TIDMSOUC

RNS Number : 1745S

Southern Energy Corp.

02 November 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES (ITS TERRITORIES OR POSSESSIONS), AUSTRALIA, JAPAN, NEW

ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN

WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE

UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE: (A) A PROSPECTUS OR OFFERING MEMORANDUM; (B) AN

ADMISSION DOCUMENT PREPARED IN ACCORDANCE WITH THE AIM RULES; OR

(C) AN OFFER FOR SALE OR SUBSCRIPTION OF ANY SECURITIES IN THE

COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR CONTAIN, AND

SHOULD NOT BE CONSTRUED AS, ANY INVITATION, SOLICITATION,

RECOMMATION, OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR,

OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES OF SOUTHERN ENERGY

CORP. IN ANY JURISDICTION IN WHICH ANY SUCH OFFER OR SOLICITATION

WOULD BE UNLAWFUL.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE MARKET ABUSE REGULATION (REGULATION 596/2014/EU) AS IT FORMS

PART OF UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL)

ACT 2018, AS AMED. UPON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

SOUTHERN ENERGY CORP. ANNOUNCES RESULTS OF FUNDRAISING

Calgary, Alberta - 2 November 2023 - Southern Energy Corp.

("Southern" or the "Company") (TSXV:SOU) (AIM:SOUC) (OTCQX:SOUTF),

a U.S.-focused, growth-oriented natural gas producer, is pleased to

announce the results of the conditional Fundraising announced on 1

November 2023.

Pursuant to the Fundraising, a total of 26,630,000 new Common

Shares (the "Fundraising Shares") have been conditionally placed

with new and existing investors at a price of 15.5 pence (the

"Placing Price") or C$0.26 (the "Prospectus Price") per new Common

Share, raising aggregate gross proceeds of US$5.0 million (GBP4.1

million, C$6.9 million). The net proceeds from the Fundraising will

be used alongside existing cash, cash flows and undrawn debt

facilities to fund the completion of the up to four drilled and

uncompleted ("DUC") wells at a cost of approximately US$3 million

per well.

The Fundraising Shares will consist of 14,863,097 Placing

Shares, 11,702,387 Prospectus Shares and 64,516 Subscription Shares

conditionally placed at the Placing Price and Prospectus Price as

appropriate, representing gross proceeds of US$2.8 million (GBP2.3

million, C$3.9 million), US$2.2 million (GBP1.8 million, C$3.0

million), and US$0.01 million (GBP0.01 million, C$0.02 million),

respectively.

The total Fundraising Shares will represent approximately 16.1

per cent. of the Company's enlarged share capital post-completion

of the Fundraising. The Placing Price represents a 16.2 per cent.

discount to the closing price on 1 November 2023 on AIM, being the

last practicable closing price prior to the announcement of the

Fundraising.

Stifel Nicolaus Europe Limited ("Stifel Europe") and Tennyson

Securities, a trading name of Shard Capital Partners LLP ("Tennyson

Securities") acted as joint bookrunners (the "Joint Bookrunners")

in connection with the Placing. Stifel Nicolaus Canada Inc.

("Stifel Canada") is acting as lead agent and bookrunner, with

Canaccord Genuity Corp, Eight Capital, and Haywood Securities Inc

as agents, in connection with the Prospectus Offering.

Participation by PDMRs

Certain persons discharging managerial responsibilities (PDMRs)

of the Company have participating in the Fundraising via the

Subscription and Prospectus Offering, acquiring a total of 746,055

new Common Shares representing gross proceeds of US$0.14 million

(GBP0.12 million, C$0.19 million). The FCA notifications, made in

accordance with the requirements of the MAR, are appended

below.

Ian Atkinson, President and CEO of Southern, commented:

"I am pleased to announce the successful Fundraising today that

will allow us to accelerate the completion of Southern's four

drilled and uncompleted wells in Gwinville in an increasingly

positive macro gas price environment. The accelerated completion of

the four wells is anticipated to provide significant production

growth and cash flow to the business and we look forward to getting

to work to bring these wells on to production."

"I would like to thank all of the shareholders who have

continued to support the Company in this Fundraising, and welcome

new investors onto the register at what we expect to be an exciting

time for the business, supported by the increasing structural

imbalance in U.S. natural gas."

Capitalised terms not otherwise defined in the text of this

announcement have the meanings given in the Company's announcement

dated 1 November 2023.

