ADP's 3Q Earnings Beat By a Penny - Analyst Blog

03 Maio 2013 - 8:00AM

Zacks

Automatic Data Processing

Inc. (ADP) reported third quarter 2013 earnings from

continuing operations of 99 cents per share, beating the Zacks

Consensus Estimate by a penny. Reported earnings per share

increased 8.8% from the year-ago quarter.

Quarter

Details

Revenues increased 7% year over

year to $3.11 billion and came in line with the Zacks Consensus

Estimate. Organic growth was 6% in the quarter. The year-over-year

revenue growth was driven by strong performance of the Employer

Services, PEO Services and Dealer Services segments.

Employer Services revenues

increased 7% year over year (6% organically) to $2.21 billion. The

number of employees on clients’ payrolls in the United States grew

2.7% in the quarter on a same-store-sales basis.

PEO Services revenue increased 10%

year over year to $565.5 million in the reported quarter. Dealer

Services revenue increased 8% on a year over year basis to $460.5

million.

Interest on funds held for clients

declined 16% year over year to $112.0 million. The decline was

primarily due to a 50 basis points (bps) drop in the average

interest yield to 1.9%, which was partially offset by a 7% increase

in average client funds balances to $23.2 billion.

Total expenses in the reported

quarter increased 7.2% year over year to $2.40 billion,

attributable to higher operating expenses (up 7.7% year over year),

selling, general & administrative expense (up 5.6% year over

year) and systems development & programming costs (up 14.3%

year over year).

The company reported pre-tax

earnings from continuing operations of $724.8 million, up 6% from

the year-ago quarter. Net earnings from continuing operations

increased 7% from the year-ago quarter to $482.7 million.

The company exited the quarter with

cash and cash equivalents (including short-term marketable

securities) of $1.68 billion compared with $1.43 billion in the

previous quarter. Long-term debt was $15.3 million.

Guidance

For fiscal 2013, ADP revised its

revenue growth outlook from 5.0%-7.0% to 6%-7% on a year-over-year

basis. Earnings growth estimates were also revised from a range of

5.0%-7.0% to 6%-7%.

Employer Services revenues are

expected to grow approximately 7% with a pre-tax margin expansion

of approximately 50 bps. PEO Services revenue is forecast to

improve 12.0%. Pre-tax margin is expected to grow slightly on a

year-over-year basis. The company expects Dealer Services revenue

to increase in the 8.0%-9.0% range with a pre-tax margin expansion

in excess of 100 bps.

The company expects interest on

funds held for clients to decline 15% year over year to

approximately $420 million.

Recommendation

The company reported

better-than-expected results on the back of improved execution and

higher client retention. However, volatile macro economic

environment and increasing competition from Paychex

Inc. (PAYX), Insperity Inc. (NSP) and

Equifax Inc (EFX) are the

near-term headwinds.

Currently, ADP has a Zacks Rank #2

(Buy).

AUTOMATIC DATA (ADP): Free Stock Analysis Report

EQUIFAX INC (EFX): Free Stock Analysis Report

INSPERITY INC (NSP): Free Stock Analysis Report

PAYCHEX INC (PAYX): Free Stock Analysis Report

To read this article on Zacks.com click here.

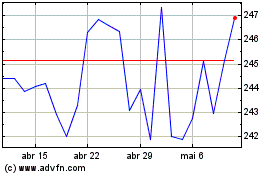

Automatic Data Processing (NASDAQ:ADP)

Gráfico Histórico do Ativo

De Ago 2024 até Set 2024

Automatic Data Processing (NASDAQ:ADP)

Gráfico Histórico do Ativo

De Set 2023 até Set 2024