TIDMROR

RNS Number : 5269U

Rotork PLC

02 August 2022

Tuesday 2(nd) August 2022

Rotork plc

2022 Half Year Results

Encouraging momentum, outlook confirmed

OCC(3)

Adjusted highlights H1 2022 H1 2021(5) % change % change

----------------------------- ---------- ----------- --------- ----------

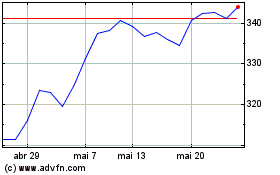

Order intake(1) GBP340.1m GBP298.2m +14.0% +12.1%

Revenue GBP280.0m GBP288.3m -2.9% -4.8%

Adjusted (2) operating

profit GBP53.3m GBP62.7m -15.0% -17.9%

Adjusted (2) operating

margin 19.0% 21.8% -280bps -300bps

Adjusted (2) basic earnings

per share 4.8p 5.5p -12.7% -15.9%

Cash conversion (4) 68% 94% - -

--------- ----------

Statutory highlights H1 2022 H1 2021(5) % change

----------------------------- ---------- ----------- ---------

Revenue GBP280.0m GBP288.3m -2.9%

Operating profit GBP44.0m GBP50.6m -12.9%

Operating margin 15.7% 17.5% -180bps

Profit before tax GBP44.6m GBP50.7m -12.0%

Basic earnings per share 3.9p 4.4p -11.4%

Interim dividend 2.40p 2.35p +2.1%

----------------------------- ---------- ----------- ---------

Summary

-- Orders were up double-digit year-on-year, reflecting an

encouraging performance from our Chemical, Process & Industrial

and Oil & Gas divisions and price increases which were

successfully implemented in January and May

-- Our supply chain improvement initiatives are taking effect

and deliveries picked up through the period. First half revenues

were lower year-on-year as expected due to supply chain challenges

in the first quarter

-- Our Shanghai site resumed full operation in early June

following the COVID-19 lockdown and made good progress delivering

delayed shipments to customers

-- Adjusted operating profit margin remained resilient at 19.0%

despite lower volumes and the phasing of price benefit due to the

record order book. Statutory operating margin was 15.7%

-- Net cash of GBP90.4m (December 2021: GBP114.1m), lower in

part due to strategic inventory build

-- We reaffirmed our commitment to improving our ESG performance

in our Sustainability Report and highlighted how our products and

services can enable a sustainable future

-- Our continuing work on strategy confirms we are well placed

to deliver on our ambition of mid to high single-digit revenue

growth and mid 20s adjusted operating profit margins over time

Kiet Huynh, Chief Executive, commenting on the results,

said:

"We enter the second half with encouraging momentum, a record

order book, and with our supply chain improvement actions taking

effect. Whilst forecasting remains challenging due to geopolitical

and macroeconomic uncertainties we continue to expect our full year

results will have a greater than usual weighting to the second

half, which will be even more pronounced than our previous

expectations if recent sterling weakness continues.

Since presenting my first set of results in March I have spent

time, together with my senior team, determining how we will deliver

on our growth ambition. Our progress to date confirms that we are

well positioned to deliver profitable growth. To summarise our

thinking on strategy, we will target the segments which offer the

greatest opportunities for profitable growth, including those which

form part of our eco-transition portfolio, whilst making ourselves

as easy to do business with as we can be. We will expand on these

themes at our Capital Markets Event in November."

(1.) Order intake represents the value of orders received during

the period.

(2.) Adjusted (4) figures exclude the amortisation of acquired

intangible assets, restructuring costs and other adjustments (see

note 4).

(3.) OCC (4) is organic constant currency results excluding

discontinued businesses and restated at 2021 exchange rates.

(4) Adjusted figures, organic constant currency ('OCC') figures,

cash conversion and ROCE are alternative performance measures and

are used consistently throughout these results. They are defined in

full and reconciled to the statutory measures in note 2.

(5) As a result of IFRIC agenda guidance in April 2021 on

Software as a Service (SaaS) and treatment under IAS38, 2021 has

been restated to reflect the updated treatment. The detail on this

restatement can be found in note 1.

Rotork plc Tel: +44 (0)1225 733 200

Kiet Huynh, Chief Executive

Jonathan Davis, Finance Director

Andrew Carter, Investor Relations

Director

FTI Consulting Tel: + 44 (0)20 3727 1340

Nick Hasell / Susanne Yule

There will be a meeting for analysts and institutional investors

at 8.30am BST today in the Library at the offices of JPMorgan

Cazenove, 60 Victoria Embankment, London, EC4Y 0JP. The

presentation will also be webcast, with access via

https://www.investis-live.com/rotork/62cec73f299ad30e007a93d2/eabwq

. Please join the meeting a few minutes before 8.30am to complete

registration.

Summary

Purpose

Our purpose and sustainability vision are one and the same:

keeping the world flowing for future generations. We play an

integral role in enabling the transition to a low-carbon economy as

well as helping preserve natural resources such as fresh water

through our intelligent products and services.

Operating responsibly

The wellbeing of our people and partners is the number one

priority of everyone at Rotork. We are proud of our 'safety first'

culture and require our employees to complete safety training each

year. We launched our Net Zero targets earlier this year and are

working hard to achieve our emissions reduction targets.

Business performance

Group order intake in the period increased 14.0% year-on-year,

and 12.1% on an OCC basis, to GBP340.1m. Orders were strongly ahead

at both Chemical, Process & Industrial ("CPI") and Oil &

Gas. Water & Power orders were modestly higher despite a tough

prior year comparison.

During the period customers continued to spend on upgrade,

refurbishment and maintenance as well as automation,

electrification and environmental projects. Hydrocarbon prices rose

to levels not experienced since 2012 reflecting recovering demand,

earlier underinvestment and geopolitical events which have

disrupted energy supplies. These events have necessitated a

reconsideration of energy security risks globally and there are

clear signs of a recovery in related project activity, particularly

in the midstream sector. Higher energy prices have contributed to

inflation increasing to levels not seen in decades. The resulting

pressure on the consumer has caused economists to reduce their

forecasts for global growth materially.

The majority of Rotork's activity continues to be driven by

customers' operational rather than capital expenditure. We estimate

that maintenance, repair and small to mid-sized automation/upgrade

projects (individual orders less than GBP100k) generate 75% of

Group orders by value in a typical year, and that orders above

GBP1m represent only 5% of Group order intake.

Our operational teams performed well in what continued to be a

challenging environment. As we reported on 29 April, our important

Shanghai facility was closed in accordance with local COVID-19

lockdown rules in mid-April. The facility resumed full production

in June and made good progress delivering delayed shipments to

customers. We thank our team for their efforts during this

difficult time.

The COVID-19 pandemic continues to pose significant challenges

for global supply chains. During the period we continued to see

shortages of semiconductors, electronics and other components,

disrupted freight services and elevated costs. Labour rates were

higher and we also experienced an increase in the cost of key

commodities such as copper, aluminium and steel.

Our self-help initiatives - such as direct purchasing and

forward buying of semiconductor chips, the re-certification and

re-engineering of products, the securing of contracted logistics

routes and tactical inventory build - have started to offset supply

chain challenges. Our Global Strategic Sourcing and Global

Distribution teams continue to focus on mitigating the impact of

higher costs through working with our materials and logistics

suppliers. Our Commercial teams remain in close contact with

customers, so required price increases are understood and do not

come as a surprise. We completed two price increases in the period,

one on 1 January, and the other on 1 May, which will deliver

greater benefit to revenue in the second half of the year. The

delay in price increases impacting revenue due to the record order

book also means we saw a price/mix headwind in the first half.

