TIDMUEM

RNS Number : 1537U

Utilico Emerging Markets Trust PLC

21 November 2023

Date: 21 November 2023

UTILICO EMERGING MARKETS TRUST PLC

UNAUDITED HALF-YEARLY FINANCIAL REPORT

FOR THE SIX MONTHS TO 30 SEPTEMBER 2023

Utilico Emerging Markets Trust plc ("UEM" or the "Company")

today announced its unaudited financial results for

the six months to 30 September 2023.

Highlights of results for the six months to 30 September

2023:

-- Net asset value ("NAV") total return per share of 6.0%*

-- NAV per share of 261.58p per share, up 4.3%

-- Gross assets of GBP529.2m, a decrease of 2.5%

-- Annual compound NAV total return since inception of 9.4%*

-- Dividends per share totalled 4.30p for the period, an

increase of 3.6%. Dividends were fully covered by earnings

-- Revenue earnings per share ("EPS") decreased 12.9% to 5.95p

-- Total revenue income of GBP14.8m, an 12.4% decrease

*See Alternate Performance Measures on pages 43 to 45 of the

Half-Yearly Financial Report for the six months to 30 September

2023

The Half-Yearly Financial Report for the six months to 30

September 2023 will be posted to shareholders in early December

2023. A copy will shortly be available to view and download from

the Company's website at www.uemtrust.co.uk and the National

Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism . Please

click on the following link to view the document:

http://www.rns-pdf.londonstockexchange.com/rns/1537U_1-2023-11-21.pdf

John Rennocks, Chairman of UEM said: "It is pleasing to report

that UEM exhibited a strong performance in the half year to 30

September 2023 and delivered a positive NAV total return of 6.0%.

This was once again significantly ahead of the MSCI EM total return

Index which was down 0.9% over the same period. The long-term

annual compound NAV total return since inception to 30 September

2023 was 9.4% exceeding the MSCI EM total return Index of 7.2%.

"UEM has declared two quarterly dividends of 2.15p each,

totalling 4.30p per share, a 3.6% increase over the previous half

year. Dividends remain fully covered by income. The retained

earnings revenue reserves increased by GBP3.3m to GBP12.9m as at 30

September 2023, equal to 6.53p per share.

"UEM's share price discount widened further over the half year

from 13.5% as at 31 March 2023 to 15.1% as at 30 September 2023.

This remains well above the level that the Board expects to see

over the medium term. The Company has continued buying back shares

for cancellation, with 4.4m shares bought back in the half year to

30 September 2023, at an average price of 222.14p. The Board would

like to re-emphasise that UEM's portfolio is predominantly invested

in relatively liquid, cash-generative companies which have

long-duration operational, infrastructure and utility assets that

the Company's Investment Managers believe are structurally

undervalued and offer the potential for excellent total

returns".

Charles Jillings, Investment Manager of UEM added: "UEM's one

year, three years, five years and since inception performance is

strongly ahead of the MSCI Index. UEM has delivered this together

with a rising dividend; a low beta (as at 30 September 2023, UEM's

five year Sterling adjusted beta versus the MSCI EM Index was

0.83); and with a portfolio which is very different from the MSCI

EM Index (UEM's active share is over 98.0%). This should be

compelling to investors who want exposure to infrastructure

megatrends in emerging markets, top performance and comparatively

low levels of volatility.

"We have identified four megatrends that should underpin the

investment opportunities for UEM - Energy Transition, Digital

Infra, Social Infra and Global Trade. There are significant

structural shifts underway which will continue irrespective of

macro or political pressures. While it is true that urbanisation

and the growth of the middle class continues to drive much of the

momentum in emerging economies, the megatrends are seeing a

determined accelerated shift in economic activity."

Contacts: Joint Portfolio Manager and Company Secretary

ICM Investment Management Limited +44(0)1372 271486

Charles Jillings / Alastair Moreton

Public Relations

Montfort Communications +44(0)20 3770 7913

Gay Collins / Pippa Bailey

utilico@montfort.london

Joint Brokers

Shore Capital +44(0)20 7408 4090

Rose Ramsden / Angus Murphy

Barclays Bank +44(0)20 7623 2323

Dion Di Miceli / Stuart Muress / Louis Reed

BarclaysInvestmentCompanies@barclays.com

PERFORMANCE SUMMARY

% Change

Half-year Half-year Annual Mar -

30 Sep 2023 30 Sep 2022 31 Mar 2023 Sep 2023

----------------------------------------------- -------------- -------------- -------------- -------------

NAV total return per share (1) (%) 6.0 (2.8) 2.1 n/a

Share price total return per share (%) 4.3 (4.0) 0.8 n/a

Annual compound NAV total return (1) (since

inception) (%) 9.4 9.3 9.3 n/a

----------------------------------------------- -------------- -------------- -------------- -------------

NAV per share (1) (pence) 261.58 243.29 250.91 4.3

Share price (pence) 222.00 211.00 217.00 2.3

Discount (1) (%) (15.1) (13.3) (13.5) n/a

Earnings per share

- Capital (pence) 8.24 (14.99) (6.61) 155.0 (4)

- Revenue (pence) 5.95 6.83 9.40 (12.9)( 4)

Total (pence) 14.19 (8.16) 2.79 273.9 (4)

----------------------------------------------- -------------- -------------- -------------- -------------

Dividends per share (pence) 4.30 (2) 4.15 8.45 3.6 (4)

--------------

Gross assets (3) (GBPm) 529.2 521.8 542.5 (2.5)

Equity holders' funds (GBPm) 517.3 501.6 507.4 2.0

Shares bought back (GBPm) 9.9 18.7 27.2 (47.1) (4)

--------------

Net overdraft (GBPm) (2.2) (3.5) (1.0) 120.0

Bank loans (GBPm) (11.8) (20.2) (35.1) (66.4)

----------------------------------------------- -------------- -------------- -------------- -------------

Net debt (GBPm) (14.0) (23.7) (36.1) (61.2)

Gearing (1) (%) (2.7) (4.7) (7.1) n/a

----------------------------------------------- -------------- -------------- -------------- -------------

Management and administration fees and

other expenses (GBPm) 3.7 3.7 7.4 0.0 (4)

----------------------------------------------- -------------- -------------- -------------- -------------

Ongoing charges figure (1) (%) 1.4 (5) 1.4 (5) 1.4 n/a

----------------------------------------------- -------------- -------------- -------------- -------------

(1) See Alternative Performance Measures on pages 43 to 45 of

the Half-Yearly Financial Report for the six months to 30 September

2023

(2) The second quarterly dividend declared has not been included

as a liability in the accounts

(3) Gross assets less liabilities excluding loans

(4) Percentage change based on comparable six month period to 30 September 2022

(5) For comparative purposes the figures have been annualised

CHAIRMAN'S STATEMENT

The half year to 30 September 2023 has continued to be truly

challenging for all, including investors. Multiple wars through to

inflation and sharply higher central bank interest rates; to rising

geopolitical friction; and to the challenges on climate change and

significant natural disasters remain headwinds for investors. To

this we can add the tragic events in Israel and the Middle East

descending back into conflict. The anticipated recovery in the

Chinese economy post Covid-19 has not met expectations and

continues to be a drag on global GDP. Understandably, volatility in

most markets has been elevated.

Despite all these challenges, it is pleasing to report that UEM

exhibited a strong performance in the half year to 30 September

2023 and delivered a positive NAV total return of 6.0%. This was

once again significantly ahead of the MSCI EM total return Index

which was down 0.9% over the same period.

UEM measures its performance on a total return basis over the

long term and the Investment Managers are seeking long term

performance to meet or exceed 10.0% per annum including a rising

dividend. Over one, three and five years and since inception, UEM

has outperformed the MSCI EM total return Index. The long term

annual compound NAV total return since inception to 30 September

2023 was 9.4%, exceeding the MSCI EM total return Index of

7.2%.

