Tufton Oceanic Assets Ltd. Divestment of Two Vessels and Extension of Charter (3063Z)

11 Janeiro 2024 - 4:00AM

UK Regulatory

TIDMSHIP TIDMSHPP

RNS Number : 3063Z

Tufton Oceanic Assets Ltd.

11 January 2024

11 January 2024

Tufton Oceanic Assets Limited (The "Company") Announces

Divestment of two Handysize Product Tankers and

Extension of one MR Product Tanker Charter

The Board of Tufton Oceanic Assets Limited (ticker: SHIP.L) is

pleased to announce the Company has agreed to sell two Handysize

Product Tankers, Pollock and Dachshund, for a total of $41.75m,

which represents a 3.1% premium to the two vessels most recent

holding NAV of $40.50m (the "Disposals"). The Disposals further

confirm Tufton's NAV methodology, while also demonstrating its

ability to divest portfolio vessels at or above NAV . The

transaction is a forward sale and is expected to close during 2Q24

after the vessels complete their current charters, the Company will

therefore also benefit from the vessel earnings during this period.

The expected realised net IRR across the two vessels will be c.25%

and net MOIC c.2.0x including earnings through the assumed delivery

dates, significantly ahead of the Company's published IRR target of

12%. Following the Disposals, the Company's fleet will comprise 20

vessels.

Furthermore, the Company has successfully extended the

employment of Exceptional, a 2015 built MR Product Tanker, with its

current charterer for up to 3 years commencing 1 January 2024. The

new charter rate implies a net yield of over 15% for the firm

extension period which, when blended with the 6-month sub-market

stub end of the previous charter, will produce a net yield of c.13%

for the next 2 years. The aggregate charter length on the Company's

fleet of Product Tankers is now c.2 years (versus 1.7 years last

quarter).

For further information, please contact:

Tufton Investment Management Ltd (Investment

Manager)

Andrew Hampson

Nicolas Tirogalas +44 (0) 20 7518 6700

Singer Capital Markets

James Maxwell, Alex Bond, Angus Campbell

(Corporate Finance)

Alan Geeves, James Waterlow, Sam Greatrex

(Sales) +44 (0) 20 7496 3000

Hudnall Capital LLP

Andrew Cade +44 (0) 20 7520 9085

About the Company

Tufton Oceanic Assets Limited invests in a diversified portfolio

of secondhand commercial sea-going vessels with the objective of

delivering strong cash flow and capital gains to investors. The

Company's investment manager is Tufton Investment Management Ltd.

The Company has raised a total of approximately $316.5m (gross)

through its Initial Public Offering on the Specialist Fund Segment

of the London Stock Exchange on 20 December 2017 and subsequent

capital raises.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISBMMRTMTBBBII

(END) Dow Jones Newswires

January 11, 2024 02:00 ET (07:00 GMT)

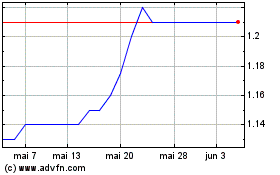

Tufton Assets (LSE:SHIP)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Tufton Assets (LSE:SHIP)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024