TIDMSMV TIDMTTM

RNS Number : 7205O

Smoove PLC

04 October 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE MARKET ABUSE REGULATION NO 596/2014 (INCORPORATED INTO UK

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 AS AMED

BY VIRTUE OF THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS 2019).

UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY

INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

FOR IMMEDIATE RELEASE

4 October 2023

RECOMMED CASH ACQUISITION

of

SMOOVE PLC

by

DIGCOM UK HOLDINGS LIMITED

(an indirect subsidiary undertaking of PEXA Group Limited)

to be effected by means of a Scheme of Arrangement under Part 26

of the Companies Act 2006

Summary and highlights

-- The boards of directors of Digcom UK Holdings Limited

("Digcom"), an indirect subsidiary undertaking of PEXA Group

Limited ("PEXA"), and Smoove plc ("Smoove"), are pleased to

announce that they have reached agreement on the terms of a

recommended cash acquisition by Digcom of the entire issued and to

be issued share capital of Smoove (the "Acquisition").

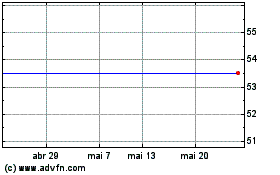

-- Under the terms of the Acquisition, Smoove Shareholders will be entitled to receive

-- 54 pence for each Smoove Share (the "Consideration")

-- The Consideration of 54 pence per Smoove Share values the

entire issued and to be issued share capital of Smoove at

approximately GBP30.8 million on a fully diluted basis and

represents a premium of approximately:

-> 69.3 per cent. to the Closing Price of 31.9 pence per

Smoove Share on 21 April 2023 (being the last Business Day before

the commencement of the Offer Period);

-> 74.1 per cent. to the volume-weighted average Closing

Price of 31.0 pence per Smoove Share for the one-month period ended

21 April 2023 (being the last Business Day before the commencement

of the Offer Period); and

-> 43.9 per cent. to the volume-weighted average Closing

Price of 37.5 pence per Smoove Share for the three-month period

ended 21 April 2023 (being the last Business Day before the

commencement of the Offer Period).

-- If, on or after the date of this announcement and before the

Effective Date, any dividend, distribution or other return of

capital or value is announced, declared, made or paid by Smoove or

becomes payable by Smoove in respect of the Smoove Shares, Digcom

reserves the right to reduce the Consideration payable for the

Smoove Shares pursuant to the Acquisition by an amount up to the

amount of such dividend and/or distribution and/or other return of

capital or value. In such circumstances, Smoove Shareholders would

be entitled to receive and retain any such dividend and/or other

distribution and/or return of capital or value.

Acquisition Overview

-- The Acquisition comprises an all-cash acquisition of Smoove

by Digcom, which the Smoove Directors intend to recommend

unanimously to Smoove Shareholders.

-- The PEXA Board believes that the Acquisition represents an

attractive opportunity for the PEXA Group to advance its stated

strategy of enhancing and leveraging its property exchange know-how

to deliver growth in different markets, including in other Torrens

title jurisdictions starting with the UK.

-- Both Smoove and PEXA share the common goal of simplifying and

enhancing the home moving process through digitalisation,

significantly reducing transaction times, whilst simultaneously

removing the pain points across the process.

-- The PEXA Board believes there is a significant opportunity

for Smoove's existing customers to benefit from PEXA's digital

property settlements platform and wider service offering,

leveraging PEXA's experience as the market leader in Australia.

Smoove has a long-standing relationship with Lloyds Banking Group

and a connection with over 75 conveyancer firms on its eConveyancer

platform and circa 2,100 conveyancing firms via lender panels.

-- The PEXA Board believes that by integrating Smoove into PEXA,

the Combined Group will be able to build scale and depth in the UK

market accelerating the path to enhancing the home moving process.

Smoove provides access to re-mortgage flows equivalent to 7 per

cent.(1) of the UK market and sales and purchase flows across the

Smoove platform which are equivalent to 3 per cent.(1) of the UK's

sales and purchase market which are intermediated by the Smoove

platform.

-- The PEXA Group's commitment to developing new revenue streams

through international expansion and investments in new digital

business and partnerships, supported by a strong balance sheet and

cash generative business model, will help to build a unique,

strong, and attractive business. Smoove will provide reach into the

'cash back market segment' not currently served by Optima Legal and

indirect access to sale and purchase conveyancing firms.

___

(1) Calculated based on Smoove's sale and purchase and

remortgage completion volumes for the financial year ended 31 March

2023, Bank of England sale and purchase transactions (Bank of

England data set LPMB4B3) and Bank of England remortage

transactions (Bank of England data set LPMVTVX)

Recommendation

-- Smoove's Directors, who have been so advised by Cavendish as

to the financial terms of the Acquisition, unanimously consider the

terms of the Acquisition to be fair and reasonable. In providing

their advice to the Smoove Directors, Cavendish has taken into

account the commercial assessments of the Smoove Directors.

Cavendish is providing independent financial advice to the Smoove

Directors for the purposes of Rule 3 of the Takeover Code.

-- Accordingly, the Smoove Directors intend to recommend

unanimously that Smoove Shareholders vote in favour of the Scheme

at the Court Meeting and the Resolution(s) to be proposed at the

General Meeting (or in the event that the Acquisition is

implemented by way of a Takeover Offer, to accept or procure the

acceptance of such Takeover Offer) as the Smoove Directors who are

beneficially interested in Smoove Shares (who, for the avoidance of

doubt, do not include Smoove Directors whose interests in Smoove

Shares comprise only unexercised options under the Smoove Share

Plans, nor Oliver Scott who has an indirect beneficial interest in

Smoove Shares as well as being a partner of Kestrel Partners LLP,

an entity interested in Smoove Shares) have irrevocably undertaken

to do in respect of their entire beneficial holdings of 85,000

Smoove Shares representing, in aggregate, approximately 0.15 per

cent. of Smoove's total issued share capital as at the close of

business on the Last Practicable Date.

Irrevocable undertakings and letter of intent

-- In addition to the irrevocable undertakings received from the

Smoove Directors, Digcom has also received irrevocable undertakings

from Kestrel Partners LLP (a partner of which, Oliver Scott, is a

Non-Executive Director of Smoove), Harwood Capital Management

Limited and Herald Investment Management Limited to vote in favour

(or procure the voting in favour, as applicable) of the Scheme at

the Court Meeting and the Resolution(s) to be proposed at the

General Meeting (or in the event that the Acquisition is

implemented by way of a Takeover Offer, to accept or procure the

acceptance of such Takeover Offer) in respect of, in aggregate,

26,560,625 Smoove Shares, representing approximately 46.58 per

cent. of Smoove's total issued share capital as at the close of

business on the Last Practicable Date.

-- In addition, Digcom has received a non-binding letter of

intent from Schroders Investment Management Limited to procure the

voting in favour of the Scheme at the Court Meeting and the

Resolution(s) to be proposed at the General Meeting (or in the

event that the Acquisition is implemented by way of a Takeover

Offer, to procure the acceptance of such Takeover Offer) in respect

of 5,365,237 Smoove Shares, representing approximately 9.41 per

cent. of Smoove's total issued share capital as at the close of

business on the Last Practicable Date.

-- Further details of these irrevocable undertakings and letter

of intent, together with the irrevocable undertakings received from

the Smoove Directors, are set out in Appendix 3 to this

announcement.