GLOBAL ECONOMY

As referred to above, there are numerous headwinds currently

faced by the markets, each of which is challenging in its own

right. We have historically discussed a number of these and they

largely remain unresolved. We continue to witness a significant

rise in nationalism, wealth inequality and global migration. All of

these issues and challenges no doubt continue to tear at the fabric

of our societies and institutions.

While Covid-19 is behind us, the legacy of Covid-19 and the

West's response to it has undoubtedly led to higher debt and higher

inflation in the developed western economies. Furthermore, the war

in Ukraine has seen sharply higher commodity prices and

accelerating inflation especially in Latin America. The response by

the central banks to higher inflation has been to rapidly raise

interest rates to bring inflation under control.

The markets are rightly concentrating on the US and the Federal

Reserve in particular, given the size of the US market and global

dominance of the US Dollar. The Federal Reserve is laser-focused on

reducing inflationary pressures by raising interest rates and has

encouraged the market to adopt a "higher for longer" outlook. The

resilience of the US markets has been unexpected. With GDP growth

in the last quarter of over 4.0% and unemployment remaining low, it

is unsurprising the Federal Reserve has raised rates to 5.25%. The

higher for longer expectation is starting to be seen in longer

duration treasuries. They started the half year at 3.5% and stood

at 4.6% as at 30 September 2023. This has had two outcomes: first,

many central banks reference the Federal Reserve and cannot risk

currency weakness by cutting rates in their local currency; and

second, investors have been reducing investments in equities and

moving into bonds.

Again, as we have noted before, the need to have resilient and

diversified supply chains, energy security, green energy and

increased defence capabilities will see resources diverted and

reinvested with an urgency and scale not previously witnessed in

our lifetime. This shift will give rise to new opportunities for

investors, including UEM. There are a number of megatrends that

should provide many of UEM's investment strong tailwinds.

EMERGING MARKETS

EM were mixed over the half year reflecting local headwinds,

higher interest rates and lower valuations. Bucharest's BET Index

was up 18.4%, Brazil's Bovespa Index was up 14.4%, the Indian

Sensex was up 11.6%, Chile's IPSA Index was up 9.6% and Vietnam's

Ho Chi Minh Index was up 8.4%. Meanwhile the Hong Kong Hang Seng

Index was down 12.7%, the Mexican Bolsa was down 5.6% and the

Philippine PSEI Index was down 2.7%. A common theme has been rising

inflation in Latin America and Eastern Europe and weakening

consumer confidence in Asia.

Most currencies continued to be weak against UK Sterling,

although the exceptions included the Mexican Peso, up 5.3%, the

Brazilian Real, up 2.6%, and the Hong Kong Dollar, up 1.5%. Oil

rose 19.5% over the six months to 30 September 2023, in response to

rising uncertainties and supply constraints.

UNLISTED INVESTMENTS (LEVEL 3 INVESTMENTS)

Over the half year to 30 September 2023, the value of the level

3 investments reduced to GBP43.8m from GBP58.7m as at 31 March

2023. This was driven mainly by reduced valuations on two

investments Petalite Limited ("Petalite") and Conversant Solutions

Pte Ltd ("Conversant"). As at 30 September 2023 the level 3

investments represented 8.2% of the total portfolio.

Petalite is a disruptive technology start up business and gives

UEM exposure to the electric vehicle revolution through charging

infrastructure. Conversant is a Singapore based provider of

internet network and edge computing services.

More details on these investments can be found in the Investment

Managers' Report.

REVENUE EARNINGS AND DIVID

It was disappointing to see UEM's revenue earnings per share

("EPS") decrease by 12.9% to 5.95p, in part due to having lower

average gearing and selling higher paying dividend investments.

UEM has declared two quarterly dividends of 2.15p each,

totalling 4.30p per share, a 3.6% increase over the previous half

year. Dividends remain fully covered by income. The retained

earnings revenue reserves increased by GBP3.3m to GBP12.9m as at 30

September 2023, equal to 6.53p per share.

The Board would like to re-emphasise that UEM's portfolio is

predominantly invested in relatively liquid, cash-generative

companies which have long-duration operational, infrastructure and

utility assets that the Company's Investment Managers believe are

structurally undervalued and offer the potential for excellent

total returns.

SHARE BUYBACKS

Disappointingly UEM's share price discount widened further over

the half year from 13.5% as at 31 March 2023 to 15.1% as at 30

September 2023. This remains well above the level that the Board

expects to see over the medium term. The Company has continued

buying back shares for cancellation, with 4.4m shares bought back

in the half year to 30 September 2023, at an average price of

222.14p.

While the Board is keen to see the discount narrow, any share

buyback remains an independent investment decision. Historically

the Company has bought back shares if the discount widens in normal

market conditions to over 10.0%. Since inception, UEM has bought

back 79.3m ordinary shares totalling GBP148.7m. The share buybacks

have contributed 0.3% to UEM's total returns during the six months

ended 30 September 2023.

ONGOING CHARGES

Ongoing charges were again unchanged at 1.4% for the year to 30

September 2023, a good result especially given the wider

inflationary environment.

BOARD

Your Board has consciously reduced to four Directors. This has

seen our gender diversity reduce to 25.0% which we note is below

targets set by the wider corporate governance framework. The Board

will continue to have regard to boardroom diversity during its

consideration of succession planning and future Board

appointments.

ADVISER AND INVESTOR COMMUNICATION

UEM is continuing to rejuvenate its marketing presentation and

draw attention to a number of megatrend tailwinds benefitting UEM.

The drive is to improve investor knowledge and broaden UEM's

investor base, especially the retail sector. The breadth of

coverage now being achieved by UEM is excellent and we hope that

once sentiment turns, there will be a rising trend of retail and

high net worth investors who will be inclined to buy into UEM.

OUTLOOK

The megatrends driving most emerging economies are expected to

continue and even accelerate over the coming year. The strong

results being reported by our investee companies combined with low

valuations leads us to remain optimistic that UEM offers

significant value to its shareholders.

John Rennocks

Chairman

21 November 2023

INVESTMENT MANAGERS' REPORT

It is good to see UEM deliver another positive NAV gain, with a

NAV total return for the half year to 30 September 2023 of 6.0%,

building on the 2.1% uplift for the year ended 31 March 2023. This

performance was again substantially ahead of the MSCI EM total

return Index which was down by 0.9% during the half year to 30

September 2023.

UEM's one year, three years, five years and since inception

performance is strongly ahead of the MSCI Index. UEM has delivered

this together with a rising dividend; a low beta (as at 30

September 2023, UEM's five year Sterling adjusted beta versus the

MSCI EM Index was 0.83); and with a portfolio which is very

different from the MSCI EM Index (UEM's active share is over

98.0%). This should be compelling to investors who want exposure to

infrastructure megatrends in EM, top performance and comparatively

low levels of volatility.

We were surprised and disappointed by the slow response of

China's economy to the lifting of Covid-19 restrictions, having

expected a surge in demand as China reopened, in line with other

economies. We increased our investments in China, including a

GBP7.5m position in Shanghai International Airport Co., Ltd

("SHIA") as at 31 March 2023 and in the half year to 30 September

2023, we added GBP1.0m to this position. However, the "revenge

travel" bounce seen in other economies has been slow to

materialise. Reflecting this the shares in SHIA have declined by

32.0% over the six months.

China's continued recovery will be a key factor, not only for

investments in China but also for the wider EM given the country's

high import/export led economy. It is an undoubted global growth

driver, and whilst the Chinese government continues to support the

economy, to date the stimulus policies have had limited impact.

The world is still faced with a number of unresolved deep-seated

challenges. As noted in the Chairman's Statement these range from

inflation to climate change. We have addressed these before, but it

is worth emphasising the inflation and interest rate outlook.

