Rotork PLC - Interim Results

30 Julho 1998 - 4:30AM

UK Regulatory

RNS No 0039c

ROTORK PLC

30th July 1998

Contacts: Bill Whiteley, Chief Executive

Rotork p.l.c. Tel: 0171 831 3113

(10.30am - 1.00pm)

Charles Watson / Tom Baldock

Financial Dynamics Tel: 0171 831 3113

Rotork p.l.c.

INTERIM RESULTS 1998

Rotork p.l.c., the international specialist engineering group, today

announces results for the six months to 30 June 1998.

Highlights include:

* Pre-tax profit up 16% to #12.3m (1997 #10.5m)

* Earnings per share up 17% to 9.1p (1997 7.8p)

* Dividend per share up 13% to 3.9p (1997 3.45p)

Commenting on the results, Chief Executive, Bill Whiteley said:

"Against the background of continued sterling strength and weakness in some

of our geographic and end-user markets, I am pleased with the progress

Rotork has achieved in the first six months. The attractiveness of our

existing product ranges, the programme for new product introduction and our

focused strategy continue to be the source of our strength."

REVIEW OF OPERATIONS

Despite an unpromising outlook for export orientated UK engineering

companies Rotork's trading in the first half of the year has remained

strong. The order book, which was at unusually high levels at the end of

1997, has grown further in the half year to June 1998. Turnover has moved

ahead by 14% to #53.8m and profits by 16% to #12.3m. Earnings per ordinary

share, aided by the share buy-backs at the end of 1997, improved by 17% from

7.8p to 9.1p.

There have been weaknesses in some of our geographic and end user markets.

These, however, have been more than compensated for by work associated with

large projects awarded over the past 12 months. All overseas subsidiaries

operated profitably, including those in Asia, all six of which were ahead of

budget at the half year. Business is particularly strong in China,

Australia, Spain and the USA, while slower business environments are evident

in Holland, Italy, Venezuela and, particularly, Korea. Rotork's strategy of

enhancing its international market coverage has been validated, with new

companies in Thailand and Malaysia performing well. An increased selling

presence is being put in place in China and the Middle East.

Outside the main electric actuator business the restructuring of the Fluid

Power activities is proving successful. An extended product range, coupled

with a more intense selling effort, has resulted in substantial sales gains.

Alecto, the Dutch gearbox manufacturer acquired earlier this year, is

exceeding expectations and it, together with Exeeco in Leeds which is also

performing well ahead of target, make a formidable combination in the valve

gearbox market.

Product development aimed at enhancing the existing ranges and moving Rotork

into new but related markets is receiving significant resources. The

electric fail safe actuator has been launched. Considerable interest is

being shown by, and orders are being received from, major oil companies.

ORDINARY DIVIDEND

On 2 October 1998 the directors intend to pay an interim dividend of 3.9p

per share. This represents a 13% increase year on year.

PREFERENCE SHARES

Following ordinary and preference shareholder approval, 867,936 shares

(55.97%) have been bought in at an average price of 150p, since May 1998.

Further repurchases will be made if the opportunities to do so present

themselves.

OUTLOOK

In spite of the problems afflicting the international market place and the

uncertainties that these create, there is confidence that the strength of

the company's products and its focused strategy will enable Rotork to make

further progress in the second half of the year.

Dr Robert Hawley, CBE

Chairman

Rotork p.l.c.

30 July 1998

This report is being sent to all shareholders. Copies may be obtained from

The Secretary, Rotork p.l.c., Bath BA1 3JQ

ROTORK GROUP INTERIM RESULTS 1998

Unaudited

First First First Full Full

half half half year year

1998 1997 1997 1997 1997

restated restated

#m #m #m #m #m

Turnover 53.82 47.19 47.19 92.85 92.85

Operating profit 11.32 9.66 9.57 20.38 20.20

Net interest and

similar income 0.94 0.87 0.87 1.94 1.94

Profit before

taxation 12.26 10.53 10.44 22.32 22.14

Taxation

UK (1.83) (1.60) (1.60) (4.86) (4.86)

Overseas (2.53) (2.03) (2.03) (3.25) (3.25)

Earnings 7.90 6.90 6.81 14.21 14.03

Earnings per

share - basic 9.09p 7.79p 7.68p 16.06p 15.85p

DIVIDEND

An interim dividend increased by 13% to 3.90p per ordinary share (1997

3.45p) will be paid on 2 October 1998 to shareholders on the register at the

close of business on 14 August 1998. The interim dividend will absorb

#3,358,615 (1997 #3,025,391).

Note:

The comparative financial information as at 30 June 1997 and 31 December

1997 and for the periods then ended has been restated in accordance with

FRS10 "goodwill and intangibles" which is effective for the first time in

the year ending 31 December 1998. This has resulted in the inclusion of

goodwill as an asset in the Balance Sheet and an amortisation charge in

determining operating profits. The effect of the company adopting this

transitional option was to reduce operating profit for the half year by

#93K.

ROTORK GROUP BALANCE SHEET

Unaudited

30 June 30 June 30 June 31 Dec 31 Dec

1998 1997 1997 1997 1997

restated restated

#m #m #m #m #m

Fixed assets

- Tangibles 10.9 9.9 9.9 9.7 9.7

- Intangibles 5.5 3.1 3.0

16.4 13.0 12.7

Current assets

Stocks 12.5 11.3 11.3 14.0 14.0

Debtors 24.5 19.8 19.8 22.4 22.4

Net cash 30.3 33.7 33.7 34.0 34.0

67.3 64.8 64.8 70.4 70.4

Creditors and

provisions (29.4) (26.8) (26.8) (35.2) (35.2)

37.9 38.0 38.0 35.2 35.2

Net assets 54.3 47.9 51.0 44.9 47.9

Share capital 5.0 5.9 5.9 5.9 5.9

Reserves 49.3 42.0 45.1 39.0 42.0

Shareholders' funds 54.3 47.9 51.0 44.9 47.9

The financial information for the year ended 31 December 1997 is an abridged

version of the full accounts for that year, which received an unqualified

report from the auditors and which have been filed with the Registrar of

Companies.

END

IR DKFFLVDKXBKE

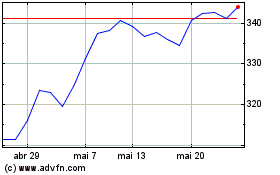

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Rotork (LSE:ROR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024