-- Accordingly, Digcom has received irrevocable undertakings and

a letter of intent to vote, or procure the voting, in favour of the

Scheme at the Court Meeting and the Resolution(s) to be proposed at

the General Meeting (or in the event that the Acquisition is

implemented by way of a Takeover Offer, to accept or procure the

acceptance of such Takeover Offer) in respect of a total of

32,010,862 Smoove Shares, representing, in aggregate, approximately

56.14 per cent. of the total issued share capital of Smoove as at

the close of business on the Last Practicable Date.

Information on the PEXA Group and Digcom

The PEXA Group

-- PEXA is the operator of the leading digital property

settlements platform in Australia, employing approximately 1,000

people and listed on the ASX with a market capitalisation of A$

2.016 billion on the Last Practicable Date.

-- Having started in 2010 as a joint initiative of various state

governments and the largest banks in Australia to phase out the use

of inefficient paper-based property settlements, the PEXA Group

today offers the world's first digital platform for managing the

lodgement and settlement of property transactions.

-- "PEXA Exchange" operates primarily as an Electronic Lodgement

Network Operator ("ELNO") facilitating the electronic lodgement and

settlement of property transactions through an integrated,

cloud-based platform connecting key property market

stakeholders.

-- PEXA Exchange's facilitation of secure, reliable and

efficient digital settlements has established the platform as a

critical and trusted component of the Australian property market,

providing confidence and stability for all participants in a

property transaction.

-- Through its PEXA Digital Growth business, PEXA offers

property-related insight and analytics solutions to its customers

and stakeholders which aim to reduce transaction costs in the

property chain and enhance the experience of developing, buying and

selling, financing, settling, owning, and servicing property. PEXA

Digital Growth also identifies and invests in opportunities across

the property ecosystem to complement and enhance its core insights

and analytics offering.

-- For the year ended 30 June 2023, PEXA Group generated

business revenue of A$283.4m and an operating EBITDA of A$98.7m.

Additional information on PEXA Group's latest financial results can

be found at

https://investors.pexa.com.au/investor-centre/?page=results-centre.

Digcom

-- Having created the leading digital property settlements

platform in Australia, PEXA established Digcom in 2020 to enable it

to enter the UK market and implement its strategy to transform the

UK property market.

-- In seeking to extend its digital property settlements

platform knowledge in new geographies, the PEXA Group launched its

initial remortgage offering in the UK in September 2022 following

the successful testing of the PEXA settlement payment solution with

the Bank of England. Shortly after the UK launch, Digcom acquired

Optima Legal, a high-volume remortgage conveyancing firm that

provides legal services in the UK remortgage market.

Timetable and Conditions

-- It is intended that the Acquisition will be implemented by

way of a Court-sanctioned scheme of arrangement under Part 26 of

the Companies Act (although Digcom reserves the right to effect the

Acquisition by way of a Takeover Offer, subject to the consent of

the Panel and the terms of the Co-operation Agreement).

-- The Acquisition will be put to Smoove Shareholders at the

Court Meeting and the General Meeting. The Court Meeting and the

General Meeting are required to enable Smoove Shareholders to

consider and, if thought fit, to vote in favour of the Scheme and

the Resolution(s) to implement the Scheme. In order to become

Effective, the Scheme must be approved by a majority in number of

Scheme Shareholders present and voting (and entitled to vote) at

the Court Meeting, whether in person or by proxy, representing 75

per cent. or more in value of the Scheme Shares held by those

Scheme Shareholders (or the relevant class or classes thereof). In

addition, in order for the Scheme to become Effective, at the

General Meeting, the Resolution(s) must be passed by Smoove

Shareholders representing at least 75 per cent. of the votes

validly cast on the Resolution(s). The General Meeting will be held

immediately after the Court Meeting.

-- The Acquisition will be subject to the other Conditions and

terms set out in Appendix 1 of this announcement, including the

receipt of regulatory approvals, and to the full terms and

conditions of the Acquisition which will be set out in the Scheme

Document.

-- The Scheme Document containing further information about the

Acquisition and the notices of the Meetings, together with the

accompanying Forms of Proxy, are expected to be published within 28

days of the date of this announcement (unless the Panel agrees

otherwise). An expected timetable of principal events will be

included in the Scheme Document.

-- The Acquisition is expected to become Effective in Q4 2023,

subject to the satisfaction (or, where applicable, waiver) of the

Conditions and further terms set out in Appendix 1.

Commenting on today's announcement, Glenn King, PEXA Group CEO

and Managing Director said:

"The acquisition is aligned with PEXA Group's strategy of

enhancing and leveraging our property exchange know-how to deliver

growth from different markets, including in other Torrens title

jurisdictions, starting with the UK.

Since entering the UK market, the PEXA Group has launched its

first re-mortgage product, successfully brought two lenders onto

the PEXA platform and acquired and progressed integration of

specialist re-mortgage conveyancer, Optima Legal.

The acquisition and integration of Smoove into the PEXA UK

business will further help us address the many detriments suffered

by consumers due to the UK's fragmented, inefficient conveyancing

processes. The acquisition will allow us to build additional scale

and depth in the UK market, enabling the PEXA product suite to

reach more customers, whilst streamlining and improving the UK

property transaction experience."

Commenting on the Acquisition, Martin Rowland, the Chairman of

Smoove, said:

"Both Smoove and PEXA share a common objective, to simplify and

improve the home moving experience for consumers. The acquisition

of Smoove by Digcom accelerates execution of the plans for both

Smoove and PEXA. Whist the Board of Smoove continues to believe in

Smoove's strategy and prospects as an independent company, they

believe that the combination may provide Smoove with additional

scale and help accelerate its plans to materially change the home

moving experience.

The offer from PEXA allows shareholders to receive all cash

consideration at a 69.3 per cent. premium to the Closing Price of

31.9 pence per Smoove Share on 21 April 2023 (being the last

Business Day before the commencement of the Offer Period) which the

Smoove Board believes to represent an attractive price for the

business ."

This summary should be read in conjunction with, and is subject

to, the full text of this announcement and the Appendices. The

Acquisition will be subject to the Conditions and other terms set

out in Appendix 1 and to the full terms and conditions which will

be set out in the Scheme Document. Appendix 2 contains the bases of

calculation and sources of certain information contained in this

announcement. Details of irrevocable undertakings and the letter of

intent received by Digcom in connection with the Acquisition are

set out in Appendix 3. Certain terms used in this announcement are

defined in Appendix 4.

The person responsible for making this announcement on behalf of

Smoove is Martin Rowland, Chairman.

Enquiries:

PEXA Group Limited

Numis Securities Limited (Financial Tel: +44 20 7260 1000

adviser to PEXA)

Simon Willis, Stuart Ord, William

Wickham

Cato & Clive (Media and PR adviser Tel: +61 411 888 425

to PEXA)

Clive Mathieson

MHP Group (Media and PR adviser Tel: +44 20 3128 8100

to PEXA)

Dan Pike; Chanice Smith; Issie Rees-Davies

Smoove plc Via Walbrook PR

Jesper With-Fogstrup, CEO

Michael Cress, CFO

Cavendish Securities plc (Rule 3 Tel: +44 (0)20 7220 0500

Adviser to Smoove)

Adrian Hadden, George Lawson, Hamish

Waller

Panmure Gordon (UK) Limited (NOMAD Tel: +44 (0)20 7886 2500

and Broker to Smoove)

Dominic Morley

Amrit Mahbubani

Walbrook PR Limited (PR to Smoove) smoove@walbrookpr.com or

Tom Cooper, Nick Rome Tel: 020 7933 8780

Addleshaw Goddard LLP is acting as legal adviser to PEXA and

Digcom in connection with the Acquisition.

