RNS Number:9048W

Rotork PLC

25 March 2004

Thursday, 25th March 2004

Rotork p.l.c.

Preliminary Announcement

Rotork p.l.c., the international specialist engineering group, announces audited

results for the year ended 31 December 2003.

Financial Highlights

* Turnover up 4.8% on continuing operations

* Net profit before goodwill and tax up 7%

* Basic earnings per share up 8%

* Cash flowfrom operations up 31% to #34m

* Special interim dividend for 2004 of 5.85p per share

* Luton property sold for #1.7m

Operational review

* All three actuator businesses achieved sales and profit growth

* Rotork Fluid System now accounts for 13.4% of Group turnover up from 12.5%

in 2002

* US second half order intake 32% above first half

* IQT launched to plan in September

* Acquisition of DVA in Australia successfully integrated.

Chief Executive Bill Whiteley, commenting on the results said:

"The year under review was marked by some strong movements in the Group's

geographic and end user markets both within the year and in comparison to the

prior year. Our extensive worldwide coverage andinvestment in developing

markets has allowed us to make progress which would not have been possible had

we had to rely solely on our traditional markets and customers."

For further information, please contact:

Rotork p.l.c. Tel: 01225 733 200

Bill Whiteley, Chief Executive

Bob Slater, Finance Director

Financial Dynamics Tel: 020 7269 7121

Peter Otero

CHAIRMAN'S STATEMENT

Introduction

Trading conditions for Rotork varied around the world, with good levels of

demand in the Far East and Europe being partially offset by difficulties in the

Americas and in the UK. The oil and gas markets were generally more active,

while some of our water andwaste water markets contracted. From continuing

operations before tax, goodwill and exceptional profit from the disposal of the

Luton building, profit increased by 7% to #29m on Group sales 5% ahead at #136m.

If turnover were converted at constant currency year on year, the effect would

have been negligible. The year-end order book was unchanged over the previous

year.

Net cash increased by #12m to #32m and from this substantial balance we intend

to return some cash to investors in the form of an additional interim dividend

to be paid in May with the final dividend. We are also recognising the

underfunded position of the pension scheme with a one off contribution

equivalent to the extra dividend.

Business review

Overall our businesses have performed well in the year. All of the companies

were profitable except the Malaysian assembly facility although the new AWT

actuator produced there did record a positive profit contribution to the Group

as a whole. The US improvedin the second half although the benefit of this was

diluted by the deteriorating dollar. Most of our Far East operations, in

particular China, delivered good growth in the year.

The Electric Actuation business launched its new quarter turn actuator, the IQT,

in the third quarter and this has been well received by customers. This product

offers more benefits than the unit it replaces, representing value for money

improvement and new levels of technical excellence in all its applications. The

AWT actuator, built in Malaysia and launched at the end of 2002, is gaining

acceptance in the market and winning new customers. The factory is now operating

as planned although not yet at capacity.

In Fluid System, the move to the new premises in Lucca at the beginning of the

year was achieved with the minimum of disruption as was the simultaneous

implementation of a new production system. The business has won some large

projects in the year and executed them successfully delivering growth of nearly

17% in operating profit before goodwill on an increase in sales of 13%. This

further progress in profit of the division is driven by our growing ability,

through product and marketing initiatives, to exploit the opportunities in the

fluid power market. Its impact in the US has however been constrained by the

weakening dollar, affecting the cost of its products into the US market. The

acquisition of the Australian business, Deanquip Valve Automation in January

2004, will improve our customer focus in Australasia and complement our Fluid

System service centre in Singapore.

The Leeds based Gears business did well in the year recording a 13% improvement

in both sales volume and in operating profit. The Dutch operation, where

management changes were made at the end of the prior year, has seen much

improved margin performance and contributed well to the results of the division.

The drive in Gears to reduce costs through Far East procurement is now making a

positive impact on the margins as well as enabling us to better meet customer

requirements for cost effective timely product deliveries.

Dividend and Cash

A final dividend of 9.50p is proposed which is an increase of 7% over last year,

and gives a dividend for the year up 6% over 2002.

