource last year has already resulted

in some new products which are helping broaden our addressable

market and the coming months will see the launch of further range

expansions and new developments.

Rotork Instruments

GBPm H1 2013 H1 2012 Change OCC*(2) Change

Revenue 12.4 8.3 +48.9% +10.4%

Adjusted*(1) operating

profit 3.9 2.7 +43.8% +3.7%

Adjusted operating

margin 31.4% 32.6% -120 bps -200 bps

Order intake was weighted to the first half in Instruments last

year and, against this background, Fairchild has grown 10.5%

organically. Inclusive of the initial contribution from Soldo,

purchased last November, total order input was 53.8% higher. As the

division with the shortest lead times, the order book in

Instruments is only GBP2.1m but this is a 31.8% increase since the

start of the year. Soldo has been fully integrated with Fairchild

in the USA and in the rest of the world the integration of the

sales teams is well underway. In addition to the increased

investment in sales resources, the engineering team has increased

as we look to accelerate product development initiatives. These

increased costs are the key factor behind the 120 basis point

margin reduction as we invest for future growth. With Soldo

generating 35.5% margins, the division as a whole achieved a margin

of 31.4%.

Principal risks and uncertainties

The Group has an established risk management process as part of

the corporate governance framework set out in the 2012 Annual

Report & Accounts. We regularly review the principal risks and

uncertainties facing our businesses and examine the potential

impacts on our processes and procedures. The risk management

process is described in detail on pages 30 and 31 of the 2012

Annual Report & Accounts. We identify risks in the form of

strategic, operational and financial risks and set out mitigations

and improvements to our processes and procedures as necessary to

manage these risks. The Group has reviewed these risks and

concluded that they remain applicable to the second half of the

financial year. The principal risks and uncertainties are:

-- Competition on price as a result of a competitor moving to

manufacture in a lower cost area of the world;

-- Rotork not having the appropriate products, either in terms of features or costs;

-- Lower investment in Rotork's traditional market sectors;

-- Major in field product failure arising from a component

defect or warranty issue which might require a product recall;

-- Failure of a key supplier or a tooling failure at a supplier causing disruption to planned manufacturing;

-- Failure of an acquisition to deliver the growth or synergies

anticipated, due to incorrect assumptions or changing market

conditions, or failure to integrate an acquisition to ensure

compliance with Rotork's policies and procedures;

-- Failure of the centralised IT environment, or loss or theft of data;

-- Volatility of exchange rates;

-- Political instability in a key end-market;

-- Defined benefit pension scheme deficit.

Statement of Directors' Responsibilities

The Directors confirm that this condensed consolidated interim

financial information has been prepared in accordance with IAS 34

as adopted by the European Union and that the interim management

report includes a fair review of the information required by DTR

4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- material related party transactions in the first six months and any material changes in the related-party transactions described in the last annual report.

The Directors of Rotork plc are listed in the Rotork plc Annual

Report & Accounts for 31 December 2012. A list of current

directors is maintained in the About Us section of the Rotork

website: www.rotork.com.

Dividend

The interim dividend is to be increased by 10.1% to 18.05p per

ordinary share and will be paid on 27 September 2013 to

shareholders on the register at the close of business on 30 August

2013.

Outlook

We continue to invest for further growth and anticipate that, as

in previous years, the Group's performance in 2013 will be weighted

towards the second half. The order book, project activity in the

broad geographic regions we serve and our diverse end market

exposure provide the Board with confidence of achieving further

progress in the full year.

By order of the Board

Peter France

Chief Executive

5 August 2013

Independent Review Report to Rotork plc

Introduction

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2013 which comprises the Consolidated

Income statement, Consolidated Statement of Comprehensive Income

and Expense, Consolidated Balance sheet, Consolidated Statement of

Changes in Equity, Consolidated Statement of Cash flows and the

related explanatory notes. We have read the other information

contained in the half-yearly financial report and considered

whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of

financial statements.

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the Disclosure and Transparency Rules ("the DTR")

of the UK's Financial Conduct Authority ("the UK FCA"). Our review

has been undertaken so that we might state to the company those

matters we are required to state to it in this report and for no

other purpose. To the fullest extent permitted by law, we do not

accept or assume responsibility to anyone other than the company

for our review work, for this report, or for the conclusions we

have reached.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the DTR of the UK FCA.

The annual financial statements of the group are prepared in

accordance with IFRSs as adopted by the EU. The condensed set of

financial statements included in this half-yearly financial report

has been prepared in accordance with IAS 34Interim Financial

Reporting as adopted by the EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK and Ireland) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Whilst the company has previously produced a half-yearly report

containing a condensed set of financial statements, those financial

statements have not previously been subject to a review by an

independent auditor. As a consequence, the review procedures set

out above have not been performed in respect of the comparative

period for the six months ended 30 June 2012.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2013 is not prepared, in all material respects, in accordance

with IAS 34 as adopted by the EU and the DTR of the UK FCA.