Shoosmiths LLP is acting as legal adviser to Smoove in

connection with the Acquisition.

Further information

This announcement is for information purposes only and is not

intended to, and does not constitute, or form any part of any

offer, invitation or the solicitation of an offer to purchase,

otherwise acquire, subscribe for, sell or otherwise dispose of any

securities, or the solicitation of any vote or approval in any

jurisdiction, pursuant to the Acquisition or otherwise, nor shall

there be any sale, issuance or transfer of securities of Smoove in

any jurisdiction in contravention of applicable law. The

Acquisition will be made and implemented solely pursuant to the

terms of the Scheme Document (or if the Acquisition is implemented

by way of a Takeover Offer, the Offer Document), which will contain

the full terms and conditions of the Acquisition, including details

of how to vote in respect of the Acquisition. Any vote in respect

of, or other response to, the Acquisition should be made only on

the basis of the information contained in the Scheme Document (or

if the Acquisition is implemented by way of a Takeover Offer, the

Offer Document).

Smoove and Digcom will prepare the Scheme Document (or if the

Acquisition is implemented by way of a Takeover Offer, the Offer

Document) to be distributed to Smoove Shareholders. Smoove and

Digcom urge Smoove Shareholders to read the Scheme Document (or if

the Acquisition is implemented by way of a Takeover Offer, the

Offer Document) when it becomes available because it will contain

important information relating to the Acquisition.

This announcement does not constitute a prospectus, prospectus

equivalent document or an exempted document.

The statements contained in this announcement are made as at the

date of this announcement, unless some other time is specified in

relation to them, and publication of this announcement shall not

give rise to any implication that there has been no change in the

facts set forth in this announcement since such date.

Disclaimers

Numis Securities Limited ("Numis"), which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

is acting as financial adviser to Digcom and PEXA, and no one else,

in connection with the matters set out in this announcement, and

will not be responsible to anyone other than the Boards of Digcom

and PEXA for providing the protections afforded to clients of Numis

nor for providing advice in relation to the contents of this

announcement or any other matter or arrangement referred to herein.

Neither Numis nor any of its affiliates owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Numis in connection with this

announcement, any matter, arrangement or statement contained or

referred to herein or otherwise.

Cavendish Securities plc ("Cavendish") is acting for Smoove and

no one else in connection with the matters set out in this

announcement and will not be responsible to anyone other than

Smoove for providing the protections afforded to clients of

Cavendish for providing advice in relation to the possible offer,

the contents of this announcement or any other matters referred to

in this announcement.

Overseas jurisdictions

This announcement has been prepared in accordance with, and for

the purposes of complying with, English law, the Takeover Code, the

Market Abuse Regulation and the AIM Rules, and information

disclosed may not be the same as that which would have been

disclosed if this announcement had been prepared in accordance with

the laws of jurisdictions outside of England.

The release, publication or distribution of this announcement

in, into or from jurisdictions other than the United Kingdom may be

restricted by law and therefore any persons who are subject to the

laws of any jurisdiction other than the United Kingdom should

inform themselves about and observe any applicable

requirements.

The availability of the Acquisition to Smoove Shareholders who

are not resident in and citizens of the United Kingdom may be

affected by the laws of the relevant jurisdictions in which they

are located or of which they are citizen. Persons who are not

resident in the United Kingdom should inform themselves of, and

observe, any applicable legal or regulatory requirements of their

jurisdictions. In particular, the ability of persons who are not

resident in the United Kingdom to vote their Smoove Shares with

respect to the Scheme at the Meetings, or to execute and deliver

Forms of Proxy (or other proxy instructions) appointing another to

vote at the Meetings on their behalf, may be affected by the laws

of the relevant jurisdictions in which they are located. Any

failure to comply with the applicable restrictions may constitute a

violation of the securities laws of any such jurisdiction. To the

fullest extent permitted by applicable law, the companies and

persons involved in the Acquisition disclaim any responsibility or

liability for the violation of such restrictions by any person.

Further details in relation to Overseas Shareholders will be

contained in the Scheme Document.

Unless otherwise determined by Digcom or required by the

Takeover Code, and permitted by applicable law and regulation, the

Acquisition will not be made available, in whole or in part,

directly or indirectly, in, into or from a Restricted Jurisdiction

where to do so would constitute a violation of the relevant laws or

regulations of such jurisdiction and no person may vote in favour

of the Acquisition by any such use, means, instrumentality or from

within a Restricted Jurisdiction or any other jurisdiction if to do

so would constitute a violation of the laws of that jurisdiction.

Copies of this announcement and any formal documentation relating

to the Acquisition are not being, and must not be, directly or

indirectly, mailed or otherwise forwarded, distributed or sent in

or into or from any Restricted Jurisdiction and persons receiving

such documents (including custodians, nominees and trustees) must

not mail or otherwise forward, distribute or send it in or into or

from any Restricted Jurisdiction. Doing so may render invalid any

related purported vote in respect of the Acquisition. If the

Acquisition is implemented by way of a Takeover Offer (unless

otherwise permitted by applicable law and regulation), the Takeover

Offer may not be made, directly or indirectly, in or into, or by

the use of mails or any means or instrumentality (including, but

not limited to, facsimile, e-mail or other electronic transmission,

telex or telephone) of interstate or foreign commerce of, or of any

facility of a national, state or other securities exchange of any

Restricted Jurisdiction and the Takeover Offer may not be capable

of acceptance by any such use, means, instrumentality or

facilities.

The Acquisition will be subject to English law and the

jurisdiction of the Court, and the applicable requirements of the

Takeover Code, the Panel, the London Stock Exchange (including

pursuant to the AIM Rules) and the Registrar of Companies.

Notice to US investors in Smoove

The Acquisition relates to the shares of an English company with

a quotation on AIM and is being made by means of a scheme of

arrangement provided for under English company law. A transaction

effected by means of a scheme of arrangement is not subject to the

tender offer rules or the proxy solicitation rules under the US

Securities Exchange Act of 1934. Accordingly, the Acquisition is

subject to the disclosure requirements and practices applicable in

the United Kingdom to schemes of arrangement which differ from the

disclosure requirements of United States tender offer and proxy

solicitation rules. Neither the United States Securities and

Exchange Commission, nor any securities commission of any state of

the United States, has approved or disapproved any offer, or passed

comment upon the adequacy or completeness of any of the information

contained in this announcement. Any representation to the contrary

may be a criminal offence.

If, in the future, Digcom exercises the right, with the consent

of the Panel (where necessary), to implement the Acquisition by way

of a Takeover Offer and determines to extend the offer into the

United States, the Acquisition will be made in compliance with

applicable United States laws and regulations, including Section

14(e) of the US Securities Exchange Act 1934 and Regulation 14E

thereunder.

Financial information included in this announcement and the

Scheme Document (or, if the Acquisition is implemented by way of a

Takeover Offer, the Offer Document) has been or will have been

prepared in accordance with accounting standards applicable in the

United Kingdom or Australia (as applicable) that may not be

comparable to financial information of US companies or companies

whose financial statements are prepared in accordance with

generally accepted accounting principles in the United States.

The receipt of cash pursuant to the Acquisition by a US holder

of Smoove Shares as consideration for the transfer of its Scheme

Shares pursuant to the Scheme may be a taxable transaction for US

federal income tax purposes and under applicable US state and

local, as well as foreign and other, tax laws. Each Smoove

Shareholder is therefore urged to consult with independent legal,

tax and financial advisers in connection with making a decision

regarding the Acquisition.