Our continued strong cash generation has contributed to balances exceeding #32m

at the year-end. Assuming that trading remains in line with expectations this

trend will continue in 2004. With this in mind the Board has decided to

recommend the return of some of this cash to shareholders by way of an

additional dividend for 2004 of 5.85p, to be paid on May 28 with the 2003 final

dividend to shareholders on the register at 2 April. Over the last few years our

dividend cover has reduced to around 1.5 times, a level that is lower than we

would like. It is therefore our current intention that when recommending the

levels of interim and final dividends for 2004, following our announcement of

the additional interim dividend for 2004 mentioned above, we will seek to move

towards a greater level of cover. Dividend cover for the year under review is

1.5 times.

Recognising the deficit in the defined benefit pension scheme has encouraged us

to address part of this shortfall with an additional contribution into the

scheme of #5m in 2004, which is approximately equivalent to the third dividend

payment for 2004. This contribution is ahead of the actuarial valuation of the

scheme set for 31 March 2004. There will be no reduction in profit as a result

of this contribution, which is taken account of in the ongoing pension cost

accruals.

Outlook

Overall market indicators are positive, and there is a reasonable level of large

project activity around the world. The weakness of the US dollar, in which a

third of our revenues are denominated, and the strength of the pound against

most other trading currencies will, if maintained at current levels, impact our

expected growth in sterlingterms. However mitigation should come from our cost

reduction programmes, which include procurement from dollar related sources.

These factors, combined with the good level of order intake in the last few

months, give us the confidence to look forward to further progress in 2004.

Roger Lockwood

Chairman

CHIEF EXECUTIVE'S REVIEW

Overview

The year under review was marked by some strong movements in the Group's

geographic and end user markets both within the year itself and in comparison

with the prior year. Our extensive worldwide coverage and investment in

developing markets allowed us to make progress which would not have been

possible had we had to rely solely on our traditional markets and customers. In

the first half of the year we continued to see some of the caution in funding

capital projects which was present for much of 2002, resulting in the end of

June order input being down on the first half of 2002. For the year as a whole

like for like order input was up 4.3% with second half input being 9.2% above

the second half of 2002. The main improvement seen in the second half came from

the US operation where second half order intake was 32% above the first half in

sterling and 38% in US dollar. Worldwide turnover on continuing operations was

up 4.8% over the prior year.

Within the body of the income statement this year there are a number of

adjustments to show the effects of the profit from the Luton business disposed

of in 2002, the sale of that company's building in early 2003, and the effect of

the insurance claim in the Netherlands in 2002, shown in other income in that

year. The statutory accounts record an increase in profit before tax of 7.3%

this year. If we remove the profitsfrom discontinued operations in both years

and the #752k insurance receipt in 2002, the underlying profit growth is 10.2%.

If the accounts had been translated at constant currency, this increase would

have been 10.6%.

All three of our valve actuator businesses achieved sales and profit growth.

The highlight of our electric actuator business was good growth from most

European and Asian markets, offsetting weaker figures from the Americas.

Although difficult trading conditions continued to affect our Venezuelan

operation it managed to make a small profit against the loss suffered in 2002.

The IQT, a quarter turn variant of the successful IQII actuator, was launched to

plan in September. Its reception has been excellent and sales since the launch

are well ahead of forecast.

Further progress was made in overseas sourcing which helped to mitigate

competitive pressures and increase margins.

The Malaysian manufacturing plant set up at the end of 2002 geared up production

throughout the year and it recorded a positive contribution to the Group.

Jordan, with its dependence on the US power sector and Venezuelan oil markets,

experienced difficult trading conditions.

The Rotork Fluid System business continued to make excellent progress and now

accounts for 13.4% of Group turnover. Order intake was up 14.1%, output was up

12.8% and operating profit, which exceeded #2m, was up 16.7%. This was achieved

against a difficult North American market and poor operating results for the US

fluid power operations. The highlights for this business were the opening of a

new larger production facility in Lucca, Italy, the success of new product

lines, and the acquisition of the Deanquip Valve Automation business in

Australia at the beginning of 2004.

Rotork Gears saw a positive turnaround in their operations. Its business

accounts for 11.6% of Group turnover. Order intake was up 6.4%, sales output up

12.4% and operating profits up 11.1%. These results were due to the continued

success of the broadening of the customer base for the Leeds operation and a

much improved performance from Rotork Gears B.V. in the Netherlands.