INFLATION AND INTEREST RATES

A year ago, we noted most central banks were grappling with

strongly rising inflation and the need to raise interest rates

higher. Most economies had negative real interest rates (inflation

running ahead of interest rates). Today many global economies are

faced with inflation subsiding and positive real interest rates.

This should mean central banks have room to reduce rates going

forward with a number of economies having record positive real

rates.

We believe that the US Federal Reserve is key to understanding

the outlook for most central banks, who do not want to reduce their

local rates, risking currency weakness and thereby imported

inflation. While it is true that a number of countries have

marginally reduced rates, they will naturally temper further cuts

by reference to the Federal Reserve. The US Dollar remains the

global reserve currency and will do so for some considerable time.

Given the nature of many emerging economies they are sensitive to

the US and therefore US Dollar interest rates.

The Federal Reserve in turn is being driven by the resilience in

the US economy. GDP increased last quarter at an annual rate of

4.9%; unemployment is under long term trends; and employment is

rising. Given the speed of the Federal Reserve interest rate rises

and the fact that the rate today of 5.25% is at a 22 year high, it

is remarkable that the world's biggest economy is so strong. It is

unsurprising the Federal Reserve has encouraged a "higher for

longer" stance as it sees the need to weaken the economy. We

believe the Federal Reserve could adopt this stance well into next

year. As such we see global interest rates remaining elevated.

This is important as it will be a drag on economies, but markets

are able to look to the future and we expect many EM to price in

these further opportunities to reduce rates. EM are well placed for

this gain in markets.

Inflation has not been as much of a challenge in Asia and we

suspect this results from higher unemployment levels at the start

of Covid-19. Consequently, wage pressures are lower, as is

inflation. It is worth noting that China's inflation is running at

under 2.0%.

MEGATRS

We have identified four megatrends that should underpin the

investment opportunities for UEM. These are Energy Transition,

Digital Infra, Social Infra and Global Trade. There are significant

structural shifts underway which will continue irrespective of

world macro or political pressures. While it is true that

urbanisation and the growth of the middle class continues to drive

much of the momentum in emerging economies, the megatrends are

seeing a determined accelerated shift in economic activity.

Energy transition is seeing an enormous investment in renewable

energy and the infrastructure which is needed to support it. To

grow their economies EM need to invest in energy supply. As an

observation energy demand often outstrips GDP growth as economies

expand and many EM are choosing to invest in renewables to support

that growth. While the developed world is typically shifting from

fossil fuels to renewables, emerging economies have an advantage

that they can look to renewables rather than fossil fuels to

develop. It is no accident that many EM already have a higher

renewables mix as a result, with many looking to phase out existing

fossil fuel capacity as well. This shift is providing many

investment opportunities for UEM including the renewable asset

owners, such as Omega Energia; the transmission grid operators

connecting up wind and solar farms, such as Power Grid Corporation

of India Limited; and legacy power generation companies which are

transitioning from coal to renewables, such as Engie Energia Chile

S.A.

Digital infra is an enabler of structural change and

technological innovation globally and especially in EM. Fast,

universal and affordable access to the internet is increasingly

considered a necessary utility, even in the least developed

markets. There are attractive opportunities to invest in companies

offering and improving 4G and 5G mobile connectivity and fibre

broadband direct to consumers and in passive infrastructure

companies offering mobile towers, fibre connections and data centre

services to telecoms operators and other corporate clients. EM

companies can deliver IT services and software development to

global clients in a cost-effective way, such as FPT Corporation and

Telelink Business Services. The continuing rapid growth in data

consumption is driving demand for new data centres, such as Korean

Internet Neutral Exchange, which is building a new data centre in

Seoul, due to complete in 2024.

Social infra development is a critical requirement for EM.

Urbanisation is driving significant demand for the essential

services which support improved quality of life, such as water and

sewerage connections, waste facilities, electricity connections and

healthcare. In many EM the social infrastructure outside of the

major cities is often under-developed, and governments are

committing significant resources towards improving this directly or

through incentivised schemes, such as public-private partnerships.

Water, waste and electricity distribution businesses are natural

monopolies and are typically highly regulated with opportunities

such as Aguas Andinas and Cia de Saneamento Basico do Estado de Sao

Paulo ("Sabesp") offering predictable, long-term returns. Solid

waste operators, such as Orizon Valorizacao de Residuos S.A.

("Orizon"), tend to be more commercial, with opportunities to move

up the value chain (e.g. biogas, carbon credits) as well as to

consolidate fragmented, nascent markets.

Global trade is continually evolving and historically has been

dominated by more developed countries. However, by 2040 EM as a

percentage of global GDP is expected to exceed that of developed

markets, being driven by increases in EM's GDP per capita, growth

in consumption and improvements in productivity. This long term

shift towards EM is therefore providing investment opportunities,

such as International Container Terminal Services, Inc. ("ICT").

However, over the last two to five years there have been additional

forces changing the way in which global trade is conducted.

Covid-19 caused manufacturers to reassess their global supply

chains, resulting in many now having more than one manufacturing

location, to ensure supply chains are more diversified, resilient

and stable so they can trade through supply shock disruptions.

Countries such as Mexico, India and Vietnam are benefiting from

this. Furthermore, there has been a reshaping of the competitive

environment; the geopolitical tensions and competition between the

US and China has impacted the multilateral trading systems; and the

war in Ukraine has also added another dynamic. The desire to bring

production of goods closer to the final consumer is driving near

shoring and friend shoring. Mexico is one country that is

benefiting here.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ("ESG")

ESG remains a continued focus for UEM. ICM has implemented a

sound and robust framework enabling it to engage with portfolio

companies. ICM sees this as a journey on which it expects to see

changes in behaviour and outcomes over time. While the key driver

for investments by UEM is equity total returns, to UEM the clear

expectation is the need for all portfolio businesses to engage in

processes which meet global expectations. There can be no doubt

that companies will face increased scrutiny from all investors and

the public over ESG issues and UEM's portfolio needs to be on that

journey.

CLIMATE CHANGE

Climate change remains at the forefront of global debate,

heightened by the increased impact of climate disasters worldwide.

The past year has provided a stark reminder of the devastation that

can arise from climate change-related disasters. We have been aware

of the impacts of climate and the El Nino and La Nina phases and

have tracked for some time hydrology and the impact on rivers, dams

and agricultures in Brazil. Rainfall can and does impact energy

pricing and agriculture output.

It is obvious that climate-driven events are becoming more

frequent and severe. This can range from days lost at a port due to

disruptive weather through to flooding and the evident social

impacts on clean water. Climate change risk is monitored across the

portfolio, however predicting the likelihood and impact of events

remains a difficult task. Currently, we see geographical

diversification as the best way to mitigate the risk posed by

climate-related disasters.

PORTFOLIO

UEM's gross assets (less liabilities excluding loans) decreased

to GBP529.2m as at 30 September 2023 from GBP542.5m as at 31 March

2023. This reflects the repayment of bank loans of GBP22.7m, the

share buybacks of GBP9.9m and net capital returns of GBP16.5m in

the half year.

As at 30 September 2023 the top thirty holdings accounted for

71.5% of the total portfolio (31 March 2023: 67.7%). There have

been new entrants into the top thirty holdings over the half year.

UEM increased its investment in Sabesp by GBP2.0m and Omega Energia

S.A. by GBP1.2m. This together with some strong share price

performances from PT Pertamina Geothermal Energy Tbk. up by 108.7%

and TTS (Transport Trade Services) S.A. up by 73.6%, moved them all

into the top thirty holdings. Ocean Wilsons Holdings Limited's

share price firmed by 7.9% and this moved it into thirtieth

position as we reduced other holdings.

UEM halved its holdings in the Mexican Airports and they

continue to perform exceptionally well at an operating level.