Group revenue was 2.9% lower year-on-year (OCC: -4.8%) at

GBP280.0m with higher price realisation and favourable currency

translation more than offset by reduced volumes. The lower

deliveries reflected component availability and logistics

challenges and the cessation of deliveries to Russia. CPI revenue

was ahead double digits, with all three sectors up year-on-year.

Oil & Gas sales were down mid-single digits. Water & Power

revenues were down double-digits, particularly impacted by

semiconductor shortages.

By geography, Asia Pacific revenues by destination were

unchanged year-on-year. Europe, Middle East & Africa ("EMEA")

sales were lower, the result of a significant reduction in activity

at Oil & Gas. Americas revenues were ahead, with higher Oil

& Gas activity more than offsetting a decline at Water &

Power.

Rotork Site Services, our global service network and a key

differentiator in our industry, made good progress in the period.

Sales were broadly unchanged year-on-year despite disruption due to

supply chain issues. Rotork Site Services is managed as a separate

unit within Rotork's divisions and continues to contribute a

significant proportion of Group sales (19% in the period).

Adjusted operating profit was 15.0% lower year-on-year (17.9%

OCC) reflecting lower volumes and higher materials and labour costs

which more than offset increased sales prices and Growth

Acceleration Programme savings. Adjusted operating margins were 280

basis points lower at 19.0%.

Return on capital employed was 27.0% (H1 2021: 32.9%), driven by

lower operating profit and higher capital employed. Cash conversion

was 68% (H1 2021: 94%) reflecting the lower working capital

position at the start of this year, the investment in tactical

inventory and the phasing of sales activity within the second

quarter.

Our balance sheet remains strong, with a net cash position of

GBP90.4m at the period end (December 31: GBP114.1m). This provides

us with optionality in uncertain times and the financial

flexibility to implement our organic investment plans, pay a

progressive dividend and execute our targeted M&A strategy. We

regularly review our capital needs and in the event in the future

we determine we have surplus cash, we will look to return it to

shareholders.

Dividend

We recognise the importance of a growing dividend to our

shareholders and are committed to a progressive dividend policy

subject to satisfying cash requirements, which can vary

significantly from year to year. The Board is declaring an interim

dividend of 2.4p per share which is equivalent to 2.0 times cover

based on adjusted earnings per share. The interim dividend will be

payable on 23 September 2022 to shareholders on the register on 19

August 2022.

Outlook

We enter the second half with good momentum, a record order

book, and with our supply chain improvement actions taking effect.

Whilst forecasting remains challenging due to geopolitical and

macroeconomic uncertainties we continue to expect our full year

results will have a greater than usual weighting to the second

half, which will be even more pronounced than our previous

expectations if recent sterling weakness continues.

Strategy update

During my first six months as CEO of Rotork I have spent time

together with my senior team and the Board reviewing the Group's

current shape and formulating our future strategy. Thanks to our

Growth Acceleration Programme ("GAP") Rotork's current portfolio is

well positioned for the future. GAP has enhanced many aspects of

the business: our culture; our commercial front end; our product

and services portfolio, our infrastructure and processes; our

operations and supply chain. We continue to deliver GAP initiatives

including supply chain consolidation, improving and standardising

core business processes and continuing our IT development.

Our ambition remains to deliver mid to high single-digit revenue

growth through a combination of organic growth and acquisitions and

mid 20s adjusted operating margins over time. In delivering our

growth ambition, we benefit from the industrial megatrends of

automation, electrification and digitalisation. We aim to play our

part in helping our customers better their own environmental

performance, while at the same time working to improve our own

environmental and social performance as well as those of our end

users and our suppliers.

We look forward to sharing more detail on our strategy later in

the year. Importantly our work to date has confirmed that we are

well placed to deliver on our growth ambition. Our strategy will

incorporate growth focused initiatives such as the targeting of

high potential sectors, including those in our Eco-transition

portfolio, greater customer value and the launching of new

innovative products and services.

1) Target segments

Key to our thinking is the identification of segments within

each of our divisions where we have the right to play and that we

believe offer significant opportunities for profitable growth. The

most important megatrends are:

-- Opportunities in developing markets. Industry analysts

forecast that more than half of global flow control spend over the

next five years will occur in Asia Pacific.

-- Automation, energy efficiency and electrification. AE&E

are the three major megatrends of the industrial world and are

forecast to accelerate.

-- Digitalisation and the industrial internet. Digitalisation is

transforming industry and condition monitoring and remote

diagnostics are being embraced by more and more of our

customers.

-- Infrastructure modernisation. Global infrastructure

investment and modernisation are forecast to grow significantly

faster than GDP for decades.

-- Climate change aligned. It is imperative that our target

segments are aligned with our 'enabling a sustainable future'

principle. We see significant opportunities in climate change

mitigation and adaptation.

2) Customer value

Due to GAP's Commercial and Operational Excellence initiatives

we have made good progress in becoming easier to do business with.

We can, however, go further and put customer value front and centre

of everything we do. We are looking at areas that leverage many of

GAP's commercial and operational initiatives, such as :

-- Enhancing our go to market proposition. Strengthening our

relationships with end users and key EPCs, leveraging our earlier

salesforce alignment work.

-- Global supply chain improvement. Developing a supply chain programme which will optimise our transportation network and provide an earlier warning of parts shortages.

-- Customer experience improvement and reduced lead times.

Further streamlining our internal processes allowing us to quote

more quickly and be more responsive to customer needs.

-- Leveraging our global service offering. Identifying

opportunities to expand our service footprint and our partner

programme.

3) Innovative products and services

Innovation is the lifeblood of Rotork. Over the last several

years we have brought our teams together and streamlined how we

deliver innovation and new product development. Our teams are

focused on projects aligned with our target segments and our

'enabling a sustainable future' principle. Key innovation drivers

include electrification (electric alternatives to traditional

actuation products), connectivity (wired and wireless

communications), predictive analytics (and value-added services

such as Lifetime Management) and product efficiency (including both

energy consumption and in use GHG emissions). Our engineers remain

focused on the affordability of our products and their ease of

manufacture. We will continue to innovate and develop new products

whilst always weighing 'make versus buy' arguments. Disciplined

M&A will be one of the drivers of our growth.

We will provide a further update on each area at our Capital

Markets Event in November.

Enabling a sustainable future

Managing Environmental, Social & Governance ("ESG")

opportunities and risks is integrated throughout Rotork's business.

We have worked hard to articulate our ambitions and underpin our

approach, and in June we published our second annual Sustainability

Report. In it we reaffirm our full commitment to improving our ESG

performance in all areas and highlight the many ways Rotork's

products and services can enable a sustainable future.

Sustainability is core to our Purpose and a key part of our growth

agenda.

-- We have a major role to play in the new energies and

technologies that will support the transition to a low-carbon

economy. Our products and services have applications in the

production of low- and no- carbon fuels such as hydrogen and in

climate change mitigation technologies, such as carbon capture and

storage, and helping customers to tackle methane emissions from

their operations.

-- Rotork's products and services also have applications in

processes that help preserve natural resources such as fresh water,

through leak reduction, water recovery, recycling and treatment.

Our products are widely used elsewhere to manage water, including

in flood protection and desalination.

-- In addition, Rotork can support a broad spread of industries

as they make greater use of automation, electrification and

digitalisation to reduce the environmental impact of their

operations, including through facilitating the use of renewable

energy.

Key highlights from the report include:

-- Our 'Eco-transition portfolio' of products and services, with

examples of projects that Rotork is supporting in each of the three

sub-portfolios: 'Methane emissions reduction', 'New energies &

technologies' and 'Water and wastewater'. Case studies cover our

role in global climate agreements, methane emission abatement,

lithium production, low-carbon chemical production, hydrogen market

opportunities, energy efficiency measures, and water management in

desalination, water treatment and purification.