Philip Cotton

for and on behalf of KPMG Audit Plc

Chartered Accountants

100 Temple Street, Bristol, BS1 6AG

5 August 2013

Consolidated Income Statement

First half First half Full year

2013 2012 2012

Notes GBP000 GBP000 GBP000

---------- ---------- ---------

Revenue 2 276,051 245,871 511,747

Cost of sales (143,805) (129,992) (272,199)

---------- ---------- ---------

Gross profit 132,246 115,879 239,548

Other income 73 62 908

Distribution costs (2,688) (2,395) (4,214)

Administrative expenses (65,161) (55,416) (111,743)

Other expenses (4) (13) (32)

Operating profit before the amortisation

of

acquired intangible assets 70,210 61,745 131,866

Amortisation of acquired intangible

assets (5,744) (3,628) (7,399)

----------------------------------------- ----- ---------- ---------- ---------

Operating profit 2 64,466 58,117 124,467

Net finance expense 3 (856) (2) (273)

Profit before tax 63,610 58,115 124,194

Income tax expense 4

UK (4,327) (4,284) (8,686)

Overseas (13,500) (12,420) (26,193)

---------- ---------- ---------

(17,827) (16,704) (34,879)

Profit for the period 45,783 41,411 89,315

========== ========== =========

pence pence pence

Basic earnings per share 7 52.8 47.8 103.1

Adjusted basic earnings per share 7 57.6 50.8 109.3

Diluted earnings per share 7 52.6 47.6 102.6

Adjusted diluted earnings per share 7 57.3 50.6 108.7

Consolidated Statement of Comprehensive Income and Expense

First half First half Full year

2013 2012 2012

GBP000 GBP000 GBP000

Profit for the period 45,783 41,411 89,315

Other comprehensive income and expense

Items that may be subsequently reclassified

to the income statement:

Foreign currency translation differences 6,788 (3,015) (3,967)

Effective portion of changes in fair value

of cash flow

hedges net of tax (1,829) 591 399

---------- ---------- ---------

4,959 (2,424) (3,568)

Items that are not subsequently reclassified

to the income statement:

Actuarial loss in pension scheme net of tax - - (8,598)

---------- ---------- ---------

Income and expenses recognised directly in

equity 4,959 (2,424) (12,166)

Total comprehensive income for the period 50,742 38,987 77,149

========== ========== =========

Note: The June 2013 results are unaudited and have been subject

to review by KPMG. The June 2012 results are unaudited and have not

been subject to review. The December 2012 results have been audited

by KPMG.

Consolidated Balance Sheet

30 June 30 June 31 Dec

2013 2012 2012

Notes GBP000 GBP000 GBP000

------- ------- -------

Property, plant and equipment 44,521 36,379 38,445

Goodwill 105,547 67,664 80,729

Intangible assets 56,435 34,835 40,743

Deferred tax assets 13,549 12,993 12,984

Derivative financial instruments - 545 -

Other receivables 1,644 1,490 1,674

Total non-current assets 221,696 153,906 174,575

Inventories 8 86,723 72,239 71,100

Trade receivables 103,862 91,558 95,822

Current tax 2,162 1,841 1,946

Derivative financial instruments 582 1,592 2,254

Other receivables 12,554 9,814 9,662

Cash and cash equivalents 41,594 56,185 59,868

------- ------- -------

Total current assets 247,477 233,229 240,652

Total assets 469,173 387,135 415,227

======= ======= =======

Ordinary shares 9 4,341 4,338 4,340

Share premium 8,301 7,905 8,258

Reserves 15,315 11,500 10,356

Retained earnings 268,870 220,793 246,369

------- ------- -------

Total equity 296,827 244,536 269,323

------- ------- -------

Interest-bearing loans and borrowings 1,936 160 116

Employee benefits 30,727 24,798 32,060

Deferred tax liabilities 15,799 12,305 13,488

Provisions 1,881 2,246 2,701

------- ------- -------

Total non-current liabilities 50,343 39,509 48,365

Interest-bearing loans and borrowings 226 86 56

Trade payables 42,710 40,518 36,355

Employee benefits 10,312 6,502 10,742

Current tax 19,507 16,427 11,143

Derivative financial instruments 3,104 177 96

Other payables 41,576 34,979 35,212

Provisions 4,568 4,401 3,935

------- ------- -------

Total current liabilities 122,003 103,090 97,539

Total liabilities 172,346 142,599 145,904

Total equity and liabilities 469,173 387,135 415,227

======= ======= =======

Note: The June 2013 Balance sheet is unaudited and has been

subject to review by KPMG. The June 2012 balance sheet is unaudited

and has not been subject to review. The December 2012 balance sheet

has been audited by KPMG.

