The

Automatic Data Processing (ADP) employment

survey was stronger than expected in October. It shows that private

sector employment rose by 110,000, above consensus expectations for

a 100,000 increase. The September numbers were revised up to a gain

of 116,000 jobs from the initial report of a 91,000 gain.

On average, the ADP report does a fairly good job of predicting the

private sector totals that the BLS reports the following Friday,

although in any given month it can be off substantially. It is

prone to fairly large errors in both directions. Last month it was

a bit on the too-pessimistic side, particularly before the

revision. The BLS private sector job gains were 137,000.

If confirmed by the BLS on Friday it would indicate that the

economy continues to wallow along in a pseudo-recovery: growing,

but not growing fast enough for anybody to really feel like it is

growing. However, it would not indicate a renewed downturn.

Over time, the ADP numbers do tend to align with the BLS numbers.

There can, however, be substantial differences between the two

reports on a month-to-month basis. As the chart below shows, the

ADP (blue) numbers track the BLS (red) numbers pretty well over

time, but the BLS numbers tend to be somewhat more volatile month

to month. Also note that in terms of private sector employment,

this recovery has been stronger than the last recovery was up until

this point, regardless of which number you used.

Small businesses, defined as those with fewer than 50 employees

rose a total of 58,000 jobs in the month. Medium-sized firms, those

with between 50 and 499 employees gained 53,000 jobs while large

firms with 500 or more employees actually lost 1,000 jobs. Large

businesses are a relatively small share of total employment in the

country, accounting for just 17.464 million out of a total of

109,067 million private sector jobs in the country (16.0%). Small

business is the largest source of employment at 49.442 (45.3%)

million, followed by medium businesses at 42.161 million

(38.6%).

The goods-producing sector -- made up of Manufacturing,

Construction and Mining -- actually lost 4,000 jobs. Overall, goods

producing industries are not that big a source of jobs in this

country, just 17.823 million (16.4%) in total. Employment in goods

producing industries tends to be more volatile than in the service

sector, and thus the goods producing industries have an outsized

influence on the overall strength of the job market.

Construction industry employment was down by 1,000 in October.

Since their peak in January 2007, construction jobs have shrunk by

a total of 2.131 million. That is almost one third of the total

jobs lost in the entire economy since the recession started.

Manufacturing was a bright spot in this recovery, but it started to

falter in the fall. It sort of looks dead in the water, down 8,000

this month. There were 11.652 million manufacturing jobs, or just

10.7% of the overall private sector workforce. With other evidence

pointing to an easing of the supply chain disruptions stemming from

the Japanese disaster, this decline is disappointing.

Within the goods-producing sector, medium sized firms were doing

the best, gaining 6,000 jobs. Small firms had unchanged employment

levels while large firms dropped a total of 10,000 goods-producing

jobs.

The Service sector is far larger, accounting for 91.244 million

jobs or 83.6% of the private sector total. It added 114,000. Of the

jobs gained in October, 58,000 were added by small service firms,

while medium-sized firms added 47,000 and large service firms added

just 9,000.

The ADP report only covers private sector employment, not

government jobs at any level, and thus should be compared to the

BLS private sector total, not to the BLS headline number.

Government employment has been falling consistently over the last

two years (except for the Census in 2010), particularly at the

state and local level, and that trend is widely expected to

continue.

Looking Ahead to Friday's BLS Report

I am expecting about 30,000 public sector layoffs for the month.

Thus, if the ADP numbers prove accurate, it means that the headline

number on Friday is probably going to be around 80,000. That is

still weak for even an average month. It is sure not very inspiring

coming out of a deep recession.

The consensus is looking for a gain of 85,000 jobs on Friday, with

more than all of the gains coming from the private sector. The ADP

numbers should not significantly change those expectations.

Report Card: C+

This was a pretty good report -- better than expected -- but only

mediocre in an absolute sense. The numbers implied by this report

are below the level needed to keep up with population growth and

thus bring down the unemployment rate.

If the economy is really starting to turn around, the participation

rate must continue to rebound. That would put upward pressure on

the unemployment rate even if the economy starts to do better in

job creation. With the numbers implied from this report, a

continued drop in the participation rate would be the only way to

keep the unemployment rate will go down. That might look OK on

paper, but would not reflect any improvement in the real world.

AUTOMATIC DATA (ADP): Free Stock Analysis Report

Zacks Investment Research

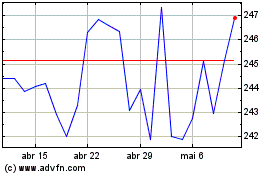

Automatic Data Processing (NASDAQ:ADP)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Automatic Data Processing (NASDAQ:ADP)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024