The key drivers for the Group's businesses are related to the investment in oil

and gas, water and waste water and power generation installations around the

world with demand being generated by new and expanded capacity, upgrades to

existing facilities and replacements. This is often linked to projects which

are aimed at improving efficiency, safety and environmental performance of

plants. Valve actuators are critical components and their long-term reliability

and performance is of importance to users. They also act as an important

interface between plant control systems and related hardware. Rotork's

reputation for quality, worldwide support and technical innovation is crucial to

its leadership position in the field. The broad geographic spread of our

operations and applications means that we have a large number of repeat

customers around the world and no one customer accounts for more than 5% of our

turnover in any year.

Programmes aimed at increasing the efficiency of our processes were underway at

most of our main operations during the year. These 'lean' programmes are

enabling us to become more effective and efficient suppliers to our market

place.

Electric actuators

UK Operations

The UK market both for new projects and our important retrofit activities

remained subdued. A certain amount of predicted investment activity was delayed

due to re-organisations in the water industry. The main electric actuator

manufacturing plant in Bath again had to contend with inconsistent production

programmes but coped well with a late surge of delivery requirements and the

introduction of a major new product line, the IQT.

Rotork adhere to an in-house assembly only philosophy of manufacture in which we

rely on high quality vendors for all of our components. There is an on going

initiative to develop more Far Eastern sources for components to reduce our

costs and the sterling component of the cost base. Further progress was made in

2003 which meant that our cost reduction targets were exceeded and that we are

positioned to reap further benefits during 2004. Most of our new sources of

supply are purchased in US dollars or in currencies closely tied to the US

dollar.

Europe

Our European sales companies traded successfully during the year. The star

performance was undoubtedly from our German subsidiary which benefited from its

customers' successes in Eastern Europe. The Italian and Spanish companies also

saw substantial increases in their sales and profits. The French and Dutch

companies' profits met our expectations but were down from a very good prior

year in France and a result in the prior year in the Netherlands which included

an insurance receipt following a fire. As expected a stronger euro assisted all

these companies.

The Americas

Our US and Canadian subsidiaries recorded high growth in 2002, which was not

maintained in the year. Sales and profits for both subsidiaries were down,

which was exacerbated by the steep decline in the US dollar when translated into

sterling. Order intake in the US was particularly hard to come by in the first

half of the year. Fortunately the second half showed a significant improvement

with a number of the projects which had been anticipated in the first half being

booked. The number of actuators sold to municipalities was lower than the prior

year while those destined for hydro carbon projects increased. The new Houston

service and support operation benefited our regional business in the Gulf Coast

market. In Canadathis trend was reversed with less business in the Western

oil and gas sector and more in the East where more diverse users are served.

The economic and political problems in Venezuela continued to be present for the

whole year. Our strategy, in this uncertain but important market, was to reduce

our exposure, while maintaining a strong presence, and to eliminate the loss

suffered in 2002. We succeeded in making a profit but on a much reduced

turnover.

Jordan Controls continued to face difficult market conditions in the US power

sector which, together with problems in its Venezuelan market, held back its

profits. However, Jordan took important steps in establishing sales in the Far

East, Latin America and Europe which it should benefit from in 2004. Further

benefits will accrue from the current re-organisation of its production

processes to bring it in line with Rotork's methodology.

The Far East and Rest of the World

We again saw good growth from this region with most of our operations exceeding

their targets and the prior year's figures. Impressive growth was recorded in

China, Singapore, Australia and South Africa.

The new production facility in Malaysia steadily increased its output during the

year. As expected this operation made a trading loss in its first year of

operation. However, margins at our sales companies for products manufactured

at this facility were better than expected which meant that the project as a

whole made a positivecontribution to Group results.

Rotork Fluid System

Rotork Fluid System design, produce and market fluid power valve actuators,

which are operated either pneumatically or hydraulically. This business

continued to make good progress on all fronts. Order input was up 14.1%, sales

output was up 12.8% and operating profits were up 16.7%. This meant that its

order book was up at the year-end and that it achieved a further increase in its

percentage return on sales. These figures were achieved despite a disappointing

US performance and an unhelpful euro cost base.

The new, larger, production facility in Lucca, Italy, played an important role

in enabling us to meet the increased sales targets and in taking on large, more

complex, projects. The unit recorded a major increase in its operating profits.