Consolidated Statement of Changes in Equity

Issued Capital

equity Share Translation redemption Hedging Retained

capital premium reserve reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- --------- ------------- ------------ ---------- ----------- ---------

Balance at 31 December

2011 4,338 7,835 11,616 1,644 664 198,072 224,169

Profit for the period - - - - - 41,411 41,411

Other comprehensive income

--------- --------- ------------- ------------ ---------- ----------- ---------

Foreign currency translation

differences - - (3,015) - - - (3,015)

Effective portion of

changes in fair value

of cash flow hedges - - - - 782 - 782

Tax in other comprehensive

income - - - - (191) (191)

--------- --------- ------------- ------------ ---------- ----------- ---------

Total other comprehensive

income - - (3,015) - 591 - (2,424)

--------- --------- ------------- ------------ ---------- ----------- ---------

Total comprehensive income - - (3,015) - 591 41,411 38,987

Transactions with owners,

recorded directly in

equity

Equity settled share

based payment transactions - - - - - (47) (47)

Tax on equity settled

share based payment

transactions - - - - - 11 11

Share options exercised

by employees - 70 - - - - 70

Own ordinary shares acquired - - - - - (2,050) (2,050)

Own ordinary shares awarded

under share schemes - - - - - 3,114 3,114

Dividends - - - - - (19,718) (19,718)

--------- --------- ------------- ------------ ---------- ----------- ---------

Balance at 30 June 2012 4,338 7,905 8,601 1,644 1,255 220,793 244,536

Profit for the period - - - - - 47,904 47,904

Other comprehensive income

--------- --------- ------------- ------------ ---------- ----------- ---------

Foreign currency translation

differences - - (952) - - - (952)

Effective portion of

changes in fair value

of cash flow hedges - - - - (243) - (243)

Actuarial loss on defined

benefit pension plans

net of tax - - - - - (9,912) (9,912)

Tax in other comprehensive

income - - - - 51 1,314 1,365

--------- --------- ------------- ------------ ---------- ----------- ---------

Total other comprehensive

income - - (952) - (192) (8,598) (9,742)

--------- --------- ------------- ------------ ---------- ----------- ---------

Total comprehensive income - - (952) - (192) 39,306 38,162

Transactions with owners,

recorded directly in

equity

Equity settled share

based payment transactions

net of tax - - - - - 1,139 1,139

Tax on equity settled

share based payment

transactions - - - - - 116 116

Share options exercised

by employees 2 353 - - - - 355

Own ordinary shares acquired - - - - - (800) (800)

Own ordinary shares awarded

under share schemes - - - - - 21 21

Dividends - - - - - (14,206) (14,206)

--------- --------- ------------- ------------ ---------- ----------- ---------

Balance at 31 December

2012 4,340 8,258 7,649 1,644 1,063 246,369 269,323

========= ========= ============= ============ ========== =========== =========

Note: The June 2012 and December 2012 Statement of changes of

equity is unaudited and has not been reviewed. The Balance at 31

December 2012 has been audited by KPMG.

Consolidated Statement of Changes in Equity (continued)

Issued Capital

equity Share Translation redemption Hedging Retained

capital premium reserve reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- --------- ------------- ------------ ---------- ----------- ---------

Balance at 31 December

2012 4,340 8,258 7,649 1,644 1,063 246,369 269,323

Profit for the period - - - - - 45,783 45,783

Other comprehensive income

--------- --------- ------------- ------------ ---------- ----------- ---------

Foreign currency translation

differences - - 6,788 - - - 6,788

Effective portion of

changes in fair value

of cash flow hedges - - - - (2,383) - (2,383)

Tax in other comprehensive

income - - - - 554 - 554

--------- --------- ------------- ------------ ---------- ----------- ---------

Total other comprehensive

income - - 6,788 - (1,829) - 4,959

--------- --------- ------------- ------------ ---------- ----------- ---------

Total comprehensive income - - 6,788 - (1,829) 45,783 50,742

Transactions with owners,

recorded directly in

equity

Equity settled share

based payment transactions - - - - - (1,301) (1,301)

Tax on equity settled

share based payment

transactions - - - - - 302 302

Share options exercised

by employees 1 43 - - - - 44

Own ordinary shares acquired - - - - - (3,601) (3,601)

Own ordinary shares awarded

under share schemes - - - - - 4,400 4,400

Dividends - - - - - (23,082) (23,082)

--------- --------- ------------- ------------ ---------- ----------- ---------

Balance at 30 June 2013 4,341 8,301 14,437 1,644 (766) 268,870 296,827

========= ========= ============= ============ ========== =========== =========

Note: The June 2013 Statement of changes of equity is unaudited

and has been subject to review by KPMG.