However, given the strong performance and some uncertainties around

the regulation of the concessions as they come up for renewal, this

resulted in a reduction of our positions by GBP12.3m. Fortuitously,

an element of the regulatory framework was changed by the

government, surprising the market and the shares sold off

significantly in October 2023. As noted, SHIA failed to see a

strong bounce in international passengers and muted customer

spending and its share price declined by 32.0%. Grupo Traxion

S.A.B. de C.V.'s share price fell by 20.4% following a clumsy

secondary placement. These holdings all fell out of the top thirty

as a result.

Purchases in the portfolio decreased to GBP24.5m in the half

year ended 30 September 2023 (30 September 2022: GBP52.6m) and

realisations decreased to GBP56.4m (30 September 2022: GBP67.3m).

This reflects in part, a reluctance to invest when uncertainties

are rising over China's economic recovery, together with the

uncertainties over US interest rates. An active decision was

therefore taken to slowly decrease UEM's debt. UEM ended the half

year with its bank loans at GBP11.8m, 23.7 % of the available

GBP50.0m facility

(31 March 2023: GBP35.1m).

LEVEL 3 INVESTMENTS

UEM ended the half year to 30 September 2023 with level 3

investments totalling GBP43.8m (31 March 2023: GBP58.7m),

representing 8.2% of total investments (31 March 2023: 10.8%). The

decrease in the half year resulted mainly from reduced valuations

for Petalite and Conversant. There were also realisations of

GBP4.3m mainly from the sale of an unlisted renewables company in

India which saw GBP3.7m returned to UEM. The sale resulted in UEM

realising an annual rate of return of 24.8% in Sterling terms after

tax on the investment.

In 2020 UEM initially invested a modest amount in Petalite and

provided additional investment in June 2022 following significant

progress as part of the introduction of a strategic partner and

investor. Based on the valuation of the June 2022 fundraise, the

holding in Petalite was valued upwards to GBP28.6m as at 31 March

2023. While progress continues to be made, in the wider market

comparable valuations for listed peers have softened. In line with

this, UEM reduced the Petalite carrying value by 12.9% as at 30

September 2023. Petalite signed a co-development agreement with a

major UK charge point operator and in October 2023 UEM provided a

temporary GBP2.5m loan facility to Petalite to support the business

whilst it completes a Series A fundraise.

Conversant reported strong operating results and raised new

equity at SGD 6.00 per share in 2022. However, UEM has now been

more cautious on its near-term prospects following the unexpected

death of the founder in late 2022. Based on Conversant's profit

expectations for 2023, as well as peer group multiples, UEM has

conservatively marked the valuation down by 57.2% to SGD 2.57 per

share.

SHARE BUYBACKS

UEM continues to actively buy back its shares. In the half year

to 30 September 2023 UEM bought back 4.4m shares at GBP9.9m. The

average price paid over the six months to 30 September 2023 was

222.14p per share. This was enhancing to NAV per share which was

261.58p as at 30 September 2023.

Since inception UEM has bought back 79.3m shares at a cost of

GBP148.7m and an average price of 187.06p.

BANK DEBT

UEM's net debt, being bank loans and overdrafts less cash,

decreased significantly over the half year from GBP36.1m as at 31

March 2023 to GBP14.0m as at 30 September 2023. UEM's GBP50.0m

committed multicurrency loan facility matures in March 2024.

REVENUE RETURN

Revenue income decreased 12.4% to GBP14.8m for the six months to

30 September 2023, from GBP16.9m for the six months to 30 September

2022. This arose from a marginal shift in the portfolio to

companies investing for the longer term in companies such as Orizon

and selling higher paying dividend investments.

Management fees and other expenses were largely unchanged at

GBP1.6m for the half year. While finance costs doubled, they

remained modest at GBP0.2m. Taxation rose by 10.0% to GBP1.1m for

the period to 30 September 2023, prior half year was GBP1.0m.

Arising from the above, profit for the half year decreased by

17.4% to GBP11.9m from GBP14.4m at the prior half year. EPS

decreased by 12.9% to 5.95p compared to the prior half year of

6.83p with the decrease in profit being offset by a reduced average

number of shares in issue following buybacks. Dividends per share

of 4.30p were fully covered by earnings.

Retained revenue reserves rose to GBP12.9m as at 30 September

2023, equating to 6.53p per share.

CAPITAL RETURN

The portfolio gained GBP19.3m during the half year to 30

September 2023 (30 September 2022: loss of GBP28.6m). There were

gains on foreign exchange of GBP0.4m (30 September 2022: loss of

GBP0.6m). The resultant total income gain on the capital return was

GBP19.7m against prior half year loss of GBP29.3m.

Management and administration fees were largely unchanged at

GBP2.2m for the half year. Finance costs remain modest at GBP0.7m

but rose by 250.0% in the half year as a result of higher interest

rate costs from GBP0.2m in the prior half year. Taxation was a cost

of GBP0.3m in the half year versus a gain of GBP0.1m in the prior

half year, which arose mainly from increased Indian deferred

capital gains tax on unrealised gains in the period. The net effect

of the above was a gain on capital return of GBP16.5m (30 September

2022: a loss of GBP31.6m).

INVESTOR COMMUNICATION

We have been increasing the marketing of UEM to the wider

investment community, including retail investors, through a number

of initiatives. These include regular publications of research

notes from UEM's broker, Shore Capital and Corporate Limited and

Edison Investment Research Limited; utilising the Investor Meet

Company platform which provides an excellent recorded video

platform for communicating to individual investors; and increasing

the content on UEM's website via our 'insights' page.

Charles Jillings

ICM Investment Management Limited and ICM Limited

21 November 2023

HALF-YEARLY FINANCIAL REPORT AND RESPONSIBILITY STATEMENT

The Chairman's Statement and the Investment Managers' Report

give details of the important events which have occurred during the

period and their impact on the financial statements.

PRINCIPAL RISKS AND UNCERTAINTIES

Most of UEM's principal risks and uncertainties are market

related and are similar to those of other investment companies

investing mainly in listed equities in emerging markets.

The principal risks and uncertainties were described in more

detail under the heading "Principal Risks and Risk Mitigation"

within the Strategic Report section of the Annual Report and

Accounts for the year ended 31 March 2023 and have not changed

materially since the date of that document.

The principal risks faced by UEM include not achieving long term

total returns for its shareholders, adverse market conditions

leading to a fall in NAV, loss of key management, its shares

trading at a discount to NAV, losses due to inadequate controls of

third party service providers, gearing risk and regulatory risk. In

addition, the Board continues to monitor a number of emerging risks

that could potentially impact the Company, the principal ones being

geopolitical risk and climate change risk.

The Annual Report and Accounts is available on the Company's

website, www.uemtrust.co.uk

RELATED PARTY TRANSACTIONS

Details of related party transactions in the six months to 30

September 2023 are set out in note 9 to the accounts and details of

the fees paid to the Investment Managers are set out in note 2 to

the accounts. Directors' fees were increased by approximately 5.0%

with effect from 1 April 2023 to: Chairman GBP52,500 per annum;

Chair of Audit & Risk Committee GBP49,100 per annum; and other

Directors GBP38,900 per annum.

The net fee entitlement of each Director is satisfied in shares

of the Company, purchased in the market by each Director at around

each quarter end.

DIRECTORS' RESPONSIBILITY STATEMENT

In accordance with Chapter 4 of the Disclosure Guidance and

Transparency Rules, the Directors confirm that to the best of their

knowledge:

-- the condensed set of financial statements contained within

the report for the six months to 30 September 2023 has been

prepared in accordance with International Accounting Standard 34

"Interim Financial Reporting" on a going concern basis and gives a

true and fair view of the assets, liabilities, financial position

and return of the Company;

-- the half-yearly report, together with the Chairman's

Statement and Investment Managers' Report, includes a fair review

of the important events that have occurred during the first six

months of the financial year and their impact on the financial

statements as required by DTR 4.2.7R;

-- the Directors' statement of principal risks and uncertainties

above is a fair review of the principal risks and uncertainties for

the remainder of the year as required by DTR 4.2.7R; and

-- the half-yearly report includes a fair review of the related

party transactions that have taken place in the first six months of

the financial year as required by DTR 4.2.8R.