It may be difficult for US holders of Smoove Shares to enforce

their rights and any claim arising out of the US federal laws in

connection with the Acquisition, since Digcom and Smoove are

located in, and organised under the laws of, a non-US jurisdiction,

and some or all of their officers and directors may be residents of

a non-US jurisdiction. US holders of Smoove Shares may not be able

to sue a non-US company or its officers or directors in a non-US

court for violations of the US securities laws. Further, it may be

difficult to compel a non-US company and its affiliates to subject

themselves to a US court's jurisdiction or judgement.

In accordance with normal UK practice and pursuant to Rule

14e-5(b) of the US Securities Exchange Act of 1934, Digcom, certain

affiliated companies and their nominees or brokers (acting as

agents), may from time to time make certain purchases of, or

arrangements to purchase, Smoove Shares outside of the US, other

than pursuant to the Acquisition, until the date on which the

Acquisition and/or Scheme becomes Effective, lapses or is otherwise

withdrawn. Also, in accordance with Rule 14e-5(b) of the US

Securities Exchange Act of 1934, each of Numis and Cavendish will

continue to act as an exempt principal trader in Smoove Shares on

the London Stock Exchange. If such purchases or arrangements to

purchase were to be made, they would occur either in the open

market at prevailing prices or in private transactions at

negotiated prices and comply with applicable law, including the US

Securities Exchange Act of 1934. Any information about such

purchases will be disclosed as required in the UK, will be reported

to the Regulatory News Service of the London Stock Exchange and

will be available on the London Stock Exchange website at

www.londonstockexchange.com.

Cautionary Note Regarding Forward-Looking Statements

This announcement (including information incorporated by

reference into this announcement), statements made regarding the

Acquisition, and other information to be published by Digcom, PEXA

and/or Smoove, contain statements which are, or may be deemed to

be, "forward-looking statements". Forward-looking statements are

prospective in nature and not based on historical facts, but rather

are based on current expectations and projections of the management

of Digcom, PEXA and/or Smoove about future events, and are

therefore subject to risks and uncertainties which could cause

actual results to differ materially from the future results

expressed or implied by the forward-looking statements.

The forward-looking statements contained in this announcement

include statements with respect to the financial condition, results

of operations and business of Smoove and certain plans and

objectives of Digcom and PEXA with respect thereto and other

statements other than historical facts. Often, but not always,

forward-looking statements can be identified by the fact that they

do not relate only to historical or current facts and may use words

such as "anticipate", "target", "expect", "estimate", "forecast",

"intend", "plan", "budget", "scheduled", "goal", "believe", "hope",

"aims", "continue", "will", "may", "should", "would", "could", or

other words of similar meaning. These statements are based on

assumptions and assessments made by Smoove and/or Digcom and/or

PEXA in light of their experience and their perception of

historical trends, current conditions, future developments and

other factors they believe appropriate. By their nature,

forward-looking statements involve known and unknown risk and

uncertainty and other factors which may cause actual results,

performance or developments to differ materially from those

expressed in or implied by such, because they relate to events and

depend on circumstances that will occur in the future. Although

Digcom and/or PEXA and/or Smoove believe that the expectations

reflected in such forward-looking statements are reasonable, no

assurance can be given that such expectations will prove to have

been correct and you are therefore cautioned not to place reliance

on these forward-looking statements which speak only as at the date

of this announcement. Neither Digcom nor PEXA nor Smoove assumes

any obligation to update or correct the information contained in

this announcement (whether as a result of new information, future

events or otherwise), except as required by applicable law.

There are a number of factors which could cause actual results

and developments to differ materially from those expressed or

implied in forward-looking statements. The factors that could cause

actual results to differ materially from those described in the

forward-looking statements include, but are not limited to: the

ability to complete the Acquisition; the ability to obtain

requisite regulatory and shareholder approvals and the satisfaction

of other Conditions on the proposed terms; changes in the global,

political, economic, business and competitive environments and in

market and regulatory forces; changes in future exchange and

interest rates; changes in tax rates; future business combinations

or dispositions; changes in general and economic business

conditions; changes in the behaviour of other market participants;

the anticipated benefits of the Acquisition not being realised as a

result of changes in general economic and market conditions in the

countries in which Digcom, PEXA and Smoove operate; weak, volatile

or illiquid capital and/or credit markets; changes in the degree of

competition in the geographic and business areas in which Digcom,

PEXA and Smoove operate; and changes in laws or in supervisory

expectations or requirements. Other unknown or unpredictable

factors could cause actual results to differ materially from those

expected, estimated or projected in the forward-looking statements.

If any one or more of these risks or uncertainties materialises or

if any one or more of the assumptions proves incorrect, actual

results may differ materially from those expected, estimated or

projected. Such forward-looking statements should therefore be

construed in the light of such factors.

Neither Digcom nor PEXA nor Smoove, nor any of their respective

associates or directors, officers or advisers, provides any

representation, assurance or guarantee that the occurrence of the

events expressed or implied in any forward-looking statements in

their announcement will actually occur. Given the risks and

uncertainties, you are cautioned not to place any reliance on these

forward-looking statements.

Other than in accordance with their legal or regulatory

obligations, neither Digcom nor PEXA nor Smoove is under any

obligation, and Digcom, PEXA and Smoove expressly disclaim any

intention or obligation, to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Dealing and Opening Position Disclosure Requirements

Under Rule 8.3(a) of the Takeover Code, any person who is

interested in one per cent. or more of any class of relevant

securities of an offeree company or of any securities exchange

offeror (being any offeror other than an offeror in respect of

which it has been announced that its offer is, or is likely to be,

solely in cash) must make an Opening Position Disclosure following

the commencement of the Offer Period and, if later, following the

announcement in which any securities exchange offeror is first

identified.

An Opening Position Disclosure must contain details of the

person's interests and short positions in, and rights to subscribe

for, any relevant securities of each of (i) the offeree company and

(ii) any securities exchange offeror(s). An Opening Position

Disclosure by a person to whom Rule 8.3(a) applies must be made by

no later than 3.30 p.m. (London time) on the 10(th) business day

following the commencement of the Offer Period and, if appropriate,

by no later than 3.30 p.m. (London time) on the 10(th) business day

following the announcement in which any securities exchange offeror

is first identified. Relevant persons who deal in the relevant

securities of the offeree company or of a securities exchange

offeror prior to the deadline for making an Opening Position

Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Takeover Code, any person who is, or

becomes, interested in one per cent. or more of any class of

relevant securities of the offeree company or of any securities

exchange offeror must make a Dealing Disclosure if the person deals

in any relevant securities of the offeree company or of any

securities exchange offeror. A Dealing Disclosure must contain

details of the dealing concerned and of the person's interests and

short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror, save to the extent that these details

have previously been disclosed under Rule 8. A Dealing Disclosure

by a person to whom Rule 8.3(b) applies must be made by no later

than 3.30 p.m. (London time) on the business day following the date

of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Panel's website at www.thetakeoverpanel.org.uk, including

details of the number of relevant securities in issue, when the

Offer Period commenced and when any offeror was first identified.

You should contact the Panel's Market Surveillance Unit on +44

(0)20 7638 0129 if you are in any doubt as to whether you are

required to make an Opening Position Disclosure or a Dealing

Disclosure.