The new product ranges launched in 2002 were well received in the market and

accounted for #2m of sales. Further product developments were undertaken to

capitalise on our increasing market penetration. Enhanced fluid power

operations were established at a number of our companies around the world and a

number of key appointments were made. In early January 2004 we announced the

acquisition of Deanquip Valve Automationfor 2 million Australian dollars. This

company, which is based in Melbourne, is the major distributor of fluid power

actuators in Australia and will become the focus of our fluid power product and

service offerings in the region.

Rotork Gears

The positive results for the year were driven by increased sales and profits

from the Leeds operation due to a broader product range, component cost savings

and positive sales growth in most of our markets. Rotork Gears B.V. also

increased its profits significantly due to improved cost control and management

of the operation in the Netherlands following the re-organisation in late 2002.

Rotork Valvekits, based near Nottingham, UK, achieved sales growth, but ended

with similar operating profits to the prior year.

Research & Development

In the year under review we spent #2.1m on research and development. This was

slightly down on the prior year due to the timing of expenditure for the two

major new ranges, the IQT and AWT, falling into the prior year. The IQT range,

which was launched in September, brings IQII technology to quarter turn

actuators. Since its launch, sales of the product have exceeded expectations

and it has considerably enhanced the attractiveness of theIQ range of products.

We have also increased the range and capability of our digital actuator

control system offerings and continue to invest in this important area of

activity.

Innovation has been a fundamental driver to our past success andremains at the

heart of our strategy for future growth. Important initiatives are in place to

ensure that innovative ideas for valve actuation are nurtured and brought to the

market.

Treasury

With 75% of the Group's turnover, and 57% of its operating profit originating

from outside the UK, the Group's results are sensitive to movements in exchange

rates, particularly the US dollar and the euro. Currency movements in the year

affect our results through the translation of local currency profits into

sterling, as well as the transaction impact arising from the movement of

components and products around the world. An increasing proportion of our

components are being sourced in the Far East.

Free Cash flow

Rotork is highlycash generative. Fixed asset spend is usually around the level

of depreciation. Working capital, although historically not excessive, has seen

debtors, in terms of days outstanding, reduce over the last three years. They

are currently 67 days compared with 70 days last year.

In the current year free cash flow available to shareholders has been #24.7m:

#m Year ended Year ended

31 December 2003 31 December 2002

Cash flow from operations 33.8 25.8

Purchase of fixed assets (2.3) (2.6)

Sale offixed assets 1.8 0.7

Interest 0.6 0.4

Tax (9.2) (9.0)

____ ____

Free cash flow 24.7 15.3

Tax

The effective tax rate onprofit before goodwill amortisation has decreased

slightly from 32.3% to 32.1%. This is mainly as a result of the gain in April on

the disposal of the Luton building, which was covered by capital losses from

prior years, and the lower earnings from the US, offset by the effect of

dividend repatriation from the Far East. We are anticipating the tax rate for

2004 to be around 32.5%.

Earnings per share and Dividend

Profit after tax amounted to #18.6m (#17.3m in 2002) giving basic earningsper

share up 8% at 21.7p (2002: 20.1p). If we exclude goodwill, the earnings per

share was 23.2p (2002: 21.6p). As stated in the Chairman's statement and the

directors' report, the Board are recommending an increase in the final dividend

and an additional interim dividend for 2004 to be paid at the same time as the

final dividend for 2003, in May. Our strong cash resources and cash generation

gives us the confidence to do this, but we would like to move toward a stronger

level of dividend cover over time.

Bill Whiteley

Chief Executive

Audited Consolidated Profit and Loss Account

for the year ended 31 December 2003

2003 2002

#'000 #'000

Turnover

Continuing operations 135,964 129,677

Discontinued operations - 3,783

135,964 133,460

Cost of sales (72,159) (71,875)

_____ _____

Gross profit 63,805 61,585

Distribution costs (1,768) (1,748)

Administrative expenses (35,586) (35,348)

Other operating income 262 1,233

Operating profit

Continuing operations 26,713 25,248

Discontinued operations - 474

26,713 25,722

Continuing operations before amortisation of goodwill 28,018 26,553

Discontinued operations - 474

_____ _____

Operating profit before amortisation of goodwill 28,018 27,027

Amortisation of goodwill (1,305) (1,305)

_____ _____

Operating profit 26,713 25,722

Profit on disposal of fixed assets - discontinued 597 -

operations

Interest receivable and similar income 841 530

Interest payable and similar charges (80) (90)