On behalf of the Board

John Rennocks

Chairman

21 November 2023

CONDENSED STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

Six months to Six months to

30 September 2023 30 September 2022

Notes Revenue Capital Total Revenue Capital Total

return return return return return return

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

----------------------------------------------- -------- -------- -------- -------- -------- --------

Gains/(losses) on investments - 19,284 19,284 - (28,628) (28,628)

Foreign exchange gains/(losses) - 403 403 - (623) (623)

Investment and other income 14,758 - 14,758 16,887 - 16,887

----------------------------------------------- -------- -------- -------- -------- -------- --------

Total income/(loss) 14,758 19,687 34,445 16,887 (29,251) (12,364)

2 Management and administration fees (699) (2,169) (2,868) (712) (2,216) (2,928)

Other expenses (877) - (877) (789) - (789)

----------------------------------------------- -------- -------- -------- -------- -------- --------

Profit/(loss) before finance costs and taxation 13,182 17,518 30,700 15,386 (31,467) (16,081)

Finance costs (166) (663) (829) (50) (199) (249)

----------------------------------------------- -------- -------- -------- -------- -------- --------

Profit/(loss) before taxation 13,016 16,855 29,871 15,336 (31,666) (16,330)

3 Taxation (1,076) (315) (1,391) (954) 85 (869)

----------------------------------------------- -------- -------- -------- -------- -------- --------

Profit/(loss) for the period 11,940 16,540 28,480 14,382 (31,581) (17,199)

----------------------------------------------- -------- -------- -------- -------- -------- --------

4 Earnings per share (basic) - pence 5.95 8.24 14.19 6.83 (14.99) (8.16)

----------------------------------------------- -------- -------- -------- -------- -------- --------

All items in the above statement derive from continuing

operations.

The 'Total' column of this statement is the profit and loss

account of the Company and the 'Revenue' and 'Capital' columns

represent supplementary information prepared under guidance issued

by the Association of Investment Companies.

The net return on ordinary activities after taxation represents

the profit for the period and also the total comprehensive

Income.

CONDENSED STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

for the six months to 30 September 2023

Ordinary Capital Retained earnings

Notes share Merger redemption Special Capital Revenue

capital reserve reserve reserve reserves reserve Total

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

--------------------------------- -------- -------- ---------- -------- --------- -------- --------

Balance as at 31 March 2023 2,023 76,706 322 432,577 (13,841) 9,587 507,374

Shares purchased by the

7 Company and cancelled (45) - 45 (9,918) - - (9,918)

Profit for the period - - - - 16,540 11,940 28,480

5 Dividends paid in the period - - - - - (8,614) (8,614)

Balance as at 30 September 2023 1,978 76,706 367 422,659 2,699 12,913 517,322

--------------------------------- -------- -------- ---------- -------- --------- -------- --------

for the six months to 30 September 2022

Ordinary Capital Retained earnings

Notes share Merger redemption Special Capital Revenue

capital reserve reserve reserve reserves reserve Total

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

--------------------------------- -------- -------- ---------- -------- --------- -------- --------

Balance as at 31 March 2022 2,148 76,706 197 459,736 (139) 7,268 545,916

Shares purchased by the

7 Company and cancelled (86) - 86 (18,674) - - (18,674)

(Loss)/profit for the period - - - - (31,581) 14,382 (17,199)

5 Dividends paid in the period - - - - - (8,414) (8,414)

Balance as at 30 September 2022 2,062 76,706 283 441,062 (31,720) 13,236 501,629

--------------------------------- -------- -------- ---------- -------- --------- -------- --------

for the year ended 31 March 2023

Ordinary Capital Retained earnings

Notes share Merger redemption Special Capital Revenue

capital reserve reserve reserve reserves reserve Total

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

--------------------------- -------- -------- ---------- -------- --------- -------- --------

Balance as at 31 March 2022 2,148 76,706 197 459,736 (139) 7,268 545,916

Shares purchased by the

7 Company and cancelled (125) - 125 (27,159) - - (27,159)

(Loss)/profit for the year - - - - (13,702) 19,474 5,772

5 Dividends paid in the year - - - - - (17,155) (17,155)

--------------------------- -------- -------- ---------- -------- --------- -------- --------

Balance as at 31 March 2023 2,023 76,706 322 432,577 (13,841) 9,587 507,374

--------------------------- -------- -------- ---------- -------- --------- -------- --------

CONDENSED STATEMENT OF FINANCIAL POSITION (UNAUDITED)

Notes as at 30 Sep 2023 30 Sep 2022 31 Mar 2023

GBP'000s GBP'000s GBP'000s

------------------------------------- ----------- ----------- -----------

Non-current assets

11 Investments 533,066 528,400 545,657

------------------------------------- ----------- ----------- -----------

Current assets

Other receivables 2,460 2,351 1,444

Cash and cash equivalents 774 907 456

------------------------------------- ----------- ----------- -----------

3,234 3,258 1,900

------------------------------------- ----------- ----------- -----------

Current liabilities

Other payables (5,206) (8,002) (3,461)

Bank loans (11,837) - (35,102)

------------------------------------- ----------- ----------- -----------

(17,043) (8,002) (38,563)

------------------------------------- ----------- ----------- -----------

Net current liabilities (13,809) (4,744) (36,663)

------------------------------------- ----------- ----------- -----------

Total assets less current liabilities 519,257 523,656 508,994

Non-current liabilities

6 Bank loans - (20,185) -

Deferred tax (1,935) (1,842) (1,620)

------------------------------------- ----------- -----------

Net assets 517,322 501,629 507,374

------------------------------------- ----------- ----------- -----------

Equity attributable to equity holders

7 Ordinary share capital 1,978 2,062 2,023

Merger reserve 76,706 76,706 76,706

Capital redemption reserve 367 283 322

Special reserve 422,659 441,062 432,577

Capital reserves 2,699 (31,720) (13,841)

Revenue reserve 12,913 13,236 9,587

------------------------------------- ----------- ----------- -----------

Total attributable to equity holders 517,322 501,629 507,374

------------------------------------- ----------- ----------- -----------

8 Net asset value per share

Basic - pence 261.58 243.29 250.91

------------------------------------- ----------- ----------- -----------

CONDENSED STATEMENT OF CASH FLOWS ( UNAUDITED)

Six months to Six months to Year to

30 Sep 2023 30 Sep 2022 31 Mar 2023

GBP'000s GBP'000s GBP'000s

------------------------------------------------------ -------------- -------------- -------------

Operating activities

Profit/(loss) before taxation 29,871 (16,330) 7,198

Deduct investment income - dividends (13,890) (16,184) (22,671)

Deduct investment income - interest (828) (702) (1,627)

Deduct bank interest received (40) (1) (28)

Add back interest charged 829 249 843

Add back (gains)/losses on investments (19,284) 28,628 8,389

Add back foreign currency (gains)/losses (403) 623 515

Increase in other receivables (31) (33) (31)

Decrease in other payables (20) (50) (88)

------------------------------------------------------ -------------- -------------- -------------

Net cash outflow from operating activities

before dividends and interest (3,796) (3,800) (7,500)

Interest paid (1,044) (241) (646)

Dividends received 13,444 15,069 22,417

Investment income - interest received 321 236 475

Bank interest received 40 1 28

Taxation paid (1,086) (912) (1,691)

------------------------------------------------------ -------------- -------------- -------------

Net cash inflow from operating activities 7,879 10,353 13,083

------------------------------------------------------ -------------- -------------- -------------

Investing activities

Purchases of investments (23,368) (50,888) (106,821)