-- Further progress in implementing the recommendations of the

Task Force on Climate-related Financial Disclosures (TCFD),

including the outputs of our work to quantify the potential impacts

of climate risks and opportunities.

-- Our net-zero roadmap and science-based targets for scopes 1

& 2 and scope 3, and how these are being integrated into

corporate strategy, new product development and our governance

processes.

-- Expanded disclosures on environmental, social and governance

topics as part of our commitment to transparency and meeting the

requirements of our stakeholders.

-- Progress on our diversity and inclusion initiatives during

the year, including refreshed schemes to develop young talent and

our new 'women@rotork' initiative to support female talent.

-- Continued good progress in Rotork's own ESG performance,

including a reduction of 7% in carbon emissions and 17% in lost

time injury rates, as well as achieving high rankings in key

external ESG ratings.

Our 2021 Sustainability Report has been prepared in accordance

with the Global Reporting Initiative (GRI) Standards: Core option.

It also provides disclosures against the SASB (Sustainability

Accounting Standards Board) framework. Alignment to these

frameworks has been independently checked by Corporate

Citizenship.

Divisional review

Oil & Gas

GBPm H1 2022 H1 2021 Change OCC Change

Revenue 122.3 129.6 -5.6% -7.4%

Adjusted operating

profit 23.6 26.9 -12.5% -12.9 %

Adjusted operating

margin 19.3% 20.8% -150bps -13 0bps

During the first half, Oil & Gas experienced a continuation

of the recovery in end markets which commenced in the second half

of 2021. As hydrocarbon demand recovered to pre-Covid levels,

customers increased their spending on upgrade, refurbishment and

maintenance as well as automation, electrification and

environmental projects. The conflict in the Ukraine saw hydrocarbon

prices rise further to levels not experienced since 2008 and

triggered an acceleration of large project planning and a

reconsideration of global energy security risks. The outlook for

oil & gas industry spending is positive for all three segments

(upstream, midstream and downstream), with spend expected to grow

over the medium term.

Divisional revenues fell 5.6% year-on-year (-7.4% OCC),

reflecting supply chain challenges and our withdrawal from Russia.

All three segments (upstream, midstream and downstream) reported

lower sales. In EMEA, growth in Lifetime Management revenue was

insufficient to offset these headwinds and the region reported the

largest year-on-year decline in sales. Asia Pacific sales were

lower, with a significant increase in upstream activity

insufficient to offset a decrease in the downstream. Americas

revenues were double digits ahead with both the downstream and the

midstream ahead. Sales of our electric products into upstream

wellhead applications grew.

Adjusted operating profits were GBP23.6m, 12.5% lower

year-on-year (-12.9% OCC). The decline in profits reflected reduced

volumes and higher component costs partly offset by efficiency

savings. The benefit from increased selling prices was reduced by

the relative size of the orderbook entering the period. Adjusted

margins fell 150 basis points to 19.3%, reflecting the above

factors plus a positive product mix.

We consider the energy transition to be a significant

opportunity where Oil & Gas plays an important role. The

production, distribution, and utilisation of low and zero carbon

fuels (including hydrogen and biofuels such as HVO) is valve and

actuator intensive. We have an important part to play in climate

change mitigation technologies such as methane emissions reduction

and carbon capture usage and storage. The focus on the oil &

gas industry's methane emissions is high on the climate policy

agenda. We believe that electrification has an important role to

play in emissions reduction across upstream, midstream and

downstream processes, and that as the world leader in electric

actuation we are well placed to assist the industry on this

journey. Gasification / fuel switching in the power generation

sector in the US and Europe and in the residential and industrial

sectors in Asia Pacific is expected to benefit the midstream

sector.

Chemical, Process & Industrial ("CPI")

GBPm H1 2022 H1 2021 Change OCC Change

Revenue 92.8 81.2 14.3% 12.4%

Adjusted operating

profit 22.7 20.6 10.2% 10.4 %

Adjusted operating

margin 24.5% 25.4% -90bps -40 bps

CPI delivered an encouraging performance in the first half. The

division serves a broad range of end markets and has a higher

proportion of short-cycle sales and a shorter order book than

Rotork's other divisions. CPI is benefiting from global growth as

well as earlier GAP initiatives such as focusing on new

opportunities in new markets including mining, hydrogen,

semi-conductor, li-ion battery and data centres.

Revenues grew 12.4% year-on-year on an OCC basis demonstrating

the benefits of the division's strategic focus. Asia Pacific saw

the strongest growth, with all segments well ahead of the prior

period and instruments particularly strong. EMEA sales were ahead

year-on-year with the chemical segment strong. Americas revenues

were unchanged despite good growth in the mining market.

The process sector represents a substantial proportion of CPI

overall. Process revenues were ahead in all geographic regions.

EMEA saw particularly strong growth in the UK. In Asia Pacific, we

continued to see strong demand from control valve OEMs in China.

Americas process sales were slightly higher. Both chemical and

industrial sector revenues were higher year-on-year.

The division's adjusted operating profit was GBP22.7m, 10.2% up

year-on-year. The shorter lead time nature of many CPI sales

ensured price increases had the greatest benefit here and this was

combined with volume growth. Despite operational gearing and

efficiency improvements, higher component costs and a higher share

of common costs as a result of the division's growth resulted in a

net decline in margins. Adjusted operating margins were 24.5%,

90bps lower year-on-year.

The decarbonisation trend presents a key opportunity for CPI -

through new industrial processes such as hydrogen, carbon capture

usage and storage and plastic recycling, as well as the

substitution of high maintenance and inefficient pneumatic systems

with electric actuators.

Water & Power

GBPm H1 2022 H1 2021 Change OCC Change

Revenue 64.9 77.5 -16.2% -18.4%

Adjusted operating

profit 13.4 21.0 -36.2% -37.4 %

Adjusted operating

margin 20.7% 27.1% -640bps -630 bps

Water & Power's products and services, and those of its

customers, are generally considered essential, and customer

activity largely continued without any significant disruption

throughout the pandemic. The world's governments have identified

water infrastructure investment as a priority, not only for

population health and safety reasons but also for economic

development and the division is well placed to support these

efforts.

The division has the highest proportion of electric actuator

sales amongst Rotork's divisions and was again the most impacted by

electronics and semiconductor shortages and cost increases in the

period. Revenues decreased 16.2% year-on-year (18.4% OCC) with

lower sales in all geographic regions on an OCC basis reflecting

component shortages and to a lesser extent the non-repeat of power

sector project business in Asia Pacific and the Americas. Water and

power segment sales were both lower in Asia Pacific. In the

Americas, both segments reported a decline with power sales down

the most due to a strong comparison. In EMEA, both segments saw

sales reduce as a result of component shortages and logistics

challenges. For the division overall, water sales were down

mid-single digits year-on-year on an OCC basis.

The division's adjusted operating profits were GBP13.4m, 36.2%

lower year-on-year. The two major power projects in the first half

of 2021 combined with delays to deliveries of electric actuators

have had a negative mix and operational gearing impact. Adjusted

margins were 20.7%, down from 27.1% the prior year. The margin

decline reflected the factors highlighted above together with the

higher component costs noted across all divisions in respect of

electric actuators.

We see significant growth opportunities in Water & Power

driven by the water sector's need to achieve higher water quality

standards, lower operational costs, reduce water leakage and

increase the lifecycle of assets above- and under- ground. In

power, our teams are targeting environmental opportunities such as

waste-to-energy investments, flue-gas desulphurisation retrofits

and seeking refurbishment opportunities within our large installed

base.