Consolidated Statement of Cash Flows

First half First half Full year

2013 2012 2012

GBP000 GBP000 GBP000

---------- ---------- ---------

Profit for the period 45,783 41,411 89,315

Amortisation of acquired intangible assets 5,744 3,628 7,399

Amortisation of development costs 602 464 924

Depreciation 3,130 2,567 5,452

Equity settled share based payment expense 1,037 877 2,030

Net profit on sale of property, plant and

equipment (40) (38) (859)

Net finance expense 856 2 273

Income tax expense 17,827 16,704 34,879

74,939 65,615 139,413

Increase in inventories (11,633) (10,456) (9,474)

(Increase) / decrease in trade and other receivables (5,409) 2,075 (2,220)

Increase / (decrease) in trade and other payables 7,910 1,183 (3,341)

Difference between pension charge and cash

contribution (285) (3,242) (7,211)

(Decrease) / increase in provisions (421) 494 (264)

(Decrease) / increase in employee benefits (1,021) (3,224) 1,711

---------- ---------- ---------

64,080 52,445 118,614

Income taxes paid (13,617) (14,442) (37,641)

---------- ---------- ---------

Cash flows from operating activities 50,463 38,003 80,973

Purchase of property, plant and equipment (4,453) (7,649) (12,564)

Development costs capitalised (714) (924) (2,075)

Proceeds from sale of property, plant and

equipment 91 74 1,007

Acquisition of subsidiaries, net of cash acquired (34,255) 280 (20,674)

Contingent consideration paid (200) (150) (200)

Interest received 469 403 623

---------- ---------- ---------

Cash flows from investing activities (39,062) (7,966) (33,883)

Issue of ordinary share capital 44 70 425

Purchase of ordinary share capital (3,601) (2,050) (2,850)

Interest paid (292) (20) (163)

Repayment of amounts borrowed (193) (49) (64)

Repayment of finance lease liabilities (7) (25) (68)

Dividends paid on ordinary shares (23,082) (19,718) (33,924)

Cash flows from financing activities (27,131) (21,792) (36,644)

Net (decrease) / increase in cash and cash

equivalents (15,730) 8,245 10,446

Cash and cash equivalents at 1 January 59,868 48,519 48,519

Effect of exchange rate fluctuations on cash

held (2,544) (579) 903

---------- ---------- ---------

Cash and cash equivalents at end of period 41,594 56,185 59,868

========== ========== =========

Note: The June 2013 Statement of cash flows is unaudited and has

been subject to review by KPMG. The June 2012 Statement of cash

flows is unaudited and has not been subject to review. The December

2012 Statement of cash flows has been audited by KPMG.

Notes to the Half Year Report

1. Status of condensed consolidated interim statements,

accounting policies and basis of significant estimates

General information

Rotork plc is a company domiciled in England and Wales.

The Company has its premium listing on the London Stock

Exchange.

The condensed consolidated interim financial statements for the

6 months ended 30 June 2013 are unaudited and the auditors have

reported in accordance with International Standard on Review

Engagements (UK and Ireland) 2410, 'Review of Interim Financial

Information Performed by the Independent Auditor of the

Entity'.

The comparative consolidated interim financial statements for

the 6 months ended 30 June 2012 are unaudited and the auditors have

not reported in accordance with International Standard on Review

Engagements (UK and Ireland) 2410, 'Review of Interim Financial

Information Performed by the Independent Auditor of the

Entity'.

The information shown for the year ended 31 December 2012 does

not constitute statutory accounts within the meaning of Section 435

of the Companies Act 2006, statutory accounts for the year ended 31

December 2012 were approved by the Board on 4 March 2013 and

delivered to the Registrar of Companies. The Auditors' report on

those financial statements was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under Section 498 of the Companies Act 2006.

The consolidated financial statements of the Group for the year

ended 31 December 2012 are available from the Company's registered

office or website, see note 16.

Basis of preparation

The condensed consolidated interim financial statements of the

Company for the six months ended 30 June 2013 comprise the Company

and its subsidiaries (together referred to as 'the Group').

These condensed consolidated interim financial statements have

been prepared in accordance with the Disclosure and Transparency

Rules of the Financial Services Authority and with International

Accounting Standard 34, 'Interim Financial Reporting' as adopted by

the European Union. They do not include all of the information

required for full annual financial statements and should be read in

conjunction with the consolidated financial statements of the Group

for the year ended 31 December 2012, which have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union.