Sales of investments 55,550 67,208 125,649

Net cash inflow from investing activities 32,182 16,320 18,828

------------------------------------------------------ -------------- -------------- -------------

Financing activities

Repurchase of shares for cancellation (9,751) (18,144) (27,159)

Dividends paid (8,614) (8,414) (17,155)

Drawdown of bank loans 1,599 4,280 35,385

Repayment of bank loans (24,283) (8,536) (24,440)

Net cash outflow from financing activities (41,049) (30,814) (33,369)

------------------------------------------------------ -------------- -------------- -------------

Decrease in cash and cash equivalents (988) (4,141) (1,458)

Cash and cash equivalents at the start of the period (1,026) 452 452

Effect of movement in foreign exchange (178) 157 (20)

------------------------------------------------------ -------------- -------------- -------------

Cash and cash equivalents at the end of the period (2,192) (3,532) (1,026)

------------------------------------------------------ -------------- -------------- -------------

Comprised of:

Cash 774 907 456

Bank overdraft (2,966) (4,439) (1,482)

---------------- -------- -------- --------

Total (2,192) (3,532) (1,026)

---------------- -------- -------- --------

NOTES TO THE ACCOUNTS (UNAUDITED)

1. ACCOUNTING POLICIES

The Company is an investment company incorporated in the United

Kingdom with a premium listing on the London Stock Exchange.

The unaudited condensed accounts have been prepared in

accordance with UK adopted International Accounting Standards,

which comprise standards and interpretations approved by the IASB

and International Accounting Standards and Standing Interpretations

Committee interpretations approved by the IASC that remain in

effect and to the extent that they are in conformity with the

requirement of the Companies Act 2006 ("IFRS"), IAS 34 "Interim

Financial Reporting" and the accounting policies set out in the

audited statutory accounts for the year ended 31 March 2023.

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates. The significant judgements

made by the Directors in applying the accounting policies and key

sources of uncertainty were the same as those applied to the

financial statements as at and for the year ended 31 March

2023.

The condensed Accounts do not include all of the information

required for full annual accounts and should be read in conjunction

with the accounts of the Company for the year ended 31 March 2023,

which were prepared under full IFRS requirements.

2. MANAGEMENT AND ADMINISTRATION FEES

The Company has appointed ICMIM as its Alternative Investment

Fund Manager and joint portfolio manager with ICM, for which they

are entitled to a management fee. The aggregate fees payable by the

Company are apportioned between the Investment Managers as agreed

by them.

The relationship between ICMIM and ICM is compliant with the

requirements of the UK version of the EU Alternative Investment

Fund Managers Directive as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018, as amended, and

also such other requirements applicable to ICMIM by virtue of its

regulation by the Financial Conduct Authority.

The annual management fee is a tiered structure as follows: 1.0%

of NAV up to and including GBP500m; 0.9% of NAV exceeding GBP500m

up to and including GBP750m; 0.85% of NAV exceeding GBP750m up to

and including GBP1,000m; and 0.75% of NAV exceeding GBP1,000m,

payable quarterly in arrears. The management fee is allocated 80%

to capital return and 20% to revenue return. The investment

management agreement may be terminated upon six months' notice.

ICMIM also provides company secretarial services to the Company,

with the Company paying GBP35,000 (30 September 2022: GBP35,000 and

31 March 2023: GBP70,000) equivalent to 45% of the costs associated

with this office and recharges research fees to the Company based

on a budget of GBP0.3m per annum, paid quarterly in arrears. These

charges are allocated 80% to capital return and 20% to revenue

return.

JPMorgan Chase Bank N.A. - London Branch has been appointed

Administrator and ICMIM has appointed Waverton to provide certain

support services (including middle office, market dealing and

information technology support services).

3. TAXATION

The revenue return taxation charge of GBP1,076,000 (30 September

2022: GBP954,000 and 31 March 2023: GBP1,638,000) relates to

irrecoverable overseas taxation suffered on dividend and interest

income.

The capital return taxation expense of GBP315,000 (30 September

2022: income of GBP85,000 and 31 March 2023: income of GBP212,000)

relates to capital gains on realised gains on sale of overseas

investments and deferred tax in respect of capital gains tax on

overseas unrealised investment gains that may be subject to

taxation in future years.

4. EARNINGS PER SHARE

Earnings per share is the profit attributable to shareholders

and based on the following data:

Six months to Six months to Year to

30 Sep 2023 30 Sep 2022 31 Mar 2023

GBP'000s GBP'000s GBP'000s

-------------------------------------------------------------- -------------- -------------- -------------

Revenue return 11,940 14,382 19,474

Capital return 16,540 (31,581) (13,702)

-------------------------------------------------------------- -------------- -------------- -------------

Total return 28,480 (17,199) 5,772

-------------------------------------------------------------- -------------- -------------- -------------

Number Number Number

-------------------------------------------------------------- -------------- -------------- -------------

Weighted average number of ordinary shares in issue

during the period for basic earnings per share calculations 200,672,201 210,727,891 207,220,648

-------------------------------------------------------------- -------------- -------------- -------------

Pence Pence Pence

-------------------------------------------------------------- -------------- -------------- -------------

Revenue return per share 5.95 6.83 9.40

Capital return per share 8.24 (14.99) (6.61)

-------------------------------------------------------------- -------------- -------------- -------------

Total return per share 14.19 (8.16) 2.79

-------------------------------------------------------------- -------------- -------------- -------------

5. DIVIDS

30 Sep

2023

Record date Payment date GBP'000s 30 Sep 2022 GBP'000s 31 Mar 2023 GBP'000s

----------------------------- ------------- -------------- ---------- --------------------- ---------------------

2022 Fourth quarterly

dividend of 2.00p per share 06-Jun-22 24-Jun-22 - 4,250 4,250

2023 First quarterly

dividend of 2.00p per share 02-Sep-22 23-Sep-22 - 4,164 4,164

2023 Second quarterly

dividend of 2.15p per share 02-Dec-22 16-Dec-22 - - 4,384

2023 Third quarterly

dividend of 2.15p per share 03-Mar-23 24-Mar-23 - - 4,357

2023 Fourth quarterly -

dividend of 2.15p per share 02-Jun-23 23-Jun-23 4,334 -

2024 First quarterly -

dividend of 2.15p per share 01-Sep-23 22-Sep-23 4,280 -

----------------------------- ------------- -------------- ---------- --------------------- ---------------------

8,614 8,414 17,155

---------------------------------------------------------- ---------- --------------------- ---------------------

The Directors have declared a second quarterly dividend in

respect of the year ending 31 March 2024 of 2.15p per share payable

on 15 December 2023 to shareholders on the register at close of

business on 1 December 2023. The total cost of the dividend, which

has not been accrued in the results for the six months to 30

September 2023, is GBP4,217,000 based on 196,121,375 shares in

issue as at 20 November 2023.

6. BANK LOANS

The Company has an unsecured committed senior multicurrency

revolving facility of GBP50,000,000 with the Bank of Nova Scotia,

London Branch expiring on 15 March 2024. Commitment fees are

charged on any undrawn amounts at commercial rates. The terms of

the loan facility, including those related to accelerated repayment

and costs of repayment, are typical of those normally found in

facilities of this nature. The existing loan rolls over on a

periodic basis subject to usual conditions including a covenant

with which the Company is comfortable it can ensure compliance

As at 30 September 2023 GBP11,837,000 (30 September 2022:

GBP20,185,000 and 31 March 2023: GBP35,102,000) was drawn down.