Financial Key Performance Indicators (KPIs) H1 2021

H1 2022 (Restated)(5) FY 2021

--------- ---------------- ---------

Revenue growth -2.9% 1.8% -5.9%

Adjusted operating margin 19.0% 21.8% 22.5%

Cash conversion 68.1% 94.0% 108.0%

Return on capital employed 27.0% 32.9% 30.1%

Adjusted EPS growth -12.7% 1.9% -9.6%

--------- ---------------- ---------

The KPIs are defined below:

* Revenue growth is defined as the increase in revenue

divided by prior period revenue.

* Adjusted operating margin is defined as adjusted

operating profit as a percentage of revenue (note

2a).

* Cash conversion is defined as cash flow from

operating activities before tax outflows, payments of

restructuring charges and the pension charge to cash

adjustment as a percentage of adjusted operating

profit (note 2a).

* Return on capital employed is defined as adjusted

operating profit as a percentage of average capital

employed. Capital employed is defined as

shareholders' funds less net cash held, with the

pension fund surplus net of related deferred tax

liability removed (note 2d).

* Adjusted EPS growth is defined as the

increase/(decrease) in adjusted basic EPS (based on

adjusted profit after tax) divided by the prior year

adjusted basic EPS (note 2c).

Adjusted items

Adjusted profit measures are presented alongside statutory results as

the directors believe they provide a useful comparison of business trends

and performance from one period to the next.

The statutory profit measures are adjusted to exclude amortisation of

acquired intangibles and other adjustments. Other adjustments to profit

items may include but are not restricted to: costs of significant business

restructuring, significant impairments of intangible or tangible assets,

software as a service configuration costs and other items due to their

significance, size or nature. The costs of ceasing operations in Russia

and the impairment of the gross assets of the Russian entity have been

recognised in other adjustments during the first half of 2022. Software Russia

Statutory as a market Other Adjusted

GBPm results Amortisation Service exit Adjustments results

---------- ------------- ----------- -------- ------------ ----------

Operating

profit 44.0 3.1 3.5 3.6 (0.9) 53.3

Profit

before

tax 44.6 3.1 3.5 3.6 (0.9) 53.9

Tax (10.9) (0.8) (1.3) - 0.1 (12.9)

---------- ------------- ----------- -------- ------------ ----------

Profit

after

tax 33.7 2.3 2.2 3.6 (0.8) 41.0

---------- ------------- ----------- -------- ------------ ----------

Financial position

The balance sheet remains strong and we ended the period with net cash

of GBP90.4m (Dec 2021: GBP114.1m). Net cash comprises cash balances

of GBP100.4m less loans and borrowings and leases of GBP10.0m.

Net working capital has increased by GBP33.5m since the year end to

GBP157.3m at the period end; this was largely driven by inventory and

trade receivables. Inventory levels have increased following the tactical

decision to hold higher levels of components to help mitigate the risk

of supply chain disruption. Days sales outstanding has reduced by 5

days since December 2021 to 51 days. However, trade receivables have

increased due to a greater weighting of sales being towards the end

of the period in H1. In total, net working capital as a percentage of

sales was 28.1% compared with 21.8% in December 2021 and 22.9% in June

2021.

The increase in working capital has resulted in cash conversion of 68.1%

of adjusted operating profit into operating cash, down from 94.0% in

H1 2021.

The estimated effective tax rate used for the year ending 31 December

2022 is 24.4% (2021 actual rate: 24.2%) and the estimated adjusted effective

tax rate for the year ending 31 December 2022, based on adjusted profit

before tax, is 23.9% (2021 actual: 23.8%).

Retirement benefits

The Group operates two defined benefit pension schemes, the larger of

which is in the UK. Both the UK and US schemes are closed to future

accrual.

The pension scheme has moved from a deficit of GBP7.6m at 31 December

2021 to a surplus of GBP11.2m at 30 June 2022, principally due to an

increase in the discount rate, used to determine the present value of

future obligations.

Currency

Overall, currency tailwinds increased revenue by GBP5.5m (2.0%) compared

with the first half of 2021. The average US dollar rate was $1.30 (H1

2021: $1.39) and the average Euro rate was EUR1.19 (H1 2021: EUR1.15),

whilst the rates at 30 June 2022 were $1.22 and EUR1.16 respectively

(30 June 2021: $1.38 and EUR1.17).

Dividend

The Board has declared an interim dividend of 2.40p per ordinary share.

The interim dividend will be paid on 23 September 2022 to shareholders

on the register at the close of business on 19 August 2022.

Ukraine conflict

Deliveries to Russia ceased at the start of March. Rotork had no manufacturing

presence in Russia and is suspending the activities of its sales and

service operations in the country in an orderly manner, with a small

number of employees retained to manage this process. The Russia, Ukraine

and Belarus region contributed around 3% to group sales in 2021. The

costs associated with exiting the Russian market and impairing the assets

have been recognised in other adjustments in the period.

Non-controlling interest

The Group invested GBP4,059,000 for 75% of the share capital in a newly-established

entity in Saudi Arabia during April 2022, with the remaining 25% owned

by a third party. Owing to this third party shareholding, a "Non-controlling

interests" position is now reported in the financial statements.

Principal risks and uncertainties

The Group has an established risk management process as part of the

corporate governance framework set out in the 2021 Annual Report and

Accounts. The principal risks and uncertainties facing our businesses

are monitored on an ongoing basis in line with the Corporate Governance

Code. The risk management process is described in detail on pages 83

to 85 of the 2021 Annual Report and Accounts. The Group's principal

risks and uncertainties have been reviewed by the Board and the Board

have concluded that they remain applicable for the second half of the

financial year. A more detailed description of the Group's principal

risks and uncertainties is set out on pages 86 to 92 of the 2021 Annual

Report and Accounts.

Risk update

Whilst there has been no change in the principal risks and uncertainties

under review by the business, the following risks have increased.

* Geopolitical instability - we have seen an increase

in geopolitical instability and continue to monitor

potential impacts such as forecasting challenges or

disruption to the business.

* Supply chain disruption - we continue to see this

risk as elevated due to component shortages and

constraints driving uncertainty in supply. Management

actions to improve the reliability of logistics and

secure the supply of key components have mitigated

potentially more severe outcomes including key

initiatives such as the global transportation

programme and the global shortages programme.

Impacts of COVID-19 on Rotork's risk profile

We continue to monitor the impact of COVID-19 across our principal risks

and uncertainties. Many of the risks associated with COVID-19 are now

part of our business as usual risk management practices.

Climate risk

We continue to monitor climate risk closely given its significance internally

and externally. As we noted in our 2021 Sustainability Report, we have

performed both a qualitative and quantitative analysis of our climate-related

risks and opportunities and the results of our analysis provide detailed

information about the magnitude of potential impacts of climate change

on our business and operations. Understanding these impacts will enable

us to strengthen the business case for investment in mitigation and

adaptation measures and address those risks that have the largest potential

impacts first.

Emerging risks

We continue to monitor and review emerging risks that may impact our

business including people, market, environmental, climate and sustainability

risks.

Principal risks and uncertainties

1. Decline in market confidence: A decline in government and private

sector confidence and spending will lead to cancellations of expected

projects or delays to existing expenditure commitments. This lower investment

in Rotork's traditional market sectors would result in a smaller addressable

market, which in turn could lead to a reduction in revenue from that

sector.

2. Increased competition: Increased competition on price or product

offering leading to a loss of sales globally or market share.