Publication on website

In accordance with Rule 26.1 of the Takeover Code a copy of this

announcement and the documents required to be published under Rule

26 of the Takeover Code, will be made available free of charge,

subject to certain restrictions relating to persons resident in

Restricted Jurisdictions, on PEXA's website at

https://investors.pexa.com.au/investor-centre and Smoove's website

at www.hellosmoove.com/investorrelations by no later than 12 noon

(London time) on the first business day following the date of this

announcement. For the avoidance of doubt, neither the contents of

these websites nor the contents of any websites accessible from any

hyperlinks are incorporated into or form part of this

announcement.

Neither the contents of PEXA's website, nor those of Smoove's

website, nor those of any other website accessible from hyperlinks

on either PEXA's or Smoove's websites, are incorporated into or

form part of this announcement.

No profit forecasts, profit estimates or quantified benefits

statements

No statement in this announcement is intended as a profit

forecast, profit estimate or quantified benefits statement for any

period and no statement in this announcement should be interpreted

to mean that earnings or earnings per share for Smoove for the

current or future financial years would necessarily match or exceed

the historical published earnings or earnings per share for

Smoove.

Requesting hard copy documents

In accordance with Rule 30.3 of the Takeover Code, Smoove

Shareholders, persons with information rights and participants in

the Smoove Share Plans may request a hard copy of this announcement

by contacting Smoove's registrars, Equiniti, by: (i) submitting a

request in writing to Equiniti, Aspect House, Spencer Road,

Lancing, West Sussex BN99 6DA, United Kingdom; or (ii) calling +44

(0)371 384 2050. Calls are charged at the standard geographical

rate and will vary by provider. Calls outside the United Kingdom

will be charged at the applicable international rate. Phone lines

are open between 8.30 a.m. and 5.30 p.m. (London time), Monday to

Friday (excluding public holidays in England and Wales). Please

note that Equiniti cannot provide any financial, legal or tax

advice and calls may be recorded and monitored for security and

training purposes.

For persons who receive a copy of this announcement in

electronic form or via a website notification, a hard copy of this

announcement will not be sent unless so requested. Such persons may

also request that all future documents, announcements and

information to be sent to them in relation to the Acquisition

should be in hard copy form.

Electronic communications

Please be aware that addresses, electronic addresses and certain

other information provided by Smoove Shareholders, persons with

information rights and other relevant persons for the receipt of

communications from Smoove may be provided to Digcom and/or PEXA

during the Offer Period as required under Section 4 of Appendix 4

to the Takeover Code to comply with Rule 2.11(c) of the Takeover

Code.

Rounding

Certain figures included in this announcement have been

subjected to rounding adjustments. Accordingly, figures shown for

the same category presented in different tables may vary slightly

and figures shown as totals in certain tables may not be an

arithmetic aggregation of figures that precede them.

General

Digcom reserves the right to elect, with the consent of the

Panel (where necessary), and subject to the terms and conditions of

the Co-operation Agreement, to implement the Acquisition by way of

a Takeover Offer for the entire issued and to be issued share

capital of Smoove not already held by Digcom as an alternative to

the Scheme. In such an event, a Takeover Offer will be implemented

on substantially the same terms, so far as applicable, as those

which would apply to the Scheme.

If the Acquisition is effected by way of Takeover Offer, and

such Takeover Offer becomes or is declared unconditional and

sufficient acceptances are received, Digcom intends to exercise its

rights to apply the provisions of Chapter 3 of Part 28 of the

Companies Act so as to acquire compulsorily the remaining Smoove

Shares in respect of which the Takeover Offer has not been

accepted.

If you are in any doubt about the contents of this announcement

or the action you should take, you are recommended to seek your own

independent financial advice immediately from your stockbroker,

bank manager, solicitor or independent financial adviser duly

authorised under the Financial Services and Markets Act 2000 (as

amended) if you are resident in the United Kingdom or, if not, from

another appropriately authorised independent financial adviser.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE MARKET ABUSE REGULATION NO 596/2014 (INCORPORATED INTO UK

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 AS AMED

BY VIRTUE OF THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS 2019).

UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY

INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

FOR IMMEDIATE RELEASE

4 October 2023

RECOMMED CASH ACQUISITION

of

SMOOVE PLC

by

DIGCOM UK HOLDINGS LIMITED

(an indirect subsidiary undertaking of PEXA Group Limited)

to be effected by means of a Scheme of Arrangement under Part 26

of the Companies Act 2006

1. Introduction

The boards of directors of Digcom UK Holdings Limited

("Digcom"), an indirect subsidiary undertaking of PEXA Group

Limited ("PEXA"), and Smoove plc ("Smoove"), are pleased to

announce that they have reached agreement on the terms of a

recommended cash acquisition by Digcom of the entire issued and to

be issued share capital of Smoove (the "Acquisition").

2. The Acquisition

It is intended that the Acquisition will be implemented by way

of a Court-sanctioned scheme of arrangement under Part 26 of the

Companies Act. The purpose of the Scheme is to enable Digcom to

acquire the whole of the issued and to be issued share capital of

Smoove.

Under the terms of the Acquisition, which will be subject to the

Conditions and other terms set out in this announcement and to the

full terms and conditions which will be set out in the Scheme

Document, Smoove Shareholders will be entitled to receive:

54 pence for each Smoove Share (the "Consideration")

The Consideration of 54 pence per Smoove Share values the entire

issued and to be issued share capital of Smoove at approximately

GBP30.8 million on a fully diluted basis and represents a premium

of approximately:

-> 69.3 per cent. to the Closing Price of 31.9 pence per

Smoove Share on 21 April 2023 (being the last Business Day before

the commencement of the Offer Period);

-> 74.1 per cent. to the volume-weighted average Closing

Price of 31.0 pence per Smoove Share for the one-month period ended

21 April 2023 (being the last Business Day before the commencement

of the Offer Period); and

-> 43.9 per cent. to the volume-weighted average Closing

Price of 37.5 pence per Smoove Share for the three-month period

ended 21 April 2023 (being the last Business Day before the

commencement of the Offer Period).

If, on or after the date of this announcement and before the

Effective Date, any dividend, distribution or other return of

capital or value is announced, declared, made or paid by Smoove or

becomes payable by Smoove in respect of the Smoove Shares, Digcom

reserves the right to reduce the Consideration payable pursuant to

the Acquisition by an amount up to the amount of such dividend

and/or distribution and/or other return of capital or value. In

such circumstances, Smoove Shareholders would be entitled to

receive and retain any such dividend and/or other distribution

and/or return of capital or value.

In the event that the Acquisition is to be implemented by way of

a Takeover Offer, Smoove Shares will be acquired pursuant to the

Takeover Offer fully paid and free from all liens, charges,

equitable interests, encumbrances and rights of pre-emption and any

other interests of any nature whatsoever and together with all

rights attaching thereto including the right to receive and retain

all dividends and distributions declared, made or paid by reference

to a record date after the Effective Date.

3. Background to and reasons for the Acquisition

The PEXA Group's strategy is to enhance and leverage its

property exchange know-how to deliver growth from different

markets, including in other Torrens title jurisdictions starting

with the UK.

Since entering the UK market at the end of 2020, the PEXA Group,

via Digital Completion UK Limited, has launched its first

re-mortgage product, brought two lenders onto the platform, and

acquired a specialist re-mortgage conveyancer, Optima Legal. The

Acquisition will provide PEXA with a growing conveyancer presence

via Amity Law and Smoove Complete. The PEXA Group's aim in

executing this strategy is to help solve the many detriments

consumers and property stakeholders suffer due to the UK's

fragmented, inefficient conveyancing processes. The Acquisition

will allow PEXA to leverage Smoove's experience to obtain expert

input into development of PEXA's sale and purchase platform and

potential PEXA product enhancements.

