Ahead of Wall Street - August 1, 2012 - Ahead of Wall Street

01 Agosto 2012 - 5:54AM

Zacks

Wednesday, August 1, 2012

The Fed is in the spotlight once again today, with the post-FOMC

meeting statement coming out this afternoon. But those looking for

fresh concrete actions from the central bank will likely get

disappointed as the odds of a new round of quantitative easing are

quite low. The statement will likely reiterate the central bank’s

commitment to ‘do more’ should conditions warrant. They will also

likely acknowledge the downside risks to the economic outlook, but

will stay shy of making a new announcement.

Many see the economic picture not bad enough to warrant another

round of bond-purchase program, particularly given the questionable

utility of such a measure to the economy anyway. And the positive

looking jobs data from payroll processor Automatic Data

Processing (ADP) this morning certainly bears out that

line of thinking. Also on deck for release a little later is the

July manufacturing ISM report, but the focus of course will be on

the Fed statement coming out this afternoon.

The ADP report is showing better than expected private-sector jobs

of 163K in July and the tally June was modestly revised downwards

to 172K from 176K. The biggest increase came from smaller firms

(firms with less than 50 employees), adding 73K jobs, while medium

and large businesses added 67K and 23K jobs in July, respectively.

Service sector jobs increased by 148K in July vs. 151K in June,

while manufacturing employment increase by 9K in July after the 6K

gain in June.

The expectation for Friday’s BLS report ahead of this morning’s

ADP report was for headline gains of around 100K. If the ADP report

is painting a correct picture of private sector jobs in July, then

we will get a positive surprise on Friday from the BLS. But given

the ADP’s less than stellar record of late in foretelling the

government jobs number, hardly anyone will be making that bet with

this morning’s numbers.

But irrespective of how accurate or otherwise the ADP report is

in gauging the health of the labor market in real time, the

important takeaway may actually be that the labor market is weak

but it may not be weakening any further. And it is this takeaway

which is critical to what the Fed will or will not do on the QE

question.

Sheraz Mian

Director of Research

AUTOMATIC DATA (ADP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

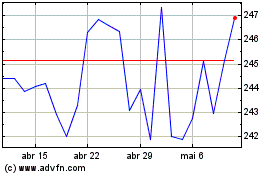

Automatic Data Processing (NASDAQ:ADP)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Automatic Data Processing (NASDAQ:ADP)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024