7. ORDINARY SHARE CAPITAL

Issued, called up and fully paid

Ordinary shares of 1p each Number GBP'000s

------------------------------------------- ------------ ---------

Balance as at 31 March 2023 202,212,256 2,023

Purchased for cancellation by the Company (4,441,578) (45)

-------------------------------------------- ------------ ---------

Balance as at 30 September 2023 197,770,678 1,978

-------------------------------------------- ------------ ---------

During the period the Company bought back for cancellation

4,441,578 (30 September 2022: 8,560,692 and 31 March 2023:

12,531,811) ordinary shares at a total cost of GBP9,918,000 (30

September 2022: GBP18,674,000 and 31 March 2023: GBP27,159,000). A

further 1,649,303 ordinary shares have been purchased for

cancellation at a total cost of GBP3,543,000 since the period

end.

8. NET ASSET VALUE PER SHARE

The NAV per share is based on the net assets attributable to the

equity shareholders of GBP517,322,000 (30 September 2022:

GBP501,629,000 and 31 March 2023: GBP507,374,000) and on

197,770,678 ordinary shares, being the number of ordinary shares in

issue at the period end (30 September 2022: 206,183,375 and 31

March 2023: 202,212,256).

9. RELATED PARTY TRANSACTIONS

The following are considered related parties of the Company: the

subsidiary undertakings (UEM (HK) Limited and UEM Mauritius

Holdings Limited), the associates of the Company (East Balkan

Properties plc, Petalite Limited ("Petalite") and Pitch Hero

Holdings Limited), the Board of UEM, ICM and ICMIM (the Company's

joint portfolio managers), Mr Saville, Mr Jillings (a key

management person of ICMIM) and UIL Limited.

As at 30 September 2023 the fair value of the loan held with UEM

(HK) Limited was GBP9,706,000 and loan interest accrued was

GBP71,000 (30 September 2022: GBP11,871,000 and GBP77,000

respectively and 31 March 2023: GBP10,118,000 and GBP71,000

respectively). In the period GBP406,000 loan interest was

capitalised. As at 30 September 2023, the fair value of the equity

holdings held in UEM(HK) Limited was GBPnil (30 September 2023:

GBP1,128,000 and 31 March 2023 GBP1,498,000). During the period the

Company did not receive any amounts from or make payments to UEM

Mauritius Holdings Limited.

There were no transactions with East Balkan Properties plc or

Petalite Limited.

Pursuant to an extension and amendment (dated 24 August 2023) of

a loan agreement dated 1 March 2021 under which UEM has agreed to

loan monies to Pitch Hero, UEM advanced to Pitch Hero GBP50,000 on

25 August 2023. As at 30 September 2023, the balance of the loan

and interest outstanding was GBP535,000 (30 September 2022:

GBP162,000 and 31 March 2023: GBP470,000). The loan bears interest

at an annual rate of 10% (prior to 24 August 2023 the rate was 5%).

The first repayment date is 25 August 2024, with a final repayment

date of 25 August 2027.

The Board received aggregate remuneration of GBP108,000 (30

September 2022: GBP121,000 and 31 March 2023: GBP225,000) included

within "Other expenses" for services as Directors. As at the period

end, GBPnil (30 September 2022: GBPnil and 31 March 2023: GBPnil)

remained outstanding to the Directors. In addition to their fees,

the Directors received dividends totalling GBP21,000 (30 September

2022: GBP26,000 and 31 March 2023: GBP45,000) during the period

under review in respect of their shareholdings in the Company.

There were no further transactions with the Board during the

period.

There were no transactions with ICM, ICMIM, ICM Investment

Research Limited or ICM Corporate Services (Pty) Ltd, subsidiaries

of ICM, other than investment management, secretarial costs,

research fees as set out in note 2 of GBP2,701,000 (30 September

2022: GBP2,770,000 and 31 March 2023: GBP5,420,000) and reimbursed

expenses included within Other Expenses of GBP30,000 (30 September

2022: GBP2,000 and 31 March 2023: GBP134,000). As at the period end

GBP1,345,000 (30 September 2022: GBP1,382,000 and 31 March 2023:

GBP1,330,000) remained outstanding in respect of management,

company secretarial and research fees.

Mr Jillings received dividends totalling GBP20,000 (30 September

2022: GBP18,000 and 31 March 2023: GBP38,000) and UIL Limited

received dividends totalling GBP784,000 (30 September 2022:

GBP1,178,000 and 31 March 2023: GBP2,051,000).

10. GOING CONCERN

Notwithstanding that the Company has reported net current

liabilities of GBP13,809,000 as at 30 September 2023 (30 September

2022: GBP4,744,000 and 31 March 2023: GBP36,663,000), the financial

statements have been prepared on a going concern basis which the

Directors consider to be appropriate for the following reasons. The

Board's going concern assessment has focused on the forecast

liquidity of the Company for at least twelve months from the date

of approval of the financial statements. This analysis assumes that

the Company would, if necessary, be able to meet some of its short

term obligations through the sale of listed securities, which

represented 91.8% of the Company's total portfolio as at 30

September 2023. As part of this assessment the Board has considered

a severe but plausible downside that reflects the impact of the

Company's key risks and an assessment of the Company's ability to

meet its liabilities as they fall due assuming a significant

reduction in asset values and accompanying currency volatility.

The Board also considered reverse stress testing to identify the

reduction in the valuation of liquid investments that would cause

the Company to be unable to meet its net liabilities, being

primarily the bank loan. The Board is confident that the reduction

in asset values implied by the reverse stress test is not plausible

even in the current volatile environment. Consequently, the

Directors believe that the Company will have sufficient funds to

continue to meet its liabilities as they fall due for at least

twelve months from the date of approval of the financial

statements.

As at the period end, the Company had a GBP50m unsecured

multicurrency loan facility with Bank of Nova Scotia, London

Branch, expiring on 15 March 2024. The Company will either extend

or replace the facility or repay the outstanding debt when due from

portfolio realisations

Accordingly, the Board considers it appropriate to continue to

adopt the going concern basis in preparing the accounts.

11. FAIR VALUE HIERARCHY

IFRS 13 'Financial Instruments: Disclosures' require an entity

to classify fair value measurements using a fair value hierarchy

that reflects the significance of the inputs used in making the

measurements. The fair value hierarchy shall have the following

levels:

Level 1 reflects financial instruments quoted in an active

market.

Level 2 reflects financial instruments whose fair value is

evidenced by comparison with other observable current market

transactions in the same instrument or based on a valuation

technique whose variables include only data from observable

markets.

Level 3 reflects financial instruments whose fair value is

determined in whole or in part using a valuation technique based on

assumptions that are not supported by prices from observable market

transactions in the same instrument and not based on available

observable market data.

The financial assets and liabilities measured at fair value in

the statement of financial position are grouped into the fair value

hierarchy as follows:

30 Sep 2023

Level 1 Level 2 Level 3 Total

GBP'000s GBP'000s GBP'000s GBP'000s

------------- ---------- ---------- ---------- ------------

Investments 481,123 8,160 43,783 533,066

------------- ---------- ---------- ---------- ------------

30 Sep 2022

Total

Level 1 GBP'000s Level 2 GBP'000s Level 3 GBP'000s GBP'000s

------------- ----------------- ----------------- ----------------- ------------

Investments 469,777 9,125 49,498 528,400

------------- ----------------- ----------------- ----------------- ------------

31 Mar 2023

Total

Level 1 GBP'000s Level 2 GBP'000s Level 3 GBP'000s GBP'000s

------------- ----------------- ----------------- ----------------- ------------

Investments 483,146 3,818 58,693 545,657

------------- ----------------- ----------------- ----------------- ------------

During the period two stocks with a value of GBP4.6m were

transferred from level 1 to level 2 due to the investee company

shares trading irregularly. The book cost and fair value was

transferred using the 31 March 2023 balances, and all subsequent

trades are therefore disclosed in the level 2 column (30 September

2023: one stock with a value of GBP5.5m was transferred from level

1 to level 2 due to the investee company shares trading irregularly

and 31 March 2023: one stock with value of GBP1.7m was transferred

from level 1 to level 2 due to the investee company shares trading

irregularly, three stocks with value of GBP8.0m were transferred

from level 2 to level 1 due to the investee companies shares

resuming regular trading in the year, one stock with value of

GBP0.8m was transferred from level 3 to level 1 due to the investee

company shares becoming listed and one stock transferred from level

1 to level 3 at GBPnil value due to the investee company shares

being suspended from trading. The book cost and fair value was

transferred using the 31 March 2022 balances except for the stock

that was suspended, the book cost and fair value transferred at the

time of suspension).