3. Geopolitical instability: Increasing social and political instability,

including Brexit, results in disruption and increased protectionism

in key geographic markets. Business disruption would impact our sales

and might ultimately lead to loss of assets located in the affected

region.

4. Failure of an acquisition to deliver value: Failure of an acquisition

to deliver the growth or synergies anticipated, either due to unforeseen

changes in market conditions or failure to integrate an acquisition

effectively. Significant financial underperformance could lead to an

impairment write down of the associated intangible assets.

5. Health, Safety and the Environment: The nature of Rotork's core

business and geographical locations involves potential risks to the

Health and Safety of our employees or other stakeholders. A failure

of our products or internal processes could have an impact on the environment.

6. Compliance with laws and regulations: Failure of our staff or third

parties who we do business with to comply with law or regulation or

to uphold our high ethical standards and values.

7. Major in-field product failure: Major in-field failure of a new

or existing Rotork product potentially leading to a product recall,

major on-site warranty programme or the loss of an existing or potential

customer.

8. Supply chain disruption: Supply chain disruption which may arise

such as a lack of availability of key components, tooling failure at

a key supplier, logistics issues or severe weather events impacting

key suppliers which would cause disruption to manufacturing at a Rotork

factory.

9. Critical IT system failure and cybersecurity: Failure to provide,

maintain and update the systems and infrastructure required by the Rotork

business. Failure to protect Rotork operations, sensitive or commercial

data, technical specifications and financial information from cybercrime.

10. Growth Acceleration Programme: The Growth Acceleration Programme

and other change projects lead to business disruption or have a negative

effect on day-to-day operations.

Statement of Directors' Responsibilities

The directors confirm that, to the best of their knowledge, this condensed

consolidated interim financial information has been prepared in accordance

with IAS 34 as adopted by the United Kingdom, the interim financial

statements give a true and fair view of the consolidated assets, liabilities,

financial position and profit of the Company and its group companies

taken as a whole; and that the interim management report includes a

fair review of the information required by DTR 4.2.7R and DTR 4.2.8R,

namely:

* An indication of important events that have occurred

during the first six months and their impact on the

condensed set of financial statements, and a

description of the principal risks and uncertainties

for the remaining six months of the financial year;

and

* Material related-party transactions in the first six

months, and any material changes in the related-party

transactions described in the last annual report.

These interim financial statements and the interim management report

are the responsibility of, and have been approved by, the directors.

A list of the current directors can be found in the "About Us" section

of the Rotork website: www.rotork.com .

By order of the Board

Kiet Huynh

Chief Executive

1 August 2022

Independent Review Report to Rotork plc

Conclusion

We have been engaged by the company to review the condensed set of financial

statements in the half-yearly financial report for the six months ended

30 June 2022 which comprises the condensed consolidated income statement,

the condensed consolidated statement of comprehensive income and expense,

the condensed consolidated balance sheet, the condensed consolidated

statement of changes in equity, the condensed consolidated statement

of cash flows and related notes 1 to 16.

Based on our review, nothing has come to our attention that causes us

to believe that the condensed set of financial statements in the half-yearly

financial report for the six months ended 30 June 2022 is not prepared,

in all material respects, in accordance with United Kingdom adopted

International Accounting Standard 34 and the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct Authority.

Basis for Conclusion

We conducted our review in accordance with International Standard on

Review Engagements (UK) 2410 "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the Financial

Reporting Council for use in the United Kingdom. A review of interim

financial information consists of making inquiries, primarily of persons

responsible for financial and accounting matters, and applying analytical

and other review procedures. A review is substantially less in scope

than an audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the group

will be prepared in accordance with United Kingdom adopted international

accounting standards. The condensed set of financial statements included

in this half-yearly financial report has been prepared in accordance

with United Kingdom adopted International Accounting Standard 34, "Interim

Financial Reporting".

Conclusion Relating to Going Concern

Based on our review procedures, which are less extensive than those

performed in an audit as described in the Basis for Conclusion section

of this report, nothing has come to our attention to suggest that the

directors have inappropriately adopted the going concern basis of accounting

or that the directors have identified material uncertainties relating

to going concern that are not appropriately disclosed.

This conclusion is based on the review procedures performed in accordance

with this ISRE (UK), however future events or conditions may cause the

entity to cease to continue as a going concern.

Responsibilities of the directors

The directors are responsible for preparing the half-yearly financial

report in accordance with the Disclosure Guidance and Transparency Rules

of the United Kingdom's Financial Conduct Authority.

In preparing the half-yearly financial report, the directors are responsible

for assessing the group's ability to continue as a going concern, disclosing

as applicable, matters related to going concern and using the going

concern basis of accounting unless the directors either intend to liquidate

the company or to cease operations, or have no realistic alternative

but to do so.

Auditor's Responsibilities for the review of the financial information

In reviewing the half-yearly financial report, we are responsible for

expressing to the group a conclusion on the condensed set of financial

statements in the half-yearly financial report. Our conclusion, including

our Conclusions Relating to Going Concern, are based on procedures that

are less extensive than audit procedures, as described in the Basis

for Conclusion paragraph of this report.

Use of our report

This report is made solely to the company in accordance with International

Standard on Review Engagements (UK) 2410 "Review of Interim Financial

Information Performed by the Independent Auditor of the Entity" issued

by the Financial Reporting Council. Our work has been undertaken so

that we might state to the company those matters we are required to

state to it in an independent review report and for no other purpose.

To the fullest extent permitted by law, we do not accept or assume responsibility

to anyone other than the company, for our review work, for this report,

or for the conclusions we have formed.

Deloitte LLP

Statutory Auditor

London, United Kingdom

1 August 2022

Condensed consolidated Income Statement

First half First half Full year

2022 2021 (Restated)(1) 2021

Notes GBP000 GBP000 GBP000

---------- ------------------ ---------

Revenue 3 280,014 288,261 569,160

Cost of sales (155,222) (155,081) (306,394)

---------- ------------------ ---------

Gross profit 124,792 133,180 262,766

Other income 374 220 587

Distribution costs (2,939) (2,504) (5,397)

Administrative expenses (78,160) (80,311) (152,064)

Other expenses (39) (34) (182)

---------- ------------------ ---------

Operating profit 3 44,028 50,551 105,710

Finance income 5 1,791 1,341 2,442

Finance expense 6 (1,229) (1,196) (2,221)

Profit before tax 44,590 50,696 105,931

Income tax expense 7 (10,882) (12,398) (25,686)

Profit for the period 33,708 38,298 80,245

Attributable to:

Owners of the parent 33,741 38,298 80,245

Non-controlling interests (33) - -

---------- ------------------ ---------

33,708 38,298 80,245

========== ================== =========

Basic earnings per share 9 3.9p 4.4p 9.2p

==========

Diluted earnings per share 9 3.9p 4.4p 9.2p

Operating profit

Adjustments: 44,028 50,551 105,710

* Amortisation of acquired intangible assets 3,096 4,655 9,001

* Other adjustments 4 6,179 7,529 13,369

-------------------------------------------------- ------ ---------- ------------------ ---------

Adjusted Operating profit 53,303 62,735 128,080

Adjusted basic earnings per share 2 4.8p 5.5p 11.3p

Adjusted diluted earnings per share 2 4.8p 5.5p 11.2p

-------------------------------------------------- ------ ---------- ------------------ ---------

1 See note 1 for details of the prior period restatement

Condensed consolidated Statement of Comprehensive Income and Expense

First half First half Full year

2022 2021 (Restated)(1) 2021

GBP000 GBP000 GBP000

---------- ------------------ ---------

Profit for the period 33,708 38,298 80,245

Other comprehensive income and expense

Items that may be subsequently reclassified

to the income statement:

Foreign currency translation differences 19,676 (8,559) (8,899)

Effective portion of changes in fair value

of cash flow

hedges net of tax (1,786) 342 (88)

---------- ------------------ ---------

17,890 (8,217) (8,987)

Items that are not subsequently reclassified

to the income statement:

Actuarial gain in pension scheme net of tax 11,412 10,241 19,469

---------- ------------------ ---------

Income and expenses recognised directly

in equity 29,302 2,024 10,482

Total comprehensive income for the period 63,010 40,322 90,727

Attributable to:

Owners of the parent 64,043 40,322 90,727

Non-controlling interests (33) - -

---------- ------------------ ---------

63,010 40,322 90,727

========== ================== =========

1 See note 1 for details of the prior period restatement

Condensed consolidated Balance Sheet

30 June 30 June 31 Dec

2021

2022 (Restated)(1) 2021

Notes GBP000 GBP000 GBP000

------- -------------- -------

Goodwill 224,575 218,283 216,778

Intangible assets 24,337 28,459 25,722

Property, plant and equipment 79,507 80,593 77,798

Deferred tax assets 10,428 12,511 10,183

Other receivables 41 332 -

Defined benefit scheme surplus 11 11,233 - -

Total non-current assets 350,121 340,178 330,481

Inventories 10 90,521 63,077 68,447

Trade receivables 108,117 104,104 94,189

Current tax 10,255 5,740 9,558

Derivative financial instruments 16 288 1,676 1,896

Other receivables 40,281 33,308 35,824

Assets classified as held for sale - - 2,884

Cash and cash equivalents 100,382 153,361 123,474

------- -------------- -------

Total current assets 349,844 361,266 336,272

Total assets 699,965 701,444 666,753

======= ============== =======

Issued equity capital 12 4,302 4,371 4,302

Share premium 19,266 17,153 18,828

Other reserves 29,909 12,717 12,019

Retained earnings 509,810 518,705 498,931

------- -------------- -------

Equity attributable to owners of the

parent 563,287 552,946 534,080

Non-controlling interests 1,382 - -

------- -------------- -------

Total equity 564,669 552,946 534,080

------- -------------- -------

Interest bearing loans and borrowings 13 6,454 5,051 5,464

Employee benefits 11 4,064 22,042 11,336

Deferred tax liabilities 2,696 1,906 1,580

Derivative financial instruments 16 403 40 106

Other payables - 314 -

Provisions 1,524 1,707 1,559

------- -------------- -------

Total non-current liabilities 15,141 31,060 20,045

Interest bearing loans and borrowings 13 3,505 4,038 3,872

Trade payables 41,332 35,385 38,800

Employee benefits 10,771 19,006 14,440

Current tax 14,071 13,074 12,226

Derivative financial instruments 16 1,024 - -

Other payables 45,902 38,316 37,986

Provisions 3,550 7,619 5,304

------- -------------- -------

Total current liabilities 120,155 117,438 112,628

Total liabilities 135,296 148,498 132,673

Total equity and liabilities 699,965 701,444 666,753

======= ============== =======

1 See note 1 for details of the prior

period restatement

Condensed consolidated Statement of Changes in Equity

Attributable

Issued Capital to owners

equity Share Translation redemption Hedging Retained of the Non-controlling

capital premium reserve reserve reserve earnings parent interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------- -------- ------------ ----------- --------- ---------- ------------- ---------------- ---------

Balance at 31

December 2021 4,302 18,828 9,475 1,716 828 498,931 534,080 - 534,080

Profit for the

period - - - - - 33,741 33,741 (33) 33,708

Other

comprehensive

(expense)/income

-------- -------- ------------ ----------- --------- ---------- ------------- ---------------- ---------

Foreign currency

translation

differences - - 19,676 - - - 19,676 - 19,676

Effective portion

of changes in

fair value of

cash flow hedges - - - - (2,205) - (2,205) - (2,205)

Actuarial gain

on defined

benefit

pension plans - - - - - 15,500 15,500 - 15,500

Tax in other

comprehensive

(expense)/income - - - - 419 (4,088) (3,669) - (3,669)

-------- -------- ------------ ----------- --------- ---------- ------------- ---------------- ---------

Total other

comprehensive

(expense)/income - - 19,676 - (1,786) 11,412 29,302 - 29,302

-------- -------- ------------ ----------- --------- ---------- ------------- ---------------- ---------

Total

comprehensive

income - - 19,676 - (1,786) 45,153 63,043 (33) 63,010

Non-controlling

interest on

newly-established

subsidiary - - - - - - - 1,415 1,415

Transactions

with owners,

recorded directly

in equity

Equity settled

share based

payment

transactions - - - - - (869) (869) - (869)

Tax on equity

settled share

based payment

transactions - - - - - 164 164 - 164

Shares issued

to satisfy

employee

awards - 438 - - - - 438 - 438

Own ordinary

shares acquired - - - - - (1,600) (1,600) - (1,600)

Own ordinary

shares awarded

under share

schemes - - - - - 2,818 2,818 - 2,818

Dividends - - - - - (34,787) (34,787) - (34,787)

-------- -------- ------------ ----------- --------- ---------- ------------- ---------------- ---------

Balance at 30

June 2022 4,302 19,266 29,151 1,716 (958) 509,810 563,287 1,382 564,669

======== ======== ============ =========== ========= ========== ============= ================ =========

Condensed consolidated Statement of Changes in Equity

(continued)

Attributable

Issued Capital to owners

equity Share Translation redemption Hedging Retained of the Non-controlling

capital premium reserve reserve reserve earnings parent interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------- -------- ------------ ----------- --------- ---------- ------------- ---------------- ---------

Balance at 31

December 2020

(Restated) (1) 4,370 16,826 18,374 1,644 916 528,624 570,754 - 570,754

Profit for the

period - - - - - 38,298 38,298 - 38,298

Other

comprehensive

(expense)/income

-------- -------- ------------ ----------- --------- ---------- ------------- ---------------- ---------

Foreign currency

translation

differences - - (8,559) - - - (8,559) - (8,559)

Effective portion

of changes in

fair value of

cash flow hedges - - - - 422 - 422 - 422

Actuarial gain

on defined

benefit

pension plans - - - - - 12,837 12,837 - 12,837

Tax in other

comprehensive

(expense)/income - - - - (80) (2,596) (2,676) - (2,676)

-------- -------- ------------ ----------- --------- ---------- ------------- ---------------- ---------

Total other

comprehensive

(expense)/income - - (8,559) - 342 10,241 2,024 - 2,024

-------- -------- ------------ ----------- --------- ---------- ------------- ---------------- ---------

Total

comprehensive

income - - (8,559) - 342 48,539 40,322 - 40,322

Transactions

with owners,

recorded directly

in equity

Equity settled

share based

payment

transactions - - - - - (4,325) (4,325) - (4,325)

Tax on equity

settled share

based payment

transactions - - - - - 817 817 - 817

Shares issued

to satisfy

employee

awards 1 327 - - - - 328 - 328

Own ordinary

shares acquired - - - - - (5,409) (5,409) - (5,409)

Own ordinary

shares awarded

under share

schemes - - - - - 5,455 5,455 - 5,455

Dividends - - - - - (54,996) (54,996) - (54,996)

-------- -------- ------------ ----------- --------- ---------- ------------- ---------------- ---------

Balance at 30

June 2021

(Restated)

(1) 4,371 17,153 9,815 1,644 1,258 518,705 552,946 - 552,946

======== ======== ============ =========== ========= ========== ============= ================ =========