For further information about Southern, please visit our website

at www.southernenergycorp.com or contact :

Southern Energy Corp.

Ian Atkinson (President and CEO) +1 587 287 5401

Calvin Yau (CFO) +1 587 287 5402

Stifel Nicolaus Europe Limited - Joint Bookrunner

& Joint Broker

Callum Stewart / Ashton Clanfield / Simon Mensley +44 (0) 20 7710 7600

Tennyson Securities - Joint Bookrunner & Joint

Broker

Peter Krens / Pav Sanghera +44 (0) 20 7186 9033

Strand Hanson Limited - Nominated & Financial

Adviser

James Spinney / James Bellman +44 (0) 20 7409 3494

Canaccord Genuity - Joint Broker

Henry Fitzgerald-O'Connor / James Asensio +44 (0) 20 7523 8000

Camarco

Owen Roberts / Billy Clegg / Hugo Liddy +44 (0) 20 3757 4980

Settlement of the Fundraising Shares and Application for

Admission

Application will be made to the London Stock Exchange for the

Fundraising Shares to be admitted to trading on AIM and to the TSXV

for the Fundraising Shares to be admitted to trading on the TSXV.

The Prospectus Offering is expected to close on or about 9 November

2023, subject to customary closing conditions, including the

approval of the TSXV. It is currently expected that admission will

become effective, and that dealings in the Fundraising Shares will

commence on AIM, at 8.00 a.m. (GMT) and on the TSXV at 9:30 a.m.

(ET) on or around 9 November 2023.

The Fundraising Shares will, when issued, be credited as fully

paid and will rank pari passu in all respects with the existing

Common Shares of the Company, including the right to receive all

dividends and other distributions thereafter declared, made or paid

on the enlarged share capital from admission.

Total Voting Rights

Following the admission of the Fundraising Shares, Southern's

total issued share capital will consist of 165,718,160 Common

Shares. The Company does not hold any Common Shares in Treasury.

Therefore, this figure may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in

interest in, the share capital of the Company under the Disclosure

Guidance and Transparency Rules of the FCA.

PDMR Disclosures

1. Details of the person discharging managerial responsibilities

/ person closely associated

a) Name 1. Ian Atkinson

2. Calvin Yau

3. Gary McMurren

4. Reginald Steven Smith

5. Bruce Beynon

6. Neil Smith

7. John Nally

--------------------------------- -----------------------------------

2. Reason for the Notification

----------------------------------------------------------------------

a) Position/status 1. Director, President & CEO

2. Chief Financial Officer

3. Chief Operating Officer

4. Non-Executive Director

5. Non-Executive Director

6. Non-Executive Director

7. Non-Executive Director

--------------------------------- -----------------------------------

b) Initial notification/Amendment Initial Notification

--------------------------------- -----------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------

a) Name Southern Energy Corp.

--------------------------------- -----------------------------------

b) LEI 213800R25GL7J3EBJ698

--------------------------------- -----------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

----------------------------------------------------------------------

a) Description of the Financial Common shares of no par value in

instrument, type of Southern Energy Corp.

instrument

Identification code ISIN: CA8428133059

--------------------------------- -----------------------------------

b) Nature of the transaction Subscription for new Common Shares

--------------------------------- -----------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

--------- ----------

1. C$0.26 76,923

--------- ----------

2. C$0.26 57,692

--------- ----------

3. C$0.26 100,000

--------- ----------

4. C$0.26 288,462

--------- ----------

5. C$0.26 120,000

--------- ----------

6. C$0.26 38,462

--------- ----------

7. 15.5p 64,516

--------- ----------

--------------------------------- -----------------------------------

d) Aggregated information:

--Aggregated volume N/A

--Price

--------------------------------- -----------------------------------

e) Date of the transaction 2 November 2023

--------------------------------- -----------------------------------

f) Place of the transaction Outside a trading venue

--------------------------------- -----------------------------------

Forward Looking Information

This Announcement contains certain forward-looking information

(collectively referred to herein as "forward-looking statements")

within the meaning of applicable Canadian securities laws.

Forward-looking statements are often, but not always, identified by

the use of words such as "forecast", "guidance", "outlook",

"anticipate", "target", "plan", "continue", "intend", "consider",

"estimate", "expect", "may", "will", "should", "could" (or the

negatives or similar words suggesting future outcomes.