Both Smoove and PEXA share a common goal of simplifying and

enhancing the home moving process through digitalisation,

significantly reducing transaction times, whilst simultaneously

removing the pain points across the process. The PEXA Board

believes there is an opportunity for Smoove's existing customers to

benefit from PEXA's digital property settlements platform and wider

service offering, leveraging PEXA's experience as the market leader

in Australia. Smoove has a long-standing relationship with Lloyds

Banking Group and a connection with over 75 conveyancer firms on

its eConveyancer platform and circa 2,100 conveyancing firms via

lender panels.

The PEXA Board strongly believes that by integrating Smoove into

Digcom, the Combined Group will be able to address the challenges

of building scale and depth in the UK market, accelerating the path

to enhancing the home moving process. Smoove provides access to

re-mortgage flows equivalent to 7 per cent.(2) of the UK market and

sales and purchase flows across the Smoove platform which are

equivalent to 3 per cent.(2) of the UK's sales and purchase market

which are intermediated by the Smoove platform.

PEXA's existing business, commitment to developing new revenue

streams through international expansion and investments in new

digital business and partnerships, supported by a strong balance

sheet and cash generative business model, will help to build a

unique, strong and attractive business. Smoove will provide reach

into the 'cash back market segment' not currently served by Optima

Legal and indirect access to sale and purchase conveyancing firms.

The Acquisition also presents an opportunity to cross-sell the PEXA

platform to panel firms of Smoove (which provides access to volumes

both on and outside of the Smoove platform).

The Consideration represents:

-- an Enterprise Value of GBP20.8 million;

-- an implied Enterprise Value / FY23 revenue multiple of 1.0x; and

-- an implied Enterprise Value / FY23 gross profit multiple of 2.7x.

4. Recommendation

Smoove's Directors, who have been so advised by Cavendish as to

the financial terms of the Acquisition, unanimously consider the

terms of the Acquisition to be fair and reasonable. In providing

their advice to the Smoove Directors, Cavendish has taken into

account the commercial assessments of the Smoove Directors.

Cavendish is providing independent financial advice to the Smoove

Directors for the purposes of Rule 3 of the Takeover Code.

Accordingly, the Smoove Directors intend to recommend

unanimously that Smoove Shareholders vote in favour of the Scheme

at the Court Meeting and the Resolution(s) to be proposed at the

General Meeting (or in the event that the Acquisition is

implemented by way of a Takeover Offer, to accept or procure the

acceptance of such Takeover Offer) as the Smoove Directors who are

beneficially interested in Smoove Shares (who, for the avoidance of

doubt, do not include Smoove Directors whose interests in Smoove

Shares comprise only unexercised options under the Smoove Share

Plans, nor Oliver Scott who has an indirect beneficial interest in

Smoove Shares as well as being a partner of Kestrel Partners LLP,

an entity interested in Smoove Shares) have irrevocably undertaken

to do in respect of their entire beneficial holdings of 85,000

Smoove Shares, representing, in aggregate, approximately 0.15 per

cent. of Smoove's total issued share capital as at the close of

business on the Last Practicable Date.

___

(2) Calculated based on Smoove's sale and purchase and

remortgage completion volumes for the financial year ended 31 March

2023, Bank of England sale and purchase transactions (Bank of

England data set LPMB4B3) and Bank of England remortage

transactions (Bank of England data set LPMVTVX)

5. Smoove Directors' interests in Smoove Shares and bonus arrangements

Each of Martin Rowland and Jesper With-Fogstrup, who are the

only Smoove Directors who are beneficially interested in Smoove

Shares (not including, for the avoidance of doubt, those Smoove

Directors whose interests in Smoove Shares comprise only

unexercised options under the Smoove Share Plans, nor Oliver Scott

who has an indirect beneficial interest in Smoove shares as well as

being a partner of Kestrel Partners LLP, an entity interested in

Smoove Shares), have given to Digcom irrevocable undertakings to

vote in favour (or procure the voting in favour, as applicable) of

the Scheme at the Court Meeting and the Resolution(s) to be

proposed at the General Meeting (or in the event that the

Acquisition is implemented by way of a Takeover Offer, to accept or

procure the acceptance of such Takeover Offer), in respect of their

entire beneficial holdings of, in aggregate, 85,000 Smoove Shares,

representing in aggregate approximately 0.15 per cent. of Smoove's

total issued share capital as at the close of business on the Last

Practicable Date.

In addition, Martin Rowland has been granted options over

750,000 Smoove Shares under the Smoove Share Plans, Jesper

With-Fogstrup has been granted options and JOA awards over

2,175,000 Smoove Shares under the Smoove Share Plans and Michael

Cress has been granted options over 750,000 Smoove Shares under the

Smoove Share Plans. Save for the options over 750,000 Smoove Shares

granted to Martin Rowland which will be exercisable as a result of

the Acquisition, it is not expected any of these options or awards

will be exercised or vest as part of the Acquisition as they are

either underwater (i.e. the exercise price is in excess of the

Consideration), or they are subject to performance share price

triggers which are in excess of the Consideration and so will not

be met. It is therefore expected that those options (other than the

options granted over 750,000 Smoove Shares to Martin Rowland) and

awards will lapse in accordance with the applicable Smoove Share

Plan rules.

Oliver Scott, a Non-Executive Director of Smoove, is a partner

of Kestrel Partners LLP which is interested in 15,711,095 Smoove

Shares. Kestrel Partners LLP has given an irrevocable undertaking

as detailed in paragraph 7 below.

Jesper With-Fogstrup and Michael Cress, along with two other

members of senior management, are entitled to receive transaction

bonuses in the event of a cash offer resulting in the acquisition

of Smoove by a third party. The entitlements of the relevant Smoove

Directors are:

-- Jesper With-Fogstrup - GBP150,000; and

-- Michael Cress - GBP75,000.

The bonus arrangements will be subject to usual tax and National

Insurance deduction.

6. Background to and reasons for the recommendation

Smoove has sought to make moving house in the UK a simpler, more

transparent and automated process for the benefit of both consumers

and the professionals who work in the sector. To that end, Smoove

has developed service offerings, such as eConveyancer, a two-sided

digital comparison marketplace connecting consumers to conveyancing

lawyers. eConveyancer allows the consumer, primarily through

introducers such as mortgage brokers, lenders, or estate agents, to

compare the cost, service, and location of conveyancing lawyers.

Smoove has developed further products and services to provide

solutions covering more of the end-to-end home moving

experience.

In the last 18 months, the home moving sector has been impacted

by challenging macroeconomic conditions. These factors include

sudden and persistently high inflation which has, in turn, led to a

rapid, and at times unpredictable, increase in interest rates from

historic lows. As a result, sale and purchase transaction volumes

in the market have fallen sharply over the past year and house

prices have been unstable and begun falling also in real terms.

These events have combined to erode the confidence of market

participants including home movers, mortgage brokers, lenders, and

estate agents. Meanwhile, and not unrelated, the environment for

trading in the shares in Smoove has, in recent times, been impacted

by poor sentiment around not only AIM, but particularly smaller

pre-profit companies, with limited trading liquidity on the stock

market.