1 See note 1 for details of the prior period restatement

Condensed consolidated Statement of Cash Flows

First half First half Full year

2022 2021 (Restated)(1) 2021

Notes GBP000 GBP000 GBP000

---------- ------------------ ---------

Cash flows from operating activities

Profit for the period 33,708 38,298 80,245

Adjustments for:

Amortisation of acquired intangible

assets 3,104 4,655 9,001

Other adjustments 4 6,179 7,529 13,369

Amortisation and impairment of development

costs 741 978 1,657

Depreciation 7,426 7,905 15,673

Equity settled share-based payment expense 2,118 1,951 3,333

Net profit on sale of property, plant

and equipment (60) (27) -

Finance income (1,791) (1,341) (2,442)

Finance expense 1,229 1,196 2,221

Income tax expense 10,882 12,398 25,686

63,536 73,542 148,743

(Increase) in inventories (16,852) (3,070) (8,330)

(Increase)/decrease in trade and other

receivables (9,439) (1,070) 5,944

Increase/(decrease) in trade and other

payables 2,514 (1,667) 2,583

Cash impact of other adjustments (5,030) (5,320) (13,346)

Difference between pension charge and

cash contribution (3,474) (3,733) (7,562)

Increase/(decrease) in provisions 341 (162) (937)

(Decrease) in employee benefits (3,823) (8,615) (9,632)

---------- ------------------ ---------

27,773 49,905 117,463

Income taxes paid (12,053) (15,245) (32,021)

---------- ------------------ ---------

Net cash flows from operating activities 15,720 34,660 85,442

Investing activities

Purchase of property, plant and equipment (3,887) (7,541) (13,170)

Purchase of intangible assets (1,041) (2,507) (5,174)

Development costs capitalised (1,327) (815) (1,806)

Sale of property, plant and equipment 4,097 3,028 3,808

Settlement of hedging derivatives (474) 205 4,102

Interest received 499 540 857

---------- ------------------ ---------

Net cash flows from investing activities (2,133) (7,090) (11,383)

Financing activities

Issue of ordinary share capital 438 328 2,006

Own ordinary shares acquired (1,600) (5,409) (7,809)

Share buyback programme - - (50,324)

Interest paid (440) (458) (881)

Decrease in bank loans (686) (34) (67)

Repayment of lease liabilities (2,536) (2,380) (4,904)

Dividends paid on ordinary shares (34,787) (54,996) (75,515)

Receipt for non-controlling interest 1,415 - -

Net cash flows from financing activities (38,196) (62,949) (137,494)

Net decrease in cash and cash equivalents (24,609) (35,379) (63,435)

Cash and cash equivalents at 1 January 123,474 187,204 187,204

Effect of exchange rate fluctuations

on cash held 1,518 1,536 (295)

---------- ------------------ ---------

Cash and cash equivalents at end of

period 100,383 153,361 123,474

========== ================== =========

1 See note 1 for details of the prior period restatement

Notes to the Half Year Report

1. Status of condensed consolidated interim statements,

accounting policies and basis of significant estimates

General information

Rotork plc is a company domiciled in England and Wales. The

Company has its premium listing on the London Stock Exchange.

The condensed consolidated interim financial statements for the

six months ended 30 June 2022 are unaudited and the auditor has

reported in accordance with International Standard on Review

Engagements (UK and Ireland) 2410, 'Review of Interim Financial

Information Performed by the Independent Auditor of the

Entity'.

The information shown for the year ended 31 December 2021 does

not constitute statutory accounts within the meaning of Section 435

of the Companies Act 2006. Statutory accounts for the year ended 31

December 2021 were approved by the Board on 28 February 2022 and

delivered to the Registrar of Companies. The auditor's report on

those financial statements was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under Section 498 (2) or (3) of the Companies Act 2006. The

consolidated financial statements of the Group for the year ended

31 December 2021 are available from the Company's registered office

or website.

Basis of preparation

The condensed consolidated interim financial statements of the

Company for the six months ended 30 June 2022 comprise the results

for the Company and its subsidiaries (together referred to as 'the

Group'). These condensed consolidated interim financial statements

have been prepared in accordance with the Disclosure and

Transparency Rules of the Financial Services Authority and with

International Accounting Standard 34, 'Interim Financial Reporting'

as adopted by the United Kingdom. They do not include all of the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2021, which

have been prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006 and International Financial Reporting Standards (IFRSs)

adopted by the United Kingdom.

Going concern

The directors are satisfied that the Group has sufficient

resources to continue in operation for the foreseeable future, a

period of not less than 12 months from the date of this report.

Accordingly, we continue to adopt the going concern basis in

preparing the condensed consolidated interim financial

information.

In forming this view, the ongoing impact of COVID-19, supply

chain disruption and geo-political instability on the Group has

been considered. The directors have reviewed: the current financial

position of the Group, which has net cash of GBP90m and unused

overdraft facilities of GBP32m as at the period end; the

significant order book, which contains customers spread across

different geographic areas and industries; and the trading and cash

flow forecasts for the Group. The directors are satisfied that any

downside scenarios are considered remote and that the Group would

continue to have headroom within current cash balance and overdraft

facilities. The Group also has a number of mitigating actions that

it can take at short notice to preserve cash, for example reduction

in capital programmes, dividend deferral and other reductions in

discretionary spend.

Critical accounting estimates and judgements

The Group makes estimates and assumptions regarding the future.

Estimates and judgements are continually evaluated based on

historical experience, and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances.

In the future, actual experience may deviate from these

estimates and assumptions. The estimates and assumptions that have

a significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the current financial year

are discussed in the financial statements for the year ended 31

December 2021.

Accounting policies

The accounting policies applied and significant estimates used

by the Group in these condensed consolidated interim financial

statements are the same as those applied by the Group in its

consolidated financial statements for the year ended 31 December

2021, except for the adoption of new standards effective as of 1

January 2022. The Group has not early adopted any other standard,

interpretation or amendment that has been issued but is not yet

effective.

Non-controlling interests

Non-controlling interests in subsidiaries are identified

separately from the Group's equity therein. The interest of

non-controlling shareholders is initially measured at the

non-controlling interests' proportion of the share of the fair

value of the acquiree's identifiable net assets. Subsequent to

acquisition, the carrying amount of non-controlling interests is

the amount of those interests at initial recognition plus the

non-controlling interests' share of subsequent changes in equity.

Total comprehensive income is attributed to non-controlling

interests even if this results in the non-controlling interests

having a deficit balance.

New accounting standards and interpretations

Change in accounting policy - Software as a Service ('SaaS')

arrangements

As noted and restated within the Annual Report for the year

ended 31 December 2021, the Group has changed its accounting policy

related to the capitalisation of certain software costs. This

change follows the IFRIC Interpretation Committee's agenda decision

published in April 2021, which clarifies the accounting treatment

of the costs of configuring or customising application software

under Software as a Service arrangements.

The Group's accounting policy has historically been to

capitalise costs directly attributable to the configuration and

customisation of SaaS arrangements as assets in the Balance Sheet.

Following the adoption of the above IFRIC agenda guidance, current

SaaS arrangements, principally relating to the Group's ongoing

transformation programme, were identified and assessed to determine

if the Group has control of the software and associated configured

and customised elements. For those arrangements where the Group

does not have control of the developed software, the Group

derecognised the asset previously capitalised.

This change in accounting policy led to adjustments in the 30

June 2021 reported financial results. Accordingly, the prior period

Balance Sheet at 30 June 2021 has been restated in accordance with

IAS 8, together with related notes. The tables on the following

page show the impact of the change in accounting policy on

previously reported financial results.