Going concern

After making enquiries, the directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. For this reason,

they continue to adopt the going concern basis in preparing the

condensed consolidated interim financial information. In forming

this view, the directors have considered trading and cash flow

forecasts, financial commitments, the significant orderbook with

customers spread across different geographic areas and industries

and the significant net cash position.

1. Status of condensed consolidated interim statements,

accounting policies and basis of significant estimates

(continued)

Critical accounting estimates and judgements

The Group makes estimates and assumptions regarding the future.

Estimates and judgements are continually evaluated based on

historical experience, and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances.

In the future, actual experience may deviate from these

estimates and assumptions. The estimates and assumptions that have

a significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the current financial year

are discussed in the financial statements for the year ended 31

December 2012.

Accounting policies

The accounting policies applied and significant estimates used

by the Group in these condensed consolidated interim financial

statements are the same as those applied by the Group in its

consolidated financial statements for the year ended 31 December

2012.

New accounting standards and interpretations

The amendments to IAS19 Employee benefits have been applied from

1 January 2013. The principal change relates to the requirement to

use the schemes' discount rate to calculate the return on assets

rather than using a rate of return appropriate to the various asset

classes.

The application of the standard in the 2012 financial year would

have increased the net pension interest cost to GBP1,092,000 from

GBP390,000 (six months to 30 June 2012: increase to GBP546,000 from

GBP192,000), reducing the pre-tax profit by GBP702,000 (six months

to 30 June 2012: reducing by GBP354,000). The impact on basic

earnings per share would be a reduction of 0.6p to 102.5p (six

months to 30 June 2012: 0.3p to 47.5p). As a result of the

adjustments not being material to the income statement, balance

sheet or shareholders' equity prior year balances have not been

restated.

The following standards and amendments have also been applied

from 1 January 2013:

-- IFRS 10 Consolidated Financial Statements

-- IFRS 11 Joint Arrangements

-- IFRS 12 Disclosure of Interests in Other Entities

-- IFRS 13 Fair Value Measurement

-- IAS 1 Presentation of Financial Statements(amendments)

Application of these standards and amendments has not had any

material impact on the disclosures, net assets or results of the

Group.

Recent accounting developments

IFRS 9 Financial Instruments has been issued but is not yet

effective and has not been adopted as application was not mandatory

for the year. The directors anticipate that the adoption of this

standard will not have a material impact on the disclosures, net

assets or results of the Group.

2. Analysis by Operating Segment:

Half year to 30 June 2013

Fluid

Controls Systems Gears Instruments Elimination Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------- --------- --------- -------------- -------------- -------------- ---------

Revenue from

external customers 152,619 89,241 22,051 12,140 - - 276,051

Inter segment

revenue - - 5,088 217 (5,305) - -

----------- --------- --------- -------------- -------------- -------------- ---------

Total revenue 152,619 89,241 27,139 12,357 (5,305) - 276,051

----------- --------- --------- -------------- -------------- -------------- ---------

Operating profit

before amortisation

of acquired

intangible assets 49,020 14,163 6,063 3,886 - (2,922) 70,210

Amortisation

of acquired

intangibles

assets (2,024) (810) (109) (2,801) - - (5,744)

Operating profit 46,996 13,353 5,954 1,085 - (2,922) 64,466

----------- --------- --------- -------------- -------------- -------------- ---------

Net financing

expense (856)

Income tax expense (17,827)

---------

Profit for the

period 45,783

---------

Half year to 30 June 2012

Fluid

Controls Systems Gears Instruments Elimination Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------- --------- --------- -------------- -------------- -------------- ---------

Revenue from

external customers 146,221 71,438 19,915 8,297 - - 245,871

Inter segment

revenue - - 5,419 - (5,419) - -

----------- --------- --------- -------------- -------------- -------------- ---------

Total revenue 146,221 71,438 25,334 8,297 (5,419) - 245,871

----------- --------- --------- -------------- -------------- -------------- ---------

Operating profit

before amortisation

of acquired

intangible assets 46,611 9,182 5,575 2,702 - (2,325) 61,745

Amortisation

of acquired

intangibles

assets (368) (1,196) (109) (1,955) - - (3,628)

Operating profit 46,243 7,986 5,466 747 - (2,325) 58,117

----------- --------- --------- -------------- -------------- -------------- ---------

Net financing

income (2)

Income tax expense (16,704)

---------

Profit for the

period 41,411

---------

Full year to 30 December 2012

Fluid

Controls Systems Gears Instruments Elimination Unallocated Group

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------- --------- --------- -------------- -------------- -------------- ---------