_____ _____

Profit on ordinary activities before taxation 28,071 26,162

Tax on profit on ordinary activities (9,439) (8,868)

_____ _____

Profit for the financial year 18,632 17,294

Dividends- including non-equity (12,592) (11,959)

_____ ______

Retained profit for the financial year 6,040 5,335

_____ ______

Pence Pence

Basic earnings per share 21.7 20.1

Basic earnings per share before goodwill amortisation 23.2 21.6

Diluted earnings pershare 21.6 20.0

Note:

If approved at the annual general meeting on 21 May 2004, the final dividend for

2003 and the additional interim dividend for 2004 will be paid on 28 May 2004 to

shareholders on the register on 2 April 2004.

Audited Group Balance Sheet

at 31 December 2003

Group Group

2003 2002

#'000 #'000

Fixed assets

Intangible assets 19,057 20,886

Tangible assets 13,640 14,816

Investments 341 958

_____ _____

33,038 36,660

_____ _____

Current assets

Stocks 18,570 17,687

Debtors due within one year 32,966 32,421

Debtors due after more than one year 486 409

Cash at bank and in hand 32,253 20,371

_____ _____

84,275 70,888

_____ _____

Creditors:

Amounts falling due within one year (37,807) (33,603)

_____ _____

Net current assets 46,468 37,285

_____ _____

Total assets less current liabilities 79,506 73,945

Creditors:

Amounts falling due after more than one year (129) (197)

Provisions for liabilities and charges (2,890) (2,038)

_____ _____

Net assets 76,487 71,710

===== =====

Capital and reserves

Called up share capital 4,342 4,358

Share premium account 4,543 4,036

Revaluation reserve 2,405 2,400

Capital redemption reserve 1,634 1,609

Profit and loss account 63,563 59,307

_____ _____

Rotork shareholders' funds 76,487 71,710

===== =====

Equity 76,437 71,658

Non-equity 50 52

Shareholders' funds 76,487 71,710

Note:

The financial information set out above does not constitute the Company's

statutory accounts for the years ended 31 December 2003 or 2002. The financial

information for 2002 is derived from the statutory accounts for 2002 which have

been delivered to the Registrar of Companies. The auditors have reported on the

2002 and 2003 accounts; their reports were unqualified and did not contain a

statement under section 237(2) or (3) of the Companies Act 1985. The statutory

accounts for 2003 will be delivered to the Registrar of Companies following the

Company's annual general meeting.

Audited Statement of Group Cash Flow

for the year ended 31 December 2003

2003 2002

#'000 #'000

Net cash inflow from operating activities 33,798 25,771

Returns on investments and servicing of finance

Interest and similar income received 729 478

Interest paid (80) (90)

Dividends paid on non-equity preference shares (5) (5)

_____ _____

644 383

_____ _____

Taxation

UK corporation tax paid (3,804) (4,032)

Overseas tax paid (5,427) (4,958)

_____ _____

(9,231) (8,990)

_____ _____

Capital expenditure and financial investments

Purchase of tangible fixed assets (2,287) (2,563)

Sale of tangible fixed assets 89 706

Sale of tangible fixed assets - exceptional 1,675 -

Purchase of own equity shares held as investments - (380)

_____ _____

(523) (2,237)

_____ _____

Acquisitions and disposals

Sale of business - 1,306

Purchase of business - (7,781)

Cash acquired with business - 202

Deferred consideration on sale of business - 77

_____ _____

- (6,196)

_____ _____

Dividends paid on equity ordinary shares (12,068) (11,423)

_____ _____

Net cash inflow / (outflow) before management of liquid 12,620 (2,692)

resources and financing

===== =====

Management of liquid resources

(Increase) in term deposits (11,301) (1,752)

Financing

Issue of ordinary share capital 516 94

Purchase of ordinary share capital (1,223) -

Purchase of own preference shares (2) (2)

(Decrease) / increase in amounts borrowed (132) 46

Repayment of capital element of finance lease (67) (55)

_____ _____

(908) 83

Increase / (decrease) in cash in the year 411 (4,361)

===== =====

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SEAFMLSLSELD

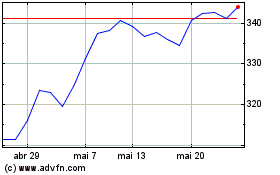

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024