Forward-looking statements in this Announcement may contain, but

are not limited to, statements concerning: Southern's business

strategy and plan, including its objectives, strengths and focus;

the completion of the Fundraising and the terms, size and timing

thereof and the use of proceeds therefrom, including the

acceleration of the completion of up to four DUC wells; the

Company's price dependent growth and acquisition and consolidation

strategies, including targets, metrics, planned investments, and

allocation of funds, anticipated operational results; capital

expenditures and drilling plans and locations the performance

characteristics of the Company's oil and natural gas properties;

the ability of the Company to achieve drilling success consistent

with management's expectations; and the source of funding for the

Company's activities including development costs.

The forward-looking statements contained in this Announcement

are based on a number of factors and assumptions made by Southern,

which have been used to develop such statements, but which may

prove to be incorrect. In addition to factors and assumptions which

may be identified in this press release, assumptions have been made

regarding and may be implicit in, among other things: the business

plan of Southern; the receipt of all approvals and satisfaction of

all conditions to the completion of the Fundraising; the timing of

and success of future drilling, development and completion

activities; the geological characteristics of Southern's

properties; prevailing commodity prices, price volatility, price

differentials and the actual prices received for the Company's

products; the availability and performance of drilling rigs,

facilities, pipelines and other oilfield services; the timing of

past operations and activities in the planned areas of focus; the

drilling, completion and tie-in of wells being completed as

planned; the performance of new and existing wells; the application

of existing drilling and fracturing techniques; prevailing weather

and break-up conditions; royalty regimes and exchange rates; the

application of regulatory and licensing requirements; the continued

availability of capital and skilled personnel; the ability to

maintain or grow the banking facilities; the accuracy of Southern's

geological interpretation of its drilling and land opportunities,

including the ability of seismic activity to enhance such

interpretation; and Southern's ability to execute its plans and

strategies. Readers are cautioned that the foregoing list is not

exhaustive of all factors and assumptions which have been used.

Although management considers these assumptions to be reasonable

based on information currently available, undue reliance should not

be placed on the forward-looking statements because Southern can

give no assurances that they may prove to be correct. By their very

nature, forward-looking statements are subject to certain risks and

uncertainties (both general and specific) that could cause actual

events or outcomes to differ materially from those anticipated or

implied by such forward-looking statements. As a result, any

potential investor should not rely on such forward-looking

statements in making their investment decisions. No representation

or warranty is made as to the achievement, or reasonableness of,

and no reliance should be placed on such forward-looking

statements. Risks and uncertainties that can materially impact the

Company's results include, but are not limited to: incorrect

assessments of the value of benefits to be obtained from

exploration and development programs; changes in the financial

landscape both domestically and abroad, including volatility in the

stock market and financial system; wars (including Russia's war in

Ukraine and the Israel-Palestinian conflict); risks associated with

the oil and gas industry in general (e.g. operational risks in

development, exploration and production, delays or changes in plans

with respect to exploration or development projects or capital

expenditures, and environmental regulations); commodity prices;

increased operating and capital costs due to inflationary

pressures; the uncertainty of estimates and projections relating to

production, cash generation, costs and expenses; health, safety,

litigation and environmental risks; access to capital; the

availability of future financings and divestitures; public and

political sentiment towards fossil fuels; and the effects of

pandemics and other public health events (including but not limited

to COVID-19). Due to the nature of the oil and natural gas

industry, drilling plans and operational activities may be delayed

or modified to react to market conditions, results of past

operations, regulatory approvals or availability of services

causing results to be delayed. Please refer to Southern's most

recent Annual Information Form for the year ended December 31, 2022

and management's discussion and analysis for the period ended June

30, 2023, and other continuous disclosure documents for additional

risk factors relating to Southern, which can be accessed either on

Southern's website at www.southernenergycorp.com or under the

Company's profile on www.sedarplus.ca.

The forward-looking statements contained in this Announcement

are made as of the date hereof and the Company does not undertake

any obligation to update publicly or to revise any of the included

forward-looking statements, except as required by applicable law.

The forward-looking statements contained herein are expressly

qualified by this cautionary statement.

Market Abuse Regulation

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIQLLBBXFLZFBQ

(END) Dow Jones Newswires

November 02, 2023 03:00 ET (07:00 GMT)

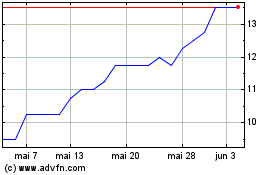

Southern Energy (LSE:SOUC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Southern Energy (LSE:SOUC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024