Revenue from

external customers 293,342 160,946 41,039 16,420 - - 511,747

Inter segment

revenue - - 11,844 - (11,844) - -

----------- --------- --------- -------------- -------------- -------------- ---------

Total revenue 293,342 160,946 52,883 16,420 (11,844) - 511,747

----------- --------- --------- -------------- -------------- -------------- ---------

Operating profit

before amortisation

of acquired

intangible assets 94,773 24,628 12,088 5,103 - (4,726) 131,866

Amortisation

of acquired

intangibles

assets (733) (2,249) (218) (4,199) - - (7,399)

Operating profit 94,040 22,379 11,870 904 - (4,726) 124,467

----------- --------- --------- -------------- -------------- -------------- ---------

Net financing

income (273)

Income tax expense (34,879)

---------

Profit for the

year 89,315

---------

2. Operating segments (continued)

Revenue from external customers by location of customer

First half First half Full year

2013 2012 2012

GBP000 GBP000 GBP000

UK 15,521 19,337 28,448

Rest of Europe 88,408 70,228 156,525

USA 58,621 54,869 106,027

Other Americas 26,059 21,784 53,323

Rest of the World 87,442 79,653 167,424

----------- ----------- ----------

276,051 245,871 511,747

----------- ----------- ----------

3. Net finance expense

Restated Restated

First half First half Full year

2013 2012 2012

GBP000 GBP000 GBP000

Interest income 469 349 616

Expected return on assets in the pension

schemes - - -

Foreign exchange gain 144 129 30

----------- ----------- ----------

613 478 646

----------- ----------- ----------

Interest expense (292) (59) (162)

Interest charge on pension scheme liabilities (584) (192) (390)

Foreign exchange loss (593) (229) (367)

----------- ----------- ----------

(1,469) (480) (919)

----------- ----------- ----------

Net finance expense (856) (2) (273)

----------- ----------- ----------

The comparatives balances for expected return from pensions

scheme assets have been reclassified to interest charge on pension

schemes to reflect the change in IAS19 which are explained in Note

1.

4. Income taxes

Income tax expense is recognised based on management's best

estimate of the weighted average annual income tax rate expected

for the full financial year. The estimated average annual tax rate

used for the year ended 31 December 2013 is 28.0% (the effective

tax rate for the year ended 31 December 2012 was 28.1%).

The Group continues to expect its effective corporation tax rate

to be higher than the standard UK rate due to higher tax rates in

the US, China, Canada, France, Germany, Italy, Japan and India.

5. Acquisitions

On 15 January 2013 the Group acquired 100% the entire share

capital of the operating companies of the Schischek group of

companies ("Schischek") for GBP35,865,000. Schischek designs and

manufactures explosion-proof electric actuators, principally for

the heating, ventilation, and air conditioning markets with its

main sites in Germany and Switzerland. The acquired business will

be reported within the Controls division. In the period since

acquisition Schischek has contributed GBP7,755,000 to Group revenue

and GBP2,497,000 to consolidated operating profit before

amortisation. The amortisation charge in the period since

acquisition from the acquired intangible assets was

GBP1,636,000.

If the acquisition had occurred on 1 January 2013 the results

would not have been materially different. It is not practicable to

disclose profit before tax or profit attributable to equity

shareholders as the Group manages its Treasury function on a Group

basis.

The acquisition had the following effect on the Group's assets

and liabilities.

Provisional Provisional

Book value Adjustments Fair values

Current assets

Inventory 1,353 (135) 1,218

Trade and other receivables 2,195 (81) 2,114

Cash 1,610 - 1,610

Current liabilities

Trade and other payables (2,308) (144) (2,452)

Loans and borrowings (295) - (295)

Corporation tax (745) (418) (1,163)

Non-current assets/liabilities

Property, plant and equipment 3,239 - 3,239

Loans and borrowings (1,824) - (1,824)

Intangible assets - 18,541 18,541

Deferred tax - (5,043) (5,043)

Total net assets 3,225 12,720 15,945

Goodwill 19,920

-------------

Purchase consideration paid in

cash 35,865

-------------

Purchase consideration 35,865

Cash held in subsidiary (1,610)

-------------

Cash outflow on acquisition 34,255

-------------

The provisional adjustments shown in the table above represent

the alignment of accounting policies to Rotork Group policies and

the fair value adjustments of the assets and liabilities at the

acquisition date.

Goodwill has arisen on the acquisition as a result of the value

attributed to staff expertise and the assembled workforce, which

did not meet the recognition criteria for a separate intangible

asset.

