Arch Capital Group Ltd. Announces Special Cash Dividend of $1.9 Billion and Senior Executive Promotions

07 Novembro 2024 - 6:28PM

Business Wire

Longtime Arch executives David Gansberg and

Maamoun Rajeh named Presidents of Arch Capital Group Ltd.

Arch Capital Group Ltd. (NASDAQ: ACGL, “Arch” or “the Company”)

today announced that its Board of Directors (Board) has declared a

special cash dividend (special dividend) of $1.9 billion to common

shareholders, representing $5.00 per outstanding common share. The

special dividend is payable on Dec. 4, 2024, to common shareholders

of record on Nov. 18, 2024.

“Arch is operating from a position of strength with a long track

record of superior performance that is among the best in the

insurance industry,” Arch CEO Nicolas Papadopoulo said. “As part of

our ongoing capital management responsibilities, the Board and

management have determined that a special dividend is the most

effective way to return capital to shareholders at this time. This

dividend underscores Arch’s robust capital position and our

commitment to delivering value to our shareholders.”

Also, as part of the Company’s long-term succession planning,

the following executive promotions were announced, both effective

immediately:

- David Gansberg has been promoted to President, Arch Capital

Group Ltd., with primary accountability for Arch’s Insurance

Group. Gansberg, who has been CEO of Arch’s Mortgage Group

since 2019, now oversees Arch’s North American and International

Insurance Operations.

- Maamoun Rajeh has been promoted to President, Arch Capital

Group Ltd., with primary responsibility for Arch’s Mortgage and

Reinsurance groups. In this expanded role, Rajeh adds

responsibility for Arch’s market-leading Mortgage Group while

maintaining oversight of the Reinsurance Group he’s led since

2017.

Commenting on the promotions, Papadopoulo said, “Maamoun and

David have been integral to Arch’s success since 2001 and are

crucial to our future performance. As we seek to further develop

our deep bench of leaders, exposing David and Maamoun to new parts

of our business will allow them to expand their knowledge while

bringing their leadership and perspectives to other segments. They

both have a keen understanding of our business and a legacy of

developing talent. I look forward to seeing the impact they will

have across the organization.”

Rajeh said, “David and I have had a strong hand in formulating

Arch’s successful strategy over the past 23 years. In this expanded

role, I remain committed to maintaining Arch’s core principles and

driving continued innovation, profitable growth and exceptional

value for our clients and shareholders.”

Gansberg added, “Maamoun and I have worked alongside one another

since we joined Arch in 2001, and we both have a track record of

delivering excellent results to go along with our deep

understanding and passion for this company and its employees. I’m

excited to help continue to build upon Arch’s outstanding growth

story.”

Before Gansberg’s tenure as CEO of Arch’s Mortgage Group, he

served as President and CEO of Arch Mortgage Insurance Company.

Prior to his work with the Mortgage Group, he was Executive Vice

President and a director at Arch Re (U.S.). He holds a bachelor’s

degree in actuarial mathematics from the University of Michigan and

an MBA from the Duke University Fuqua School of Business.

Prior to Rajeh’s role as Chairman and CEO of Arch’s Reinsurance

Group, he held CEO positions at Arch Re Bermuda from 2014-2017 and

at Arch Reinsurance Europe from 2012-2014. Rajeh joined Arch Re

Bermuda as an underwriter in 2001 and advanced to hold several

other leadership roles within Arch Re. He has a bachelor’s degree

from the Wharton School of Business of the University of

Pennsylvania.

About Arch Capital Group Ltd.

Arch Capital Group Ltd. (Nasdaq: ACGL) is a publicly listed

Bermuda exempted company with approximately $25.0 billion in

capital at Sept. 30, 2024. Arch, which is part of the S&P 500

Index, provides insurance, reinsurance and mortgage insurance on a

worldwide basis through its wholly owned subsidiaries.

Cautionary Note Regarding Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a

"safe harbor" for forward−looking statements. This release or any

other written or oral statements made by or on behalf of Arch

Capital Group Ltd. and its subsidiaries may include forward−looking

statements, which reflect the Company’s current views with respect

to future events and financial performance. All statements other

than statements of historical fact included in or incorporated by

reference in this release are forward−looking statements.

Forward−looking statements can generally be identified by the

use of forward−looking terminology such as "may," "will," "expect,"

"intend," "estimate," "anticipate," "believe" or "continue" or

their negative or variations or similar terminology.

Forward−looking statements involve the Company’s current assessment

of risks and uncertainties. Actual events and results may differ

materially from those expressed or implied in these statements. A

non-exclusive list of the important factors that could cause actual

results to differ materially from those in such forward-looking

statements includes the following: adverse general economic and

market conditions; increased competition; pricing and policy term

trends; fluctuations in the actions of rating agencies and the

Company’s ability to maintain and improve its ratings; investment

performance; the loss of key personnel; the adequacy of the

Company’s loss reserves, severity and/or frequency of losses,

greater than expected loss ratios and adverse development on claim

and/or claim expense liabilities; greater frequency or severity of

unpredictable natural and man-made catastrophic events, including

the effect of contagious diseases on our business; the impact of

acts of terrorism and acts of war; changes in regulations and/or

tax laws in the United States or elsewhere; ability to successfully

integrate, establish and maintain operating procedures as well as

integrate the businesses the Company has acquired or may acquire

into the existing operations; changes in accounting principles or

policies; material differences between actual and expected

assessments for guaranty funds and mandatory pooling arrangements;

availability and cost to the Company of reinsurance to manage our

gross and net exposures; the failure of others to meet their

obligations to the Company; an incident, disruption in operations

or other cyber event caused by cyber attacks, the use of artificial

intelligence technologies or other technology on the Company’s

systems or those of the Company’s business partners and service

providers, which could negatively impact the Company’s business

and/or expose the Company to litigation; and other factors

identified in our filings with the U.S. Securities and Exchange

Commission (SEC).

The foregoing review of important factors should not be

construed as exhaustive and should be read in conjunction with

other cautionary statements that are included herein or elsewhere.

All subsequent written and oral forward−looking statements

attributable to us or persons acting on the Company’s behalf are

expressly qualified in their entirety by these cautionary

statements. The Company’s forward-looking statements speak only as

of the date of this press release or as of the date they are made,

and the Company undertakes no obligation to publicly update or

revise any forward−looking statement, whether as a result of new

information, future events or otherwise.

arch-corporate

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107673752/en/

Media Contacts: Greg Hare ghare@archgroup.com Stephanie

Perez stperez@archgroup.com

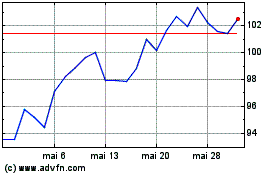

Arch Capital (NASDAQ:ACGL)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Arch Capital (NASDAQ:ACGL)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024