Smoove's current trading has been in line with the Smoove

Board's expectations despite difficult market conditions and the

Smoove Directors continue to believe that Smoove's present strategy

is capable of delivering long-term growth in revenue and profits.

However, they also believe that PEXA's scale will help to

accelerate the execution of Smoove's strategy. Access to PEXA's

digital property settlements platform is also expected to benefit

Smoove's offering to customers. The terms of the Acquisition

provide Smoove Shareholders with an immediate, certain and

attractive cash value for their investment. The Smoove Directors

believe the Acquisition appropriately recognises the growth

potential of Smoove as a standalone business.

In considering its recommendation of the Acquisition to Smoove

Shareholders, the Smoove Directors have given due consideration to

Digcom's intentions regarding Smoove's employees and other

stakeholders as set out in paragraph 10 of this announcement.

When considering the Acquisition, the Smoove Directors have

taken into account the substantial premium of the Consideration to

the Closing Price of Smoove Shares on 21 April 2023 (being the last

Business Day before the commencement of the Offer Period) . The

Consideration of 54 pence in cash per Smoove Share represents a

premium of approximately:

-> 69.3 per cent. to the Closing Price of 31.9 pence per

Smoove Share on 21 April 2023 (being the last Business Day before

the commencement of the Offer Period);

-> 74.1 per cent. to the volume-weighted average Closing

Price of 31.0 pence per Smoove Share for the one-month period ended

21 April 2023 (being the last Business Day before the commencement

of the Offer Period); and

-> 43.9 per cent. to the volume-weighted average Closing

Price of 37.5 pence per Smoove Share for the three-month period

ended 21 April 2023 (being the last Business Day before the

commencement of the Offer Period).

The Acquisition provides the certainty of a realisable value to

all Smoove Shareholders and allows them to realise their investment

in Smoove Shares for cash without incurring broking fees.

As further described below and at Appendix 3 to this

announcement, Digcom has received irrevocable undertakings and a

non-binding letter of intent in respect of 32,010,862 Smoove Shares

representing, in aggregate, approximately 56.14 per cent. of

Smoove's total issued capital as at the close of business on the

Last Practicable Date.

The Smoove Directors consider the terms of the Acquisition to be

fair and reasonable. Accordingly, following careful consideration

of both the financial terms of the Acquisition and PEXA's

intentions regarding the conduct of the Smoove business under

PEXA's ownership, the Smoove Directors intend to recommend

unanimously the Acquisition to Smoove Shareholders. In reaching its

intention to recommend unanimously the Acquisition, the Smoove

Board, in addition to the financial terms of the Acquisition, took

account of the interests of all of its key stakeholders, including

customers, employees and shareholders.

7. Irrevocable undertakings and letter of intent

In addition to the irrevocable undertakings from the Smoove

Directors described in paragraph 5 above, Digcom has also received

irrevocable undertakings from each of Kestrel Partners LLP (a

partner of which, Oliver Scott, is a Non-Executive Director of

Smoove), Harwood Capital Management Limited and Herald Investment

Management Limited to vote in favour (or procure the voting in

favour, as applicable) of the Scheme at the Court Meeting and the

Resolution(s) to be proposed at the General Meeting (or in the

event that the Acquisition is implemented by way of a Takeover

Offer, to accept or procure the acceptance of such Takeover Offer)

in respect of, in aggregate, 26,560,625 Smoove Shares, representing

approximately 46.58 per cent. of Smoove's total issued share

capital as at the close of business on the Last Practicable

Date.

In addition, Digcom has received a non-binding letter of intent

from Schroders Investment Management Limited to procure the voting

in favour of the Scheme at the Court Meeting and the Resolution(s)

to be proposed at the General Meeting (or in the event that the

Acquisition is implemented by way of a Takeover Offer, to procure

the acceptance of such Takeover Offer) in respect of 5,365,237

Smoove Shares, representing approximately 9.41 per cent. of

Smoove's total issued share capital as at the close of business on

the Last Practicable Date.

Further details of these irrevocable undertakings and letter of

intent are set out in Appendix 3 to this announcement.

Accordingly, Digcom has received irrevocable undertakings and a

letter of intent to vote, or procure the voting, in favour of the

Scheme at the Court Meeting and the Resolution(s) to be proposed at

the General Meeting (or in the event that the Acquisition is

implemented by way of a Takeover Offer, to accept or procure the

acceptance of such Takeover Offer) in respect of a total of

32,010,862 Smoove Shares representing, in aggregate, approximately

56.14 per cent. of Smoove's total issued share capital of Smoove as

at the close of business on the Last Practicable Date.

8. Information relating to Smoove

Smoove provides online digital platforms for everyone involved

in the buying, selling, and refinancing of property in the UK.

Smoove is investing in new technology to generate more value from

its partner relationships, develop new revenue streams, and build

products that improve the experience of consumers.

-- eConveyancer is a platform that brings together conveyancers

and introducers such as mortgage brokers and lenders to offer a

conveyancing comparison service to consumers. The eConveyancer

offering includes value-added tools such as DigitalMove, an

onboarding and messaging service that helps all participants in the

conveyancing process to communicate and collaborate. In the most

recent financial year, eConveyancer generated 69,662 conveyancing

instructions and 53,224 conveyancing completions. eConveyancer and

its related services account for the vast majority of Smoove's

revenue.

-- Smoove Complete is a platform for self-employed Consultant

Conveyancing Lawyers ("CCLs"). In exchange for a share of the

conveyancing fee income, Smoove provides CCLs with a suite of

services including onboarding and post-completion services, as well

as support infrastructure including technology, regulatory

oversight and professional indemnity insurance. The business is an

area of strategic focus, but because it only recently began trading

in late October 2022, it made a minimal contribution to Smoove

group revenues in the most recent financial year. Smoove Complete

trades within ALL, a conveyancing law firm acquired by Smoove in

October 2021.

-- Legal Eye provides risk management and compliance services to

solicitors and licensed conveyancers. Legal Eye accounted for

approximately 4 per cent. of group revenue in the most recent

financial year.

-- Smoove Start launched in August 2022 after a well-received

limited product pilot. The software provides a service to estate

agents encompassing ID verification, anti-money laundering, and

upfront information. In response to challenging market conditions

the product was pivoted to focus on a conveyancing-led offering to

emphasise the fee earning potential to estate agents from referral

of cases into eConveyancer. Given its limited trading history,

Smoove Start made a minimal contribution to Smoove group revenues

in the most recent financial year.

Smoove's business was founded in 2003 and was admitted to AIM in

July 2014.

Current trading

To date, Smoove has continued to trade in line with the Smoove

Board's expectations during the first half of the current financial

year. This period has been characterised by continued growth in the

remortgage segment and year-on-year volume declines in the

transactional segment. The latter trend reflects deteriorating

conditions in the housing market as increased costs in mortgage

finance since the start of the current financial year have led to

lower market transaction volumes and falling real house prices. The

cash balance at 30 September 2023 was GBP9.2 million. The reduced

rate of cash burn has benefitted from the impact of previously

announced cost reduction initiatives.

9. Information on the PEXA Group and Digcom

The PEXA Group

-- PEXA is the operator of the leading digital property

settlements platform in Australia, employing approximately 1,000

people and listed on the ASX with a market cap of A$ 2.016 billion

on the Last Practicable Date.

-- Having started in 2010 as a joint initiative of various state

governments and the largest banks in Australia to phase out the use

of inefficient paper-based property settlements, the PEXA Group

today offers the world's first digital platform for managing the

lodgement and settlement of property transactions.