The intangible assets identified are customer relationships, the

Schischek brand, product design patents and the acquired order

book

6. Dividends

First half First half Full year

2013 2012 2012

GBP000 GBP000 GBP000

---------- ---------- ---------

The following dividends were paid in

the period per

qualifying ordinary share:

26.6p final dividend (2012: 22.75p) 23,082 19,718 19,718

16.4p interim dividend - - 14,206

23,082 19,718 33,924

---------- ---------- ---------

The following dividends per qualifying

ordinary share were declared / proposed

at the balance sheet date:

26.6p final dividend - - 23,091

18.05p interim dividend declared (2012:

16.4p) 15,670 14,229 -

15,670 14,229 23,091

---------- ---------- ---------

The interim dividend of 18.05 pence will be payable to

shareholders on 27 September 2013 to those on the register on 30

August 2013.

7. Earnings per share

Earnings per share is calculated using the profit attributable

to the ordinary shareholders for the period and 86.7m shares (six

months to 30 June 2012: 86.6m; year to 31 December 2012: 86.6m)

being the weighted average ordinary shares in issue.

Diluted earnings per share is calculated using the profit

attributable to the ordinary shareholders for the period and the

weighted average ordinary shares in issue adjusted to assume

conversion of all potentially dilutive ordinary shares under the

Group's option schemes, Sharesave plan and Long-term incentive

plan.

Adjusted basic and diluted earnings per share is calculated

using the profit attributable to the ordinary shareholders for the

year after adding back the after tax amortisation charge.

First half First half Full year

2013 2012 2012

GBP000 GBP000 GBP000

---------- ---------- ---------

Net profit attributable to ordinary

shareholders 45,783 41,411 89,315

Amortisation 5,744 3,628 7,399

Tax effect on amortisation at effective

rate (1,610) (1,043) (2,078)

---------- ---------- ---------

Adjusted net profit attributable to

ordinary shareholders 49,917 43,996 94,636

---------- ---------- ---------

8. Inventories

30 June 30 June 31 Dec

2013 2012 2012

GBP000 GBP000 GBP000

Raw materials and consumables 56,478 43,832 48,279

Work in progress 14,577 12,146 11,474

Finished goods 15,668 16,261 11,347

-------- -------- --------

86,723 72,239 71,100

-------- -------- --------

9. Share capital and reserves

The number of ordinary 5p shares in issue at 30 June 2013 was

86,814,000 (30 June 2012: 86,763,000; 31 December 2012:

86,808,000).

The Group acquired 123,509 of its own shares through purchases

on the London Stock Exchange during the period, (30 June 2012:

101,010; 31 December 2012: 136,253). The total amount paid to

acquire the shares was GBP3,601,000 (30 June 2012: GBP2,050,000; 31

December 2012: GBP2,850,000), and this has been deducted from

shareholders equity. The shares are held in trust for the benefit

of Directors and employees for future payments under the Share

Incentive Plan and Long-term incentive plan. All issued shares are

fully paid.

Awards under the Group's long-term incentive plan and share

investment plan vested during the period and 100,589 and 101,706

shares respectively were transferred to employees.

Employee share options schemes: options exercised during the

period to 30 June 2012 resulted in 5,393 ordinary 5p shares being

issued (30 June 2012: 12,817 shares), with exercise proceeds of

GBP44,000 (30 June 2012: GBP70,000). The weighted average market

share price at the time of exercise was GBP27.19 (30 June 2012:

GBP20.14) per share.

10. Loans and borrowings

The following loans and borrowings were issued and repaid during

the six months ended 30 June 2013:

Carrying

Year of Interest value

maturity rate GBP000

Balance at 1 January 2013 172

Movement in the period:

Acquired as part of business combination 2017-32 2.12% 2,119

Repayment of loans 2013-32 1.95% (193)

Repayment of finance leases 2013-15 1.5% - 6.7% (7)

Exchange differences 71

Balance at 30 June 2013 2,162

---------

11. Related parties

The Group has a related party relationship with its subsidiaries

and with its directors and key management. A list of subsidiaries

is shown in the 2012 Annual Report & Accounts. Transactions

between key subsidiaries for the sale and purchase of products or

between the subsidiary and parent for management charges are priced

on an arms length basis.

Sales to subsidiaries and associates of BAE Systems plc, a

related party by virtue of non-executive director IG King's

directorship of that company, totalled GBP49,253 during the period

to 30 June 2013 (First half 2012: GBP2,000; Full year 2012:

GBP34,000) and GBP16,032 was outstanding at 30 June 2013 ( 30 June

2012: GBP2,000; 31 December 2012: GBP15,000).

