Rotork PLC Trading Update (1386I)

22 Novembro 2018 - 5:00AM

UK Regulatory

TIDMROR

RNS Number : 1386I

Rotork PLC

22 November 2018

Rotork plc

Trading update

Rotork plc ("Rotork"), the market-leading actuator manufacturer

and flow control company, issues the following trading update

covering the third quarter and the year to 28 October 2018.

We continue to anticipate a robust financial performance in 2018

and management expectations for the full year remain unchanged.

Group order intake in the third quarter decreased by 4.0%, or

2.0% on an organic constant currency (OCC) basis on the comparable

period, while revenue increased by 8.4% (+9.9% OCC), reflecting the

variation in the timing of project orders and deliveries compared

with 2017. Cumulative (to 28 October 2018) order intake was up 3.6%

(+7.0% OCC) with a 9.8% increase in revenue (+13.0% OCC) resulting

in a book to bill of 1.02. The order book at 28 October 2018 was

GBP204.1m, 6.0% (+6.9% OCC) higher than at 31 December 2017.

Q3 Cumulative YTD

Order intake Revenue Order intake Revenue

OCC(2) OCC(2) OCC(2) OCC(2)

Change Change Change Change Change Change Change Change

Controls -3.3% -1.3% 12.9% 14.9% 4.9% 8.8% 10.0% 13.9%

Fluid Systems -19.7% -17.6% 6.7% 8.4% -2.2% 1.0% 13.1% 16.1%

Gears -1.9% 0.9% -4.1% -2.6% 2.8% 5.5% 2.2% 4.7%

Instruments 11.9% 11.4% -0.1% -0.6% 6.2% 7.6% 7.8% 9.2%

Group -4.0% -2.0% 8.4% 9.9% 3.6% 7.0% 9.8% 13.0%

------- -------- ------- -------- ------- -------- ------- --------

The results for the third quarter reflect a continued

improvement in overall levels of activity, particularly in

downstream, led by the delivery of further phases of the large

projects in the Far East highlighted at the half year. Upstream was

lower than the comparative period as was the power market.

Industrial process markets continued the strong performance we saw

in the first half, whilst midstream and water showed modest growth

in the quarter compared with the slight decline in the first

half.

Geographically we saw the strongest growth in the Far East. The

Americas, Western Europe and the Middle East were similar to the

comparative period and Eastern Europe experienced a decline as a

result of project delivery timing.

Growth acceleration programme update

We continue to make good progress across the range of activities

encompassed in our growth acceleration programme. Within the

commercial excellence pillar, we have recruited a Group Strategy

and M&A Director to accelerate the development of our

end-market strategy and address the most attractive adjacencies,

and appointed a Group Engineering Director to bring a more uniform

approach to innovation and product development opportunities. Our

service organisation has grown as expected, with a further 15

engineers recruited in the third quarter. The transition from

product to market segment orientation remains on target for the

start of a phased introduction in 2019.

Under the operational excellence pillar we have now sold or

closed the three non-core business units identified in our half

year results and site improvement plans have been developed for

eight of our largest factories. Our tailored lean programme

training has been developed and is being deployed. Our new central

procurement team is now fully staffed and working on the second

wave of the programme, which focuses on higher-value components

used in the manufacture of our products, and which will drive the

savings to be generated in 2019.

As part of our talent pillar we have recruited a Talent

Acquisitions and Development Director. A coordinated approach to

recruitment and development of our key personnel will ensure we

identify and develop the next generation of leaders.

As part of our IT pillar, we have nearly completed the selection

process for our ERP implementation partner in preparation for the

first stage of the design and build programme.

We expect the second half restructuring costs of the growth

acceleration programme will be slightly lower than the first half

of the year at around GBP4m.

Financial position

The Group continues to be highly cash generative with a strong

balance sheet. Net cash at 28 October 2018 was GBP12.2m (net debt

of GBP12.6m at 31 December 2017).

Kevin Hostetler, Chief Executive, commented:

"Based on our performance to the end of October and anticipated

shipments in the remaining two months of the year, we continue to

anticipate a robust financial performance in 2018 and management

expectations for the full year remain unchanged. I am pleased with

the progress we have made across all four pillars of our growth

acceleration programme, where we have moved from consultation and

analysis to implementation and execution."

Enquiries:

Rotork plc Tel: +44 (0)1225 733 200

Kevin Hostetler, Chief Executive

Jonathan Davis, Finance Director

FTI Consulting Tel: + 44 (0)20 3727 1340

Nick Hasell / Susanne Yule

Notes

1. 2018 figures quoted are at actual exchange rates and 2017 are as previously reported.

2. OCC (organic constant currency) growth rates remove the

results of the business disposed of or closed during 2018 that were

not consistently in both periods' results and restate 2018 at 2017

exchange rates.

3. Third quarter results refer to the period from 1 July 2018 to

30 September 2018. Cumulative results refer to the period from 1

January 2018 to 28 October 2018.

4. Rotork will be announcing results for the year ending 31

December 2018 on Monday 4 March 2019.

5. This announcement contains certain forward-looking statements

with respect to the operations, performance and financial condition

of the Group. By their nature, these statements involve uncertainty

since future events and circumstances can cause results and

developments to differ materially from those anticipated. The

forward-looking statements reflect knowledge and information

available at the date of preparation of this announcement, and

Rotork undertakes no obligation to update these forward-looking

statements. Nothing in this Trading Statement should be construed

as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTLLFETLILLFIT

(END) Dow Jones Newswires

November 22, 2018 02:00 ET (07:00 GMT)

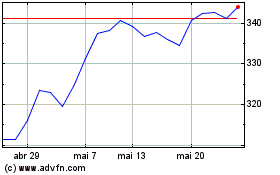

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024