-- "PEXA Exchange" operates primarily as an ELNO facilitating

the electronic lodgement and settlement of property transactions

through an integrated, cloud-based platform connecting key property

market stakeholders.

-- PEXA Exchange's facilitation of secure, reliable and

efficient digital settlements has established the platform as a

critical and trusted component of the Australian property market,

providing confidence and stability for all participants in a

property transaction.

-- Through its PEXA Digital Growth business, PEXA offers

property-related insight and analytics solutions to its customers

and stakeholders which aim to reduce transaction costs in the

property chain and enhance the experience of developing, buying and

selling, financing, settling, owning, and servicing property . PEXA

Digital Growth also i dentifies and invests in opportunities across

the property ecosystem to complement and enhance its core insights

and analytics offering.

-- For the year ended 30 June 2023, PEXA Group generated

business revenue of A$283.4 million and an operating EBITDA of

A$98.7 million. Additional information on PEXA Group's latest

financial results can be found at

https://investors.pexa.com.au/investor-centre/?page=results-centre

.

-- The Acquisition will be funded through cash currently held by

PEXA, which has been drawn down by PEXA under its existing facility

and a newly established facility (which can be used for general

commercial requirements and has a limit of $40 million AUD).

Digcom

-- Having created the leading digital property settlements

platform in Australia, Digcom was established in 2020 to enable

PEXA to enter the UK market and implement its strategy to transform

the UK property market.

-- In seeking to extend its digital property settlements

platform knowledge in new geographies, the PEXA Group launched its

remortgage offering in the UK in September 2022 following the

successful testing of the PEXA settlement payment solution with the

Bank of England. Shortly after the UK launch, Digcom acquired

Optima Legal, a high-volume remortgage conveyancing firm that

provides legal services in the UK remortgage market.

10. PEXA's intentions for the Smoove business

PEXA and Digcom's strategic plans for the Combined Group

Following Completion, PEXA intends to integrate Smoove into

PEXA's existing UK business to further advance the offering of its

digital settlements platform to lenders, conveyancers and consumers

in the UK.

PEXA has been granted access to Smoove management and

information to carry out due diligence. However, due to transaction

constraints, PEXA has not yet had access to sufficiently detailed

information to formulate a complete post-Acquisition strategy for

the integration of Smoove into PEXA's UK business. To assist with

this process, PEXA intends to carry out a review of Smoove's and

PEXA's UK business. The review is expected to take at least six

months following Completion of the Acquisition. The review will

examine the current operating and organisational structures of both

businesses and provide the basis for the development of an

integration programme designed to minimise any disruption to

customers, suppliers, employees and consumers whilst delivering the

expected opportunities and benefits of the Acquisition.

Brand

In the longer term, Digcom intends that the Smoove business will

operate under the umbrella PEXA brand but, following Completion,

will undertake a review of individual product brands (including

eConveyancer, DigitalMove, Smoove Complete, Smoove Start and Legal

Eye) to ensure that their offerings are distinguishable under the

PEXA brand.

Employees, management and directors

Digcom attaches great importance to the skills and experience of

Smoove's management and employees and recognises their important

contribution to the success that has been achieved by Smoove.

Digcom confirms that, following completion of the Acquisition,

the existing contractual and statutory employment rights of Smoove

employees will be fully safeguarded in accordance with applicable

law. Following Completion, Digcom will seek to align the employment

contracts and benefits of Smoove employees with those of the PEXA

Group so that employees benefit from matters that are of cultural

importance to the PEXA Group.

Whilst Digcom's review will seek to design an optimal strategy

for integrating Smoove into PEXA's existing UK business, given the

complementary nature of both businesses Digcom does not expect the

outcome of its review to result in any material change to Smoove's

employee skills mix and headcount. To the extent that the outcome

of Digcom's review unlocks synergies and opportunities for costs

savings Digcom will endeavour to minimise their impact on

employees.

It is expected that the Non-Executive Directors of Smoove will

resign from the Smoove Board on Completion.

Pensions

Digcom intends to maintain the rate of contributions made to the

Smoove Group's pension schemes following Completion. The Smoove

Group operates defined contribution pension arrangements for its

management and employees and has no exposure under any form of

defined benefit (final salary) pension scheme.

Management incentives

PEXA has not entered into, and has not had discussion on

proposals to enter into, any form of incentive arrangements with

any of the existing members of Smoove's management. PEXA expects to

put in place appropriate incentive arrangements for Smoove's

management following Completion.

Locations of business, fixed assets and research and

development

Following Completion, it is intended that Smoove will continue

to operate from its head office in Thame, Oxfordshire. Digcom will

review the Smoove Group's leasing arrangements in the ordinary

course to ensure they continue to meet the Smoove Group's operating

needs moving forward. Smoove does not have any material fixed

assets and the PEXA Board does not intend to redeploy any of

Smoove's fixed assets following Completion.

Smoove has no dedicated research and development function.

Trading facilities

Smoove Shares are currently traded on AIM. As set out in

paragraph 17 below, it is intended that a request will be made to

the London Stock Exchange to cancel trading in Smoove Shares on

AIM, subject to the Acquisition becoming Effective, such

cancellation to take effect from or shortly after the Effective

Date. At the same time, it is intended that Smoove will be

re-registered as a private limited company. As stated in paragraph

17 below, dealings in Smoove Shares will be suspended prior to the

Effective Date and, thereafter, there will be no trading facilities

in relation to Smoove Shares.

As a result of the cancellation of trading in Smoove Shares on

AIM, the Combined Group expects to achieve savings from Smoove no

longer having to comply with its ongoing public company reporting

obligations.

No "post-offer undertakings"

No statements in this paragraph 10 are "post-offer undertakings"

for the purposes of Rule 19.5 of the Takeover Code.

11. Share Schemes

Participants in the Smoove Share Plans will be contacted

regarding the effect of the Acquisition on their rights under the

Smoove Share Plans and provided with further details concerning the

proposals which will be made to them in due course. Details of the

proposals will be set out in the Scheme Document (or, as the case

may be, the Offer Document) and in separate letters to be sent to

participants in the Smoove Share Plans.

12. Financing of the Acquisition

The Consideration payable to Smoove Shareholders pursuant to the

Acquisition will be financed using existing cash resources of the

PEXA Group.

Numis, in its capacity as financial adviser to PEXA and Digcom,

is satisfied that sufficient resources are available to Digcom to

satisfy in full the Consideration payable by Digcom to Smoove

Shareholders pursuant to the Acquisition.

Further information on the financing of the Acquisition will be

set out in the Scheme Document.

13. Offer-related Arrangements

Confidentiality Agreement

On 9 August 2023, PEXA and Smoove entered into the

Confidentiality Agreement in connection with the Acquisition,

pursuant to which, amongst other things, the parties gave certain

undertakings to: (i) subject to certain exceptions, keep

information relating to the Acquisition and each other party

confidential and not to disclose it to third parties; and (ii) use

such confidential information only in connection with the

Acquisition. These confidentiality obligations will remain in force

until the earlier of 12 months from the date of the agreement and

Completion.

Co-operation Agreement

On 4 October 2023, Digcom and Smoove entered into the

Co-operation Agreement in relation to the Acquisition. Pursuant to

the Co-operation Agreement: (i) Digcom and Smoove have agreed to

co-operate to assist with the satisfaction of certain regulatory

conditions, subject to certain customary carve-outs; (ii) the

parties have agreed to implement certain arrangements with respect

to the Smoove Share Plans and other employee-related matters; and