UBS Investment Bank are a related party by virtue of

non-executive director SA James' directorship of UBS Limited. UBS

Investment Bank provides the Group financial advice and

stockbroking services. The current arrangement with UBS Investment

Limited is that out of pocket expenses will be reimbursed and no

fees will be charged for their regular advisory or broking

services. Expenses of GBP3,000 have been reimbursed during the

period to 30 June 2013 (First half 2012: nil: Full year 2012:

GBP4,000) and no balance was outstanding at 30 June 2013 (30 June

2012: GBPnil; 31 December 2012: GBPnil).

12. Key management emoluments

The emoluments of those members of the management team,

including directors, who are responsible for planning, directing

and controlling the activities of the Group are:

First half First half Full year

2013 2012 2012

GBP000 GBP000 GBP000

Emoluments including social security

costs 2,469 2,138 4,510

Post employment benefits 244 227 457

Share based payments 697 591 1,418

----------- ----------- ----------

3,410 2,956 6,385

----------- ----------- ----------

13. Share-based payments

A grant of shares was made on 7 March 2013 to selected members

of senior management at the discretion of the Remuneration

Committee. The key information and assumptions from this grant

were:

Equity Settled Equity Settled

TSR condition EPS condition

Grant date 7 March 2013 7 March 2013

Share price at grant date GBP29.05 GBP29.05

Shares awarded under scheme 49,416 49,416

Vesting period 3 years 3 years

Expected volatility 25.7% 25.7%

Risk free rate 0.3% 0.3%

Expected dividends expressed as a dividend

yield 1.5% 1.5%

Probability of ceasing employment before

vesting 5% p.a. 5% p.a.

Fair value GBP17.02 GBP28.19

The basis of measuring fair value is consistent with that

disclosed in the 2012 Annual Report & Accounts.

14. Events Post Balance Sheet Date

On 5 July 2013 the Group acquired 100% of the share capital of

Flowco Limited, a valve and actuator service company based near our

headquarters in Bath, United Kingdom. The acquired business will be

reported within the Rotork Controls division.

On 2 August 2013 the Group acquired 100% of the share capital of

the GT Attuatori companies, a manufacturer of pneumatic actuators

with operations based in Italy and Germany. The acquired businesses

will be reported within the Rotork Fluid Systems division.

On 2 August 2013 the Group acquired 100% of the share capital of

Renfro Associates Inc, a valve adaption manufacturer based in

Broken Arrow, USA. The acquired business will be reported within

the Rotork Gears division.

The combined provisional consideration of the above acquisitions

is GBP13,900,000 of which GBP13,050,000 was paid in cash on

completion. If performance criteria are met a further GBP450,000

will be payable in 2014 and the remaining GBP400,000 in 2015. The

businesses will contribute to Group revenue and operating profit in

the second half of the year from the dates the individual

businesses were acquired.

The provisional net assets are GBP5,200,000, including net cash

of GBP300,000. If these acquisitions had occurred on 1 January 2013

the businesses would have contributed GBP7,200,000 to Group revenue

and GBP1,100,000 to Group operating profit in the six months to 30

June.

Due to the proximity of the acquisitions to the date of approval

of the interim financial statements the initial accounting for

these business combinations is incomplete and therefore the

disclosures regarding the fair value of the assets acquired and

liabilities assumed, the valuation of the goodwill and other

intangibles, the amount of goodwill expected to be deductible for

tax purposes, the fair value of contingent liabilities and assets

and the amount and treatment of acquisition costs cannot be

made.

15. Shareholder information

This interim report is being sent to shareholders who requested

it and copies are available to the public from the Registered

Office at the address below. The interim report is also available

on the Rotork website at www.rotork.com.

General shareholder contact numbers:

Shareholder General Enquiry Number (UK): 0871 384 2030

International Shareholders - General Enquiries: (00) 44 121 415 7047

For enquires regarding the Dividend Reinvestment Plan (DRIP)

contact:

The Share Dividend Team

Equiniti

Aspect House

Spencer Road

Lancing

West Sussex

BN99 6DA

Tel: 0871 384 2268

16. Group information

Secretary and registered office:

Stephen Rhys Jones

Rotork plc

Rotork House

Brassmill Lane

Bath

BA1 3JQ

Company website:

www.rotork.com

Investor Section:

http://www.rotork.com/en/investors/index/

17. Financial Calendar

6 August 2013 Announcement of half year financial results for 2013

28 August 2013 Ex-dividend date for 2013 interim dividend

30 August 2013 Record date for 2013 interim dividend

27 September 2013 Payment date for 2013 interim dividend

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UGUPPRUPWGMA

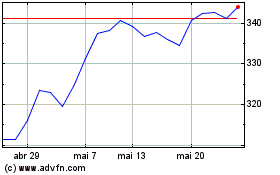

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024