A reconciliation of fair value measurements in level 3 is set

out in the following table:

Six months to Six months to Year to

30 Sep 2023 30 Sep 2022 31 Mar 2023

GBP'000s GBP'000s GBP'000s

----------------------------------------------------- -------------- -------------- -------------

Valuation brought forward 58,693 48,110 48,110

Purchases 466 2,731 3,691

Sales (4,279) (3,782) (4,423)

Gains on sale of investments 139 991 1,760

(Losses)/gains on investments held at end of period (11,236) 1,448 9,555

----------------------------------------------------- -------------- -------------- -------------

Valuation carried forward 43,783 49,498 58,693

----------------------------------------------------- -------------- -------------- -------------

Analysed

Cost of investments 25,810 28,396 29,484

Gains on investments 17,973 21,102 29,209

----------------------------------------------------- -------------- -------------- -------------

Valuation carried forward 43,783 49,498 58,693

----------------------------------------------------- -------------- -------------- -------------

12. FINANCIAL RISK MANAGEMENT - LEVEL 3 FINANCIAL

INSTRUMENTS

Valuation methodology

The objective of using valuation techniques is to arrive at a

fair value measurement that reflects the price that would be

received to sell the asset or paid to transfer the liability in an

orderly transaction between market participants at the measurement

date. The Company uses proprietary valuation models, which are

compliant with IPEV guidelines and IFRS 13 and which are usually

developed from recognised valuation techniques.

The Directors have satisfied themselves as to the methodology

used, the discount rates and key assumptions applied, and the

valuations. The methodologies used to determine fair value are

described in the 2023 Report and Accounts. The level 3 assets

comprise of a number of unlisted investments at various stages of

development and each has been assessed based on its industry,

location and business cycle. The valuation methodologies include

net assets, discounted cash flows, cost of recent investment or

last funding round, listed peer comparison or peer group multiple,

as appropriate. Where applicable, the Directors have considered

observable data and events to underpin the valuations. A discount

has been applied, where appropriate, to reflect both the unlisted

nature of the investments and business risks.

Sensitivity of level 3 financial investments measured at fair

value to changes in key assumptions

Level 3 inputs are sensitive to assumptions made when

ascertaining fair value. While the Directors believe that the

estimates of fair value are appropriate, the use of different

methodologies or assumptions could lead to different measurements

of fair value. The sensitivities shown in the table below give an

indication of the effect of applying reasonable and possible

alternative assumptions.

In assessing the level of reasonably possible outcomes

consideration was also given to the impact on valuations of the

increased level of volatility in equity markets since early 2022,

principally reflecting concerns about increasing rates of

inflation, tightening energy supplies, rising interest rates and

the Ukraine war. The impact on the valuations has been varied and

largely linked to their relevant sectors and this has been

reflected in the level of sensitivities applied.

The following table shows the sensitivity of the fair value of

level 3 financial investments to changes in key assumptions.

As at 30 September 2023

Carrying

Investment Valuation Risk Sensitivity amount Sensitivity

Investment type methodology weighting +/- GBP'000s GBP'000s

----------------------- ------------ -------------- ------------ ------------ ---------- ------------

Last funding

round

Petalite Equity * High 50% 24,916 12,458

UEM (HK) Limited

-

CGN Capital Partners

Infra Fund 3 Loan NAV Low 10% 9,706 971

Conversant Solutions Peer

Pte Ltd Equity multiples Medium 20% 3,324 665

Other investments Equity Various Medium 20% 5,307 1,061

Discounted

Other investments Loans cash flows Medium 20% 530 106

----------------------- ------------ -------------- ------------ ------------ ---------- ------------

Total 43,783 15,261

------------------------------------------------------------------- ------------ ---------- ------------

As at 30 September 2022

Carrying

Investment Valuation Risk Sensitivity amount Sensitivity

Investment type methodology weighting +/- GBP'000s GBP'000s

----------------------- ------------ -------------- ------------ ------------ ---------- ------------

Milestone

Petalite Equity analysis High 40% 18,693 7,477

UEM (HK) Limited

-

CGN Capital Partners

Infra Fund 3 Loan NAV Low 10% 11,871 1,187

Conversant Solutions Last funding

Pte Ltd Equity round Medium 20% 8,085 1,617

Other investments Equity Various Medium 20% 5,626 1,125

Other investments Equity Various Low 10% 4,723 472

Last funding

Other investments Equity round High 30% 350 105

Discounted

Other investments Loans cash flows Medium 20% 150 30

----------------------- ------------ -------------- ------------ ------------ ---------- ------------

Total 49,498 12,013

------------------------------------------------------------------- ------------ ---------- ------------

As at 31 March 2023

Carrying

Investment Valuation Risk Sensitivity amount Sensitivity

Investment type methodology weighting +/- GBP'000s GBP'000s

----------------------- ------------- -------------- ------------ ------------ ---------- ------------

Last funding

Petalite Equity round High 50% 28,607 14,304

UEM (HK) Limited

-

CGN Capital Partners

Infra Fund 3 Equity/Loan NAV Low 10% 11,615 1,162

Conversant Solutions Last funding

Pte Ltd Equity round Medium 20% 7,877 1,575

Other investments Equity Various Medium 20% 5,956 1,191

Other investments Equity Various Low 10% 4,187 419

Discounted

Other investments Loans cash flows High 20% 450 90

----------------------- ------------- -------------- ------------ ------------ ---------- ------------

Total 58,692 18,741

-------------------------------------------------------------------- ------------ ---------- ------------

* Valuation of investment in Petalite

Petalite is an unlisted electric vehicle ("EV") charging

infrastructure company based in the UK that has been developing a

new technology which enables more reliable and cost effective EV

chargers. UEM holds 28.6% of the ordinary shares in Petalite and as

at 31 March 2023, carried this investment at GBP28.6m. Since March

2023, the EV charging sector, as measured by listed stock prices,

has weakened and private capital activity has decreased. The

Directors consider these events would also apply to Petalite and

have accordingly reduced the carrying value of Petalite by an

amount equivalent to the average reduction of Petalite's peer group

comparable companies, giving a carrying value of GBP24.9m as at 30

September 2023.

13. RESULTS

The financial information contained in this Half-Yearly

Financial Report does not constitute statutory accounts as defined

in Sections 434 - 436 of the Companies Act 2006. The financial

information for the six months ended 30 September 2023 and 30

September 2022 have neither been audited nor reviewed by the

Company's auditors.

The information for the year ended 31 March 2023 has been

extracted from the latest published audited financial statements

which have been filed with the Registrar of Companies. The report

of the auditor on those accounts contained no qualification or

statement under Section 498(2) or (3) of the Companies Act

2006.

Legal Entity Identifier: 2138005TJMCWR2394O39

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BGBDBRXDDGXB

(END) Dow Jones Newswires

November 21, 2023 06:00 ET (11:00 GMT)

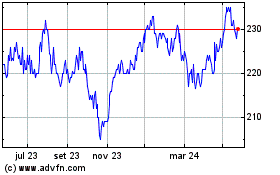

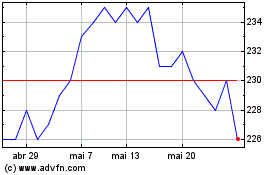

Utilico Emerging Markets (LSE:UEM)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Utilico Emerging Markets (LSE:UEM)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024