Impact on the consolidated balance sheet

(As previously

reported) (Restated)

First half Impact of First half

2021 restatement 2021

GBP000 GBP000 GBP000

============================= ============== ============= ===========

Intangible assets 46,450 (17,991) 28,459

Deferred tax assets 8,036 4,475 12,511

Other assets 660,474 --- 660,474

------------------------------ -------------- ------------- -----------

Total assets 714,960 (13,516) 701,444

------------------------------ -------------- ------------- -----------

Retained earnings 533,067 (14,362) 518,705

Deferred tax liabilities 1,060 846 1,906

Other equity and liabilities 180,833 - 180,833

------------------------------ -------------- ------------- -----------

Total equity and liabilities 714,960 (13,516) 701,444

------------------------------ -------------- ============= ===========

Impact on the consolidated income statement and statement of

comprehensive income

(As previously

reported) (Restated)

First half Impact of First half

2021 restatement 2021

GBP000 GBP000 GBP000

====================================== ============== ============= ===========

Adjusted operating profit 62,735 --- 62,735

--------------------------------------- -------------- ------------- -----------

Adjustments

- Amortisation of acquired intangible

assets (4,655) --- (4,655)

- Other adjustments (4,076) (3,453) (7,529)

--------------------------------------- -------------- ------------- -----------

Operating profit 54,004 (3,453) 50,551

--------------------------------------- -------------- ------------- -----------

Profit before tax 54,149 (3,453) 50,696

--------------------------------------- -------------- ------------- -----------

Income tax expense (13,265) 867 (12,398)

--------------------------------------- -------------- ------------- -----------

Profit for the year 40,884 (2,586) 38,298

--------------------------------------- -------------- ------------- -----------

Estimated effective tax rate 24.5% - 24.5%

--------------------------------------- -------------- ------------- -----------

Total comprehensive income for the

year 42,908 (2,586) 40,322

--------------------------------------- -------------- ============= ===========

Impact on basic and diluted earnings per share

(As previously

reported) (Restated)

First half Impact of First half

2021 restatement 2021

------------------------------------ -------------- ------------- -----------

Basic earnings per share 4.7p (0.3)p 4.4p

Adjusted basic earnings per share 5.5p --- 5.5p

Diluted earnings per share 4.7p (0.3)p 4.4p

Adjusted diluted earnings per share 5.5p --- 5.5p

------------------------------------- -------------- ------------- -----------

Impact on the consolidated statement of cash flows

(As previously

reported) (Restated)

Impact of First half

2021 restatement 2021

GBP000 GBP000 GBP000

========================================= === ============== ============= ============

Net cash flows from operating activities 38,317 (3,657) 34,660

Net cash flows from investing activities (10,747) 3,657 (7,090)

Net cash flows from financing activities (62,949) - (62,949)

Cash and cash equivalents at 30 June 153,361 - 153,361

---------------------------------------------- -------------- ------------- ------------

No impact on the overall increase in cash and cash equivalents

for the year.

Other amendments

A number of other amended standards became applicable for the

current reporting period. The application of these amendments has

not had any material impact on the disclosures, net assets or

results of the Group.

New standards and interpretations not yet adopted

Further narrow scope amendments have been issued which are

mandatory for periods commencing on or after 1 January 2022. The

application of these amendments will not have any material impact

on the disclosures, net assets or results of the Group.

2. Alternative performance measures

The Group uses adjusted figures as key performance measures in

addition to those reported under adopted IFRS, as management

believe these measures facilitate greater comparison of the Group's

underlying results with prior periods and assessment of trends in

financial performance.

The key alternative performance measures used by the Group

include adjusted profit measures and organic constant currency

(OCC). Explanations of how they are calculated and how they are

reconciled to IFRS statutory results are set out below.

a. Adjusted operating profit

Adjusted operating profit is the Group's operating profit

excluding the amortisation of acquired intangible assets and other

adjustments that are considered to be significant and where

treatment as an adjusted item provides stakeholders with additional

useful information to assess the trading performance of the Group

on a consistent basis. Further details on these adjustments are

given in note 4.

b. Adjusted profit before tax

The adjustments in calculating adjusted profit before tax are

consistent with those in calculating adjusted operating profit

above.

First half First half Full year

2022 2021 (Restated) 2021

GBP000 GBP000 GBP000

---------- --------------- ---------

Profit before tax 44,590 50,696 105,931

Adjustments:

Amortisation of acquired intangible assets 3,096 4,655 9,001

Gain on disposal of property (1,209) (1,569) (1,569)

Software as a Service configuration costs 3,549 3,453 8,493

Redundancy costs 254 2,863 3,871

Other restructuring costs 29 2,782 2,574

Russia market exit 3,555 - -

Adjusted profit before tax 53,864 62,880 128,301

---------- --------------- ---------

c. Adjusted basic and diluted earnings per share

Adjusted basic earnings per share is calculated using the

adjusted net profit attributable to the ordinary shareholders and

dividing it by the weighted average ordinary shares in issue.

Adjusted net profit attributable to ordinary shareholders is

calculated as follows:

First half First half Full year

2022 2021 (Restated) 2021

GBP000 GBP000 GBP000

---------- --------------- ---------

Net profit attributable to ordinary

shareholders 33,708 38,298 80,245

Adjustments:

Amortisation of acquired intangible assets 3,096 4,655 9,001

Gain on disposal of property (1,209) (1,569) (1,569)

Software as a Service configuration costs 3,549 3,453 8,493

Redundancy costs 254 2,863 3,871

Other restructuring costs 29 2,782 2,574

Russia market exit 3,555 - -

Tax effect on adjusted items (2,000) (2,595) (4,785)

Adjusted net profit attributable to

ordinary shareholders 40,982 47,887 97,830

---------- --------------- ---------

Diluted earnings per share is calculated by using the adjusted

net profit attributable to ordinary shareholders and dividing it by

the weighted average ordinary shares in issue adjusted to assume

conversion of all potentially dilutive ordinary shares (see note

9).

d. Return on capital employed

The return on capital employed ratio is used by management to

help ensure that capital is used efficiently.

First half First half Full year

2022 2021 (Restated) 2021

GBP000 GBP000 GBP000

---------- --------------- ---------

Adjusted operating profit

As reported - - 128,080

Rolling 12 months 118,648 144,041 -

Capital employed

Shareholders' funds 564,669 552,946 534,080

Cash and cash equivalents (100,382) (153,361) (123,474)

Interest bearing loans and borrowings 9,959 9,089 9,336

Pension (surplus)/deficit net of deferred

tax (8,747) 17,228 6,023

Capital Employed 465,499 425,902 425,965

---------- --------------- ---------

439,122 424,815

Average capital employed (1) 438,348(1) (2)

---------- --------------- ---------

Return on capital employed 27.0% 32.9% 30.1%

---------- --------------- ---------

(1) defined as the average of the capital employed at June 2021,

December 2021 and June 2022 (2021: June 2020, December 2020, and

June 2021).

(2) defined as the average of the capital employed at December

2020 and December 2021.

e. Working capital as a percentage of revenue

Working capital as a percentage of revenue is monitored as

control of working capital is key to achieving our cash generation

targets. It is calculated as inventory plus trade receivables, less

trade payables, divided by revenue.

f. Organic constant currency (OCC)

OCC results remove the results of businesses acquired or

disposed of during the period that are not consistently presented

in both periods' results. The 2022 half year results are restated

using the average exchange rates applied for the 2021 comparative

period.

For businesses acquired, the full results are removed from the

year of acquisition. In the following year, the results for the

number of months equivalent to the pre-acquisition period in the

prior year are removed. For disposals and closure of businesses,

the results are removed from the current and prior periods.